Asset Formula In Accounting

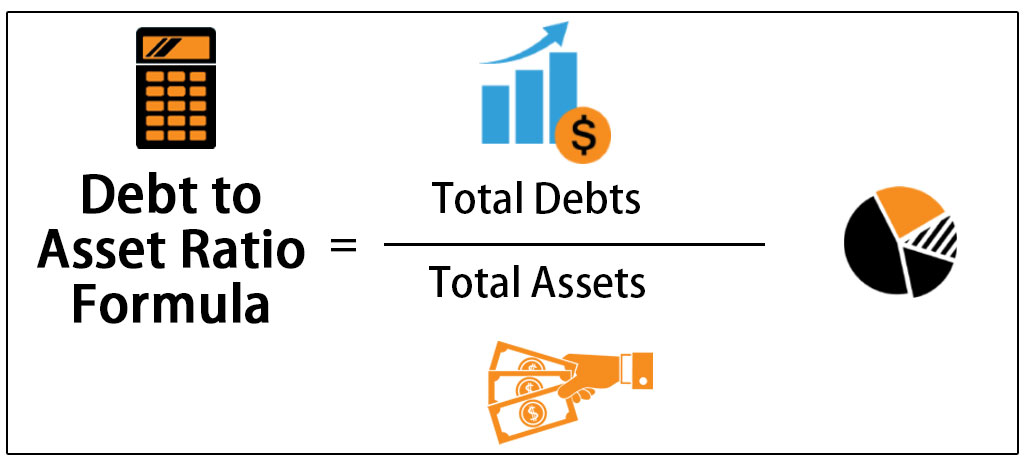

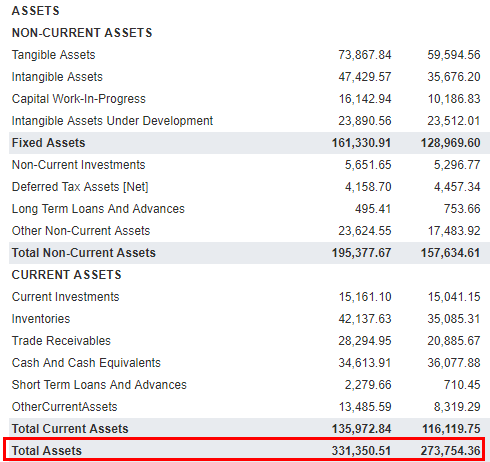

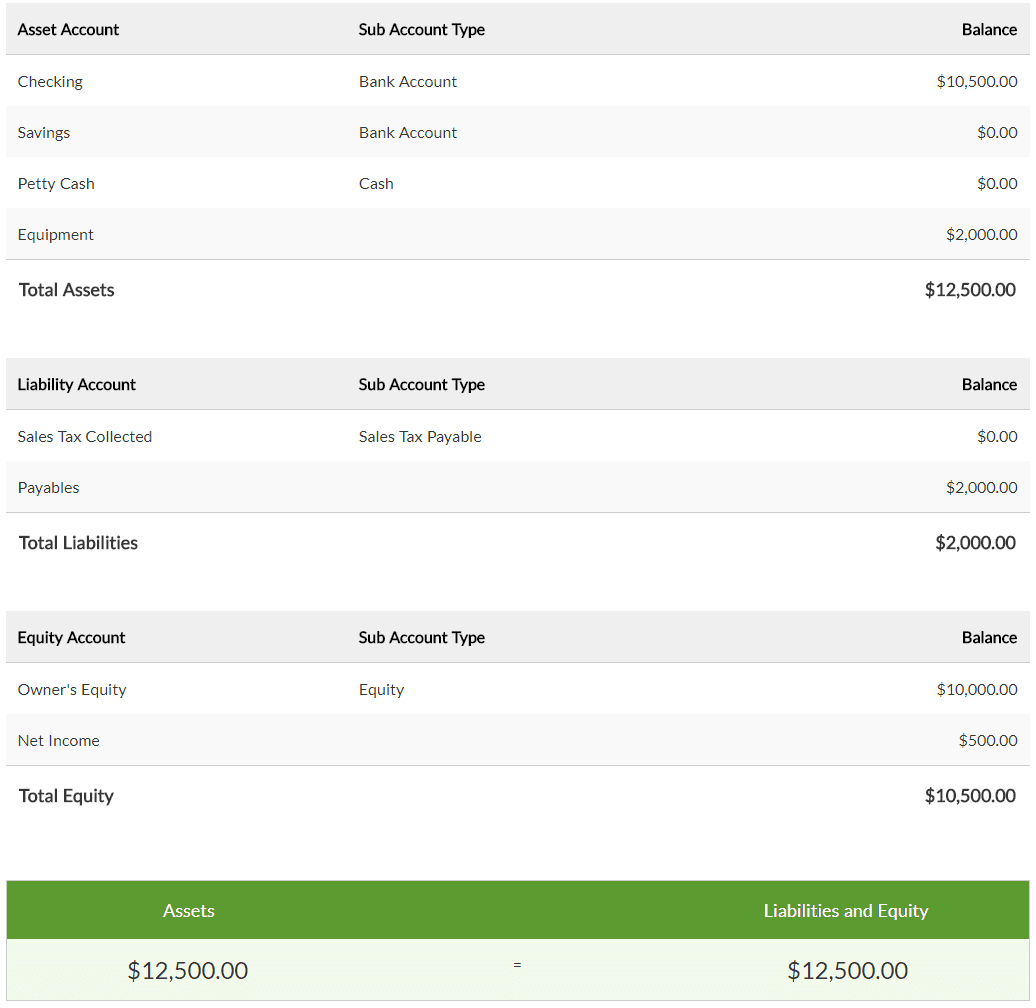

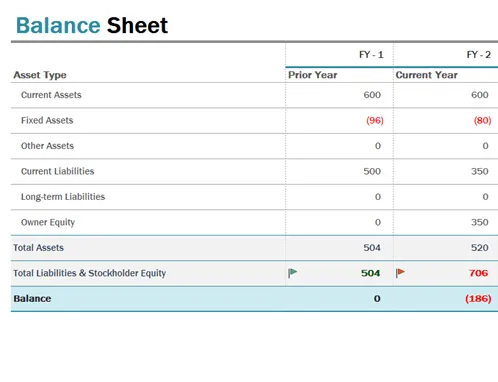

Step 2 Next, determine the total assets of the company which includes both shortterm (current) and longterm (noncurrent) assets Step 3 Finally, the formula for equity ratio can be derived by dividing the total equity (step 1) of the company by its total assets (step 2) as shown below Equity Ratio = Total Equity / Total Assets.

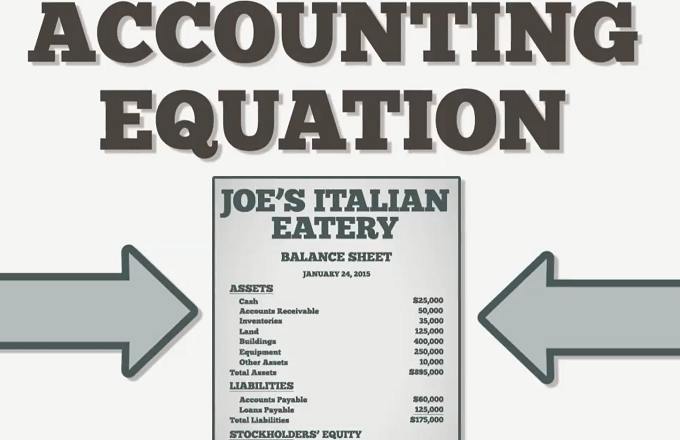

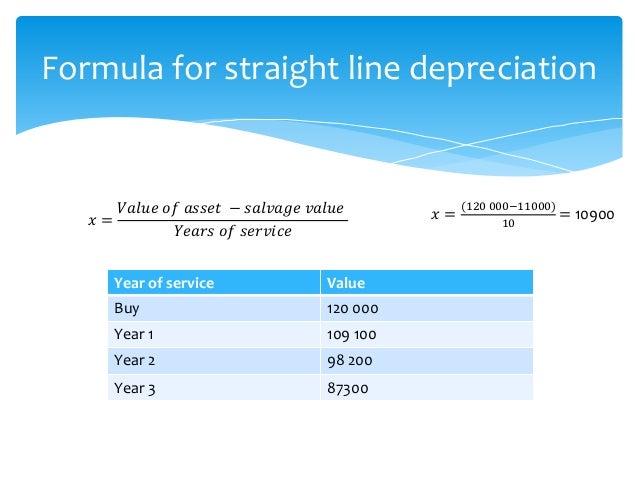

Asset formula in accounting. Net Assets Formula Net Assets = Total Assets – Total Liabilities Total Assets Formula Total Assets = Total Liabilities Owner’s Equity Determining Service Life of an Asset For accounting purposes, an asset’s service life may not match its item life The service life of an asset is an accounting and management estimate of the useful. Meaning of Net Current Assets In simple terms, Net Current Assets refers to the total amount of current assets excluding the total amount of current liabilities in a business It can also be referred to as Net Working Capital The Net Current Assets can have a positive or a negative value, wherein the two are an indicator of the wellbeing of a business. In this article, I will focus on some of most common accounting and financial formulas you can use for basic to complex calculations 1 XNPV The function is used to determine the company’s worthy using the Net Present Value of a series of discounting cash flows Unlike the excel NPV, the XNPV function uses specific dates for cash flows Syntax.

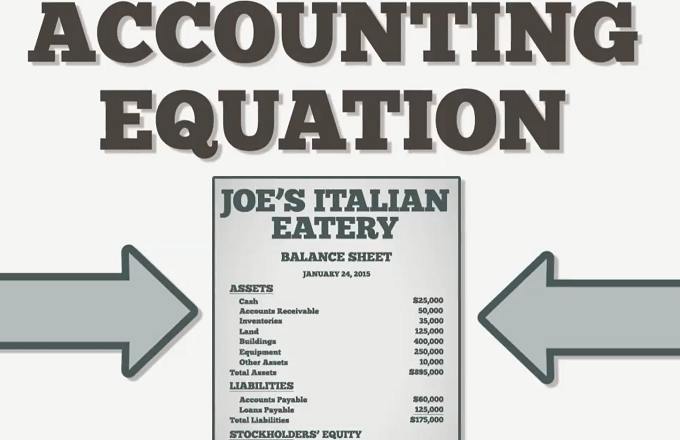

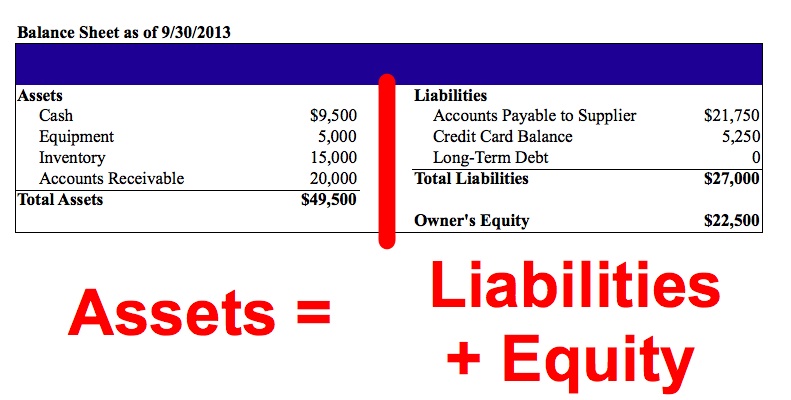

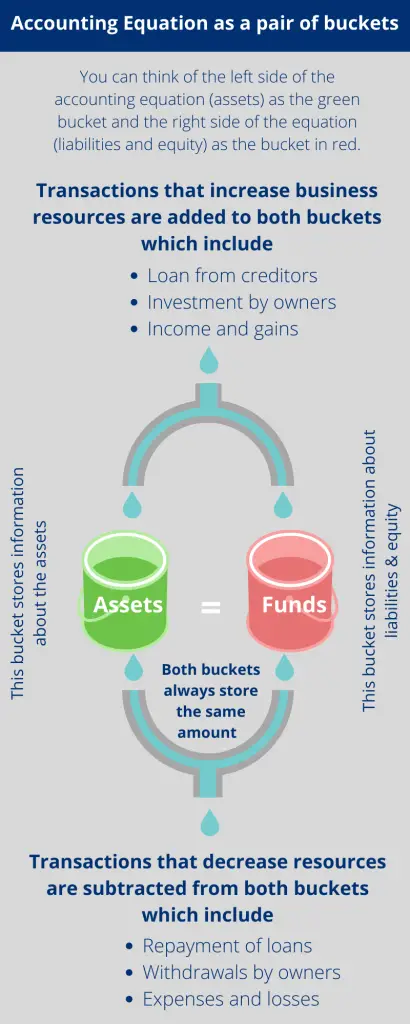

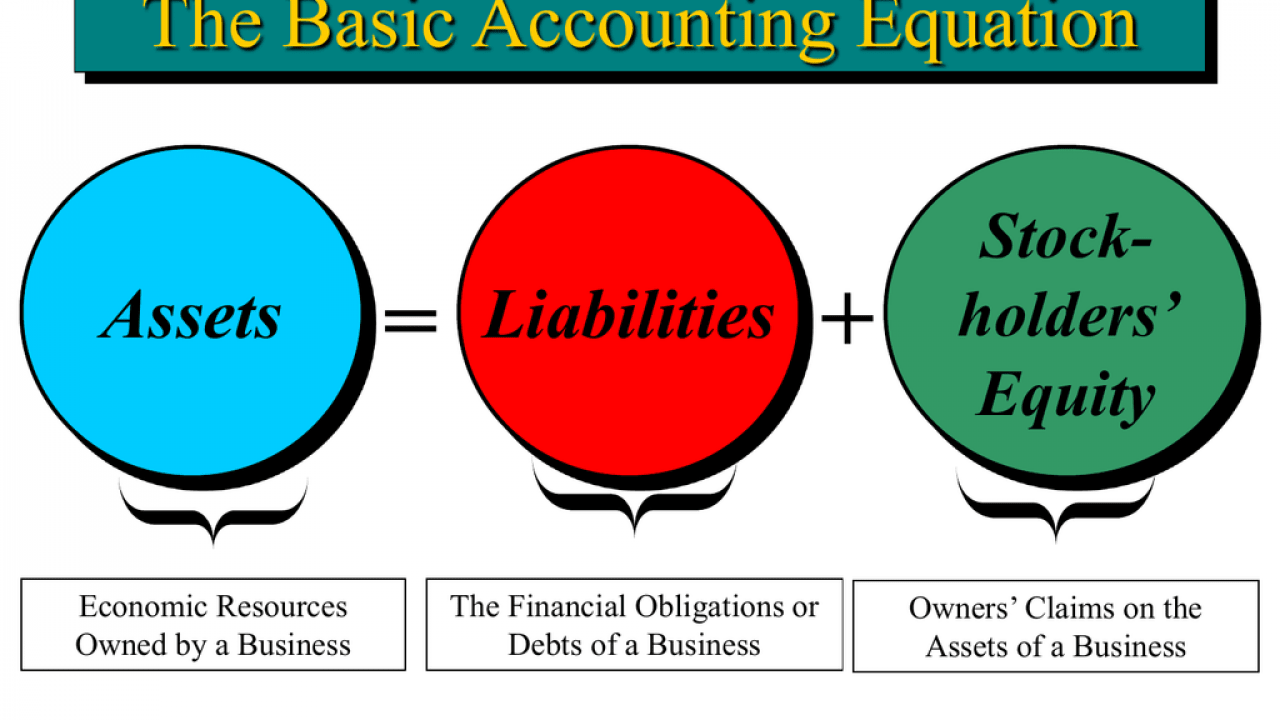

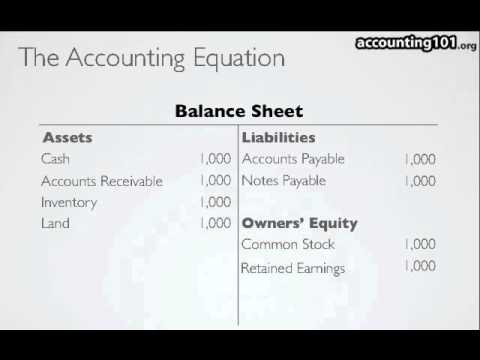

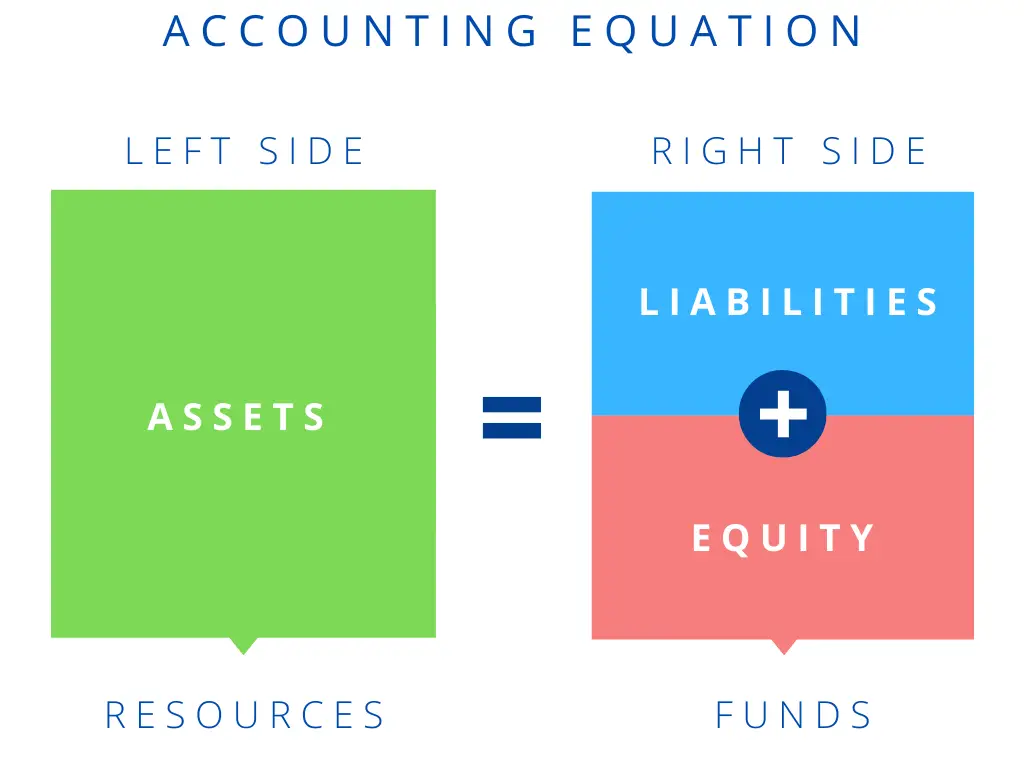

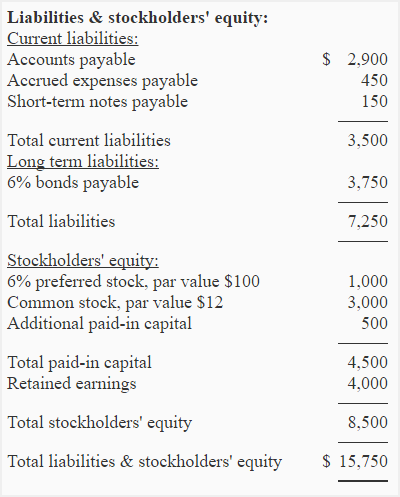

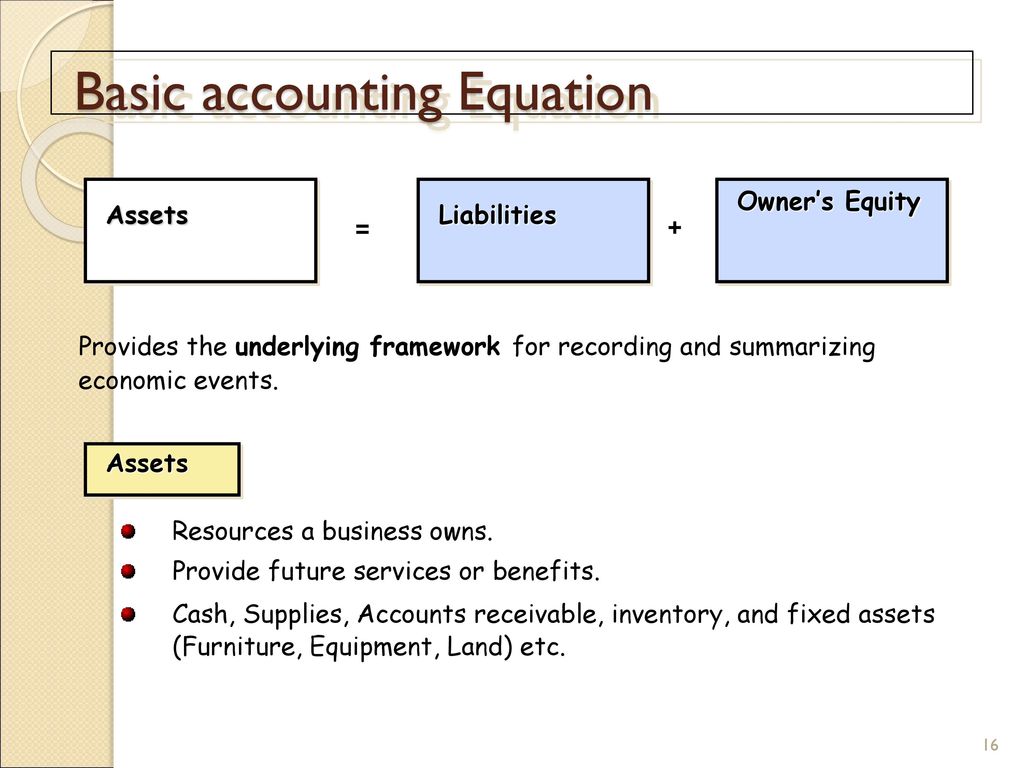

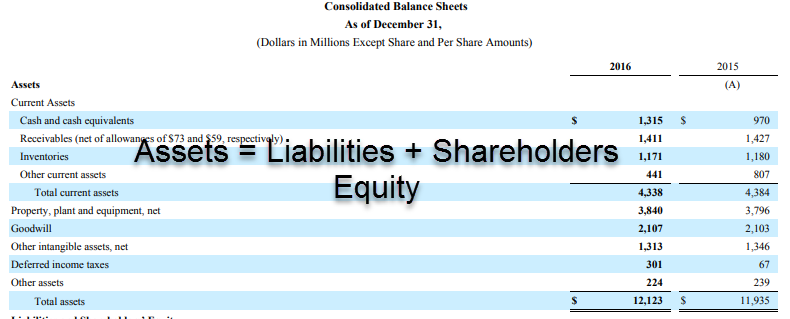

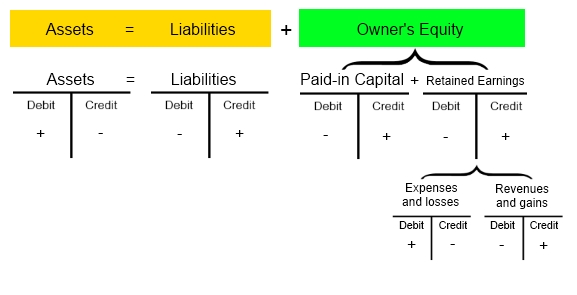

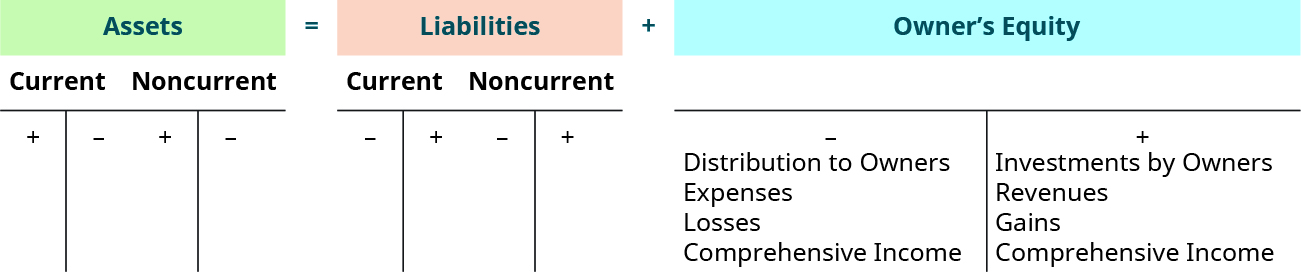

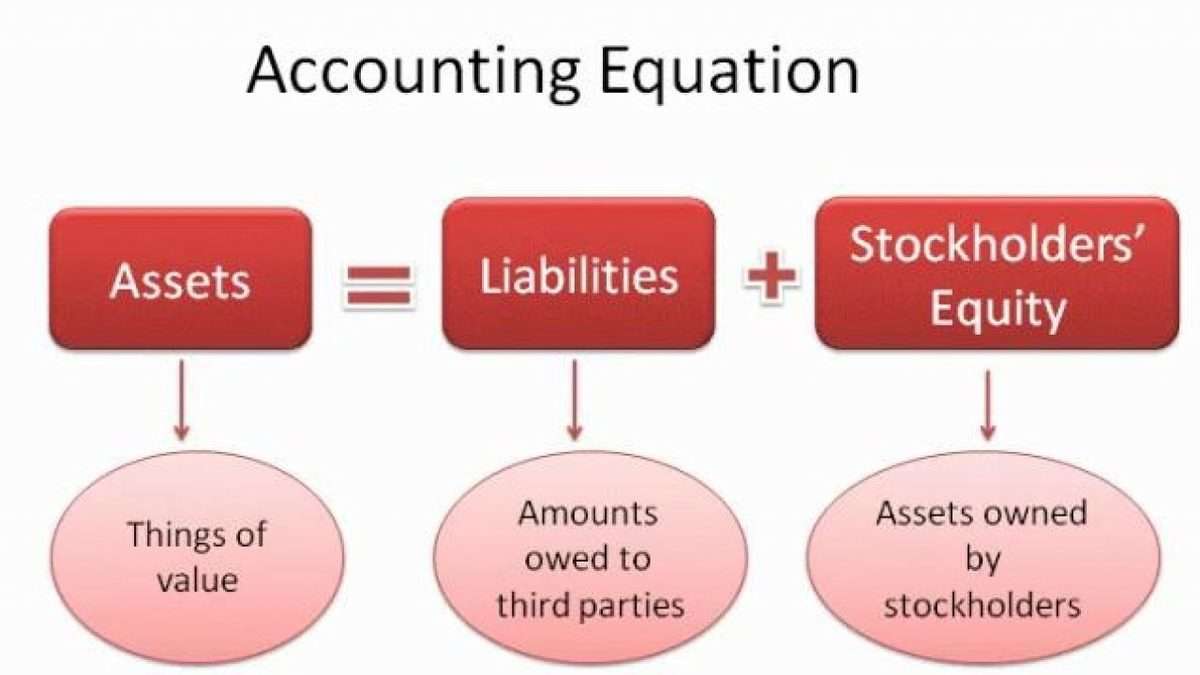

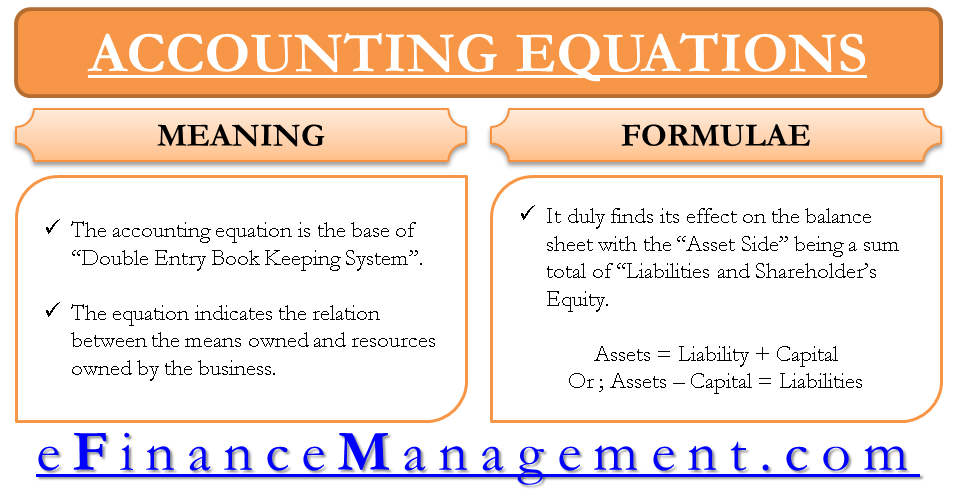

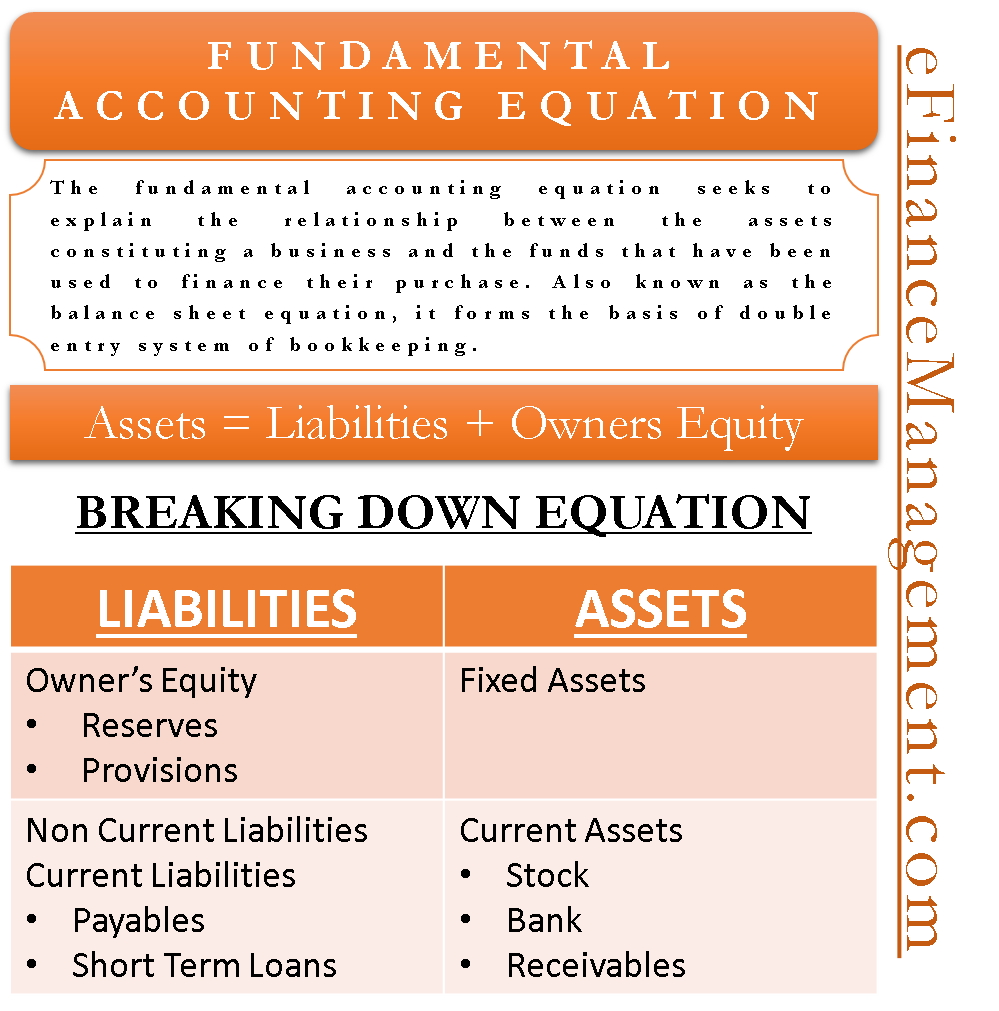

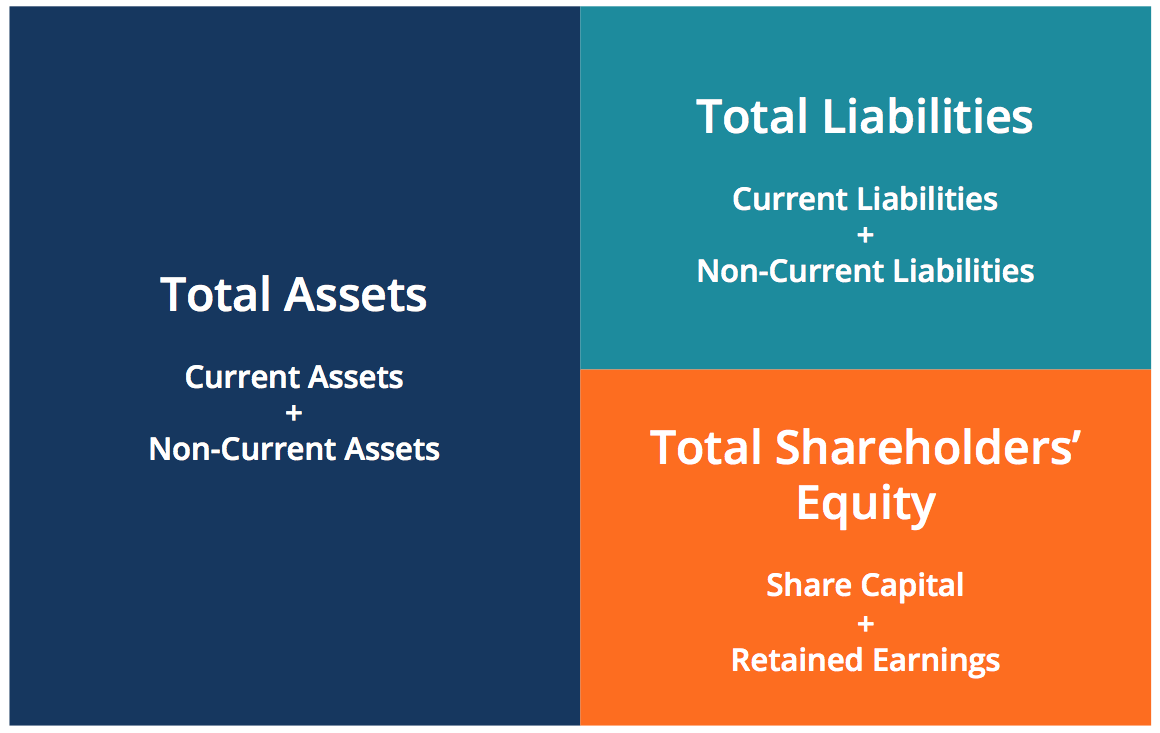

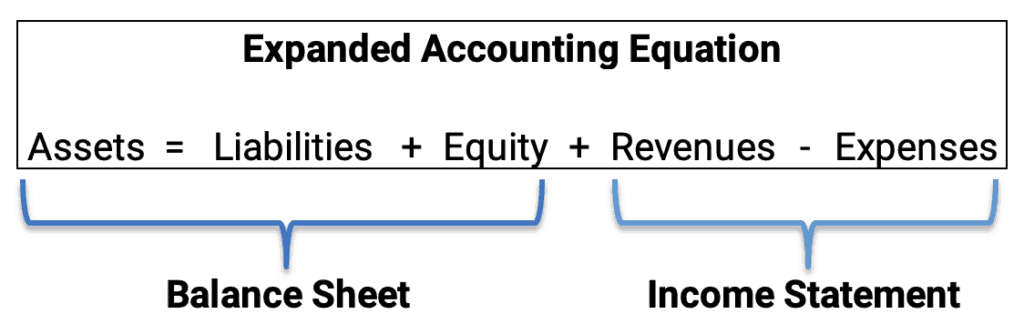

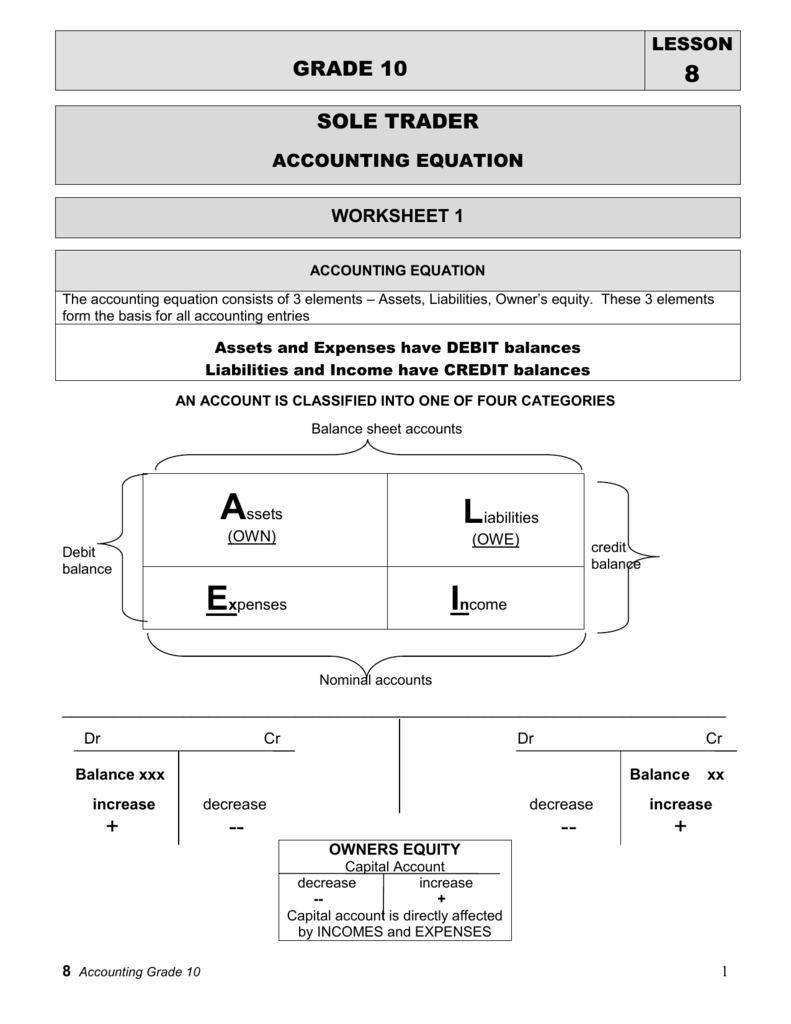

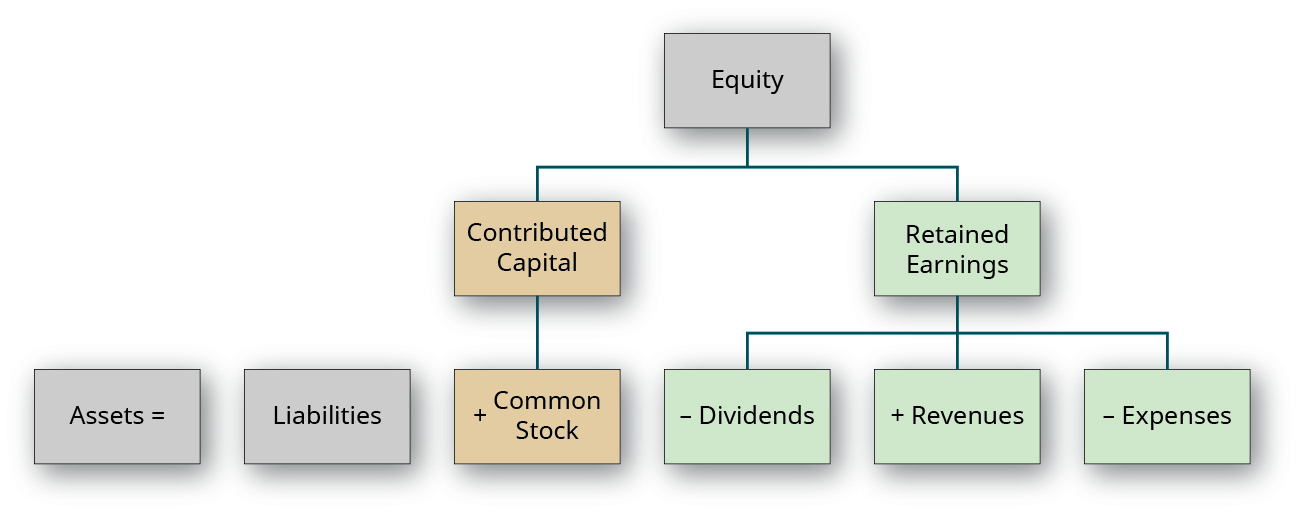

In this article, I will focus on some of most common accounting and financial formulas you can use for basic to complex calculations 1 XNPV The function is used to determine the company’s worthy using the Net Present Value of a series of discounting cash flows Unlike the excel NPV, the XNPV function uses specific dates for cash flows Syntax. Accounting equation Assets = Liabilities Stockholders’ (Owner’s) Equity classified balance sheet groups assets into the following classification current assets, investments, property, plant and equipment, and other assets Liabilities are classified as either current or longterm. In this explanation of the ABCs of Accounting, we will discuss assets, liabilities, and equity, including the Owner’s Equity Formula, the Statement of Owner’s Equity, the Balance Sheet Formula, and other helpful equations Fundamentally, accounting comes down to a simple equation Assets = Liabilities Equity.

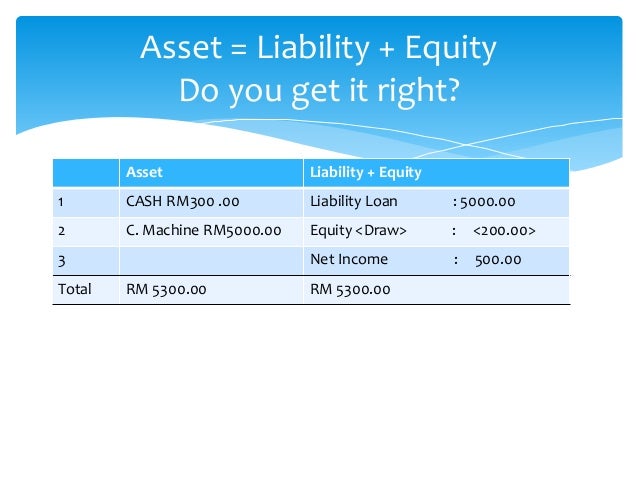

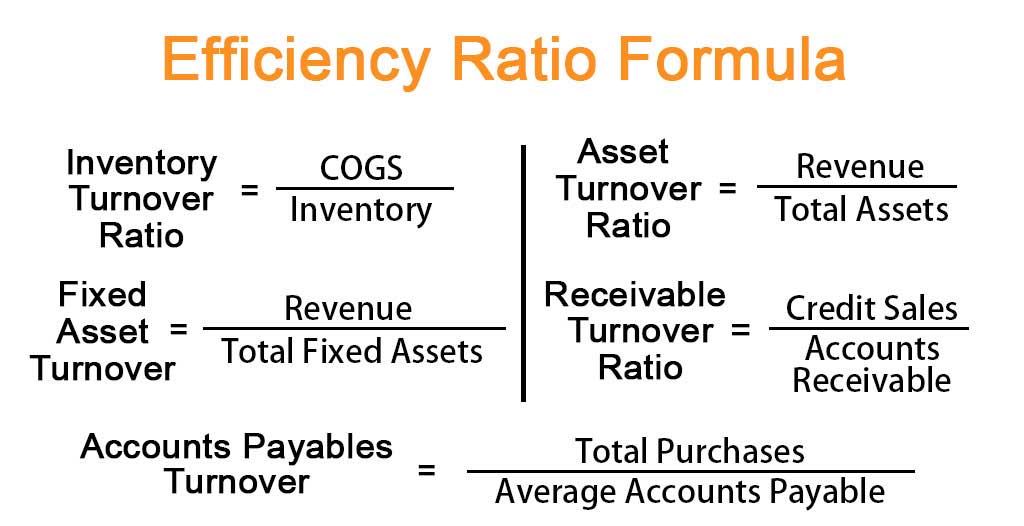

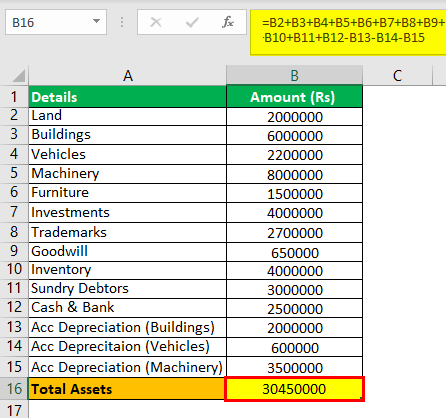

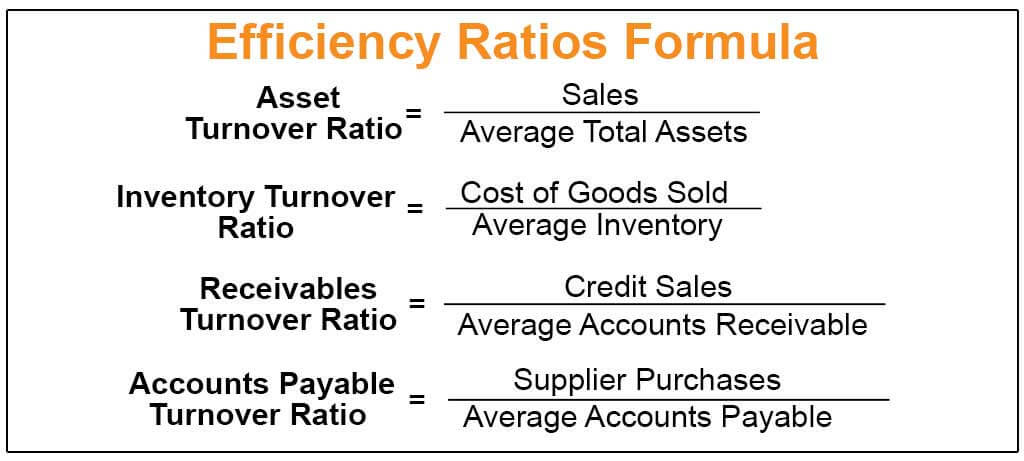

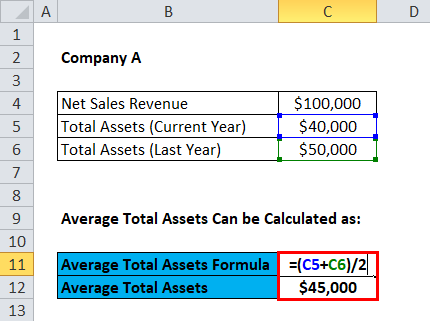

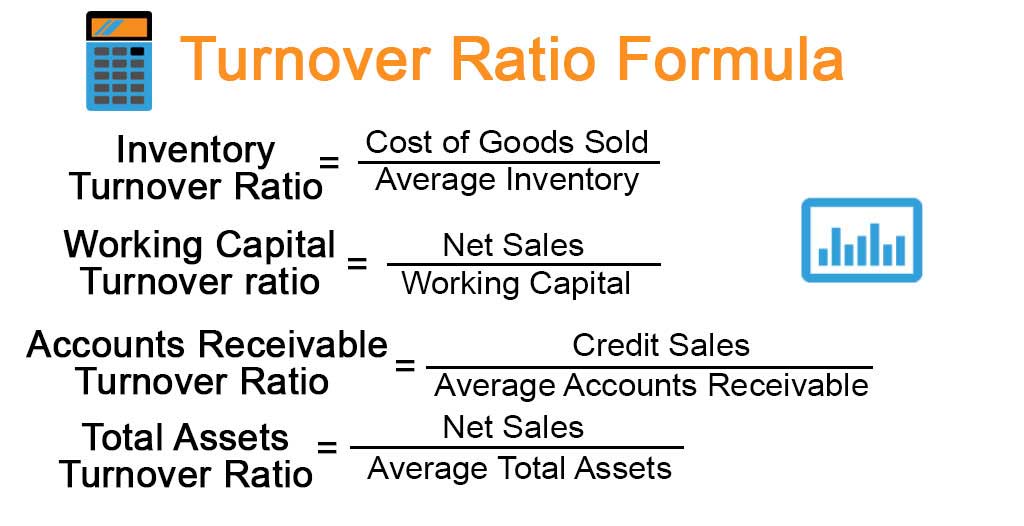

4 Check the Basic Accounting Formula In doubleentry bookkeeping, there is an accounting formula used to check if your books are correct The formula is Liabilities Equity = Assets Equity is the value of a company’s assets minus any debts owing An asset is an item of financial value, like cash or real estate. Formula The term operating profit means profit before interest and tax The term capital employed has been interpreted in different ways by different accountants and authors Some of the different meanings of capital employed are given below (1) Total of all assets ie, fixed as well as current assets. Formula Assets turnover ratio is computed by using the following formula The numerator includes net sales ie, sales less sales returns and discount The denominator includes average total assets Average total assets are equal to total assets at the beginning of the period plus total assets at the ending of the period divided by two.

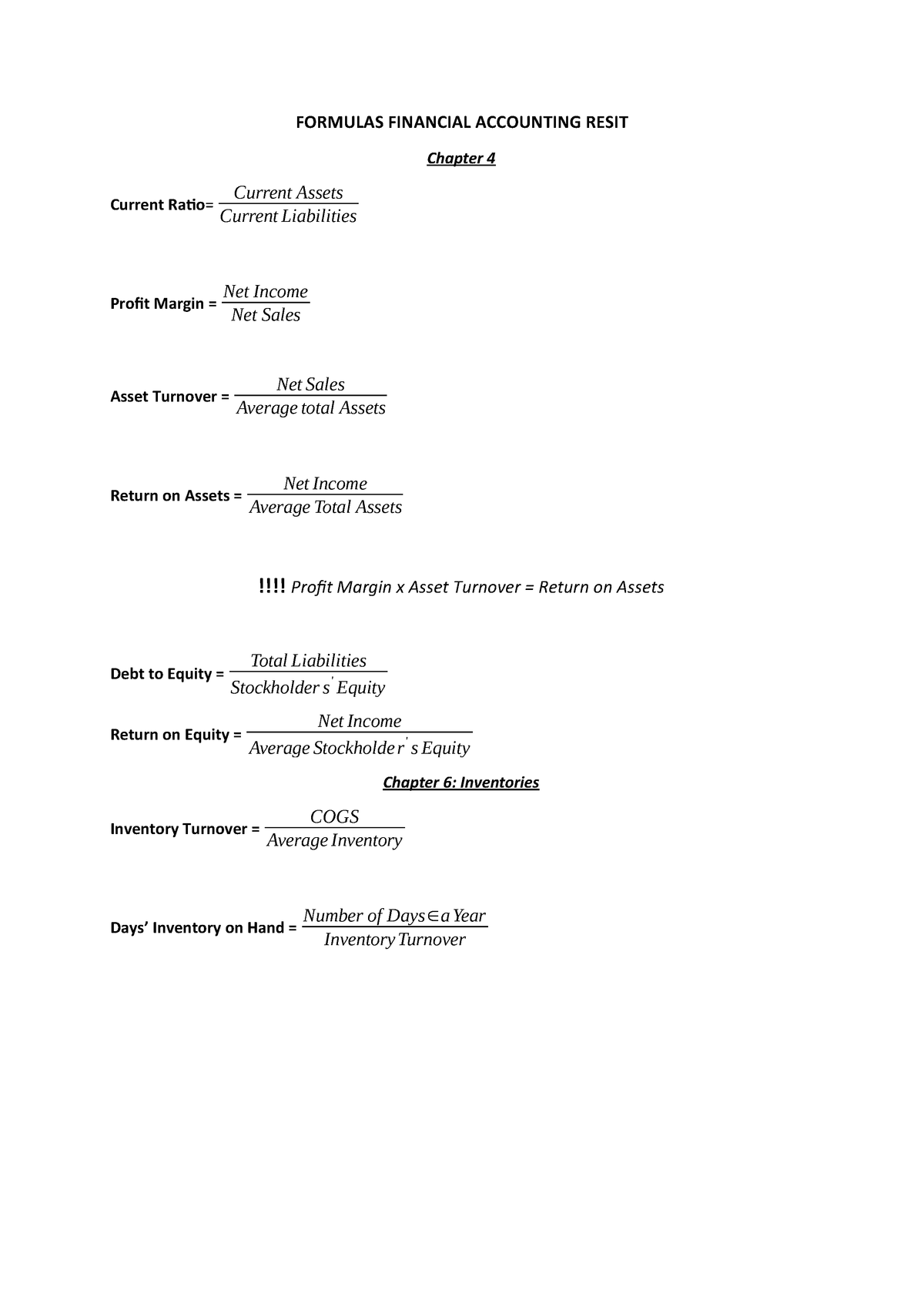

Accounting Financial Formulas STUDY PLAY Accounting Equation Formula Assets = Liabilities Equity Accounting Rate of Return Formula Average annual operating income / Average amount invested Accounts Receivable Turnover Ratio Formula Net credit sales / Average net accounts receivable. Start studying Accounting Financial Formulas Learn vocabulary, terms, and more with flashcards, games, and other study tools. Formulas Accounting Ratios Liquidity Current ratio = current assets / current liabilities Quick ratio = (current asset inventory) / (current liabilities bank overdraft) Interest coverage ratio = (earnings before interest & tax) / (interest costs) OR EBIT net profit before tax finance/interest expense Profitability can be ratio (eg, 21) or percentage (multiply by 100) Return on.

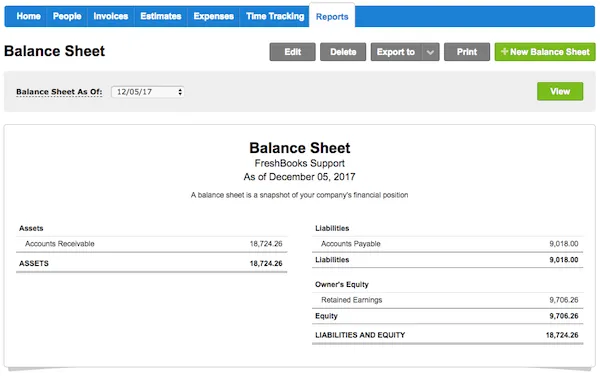

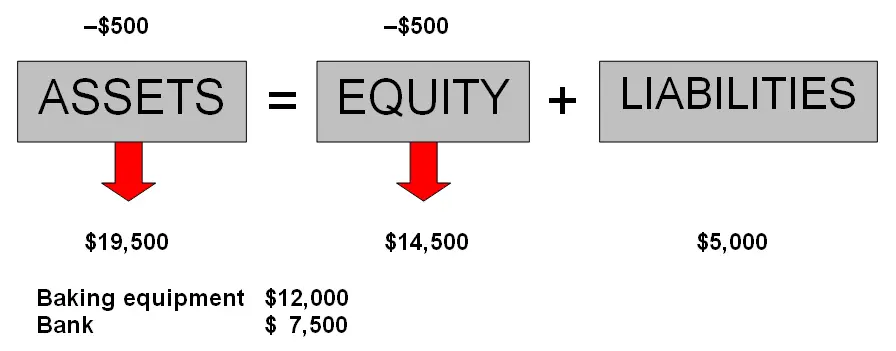

4 Check the Basic Accounting Formula In doubleentry bookkeeping, there is an accounting formula used to check if your books are correct The formula is Liabilities Equity = Assets Equity is the value of a company’s assets minus any debts owing An asset is an item of financial value, like cash or real estate. Example John invested $0 for 2 years at an annual interest rate of 5%, the future value of this investment can be calculated by typing the following formula into any Excel cell =0*(15%)^2 which gives the result 25 Depreciation of Asset In Excel user can calculate the depreciation of an asset in the given time period. Assets – liabilities = equity (or assets = liabilities equity) This basic formula must stay in balance to generate an accurate balance sheet This means that all accounting transactions must keep the formula in balance If not, the accountant has made an error.

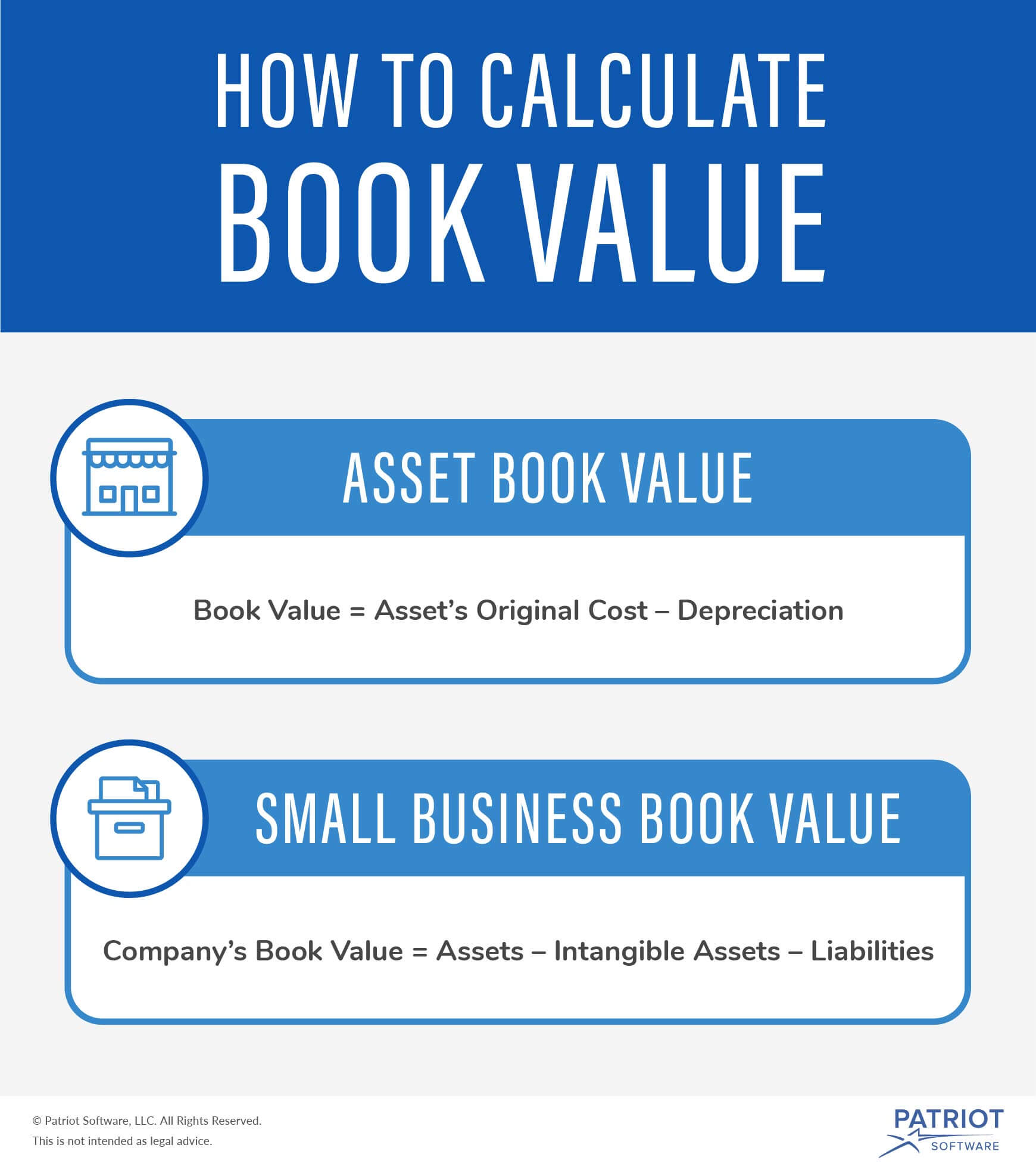

Net Assets Formula Net Assets = Total Assets – Total Liabilities Total Assets Formula Total Assets = Total Liabilities Owner’s Equity Determining Service Life of an Asset For accounting purposes, an asset’s service life may not match its item life The service life of an asset is an accounting and management estimate of the useful. The process of amortization in accounting reduces the value of the intangible asset on the balance sheet over time and reports an expense on the income statement each period to reflect the change. Meaning of Net Current Assets In simple terms, Net Current Assets refers to the total amount of current assets excluding the total amount of current liabilities in a business It can also be referred to as Net Working Capital The Net Current Assets can have a positive or a negative value, wherein the two are an indicator of the wellbeing of a business.

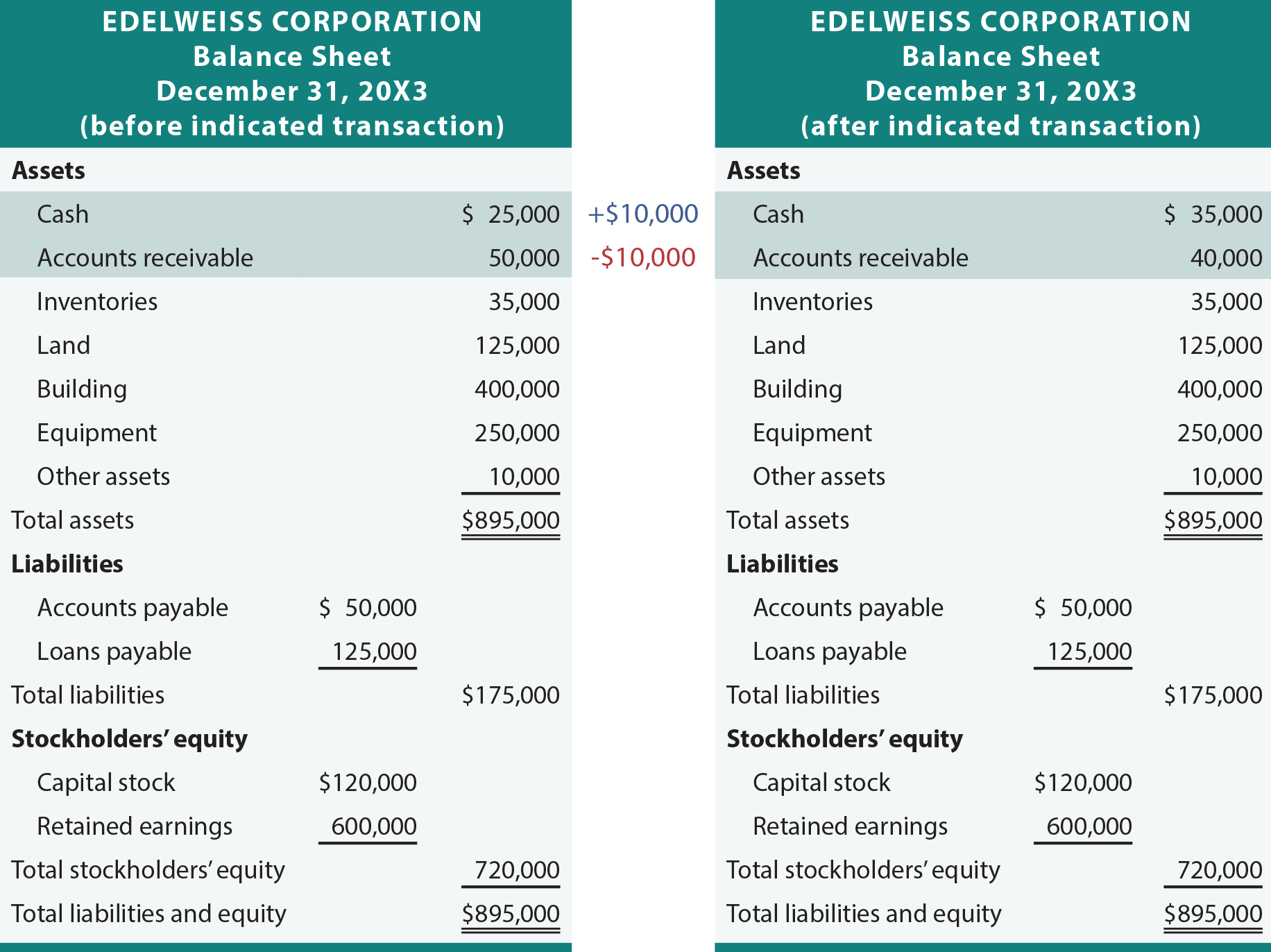

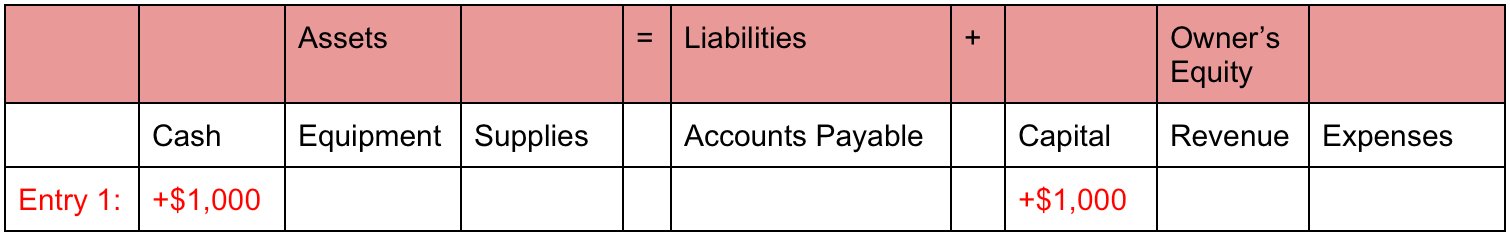

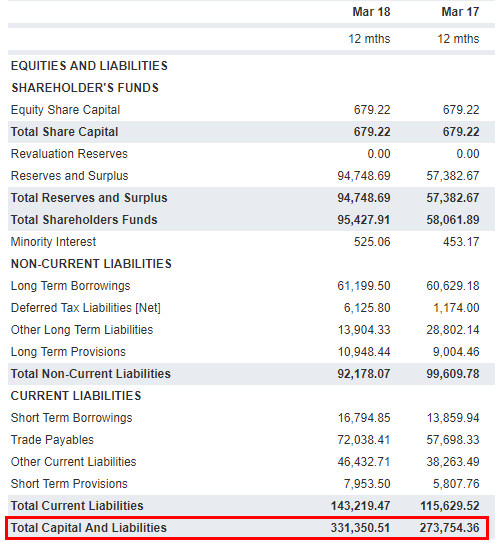

The accounting equation shows the relationship between these items Rearranging the Accounting Equation The accounting equation can also be rearranged into the following form Shareholder’s Equity = Assets – Liabilities In this form, it is easier to highlight the relationship between shareholder’s equity and debt (liabilities). To perform doubleentry accounting, you use the accounting equation, also called the balance sheet formula, to ensure your company’s assets equal the sum of your company’s liabilities and shareholder’s equity The accounting balance sheet formula makes sure your balance sheet stays balanced. Net Assets can be defined as the total assets of an organization or the firm, minus its total liabilities The number of net assets can be tallied out with the shareholder’s equity of a business One of the easiest ways to calculate net assets is by using the below formula Net Assets = Assets – Liabilities.

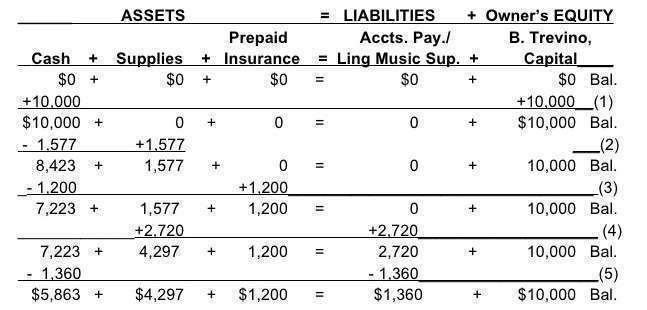

On day one, as the business is hardly more than an idea, your accounting formula would look like the following Assets = Liabilities Shareholders' Equity $0 = $0 $0. Formulas Accounting Ratios Liquidity Current ratio = current assets / current liabilities Quick ratio = (current asset inventory) / (current liabilities bank overdraft) Interest coverage ratio = (earnings before interest & tax) / (interest costs) OR EBIT net profit before tax finance/interest expense Profitability can be ratio (eg, 21) or percentage (multiply by 100) Return on. The formula for figuring the asset turnover ratio is To see how to use this formula, let's look at the example of a company that makes jewelry We'll call it Linda's Jewelry, and Linda is the owner.

Other Calculations Based on the Current Assets Formula Current Ratio = Current Assets ÷ Current Liabilities The current ratio tells you the percentage of your firm’s debts Quick Ratio = (Current Assets – Inventory Prepaid Expenses) ÷ Current Liabilities The quick ratio is similar to the. The formula for total current assets is a snapshot of your business’s shortterm financial health When accounting for current assets, here’s what you should keep in mind Current assets are balance sheet assets you have on hand that can be converted to cash within one year The formula for current assets involves adding all the assets. Formulas Accounting Ratios Liquidity Current ratio = current assets / current liabilities Quick ratio = (current asset inventory) / (current liabilities bank overdraft) Interest coverage ratio = (earnings before interest & tax) / (interest costs) OR EBIT net profit before tax finance/interest expense Profitability can be ratio (eg, 21) or percentage (multiply by 100) Return on.

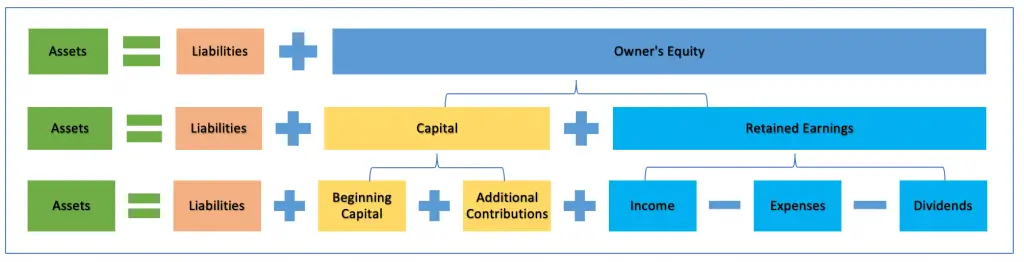

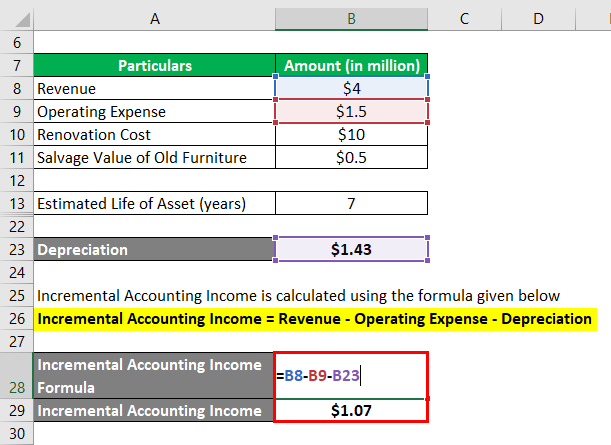

Accounting Equation Formula The basic formula of accounting equation formula is assets equal to liabilities plus owner’s equity Assets are what the company owns They include cash on hand, cash at banks, investment, inventory, accounts receivable, prepaid, advance, fixed assets, etc Liabilities are what the company owes They include. The accounting equation whereby assets = liabilities shareholders' equity is calculated as follows Accounting equation = $163,659 (total liabilities) $198,938 (equity) equals $362,597, (which. This asset is the one reflected in the books of accounts at the beginning of an accounting periodSo, the book value of the asset is written down so as to to reduce it to its residual value Now, as the book value of the asset reduces every year so does the amount of depreciation.

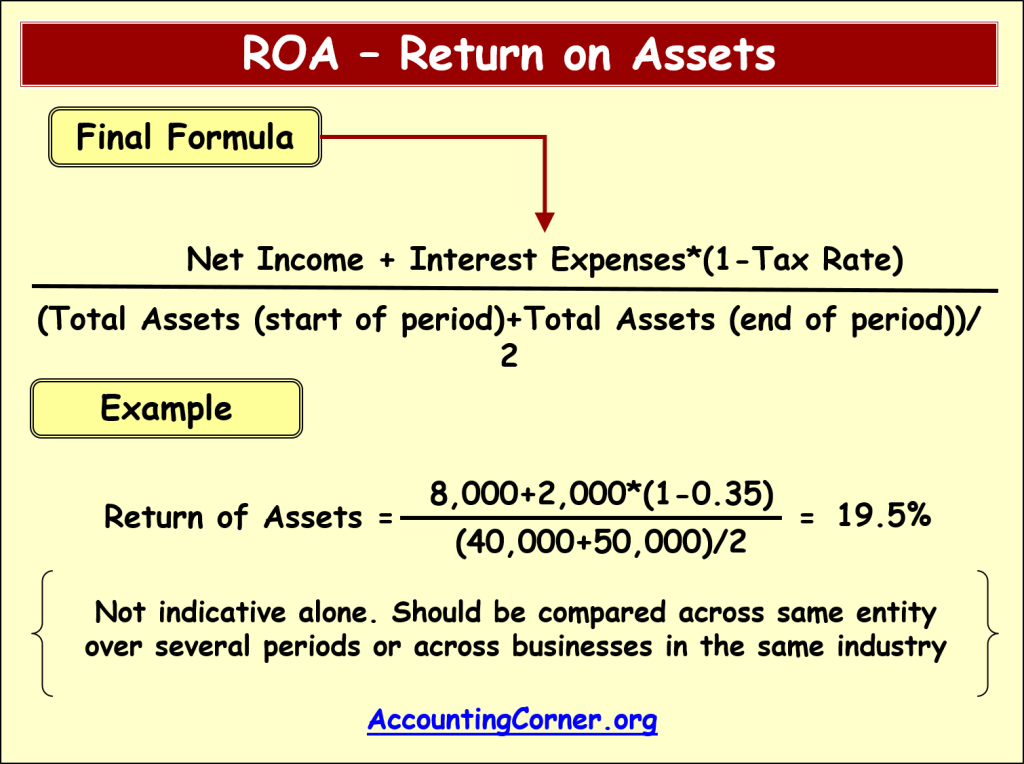

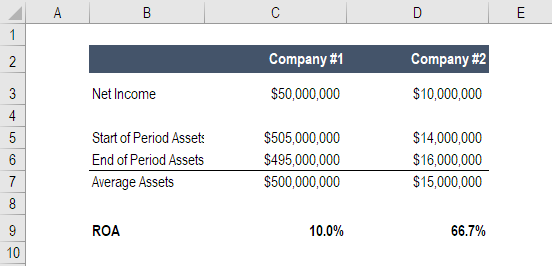

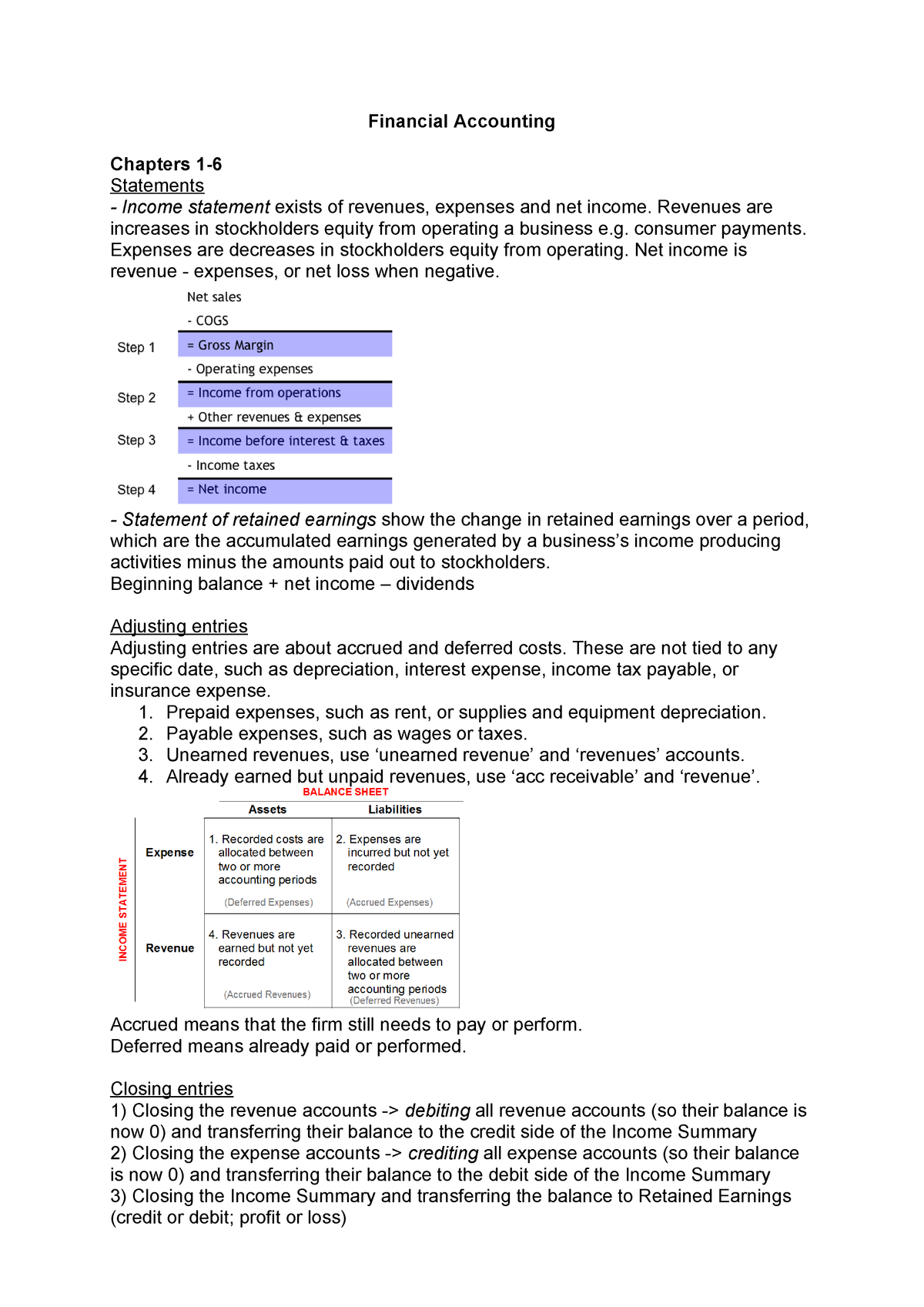

The most common ROA formula to calculate this ratio is to divide Net Income by Average Total Assets, ie ROA (Return on Assets) = Net Income / Average Total Assets Average value of assets is used since it varies through the periods and there might be quite a significant difference in value at the start of the accounting period and at its end. Accounting Equation Definition Accounting Equation states that sum of the total liabilities and the owner’s capital is equal to the company’s total assets and it is one of the most fundamental parts of the accounting on which the whole double entry system of accounting is based. The process of amortization in accounting reduces the value of the intangible asset on the balance sheet over time and reports an expense on the income statement each period to reflect the change.

Accounting equation Assets = Liabilities Stockholders’ (Owner’s) Equity classified balance sheet groups assets into the following classification current assets, investments, property, plant and equipment, and other assets Liabilities are classified as either current or longterm. To perform doubleentry accounting, you use the accounting equation, also called the balance sheet formula, to ensure your company’s assets equal the sum of your company’s liabilities and shareholder’s equity The accounting balance sheet formula makes sure your balance sheet stays balanced. There are various formulas for calculating depreciation of an asset Depreciation expense is used in accounting to allocate the cost of a tangible asset over its useful life of an asset Different methods of asset depreciation are used to more accurately reflect the depreciation and current value of an asset.

The basis of accounting balances and reports on profits and losses (financial statements) of almost all foreign organizations is based on a basic accounting equation This equation has the following formula (the accounting equation may be expressed as) Assets = Liabilities Owner’s equity. Formula The term operating profit means profit before interest and tax The term capital employed has been interpreted in different ways by different accountants and authors Some of the different meanings of capital employed are given below (1) Total of all assets ie, fixed as well as current assets. Either formula can be used to calculate the return on total assets When using the first formula, average total assets are usually used because asset totals can vary throughout the year Simply add the beginning and ending assets together on the balance sheet and divide by two to calculate the average assets for the year.

Calculate accounting ratios and equations Education Accounting Course Accounting Q&A Accounting Terms. Net Assets Formula Net Assets = Total Assets – Total Liabilities Total Assets Formula Total Assets = Total Liabilities Owner’s Equity Determining Service Life of an Asset For accounting purposes, an asset’s service life may not match its item life The service life of an asset is an accounting and management estimate of the useful. Net Asset Value Formula NAV = \dfrac{(Total\ Assets Total\ Liabilities)}{Total\ Outstanding\ Shares} Total Assets would include all the assets of the firm such as securities and other investments, cash and cash equivalents, accrued income, and receivables Note that these assets have to be expressed at their market value and not cost price.

ROA Formula / Return on Assets Calculation Return on Assets (ROA) is a type of return on investment (ROI) ROI Formula (Return on Investment) Return on investment (ROI) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost It is most commonly measured as net income divided by the original capital cost of the investment. Assets = Liabilities Shareholders' Equity The three components of the basic accounting formula are Assets These are the tangible and intangible assets of a business, such as cash, accounts receivable, inventory, and fixed assets Liabilities. 10 Useful Accounting Formulas The following are some of the most frequently used accounting formulas This list is not comprehensive, but it should cover the items you’ll use most often as you practice solving various accounting problems Balance sheet formula Assets – liabilities = equity (or assets = liabilities equity).

Calculate accounting ratios and equations Education Accounting Course Accounting Q&A Accounting Terms. Net Tangible Assets Formula Since tangible assets make up the majority of most companies’ balance sheets, it's a good metric to understand Unrestricted Net Assets Unrestricted net assets are donations made to a nonprofit organization, and the company can do what it needs to with this money (as long as it is legitimate). Formulas Accounting Ratios Liquidity Current ratio = current assets / current liabilities Quick ratio = (current asset inventory) / (current liabilities bank overdraft) Interest coverage ratio = (earnings before interest & tax) / (interest costs) OR EBIT net profit before tax finance/interest expense Profitability can be ratio (eg, 21) or percentage (multiply by 100) Return on.

What are net assets?. The reason for this is that this is the accounting equation formula which is the basic foundation of the doubleentry accounting system It is also known as an Accounting Equation balance sheet since it tells us the relation between balance sheet items ie Assets, Liabilities, and Equity. Assets belonging to this category are cash, cash equivalents, and inventory Non Current Assets As opposed to Current Assets, it normally takes a year or more to convert these assets into cash Noncurrent assets are further classified into Tangible and Intangible Assets Tangible assets manifest a physical existence or appearance.

Assets belonging to this category are cash, cash equivalents, and inventory Non Current Assets As opposed to Current Assets, it normally takes a year or more to convert these assets into cash Noncurrent assets are further classified into Tangible and Intangible Assets Tangible assets manifest a physical existence or appearance.

How To Read A Balance Sheet The Non Boring Version

Accounting Liquidity Definition Formula Top 3 Accounting Liquidity Ratio

/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg)

Asset Turnover Ratio Definition

Asset Formula In Accounting のギャラリー

Asset Turnover Ratio Double Entry Bookkeeping

Accounting Equation Formula How To Calculate Accounting Equation

Why Must Accounting Equation Always Balance Accountingo

Accounting Fundamentals Chapter 1 The Accounting Equation Top Hat

Depreciation Wikipedia

What Is The Accounting Equation Limited Liability Company Balance Sheet

Accounting Equation How Transactions Affects Accounting Equation

Accounting Equation Formula Example Concept Accountinguide

Dupont Analysis Wikipedia

The Accounting Equation What Is It Formula And Examples Purchasecontrol Software

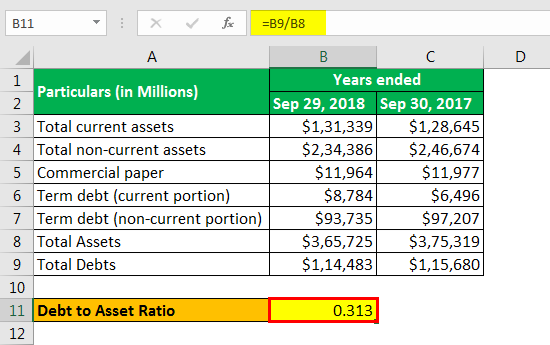

Debt To Asset Ratio Formula Calculate Debt To Total Asset Ratio

What Is An Accounting Equation Quora

Getting Started Accounting Equation T Accounts And Debits Credi

How Transactions Impact The Accounting Equation Principlesofaccounting Com

Accounting Equation Formula Example Concept Accountinguide

Q Tbn And9gct7i2xmciw5ftvktfmoudk8 Ewcvgp035uraasncdmezclyreh1 Usqp Cau

Effects Of Transactions On Accounting Equation Youtube

What Is The Accounting Equation Overview Formula And Example Bookstime

The Accounting Equation Youtube

Why Must Accounting Equation Always Balance Accountingo

Accounting Blog What Is Accounting Ratio

What Is The Accounting Equation Overview Formula And Example Bookstime

Accounting Equation Definition

What Is The Debt To Total Assets Ratio Online Accounting

Accounting Equation Accounting Basics

Common Financial Accounting Ratios Formulas Cheat Sheet From Davidpol Financial Accounting Cost Accounting Accounting

Accounting Equation Chapter 5 Accounting Equation Ppt Download

What Is Accounting Equation Checkout Accounting Play

Roa Return On Assets Ratio And Formula Accounting Corner

Accounting Equations That Always Hold Define Accrual Accounting

Chapter1 Accounting In Action Ppt Download

Calculating The Cash Ratio Abstract

Accounting Basic Equation

The Basic Accounting Equation Formula Explanation

Efficiency Ratio Formula Examples With Excel Template

What Is The Accounting Equation Overview Formula And Example Bookstime

The Importance Of Accounting Equation Accountants Day

Accounting Equation Formula How To Calculate Accounting Equation

1

The Accounting Equation Principlesofaccounting Com

Financial Ratios Balance Sheet Accountingcoach Financial Ratio Accounting And Finance Accounting

3

How To Calculate Assets A Step By Step Guide For Small Businesses

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

Property Plant And Equipment Pp E Definition

How Do You Calculate A Company S Equity

Cash Receipt Double Entry Bookkeeping

Study Expanded Accounting Equation Compute Revenues And Expenses Intro To Accounting

Accounting Equation Definition Basic Example How To Interpret

Total Assets Formula How To Calculate Total Assets With Examples

Efficiency Ratios Formula Step By Step Calculations

Asset Turnover Ratio Formula Calculator Excel Template

Accounting Rate Of Return Formula Examples With Excel Template

Accounting Equation Explained Definition Examples

What Is The Accounting Equation Examples Balance Sheet Context

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

Current And Noncurrent Assets The Difference

Accounting Clipart Accounting Equation Accounting Accounting Equation Transparent Free For Download On Webstockreview 21

Worked Example Accounting For Deferred Tax Assets The Footnotes Analyst

Accounting Equation In A Business Plan Plan Projections

Define Explain And Provide Examples Of Current And Noncurrent Assets Current And Noncurrent Liabilities Equity Revenues And Expenses Principles Of Accounting Volume 1 Financial Accounting

What Is Book Value Definition Purpose Calculation

What Is The Accounting Equation Overview Formula And Example Bookstime

The Accounting Equation May Be Expressed As A L O E Bookstime

Cheat Sheet Of Accounting Ratios Formula Sheet Finance Accounting Financial Accounting Accounting Student

O Level Accounting Methods Of Calculating Depreciation

Fundamental Accounting Equation Elements Example With Transactions

Carrying Amount Definition Formula How To Calculate

Return On Assets Roa Formula Calculation And Examples

Fundamental Accounting Equation Elements Example With Transactions

Dupont Analysis Wikipedia

How To Calculate Assets A Step By Step Guide For Small Businesses

Current Ratio Formula Examples How To Calculate Current Ratio

Turnover Ratio Formula Example With Excel Template

Fa Summary And Ratios Samenvatting Financial Accounting Financial Accounting Studeersnel

Return On Total Assets Formula Calculation Examples Excel Template

Level 3 Assets Definition Business Accounting

/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)

Accounting Equation Definition

Basic Accounting Equation Double Entry Bookkeeping

Getting Started Accounting Equation T Accounts And Debits Credi

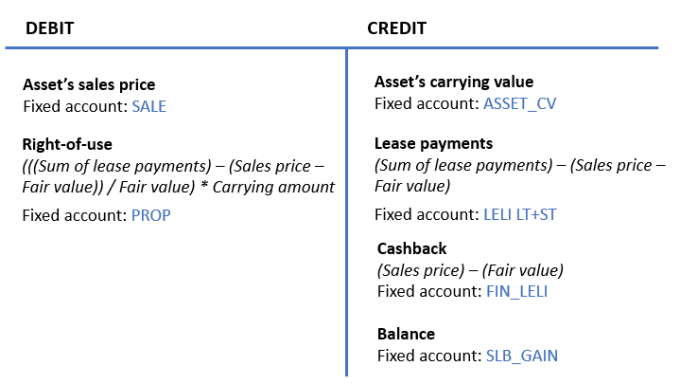

Registering A Sale And Leaseback Transaction

Accounting Equation Archives Double Entry Bookkeeping

Accounting Equation Assets Liabilities Capital Accounting Jobs Accounting And Finance Accounting Basics

Accounting Formula Example With Excel Template

Accounting Equation Overview Formula And Examples

Accounting Equation Formula How To Calculate Accounting Equation

Liquid Assets Meaning Accounting Treatment Importance

Debits And Credits Explained A Helpful Illustrated Guide Finally Learn

Grade 10 Lesson 8 Sole Trader Accounting Equation

1

Accounting Basic Equation

Using The Accounting Equation Adding Revenues Expenses Dividends Video Lesson Transcript Study Com

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

Define And Describe The Expanded Accounting Equation And Its Relationship To Analyzing Transactions Principles Of Accounting Volume 1 Financial Accounting

Fixed Assets Purchase Incurring A Liability Double Entry Bookkeeping

Working Capital Formula How To Calculate Working Capital

Net Asset Formula Step By Step Calculation Of Net Assets With Examples

Accounting Equation Expense And Revenue Accountingcoach

Balance Sheet Definition Examples Assets Liabilities Equity

Debt To Asset Ratio Formula Calculate Debt To Total Asset Ratio

Formulas Financial Accounting Studeersnel

2

Drawings Example