Fixed Asset Accounting Process

Fixed assets management is an accounting process that seeks to track fixed assets for the purposes of financial accounting, preventive maintenance, and theft deterrence Organizations face a significant challenge to track the location, quantity, condition, maintenance and depreciation status of their fixed assets A popular approach to tracking fixed assets uses serial numbered asset tags.

Fixed asset accounting process. Gain best practices insight into the efficiency and effectiveness of your business entity's fixed asset and capital project accounting process groups by completing the Fixed Assets Accounting Open Standards Benchmarking Assessment. The fixed asset accounting process How long it will take to generate the asset number?. The term “fixed” translates to the fact that these assets will not be used up or sold within the accounting year A fixed asset typically has a physical form and is reported on the balance.

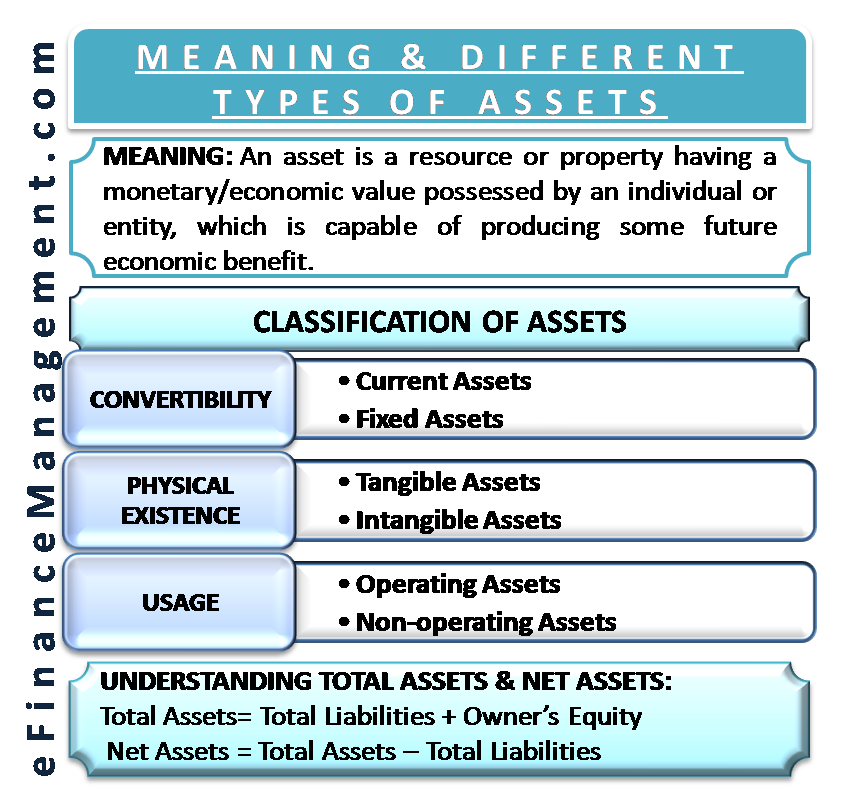

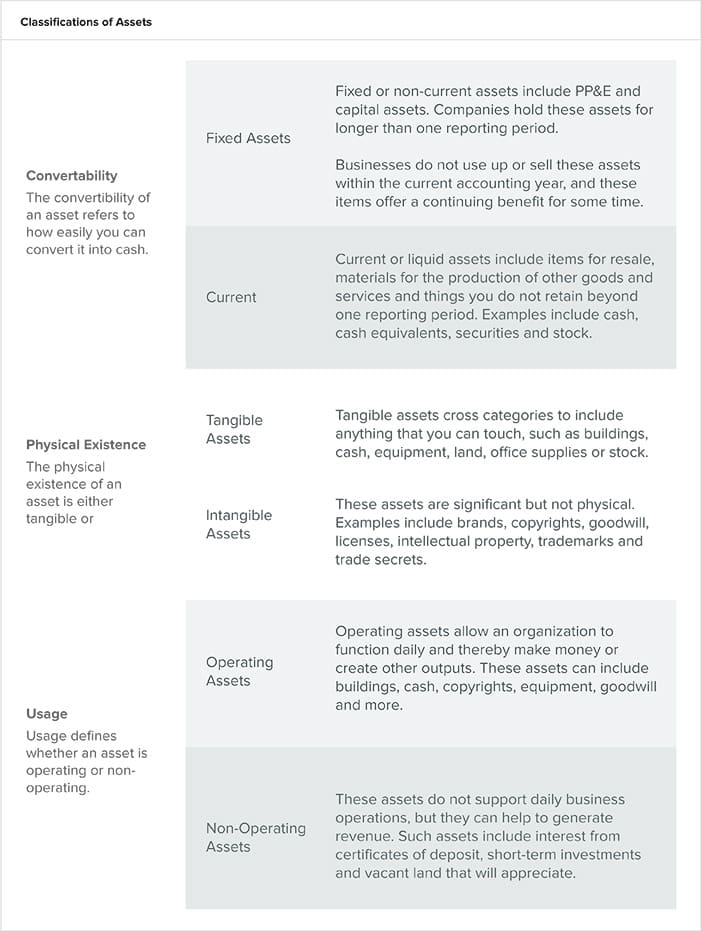

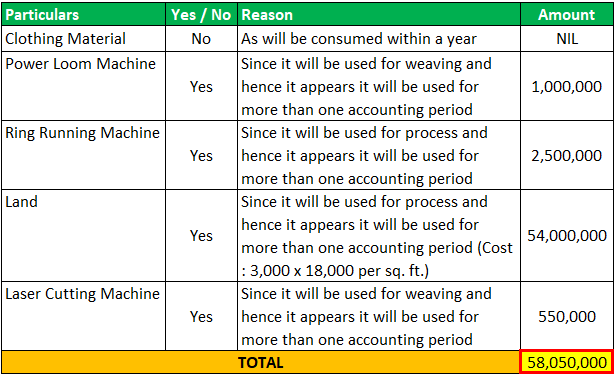

Fixed Assets vs Current Assets The concept of fixed and current assets is simple to understand The short explanation is that if it is an asset and is either in cash or likely to be converted into cash within the next 12 months (or accounting period), it is considered a current asset Fixed assets, on the other hand, as we said above, are not. The process of creation of Asset number is a one step process Every effort will be made to send the asset number within a single working day 21 With the fluctuations in the currency rate, will this process affect the Foreign orders. This risk and control matrix has been designed to help audit, IT risk and compliance professionals assess the adequacy and the effectiveness of application controls pertaining to the asset accounting (fixed assets acquiretoretire) business process in SAP R/3 environment A brief overview and description of some of the key features of this risk and control matrix.

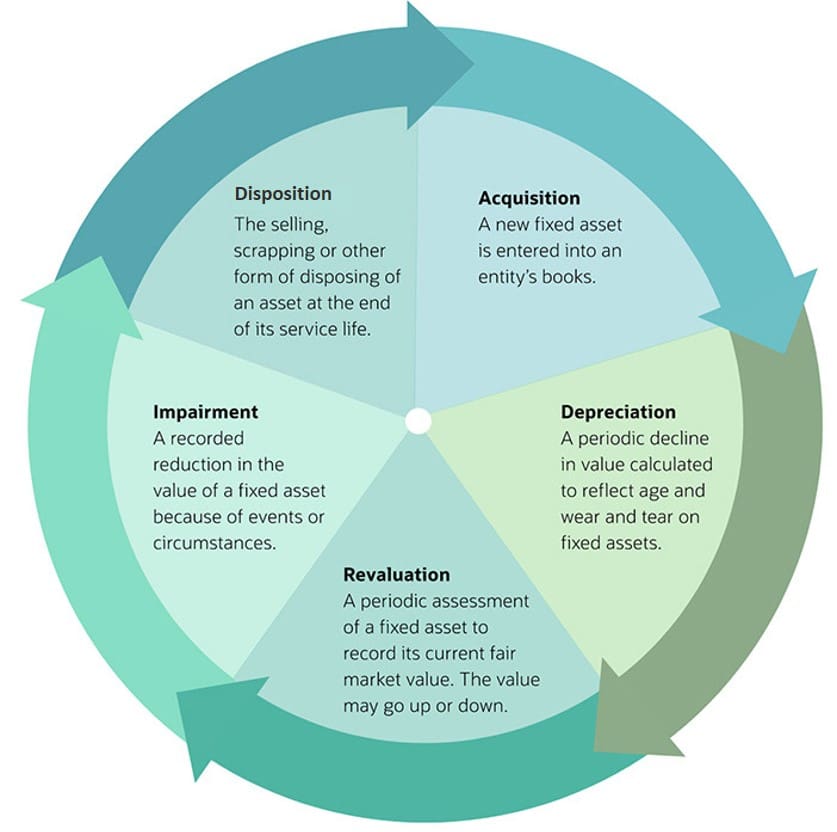

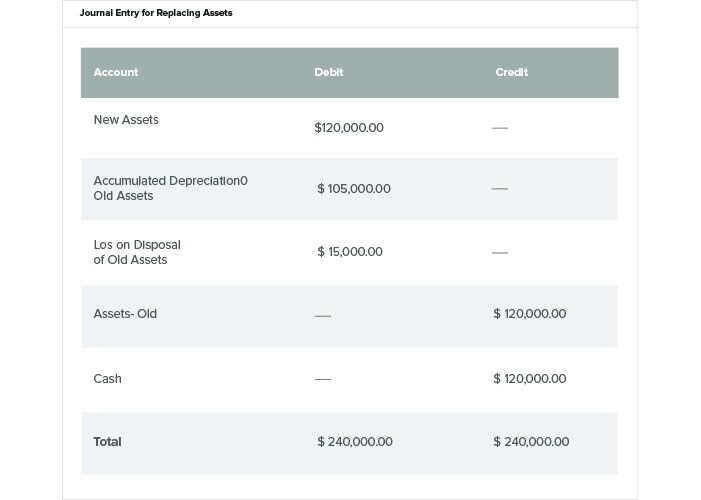

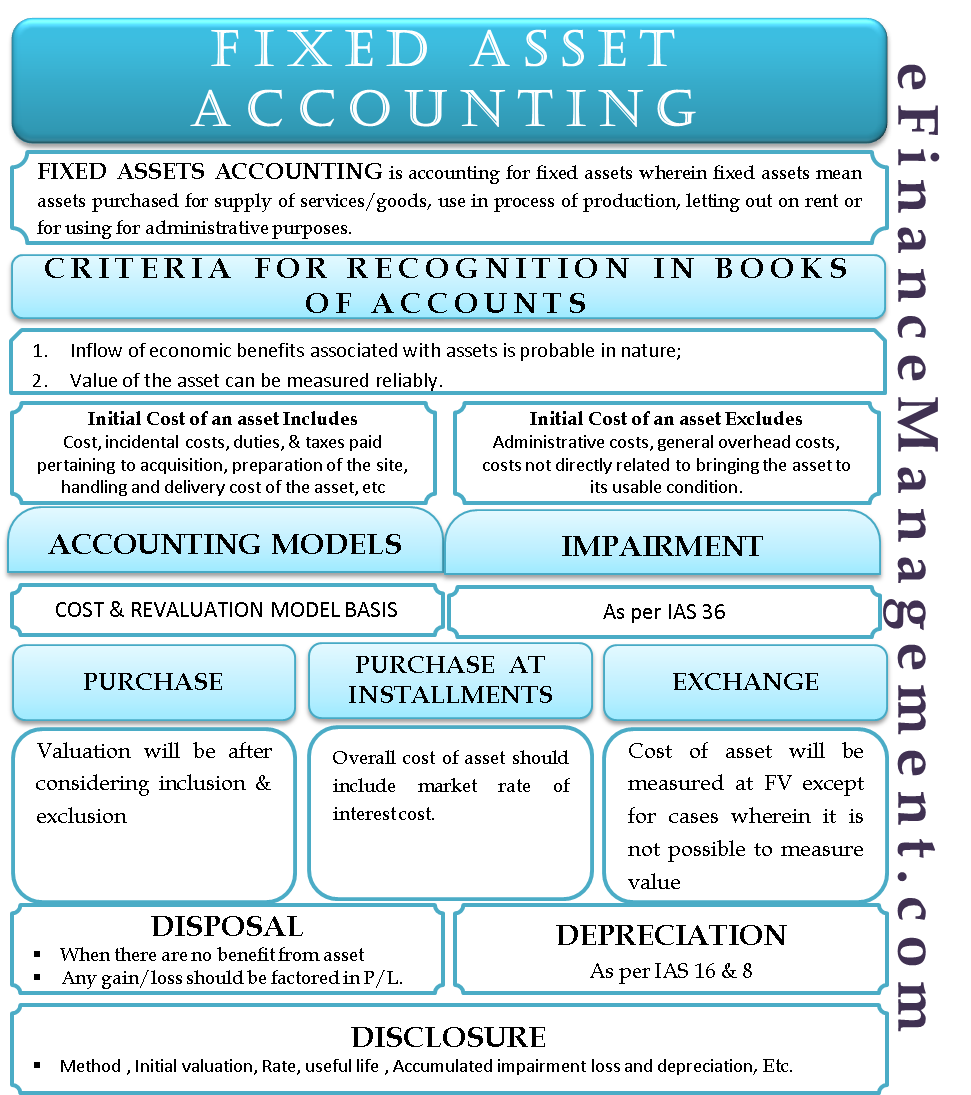

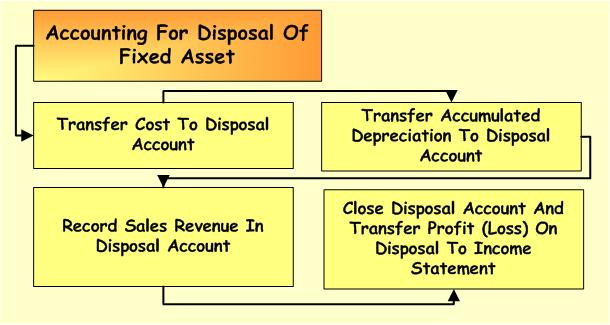

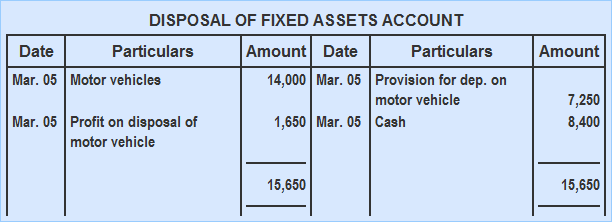

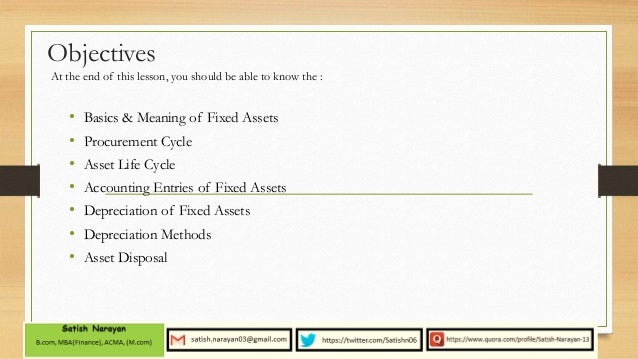

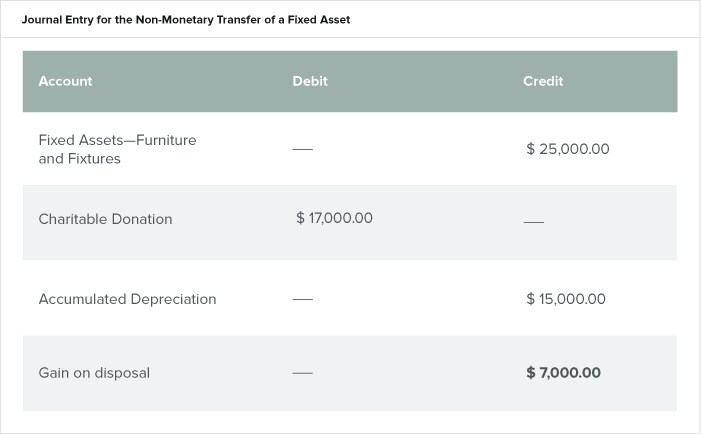

I know that I made the correct Fixed Asset accounts with the Original Cost and Depreciation accounts My question come in how to categorize the transaction of t. The FixedAsset Accounting Cycle Each fixed asset has a lifecycle that includes at least three of these stages purchase, depreciation, revaluation, impairment and disposal The FixedAsset Lifecycle These journal entries (see examples below) cover the transactions associated with the fixedasset lifecycle. Examples of Fixed Assets A fixed asset is something that will be used in the business and that has a useful life of.

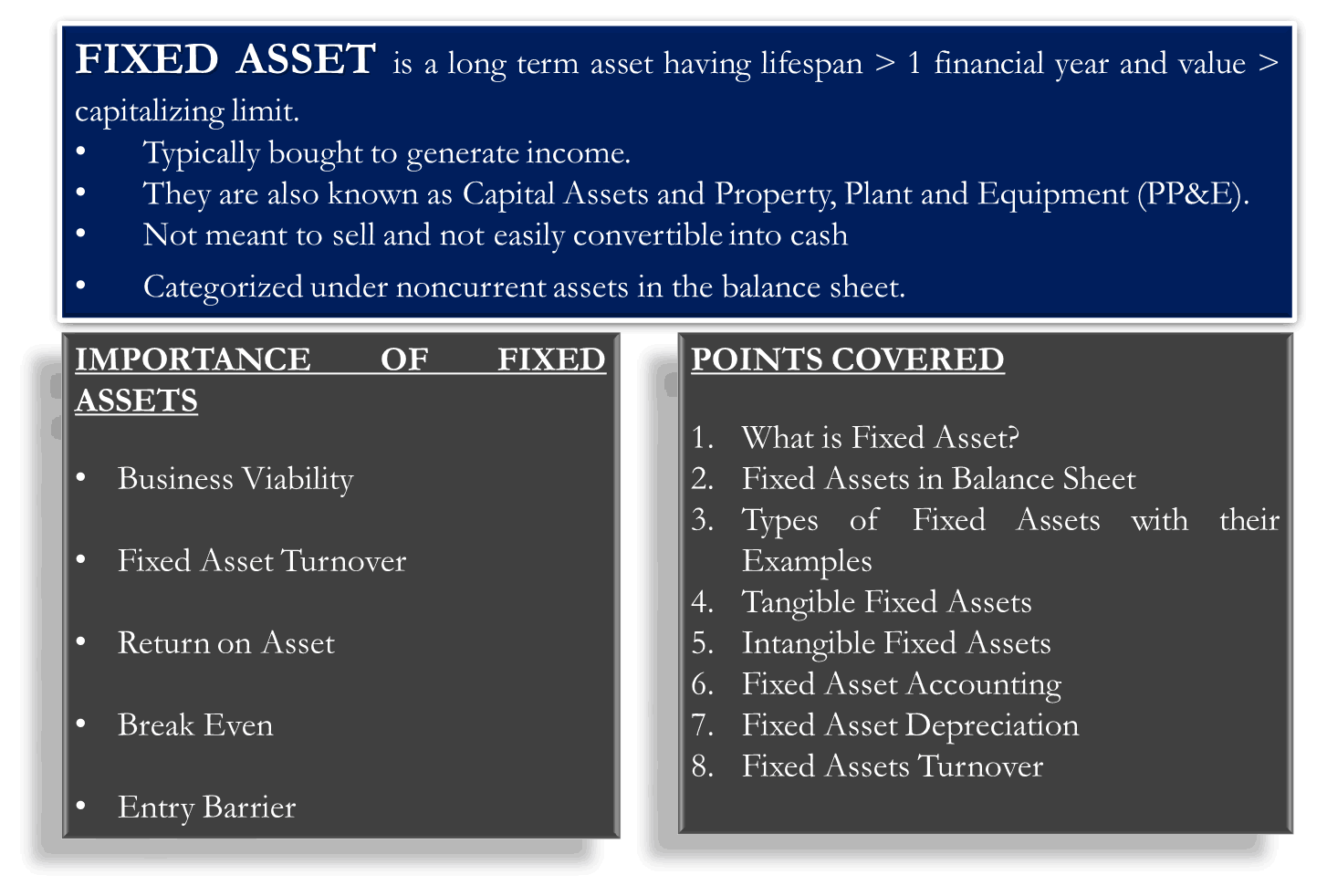

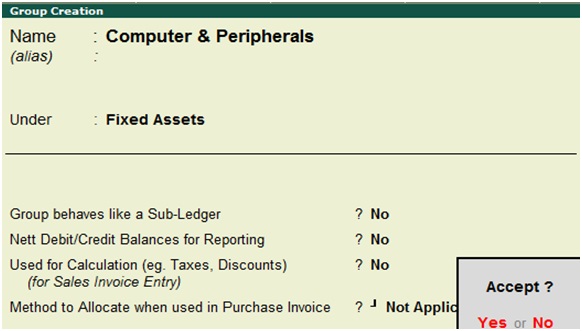

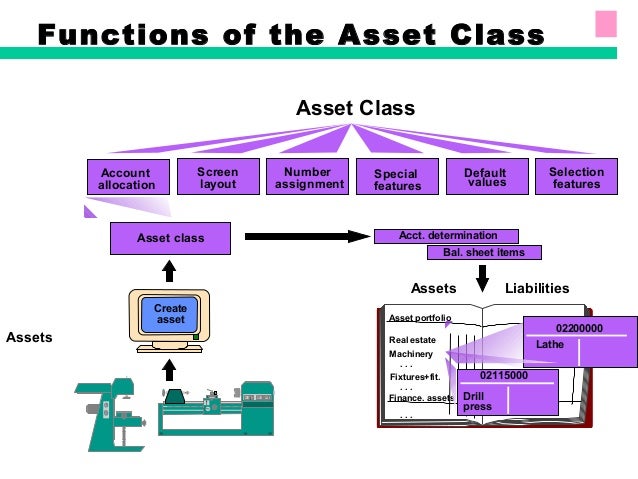

What is Fixed Asset?. Fixed asset accounting October 21, A fixed asset is an item having a useful life that spans multiple reporting periods, and whose cost exceeds a certain minimum limit (called the capitalization limit) There are several accounting transactions to record for fixed assets, which are noted below. The basic procedure is Assign an asset class Match the fixed asset to the company’s standard asset class descriptions If you are uncertain of Assign depreciation factors Assign to the fixed asset the useful life and depreciation method that are standardized for Determine salvage value.

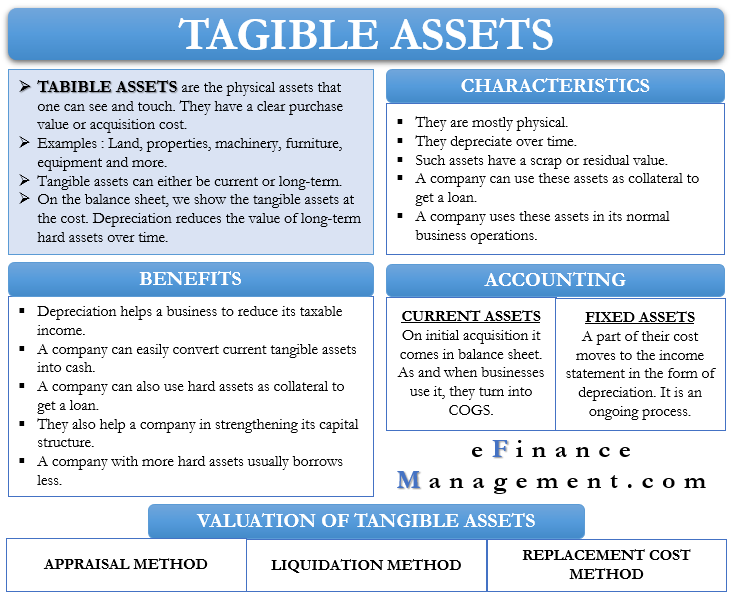

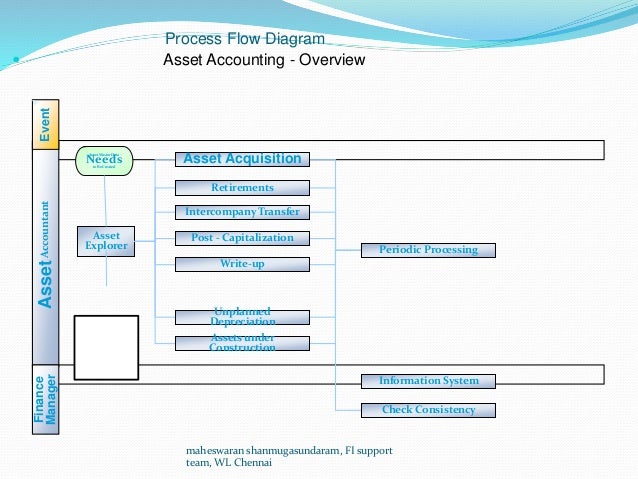

Fixed assets —also known as tangible assets or property, plant, and equipment (PP&E)—is an accounting term for assets and property that cannot be easily converted into cash The word fixed indicates that these assets will not be used up, consumed, or sold in the current accounting year. Upon successful completion of this course, participants will be able to Section 1 Recognize differences between an expense and a fixed asset, as well as further classify a fixed asset into a fixed asset category;. The Fixed Assets Packet describes how to create and maintain assets in MAGIC Key components within this package include integration points with Supplier Relationship Management (SRM), asset lifecycle, asset retirements, asset transfers, and the close process MAGIC Roles The MAGIC Roles used in these flows are FA Fixed Assets Property Officer.

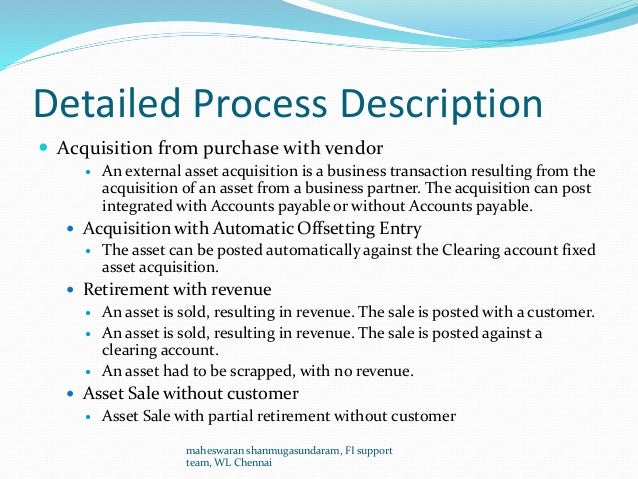

Http//wwwtechnofunccom presents another Functional Capsule on Fixed Asset process area In these functional capsules;. Accounting for costs incurred subsequent to the acquisition of the fixed asset Future costs are either capitalized OR expensed In general, costs incurred to achieve greater future benefits should be capitalized, whereas costs incurred to simply maintain a given level of service should be expensed Note that companies generally expense any expenditure below a minimum amount (materiality), eg. Introduction to Fixed Assets Fixed assets or long term assets have a long life and are for use within the business and not held for resale They are not part of the trading inventory, and are not involved in the day to day working capital cycle of the business so are not readily convertible into cash.

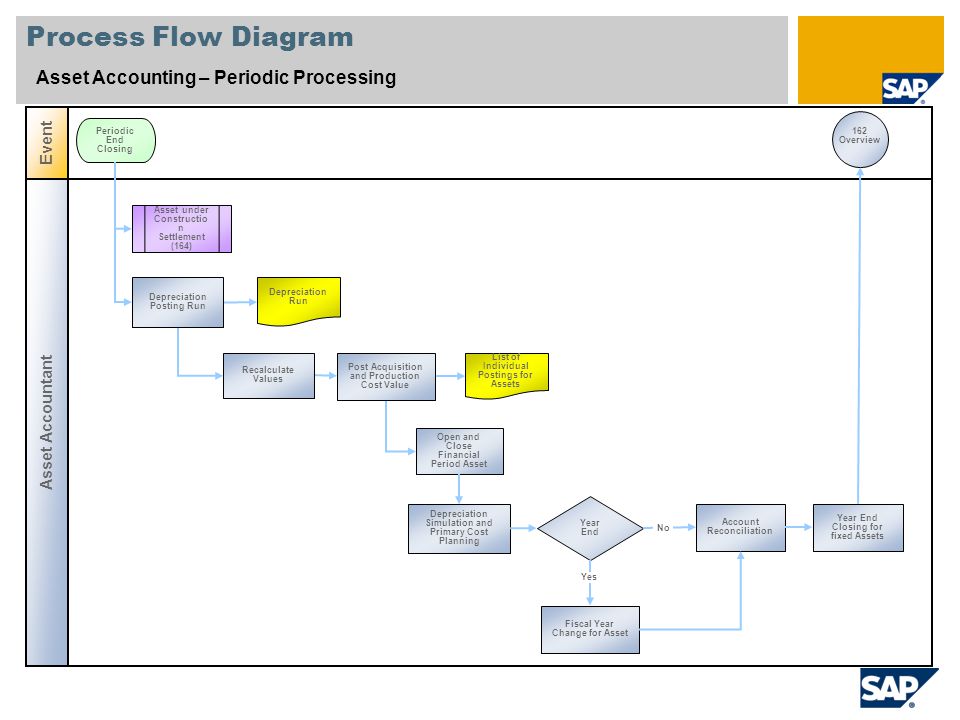

FixedAsset Accounting Process Classifications Tangible assets represent the physical items a company owns These items include property, plant and Relevant Cost The relevant cost is the first of three major items necessary to properly account for a fixed asset Useful Life The useful life of. YearEndClosing in Asset Accounting The process described in this blog assists you in keeping on top of Critical Factors, such as data consistency, which can involve a considerable amount of time and work during the yearend closing phase in asset accountingThis blog takes you through all of the steps necessary for an unproblematic yearend closing, before the critical external audit phase. Fixed asset management is the process of tracking and maintaining an organization’s physical assets and equipment Asset types include vehicles, computers, furniture and machinery Using an asset management system, organizations can Track and monitor fixed assets;.

Fixed Asset Accounting There may be a fee associated with this assessment, learn more Gain best practices insight into the efficiency and effectiveness of your business entity's fixed asset and capital project accounting process groups by completing the Fixed Assets Accounting Open Standards Benchmarking Assessment. Fixed Asset Accounting Policy Content 3 Publication 19 Review Schedule Related Documents Forms DEFINITIONS Capitalizable Assets A fixed asset with an expected useful life of greater than one year and the asset individually has a value or cost of $5,000 or greater at the date of acquisition. The process for moveable equipment and software will be as follows Units purchase items charging to one of the capital natural accounts between Plant Funds, upon review, if capitalizable, will add the asset to the new fixed asset system If not capitalizable, Plant Funds will ask the Units to move the expense to an appropriate.

"Technofunc" provides you with compr. Fixed assets management is an accounting process that seeks to track fixed assets for the purposes of financial accounting, preventive maintenance, and theft deterrence Organizations face a significant challenge to track the location, quantity, condition, maintenance and depreciation status of their fixed assets A popular approach to tracking fixed assets uses serial numbered asset tags. This process will help identify any fixed assets missing, fixed assets not recorded in accounting records, fixed assets moved from one location to another, fixed asset obsolescence, etc Company personnel can do this or a specialized service provider can be engaged to assist with the process.

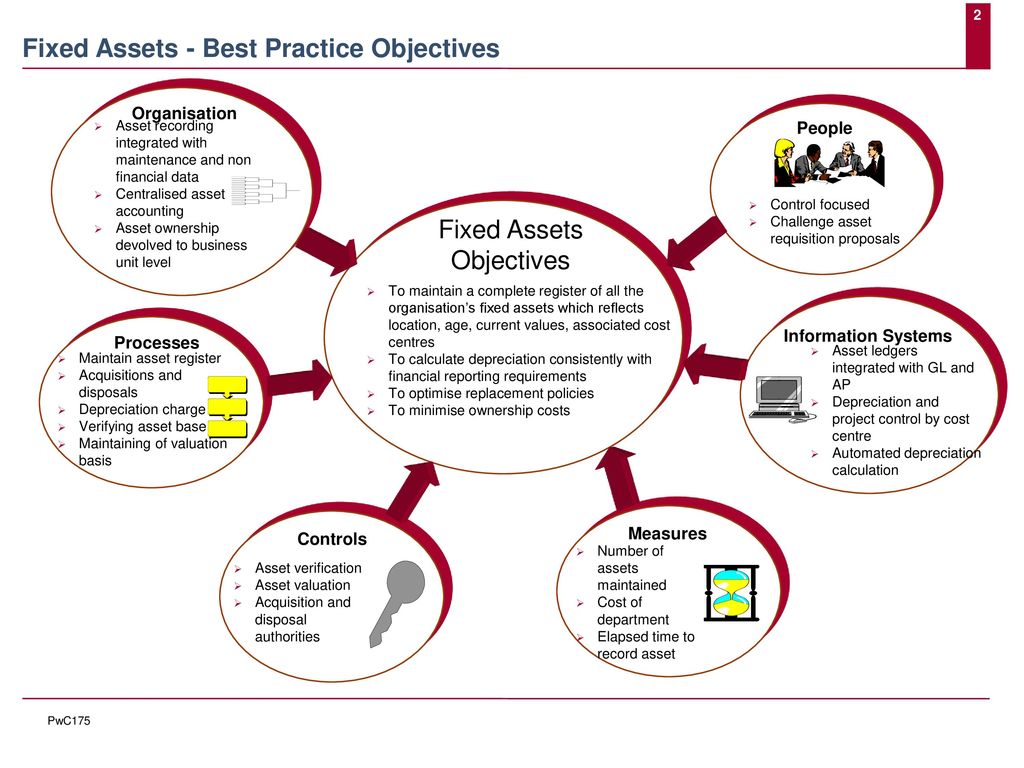

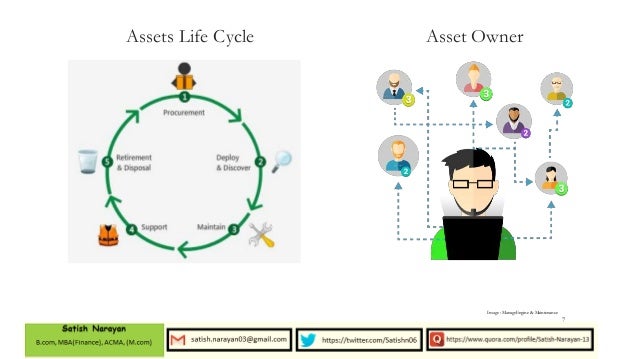

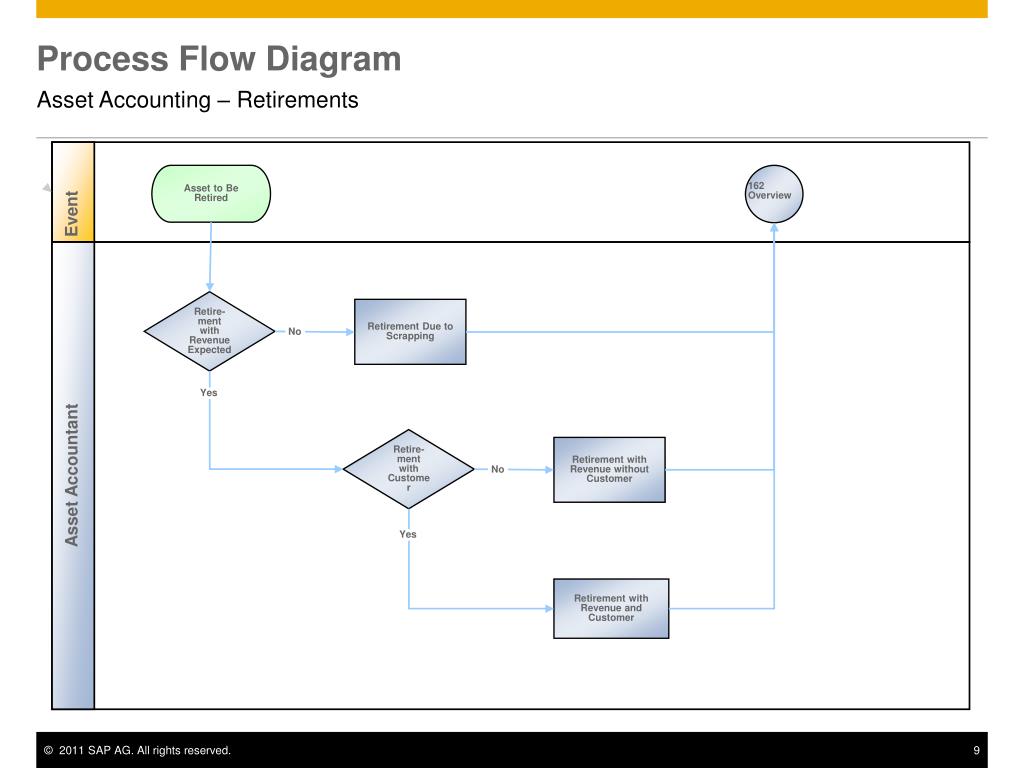

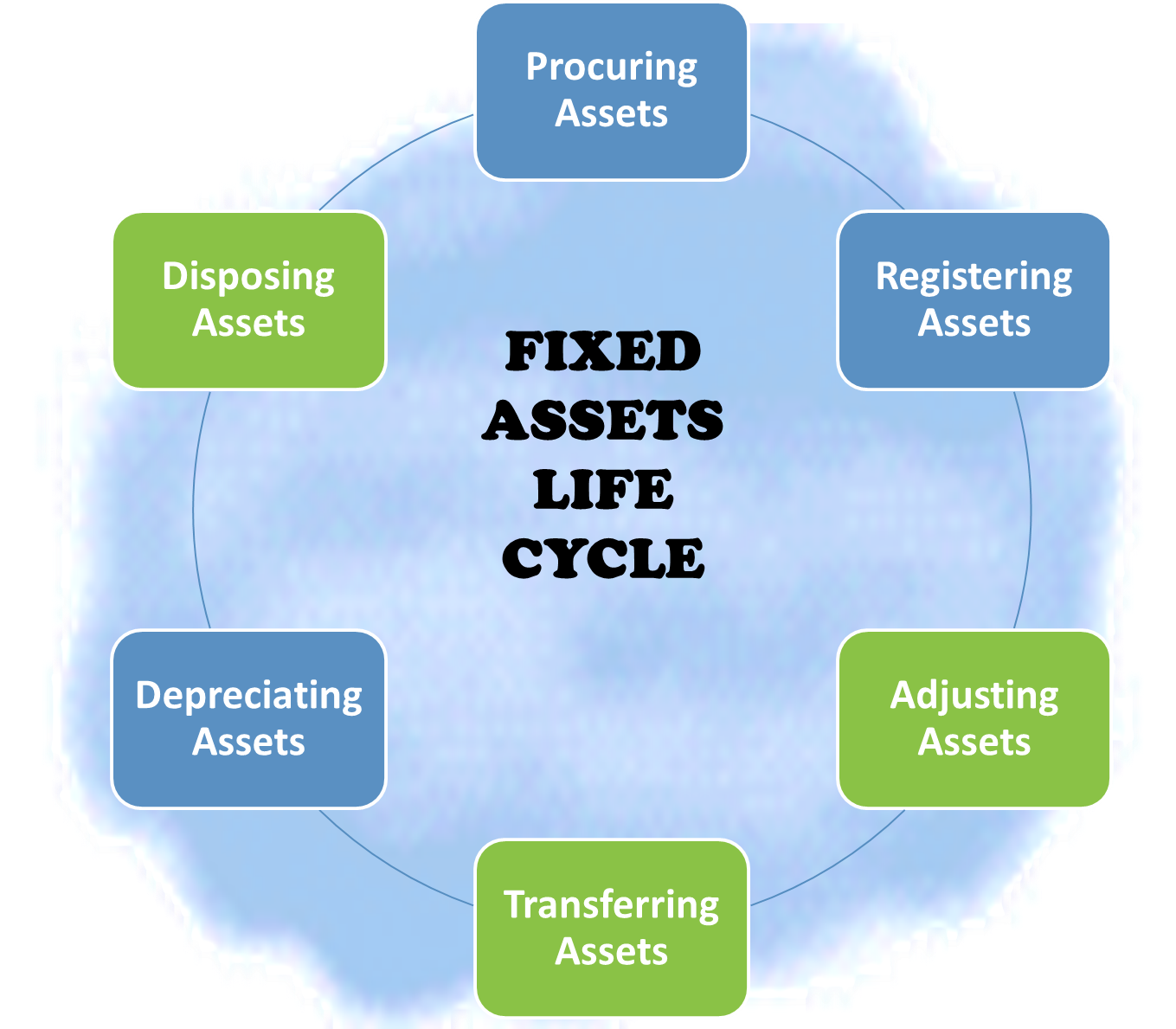

Fixed Assets Process Flow “Fixed Assets” is a sixstep process and starts with initiating and approving the request to acquire the asset and after maintaining and depreciating for useful life ends with the final disposal of the fixed asset These steps are cyclic in nature and most of them happen in any fixed management lifecycle. • All fixed assets and controlled items will be assigned an asset number upon receipt and before the item is placed into service • The department will affix tags to an asset in a conspicuous and convenient location. This process will help identify any fixed assets missing, fixed assets not recorded in accounting records, fixed assets moved from one location to another, fixed asset obsolescence, etc Company personnel can do this or a specialized service provider can be engaged to assist with the process.

And describe which costs can be recognized as a fixed asset under purchase, acquisition, lease, and exchange. The process by which fixed assets are established in both the fixed asset records and the accounting system The accounting aspect of capitalization usually entails reclassifying amounts previously recorded as expenses, expenditures, or construction in progress into a fixed asset category Capitalized assets are equal to or greater than $5,000. How To Make Fixed Asset Audits A Smoother Process For Manufacturers Fixed assets are the backbone of any business organization While these assets cannot be liquified easily, their role in an organization cannot be understated Besides increasing the company's net worth, these resources play a central role in the production of goods and services In modern accounting, fixed assets are.

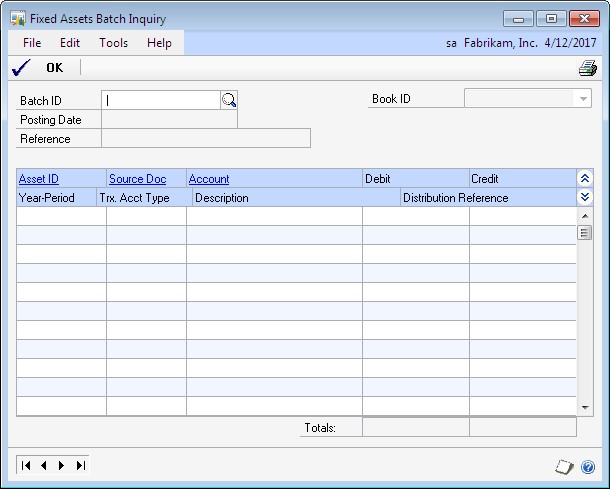

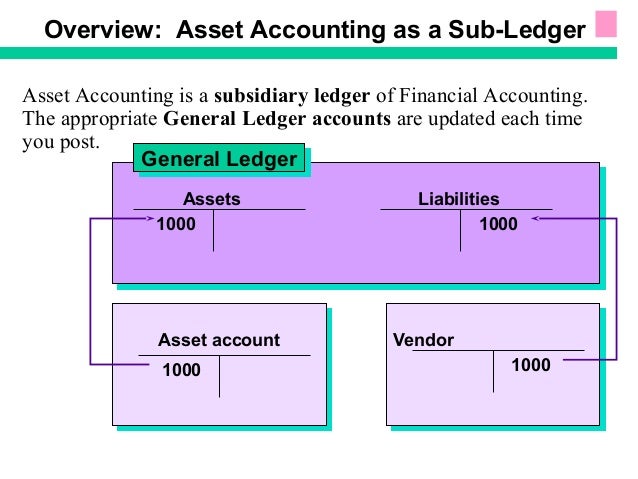

I need verify that I correctly entered the purchase of my printer (Fixed Asset with Depreciation) I am new to QB and accounting!. Fixed assets are generally not considered to be a liquid form of assets unlike current assets Examples of common types of fixed assets include buildings, land, furniture and fixtures, machines and vehicles The term ‘Fixed Asset’ is generally used to describe tangible fixed assets. The Fixed Assets and General Accounting systems access and store detailed transaction information in the same table, the Account Ledger (F0911) To maintain integrity between the two systems, you process all transactions through both the general ledger (G/L) and fixed assets.

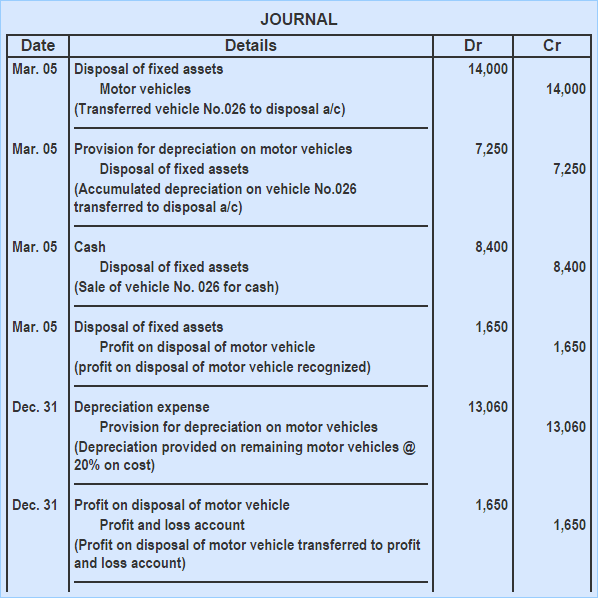

The JD Edwards EnterpriseOne Fixed Assets and JD Edwards EnterpriseOne General Accounting system systems from Oracle access and store detailed transaction information in the F0911 table To maintain integrity between the two systems, process all transactions through both the general ledger (GL) and fixed assets. The FixedAsset Accounting Cycle Each fixed asset has a lifecycle that includes at least three of these stages purchase, depreciation, revaluation, impairment and disposal The FixedAsset Lifecycle These journal entries (see examples below) cover the transactions associated with the fixedasset lifecycle. A good way of dealing with everything involved in fixed asset management is to implement a fixed asset lifecycle process This process breaks down the various stages in the life of an asset to enable a business to analyze how it is being used, opportunities for cost or efficiency savings, and when and how to replace it when business needs arise.

Finally, a comprehensive solution for fixed asset and IT asset management Learn more about Exela’s fixed asset software and IT asset management software. And managers for fixed asset management, control, accounting, and record keeping and to define fixed assets and controlled items and the guidelines for their capitalization 2 Objectives The objectives of this document are as follows • To ensure consistent Citywide procedures for fixed asset accounting, management, control, and accountability. We're going back to the basics in accounting, and the objective of this post is to walk you through the correct way to book a fixed asset journal entry and how to do fixed asset accounting, all the way from asset purchase to sale and write offBut first, what is a fixed asset?.

ADVERTISEMENTS Just as related parties can transfer land the intercompany sale of a host of other assets is possible Equipment, patents, franchises, buildings, and other longlived assets can be involved Accounting for these transactions resembles that demonstrated for land sales However, the subsequent calculation of depreciation or amortization provides an added challenge in the. The purpose of the ConstructioninProcess (CIP) and Fixed Asset Accounting Procedures is to • Ensure compliance with generally accepted accounting principles (GAAP) and applicable Federal and State regulatory and reporting requirements. We're going back to the basics in accounting, and the objective of this post is to walk you through the correct way to book a fixed asset journal entry and how to do fixed asset accounting, all the way from asset purchase to sale and write offBut first, what is a fixed asset?.

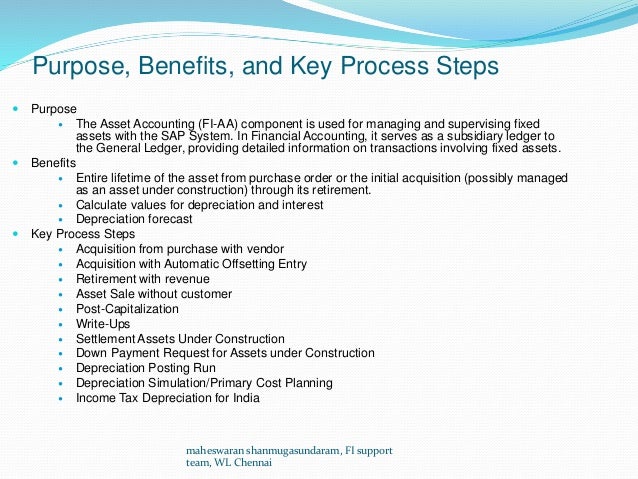

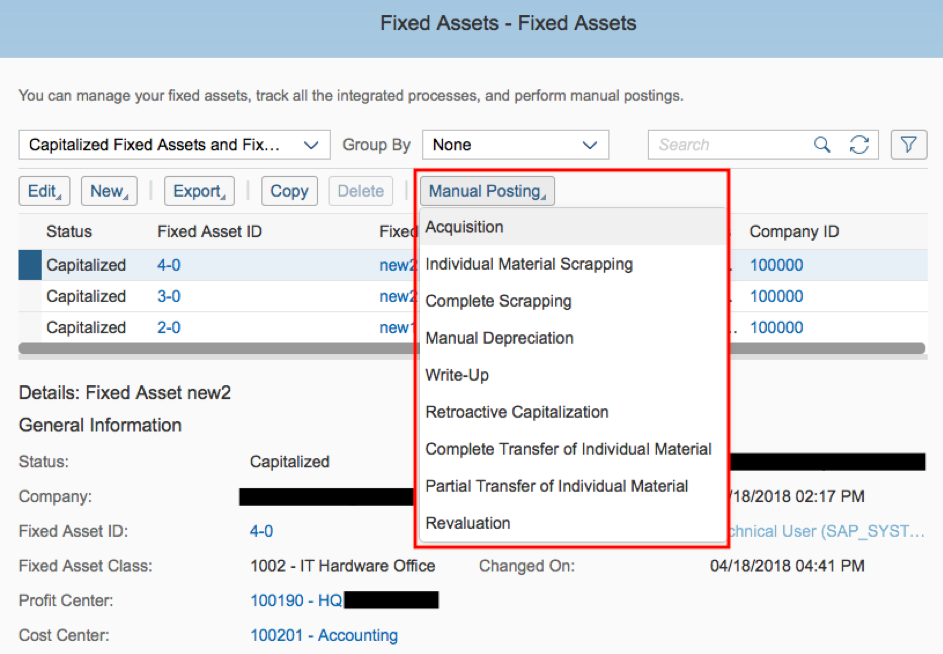

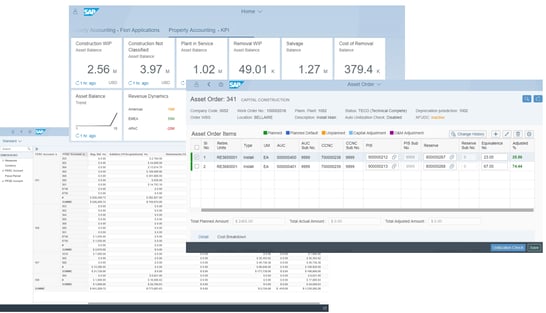

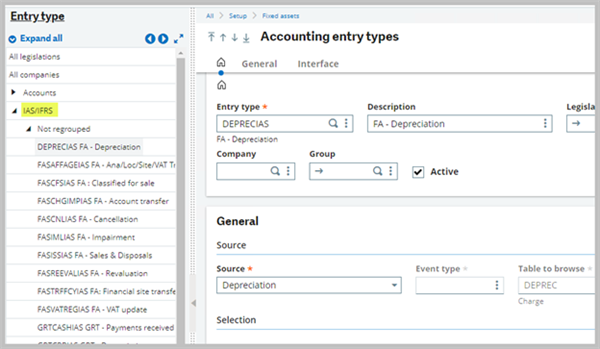

The term “fixed” translates to the fact that these assets will not be used up or sold within the accounting year A fixed asset typically has a physical form and is reported on the balance. No matter the size of your company, asset accounting is a vital process needed to manage fixed assets In the world of SAP, there have been improvements to the financial process area of SAP S/4HANA and, specifically, the asset accounting solution which has been redesigned – and is referred to as new asset accounting. CAA reviews all project expenditures for proper accounting treatment (meets capitalization policy) and classification (appropriate asset type and CAAN number is assigned), as well as reviews the appropriations versus expenditures by fund source and communicates to Design and Construction Management (DCM) and Capital Space Planning (CSP) any overdrafts.

Fixed Asset Accountant Involved in all areas of Fixed Asset Accounting and Capital Expenditures involving over 48,000 asset records Maintained Fixed Asset System, inventory controls, valuations, monthly closing activities, management reporting, variance and cost analysis, development of annual standards, internal control, and improving accounting processes. Best practices for fixed asset accounting 71 Establish a threshold for capitalization The first step towards maintaining errorfree accounts involves setting a 72 Ensure your assets have tags Many companies have fixed assets that they transport to various locations for 73 Automate your. Fixed Assets are purchased for long term and business operations purpose to generate income and which cannot be easily converted into cash, such as furniture, plant and machinery, land, building and office equipment etc.

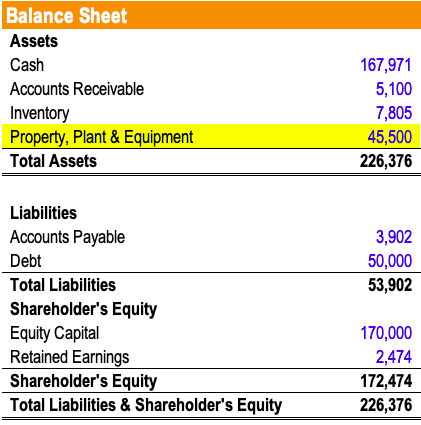

Fixed asset accounting is a specific process that tracks the value and changes in the items a company uses to complete business processes Fixed assets can include a variety of different items, such as computers, software, buildings, equipment, office décor or vehicles, among other items. The Fixed Assets and General Accounting systems access and store detailed transaction information in the same table, the Account Ledger (F0911) To maintain integrity between the two systems, you process all transactions through both the general ledger (G/L) and fixed assets. The fixed asset accounting records of an organization have farreaching effects As noted earlier, depending on the type of institution, fixed assets can represent the largest item on the balance sheet Therefore, deficient fixed asset records can lead to inaccurate process but not found in the fixed asset accounting records.

The accounting process consists of several different cycles Each cycle reflects a certain type of business activity Accountants define each transaction by activity and follow the same process to record and report related information The five accounting cycles are revenue, expenditure, conversion, financing and fixed asset. How To Make Fixed Asset Audits A Smoother Process For Manufacturers Fixed assets are the backbone of any business organization While these assets cannot be liquified easily, their role in an organization cannot be understated Besides increasing the company's net worth, these resources play a central role in the production of goods and services In modern accounting, fixed assets are. The useful life of an asset is considered extended when the change to the asset is significant enough to cause the expected useful life to increase beyond the original estimation Improvements should either increase usefulness, function, or service capacity 3 Fixed Equipment.

But in the process of making a profit, we forget that a fixed asset has a life cycle too It also has its limitation So that is why Asset Lifecycle Management is important and, in this blog, you will discover a complete life cycle of a fixed asset. Overview Fixed assets are those longterm assets which can benefit the enterprise for more than 12 months and is above the particular threshold as defined by the enterprise as guidelines made in compliance with laws and regulations as well as align with the applicable accounting standards and frameworks There are certain procurement procedures when the fixed assets are purchased. Not all lease accounting applications have a true subledger Instead, some lease accounting systems depend upon the fixed asset management system to manage the depreciation calculations In these scenarios, a complex process of aggregating data across multiple systems is required to generate the journal entries needed for each monthly close.

Fixed assets are tangible assets purchased for the supply of services or goods, use in the process of production, letting out on rent to third parties or for using for administrative purposes They are bought for usage for more than one accounting year. Fixed Asset Process activities, end to end activities of fixed asset in the company, capitalisation, journal entries, fixed asset cycle, procurement cycle, typ Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising. Examples of Fixed Assets A fixed asset is something that will be used in the business and that has a useful life of.

Fixed Assets Fixed Asset Confirmation Process For the last four fiscal years, the University Community has been asked to utilize the Fixed Asset Confirmation Tool to complete the annual fixed asset confirmations process On Wednesday, June 17, , the data in the Fixed Asset Confirmation Tool will be refreshed and the FY confirmation process will begin. The JD Edwards EnterpriseOne Fixed Assets and JD Edwards EnterpriseOne General Accounting system systems from Oracle access and store detailed transaction information in the F0911 table To maintain integrity between the two systems, process all transactions through both the general ledger (GL) and fixed assets. Automatic Accounting Instructions (AAIs) are set up on the Fixed Asset System Setup menu (G1241) Fixed Asset AAIs must be set up before asset masters are added or any other fixed asset transactions are processed This document discusses each fixed asset AAI and the correct setup Details.

In financial accounting, current assets include any balance or uses to generate income that can be converted into cash within one business cycle A fixed asset is a longterm tangible. Automatic Accounting Instructions (AAIs) are set up on the Fixed Asset System Setup menu (G1241) Fixed Asset AAIs must be set up before asset masters are added or any other fixed asset transactions are processed This document discusses each fixed asset AAI and the correct setup Details. Accurate fixed asset physical inventory records by conducting physical inventories under the coordination of the Finance Department (FIN) Annually, or at other intervals established by FIN, a complete physical inventory of all City fixed assets and controlled items will be conducted and the results reconciled with the asset records.

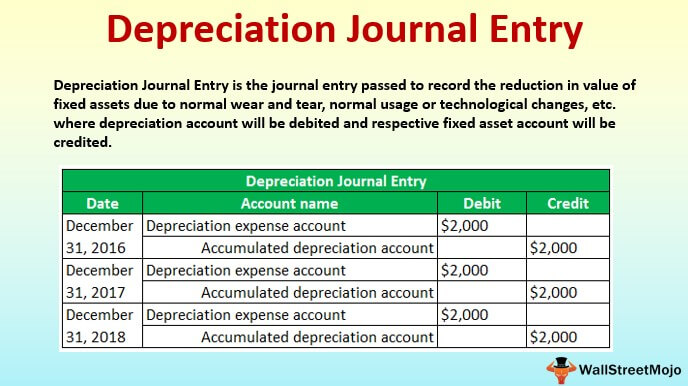

Calculation of fixed asset expenditure and allocation of its consumption value on the generated output (products, services) is realized through depreciation Depreciation is defined as a financial expression of fixed assets consumption in the process of reproduction Otherwise, depreciation can be observed in two ways as a 1. Aggregate Fixed Assets = Fixed Assets – Total Depreciation For example, consider the above example of ABC firm with a fixed asset worth 25 lakhs and the depreciating cost is five lakhs yearly Consider their net revenue is 50 lakhs If we calculate the fixed assets turnover ratio for ABC firm, it comes out to be 25.

Asset Accounting Sap Best Practices Baseline Package India Ppt Video Online Download

What Fixed Asset Accounting Has To Do In A Business Asset Infinity

Jd Edwards Enterpriseone Fixed Assets 8 12 Implementation Guide

Fixed Asset Accounting Process のギャラリー

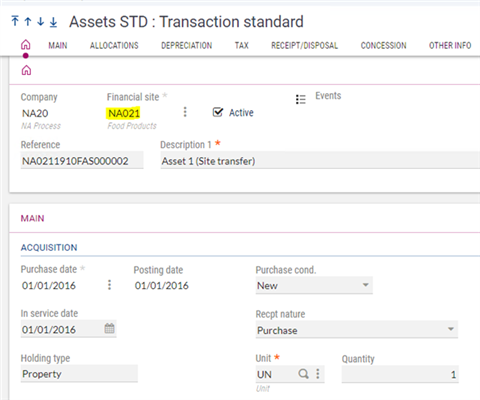

No Journal Entries For Financial Site Transfer Process Sage X3 Support Sage X3 Sage City Community

What Fixed Asset Accounting Has To Do In A Business Asset Infinity

Sap Best Practices Baseline Package Japan Depreciation Mergers And Acquisitions

Fi332 Umoja Asset Accounting Process Umoja Asset Accounting Process Version Pdf Free Download

.gif)

Fixed Assets Microsoft Docs

Asset Accounting Overview Sap Help Portal

How To Reverse Fixed Asset Depreciation In Microsoft Dynamics 365

What Does A Fixed Asset Accountant Do Zippia

Process Fixed Assets Accounting In Sap Erp Solutions For Apparel And Footwear Implement Applications Frameworks Process

Oracle E Learning Accounting Entries For The Asset Life Cycle

Physical Inventory Of Fixed Assets Actidel

Sage Fixed Asset Management Software Sage 300 Lobster Limited

Review Of Bloomberg Tax Accounting Fixed Assets Cpa Practice Advisor

Fixed Asset Management In Sap Business Bydesign

Sap Fixed Assets Accounting

Asset Accounting In Central Finance Sap Blogs

Post G L Journal Entries To Fixed Assets

Best Practice Financial Processes Fixed Assets Ppt Download

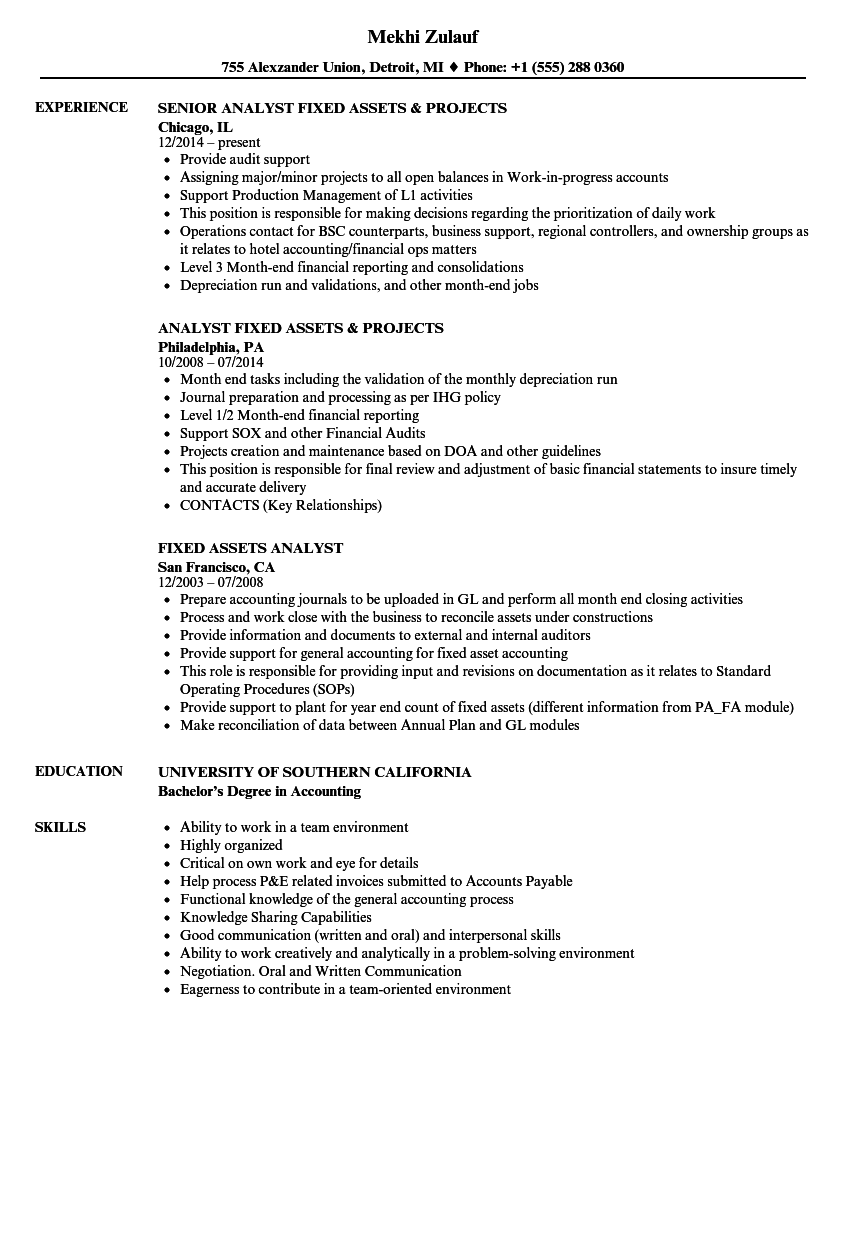

Fixed Asset Accountant Resume Samples Qwikresume

Sap Fixed Assets Accounting

Asset Accounting Fi New Sap Documentation

Fixed Asset Accounting Made Simple Netsuite

Fixed Asset Accounting Overview And Best Practices Involved

Sap Fixed Assets Accounting

Tangible Assets Meaning Importance Accounting And More

Fixed Asset Transfer Ft

What Are Fixed Assets Type Tangible Intangible Accounting Dep

Overview To Fixed Assets

Fixed Asset Accounting Overview And Best Practices Involved

Q Tbn And9gctbv Fbrwwj50dzehuir3x9fvrd6jojmajwahpk61u Cer5fvau Usqp Cau

Fixed Assets Process Guide Pdf Free Download

Fixed Asset Accounting Made Simple Netsuite

Introduction To Jd Edwards Enterpriseone Fixed Assets

Fixed Asset Management In Dynamics Gp Dynamics Gp Microsoft Docs

Sap Fi Asset Accounting Process Debits And Credits Book Value

Fixed Assets Accounting Policies Oregon University System Oregon State University

Introduction To Fixed Assets Process Youtube

Meaning And Different Types Of Assets Classification More

Sap Fixed Assets Accounting

Fixed Asset Process

Fixed Asset Accounting Examples Journal Entries Dep Disclosure

Fixed Asset Process Flow Chart Lewisburg District Umc

Fixed Asset Accounting Overview And Best Practices Involved

Q Tbn And9gcsdixhjsswpv46fz3py Jw60gdwqdrodadq9wuc7gdei1ytriiw Usqp Cau

Fixed Asset Purchase And Depreciation Entry In Tally Waytosimple

Physical Asset Verification And Reconciliation Lissom Soft

Month End Year End Process In Fixed Asset Relevant Standard Reports Oracleapps Epicenter

Acquisition Process Of Capital Assets Read Full Article Read Full Info Http Www Accounts4tutorials Com 15 10 Capital Assets Fixed Asset Asset Management

Http Www Oracle Com Us Products Applications Jd Edwards Enterpriseone Jde Enterprise1 Fixed Asset Acctg Pdf

Payroll Processing And Fixed Asset Procedures The Physical Fixed Asset System Business Information Management

Fixed Asset Accounting Overview And Best Practices Involved

Revaluation In Oracle Fixed Assets Enterprise Resource Planning And Integrations Blogspot

Physical Asset Verification And Reconciliation Lissom Soft

Asset Accounting Configuration Steps In Sap Asset Accounting Fico Sap Tutorials

Oracle Public Sector Financials User Guide

Sap Fixed Assets Training Youtube

Q Tbn And9gcsb 6brwxipkisjvkekksw1ii0d H2urso84e3nm0 Vapc0lsvv Usqp Cau

Setting Up And Generating Fixed Assets Information For Cnao Audit Files

Q Tbn And9gcqs Hzarmlv6bncim9omt7evyiiyg M15lez46mgio Rkmr6hnz Usqp Cau

Depreciation And Disposal Of Fixed Assets Examples Play Accounting

Fixed Asset Accountant Cover Letter January 21

Fixed Asset Accounting Disposal Of Fixed Asset Accounting Corner

Depreciation And Disposal Of Fixed Assets Examples Play Accounting

Depreciation Journal Entry Step By Step Examples

Fixed Asset Manager For Sap Business One

Accountant Fixed Assets Resume Sample Mintresume

Sap Fixed Assets Accounting

Asset Accounting Sap Best Practices Baseline Package Brazil Sap Best Practices Ppt Download

Fixed Asset Accounting Process Ppt Powerpoint Presentation Deck Cpb Powerpoint Presentation Sample Example Of Ppt Presentation Presentation Background

Asset Accounting In Sap Fico Step By Step Guide Skillstek

Fixed Assets In Accounting Definition List Top Examples

Fixed Assets Definition Characteristics Examples

Fixed Asset Management In Sap Business Bydesign

Fixed Asset Accounting Made Simple Netsuite

Asset Under Construction Through Mm Sap Blogs

Fixed Asset Accounting Process Ppt Powerpoint Presentation Deck Cpb Powerpoint Presentation Sample Example Of Ppt Presentation Presentation Background

Flowchart Fixed Asset Depreciation Expense Yellow Loading Chart Transparent Png

Fixed Asset Process

Ppt Asset Accounting Powerpoint Presentation Free Download Id

Sap Simple Finance Create An Asset Tutorialspoint

Fixed Asset Software Fixed Assets Osas

Sap Fixed Assets Accounting

What Is Fixed Asset Everything You Need To Know About Fixed Assets

2

Bosch Erp Individual Materials Of Fixed Assets In Sap Business Bydesign Bosch Erp

Fixed Asset Trade In Double Entry Bookkeeping

Fixed Assets Part 1 Financial Accounting Lecture Handout Docsity

The Current State Of Complexity With Asset Accounting

Fixed Assets In Accounting Definition List Top Examples

Fixed Asset Acquisition On Project Sap Blogs

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐂𝐚𝐩𝐄𝐱 𝐚𝐧𝐝 𝐎𝐩𝐄𝐱

How To Process A Depreciation Entry For An Ias Ifrs Plan Sage X3 Support Sage X3 Sage City Community

Fixed Asset Sla Oracleapps Epicenter

Www Singaporehealthcaremanagement Sg Abstracts Poster exhibition Documents Fn011 koh li li Shs Pdf

User Guide Asset Accounting Process Pdf Free Download

Fixed Asset Accounting Made Simple Netsuite

Technofunc Fixed Assets Process Flow

Fixed Assets Analyst Resume Samples Velvet Jobs

Digits Iisc Ac In Wp Content Uploads 10 Fixed Asset Accounting Faq Oct23 Pdf

Pin By Lalaine On Riddle Process Flow Chart Flow Chart Fixed Asset

Http Universa Unijales Edu Br Sap Fixed Asset Process Flows Pdf