Invoice Receipt Meaning

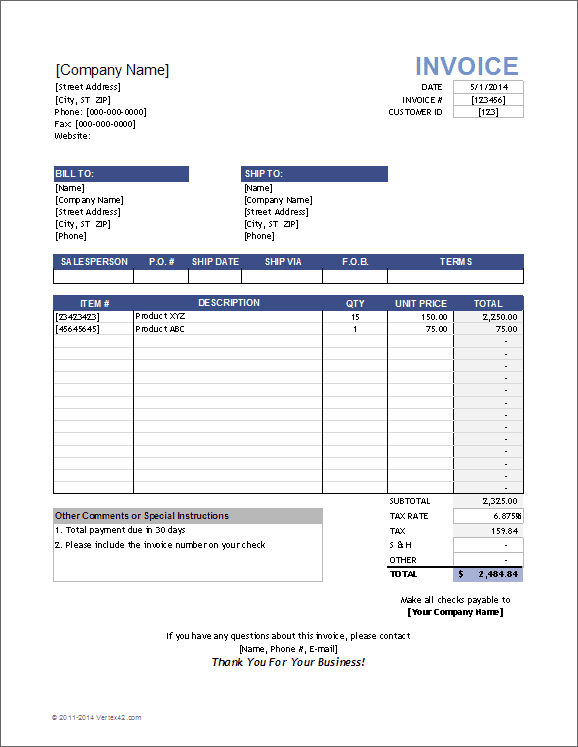

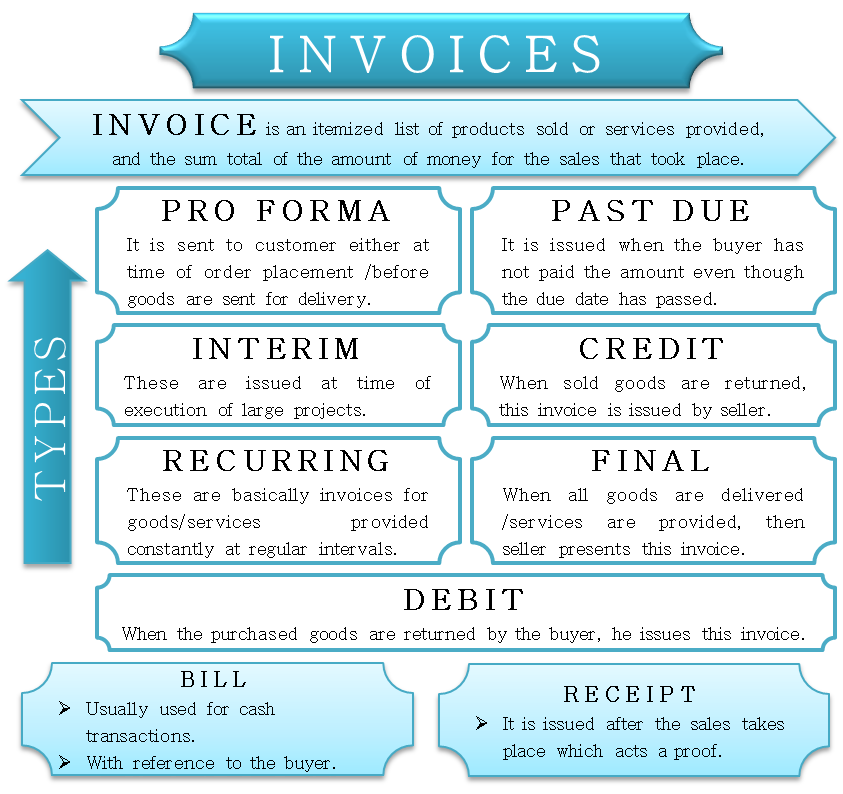

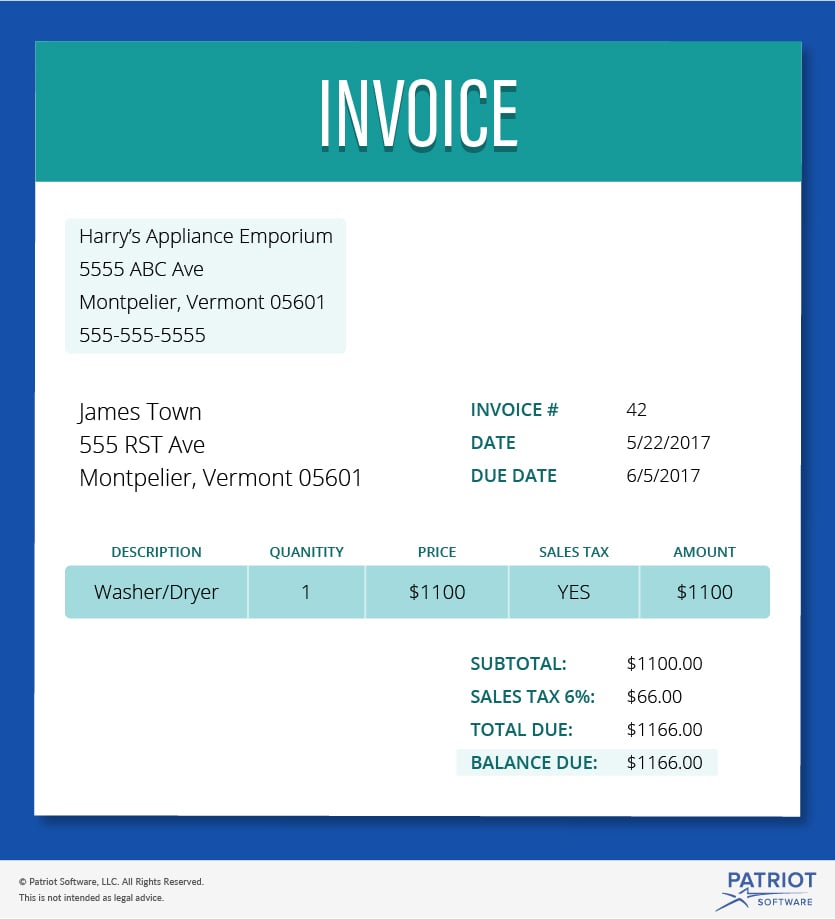

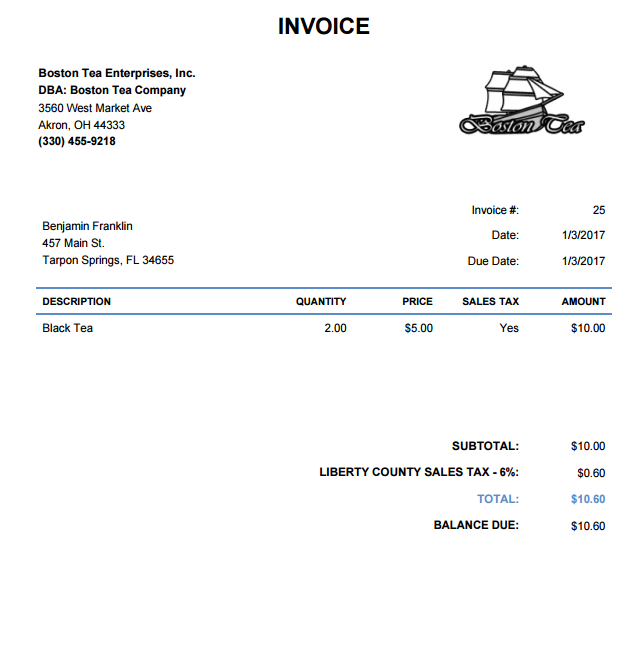

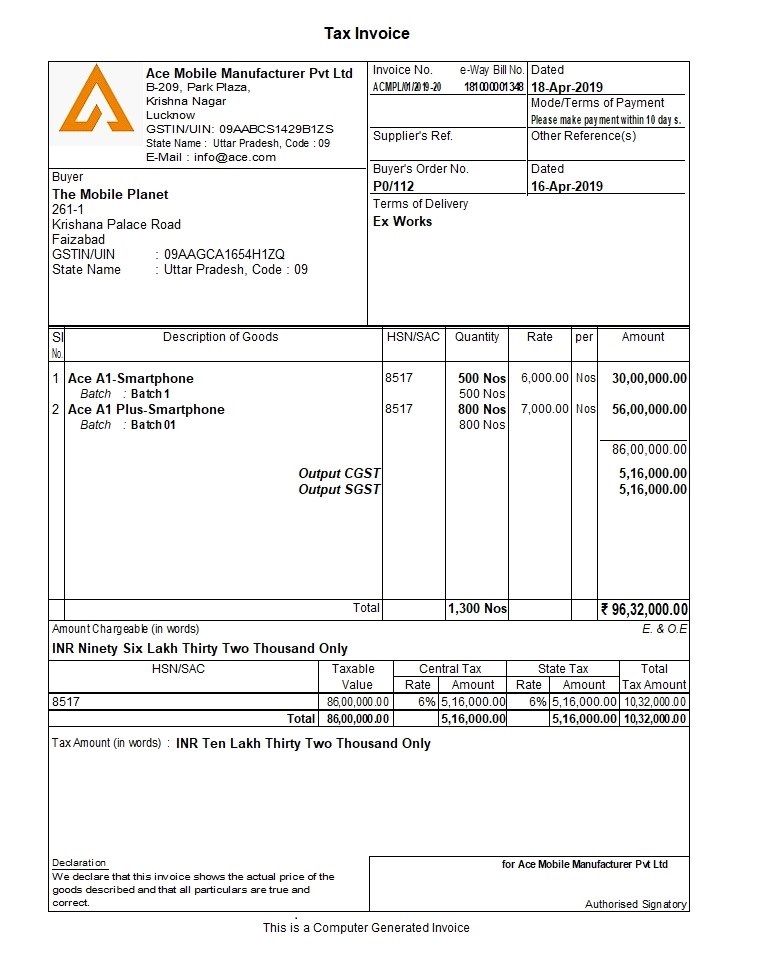

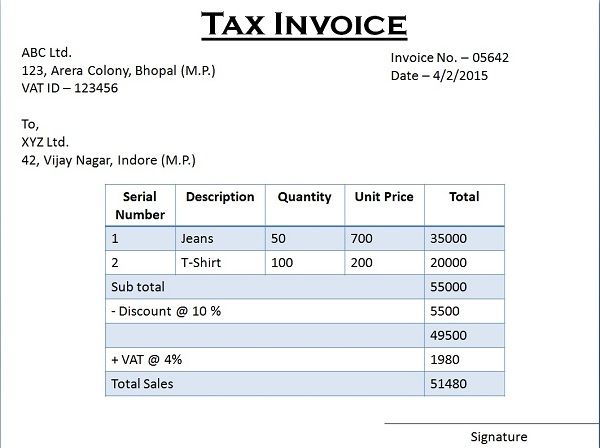

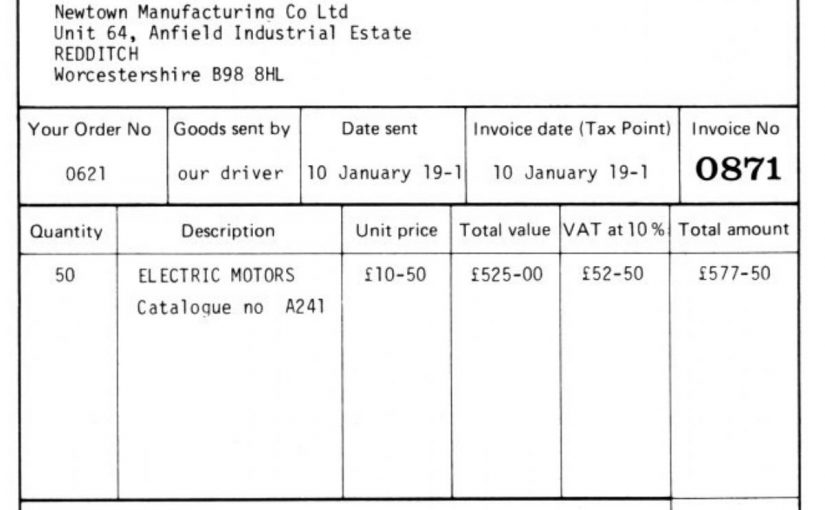

Definition An invoice is a document issued by a seller to the buyer that indicates the quantities and costs of the products or services provider by the seller An invoice specifies what a buyer must pay the seller according to the seller’s payment terms.

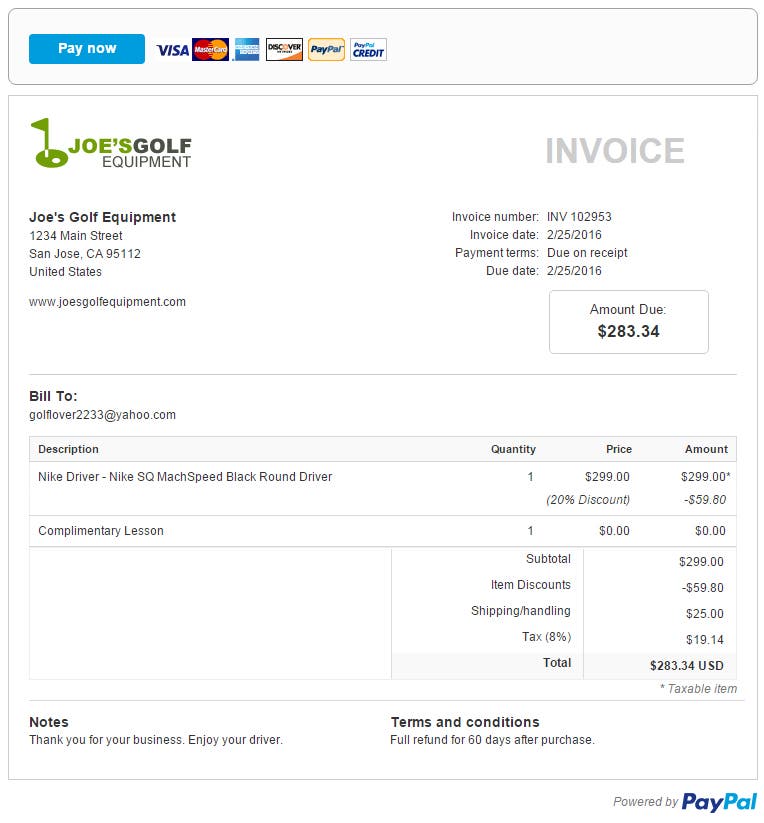

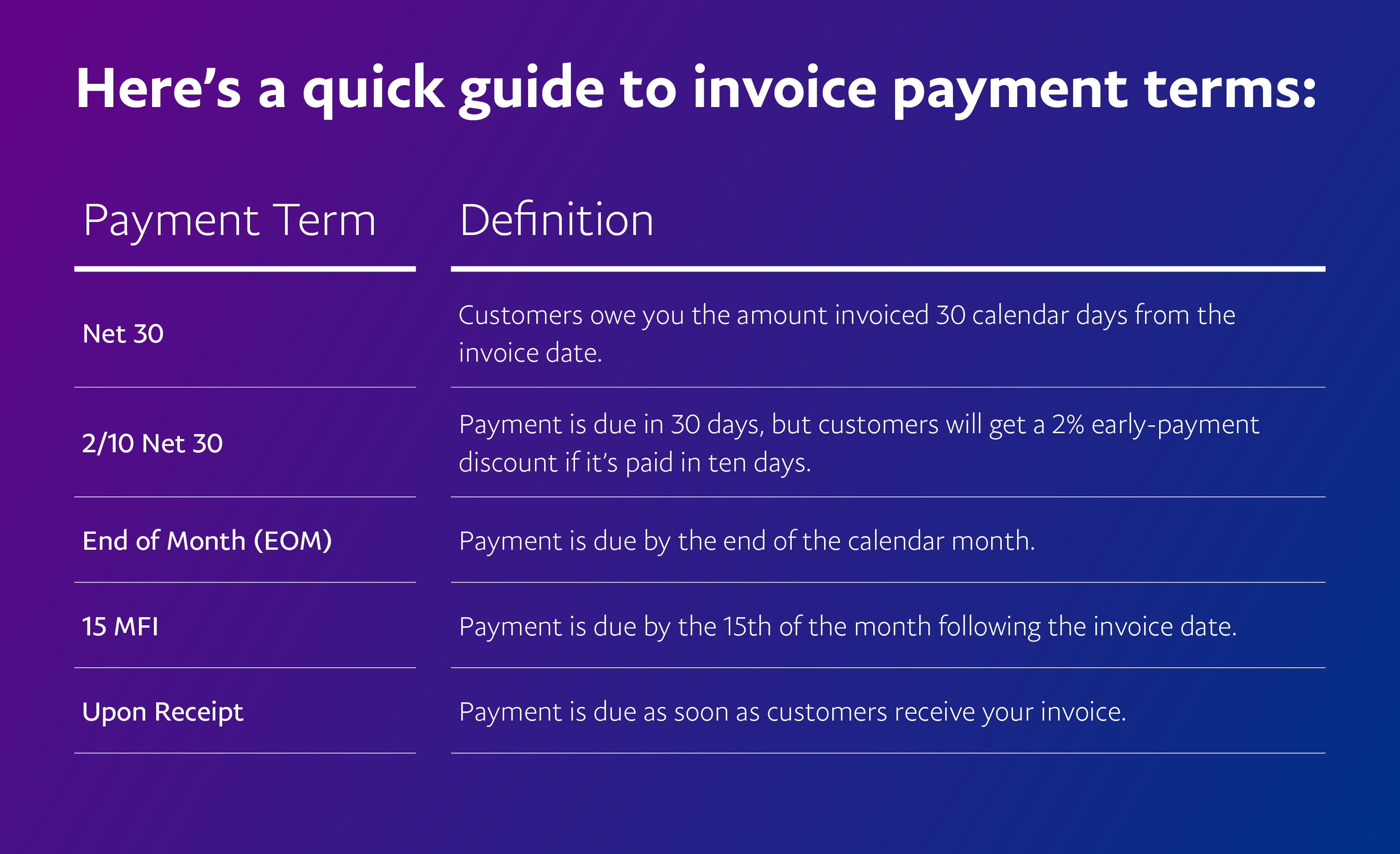

Invoice receipt meaning. “The original of each receipt or invoice shall be issued to the purchaser, customer or client at the time the transaction is effected, who, if engaged in business or in the exercise of profession, shall keep and preserve the same in his place of business for a period of three (3) years from the close of the taxable year in which such invoice or receipt was issued, while the duplicate shall be kept and preserved by the issuer, also in his place of business, for a like period. When you add “Due Upon Receipt” to an invoice for a client, it means when you turn the work in and submit the invoice, the client is expected to make payment arrangements immediately In the world of digital payments, this can sometimes mean quite literally within minutes of getting the invoice;. Invoices should have dates to clarify obligations for both the issuer and recipient The invoice date is the date of the document's issue not necessarily the date the products or services were provided Terms of payment are interpreted in relation to this date The date is also one way individual invoices are.

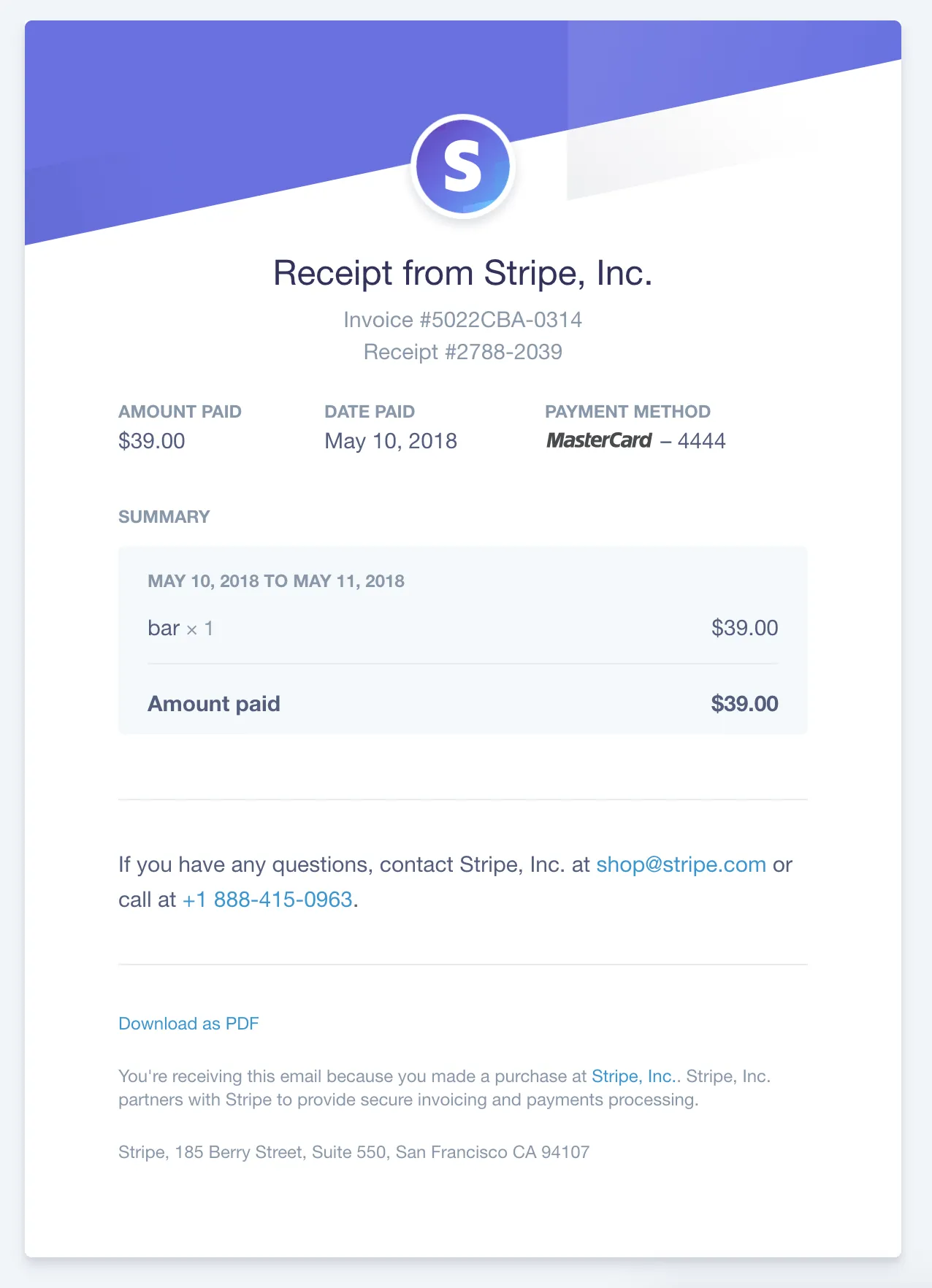

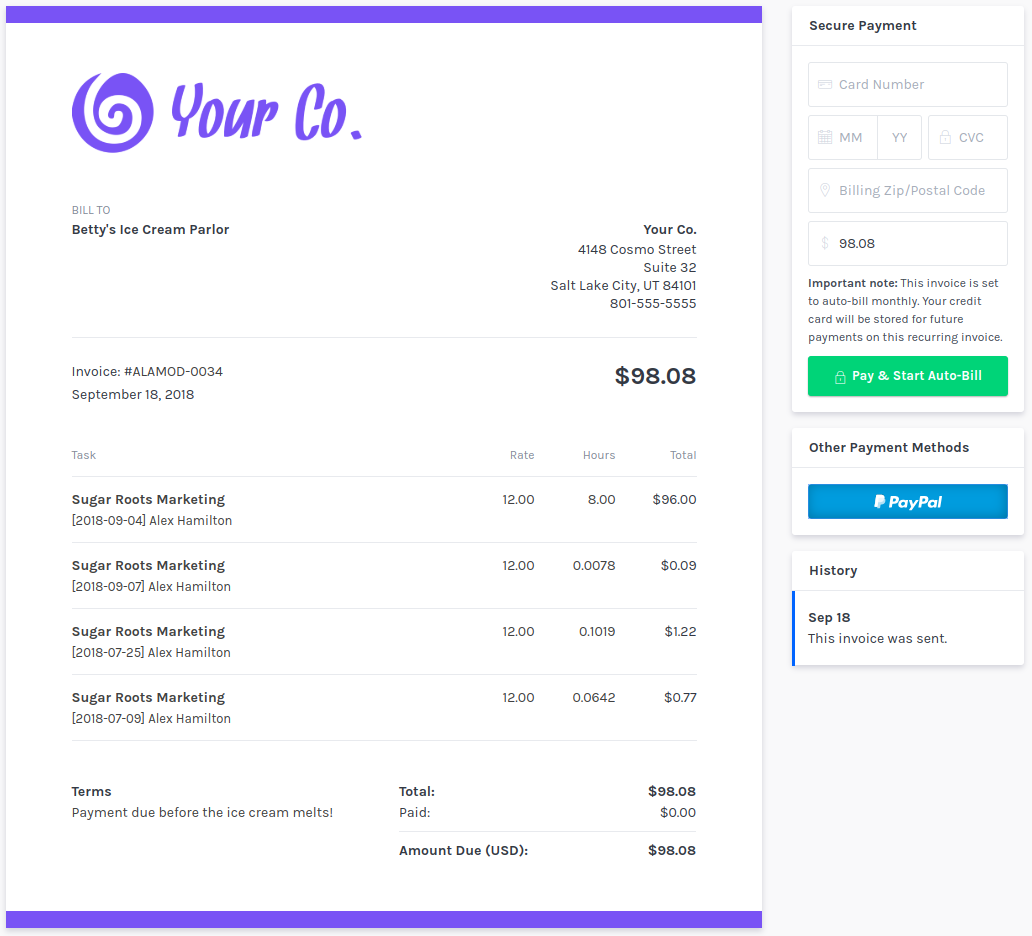

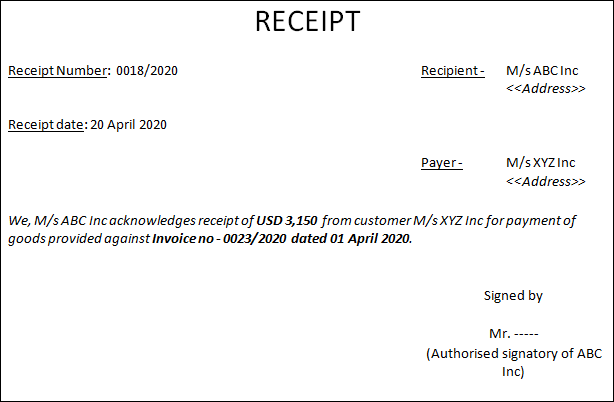

Difference between invoice and receipt The key points of difference between invoice and receipt have been listed below 1 Meaning An invoice is a legal document that evidences sale of goods by the vendor and indicates the amount payable by the customer for the sale transaction. The easiest way to tell whether you should issue an invoice or a sales receipt is to ask yourself whether you would also need to issue a payment receipt Invoices should always be followed up with a payment receipt to confirm that the money has been received and the sale is complete. An invoice and a receipt are both typically issued by the seller of a product or a service to the buyer of that item, though each document is intended for a different purpose Invoices are used as a means of documenting products or services provided by a seller to the buyer, and then requesting payment for that item.

To acknowledge in writing the payment of (a bill) The check was dated January 9, and the invoice was receipted on January 15 to give a receipt for (money, goods, etc) verb (used without object) to give a receipt, as for money or goods. In an invoice for the intraCommunity supply of a new means of transport the description of the goods supplied shall contain the particulars referred to in the definition of "new means of transport" in the VAT Act On the other hand a Fiscal Receipt should be issued from a Fiscal Cash Register or manual fiscal receipts. An invoice is also known as a bill or sales invoice” Business Dictionary defines a bill as “Document evidencing one party's indebtedness to another, such as an invoice” Each definition refers to the other term as an example.

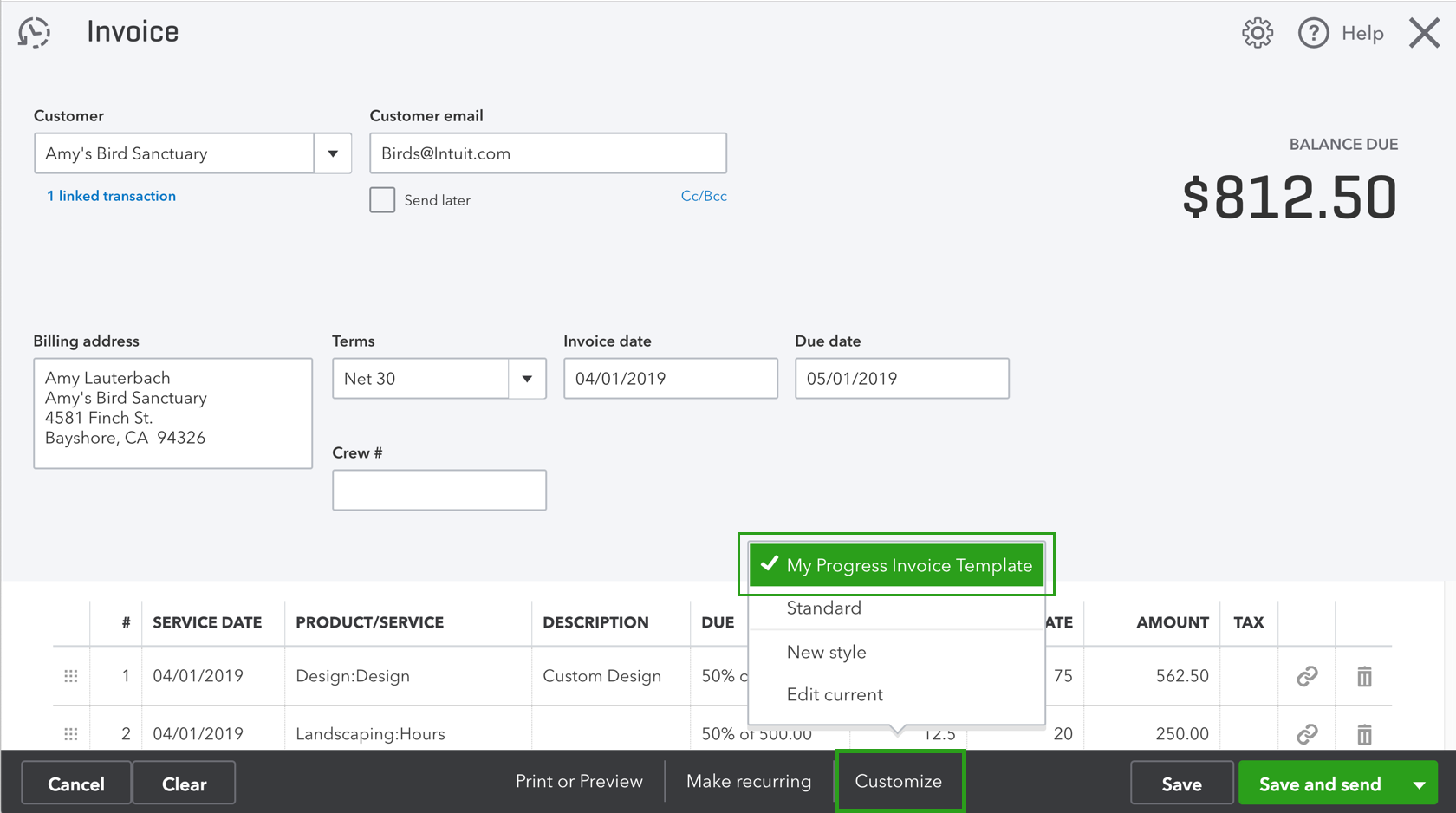

Definition An invoice is a document issued by a seller to the buyer that indicates the quantities and costs of the products or services provider by the seller An invoice specifies what a buyer must pay the seller according to the seller’s payment terms. An invoice is used when your customer agrees to pay you later You can set up terms to indicate how long the customer has to pay If they don't pay within the specified time limit, their invoice is overdue A sales receipt is used when your customer pays you on the spot for goods or services. An invoice is used when your customer agrees to pay you later You can set up terms to indicate how long the customer has to pay If they don't pay within the specified time limit, their invoice is overdue A sales receipt is used when your customer pays you on the spot for goods or services.

An Invoice is a request for payment and receipt is a confirmation of payment The significant difference between the two is that the invoice is issued prior to the payment while the receipt is issued after the payment The invoice is used to track the sale of goods or services. So, to recap, there’s a pretty significant difference between an invoice and receipt An invoice is a request for payment You send an invoice to your clients after you have provided goods or services A receipt is proof of payment You provide a receipt to a customer or client after they’ve paid for a good or service. Invoice payment terms are included on all bills small businesses send to clients outlining how quickly they expect payment for their services and the different payment methods clients can use, giving businesses better control over their cash flow and help them plan ahead for future expenses.

An invoice comes before a payment has been, while a receipt comes after the payment has been made Is tax invoice same as receipt?. What is the definition of a receipt in accounting?. Receipts and cash invoices are important for filing taxes and keeping precise accounting records in a business Although both documents signify an exchange of money for a product or service,.

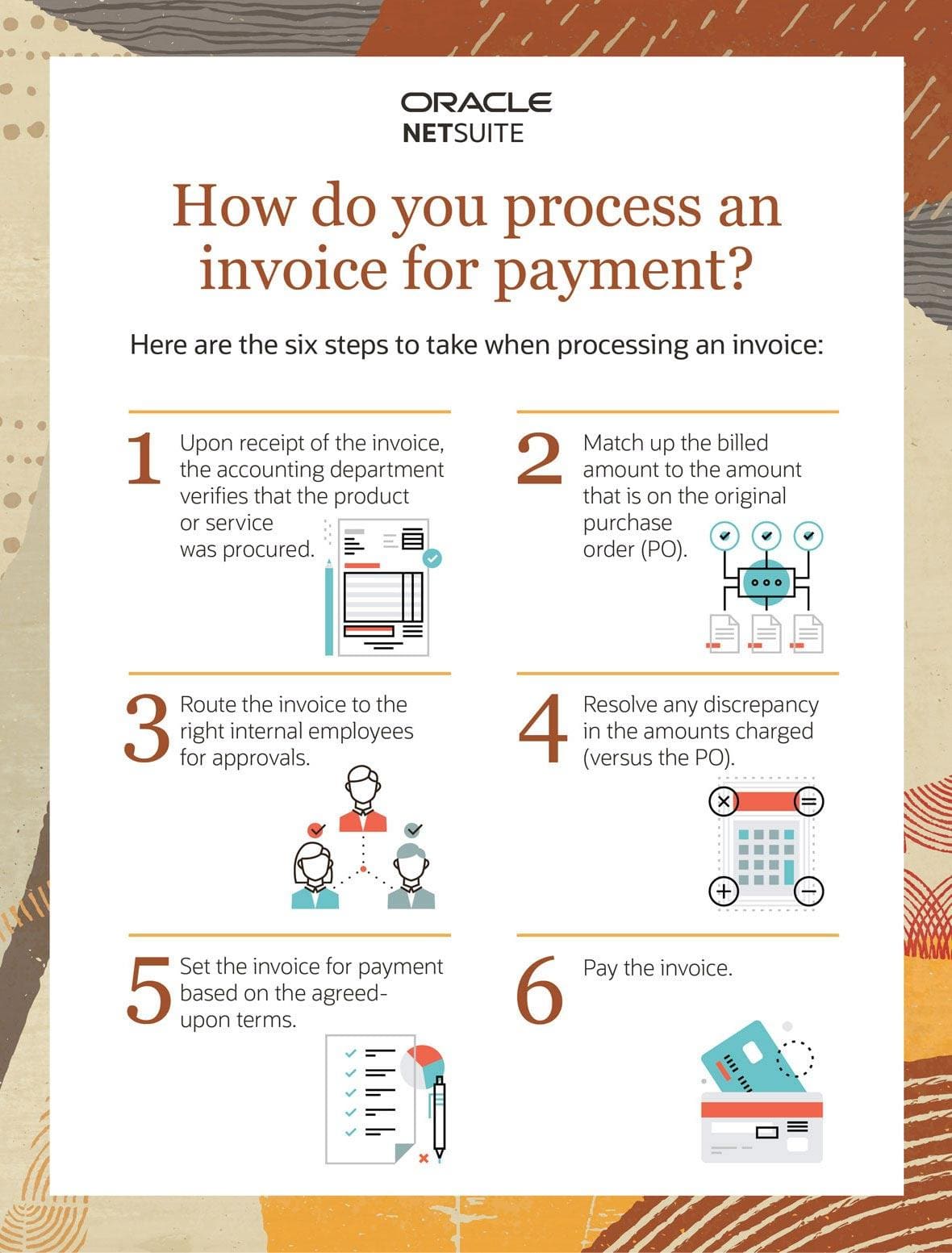

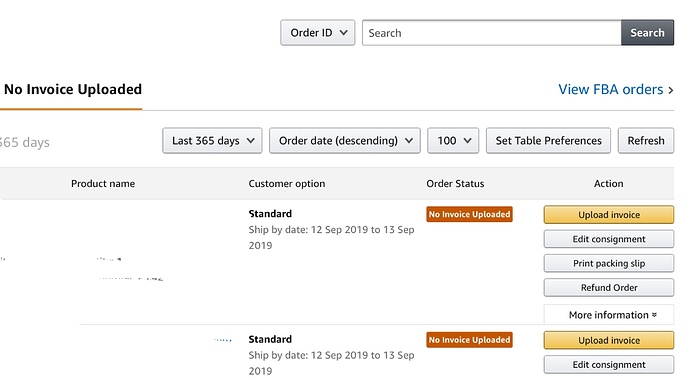

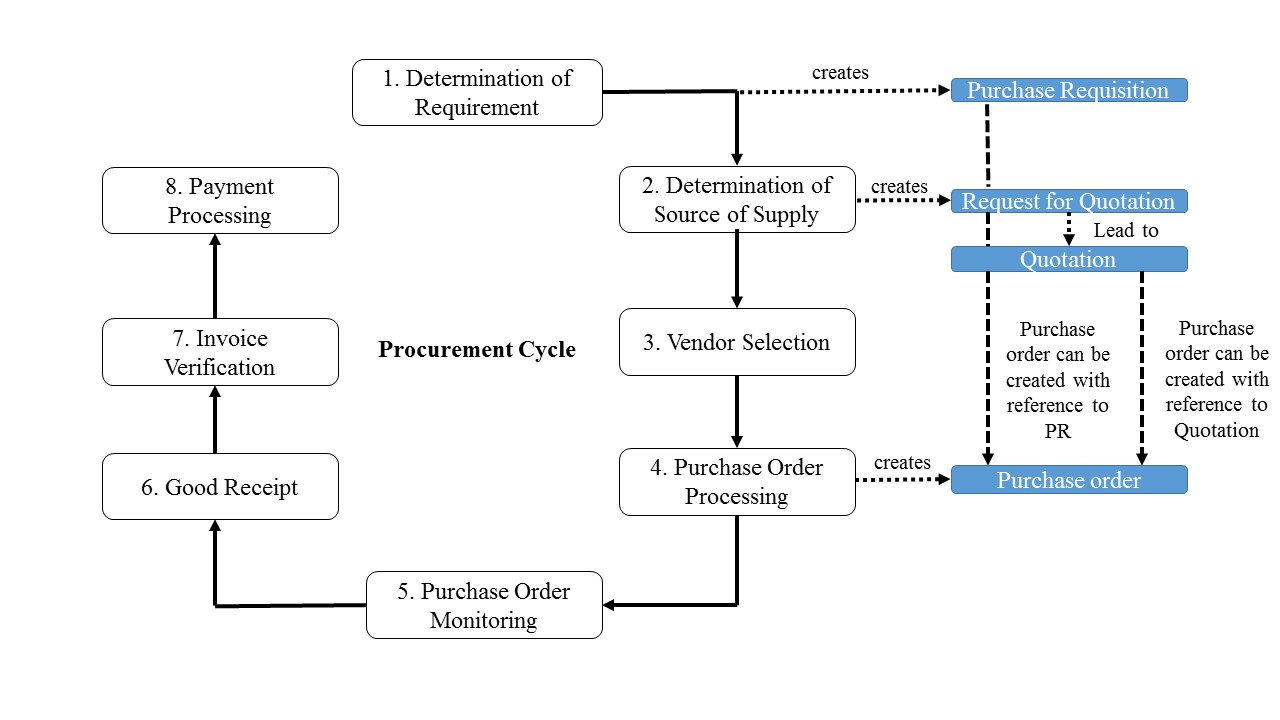

Invoice Processing Definition Invoice processing by definition is a business function performed by the accounts payable department which consists of a series of steps for managing vendor or supplier invoices from receipt to payment, and recorded in the general ledger. 6 Contents of Official Receipts and Sales Invoices Pursuant to Section (B) of Revenue Regulations No 1605 dated September 1, 05, the following shall be indicated in VAT official receipts or VAT sales invoice Statement that a seller is VATregistered followed by TIN;. Revenue Receipt Revenue receipts are funds received by a business as a result of its core business activities It leads to an overall increase in the total revenue of the companyThese funds are generated from a firm’s operating activities hence they are shown inside trading and profit and loss account and not in a balance sheet They are recurring in nature which means that they can be.

Invoices and receipts may seem like similar things – after all, they’re both related to payments – but as a business owner, there are a couple of crucial distinctions that you need to understand Learn more about invoices vs receipts with our comprehensive guide First off, let’s take a look at the definition of an invoice in a little more detail, before exploring the most important. Invoices and receipts may seem like similar things – after all, they’re both related to payments – but as a business owner, there are a couple of crucial distinctions that you need to understand Learn more about invoices vs receipts with our comprehensive guide First off, let’s take a look at the definition of an invoice in a little more detail, before exploring the most important. While the information on a tax invoice and a receipt may be similar, a tax invoice is not a receipt An invoice is a request for payment for a sale of goods or services provided by the seller to the customer.

For sales of P1,000 or more to a VATregistered person, the name, business style, if any, address, and TIN of. An invoice is a bill that details goods and services that have been or will be purchased by a buyer An invoice is similar to a purchase order, but it is initiated by the seller and is issued to the buyer A customer invoice describes the price, quantity and details associated with the transaction. In general, the term can either mean cash receipt or goods receipt The cash receipt is a document that proves the receipt of cash It often refers to the bank receipt which is the slip that the bank sends to you as a proof that the money has been credited to your bank account.

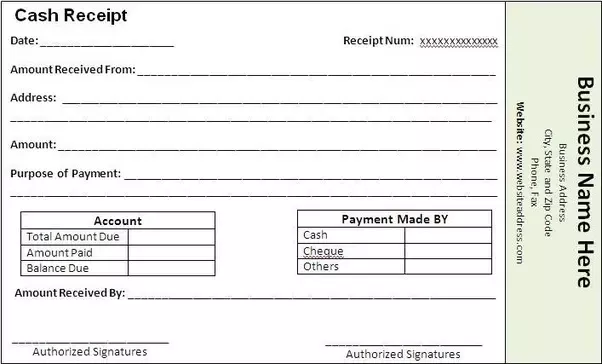

Payment on Receipt Payment on Receipt enables the user to automatically create standard, unapproved invoices for payment of goods based on receipt transactions Invoices are created using a combination of receipt and purchase order information, that eliminates duplicate manual data entry and ensures accurate and timely data processing. While invoice is the request for the payment;. Receipts and cash invoices are important for filing taxes and keeping precise accounting records in a business Although both documents signify an exchange of money for a product or service, whether payment was made immediately or on credit determines whether the seller will provide an official receipt or a cash invoice.

An invoice is issued after services or products are rendered but before payment is made A receipt is issued — largely with the same information — after payment has been made A receipt documents for both the buyer and the seller that the transaction is complete How to Use These Receipt Templates. In general, the term can either mean cash receipt or goods receipt The cash receipt is a document that proves the receipt of cash It often refers to the bank receipt which is the slip that the bank sends to you as a proof that the money has been credited to your bank account. At a very high level, an invoice is a request for payment, whereas a receipt is proof of payment made When you venture out as a small business owner, you’ll encounter new documents and accounting terminology.

Definition Gross means without deductions, so gross receipts refer to the total amount of considerations received in exchange for property or services sold, leased or rented during a given period before deducting costs or expenses Except for a few exceptions, gross receipts of a business encompass all business activities that generate income. However, electronic invoicing, also known as einvoicing or einvoices, are increasing in popularity as a more efficient means of sending invoices Although to many, electronic invoices may simply mean a scanned form of a printed invoice, electronic invoices have standards that can vary widely from country to country. Goods Found to Be Faulty After Issuing Goods Receipt If after having issued goods receipt, the goods are found to be faulty, the issued goods receipt should be reversed as soon as possible, so that the finance department or the people responsible for paying the invoice become aware of it The Benefits of Having an Efficient Goods Receipt Process.

An invoice is a legal document that evidences sale of goods by the vendor and indicates the amount payable by the customer for the sale transaction A receipt is an acknowledgement document that confirms that the vendor has duly received payment against certain invoice/s from the customer 2. Invoice definition is an itemized list of goods shipped usually specifying the price and the terms of sale bill How to use invoice in a sentence. Payment receipts created to provide the customer with a proof of payment It is a simple document that outlines the amount received by the seller It confirms that the payment has been received and gives the basics on the sale Sales receipts more structured and resemble simplified invoices (without the invoice number or customer details.

Receipt is a proof And when your customer will make payment to you, you will provide him a receipt, ie an acknowledgment that you have received the payment from him Vendor Sends An Invoice — Customer Receives It As A Bill — Makes Payment — Gets A Receipt. An invoice comes before a payment has been, while a receipt comes after the payment has been made Is tax invoice same as receipt?. A bill is an invoice in that it has the itemized list of products sold or services provided, along with the amount of money owed for each item, and a total amount owed However, when you receive an invoice, you would enter it as a bill that you owe In other words, an invoice is sent, and a bill is received Receipt A receipt is different from.

Understand invoice vs receipt distinctions to avoid confusion Invoice vs receipt Both invoices and receipts are paper or electronic slips that detail purchase transactions Invoices and receipts are not interchangeable An invoice is a request for payment while a receipt is proof of payment Customers receive invoices before they pay for a. Invoice payment terms are included on all bills small businesses send to clients outlining how quickly they expect payment for their services and the different payment methods clients can use, giving businesses better control over their cash flow and help them plan ahead for future expenses. The main difference between an invoice and a receipt is that an invoice is issued prior to a payment being made and a receipt is issued after a payment is processed An invoice is a request for payment issued by the seller, whereas a receipt is a proof of payment given to the buyer.

But generally, it refers to a payment being. What is the definition of a receipt in accounting?. Businesses, regardless of the industry or size, require regular cash flow from their clients and the customer to pay their expenses, such as their employees’ salaries and the utilities That’s why invoicing is a necessityWithout these bills, you won’t be compensated for the services rendered or products sold, which in turn means that you won’t be able to handle your expenses.

On respective PO item (ie ), item ~ tab Invoice, make sure you have tick the Invreceipt If this PO item is GR based, you need to create GR document first followed by invoice receipt subsequently Cheers,. Invoice definition is an itemized list of goods shipped usually specifying the price and the terms of sale bill How to use invoice in a sentence. Receipt definition is a writing acknowledging the receiving of goods or money How to use receipt in a sentence The history of receipt and recipe.

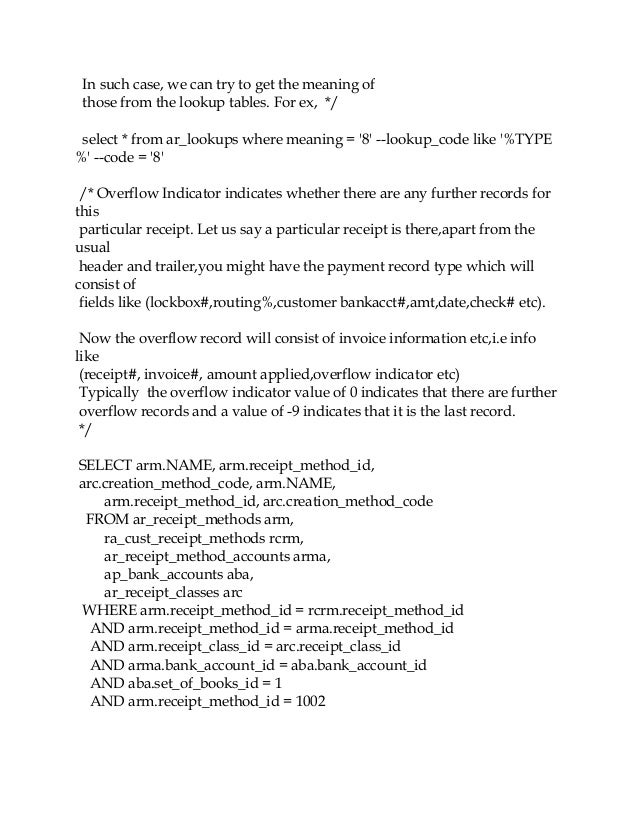

Receipt definition is a writing acknowledging the receiving of goods or money How to use receipt in a sentence The history of receipt and recipe. GR/I R is the SAP process to perform the threeway match – purchase order, material receipt, and vendor invoiceYou use a clearing account to record the offset of the goods receipt (GR) and invoice receipt (IR) postings Once fully processed, the postings in the clearing account balance To learn more about GR/IR and other SAP FICO topics please visit our new SAP FICO Learning Center please. Definition Gross means without deductions, so gross receipts refer to the total amount of considerations received in exchange for property or services sold, leased or rented during a given period before deducting costs or expenses Except for a few exceptions, gross receipts of a business encompass all business activities that generate income.

A vendor invoice completes the cycle from purchase order to product receipt to vendor invoice Although some vendor invoices connect to a purchase order, vendor invoices can also contain lines that don't correspond to purchase order lines You can also create vendor invoices that aren't associated with any purchase order. While the information on a tax invoice and a receipt may be similar, a tax invoice is not a receipt An invoice is a request for payment for a sale of goods or services provided by the seller to the customer. Invoices are payable within 30 days of receipt of the invoice, net, cash and withoutreduction to the address of the headquarters unless otherwise agreed EurLex2 The bodies in question collect the financial information (list of receipted invoices or accounting documents of equivalent probative value).

While an invoice basically requests that a payment be made, a receipt is proof that a payment has been made An invoice is issued before the payment is made A receipt is issued post the payment The invoice lists the total amount that is due or has to be paid. While both of these documents are issued by the seller, the invoice is a request for payment while the receipt is a record of payment A brief description of each item, along with the total number of units received is typically listed on an invoice. Invoice processing by definition is a business process performed by the accounts payable department which consists of a series of steps for managing vendor or supplier invoices from receipt to payment, and recorded in the general ledger.

Invoice Definition

What Is An Invoice Number How To Number Invoices

Sales Invoice Template For Excel

Invoice Receipt Meaning のギャラリー

What Is Invoice Processing Definition Steps Flowchart Software

Receipt Numbers Invoice For Mac Greatsteel

What Is An Invoice Number Invoicely

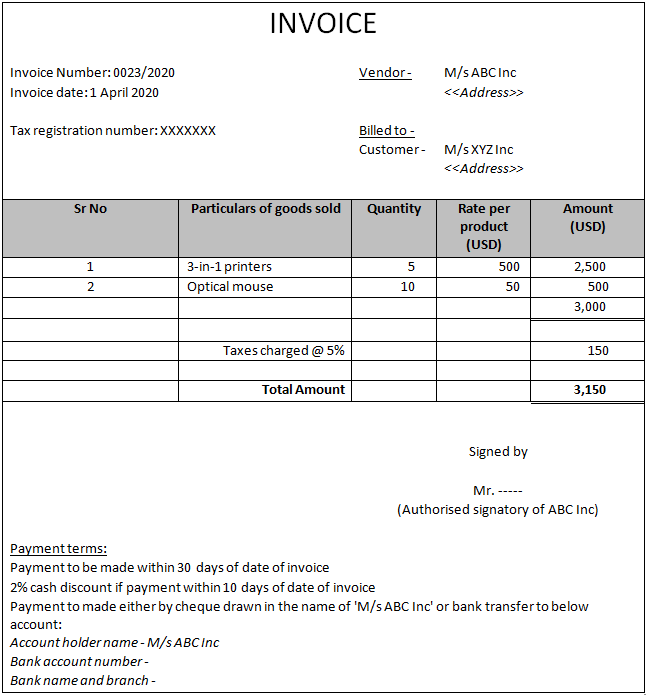

Types Of Invoice Format Vs Bills Vs Receipt Efinancemanagement

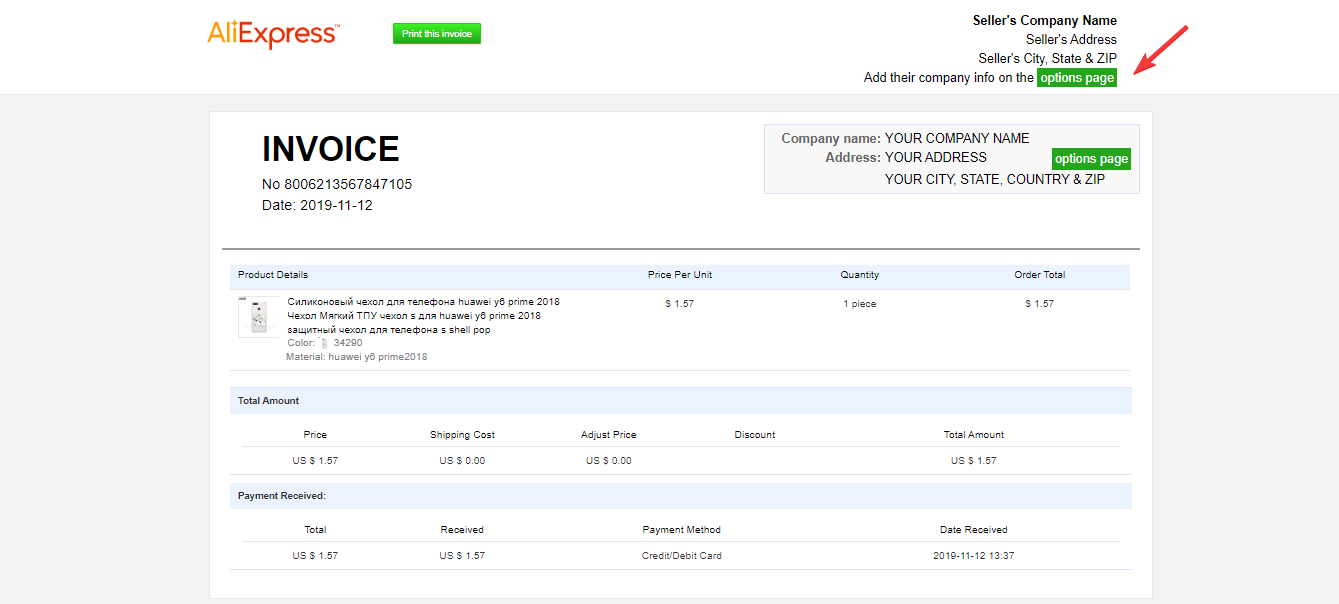

How To Get An Invoice From Aliexpress Megabonus

Difference Between Invoice And Tax Invoice Difference Between

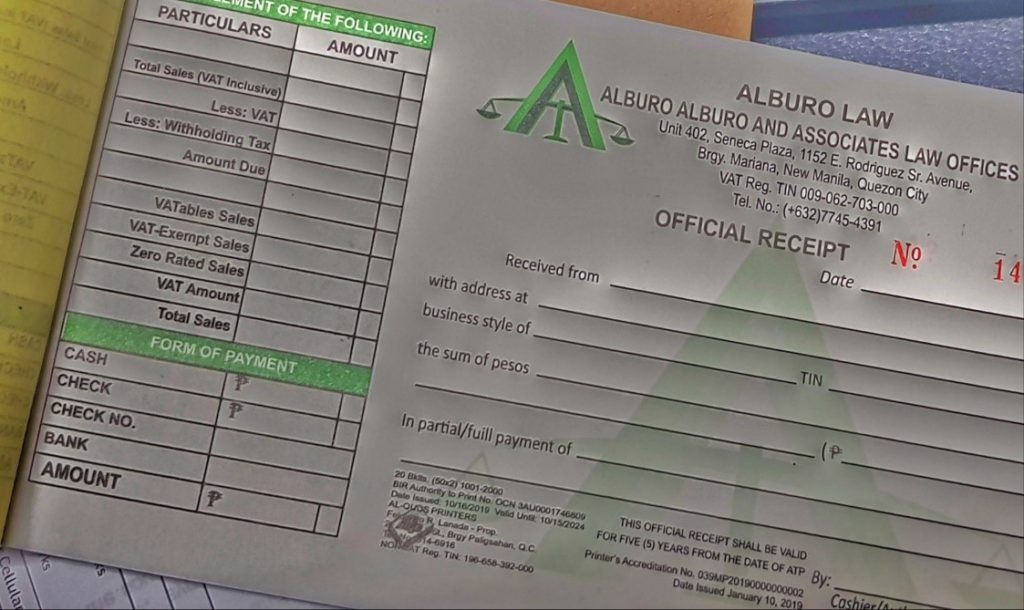

Why Are Official Receipts So Important For Business In Ph

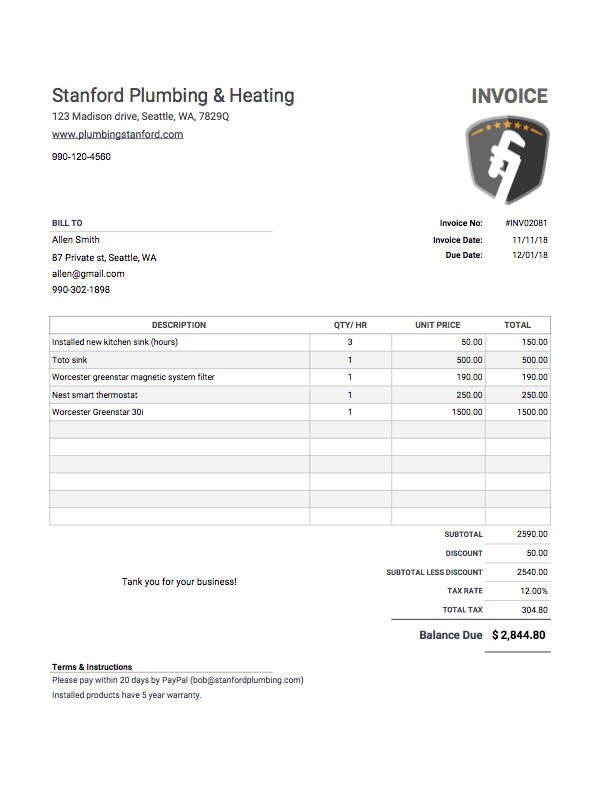

Sample Invoice Template Invoice Simple

Receipt Wikipedia

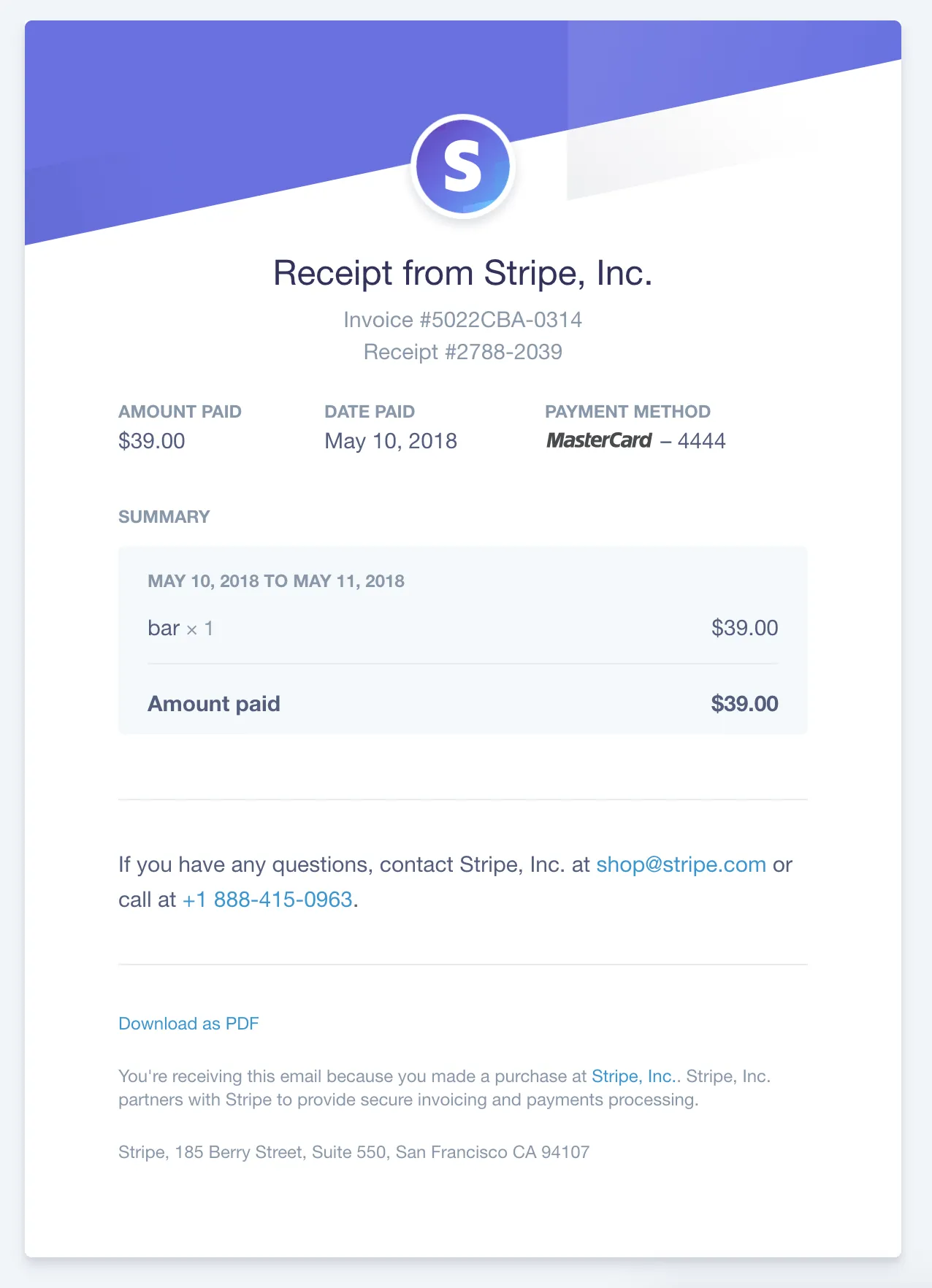

Receipt And Invoice Email Best Practices Postmark

Invoice Vs Receipt Definitions Explanations Differences Termscompared

What Is An Invoice

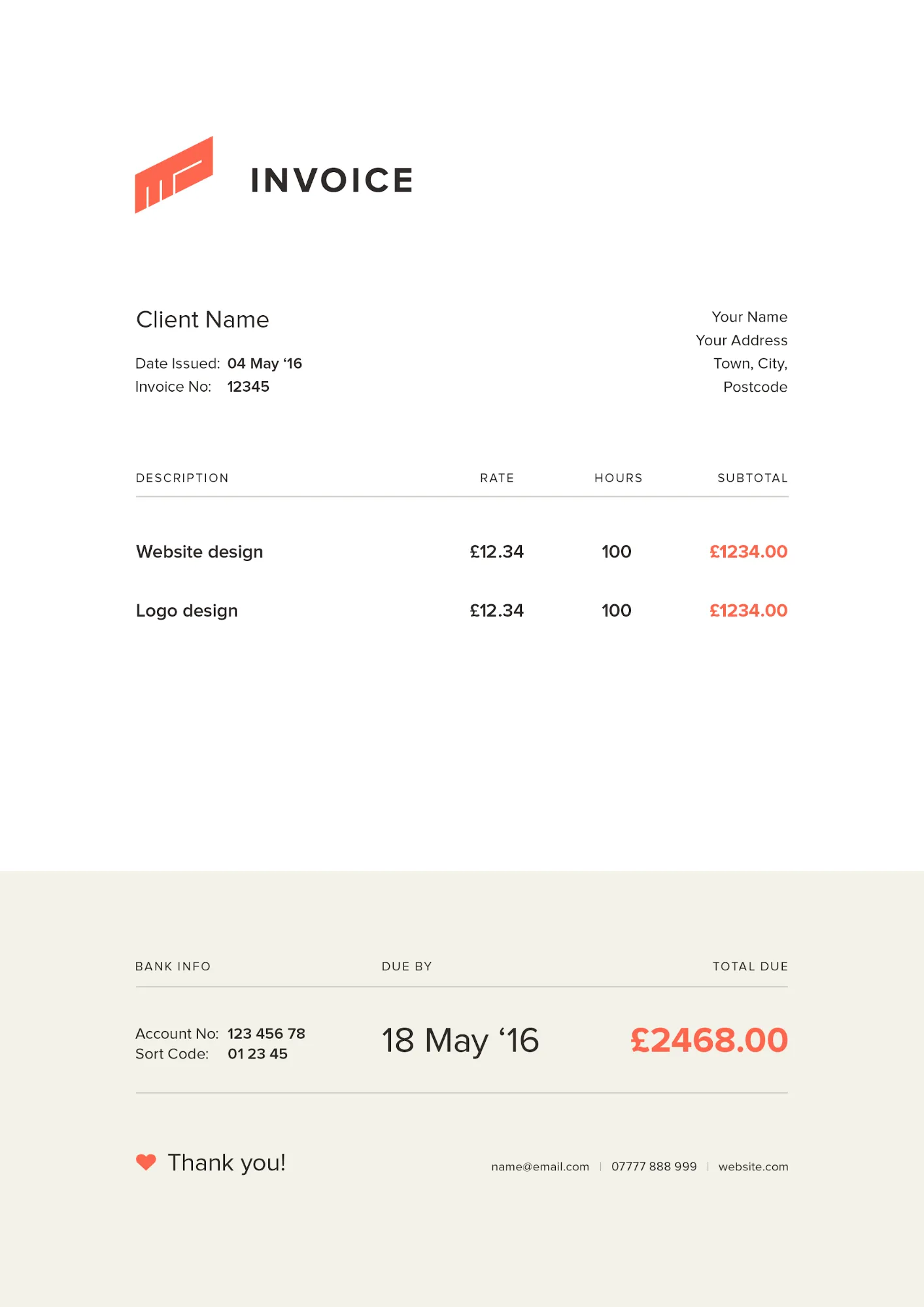

Invoice Cheat Sheet What You Need To Include On Your Invoices Sage Advice United Kingdom

Gr Ir Goods Receipt Invoice Receipt Zarantech

Is An Invoice A Receipt Key Definitions And Examples For Businesses

Ir Invoice Receipt By Acronymsandslang Com

What Is The Difference Between A Sales Invoice And A Sales Receipt Quora

Know The Difference Invoice Vs Receipt Fullsuite

Sales Invoice Or Official Receipt Alburo Law

How To Write Invoice Payment Terms Conditions Best Practices

Invoice Vs Receipt What S The Difference Sana Commerce

Icpmconference Org 19 Wp Content Uploads Sites 6 19 07 Bpi Challenge Submission 4 Pdf

What You Should Know About E Invoicing What Is E Invoicing

3

Invoice Vs Bill Vs Receipt What S The Difference

10 Invoicing Payment Terms You Need To Know Due

What Is Invoice Processing Netsuite

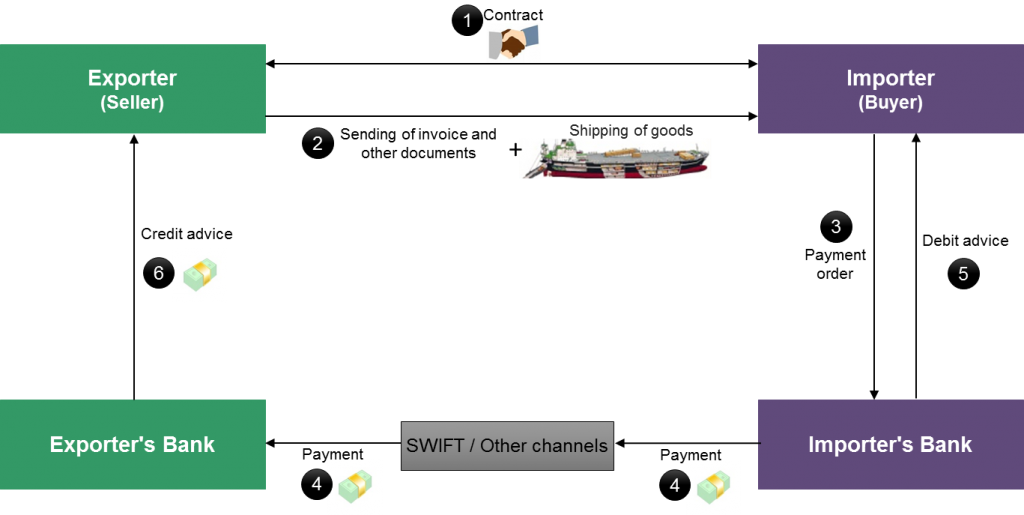

Simple Collection Or Payment Against Invoice Paiementor

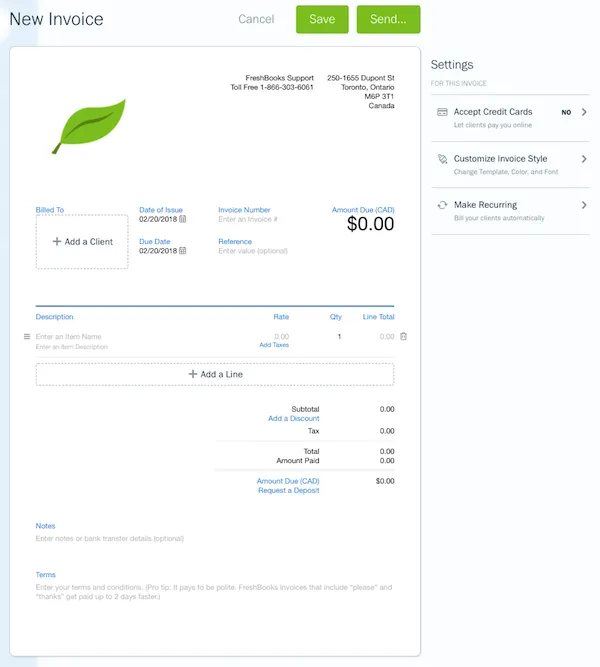

How To Quickly Simplify Your Online Invoicing With Paypal

Invoice Vs Bill Vs Receipt What S The Difference

A Quick Guide To Understand Invoice Payment Terms Paypal

Accounts Receivables Useful Information

How To Write Invoices The Right Way Online Invoicing Service For Creative Professionals Invoicebus

Can I Get A Receipt Or Invoice For My Purchase Support Hub G2a Com

Invoice Settings

The Definition And Purpose Of Sales Invoice Hashmicro Blog

Difference Between Bill Receipt And Invoice In Telugu 2mc Facts Youtube

Icpmconference Org 19 Wp Content Uploads Sites 6 19 07 Bpi Challenge Student Submission 4 Pdf

Receipt And Invoice Email Best Practices Postmark

Invoice Vs Credit Memo When And How To Issue

Purchase Orders And Invoices What S The Difference Zipbooks

Invoice Summary

Invoice Vs Vat Invoice Debitoor Invoicing Software

Invoice Vs Receipt Definitions Explanations Differences Termscompared

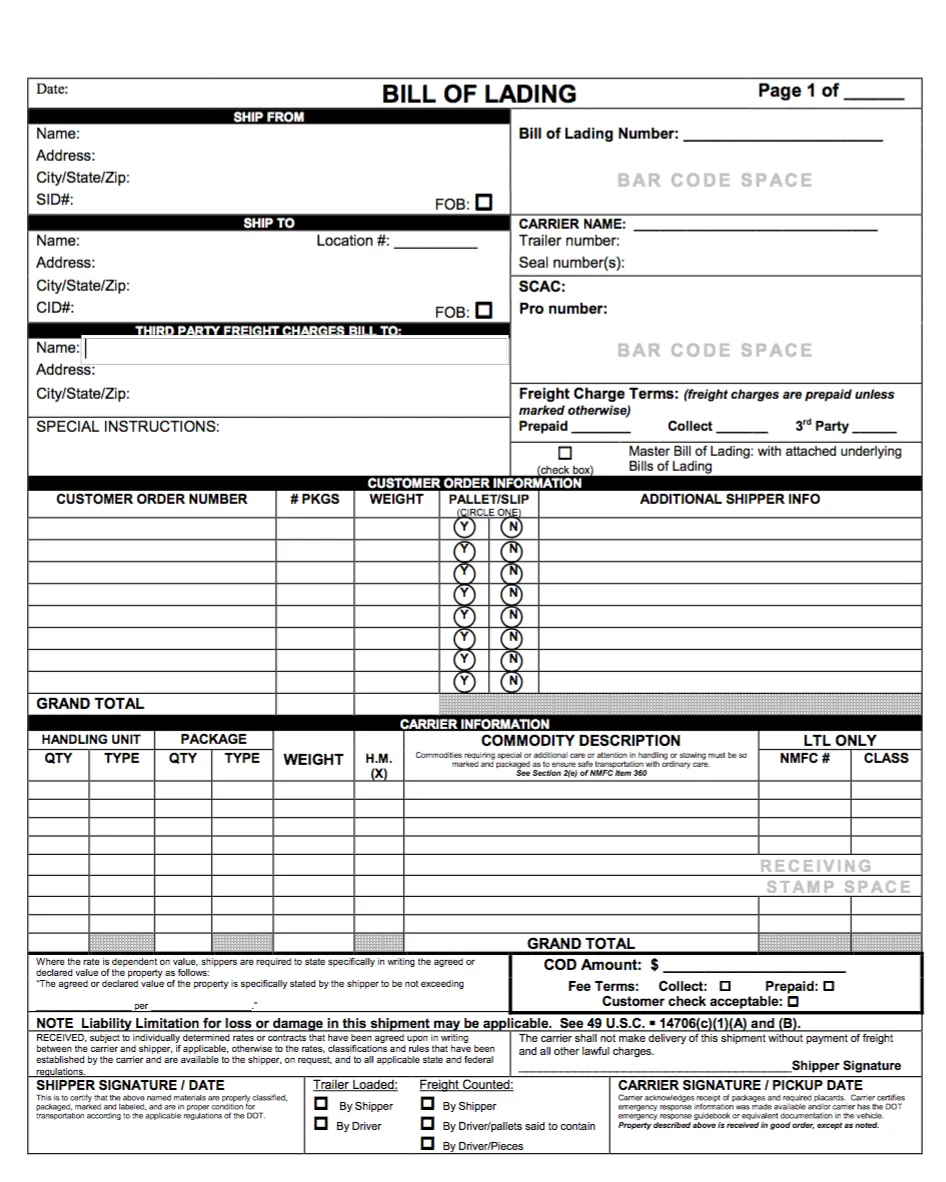

What Is A Shipping Invoice A Bill Of Lading Guide For Small Businesses

Q Tbn And9gctkzortrenpq Ktqxub4wlicxsave9pkdrywhosk Gcffx8jd2c Usqp Cau

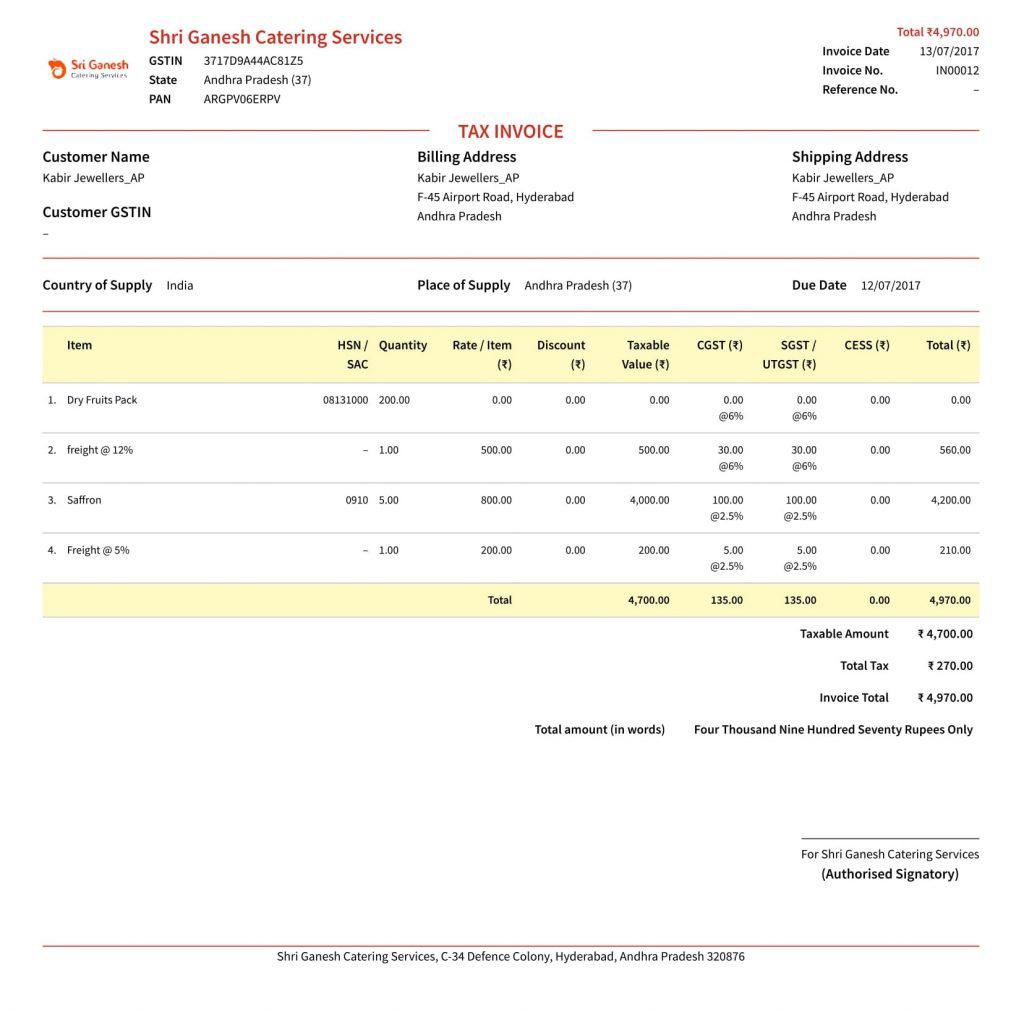

Gst Invoice Check Bill Formats Invoice Rules Payment Quickbooks

Pros Cons Of Using Due Upon Receipt Method For Invoice Payment Terms

:strip_icc()/what-is-invoice-398303_color2-5c9292c846e0fb0001442783.png)

Sales Invoice What Is It

Everything You Need To Know About Invoice Payment Terms

Meaning Of Bill Invoice Voucher Cash Memo And Receipt Youtube

How To Write Invoices The Right Way Online Invoicing Service For Creative Professionals Invoicebus

What Are The Exact Differences Between Invoices Bill And Receipt In Accounting Principles Quora

What Is An Invoice 8 Elements Each Invoice Must Have

Gross Invoice Posting Re V S Net Invoice Posting Rn Sap Blogs

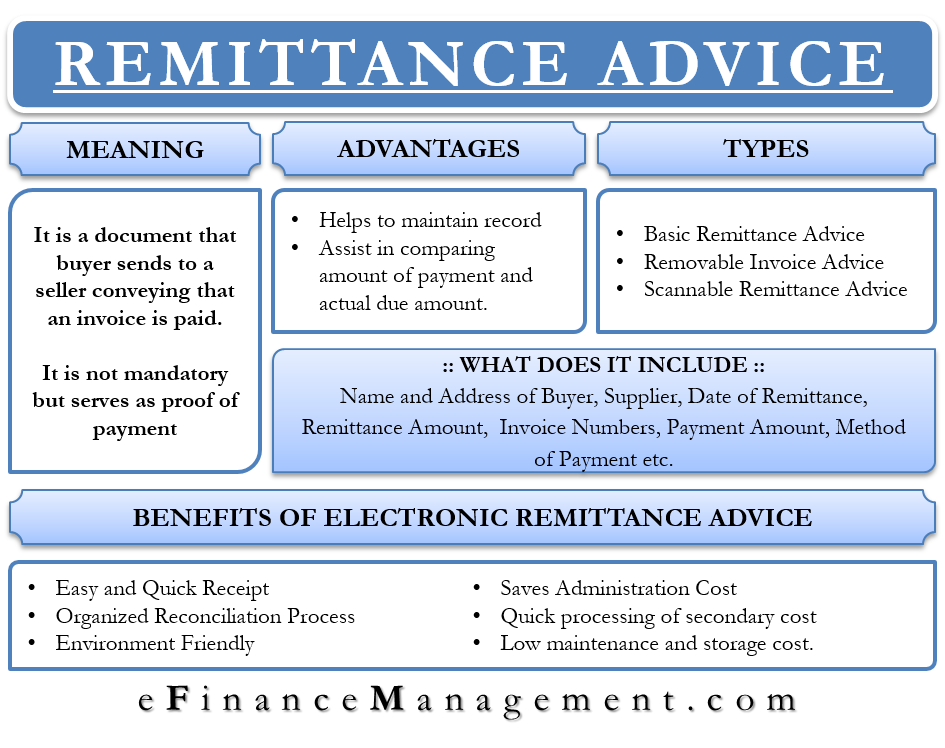

Remittance Advice Meaning Types Benefits And More

Gst Invoice Guide Learn About Gst Invoice Rules Bill Format

Due Upon Receipt Vs Net 30 What Are The Best Invoice Payment Terms Cashboard

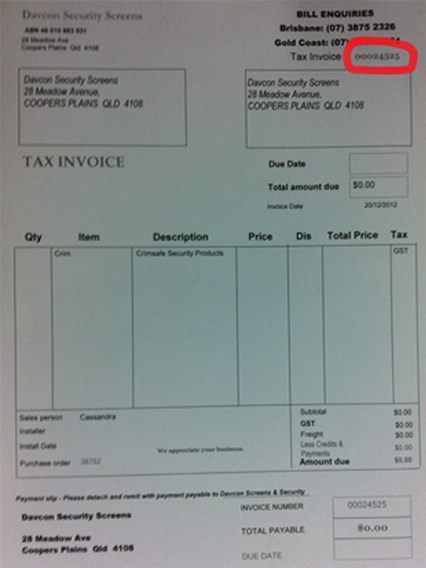

What Is A Tax Invoice Number Why Do I Need It Crimsafe Tweed

Bill Invoice Receipt And Voucher

Payment Receipt What Is A Payment Receipt Debitoor Invoicing

Due Upon Receipt Or Net D Invoice Payment Terms You Need To Know

Payment Status Terms Timelines And Delays Procurement Services

Can I Get A Receipt Or Invoice For My Purchase Support Hub G2a Com

What Is The Difference Between An Operator Invoice A Tax Invoice And A Sales Receipt Regiondo Gmbh Knowledge Base

No Invoice Uploaded General Selling On Amazon Questions Amazon Seller Forums

China Credit Insight 5 Invoice Receipt Versus Fapiao Fabutx Limited

Difference Between An Invoice And A Receipt Invoice Vs Receipt

What Is An Invoice Sending And Receiving Invoices In Business

Sap Invoice Verification Tutorial Free Sap Mm Training

Invoices Vs Sales Receipts What S The Difference Debitoor

Sap Vendor Invoice Dab Data Analyzes Consulting Gmbh

Credit Terms Definition Types Examples Tips Tally Solutions

Qpz5t P4rkmm

Dream Meaning Of Invoice Dream Interpretation

/what-is-invoice-398303_color2-5c9292c846e0fb0001442783.png)

Sales Invoice What Is It

Pro Forma Invoice Under Gst Meaning Template When It Is Used

Know The Difference Purchase Order Po Packing Slip And Invoice

Q Tbn And9gcq 4h0crlbvtxk4lbsoc Vq6t Lvpdiejyxgzinzfaqao7fbc Usqp Cau

Is Invoice A Receipt Accountingcapital

What Is The Difference Between A Pro Forma Invoice And A Receipt Quora

What Is A Receipt Definition And Examples Market Business News

Difference Between Invoice And Receipt With Comparison Chart Key Differences

Guide To Bir S New Invoicing Requirements Effective June 30 13 Gva Co Cpas

5 Delivery Invoice Templates Free Samples Examples Format Download Free Premium Templates

Free 41 Sample Receipts In Pdf Ms Word

The Definition And Purpose Of Sales Invoice Hashmicro Blog

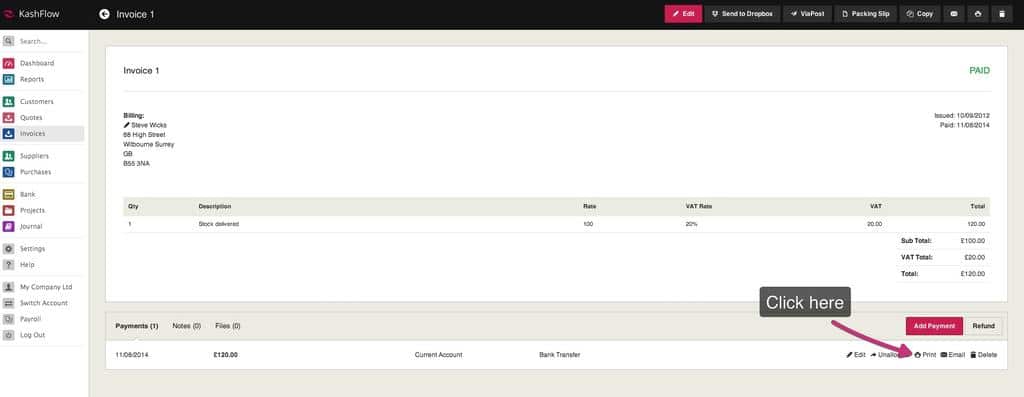

Payment Receipts Remittance Advice Kashflow

Fedex Proforma Invoice Template Professional Design Template Invoice Template Receipt Template Invoice Design

Due Upon Receipt Or Net D Invoice Payment Terms You Need To Know

Invoice What Needs To Be Included In A Business Invoice

Invoice Summary

3

Commercial Shipping Invoice International Commercial Invoice International Invoice Template Invoice Template Invoice Example Invoice Design Template

What Is An Invoice Quickbooks

What Is The Difference Between Sales Invoice And Official Receipt Reliabooks

What Does Net 30 Mean On An Invoice A Simple Definition For Small Businesses

Sap Purchase Order Default Free Of Charge Indicator Sap Blogs

Difference Between Tax Receipt Eftpos Docket

Definition Proforma Invoice Invoice Template Free 16 Meaning Proforma Invoice Invoice Template Invoice Template Word Invoicing

Is An Invoice A Receipt Key Definitions And Examples For Businesses