Crd Iv

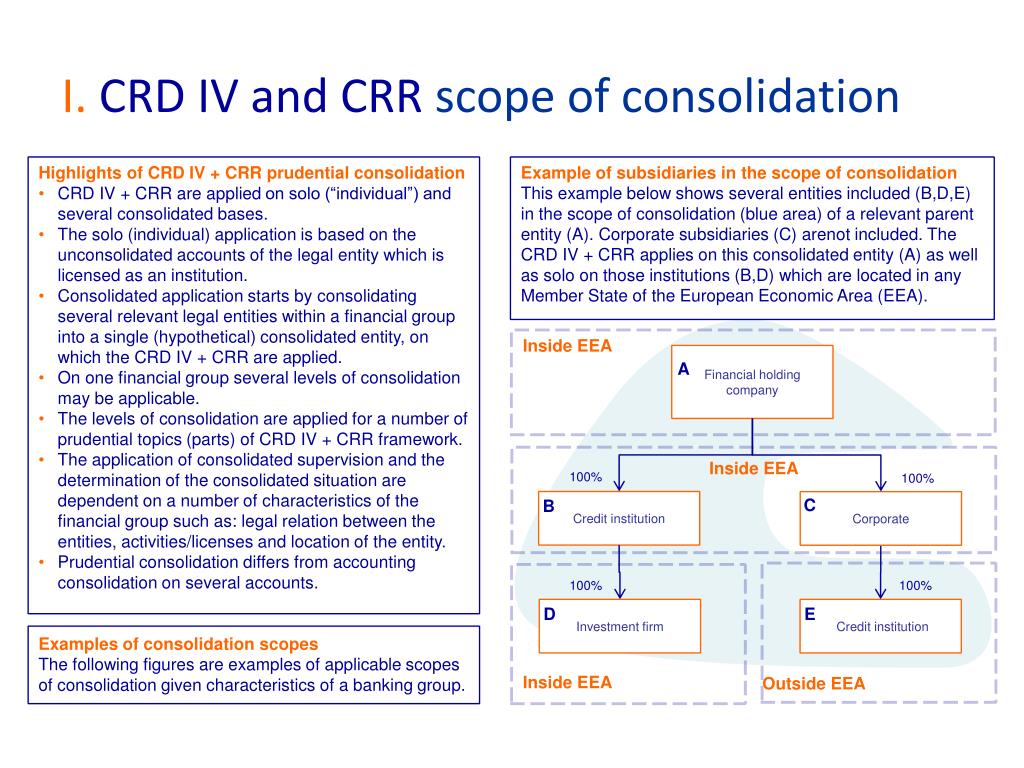

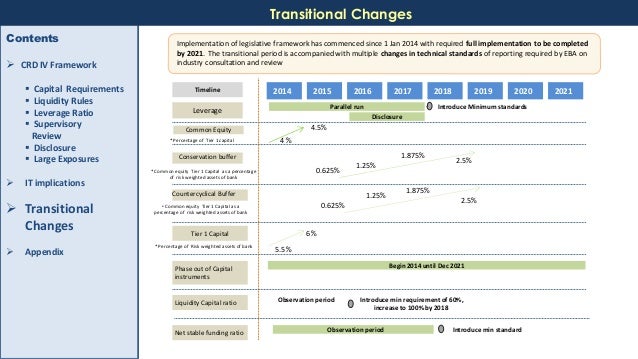

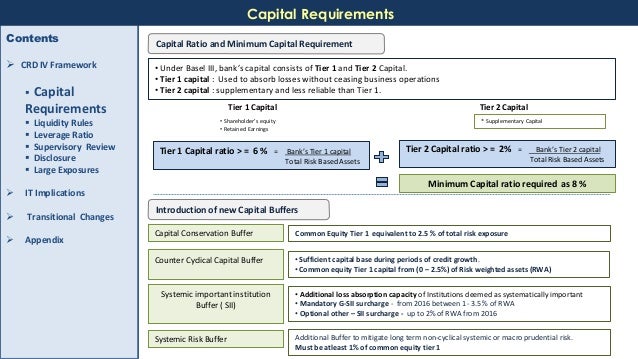

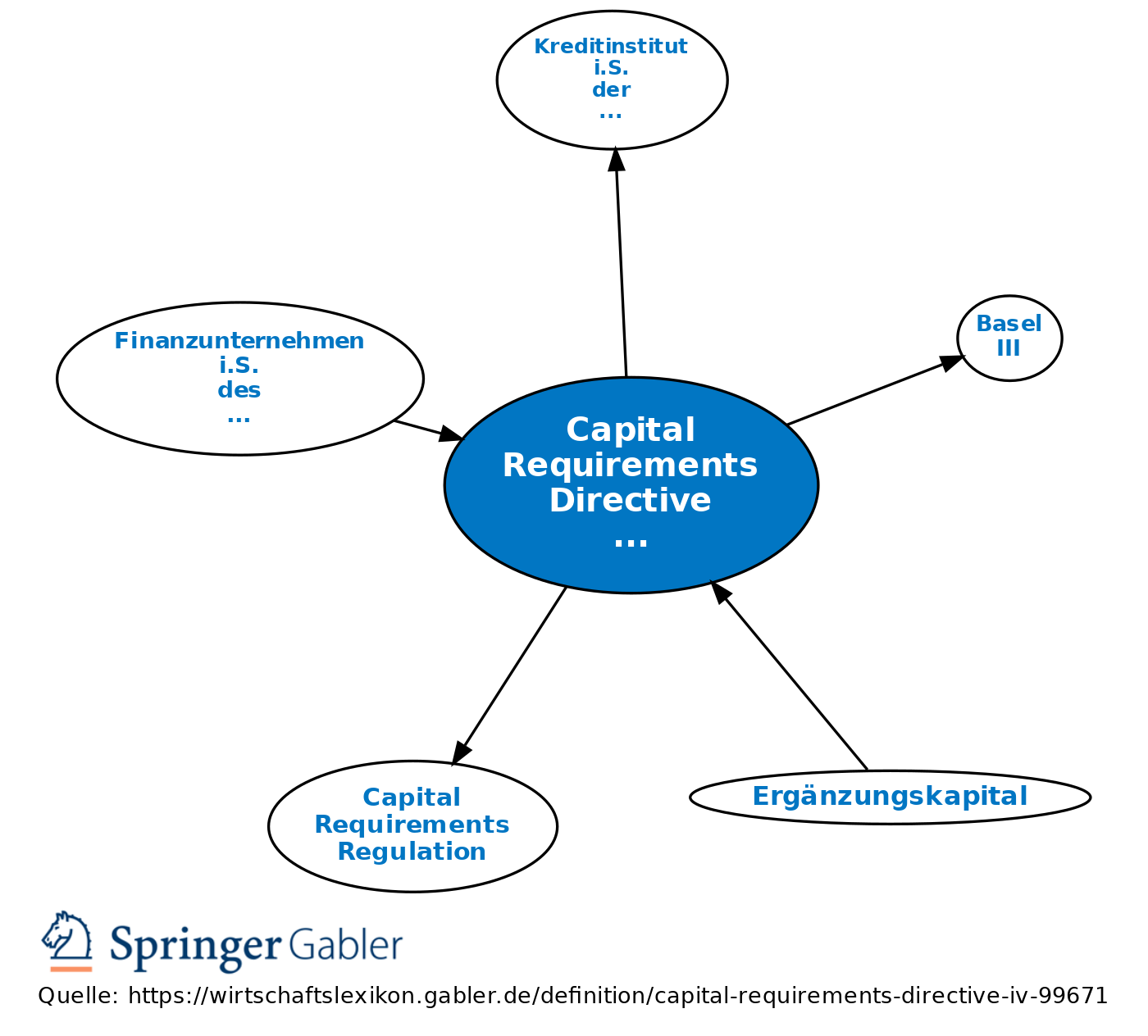

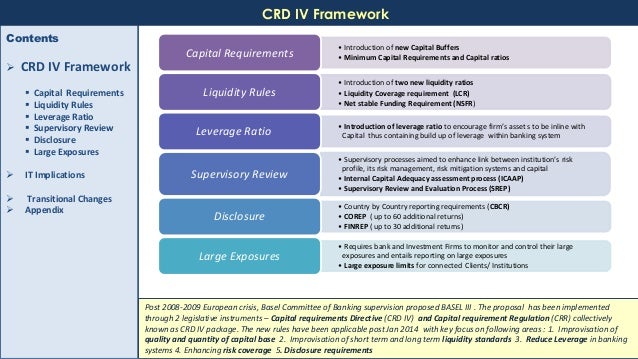

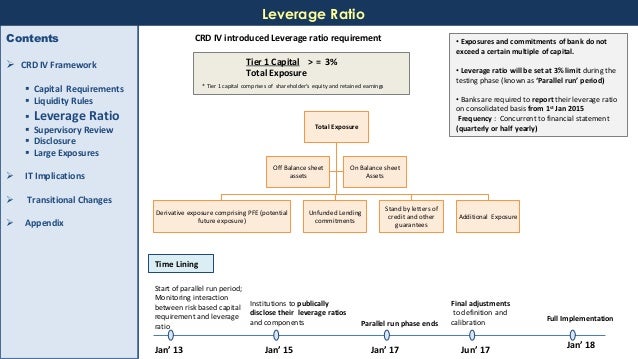

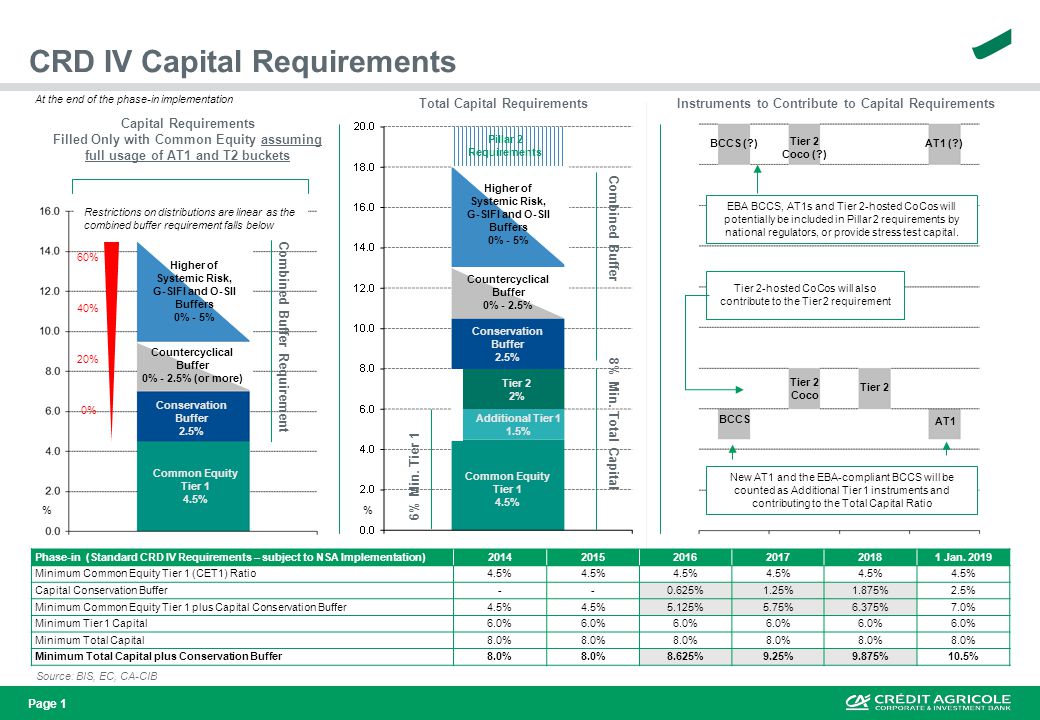

CRD IV Basel III aims to considerably increase both the quality and quantity of capital of credit institutions and investment firms with the ultimate aim of improving lossabsorption capacity in both going concern and liquidation scenarios It also intends to reduce the systemic risk The implementation of Basel III in Europe occurred via CRD IV, which is divided into two legislative instruments the Capital Requirements Directive (CRD) and the Capital Requirements Regulation (CRR).

Crd iv. The CRD IV Package is divided into two legislative instruments 1 A directive the Capital Requirements Directive (CRD), governing the access to deposittaking activities 2 A regulation the Capital Requirements Regulation (CRR), establishing the prudential requirements institutions need to respect. The fourth incarnation of the Capital Requirements Directive (CRD IV) is the EU's implementation of Basel III, the international regulatory capital framework It is one of the key responses to the financial crisis CRD IV sets prudential structures over capital requirements and constraints on remuneration It came into being on Jan 1st this year. The European Commission is in process of developing, in cooperation with the European Banking Authority, the CRD IV / CRR implementing legislation.

Article 29 Initial capital of particular types of investment firms;. CRD IV commonly refers to both the EU Directive 13/36/EU and the EU Regulation 575/13 1 The Capital Requirements Directives superseded the EU's earlier Capital Adequacy Directive that was first issued in 1993. TITLE IV INITIAL CAPITAL OF INVESTMENT FIRMS Article 28 Initial capital of investment firms;.

Statement of compliance with capital requirements directive BARCLAYS PLC Corporate Governance at Barclays Statement of Compliance with the Capital Requirements Directive (CRD IV) Article 96 of the fourth Capital Requirements Directive (CRD IV) requires an institution to include a compliance statement on its website in relation to Articles to 95 therein (the PRA and FCA have implemented these requirements in their Rulebook and Handbook, respectively). CRD IV is the EU implementation of Basel III which is a global agreement on Banking Supervision in response to the financial crisis, by the Basel Committee Within this response are proposals to increase the prudential soundness of banks, and building societies as well as cover certain MiFID investment firms within the European Union CRD IV is made up of The Capital Requirements Directive (13/36/EU) (CRD) which must be implemented through national law;. System Among the enhanced corporate governance rules, CRD IV requires diversity in board composition (without gender quotas) and improves transparency of bank activities (profits, taxes, and subsidies in various countries where banks operate) CRD IV strengthens the requirements with regard to corporate governance arrangements and processes.

Directive 13/36/EU of the European Parliament and of the Council of 26 June 13 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 02/87/EC and repealing Directives 06/48/EC and 06/49/EC Text with EEA relevance. CRD IV strengthens the requirements with regard to corporate governance arrangements and processes and introduces new rules aimed at increasing the effectiveness of risk oversight by Boards, improving the status of the risk management function and ensuring effective monitoring by supervisors of risk governance. The existing Capital Requirements Directive, known as CRD IV, came into effect on 1st January 14 The UK Regulators (the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) are responsible for prudentially regulating firms subject to CRD IV requirements CRD IV is the EU implementation of Basel III which is a global agreement on Banking Supervision in response to the financial crisis, by the Basel Committee.

Implementing a specific notification process to follow in the situation where the variable component of Identified Staff’s total remuneration would exceed the 11 ratio Based on Article 94(1)(g)(ii) of Directive 13/36/EU (CRD IV), the variable component of the total remuneration of staff members whose professional activities have a material impact on the risk profile of credit institutions and investment firms ( “Identified Staff”) shall not exceed 100 % of the fixed component (11. 2 The proposal divided the current CRD into two legislative instruments a Directive (Capital Requirement Directive IV – “CRD IV”) and a Regulation (Capital Requirement Regulation – “CRR”) – collectively known as the “CRD IV package” 3 The final consolidated text was published in the Official Journal of the EU at the end of June 13. The proposal divided the current CRD into two legislative instruments a Directive (Capital Requirement Directive IV – “CRD IV”) and a Regulation (Capital Requirement Regulation – “CRR”) – collectively known as the “CRD IV package” 3.

Capital requirements directive (CRD IV) transposition status First published on 25 January 17 (last update on 1 February ) Author Financial Stability, Financial Services and Capital Markets Union Directive 13/36/EU Transposition deadline 31 December 13 Full transposition status 27 Member States. Interactive Single Rulebook The Interactive Single Rulebook is an online tool that provides a comprehensive compendium of the level 1 text for the Capital Requirements Regulation (CRR2);. CRD IV and CRR regulatory capital checklist—derivatives The Capital Requirements Regulation (EU) 575/13 (CRR) sets out the prudential rules which apply to credit institutions which are regulated under the Capital Requirements Directive 13/36/EU (CRD IV and, together with CRR, the CRD IV package)The main aim of the CRD IV package is to provide a 'single rulebook' across the EU covering regulatory capital requirements, corporate governance and penalties.

Based on Article 94(1)(g)(ii) of Directive 13/36/EU (CRD IV), the variable component of the total remuneration of staff members whose professional activities have a material impact on the risk profile of credit institutions and investment firms ( “Identified Staff”) shall not exceed 100 % of the fixed component (11 ratio). The Capital Requirements Directive IV ( CRD IV) contains remuneration requirements that aim to ensure that remuneration policies are consistent with and promote sound and effective risk management, do not provide incentives for excessive risk taking and are aligned with the longterm interests of the institutions across the EU The FCA implemented the CRD IV remuneration requirements in SYSC 19A and SYSC 19D of the FCA Handbook. CRD IV (also referred to as CRD 4 or CRD4) was a major package of reforms to the EU's capital requirements regime for credit institutions and investment firms A key part of these reforms was the adoption of the CRD IV Directive ( 13/36/EU) and the Capital Requirements Regulation ( 575/13) (CRR), which replaced the Capital Requirements Directive ( 06/48/EC and 06/49/EC) (CRD).

The Capital Requirements Directive, CRD IV, is poised to restrict incentive compensation for an important segment of banking employees As a result, a number of firms are struggling to structure attractive reward packages so they can continue to compete effectively for talent with firms that will not be covered by this legislation. The CRD IV Directive ( 13/36/EU) and the Capital Requirements Regulation ( 575/13) (CRR) (collectively CRD IV) set out prudential requirements for EU credit institutions and investment firms They also contain core requirements for the regulation and supervision of credit institutions, including authorisation, passporting and governance. CRD IV Capital Requirements Directive (CRD) 13/36/EU The Capital Requirements Directive, or CRD for short, is one of the two legal acts comprising the new Capital Requirements Directives (CRD IV) The other element of the CRD is the Capital Requirements Regulation, or CRR for short The CRD is the legal framework for the supervision of credit institutions, investment firms and their parent companies in all Member States of the European Union and the EEA, and will be the basis of the.

The CRD IV Directive ( 13/36/EU) and the Capital Requirements Regulation ( 575/13) (CRR) (collectively CRD IV) set out prudential requirements for EU credit institutions and investment firms They also contain core requirements for the regulation and supervision of credit institutions, including authorisation, passporting and governance. CRD IV European Bank Reporting bedding down By Dave Nitchman The level of coordinated focus, at a national as well as at a panEuropean basis, on improving data quality is very impressive, although clearly it is still early days Read more. The Capital Requirements Directive, CRD IV, is poised to restrict incentive compensation for an important segment of banking employees As a result, a number of firms are struggling to structure attractive reward packages so they can continue to compete effectively for talent with firms that will not be covered by this legislation.

CRD IV Capital Requirements Directive (CRD) 13/36/EU The Capital Requirements Directive, or CRD for short, is one of the two legal acts comprising the new Capital Requirements Directives (CRD IV) The other element of the CRD is the Capital Requirements Regulation, or CRR for short The CRD is the legal framework for the supervision of credit institutions, investment firms and their parent companies in all Member States of the European Union and the EEA, and will be the basis of the. CRD IV allows firms to apply remuneration principles in a way that is appropriate to their size, internal organisation, and the nature and scale of their activities It does not specify conditions under which remuneration requirements for variable remuneration that is to be deferred, or paid in. In 13, the Capital Requirements Directive (CRD) IV package entered into application, comprising Directive 13/36/EU and Regulation (EU) No 575/13 The framework, mainly designed for banks, also applies to investment firms, including those which trade commodities.

The firms affected by the UK CRR/CRD IV are investment firms that were previously subject to the EU Capital Requirements Directive (CRD) and the Capital Requirements Regulation (CRR) – collectively referred to as CRD IV, including. CRD IV, or the Capital Requirements Directive is an EUwide legislative package that includes prudential rules for banks, building societies and investment firms The aim of CRD IV is to implement the main Basel III reforms and to prevent future financial crises by ensuring financial transparency across the EEA (European Economic Area). The Capital Requirements Directive (CRD IV) was implemented into UK law primarily through our, and the Prudential Regulation Authority (PRA), rulebooks We have made the necessary amendments to our Handbook , including all our prudential sourcebooks, and the Treasury has amended the UK CRR, to make sure that they continue to operate effectively following Brexit.

V), which introduced several amendments to the remuneration rules of Capital Requirements Directive IV (CRD IV) Members States have until 28 December to implement CRD V Until then, CRD IV and the current remuneration guidelines of the European Banking Authority (EBA) will remain in force Notably, the controversial “bonus cap” will continue to apply under CRD V The new Directive will implement material changes to the following areas. Capital Requirements Directive IV (CRD IV) is an EU legislative package covering prudential rules for banks, building societies and investment firms. CRD IV Disclosure Article of the Capital Requirements Directive IV (CRD IV) requires credit institutions and investment firms in the EU to disclose annually, specifying, by Member State and by third country in which it has an establishment, the following information on a consolidated basis for the year ended 31 December 13 name, nature of activities, geographical location, turnover and number of employees, by 1 July 14.

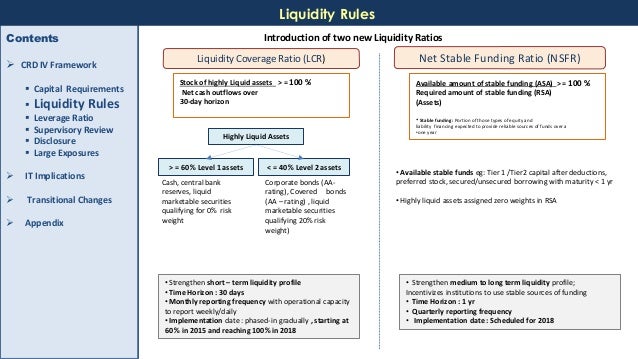

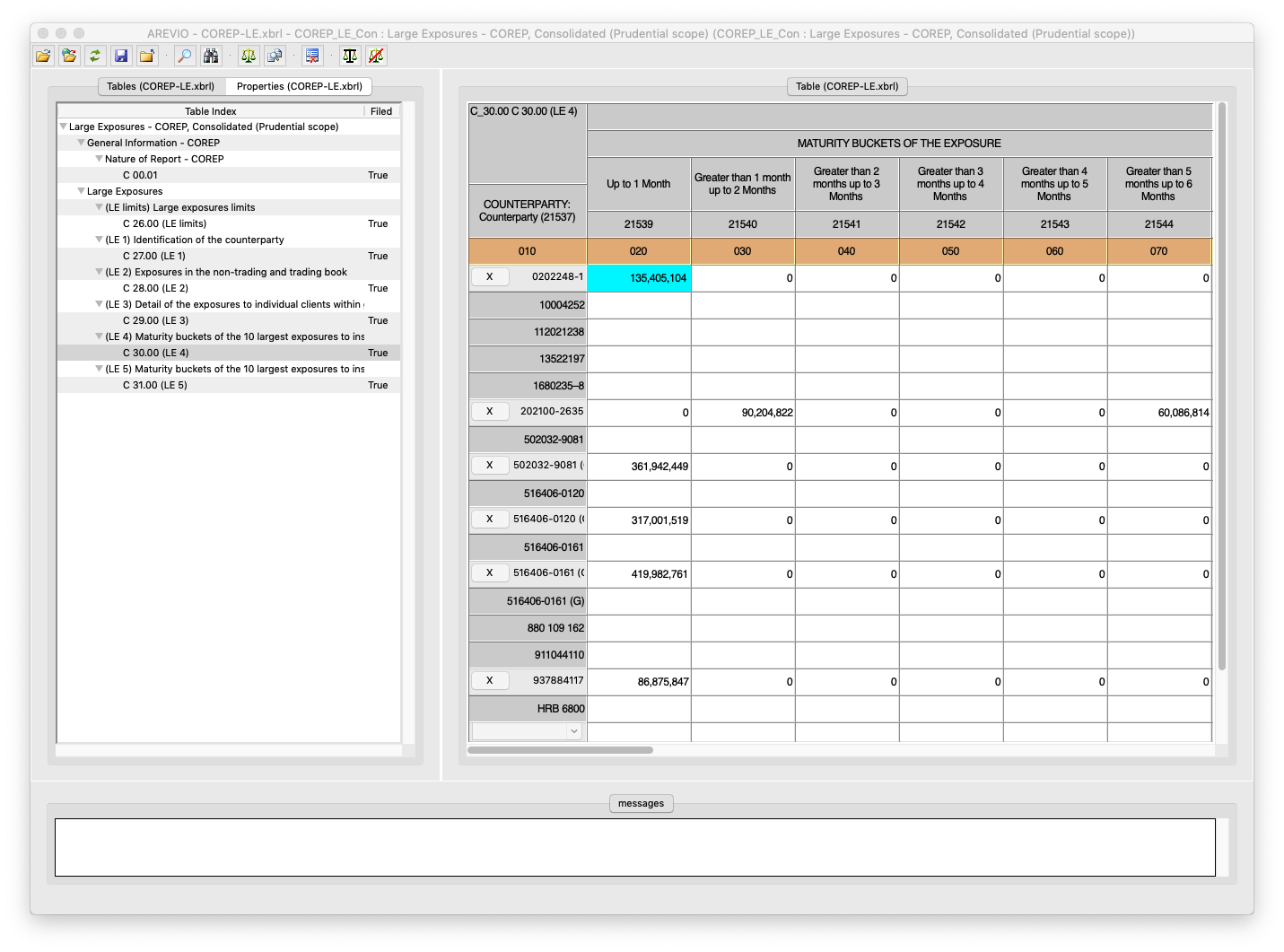

As part of the Capital Requirements Directive IV (CRD IV), the European Banking Authority (EBA) has introduced a harmonized European reporting framework for prudential information (COREP) and financial information (FINREP) FINREP is based on international financial reporting standards (IAS/IFRS) in the EU. The Deposit Guarantee Schemes Directive (DGSD);. The Capital Requirements Directive IV (CRD IV) introduced several remuneration principles in order to curb excessive risk taking and short termism in the financial services sector At the end of last week, the European Council formally adopted the text of CRD V CRD V makes several amendments to CRD IV It will be published in the EU Official Journal in June and Member States then have until 1 January 21 to transpose it into national law.

The financial crisis highlighted problems in banks’ risk management, and in the regulatory framework In 13, CRD IV and CRR – the EU legislation that implemented Basel III – sought to address many of these problems, such as the quantity and quality of banks’ capital and liquidity resources. Anti Money Laundering Directive (AMLD);. Coverage of the banking system was notably high for Group 1 banks, reaching 100% in many jurisdictions (aggregate coverage in terms of CRD IVCRR riskweighted assets (RWA) 960%), while for Group 2 banks it was lower, with more variation acrossjurisdictions (aggregate coverage 237%).

CRD IV capital buffers Background to CRDIV capital buffers CRD IV capital buffers—an overview CRD IV buffers, the Capital Planning Buffer and the introduction of the PRA buffer Impact on a bank’s capital requirements Capital buffers and capital raising Breaching capital buffers Interaction with total loss absorbing capacity. Directive 19/878 of the European Parliament and of the Council amends the fourth Capital Requirements Directive, or CRD IV (Directive 13/36/EU) The amendments to CRD IV relate to exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers, and capital conservation measures CRD V shall enter into force on the twentieth day following that of their publication in the Official Journal of the European Union. The minimum deferral period will increase from “three to five years” to “four to five years", impacting the three year deferral currently applied to “Other MRTs” under Luxembourg rules The restriction under CRD IV on listed firms using phantom awards to satisfy the payment in instruments requirement will be removed.

The Capital Requirements Directive (CRD5);. CRD IV Basel III aims to considerably increase both the quality and quantity of capital of credit institutions and investment firms with the ultimate aim of improving lossabsorption capacity in both going concern and liquidation scenarios It also intends to reduce the systemic risk The implementation of Basel III in Europe occurred via CRD IV, which is divided into two legislative instruments the Capital Requirements Directive (CRD) and the Capital Requirements Regulation (CRR). The UK CRR/CRD IV include a reporting framework for Financial Reporting (FINREP) and Common Reporting (COREP) Find out more about the supervisory reporting frameworks, including guidelines and templates Common Reporting (COREP) covers the capital requirements and own funds reporting required in the UK Financial Reporting (FINREP) covers financial reporting for supervisory purposes based on International Accounting Standards (IAS)/International Financial Reporting Standards (IFRS), as.

System Among the enhanced corporate governance rules, CRD IV requires diversity in board composition (without gender quotas) and improves transparency of bank activities (profits, taxes, and subsidies in various countries where banks operate) CRD IV strengthens the requirements with regard to corporate governance arrangements and processes. CRD IV, or the Capital Requirements Directive is an EUwide legislative package that includes prudential rules for banks, building societies and investment firms The aim of CRD IV is to implement the main Basel III reforms and to prevent future financial crises by ensuring financial transparency across the EEA (European Economic Area). CRD IV means Directive 13/36/EU of the European Parliament and of the Council of 26 June 13 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 02/87/EC and repealing Directives 06/48/EC and 06/49/EC, as amended, supplemented or restated.

Article 31 Coverage for firms not authorised to hold client money or securities;. Draft Regulatory Technical Standards (RTS) on the method for the identification of the geographical location of the relevant credit exposures under Article 140(7) of the Capital Requirements Directive (CRD) Draft Regulatory Technical Standards on the calculation of credit risk adjustments. Bank Recovery and Resolution Directive (BRRD2);.

Overview As part of the Capital Requirements Directive IV (CRD IV), the European Banking Authority (EBA) has introduced a harmonized European reporting framework for prudential information (COREP) and financial information (FINREP) FINREP is based on international financial reporting standards (IAS/IFRS) in the EU. Article 32 Grandfathering provision. Article 30 Initial capital of local firms;.

Legislative history In 13, the EU introduced the socalled CRD IV package comprising Directive 13/36/EU and Regulation (EU) N° 575/13 This is the third set of amendments to the original banking directive (CRD), following two earlier sets of revisions adopted by the Commission in 08 (CRD II) and 09 (CRD III). CRD IV Directive by Practical Law Financial Services Related Content This practice note provides an overview of the CRD IV Directive ( 13/36/EU ) The CRD IV Directive applies to credit institutions and investment firms and contains provisions relating to, among other things, the authorisation of credit institutions, qualifying holdings, passporting, corporate governance (including remuneration), Pillar 2 supervisory activities and capital buffers. In 13, the Capital Requirements Directive (CRD) IV package entered into application, comprising Directive 13/36/EU and Regulation (EU) No 575/13 The framework, mainly designed for banks, also applies to investment firms, including those which trade commodities The rules mainly address the amount of capital and liquidity that banks and investment firms hold.

CRD IV Update As explained in some detail below, Ireland transposed Directive 13/36/EU (the “CRD IV Directive”) into domestic law on March 31, 14 by means of two regulations, namely the European Union (Capital Requirements) Regulations 14 which gives effect to the CRD IV Directive and the European Union (Capital Requirements) (No 2) Regulations 14, which gives effect to a number of technical requirements in order that Regulation (EU) No 575/13 (the “CRR”) can operate. Capital Requirements Directive IV (CRD IV) is an EU legislative package covering prudential rules for banks, building societies and investment firms.

Capital Requirements Directive Crd Iv And Capital Requirements Regulation Crr Europex

Crd Iv

Datatracks Crd Iv Solution To Banking Regulatory Reporting

Crd Iv のギャラリー

Crd Iv Challenge Manualzz

Www Eba Europa Eu Documents Crdiv Crr Basel Iii Monitoring Exercise Report 1309 Pdf Fdb 6aa6 442e Bfea Eabd7d3e13c1

Crd Iv Taylor Francis Group

Www Cms Lawnow Com Media Files Regzone Reports Smart Pdf Annex I Pdf La En Rev 7e347ec4 F1bb 4280 8b3d Ed21b Hash D1b6012cdd3d87dd6e3a00e4effcd3ebe

Fwp

Crd Iv From The New Responsibilities Of The Board Of Directors To The Impact On Profitability European Institute Of Management And Finance

2

Www2 Deloitte Com Content Dam Deloitte Nl Documents Financial Services Deloitte Nl Country By Country Reporting For The Financial Services Industry Pdf

Capital Requirement Directive Crd Iv De Betekenis Volgens Ing

Crd Iv Crr Own Funds And Capital Requirements Pwc Wissen

Ppt I Crd Iv And Crr Scope Of Consolidation Powerpoint Presentation Id

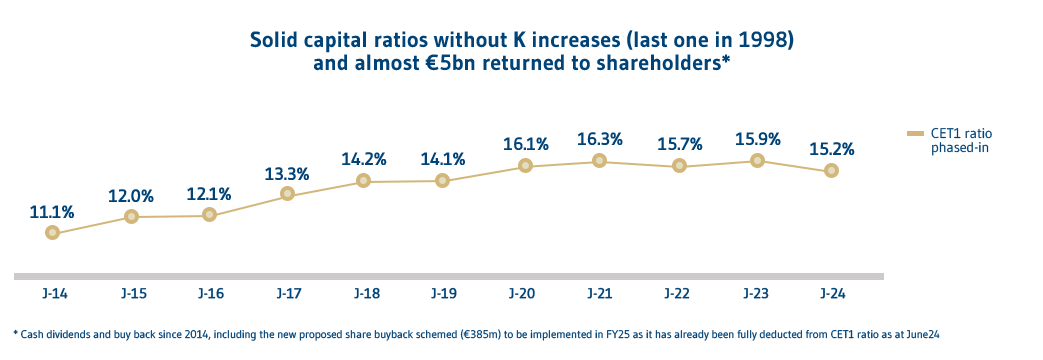

Capital Solidity Mediobanca Group

Rob Levison Design White Case Crd Iv

Www Davispolk Com Files Europeanregulatory1114 Pdf

European Regulatory Reforms Crd Iv

Crd Iv Jobs Average Salaries And Trends For Capital Requirements Directive Iv Cdr 4 Skills It Jobs Watch

2

Eba Crd Iv Corep Finrep Software And Service For Banks And Investment Firms

What Is Crd Iv

Quantitative Changes On Capital Requirements Proposed By Crd Iv Source Download Scientific Diagram

Crd Iv Edition

European Regulatory Reforms Crd Iv

European Commission Adoption Of Crd Iv Cicero Group

2

Overview Of Capital Requirements Directive Iv Download Table

The Eba Crdiv Crr Basel Iii Monitoring Exercise Shows Further Improvement Of Eu Banks Capital Leverage And Liquidity Ratios European Banking Authority

Crd Iv Reporting

Www a Org Uk Download File F Eyj1cmwioijodhrwczpcl1wvd3d3lmjiys5vcmcudwtcl3dwlwnvbnrlbnrcl3vwbg9hzhnclziwmtjclza1xc9bvfqxntc1nnyxlnbkziisinvzzxiiomzhbhnlfq

Eu Bank Regulation Crd Iv Greens Efa

Fillable Online Crd Iv Mfsa Fax Email Print Pdffiller

Eu Council Endorses Trilogue On Crd Iv Xbrl

European Regulatory Reforms Crd Iv

Crd Iv Xbrl Desktop Adapter Youtube

Geschafft Crd Iv Tritt Zum 1 Januar 14 In Kraft Ibs Innovative Banking Solutions Ag

Overview Of The Crd Iv Measures Regulation Dimension Measures Download Table

Www Cliffordchance Com Content Dam Cliffordchance Briefings 17 01 Brexit Dutch Bonus Cap Rules Pdf

Capital Adequacy Of Banks In North Cyprus From Eu Crd Iv Perspective Semantic Scholar

Silo Tips Download Implementation In Luxembourg Of The Capital Requirements Directive Iv Crd Iv

2

Capital Requirements Directive Iv Definition Gabler Banklexikon

Capital Requirements Directive Crd Iv

Mclagan Insights

Crd Iv Edition

Macro Prudential Policy And Its Instruments Online Presentation

Finnius Com Wp Content Uploads 18 08 Artikel Bart Bierman Crdiv Tvfr Pdf

Op Weg Naar Bazel Iii En Crd Iv Fundamentele Herziening Van Bazel Ii En Implementatie In De Europese Capital Requirements Directive Pdf Gratis Download

Crr Crd Iv Pdf Files Usfr Mevenshen Site

Crr En Crd Iv Laatste Loodjes Voor De Start Pdf Free Download

Kpmg Crd Iv On The App Store

Position Basel Iii Crr Crd Iv Eurochambres

Www Mayerbrown Com Media Files Perspectives Events Publications 13 08 German Legislator Decides To Cap Bonuses For Bank Files Get The Full Report Fileattachment Crdiv Eng Pdf

European Regulatory Reforms Crd Iv

Capital Ratio Equation And Overview Of Crd Iv Measures Download Scientific Diagram

Zoek Officielebekendmakingen Nl Stcrt 13 Pdf

Crd Iv Introduces

2

Http Www Toezicht Dnb Nl Binaries 50 Pdf

Crd Iv Capital Requirement Employment Besplatnaya 30 Dnevnaya Probnaya Versiya Scribd

Www Researchgate Net Profile Roger Rissi Publication Crd Iv Impact Assessment Of The Different Measures Within The Capital Requirements Directive Iv Links 5bbe96bc4efd Crd Iv Impact Assessment Of The Different Measures Within The Capital Requirements Directive Iv Pdf

Deutsche Borse Group Crd Iv Crr

Mclagan Insights

Crd Iv Jobs Average Salaries And Trends For Capital Requirements Directive Iv Cdr 4 Skills It Jobs Watch

Die Eigenkapitalvorgaben Nach Basel Iii Und Crr Crd Iv Unter Besonderer Berucksichtigung Der Relevanten Regelungen Fur Offentlich Rechtliche Sparkassen In Deutschland Buch

Bank Capital Adequacy Standards Crd Iv Europe S Transition To

Crd Iv For Investment Firms And Banks European Institute Of Management And Finance

Novosti Koje Donosi Crd Iv Omega Finance

Www2 Deloitte Com Content Dam Deloitte Lu Documents Financial Services Banking Lu Rna Transposition Crd Iv Luxembourg Pdf

Crd Iv Corep Reporting Solution Axiomsl

Www Cysec Gov Cy Cmspages Getfile Aspx Guid 151e0c3e 0fc1 4dda Ad5a 15dd8a957e71

European Regulatory Reforms Crd Iv

2

Capital Requirements Directive Iv Framework Credit Requirements Capital Requirements Directive Pdf Document

Deloitte Comment Letter On Hm Treasury Draft Regulations And Draft Guidance On Crd Iv Country By

Www Fca Org Uk Publication Documents Capita Requirements Directive Pdf

Dex Regulatory Suite Voor Crd Iv

What Is Crd Iv

Www Finextra Com Finextra Downloads Featuredocs Axiomsl crd 4 reporting Pdf

Basel S1 Bsl 3 Crd Iv On Vimeo

European Regulatory Reforms Crd Iv

Basel Iii Crd Iv Ziel Erreicht Ibs Innovative Banking Solutions Ag

Www Fmo Nl L En Library Download Urn Uuid C7f018 F7e6 4130 9593 4644d23fcb Fmo Statement Compliance Art 96 Crd Iv Pdf Format Save To Disk Ext Pdf

Www Reply Com Documents Img Emir Crd Iv Counterparty Credit Risk Capital Requirements Pdf

Crd Iv Finrep Reporting Solution Axiomsl

2

Crd Iv Unintended Consequence

Banks European Commission S Crr Crd Iv And Brrd Amendment Proposal 12 16 Article Research Center

Crd Iv And The Mandatory Structure Of Bankers Pay Ecgi

Crd Iv Capital Requirements Ppt Download

Ebi Europa Eu Wp Content Uploads 19 01 Cre Cc 81dit Agricole Cases Summary Pdf

Datatracks Crd Iv Solution To Banking Regulatory Reporting

Next Generation Banking T Systems Magyarorszag

2

Dex Regulatory Suite For Crd Iv

Crd Iv Crr Tickets London 16

Eba Crd Iv Corep Finrep Software And Service For Banks And Investment Firms

S7c Crd Iv Operational Compliance Training Course 17 By Storm 7 Issuu

Finance Watch S General Assessement Of Crd Iv Bill Finance Watch