Irr Berechnung Excel

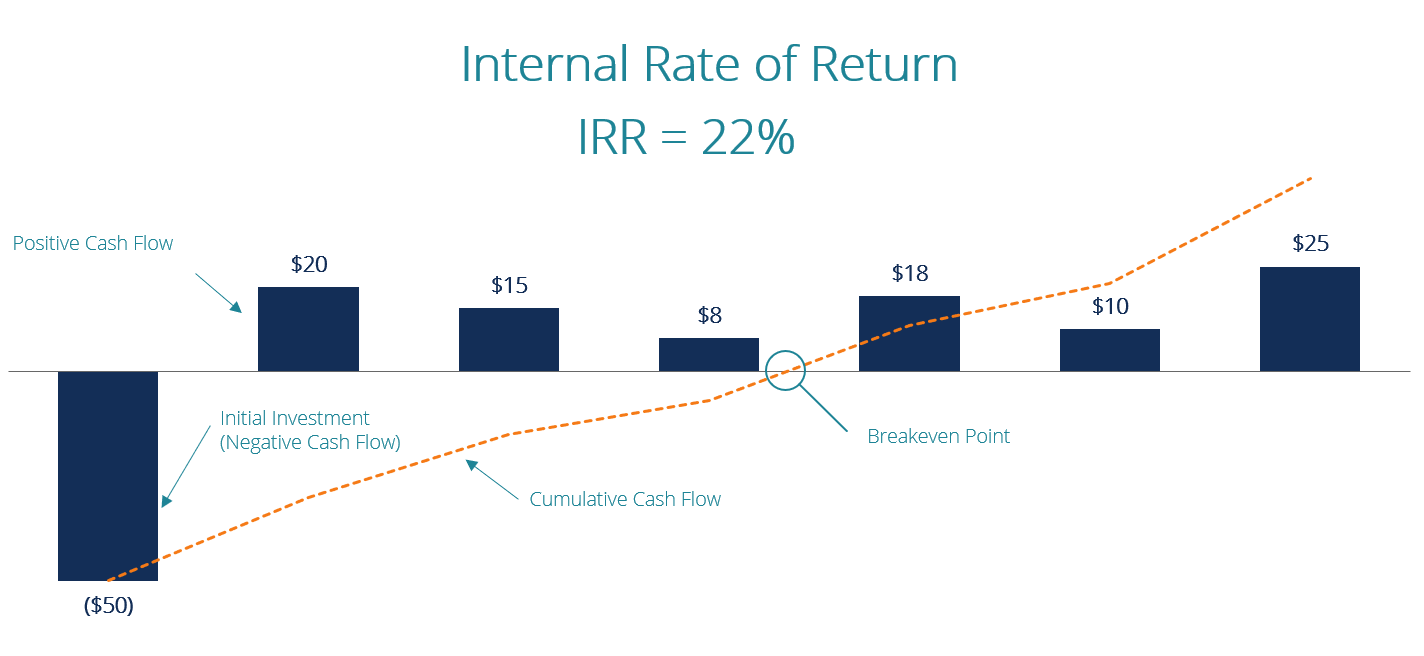

IRR Calculation in Excel IRR (Internal Rate of Return) is the most widely used financial indicator while assessing return on an investment or a project It is defined as the discount rate which makes the net present value of the cash flows from the investment equal to zero.

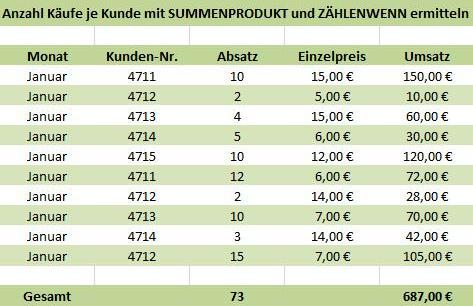

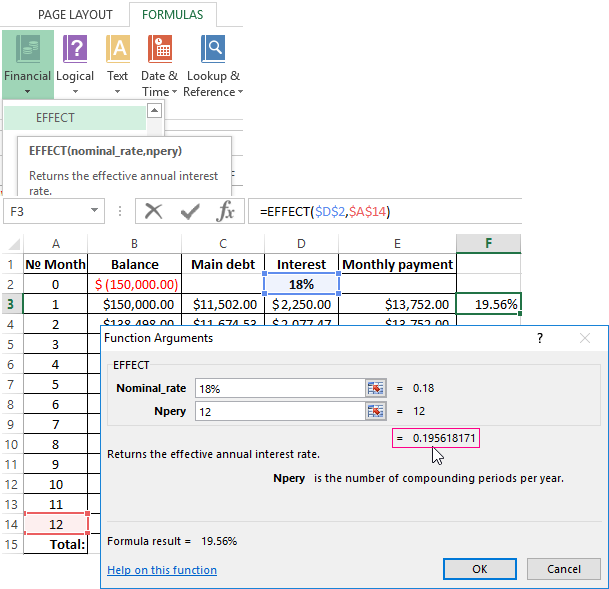

Irr berechnung excel. Wie IRR in Excel berechnen IRR oder interne Zinsfuß ist eine Schätzung, wie viel ein Unternehmen, eine Person oder ein Unternehmen zu Zeit, um in einem Projekt zu investieren, zu gewinnen. Microsoft Excel provides 3 functions for finding the internal rate of return IRR the most commonly used function to calculate the internal rate of return for a series of cash flows that occur at regular intervals. You can use the formula = (1r)^n 1 to convert the IRR to annual internal rate of return For monthly stream of cash flows, the IRR function will return the monthly interval rate of return (says 05% ), and you can convert it to annual rate 617% (formula = (105%)^121 );.

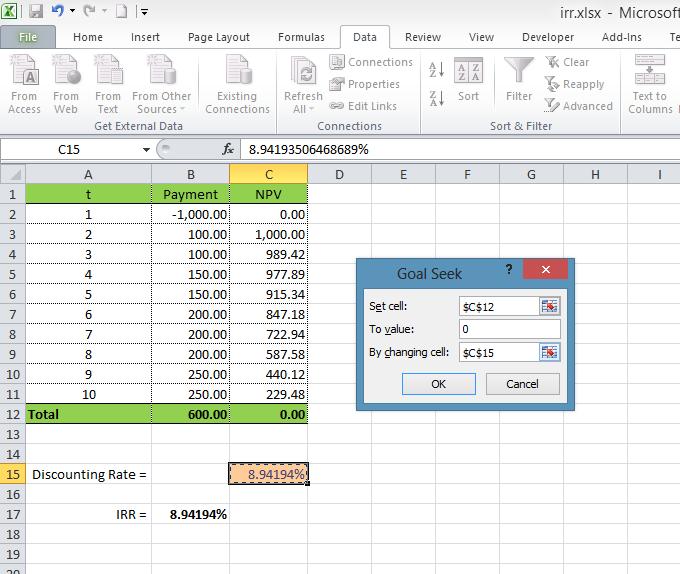

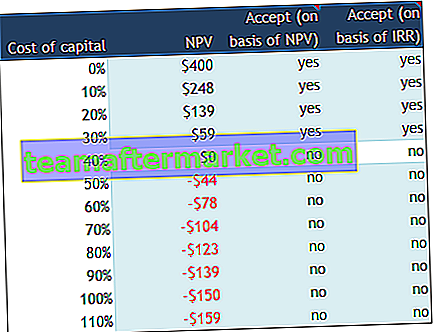

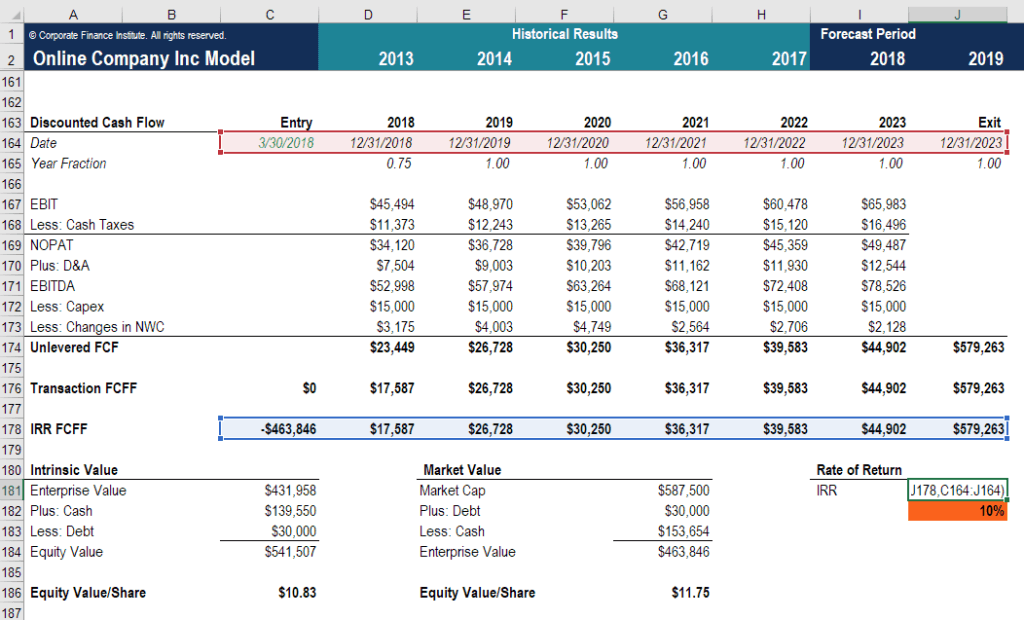

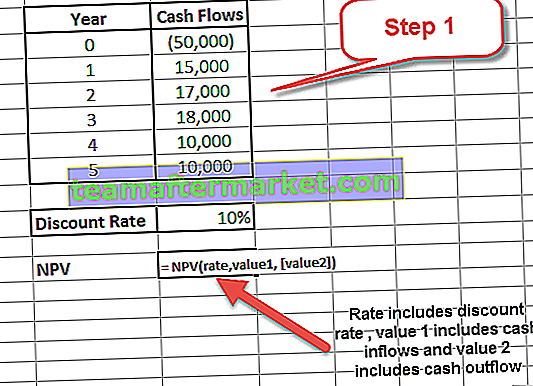

The internal rate of return (IRR) is the discount rate providing a net value of zero for a future series of cash flows The IRR and net present value (NPV) are used when selecting investments. In the second method, the inbuilt Excel formula "NPV" is used It takes two arguments, the discounting rate (represented by WACC), and the series of cashflows from year 1 to the last year. IRR can be defined as the annual compound interest rate equivalent for an investment In this lesson, we use IRR to evaluate an investment in a house We spend money purchasing the house, then several years later we receive money from selling the house In Excel, the IRR function can be used to calculate the Internal Rate of Return The.

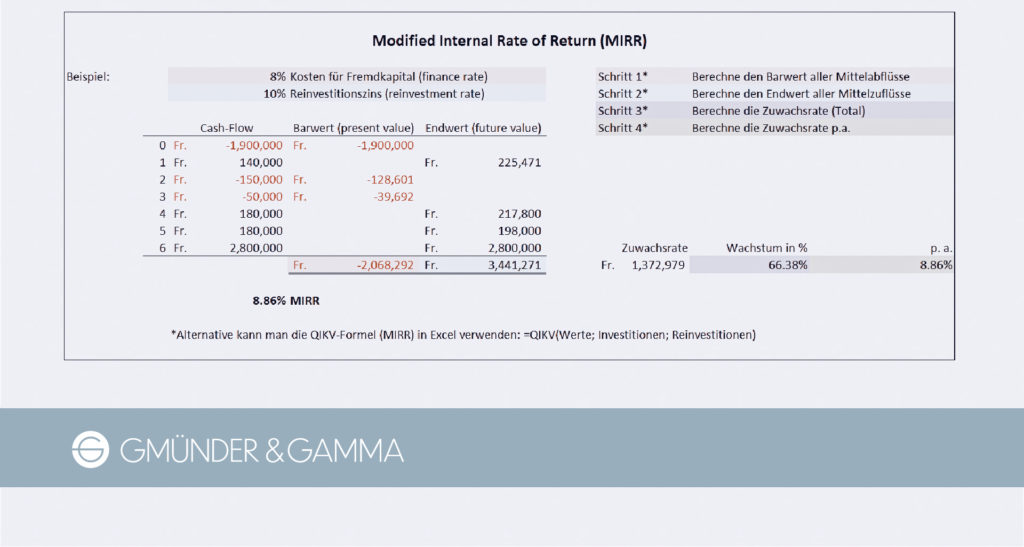

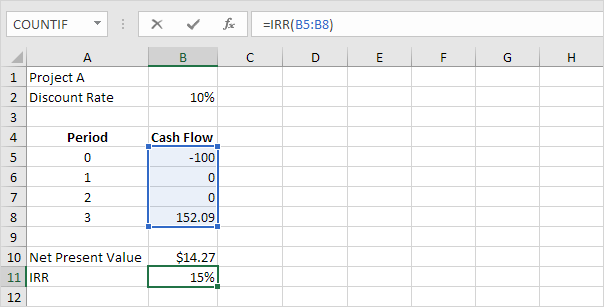

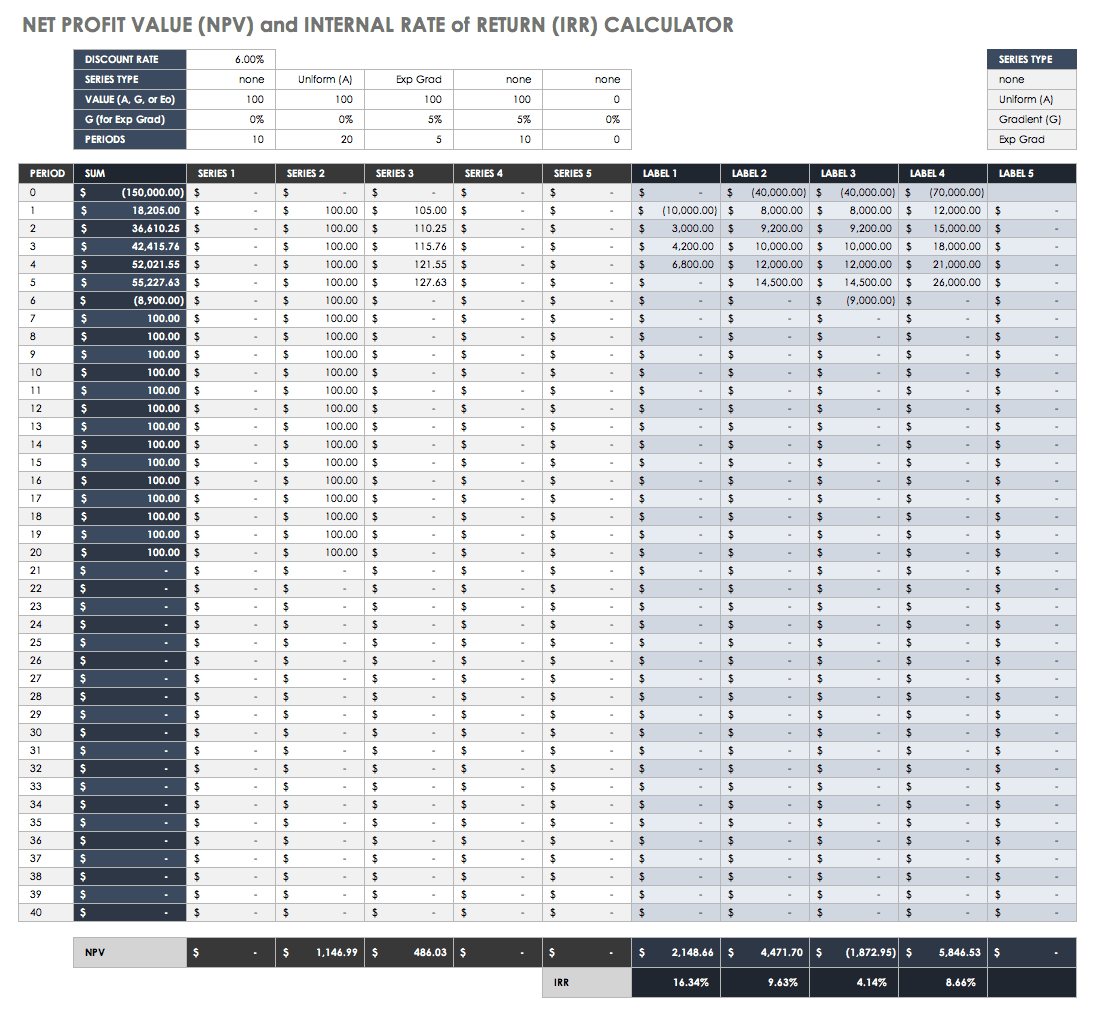

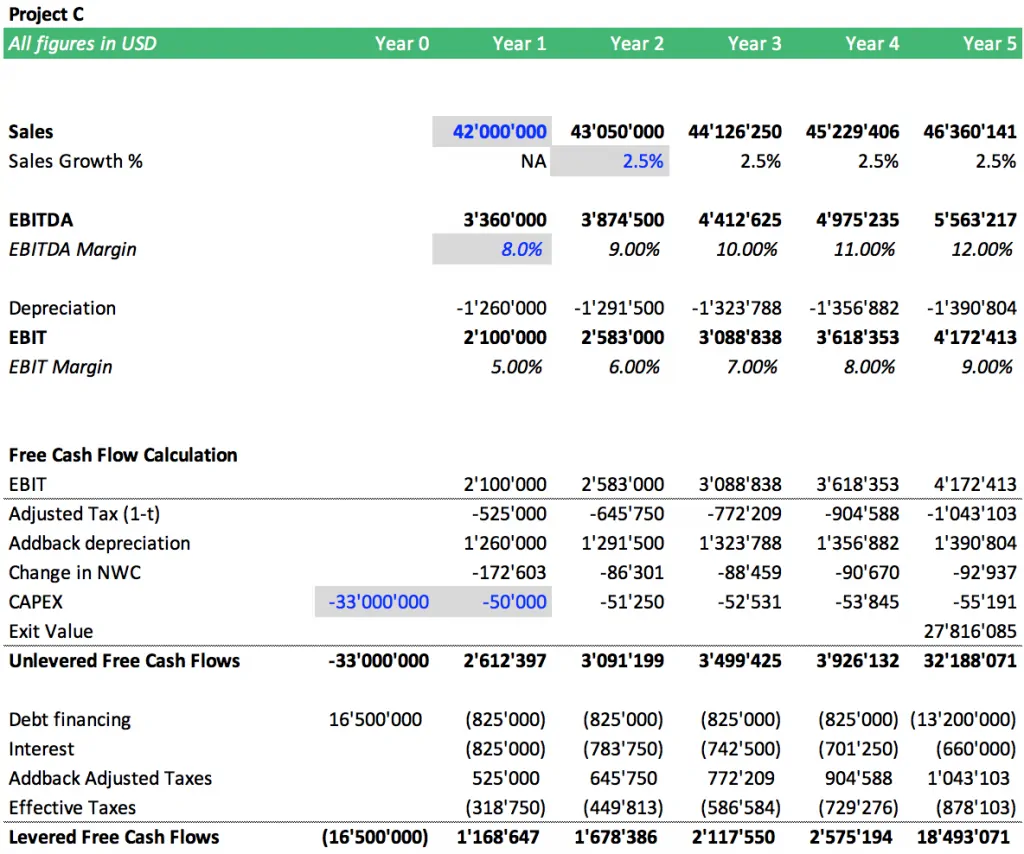

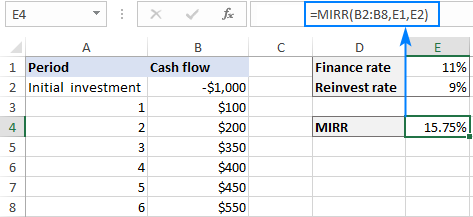

Excel allows a user to get an internal rate of return and a net present value of an investment using the NPV and IRR functions This step by step tutorial will assist all levels of Excel users in calculating NPV and IRR Excel Figure 1 The result of the NPV and IRR functions Syntax of the NPV Formula The generic formula for the NPV function is. MODIFIED INTERNAL RATE OF RETURN Modified internal rate of return (MIRR) is a similar technique to IRR Technically, MIRR is the IRR for a project with an identical level of investment and NPV to that being considered but with a single terminal payment In Excel and other spreadsheet software you will find an MIRR function of the form. The internal rate of return (IRR for short) is the most commonly reliedon return metric in equity real estate investment It is also the most complicated The internal rate of return is a discount rate that makes the net present value (NPV) of all cash flows from the investment, across time periods, equal to zero.

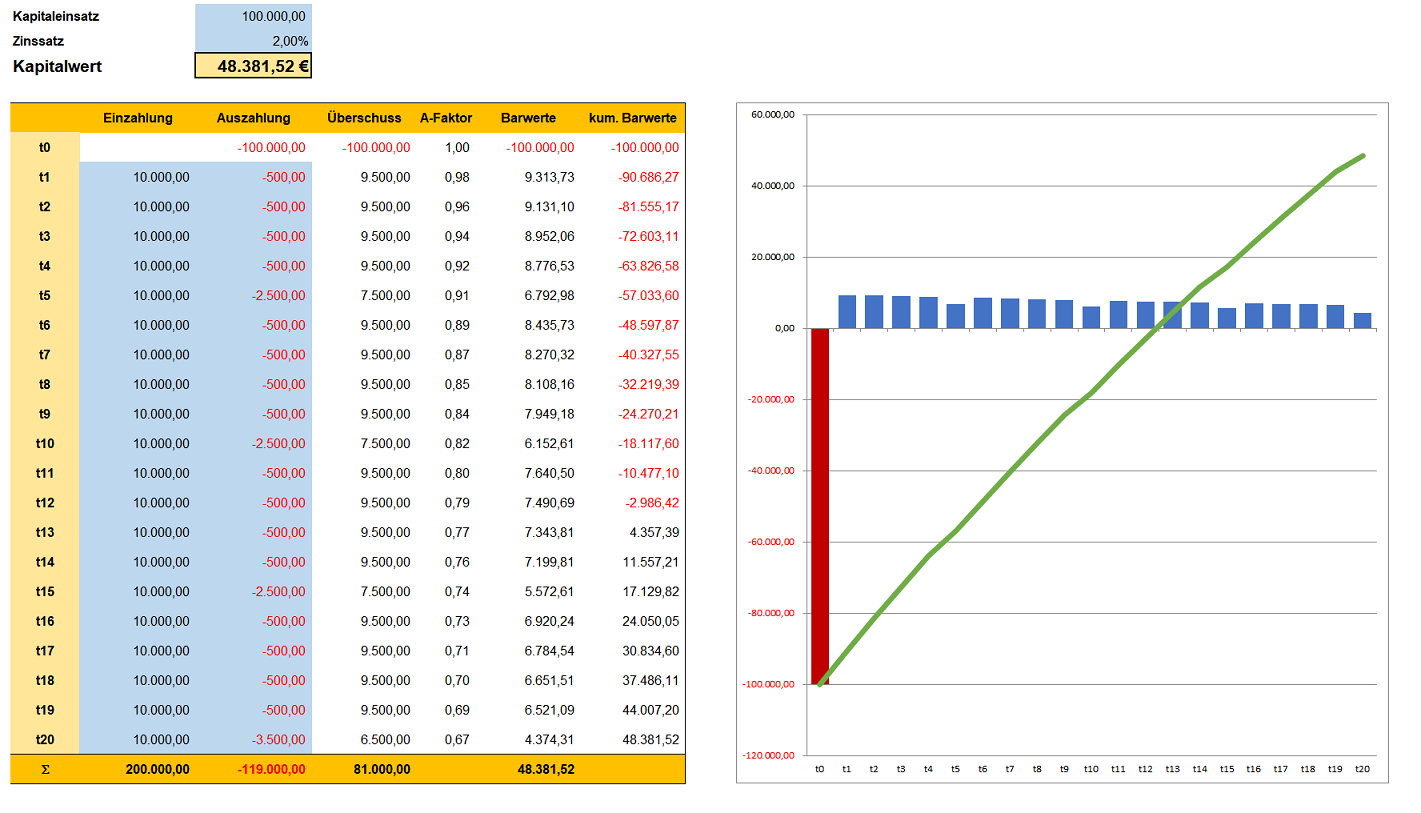

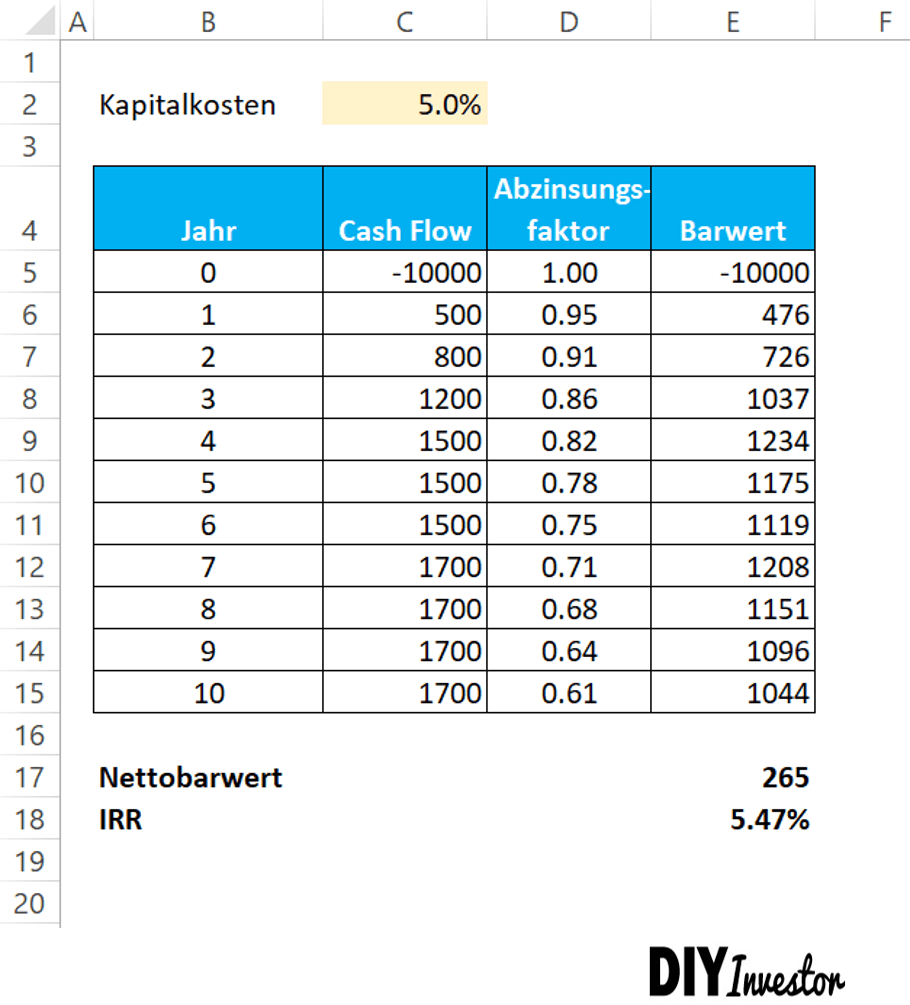

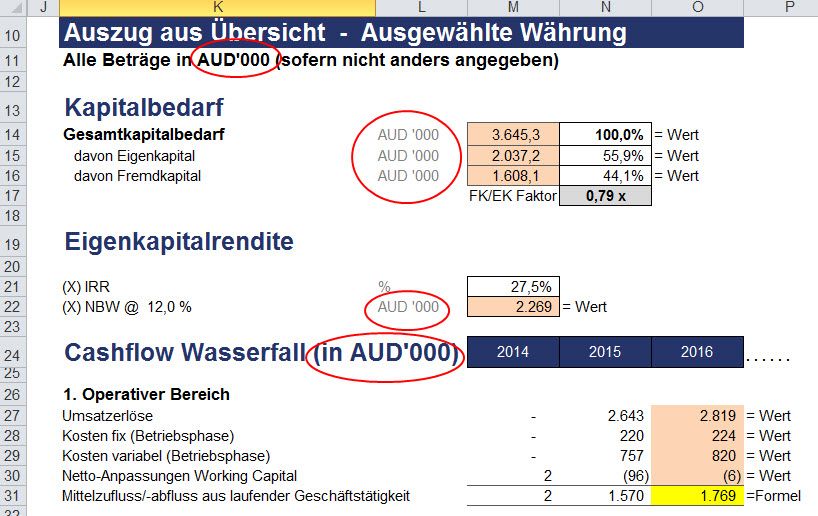

Berechnung des Nettobarwerts (NBW) mit Excel Die Berechnung des Nettobarwerts, häufig auch als Kapitalwert bezeichnet, ist ein hilfreiches Verfahren, um ein Investitionsprojekt vorausschauend beurteilen zu können Nicht nur Großunternehmen, sondern auch Selbstständige und Privatpersonen können sich diese Methode zu Nutze machen Angenommen, Sie leiten Ihren eigenen Handwerksbetrieb und. What Is Excel IRR Function?. IRR can be defined as the annual compound interest rate equivalent for an investment In this lesson, we use IRR to evaluate an investment in a house We spend money purchasing the house, then several years later we receive money from selling the house In Excel, the IRR function can be used to calculate the Internal Rate of Return The.

Internal rate of return (IRR) is the annual compound interest rate at which an investment’s net present value is zero Projects whose IRR is higher than the company’s cost of capital are good candidates for investment and projects with highest IRR must be selected There are multiple ways in which we can calculate IRR using Microsoft Excel IRR or XIRR functions, using any financial. Internal Rate of Return (IRR) in Excel Im folgenden Bild berechnen wir eine interne Rendite (IRR) Dazu verwenden wir einfach die ExcelIRRFunktion Modified Internal Rate of Return (MIRR) Wenn ein Unternehmen unterschiedliche Anleihesätze für die Reinvestition verwendet, muss die modifizierte interne Rendite (MIRR) berechnet werden. IRR can be defined as the annual compound interest rate equivalent for an investment In this lesson, we use IRR to evaluate an investment in a house We spend money purchasing the house, then several years later we receive money from selling the house In Excel, the IRR function can be used to calculate the Internal Rate of Return The.

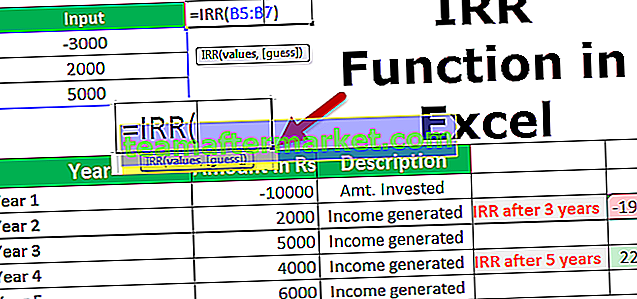

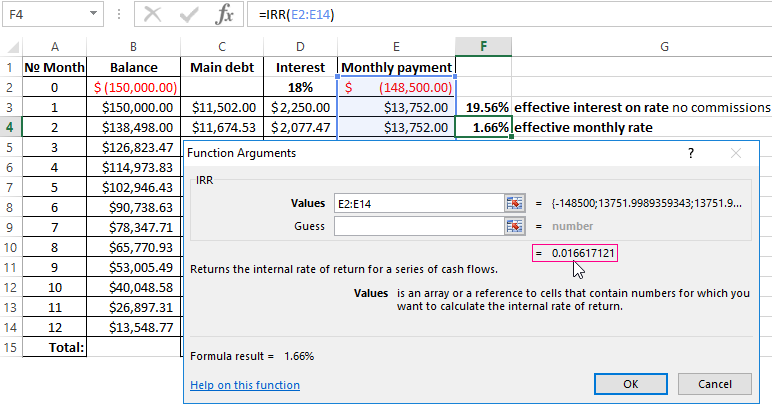

1 Excel's IRR function Excel's IRR function calculates the internal rate of return for a series of cash flows, assuming equalsize payment periods Using the example data shown above, the IRR formula would be =IRR(D2D14,1)*12, which yields an internal rate of return of 1222% However, because some months have 31 days while others have 30. The internal rate of return (IRR) is a metric used in capital budgeting to estimate the return of potential investments Using the IRR function in Excel makes calculating the IRR easy Excel. IRR Calculator Excel The IRR or internal rate of return is a means of evaluating a project by finding the discount rate at which the net present value of the cash flows is equal to zero At the IRR, the cash flow returned by the project is equal to the cash flow invested in the project This free IRR calculator allows for up to five projects.

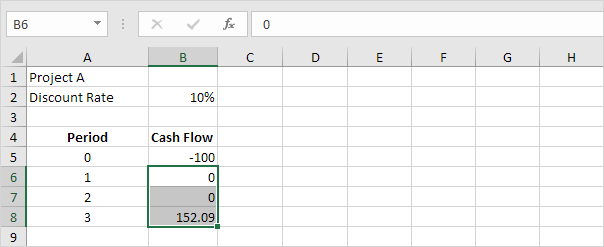

Select cell B8 and use the Excel function button (labeled "fx") to create an IRR function for the first project In the "Values" field of the Excel function window, click and drag to highlight the cells from B2 to Leave the "Guess" field of the Excel function window blank, unless you have been given a number to use Click the "OK" button. Simple IRR example Present Values IRR rule Use the IRR function in Excel to calculate a project's internal rate of return The internal rate of return is the discount rate that makes the net present value equal to zero Simple IRR example For example, project A requires an initial investment of $100 (cell B5) 1. Dies ist ein ExcelTool als Implementierung des NPVKonzept für Anleger, die etwas Geld in kurzer Zeit investieren wollen Sie müssen genauer Finanzierungsplan, wenn Sie länger als 3 Jahre mit unsicheren wirtschaftlichen Risiken investieren wollen Im Geschäftsjahr, gibt es einige StandardWertMessung, die normalerweise zur Messung, ob ein neues Geschäft oder ein neues Projekt rentabel.

There's no CAGR function in Excel However, simply use the RRI function in Excel to calculate the compound annual growth rate (CAGR) of an investment over a period of years 1 The RRI function below calculates the CAGR of an investment The answer is 8% Note the RRI function has three arguments (number of years = 5, start = 100, end = 147). Returns the internal rate of return for a series of cash flows represented by the numbers in values These cash flows do not have to be even, as they would be for an annuity However, the cash flows must occur at regular intervals, such as monthly or annually The internal rate of return is the interest rate received for an investment consisting of payments (negative values) and income. IRR function calculates the internal rate of return for a series of cash flows occurring at regular intervals Calculate Internal Rate of Return of an investment For the initial investment of $10,000, the earnings of the 1 st, 2 nd, 3 rd, and 4 th quarters are given in the above table.

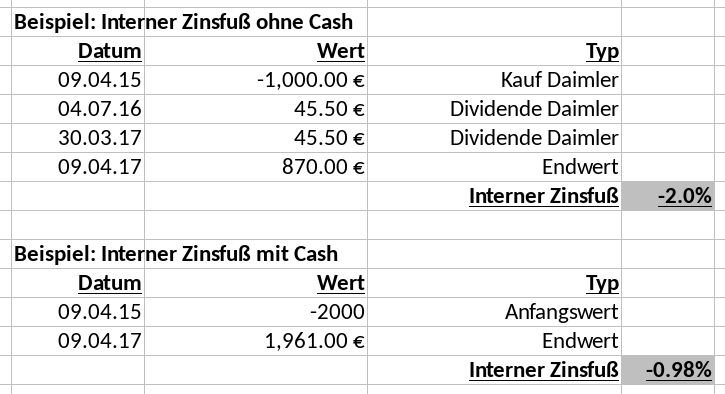

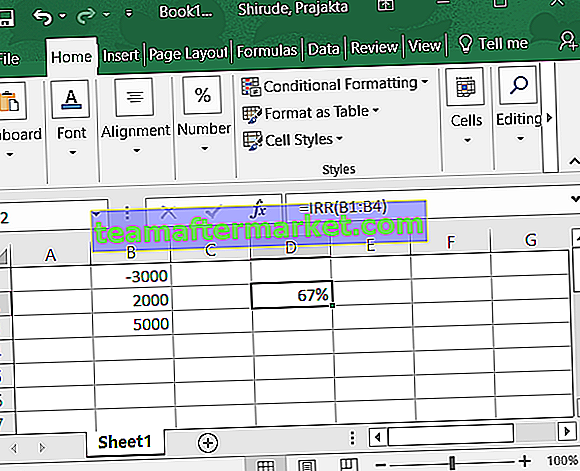

So the formula ( or function) for calculating IRR in Excel is IRR (value1,value2, ) In the above formula the value1 would be the initial investment (Period 0 with negative cash flow) followed by cash flows from all other periods. The standard Internal rate of return function (IRR) assumes all cash flows are reinvested at the same rate as the IRR The modified internal rate of return function (MIRR) accepts both the cost of investment (discount rate) and a reinvestment rate for cash flows received In the example shown, the formula in F6 is =. So lässt sich der interne Zinsfuß mit EXCEL berechnen Wie bereits geschrieben soll es das Ziel sein, ein praxisnahes Beispiel zu bringen Aus diesem Grund hole ich ein bisschen weiter aus und gebe mit der Berechnung des internen Zinsfußes gleich einen schematischen Überblick für eine kleine „excelbasierte Depotverwaltung“.

The Internal Rate of Return Internal Rate of Return (IRR) The Internal Rate of Return (IRR) is the discount rate that makes the net present value (NPV) of a project zero In other words, it is the expected compound annual rate of return that will be earned on a project or investment is the discount rate that sets the Net Present Value (NPV) of all future cash flow of an investment to zero. Microsoft Excel has a special function for calculating NPV, but its use can be tricky especially for people who have little experience in financial modeling The purpose of this article is to show you how the Excel NPV function works and point out possible pitfalls when calculating the net present value of a series of cash flows in Excel. 3 Steps How to Calculate Internal Rate of Revenue in Excel 1 Initial Cash Flow into the Spreadsheet Keep in mind that this initial investment has to be a negative number For 2 Subsequent Cash Flow Values for Each Period In the cells directly under the initial investment amount, type cash.

Excel führt eine iterative Berechnung durch, die den Schätzwert kontinuierlich aktualisiert, bis eine akzeptable Hurdle Rate gefunden wird Wenn Excel mehrere akzeptable Werte findet, wird nur der erste zurückgegeben Wenn die Funktion jedoch keinen akzeptablen Wert findet, wird ein Fehler zurückgegeben. The english function name IRR() has been translated into 17 languages For all other languages, the english function name is used There are some differences between the translations in different versions of Excel. Internal Rate of Return (IRR) is a discount rate that is used to identify potential/future investments that may be profitable The IRR is used to make the net present value (NPV) of cash flows from a project/investment equal to zero Generally, the easiest way to calculate IRR is using an Excel spreadsheet.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features Press Copyright Contact us Creators. How to calculate IRR (Internal Rate Of Return) in Excel IRR is the acronym for Internal Rate Of ReturnIt is defined in the terms of NPV or Net Present ValueThe IRR can be stated as the discount rate that makes the NPV of all cash flows ( both positive and negative cash flows) from a project or investment equal to zero. The IRR function is categorized under Excel Financial functions IRR will return the Internal Rate of Return for a given cash flow, that is, the initial investment value and a series of net income values In financial modeling, as it helps calculate the return an investment would earn based on series of cash flows.

The internal rate of return (IRR) is the interest rate received for an investment with payments and income occurring at regular intervals (ie monthly, annual) Payments are expressed as negative values and income as positive values Amounts can vary, but intervals need to be the same The first value is negative, since it represents an outflow Excel uses iteration to arrive at a result, starting with the guess (if provided) or with 1 (10%) if not. Berechnung des Nettobarwerts (NBW) mit Excel Die Berechnung des Nettobarwerts, häufig auch als Kapitalwert bezeichnet, ist ein hilfreiches Verfahren, um ein Investitionsprojekt vorausschauend beurteilen zu können Nicht nur Großunternehmen, sondern auch Selbstständige und Privatpersonen können sich diese Methode zu Nutze machen Angenommen, Sie leiten Ihren eigenen Handwerksbetrieb und. The McKinsey consultants offer the best advice about the IRR Avoid it However, the idea of an IRR is so widely accepted that this is difficult to do in many companies Therefore, Excel offers a different solution, the MIRR (Modified IRR) function Excel’s MIRR function is an alternative to the IRR function It has this form.

Dies ist ein ExcelTool als Implementierung des NPVKonzept für Anleger, die etwas Geld in kurzer Zeit investieren wollen Sie müssen genauer Finanzierungsplan, wenn Sie länger als 3 Jahre mit unsicheren wirtschaftlichen Risiken investieren wollen Im Geschäftsjahr, gibt es einige StandardWertMessung, die normalerweise zur Messung, ob ein neues Geschäft oder ein neues Projekt rentabel. Der Standardwert der Schätzung in Excel beträgt 10%, der Benutzer kann jedoch eine andere Bewertung in die Formel eingeben Excel führt eine iterative Berechnung durch, die den Schätzwert kontinuierlich aktualisiert, bis eine akzeptable Hurdle Rate gefunden wird Wenn Excel mehrere akzeptable Werte findet, wird nur der erste zurückgegeben. Die IRR ist eine dynamische Rentabilitätskennziffer Was bedeutet Internal rate of return (IRR)?.

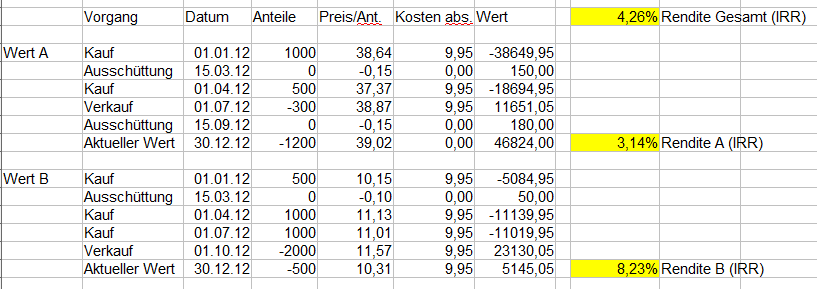

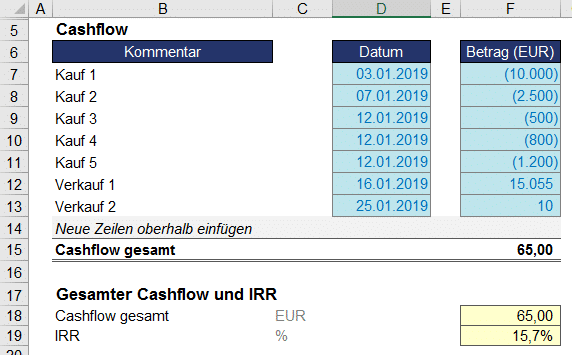

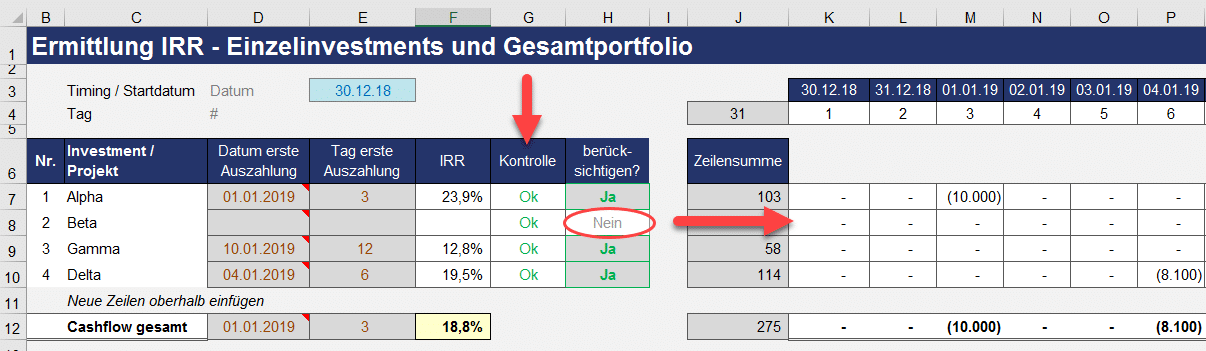

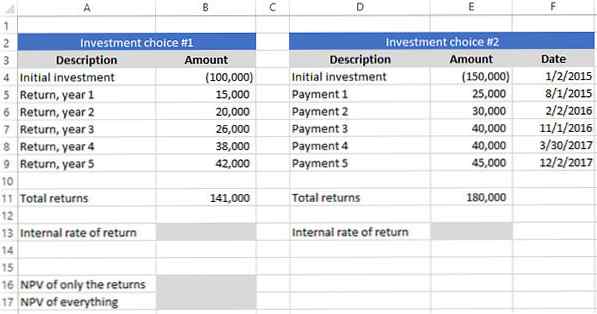

Schließlich gilt es, die IRR des Gesamtportfolios zu ermitteln Abb 11 zeigt eine einfache Investition Alle Auszahlungen sind dabei negativ zu erfassen (Werte in Klammern nach internationaler Konvention negativ), alle Einzahlungen positiv Excel hält im Grunde zwei verschiedene Funktionen zur Berechnung des Internen Zinsfußes bereit. MODIFIED INTERNAL RATE OF RETURN Modified internal rate of return (MIRR) is a similar technique to IRR Technically, MIRR is the IRR for a project with an identical level of investment and NPV to that being considered but with a single terminal payment In Excel and other spreadsheet software you will find an MIRR function of the form. Excel allows a user to get a negative internal rate of return of an investment using the IRR function This step by step tutorial will assist all levels of Excel users in displaying a negative IRR Figure 1 The result of the IRR function Syntax of the IRR Formula The generic formula for the IRR function is =IRR (values, guess).

3 Instruct Excel to Calculate the IRR To instruct Excel to calculate IRR, type in the function command "=IRR(A1)" into the A5 cell (directly under all the values) When you hit the Enter key, the IRR value should be displayed in that cell. Excel for Microsoft 365 Excel for ที่คุณคาดว่าใกล้เคียงกับผลลัพธ์ของ IRR Microsoft Excel จะใช้เทคนิคการวนซ้ำในการคำนวณ IRR โดยเริ่มจากการคาดเดา IRR จะคำนวณไป. IRR ist die Abkürzung von Internal Rate of Return, das kommt aus dem Englischen und bedeutet so viel wie “interne Bewertung des Gewinns” Damit wird der interne Zinsfuß bei Investitionen bezeichnet.

Die Formel zur Berechnung des internen Zinsfußes sieht wie folgt aus 0 = P 0 (P 1 / (1 IRR)) (P 2 / (1 IRR 2)) (P n / (1 IRR n)) Formel Interner Zinsfuß Dabei stellen P 0 bis P n die Cashflows (Zahlungsströme) der Investition dar und IRR den internen Zinsfuß Die Formel gibt somit die oben genannte Definition wieder. 1 Excel's IRR function Excel's IRR function calculates the internal rate of return for a series of cash flows, assuming equalsize payment periods Using the example data shown above, the IRR formula would be =IRR(D2D14,1)*12, which yields an internal rate of return of 1222% However, because some months have 31 days while others have 30. Y app IRR Calculation in Excel IRR or internal rate of return is used to calculate the internal profit for some investment in financials, IRR is an inbuilt function in excel which is used to calculate the same and it is also a financial formula, this function takes a range of values as an input for which we need to calculate internal rate of return and a guess value as the second input.

IRR function in Excel returns the internal rate of return for a series of cash flows represented by the positive and negative numbers These cash flows do not have to be consistent, as they would be for an annuity However, the cash flows must occur at regular intervals, such as monthly, quarterly, or annually. Excel’s Internal Rate of Return (IRR) function is an annual growth rate formula for investments that pay out at regular intervals It takes a list of dates and payments and calculates the average rate of return The XIRR function is similar, but works for investments that pay at irregular intervals. Excel’s Internal Rate of Return (IRR) function is an annual growth rate formula for investments that pay out at regular intervals It takes a list of dates and payments and calculates the average rate of return The XIRR function is similar, but works for investments that pay at irregular intervals.

IRR calculation in Excel As the internal rate of return is the discount rate at which the net present value of a given series of cash flows is equal to zero, the IRR calculation is based on the traditional NPV formula If you are not very familiar with the summation notation, the extended form of the IRR formula may be easier to understand.

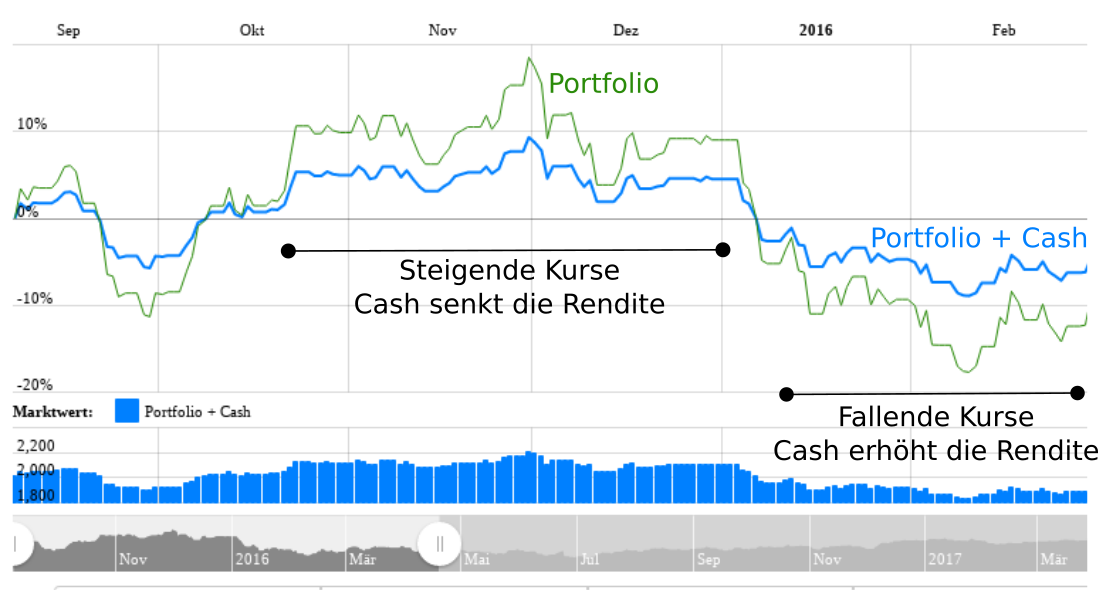

Rendite In Excel Technische Analyse Fundamentalanalyse Handelsstrategien Wertpapier Forum

Berechnung Der Cagr In Excel Compound Annual Growth Rate Formula

Internal Rate Of Return Irr A Guide For Financial Analysts

Irr Berechnung Excel のギャラリー

How To Use The Excel Irr Function Exceljet

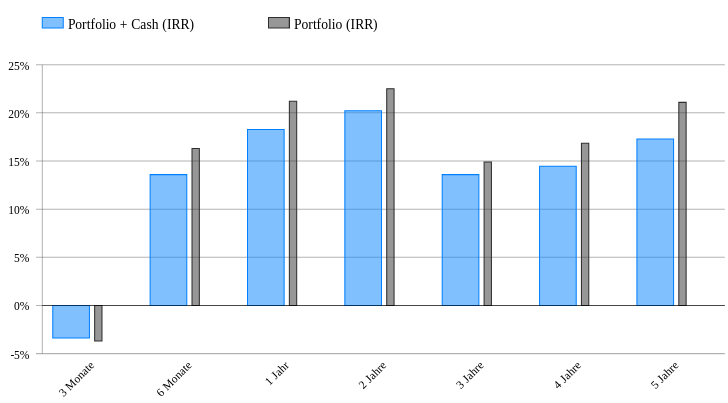

Interner Zinsfuss Bei Der Renditeberechnung Fondsdiscounter 2 0 Der Seite Fur Clevere Fondssparer

Ermittlung Der Bevorzugung Einer Investitionsvariante Aufgrund Ihrer Rendite Pdf Kostenfreier Download

Learn How To Calculate An Irr With A Terminal Value In Excel Excelchat

So Lasst Sich Der Interne Zinsfuss Mit Excel Berechnen

Calculating Irr With Excel

Know How Der Modified Internal Rate Of Return Mirr Als Vergleichsgrosse Fur Immobilieninvestoren Gmunder Gamma Ag

Calculate Irr In Excel How To Use Irr Function With Examples

Berechnen Der Internen Rendite Mit Excel 21 Talkin Go Money

Internerzinsfusd

Irr In Excel Berechnen Wie Benutze Ich Die Irr Funktion Mit Beispielen

Xirr Xintzinsfuss Renditeberechnung In Excel P2p Hero

Irr Function In Excel To Calculate Internal Rate Of Return

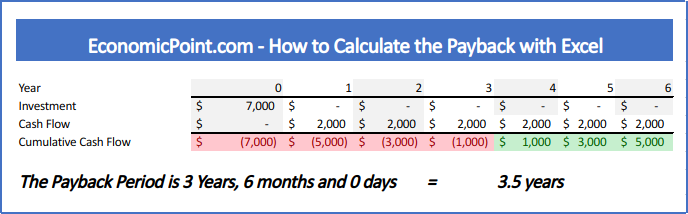

Payback Period Excel With Excel Master

How To Calculate Irr For Real Estate Investment Mashvisor

Excel Xirr Function To Calculate Irr For Non Periodic Cash Flows

Ermittlung Der Rendite Irr Interner Zinsfuss Fur Einzelinvestments Und Fur Ein Komplettes Portfolio Fimovi

Ermittlung Der Rendite Irr Interner Zinsfuss Fur Einzelinvestments Und Fur Ein Komplettes Portfolio Fimovi

Calculating Internal Rate Of Return Irr Using Excel Excel Vba Templates

Die Top 10 Excel Funktionen Fur Das Finanzwesen

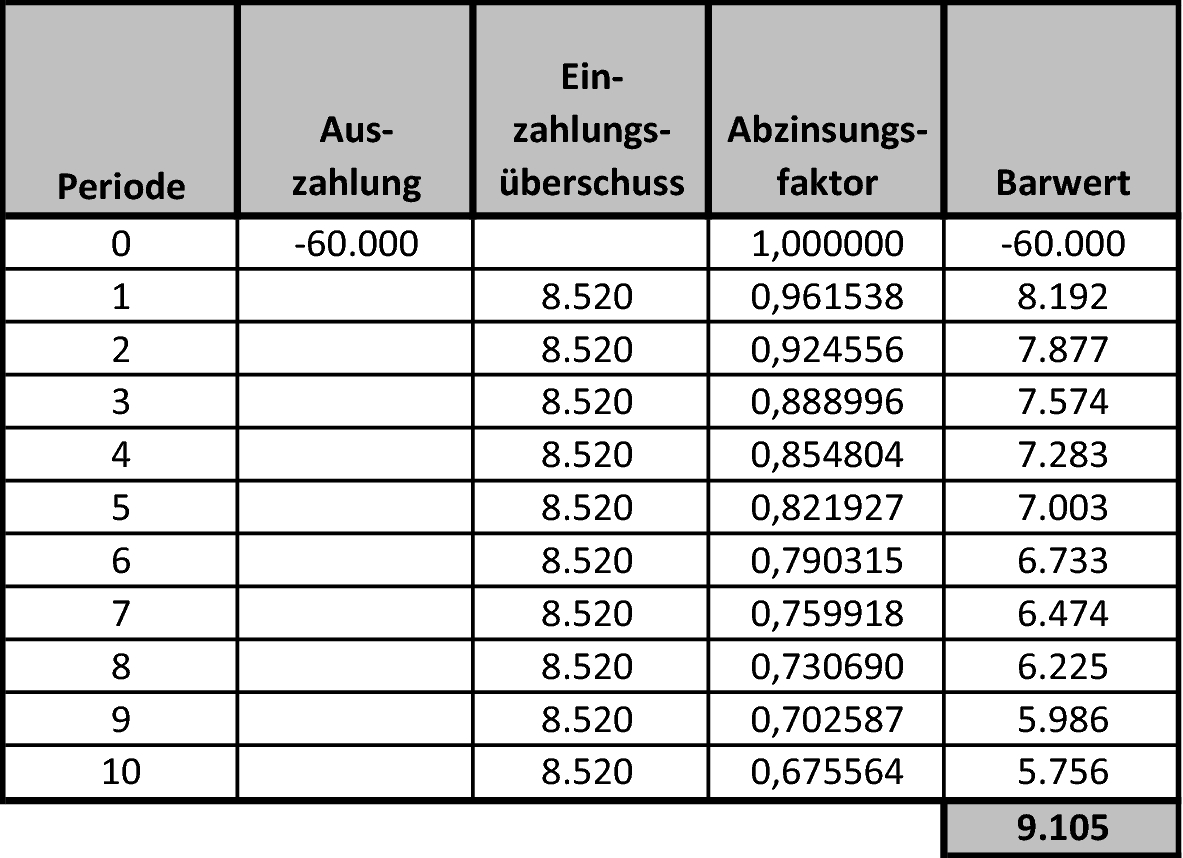

Investitionsrechnung Mit Der Internen Zinsfussmethode In Excel Clevercalcul

How To Calculate An Irr In Excel 10 Steps With Pictures

Www Excelfunktionen De

Lesson 7 Of 99 Moic And Irr Are Different Things And It Matters By Ali Hamed Medium

Kapitalwertmethode Oder Barwert Und Net Present Value Berechnen Investitionsrechnung Und Methoden Zur Bewertung Business Wissen De

Berechnung Von Npv Und pv Formeln Mit Excel 21 Talkin Go Money

/sum-offset-formula-excel-56a8f81f3df78cf772a251d0.gif)

Calculating Irr With Excel

How To Calculate An Irr In Excel 10 Steps With Pictures

Irr Berechnung Mit Mehreren Investitionen Antworten Hier

Berechnung Der Cagr In Excel Compound Annual Growth Rate Formula

Kalkulationstabellen Fur Finanzen Berechnung Der Internen Rendite Computerfahigkeiten Website Entwicklung Computerspiele Und Mobile Anwendungen

Interner Zinsfuss Bei Der Renditeberechnung Fondsdiscounter 2 0 Der Seite Fur Clevere Fondssparer

Investitionsrechnung Interner Zinssatz Mit Excel Youtube

Interner Zinsfuss Kapitalwert In Ms Excel Youtube

How To Calculate An Irr In Excel 10 Steps With Pictures

Payback Period Formula Calculator Excel Template

Incremental Irr Analysis Formula Example Calculate Incremental Irr

Project Irr Vs Equity Irr E Capslock

Irr Interner Zinsfuss Diy Investor

How To Use The Irr Function Easy Excel Formulas

Here Is How You Can Calculate The Quartlery Irr In Excel Excelchat

Www Excelfunktionen De

Mehrere Wahrungen Und Wechselkurse In Einem Excel Finanzmodell

Opportunityfinder Mit Unserem Kostenlosen Excel Tool Die Immobilien Rendite Berechnen

Microsoft Excel 3 Ways To Calculate Internal Rate Of Return In Excel

Grundlagen Der Investitionsrechnung Springerlink

How Do I Calculate A Discount Rate Over Time Using Excel

Dynamische Investitionsrechnung Mit Ti Basic Excel Erhard Rainer

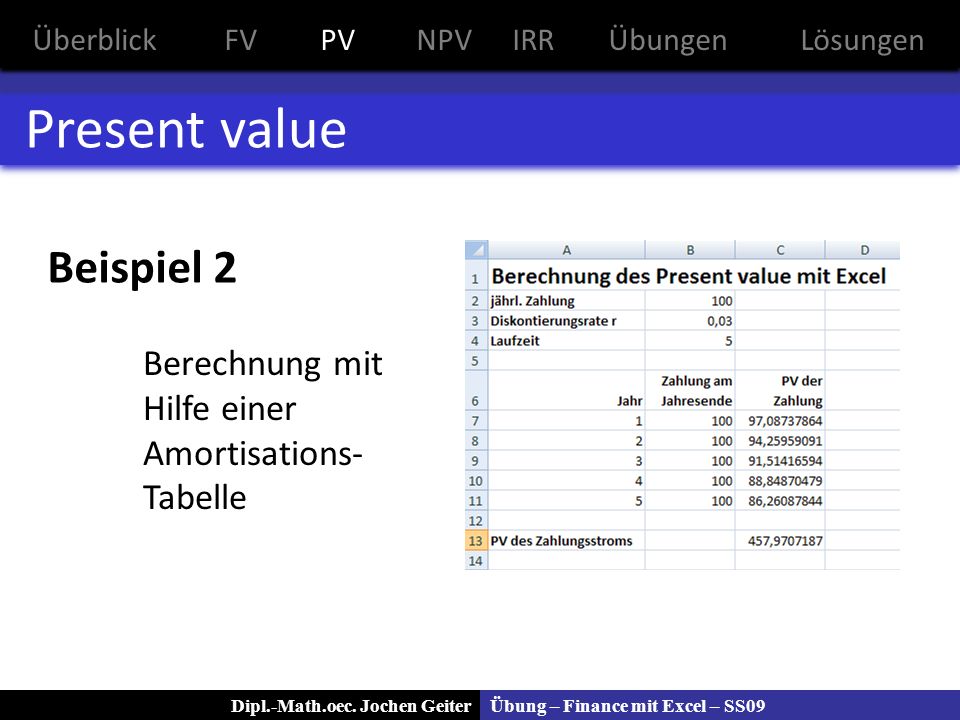

Ubung Finance Mit Excel Ppt Herunterladen

Interne Rendite Irr Definition Formel Berechnungen

How To Use The Irr Function Easy Excel Formulas

Calculation Of The Effective Interest Rate On Loan In Excel

How To Calculate The Payback Period In Excel

Excel Formula Cagr Formula Examples Exceljet

How To Calculate The Irr Of Startups Startup Valuation School

Auflistung Uber 100 Excel Tipps Und Tricks Auf Der Controllerspielwiese

Investitionsrechnung Mit Der Internen Zinsfussmethode In Excel Clevercalcul

Mit Excel Die Interne Zinssatzmethode Berechnen Vripmaster

Internal Rate Of Return Irr A Guide For Financial Analysts

Internal Rate Of Return Irr Accounting Simplified

Calculating Irr With Excel

Free Roi Templates And Calculators Smartsheet

Sap Effective Interest Rate Vs Ms Excel Irr Xirr Sap Blogs

Verwendung Von Finanzfunktionen

Dynamische Investitionsrechnung Mit Ti Basic Excel Erhard Rainer

Interner Zinsfuss Bei Der Renditeberechnung Fondsdiscounter 2 0 Der Seite Fur Clevere Fondssparer

Calculation Of The Effective Interest Rate On Loan In Excel

Irr Calculator Calculate Internal Rate Of Return Online

Wie Lautet Die Formel Fur Die Berechnung Der Internen Verzinsung Irr Talkin Go Money

Calculate Irr In Excel Formula Examples Irr Calculation In Excel Youtube

Investitionsrechnung Mit Der Internen Zinsfussmethode In Excel Clevercalcul

Ubung Finance Mit Excel Ppt Herunterladen

How To Calculate The Irr Of Startups Startup Valuation School

Internal Rate Of Return Irr A Guide For Financial Analysts

Dynamische Investitionsrechnung Mit Ti Basic Excel Erhard Rainer

Incremental Irr Analysis Formula Example Calculate Incremental Irr

Dynamische Investitionsrechnung Mit Ti Basic Excel Erhard Rainer

Irr Levered Vs Unlevered An Internal Rate Of Return Example Efinancialmodels

Excel Mirr Function To Calculate Modified Internal Rate Of Return

Ermittlung Der Rendite Irr Interner Zinsfuss Fur Einzelinvestments Und Fur Ein Komplettes Portfolio Fimovi

Calculate Irr Using Excel Youtube

Irr In Excel Berechnen Wie Benutze Ich Die Irr Funktion Mit Beispielen

Learn How To Calculate An Irr With A Terminal Value In Excel Excelchat

Npv Vs Irr Welcher Ansatz Ist Fur Die Projektevaluierung Besser

How To Calculate An Irr In Excel 10 Steps With Pictures

Investitionsrechnung Mit Der Internen Zinsfussmethode In Excel Clevercalcul

Problem Mit Ikv Office Loesung De

Was Ist Payback Und Wie Man Es Interpretiert Blog Luz Spreadsheets

How To Calculate The Irr Of Startups Startup Valuation School