Fixed Asset Accounting Cycle

Fixed assets are the assets that are purchased for a longer period of time to be used and are not likely to be converted into cash in a short period of fewer than twelve monthsExamples of fixed assets are land, building, and equipment, etc The fixed assets are at risk of being misreported, which imbalance the whole books of accounts for a company.

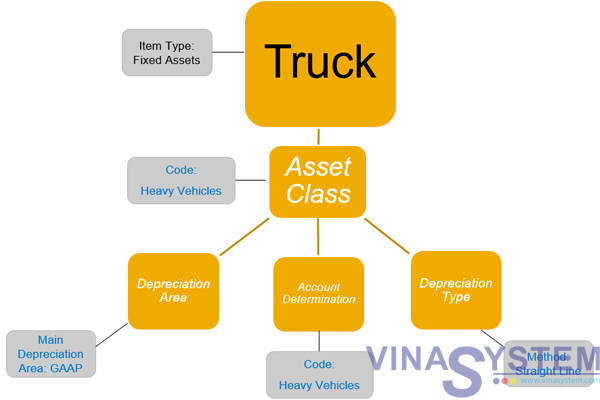

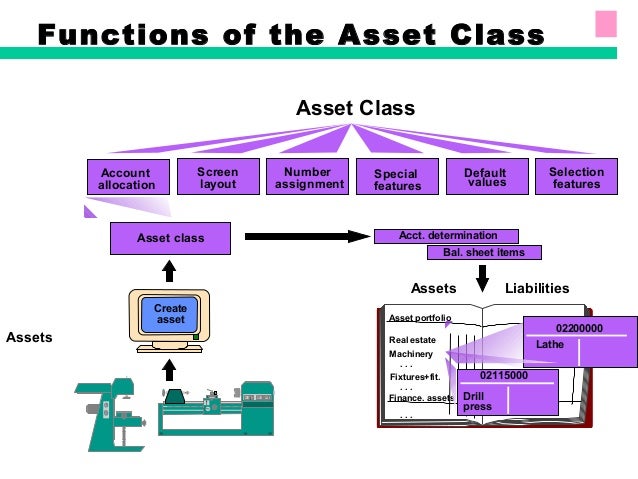

Fixed asset accounting cycle. We're going back to the basics in accounting, and the objective of this post is to walk you through the correct way to book a fixed asset journal entry and how to do fixed asset accounting, all the way from asset purchase to sale and write offBut first, what is a fixed asset?. Fixed assets (also called capital assets or property, plant and equipment (PPE)) are operational assets that generate economic benefits for a business over a longterm period For an asset to be classified as a fixed asset, it must be fundamental to the company’s operations For example, an investment in bonds held over longterm can’t be classified as a fixed asset because it is a non. Umoja Fixed Assets deals with the tracking of assets from the financial accounting perspective Only assets that meet the UN IPSAS capitalization criteria will have a Fixed Asset record in Umoja In compliance with • OCSS & DFS Published Guidance • Property, Plant and Equipment (IPSAS 17) • UN IPSAS Corp guidance#10, #6, #5, #3.

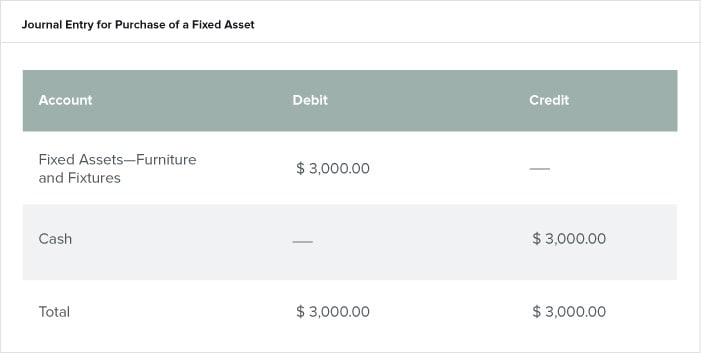

Examples of Fixed Assets A fixed asset is something that will be used in the business and that has a useful life of. The fixed assets journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of fixed assets In each case the fixed assets journal entries show the debit and credit account together with a brief narrative. We're going back to the basics in accounting, and the objective of this post is to walk you through the correct way to book a fixed asset journal entry and how to do fixed asset accounting, all the way from asset purchase to sale and write offBut first, what is a fixed asset?.

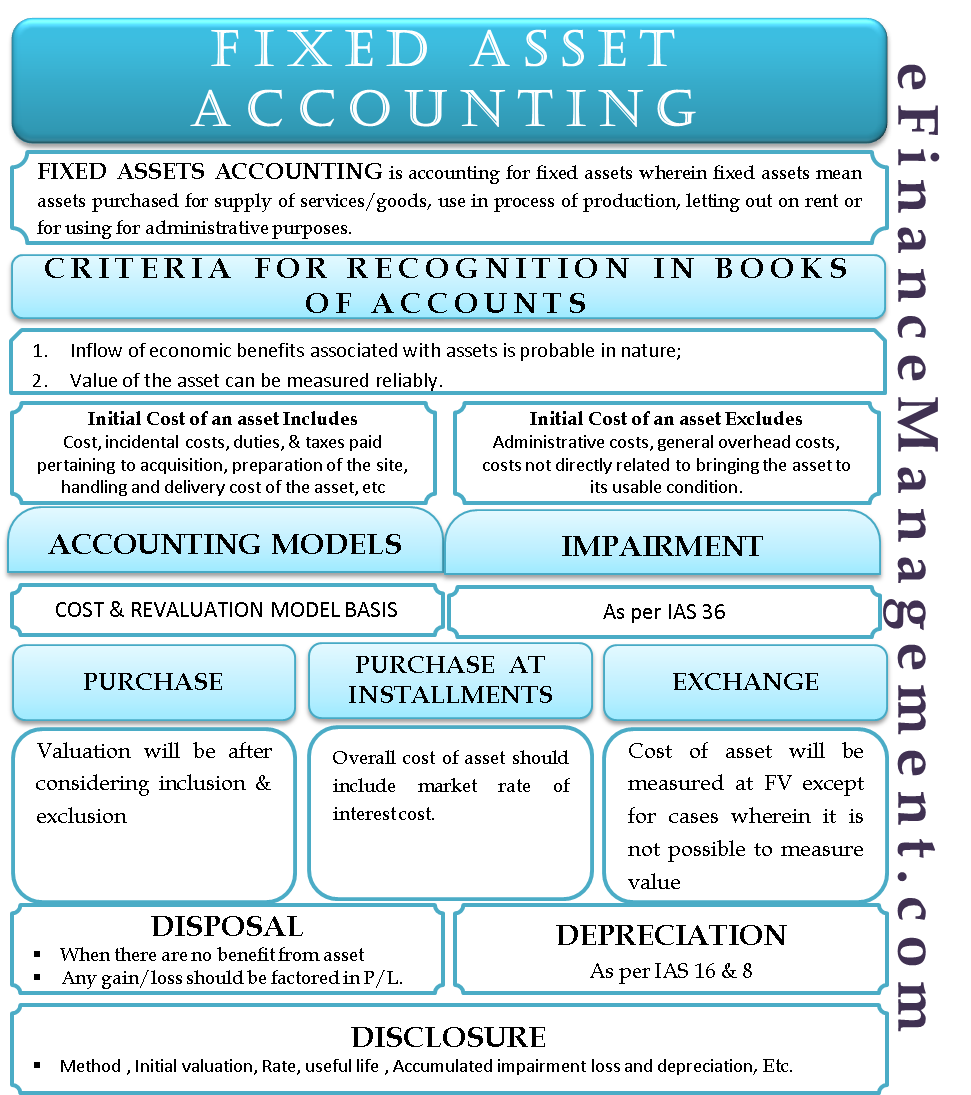

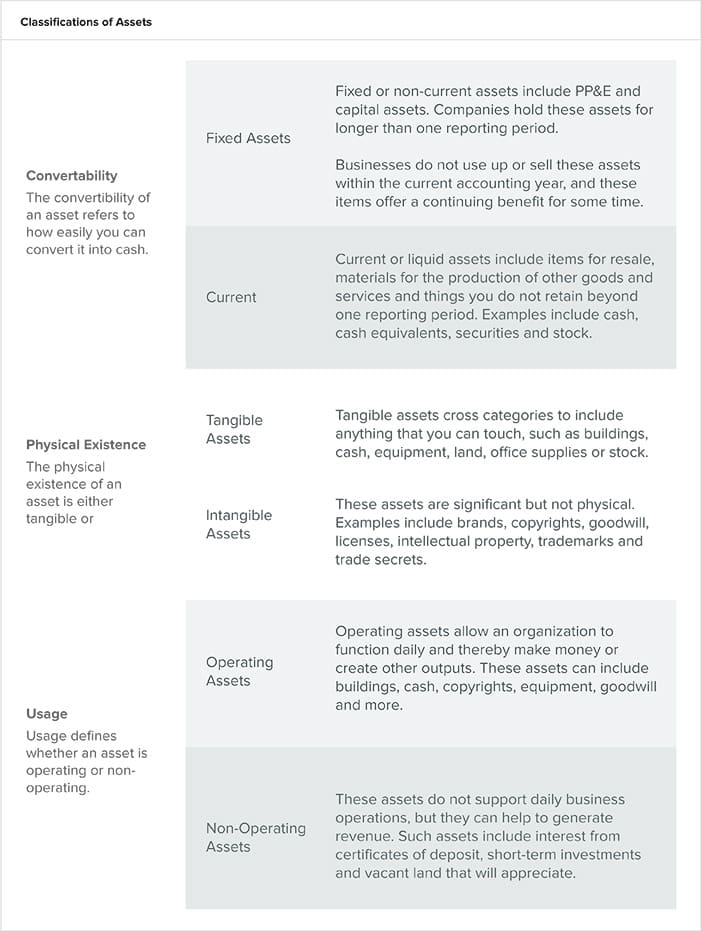

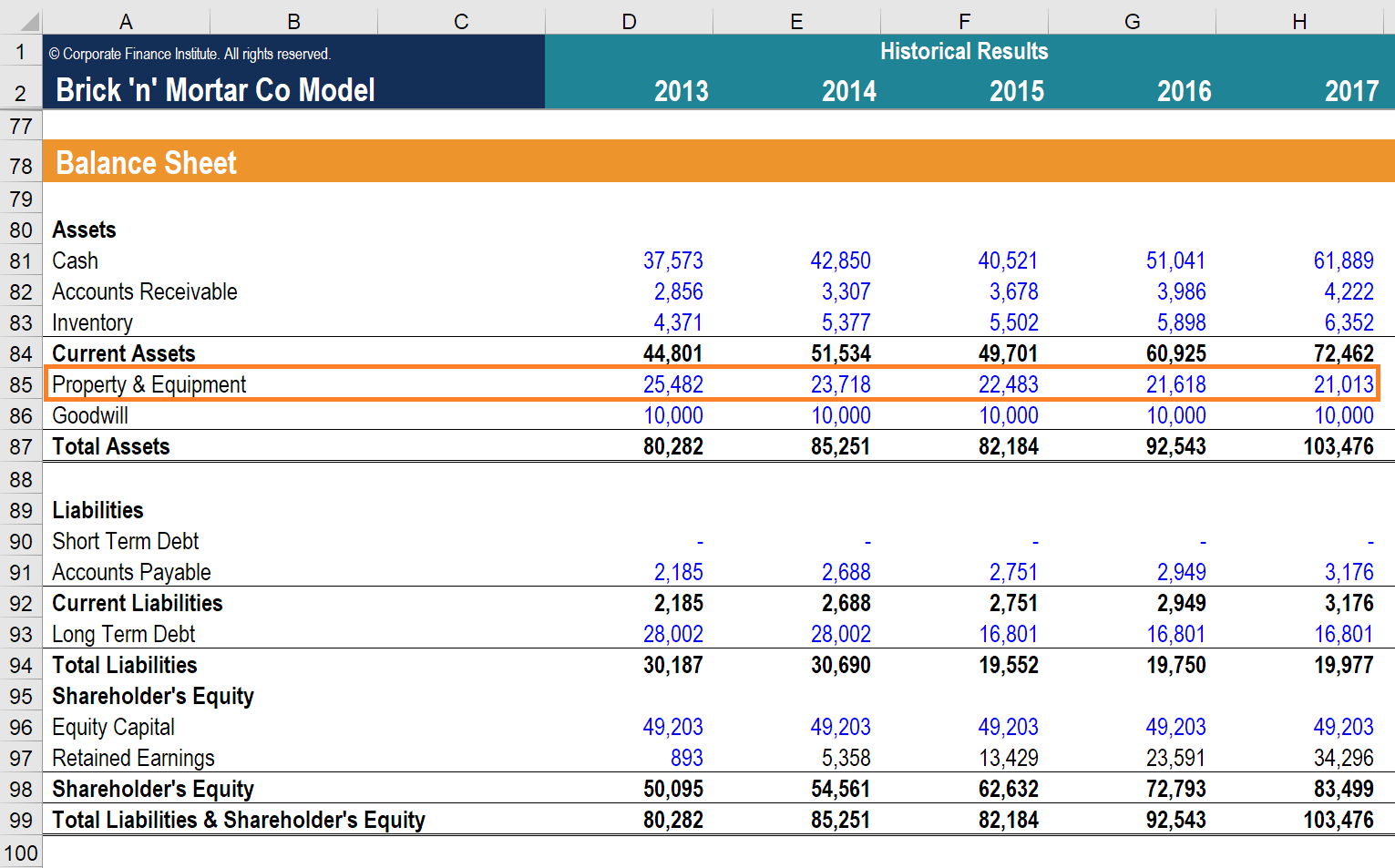

Review fixed assets impairment assessment Based on IAS 36 Impairment, the entity needs to assess the impairment every year The auditor should consider reviewing the procedures and processes that managers use to assess the impairments Derecognition of fixed assets is agreed to the de recognition procedure and policy. Businesses must own a minimum number of fixed assets for accounting reasons 2 What happens to fixed assets on the financial statements if no fixed assets are purchased or sold?. In Balance Sheet accounting, capital items are reported separately from Current assets Fixed items are considered less liquid than Current items because capital items would be more difficult to convert into cash in the shortterm Fixed Assets The term fixed asset is sometimes used interchangeably with capital or non current assets.

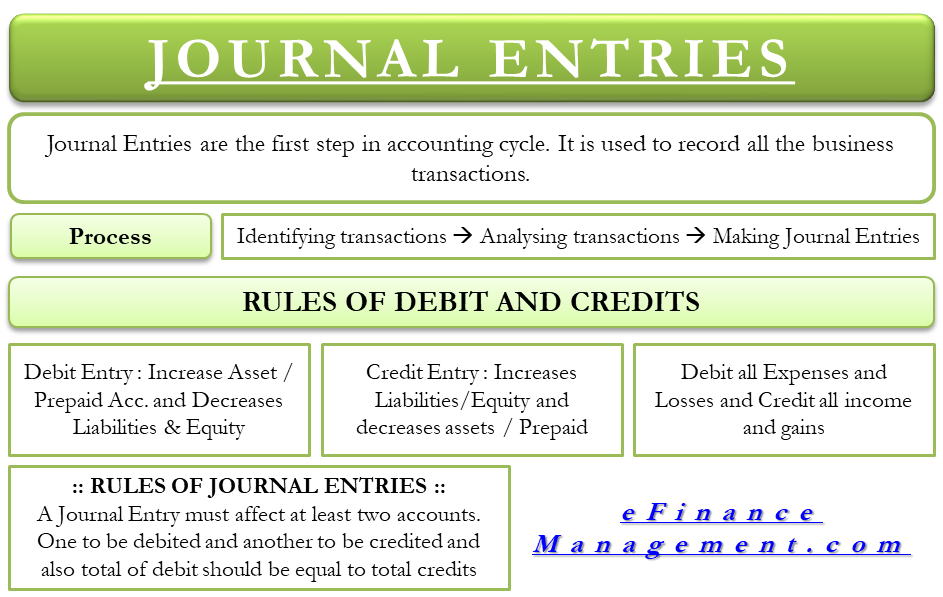

When the invoice for the asset is entered;. The asset ledger is the portion of a company's accounting records that detail the journal entries relating only to the asset section of the balance sheet more What Is a Debit Ticket in Accounting?. Accounting cycle Series of steps performed during the accounting period to analyze, record, classify, summarize, and report useful financial information for the purpose of preparing financial statementsThe steps include analyzing transactions, journalizing transactions, posting journal entries, taking a trial balance and completing the work sheet, preparing financial statements, journalizing.

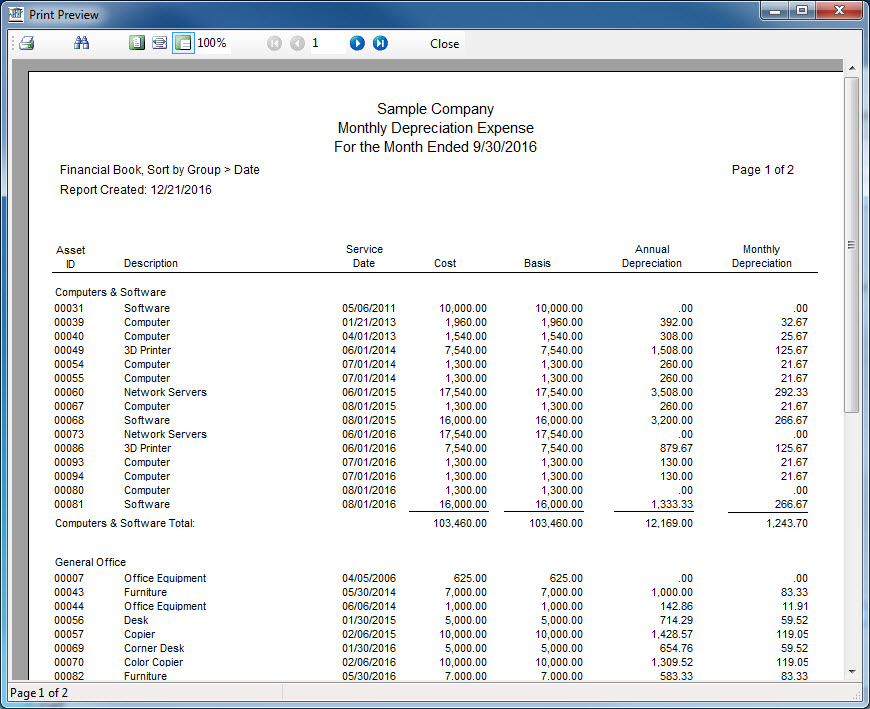

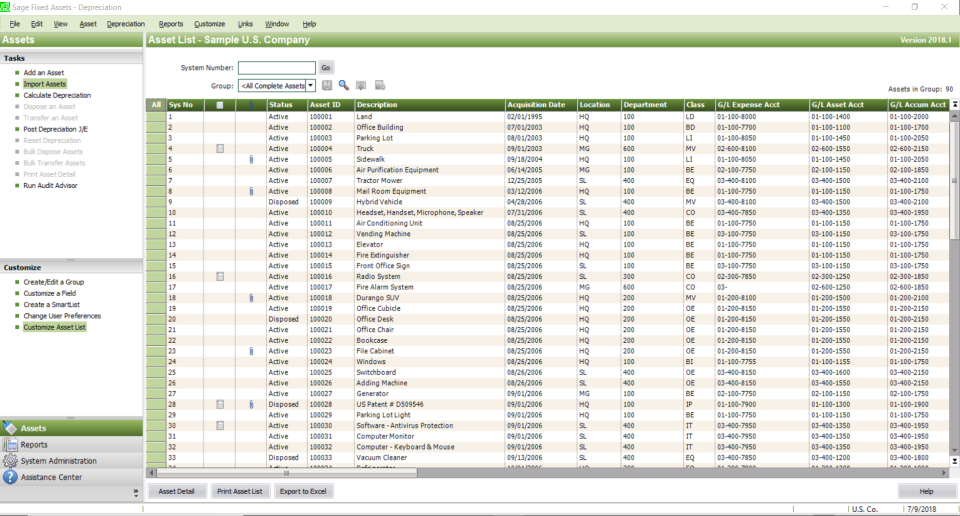

C fixed assets D intangible assets Aoperating cycle B accounting cycle C production time D sales time A operating cycle Property, plant, and equipment are _____ A also called fixed or plant assets B either tangible or intangible assets C presented in order of the category name, with Land being presented last. The fixed assets journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of fixed assets In each case the fixed assets journal entries show the debit and credit account together with a brief narrative. Sage Fixed Assets has served me well for more than 30 years,” said Jensen “I have a great deal of confidence in the system’s accuracy, and our accounting department has enjoyed the convenience of automatic tax law updates and smooth data integration between Sage Fixed Assets and our ERP system.

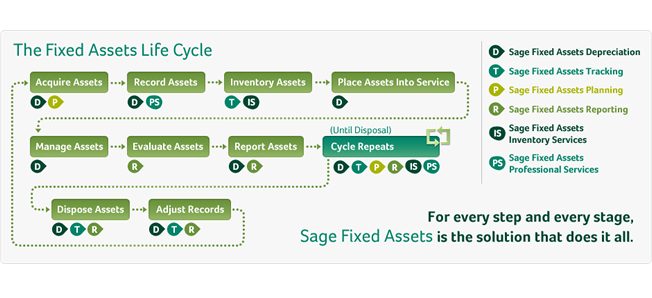

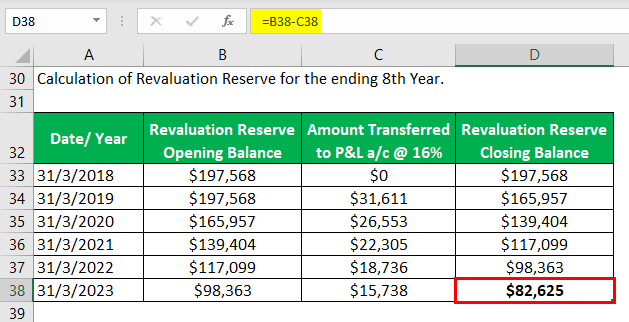

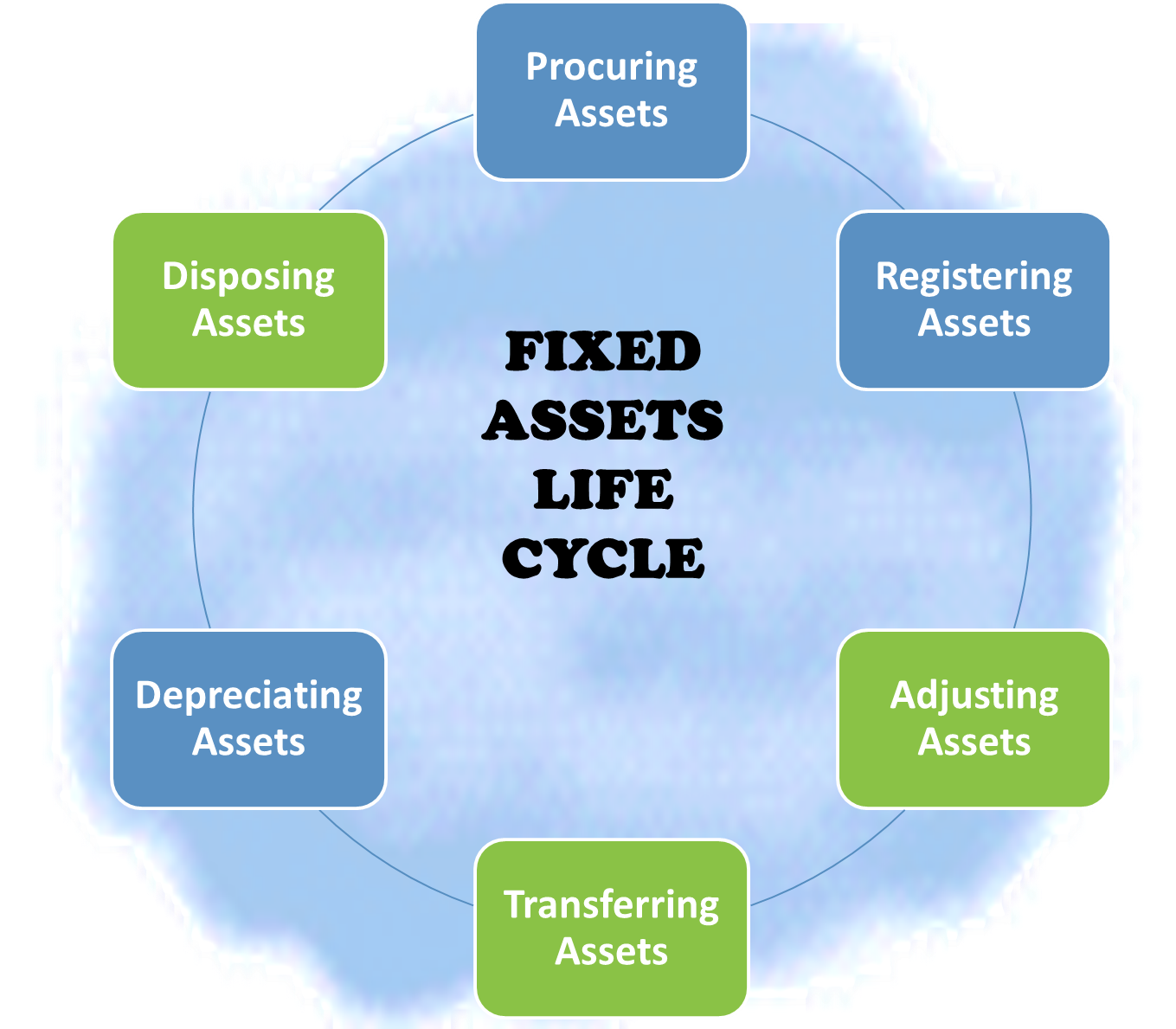

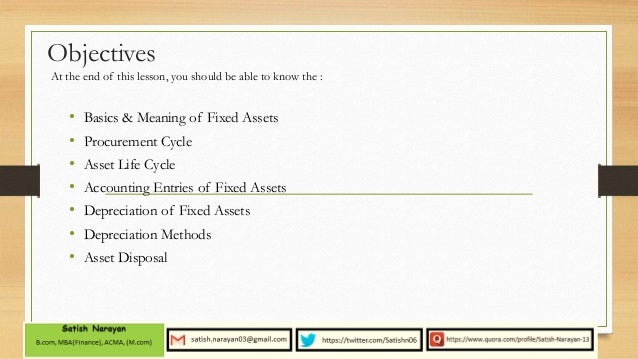

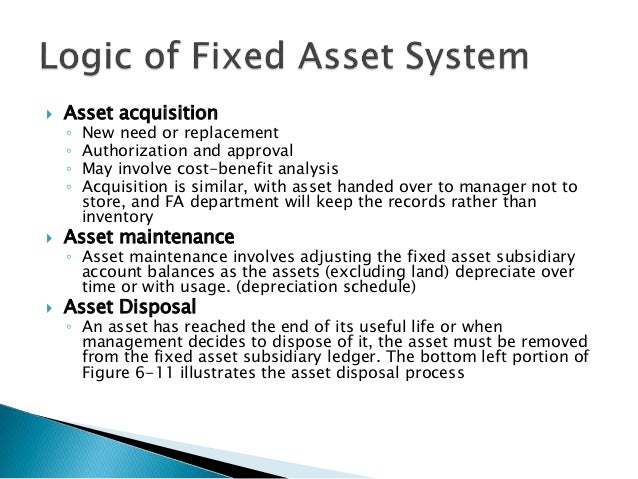

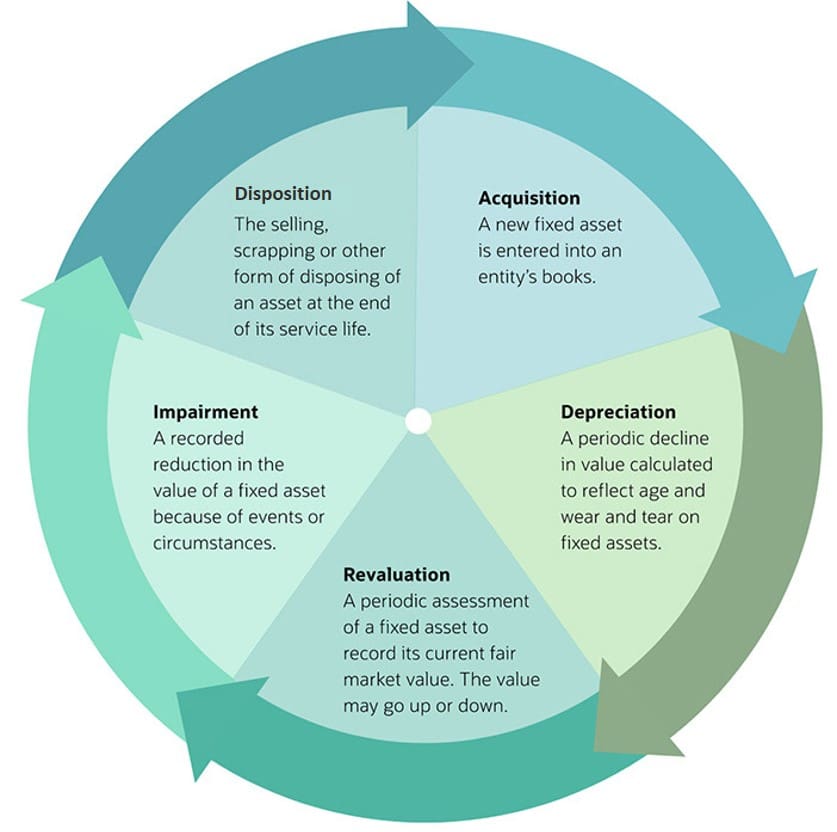

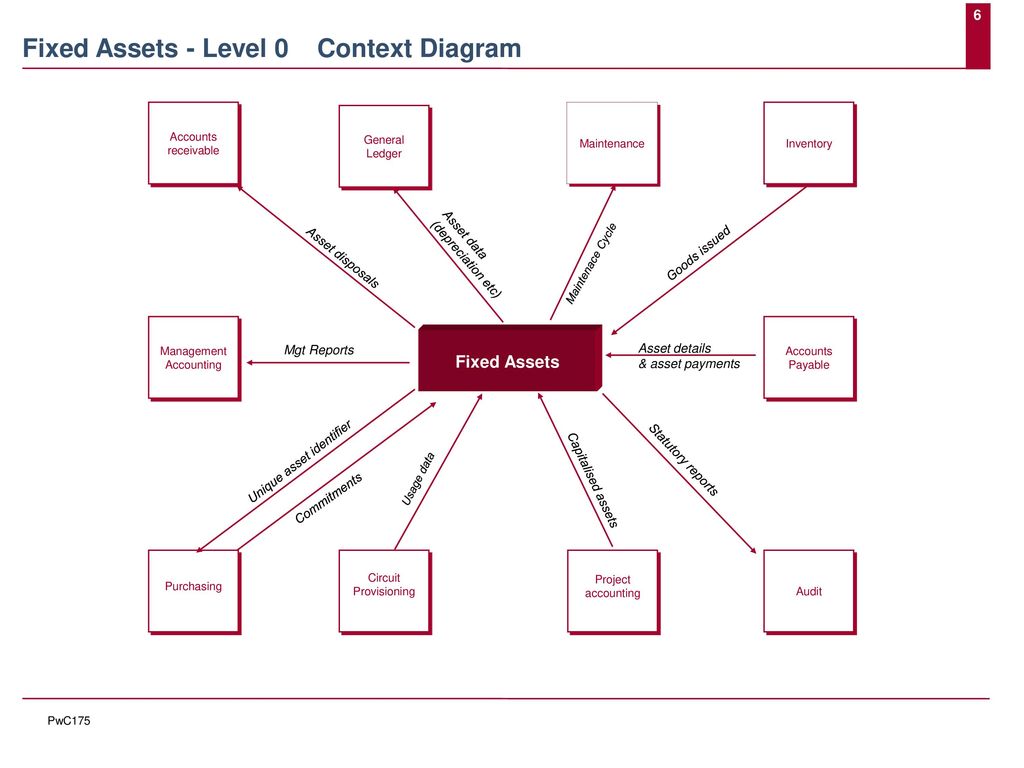

All fixed assets go through the same life cycle Acquisition a new fixed asset is entered into an entity’s books Depreciation/Amortization a periodic decline in value calculated to reflect the age and wear and tear on fixed assets Revaluation a periodic assessment of a fixed asset to record its. YearEndClosing in Asset Accounting The process described in this blog assists you in keeping on top of Critical Factors, such as data consistency, which can involve a considerable amount of time and work during the yearend closing phase in asset accountingThis blog takes you through all of the steps necessary for an unproblematic yearend closing, before the critical external audit phase. Http//wwwtechnofunccom presents another Functional Capsule on Fixed Asset process area In these functional capsules;.

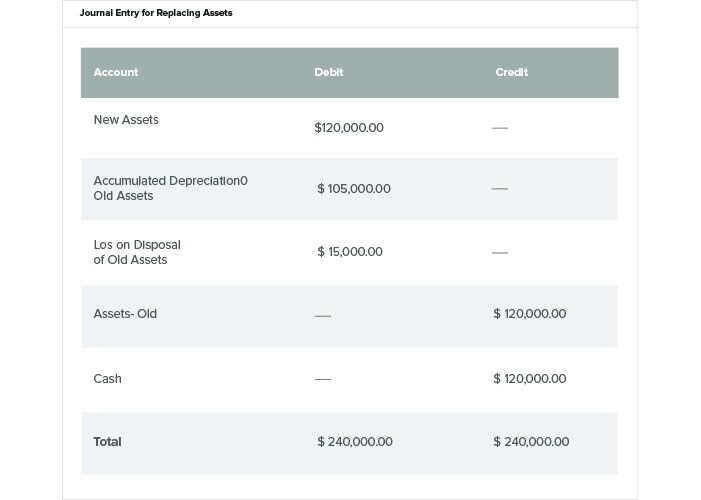

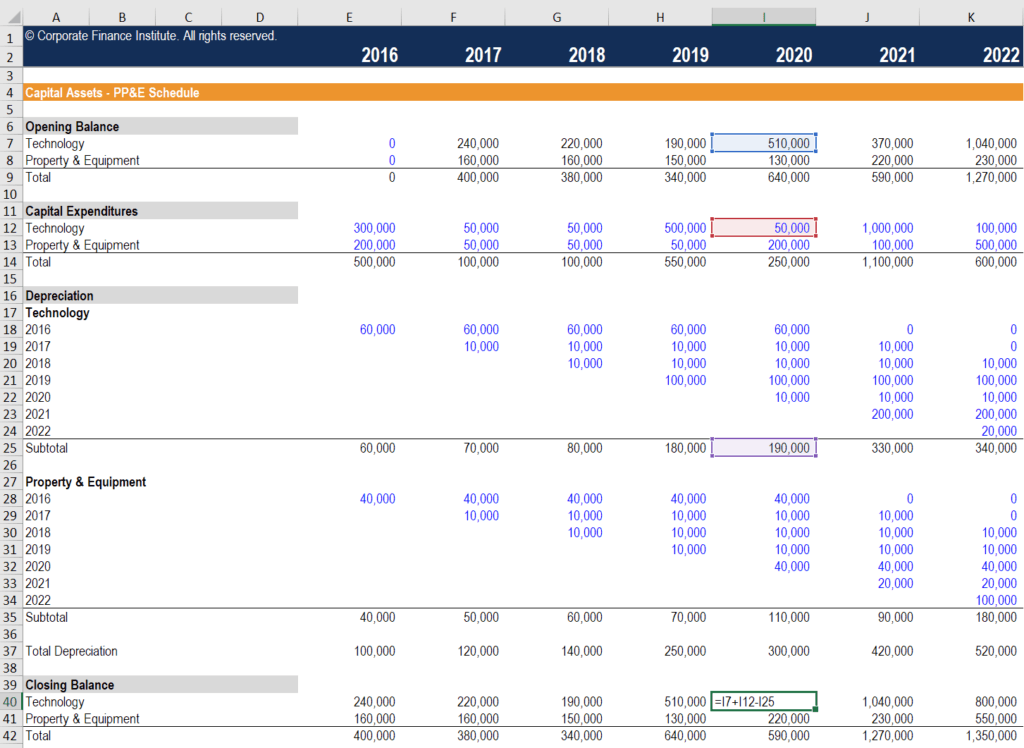

In most cases, fixed assets are acquired through exchange of monetary assets, such as cash However, there are instances where two companies engage in barter transactions of fixed assets In accounting for such exchanges of nonmonetary assets, we need to find out if the transaction has commercial substance. The purchase and depreciation of fixed assets are common transactions in this cycle Selling off old or outdated assets also falls under this cycle The fixedasset cycle may have close ties to the financing cycle Many companies use external financing to purchase fixed assets A fixed transaction can therefore have a related transaction in the financing cycle. There are several accounting transactions to record for fixed assets, which are noted below Initial Asset Recordation On the assumption that the asset was purchased on credit, the initial entry is a credit to accounts payable and a debit to the applicable fixed asset account for the cost of the asset The cost of an asset can include any associated freight charges, sales taxes, installation fees, testing fees, and so forth.

And managers for fixed asset management, control, accounting, and record keeping and to define fixed assets and controlled items and the guidelines for their capitalization 2 Objectives The objectives of this document are as follows • To ensure consistent Citywide procedures for fixed asset accounting, management, control, and accountability. Businesses must own a minimum number of fixed assets for accounting reasons 2 What happens to fixed assets on the financial statements if no fixed assets are purchased or sold?. This means that they have a physical substance unlike intangible assets which have no physical existence such as copyright and trademarks Fixed assets are not held for resale but for the production, supply, rental or administrative purposes Assets that held for resale must be accounted for as inventory rather than fixed asset So for example, if a company is in the business of selling cars, it must not account for cars held for resale as fixed assets but instead as inventory assets.

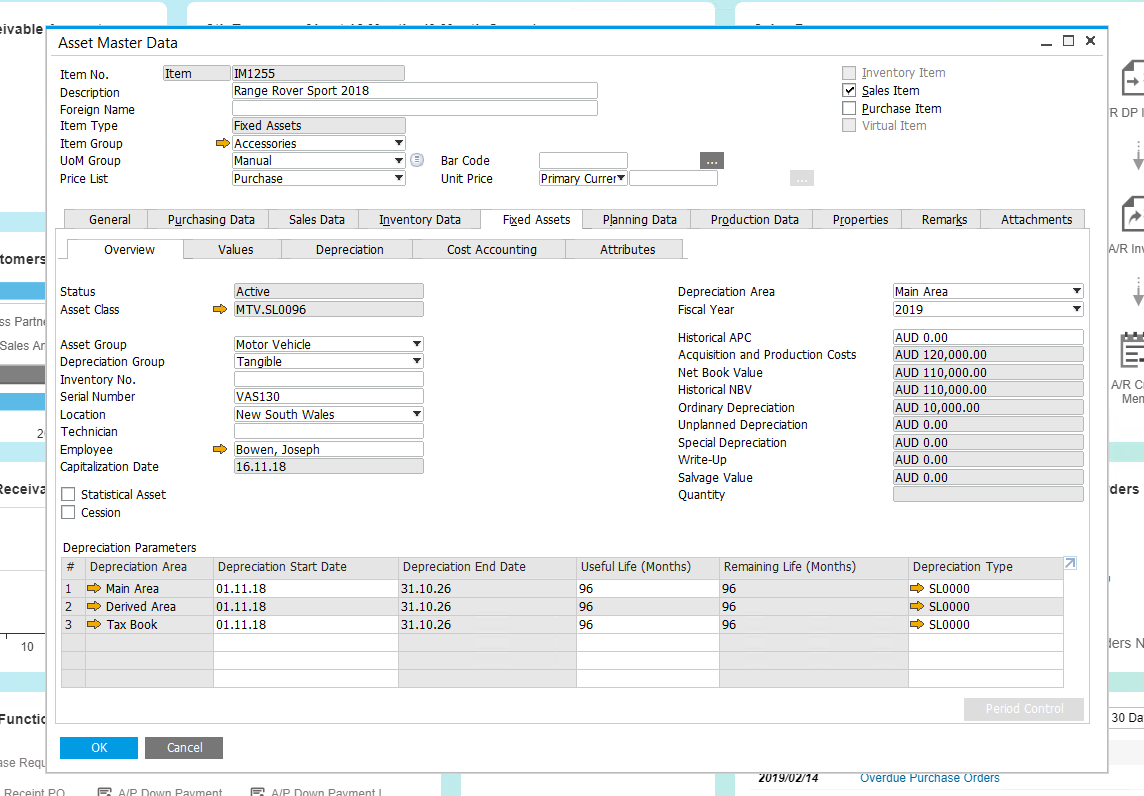

And managers for fixed asset management, control, accounting, and record keeping and to define fixed assets and controlled items and the guidelines for their capitalization 2 Objectives The objectives of this document are as follows • To ensure consistent Citywide procedures for fixed asset accounting, management, control, and accountability. The Fixed Assets Packet describes how to create and maintain assets in MAGIC Key components within this package include integration points with Supplier Relationship Management (SRM), asset lifecycle, asset retirements, asset transfers, and the close process. A fixed asset could be a selfconstructed asset or maybe an acquired asset Once the AR is approved a Purchase Order is issued in case the asset needs to be procured from a Vendor An asset is most often entered into the accounting system;.

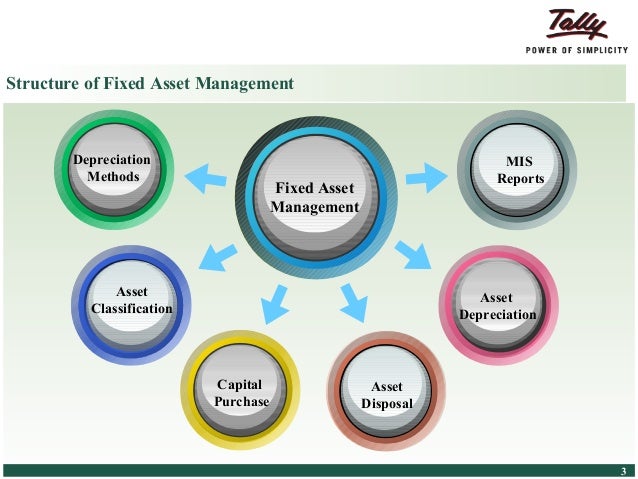

"Technofunc" provides you with compr. Fixed Assets is an important part of the accounting It is usually one of the areas that are implemented in SAP, and often it goes in the same phase as all other Core Finance components General Ledger, Accounts Payable, Accounts Receivable. Fixed Assets Process Flow “Fixed Assets” is a sixstep process and starts with initiating and approving the request to acquire the asset and after maintaining and depreciating for useful life ends with the final disposal of the fixed asset These steps are cyclic in nature and most of them happen in any fixed management lifecycle.

The accounting equation shows the financial position as Assets = Liabilities Owner’s Equity Step 11 Analysis and interpretation The final step in the accounting cycle is the analysis and interpretation of the information contained in the financial statements. C fixed assets D intangible assets Aoperating cycle B accounting cycle C production time D sales time A operating cycle Property, plant, and equipment are _____ A also called fixed or plant assets B either tangible or intangible assets C presented in order of the category name, with Land being presented last. Examples of Fixed Assets A fixed asset is something that will be used in the business and that has a useful life of.

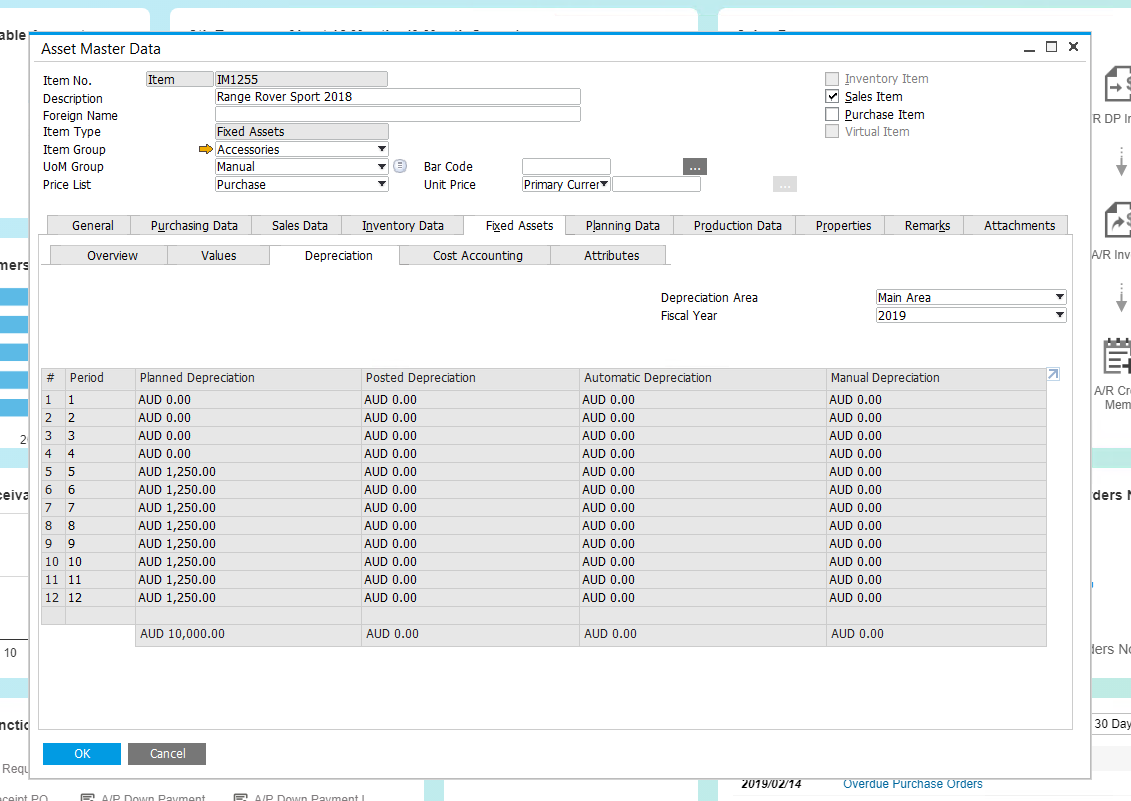

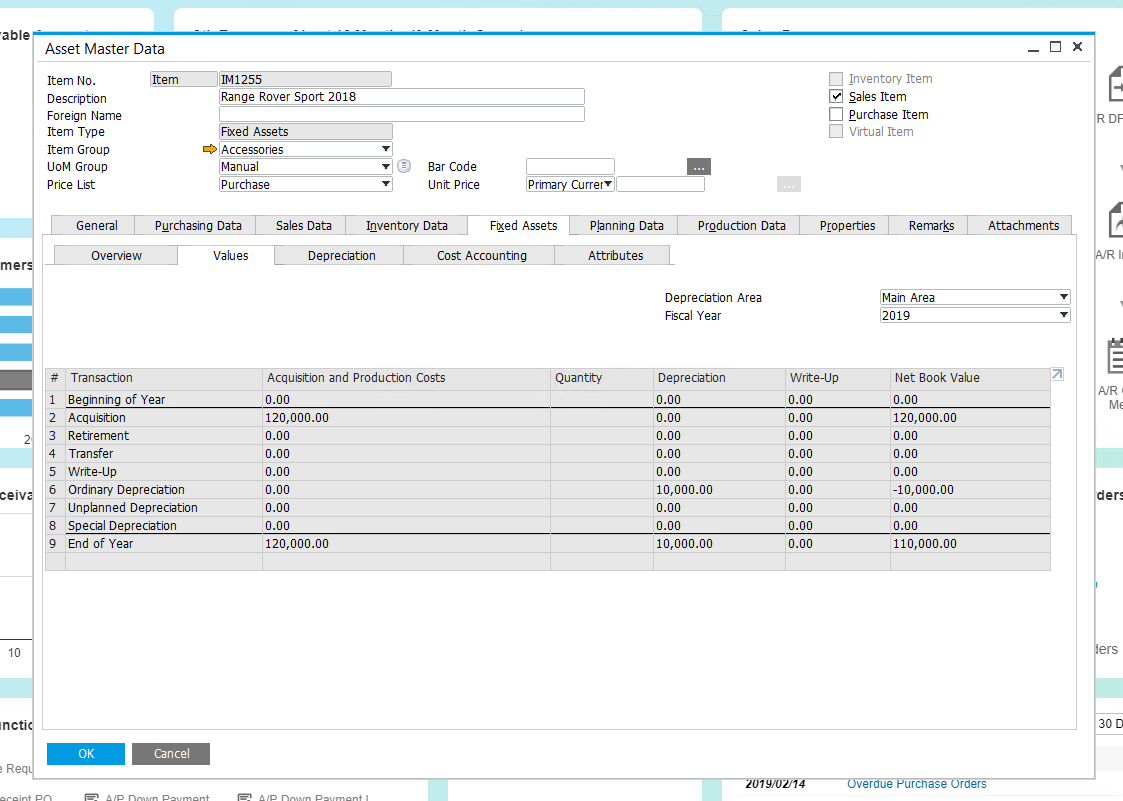

Record the values of intangible and tangible fixed assets These will be entered in the company's balance sheet under the category "noncurrent assets" or "fixed assets" at the end of an accounting cycle An accounting cycle can be monthly, quarterly or annually. In Balance Sheet accounting, capital items are reported separately from Current assets Fixed items are considered less liquid than Current items because capital items would be more difficult to convert into cash in the shortterm Fixed Assets The term fixed asset is sometimes used interchangeably with capital or non current assets. Overview Depreciation definition Depreciation can be one of the more confusing components of the accounting cycleUsed to properly allocate the cost of a fixed or tangible asset, depreciation is.

Key Accounting Issues on the Fixed Asset Life Cycle Life Cycle The fixed asset life cycle begins when the company acquires the asset and ends when the company disposes of Acquisition Companies acquire assets through various methods Each method of acquisition raises different accounting. Fixed Asset life cycle is very crucial it lets you manage your valuable items effectively & add more useful life of an asset to your organization However, it is important to have a software application that ensures proper upgrading, replacement, and disposal of an asset Overall, it optimizes the life cycle of the asset. Into the accounts payable;.

Fixed assets (also called capital assets or property, plant and equipment (PPE)) are operational assets that generate economic benefits for a business over a longterm period For an asset to be classified as a fixed asset, it must be fundamental to the company’s operations For example, an investment in bonds held over longterm can’t be classified as a fixed asset because it is a non. Fixed Asset Also known as property, plant and equipment, a "Fixed Asset" is a term used in accounting for assets which cannot easily convert into cash Compared with current assets such as cash or bank accounts, which are described as liquid assets, only tangible assets are referred to as fixed. Fixed Asset Manager’s Guide to SarbanesOxley Compliance Safeguards and features in FAS fixed asset management solutions October 05 wwwIMSolutionsnet Toll Free , Facsimile US Highway 19 North, Suite 314 FAS Asset Accounting database Using stateoftheart bar code technology,.

A fixed asset is a longterm tangible piece of property or equipment that a firm owns and uses in its operations to generate income Fixed assets are not expected to be consumed or converted into. Accounting for fixed assets is not in accordance with GAAP Under the former rules, the above costs were accumulated in property ledgers and the totals were then posted to the Development account, the Modernization account, or the Fixed Asset account in the general ledger This means that the detail of the fixed assets is not in the general. Record the values of intangible and tangible fixed assets These will be entered in the company's balance sheet under the category "noncurrent assets" or "fixed assets" at the end of an accounting cycle An accounting cycle can be monthly, quarterly or annually.

Fixed Asset Process activities, end to end activities of fixed asset in the company, capitalisation, journal entries, fixed asset cycle, procurement cycle, typ Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising. A fixed asset typically goes through the life cycle of acquisition, usage, and disposal For each of these stages of the life cycle, discuss one key accounting issue related to a fixed asset the company must address. Inventory is a noncurrent asset;.

Fixed assets are the assets that are purchased for a longer period of time to be used and are not likely to be converted into cash in a short period of fewer than twelve monthsExamples of fixed assets are land, building, and equipment, etc The fixed assets are at risk of being misreported, which imbalance the whole books of accounts for a company. Fixed assets are tangible assets purchased for the supply of services or goods, use in the process of production, letting out on rent to third parties or for using for administrative purposes They are bought for usage for more than one accounting year. Hence all these assets are not included while computing fixed assets Example #2 – Fixed Asset Account Hydra Inc purchased a machine during January 16 worth $15 million (trade discount = $150,000) and incurred $50,000 for transportation and installation.

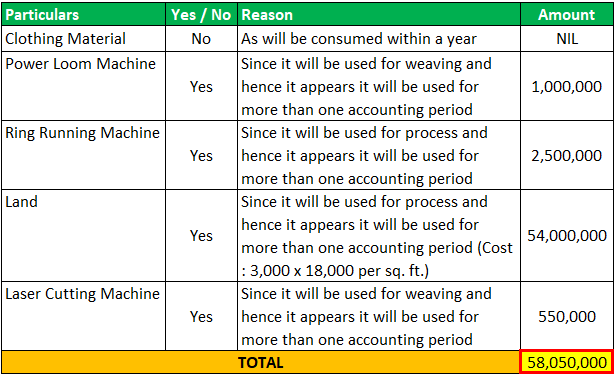

A fixed asset typically goes through the life cycle of acquisition, usage, and disposal For each of these stages of the life cycle, discuss one key accounting issue related to a fixed asset the company must address. Umoja Fixed Assets deals with the tracking of assets from the financial accounting perspective Only assets that meet the UN IPSAS capitalization criteria will have a Fixed Asset record in Umoja In compliance with • OCSS & DFS Published Guidance • Property, Plant and Equipment (IPSAS 17) • UN IPSAS Corp guidance#10, #6, #5, #3. Hence all these assets are not included while computing fixed assets Example #2 – Fixed Asset Account Hydra Inc purchased a machine during January 16 worth $15 million (trade discount = $150,000) and incurred $50,000 for transportation and installation.

For most businesses, fixed assets represent a significant capital investment, so it is critical that the accounting be applied correctly Here are some key facts to understand and insights to keep in mind Fixed assets are capitalized That’s because the benefit of the asset extends beyond the year of purchase, unlike other costs, which are period costs benefitting only the period incurred Fixed assets should be recorded at cost of acquisition. Inventory is a noncurrent asset;. The basic difference between fixed asset and current asset lies in the fact that how liquid the assets are, ie if they can be converted into cash within one year, then they are considered as a current asset while when the asset is kept by the firm for more than one accounting year, then it is known as fixed assets or noncurrent assets.

Our fixed asset accounting solution that allows you to account for these changing values of assets to again make sure that we’re accounting for the asset correctly, we’re depreciating it correctly, we are storing the correct gross and net book values against our assets as well The other thing that could occur are things like enhancements. • Compliance with accounting standards and asset management best practices • Guidance for all transactions encountered through the asset life cycle • Assignment of asset management responsibilities and job descriptions • Training for new and existing employees • Processes to safeguard capital assets. Fig 1 Accounts and accounting in Fixed Assets Fig 2 Accounts and accounting in Fixed Assets Next we will see the different accounting at various transactional events Depreciation Accounting Whenever you run depreciation, Oracle Assets creates accounting entry with your accumulated depreciation accounts and your depreciation expense accounts.

To carry out fixed asset auditing, auditors tend to observe or recalculate the following business records Purchase and disposal authorizations Lease documentation Appraisal reports Accumulated depreciation or amortization amounts. IAS 16 outlines the accounting treatment for most types of property, plant and equipment Property, plant and equipment is initially measured at its cost, subsequently measured either using a cost or revaluation model, and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life IAS 16 was reissued in December 03 and applies to annual periods.

Fixed Asset Management In Sap Business Bydesign

Bookkeepers And Accountants Save Time By Automating Fixed Asset Depreciation

Fixed Assets In Sap Business One Introduction

Fixed Asset Accounting Cycle のギャラリー

Fixed Asset Accounting Mri Software

Asset Accounting Overview Sap Documentation

Fixed Asset Accounting Overview And Best Practices Involved

Technofunc The Accounting Cycle

Fixed Asset Pro Moneysoft Calculate Asset Depreciation Fast

Fixed Asset Functions And Setup Steps Oracle E Business Suite Support Blog

Fixed Asset Software

Sage Fixed Assets Fixed Asset Management Fixed Asset Training

Udemy 100 Off Financial Accounting Depreciation Calculation Fixed Assets Fixed Asset Financial Accounting Accounting Classes

Fixed Assets In Sap Business One Introduction

Quotes About Fixed Assets 19 Quotes

03 Financing And Investing Cycle Depreciation Mergers And Acquisitions

Introducing New Asset Accounting In S 4 Hana

Accounting Cycle Steps Double Entry Bookkeeping

Top 22 Fixed Asset Management Software In Reviews Features Pricing Comparison Pat Research B2b Reviews Buying Guides Best Practices

What Is Accounting Process Each Step In Detail omassistant

Asset Accounting In Sap Fico Step By Step Guide Skillstek

Accounting Equation And Why It Matters In Business Fourweekmba

Challenges In Tracking Fixed Assets Through Its Life Cycle

Fixed Assets Basics In Accounting Double Entry Bookkeeping

Fixed Asset Management Guide With Sap Business One

Fixed Asset Accounting Made Simple Netsuite

Journal Entry Definition Process Rules Of Journal Entries With Example

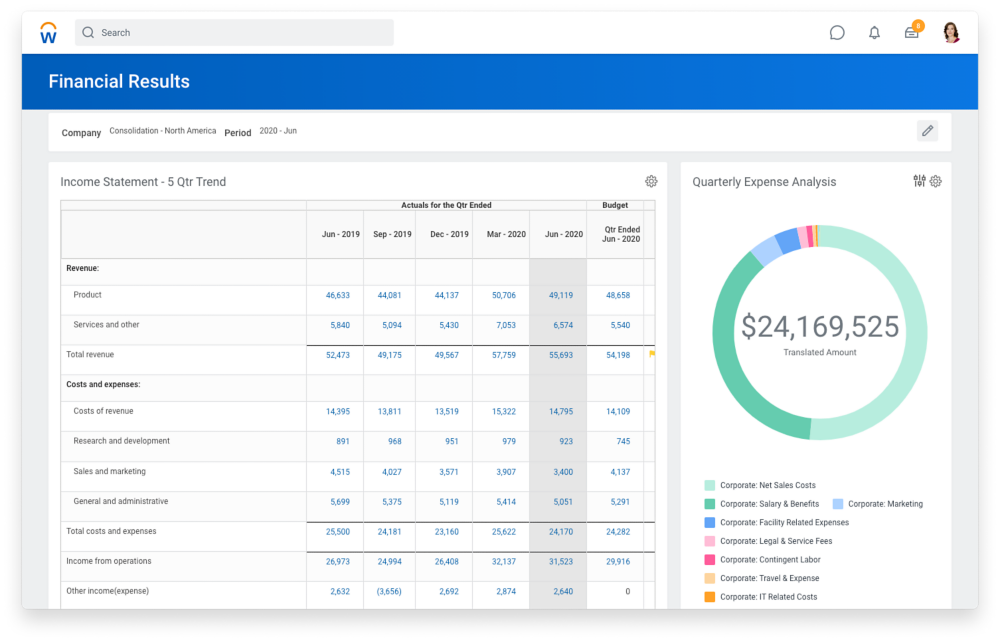

Enterprise Accounting And Finance Software Workday

Fixed Asset Accounting Examples Journal Entries Dep Disclosure

Corp Tax And Vat On Fixed Assets 2e Accountants

Fixed Assets In Accounting Definition List Top Examples

Fixed Assets In Accounting Definition List Top Examples

Asset Transactions Chapter 3 Rb

Central Wa University Department Of Accounting Syllabus For Acct 350 Intermediate Accounting I

Fixed Asset Accounting Overview And Best Practices Involved

Overview Of Physical Inventory In Oracle Assets Oracle E Business Suite Support Blog

Fixed Asset Accounting Overview And Best Practices Involved

Fixed Asset Examples Examples Of Fixed Assets With Excel Template

Fixed Asset Accounting Cycle With Acquisition Valuation And Disposal Presentation Graphics Presentation Powerpoint Example Slide Templates

Fixed Asset Management In Sap Business Bydesign

Fixed Assets Accounting In South Extension Ii New Delhi Id

Nature Of Fixed Assets Course Hero

What Is Operating Fixed Assets Definition Of Fixed Asset

What Are The Various Stages Of The Fixed Asset Life Cycle Asset Infinity

Liquid Assets Meaning Accounting Treatment Importance

Technofunc Fixed Assets Process Flow

Fixed Asset Accounting Policies And Procedures Pdf Free Download

Asset Accounting Fi Depreciation Balance Sheet

Introduction To Fixed Assets Process Youtube

What Is Fixed Asset Types Formula Calculation Methods

How To Reverse A Fixed Asset Disposal Sale Transaction Microsoft Dynamics 365 Blog

Fixed Asset Management Guide With Sap Business One

Fixed Asset Accounting Overview And Best Practices Involved

3

Fixed Asset Process

Hive Enterprise Asset Management System

What Fixed Asset Accounting Has To Do In A Business Asset Infinity

Asset Accounting Overview Sap Help Portal

Fixed Asset Management Guide With Sap Business One

Proactivesoft Fixed Assets System

Tally Erp 9 For Fixed Asset

Asset Management Policies And Fixed Asset Registers By Wesselsassociatessa Issuu

Fixed Asset Life Cycle In Asset Accounting Powerpoint Slides Diagrams Themes For Ppt Presentations Graphic Ideas

Accounting Entries For The Asset Life Cycle Oracleapps Epicenter

Reorganization Process For Fixed Assets Sap Documentation

Fixed Asset Process

Www Qad Com Documents Data Sheets Financials Fixed Assets Pdf

Accounting Cycle Definition Flow Chart And Importance Steps

Fixed Asset Accounting Made Simple Netsuite

Q Tbn And9gctbv Fbrwwj50dzehuir3x9fvrd6jojmajwahpk61u Cer5fvau Usqp Cau

Introduction To General Ledger Youtube

Sap Fi Overview Tutorialspoint

Fixed Assets Sap Business One Version 9

The Expenditure Cycle Fixed Asset System Depreciation Fixed Asset

Q Tbn And9gcsdixhjsswpv46fz3py Jw60gdwqdrodadq9wuc7gdei1ytriiw Usqp Cau

Fixed Assets Journal Entries Double Entry Bookkeeping

Sap Fixed Assets Accounting

How To Reverse A Fixed Asset Disposal Sale Transaction Microsoft Dynamics 365 Blog

Lecture 23 Expenditure Cycle Part Ii Fixed Assets Accounting Inform

How To Reverse A Fixed Asset Disposal Sale Transaction Microsoft Dynamics 365 Blog

Post G L Journal Entries To Fixed Assets

What Fixed Asset Accounting Has To Do In A Business Asset Infinity

Asset Accounting Configuration Steps In Sap Asset Accounting Fico Sap Tutorials

Fixed Asset Accounting Made Simple Netsuite

What Are The Various Stages Of The Fixed Asset Life Cycle Asset Infinity

Fixed Assets Register Cycom Business Solutions Ltd

Qb Power Hour Managing Fixed Assets In Quickbooks Desktop Youtube

Fixed Asset Accounting Made Simple Netsuite

Pp E Property Plant Equipment Overview Formula Examples

Fixed Asset Accounting Life Cycle Template Presentation Sample Of Ppt Presentation Presentation Background Images

Best Practice Financial Processes Fixed Assets Ppt Download

Http Universa Unijales Edu Br Sap Fixed Asset Process Flows Pdf

Pp E Property Plant Equipment Overview Formula Examples

.gif)

Fixed Assets Microsoft Docs

Top 10 Fixed Asset Management Software Free Paid Softwareworld

Fixed Asset Management System Virmati Group

Q Tbn And9gcqs Hzarmlv6bncim9omt7evyiiyg M15lez46mgio Rkmr6hnz Usqp Cau

Accounting Entries For The Asset Life Cycle Oracleapps Epicenter

Controller S Office Fixed Assets Accounting

Payroll Processing And Fixed Asset Procedures The Conceptual Fixed Asset System Business Information Management

Top 10 Fixed Asset Management Software Free Paid Softwareworld

Fixed Assets Management Software India

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐂𝐚𝐩𝐄𝐱 𝐚𝐧𝐝 𝐎𝐩𝐄𝐱

Fixed Asset Life Cycle In Asset Accounting Powerpoint Slides Diagrams Themes For Ppt Presentations Graphic Ideas

Sage Fixed Assets Software Paragon International