Asset Meaning In Accounting

The meaning is clear.

Asset meaning in accounting. Assets Ever heard the phrase “Tom is an asset to the company”?. Definition Generally Speaking depreciation is the gradual decrease in the value of an asset due to any causeIt has been defined as “The permanent and continuing diminution in the quality,quantity or value of an asset“. An asset is a resource with economic value that an individual, corporation, or country owns or controls with the expectation that it will provide a future benefit Assets are reported on a.

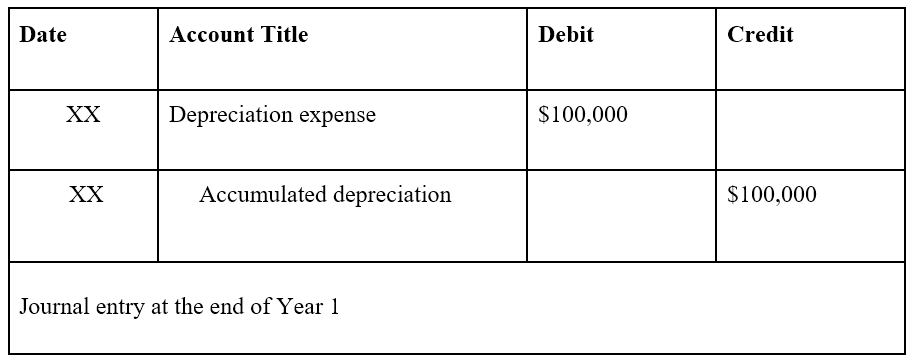

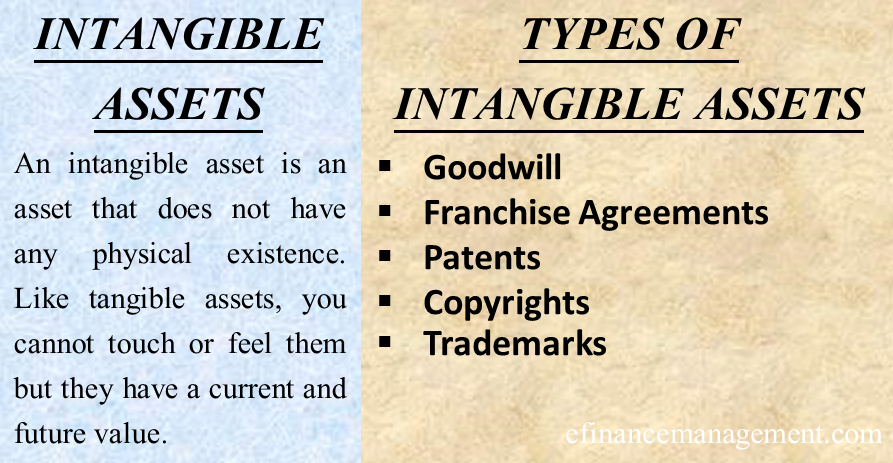

In accounting, an intangible asset is a resource with longterm financial value to a business It also isn’t a material object The meaning of intangible is something that can’t be touched or physically seen, according to the Cambridge Dictionary. Accounting Standard 6 issued by the Institute of the Chartered Accountants of India defines ‘depreciation’ as “a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, effluxion of time or obsolescence through technology and market changes. Asset management has two general definitions, one relating to advisory services and the other relating to corporate finance In the first instance, an advisor or financial services company provides asset management by coordinating and overseeing a client's financial portfolio eg, investments, budgets, accounts, insurance and taxes.

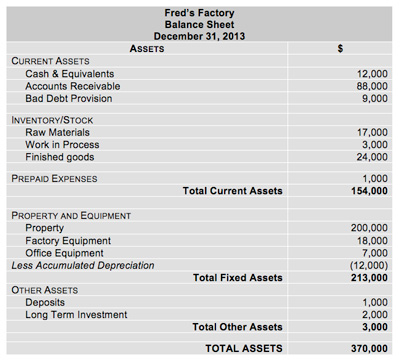

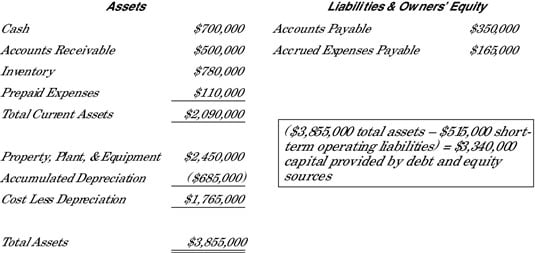

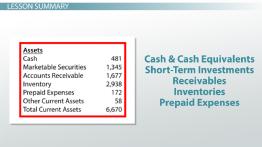

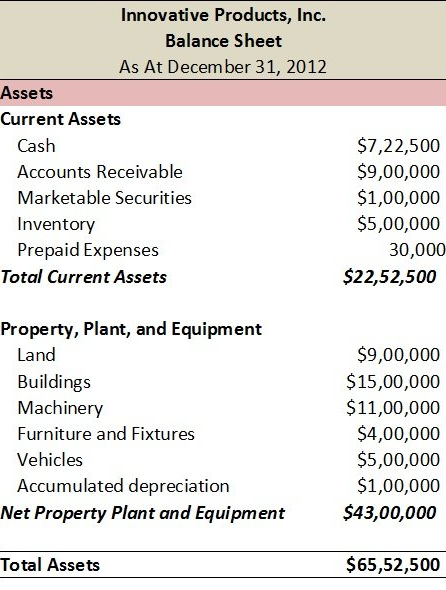

It is a contraasset account and is presented as a deduction to the related asset – accounts receivable Inventories – assets held for sale in the ordinary course of business Prepaid expenses – expenses paid in advance, such as, Prepaid Rent, Prepaid Insurance, Prepaid Advertising, and Office Supplies. Since, by definition, an asset must be controlled by the entity in order for it to be recognized in the financial statements, certain ‘Assets’ would not qualify for recognition Consider a highly dedicated workforce Generally speaking, a hardworking and motivated workforce is the most valuable asset of any successful company. Meaning of Depreciation The monetary values of all tangible assets tend to reduce gradually over time due to factors like wear and tear The meaning of depreciation, in very simple words, is the rate at which this value drops Hence, it compares an asset’s current value with its original cost at the time of acquisition or purchase.

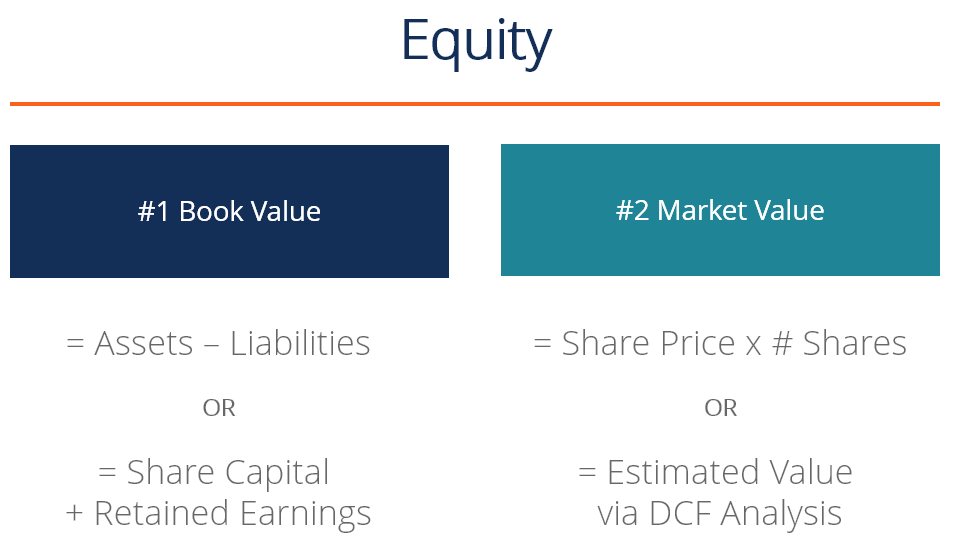

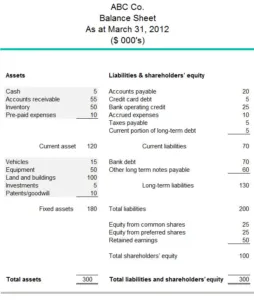

O E Owner’s Equity;. In financial accounting, an asset is any resource owned or controlled by a business or an economic entity It is anything (tangible or intangible) that can be utilized to produce value and that is held by an economic entity and that could produce positive economic valueSimply stated, assets represent value of ownership that can be converted into cash (although cash itself is also considered. In accounting, the value of a company's total assets less its total liabilities and intangible assets Put another way, the book value is the shareholders' equity , or how much the company would be worth if it paid of all of its debts and liquidated immediately.

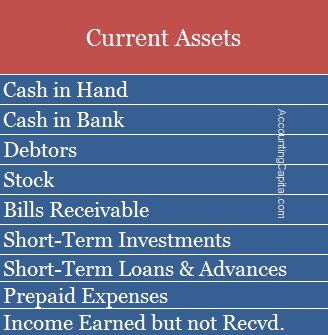

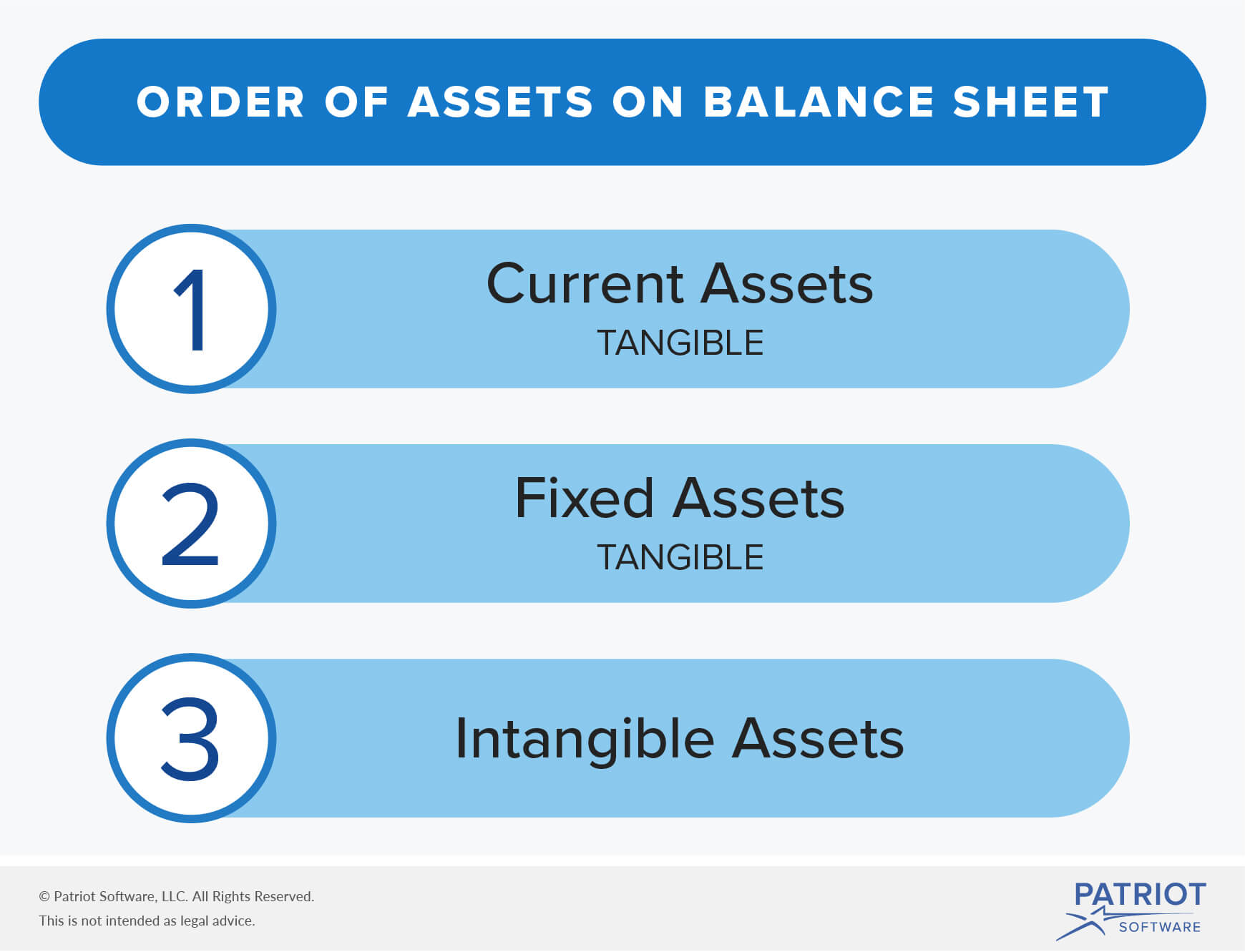

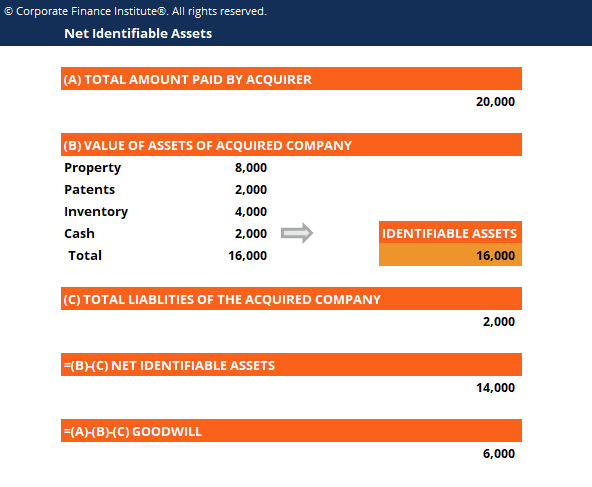

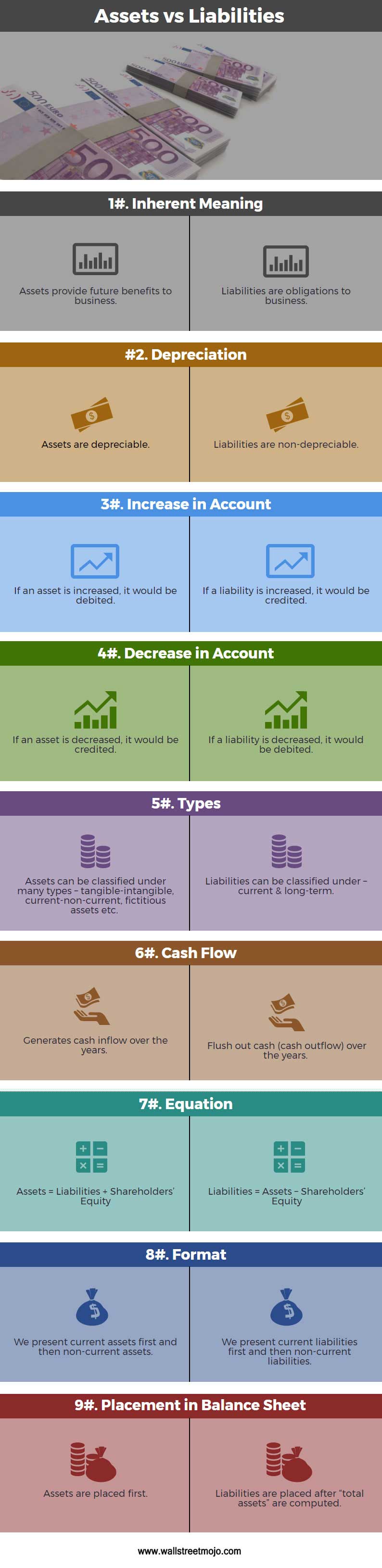

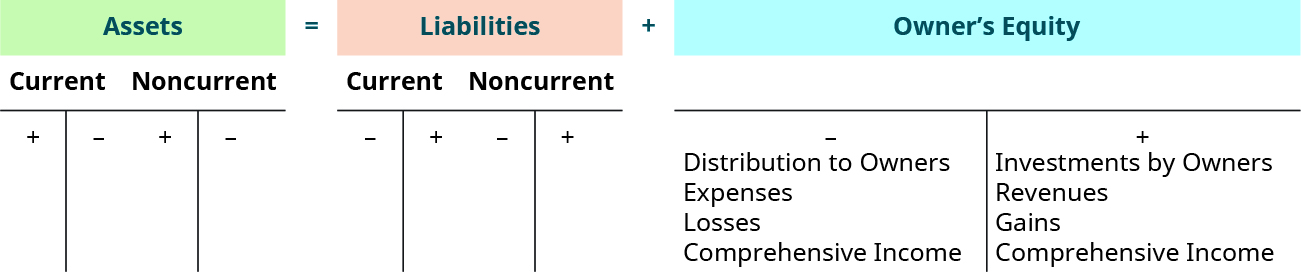

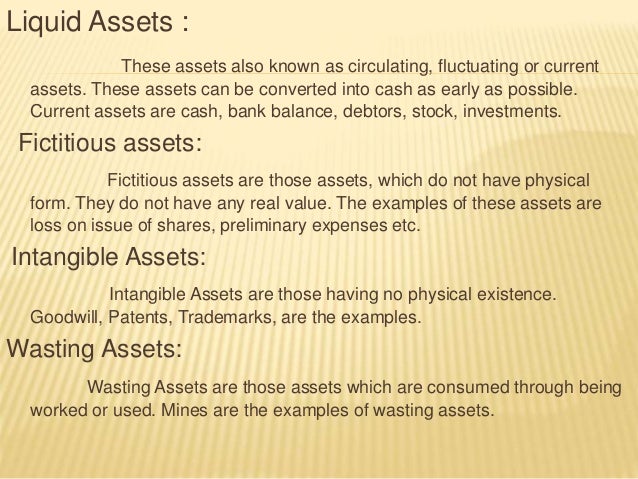

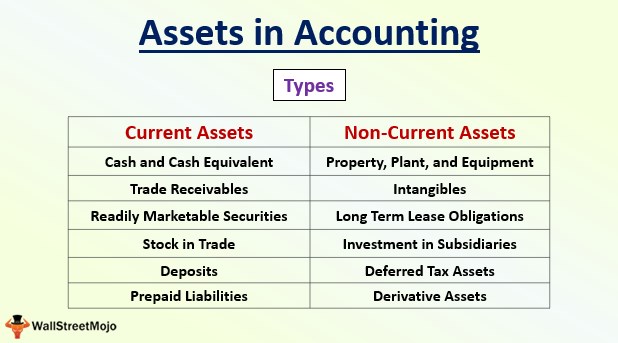

This is one of the basic concepts of accounting The equation for the same goes like this Assets = Liabilities Owner’s Equity Here is the meaning of every term that ALOE stands for Assets Assets are the items that belong to you and you are the owner of it These items correspond to. If assets are classified based on their convertibility into cash, assets are classified as either current assets or fixed assets An alternative expression of this concept is shortterm vs longterm assets 1 Current Assets Current assets are assets that can be easily converted into cash and cash equivalents (typically within a year). In accounting, goodwill is the value of the business that exceeds its assets minus the liabilities It represents the nonphysical assets, such as the value created by a solid customer base, brand recognition or excellence of management.

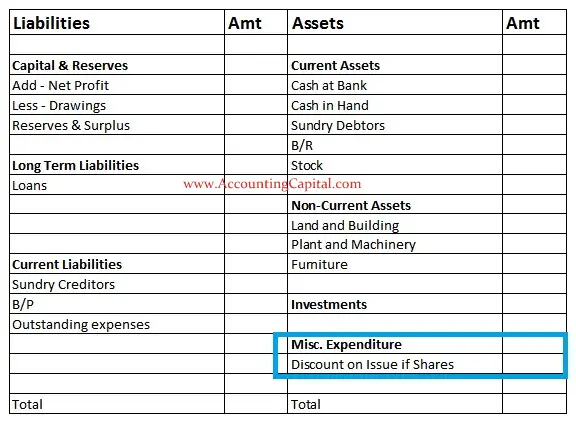

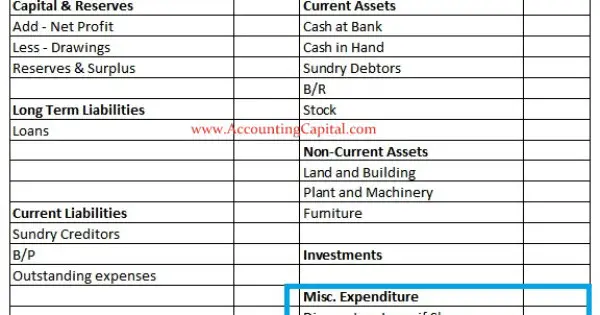

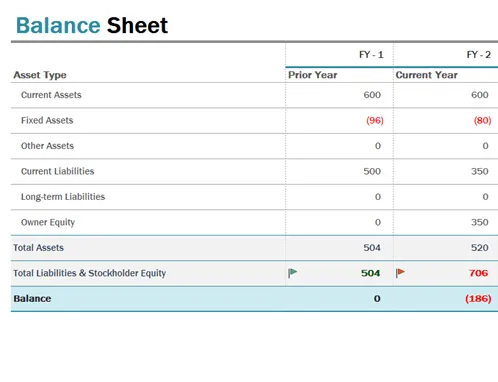

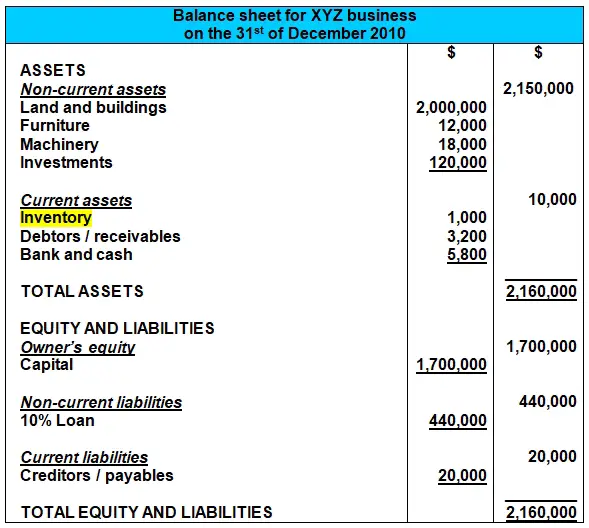

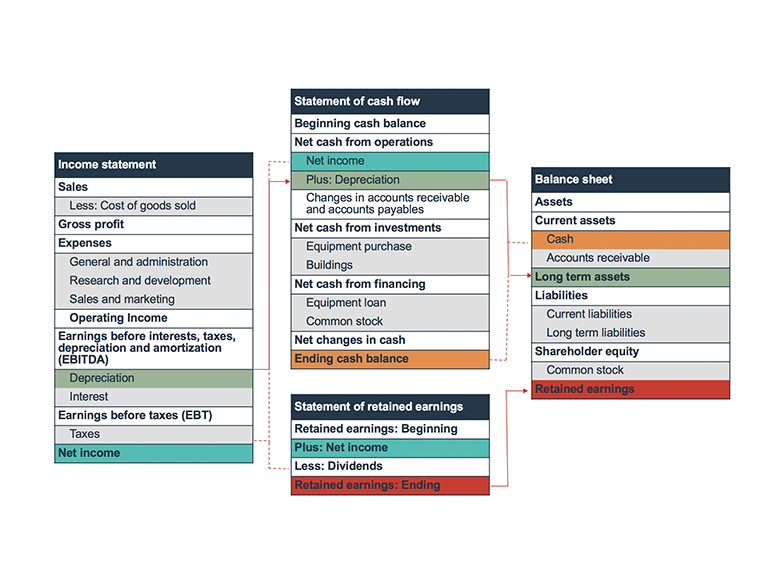

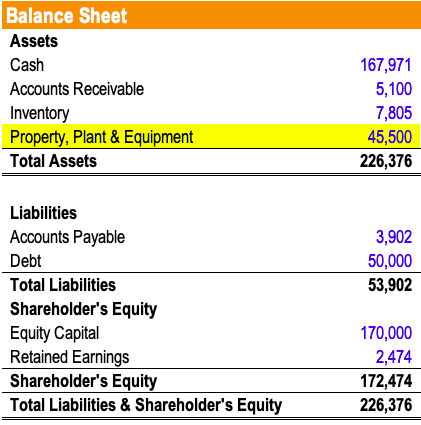

Asset definition in English dictionary, asset meaning, synonyms, see also 'assets',asset value',chargeable asset',wasting asset' Enrich your vocabulary with the English Definition dictionary. The most important equation in all of accounting Let’s take the equation we used above to calculate a company’s equity Assets – Liabilities = Equity And turn it into the following Assets = Liabilities Equity Accountants call this the accounting equation (also the “accounting formula,” or the “balance sheet equation”) It might not seem like much, but without it, we wouldn. Definition Assets are resources that control by the entity and those resources are expected to have the economic inflow into the entity in the future Those assets included cash, account receivables, cares, computer equipment, land, building, and any other resources that control by the entity The balance sheet is one of five financial statements that report the entity’s financial.

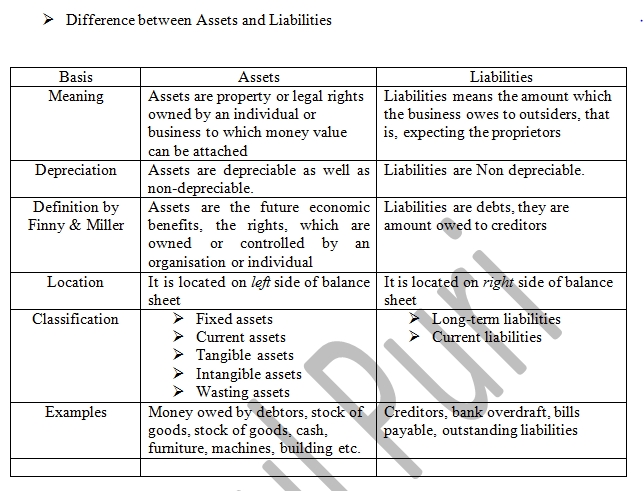

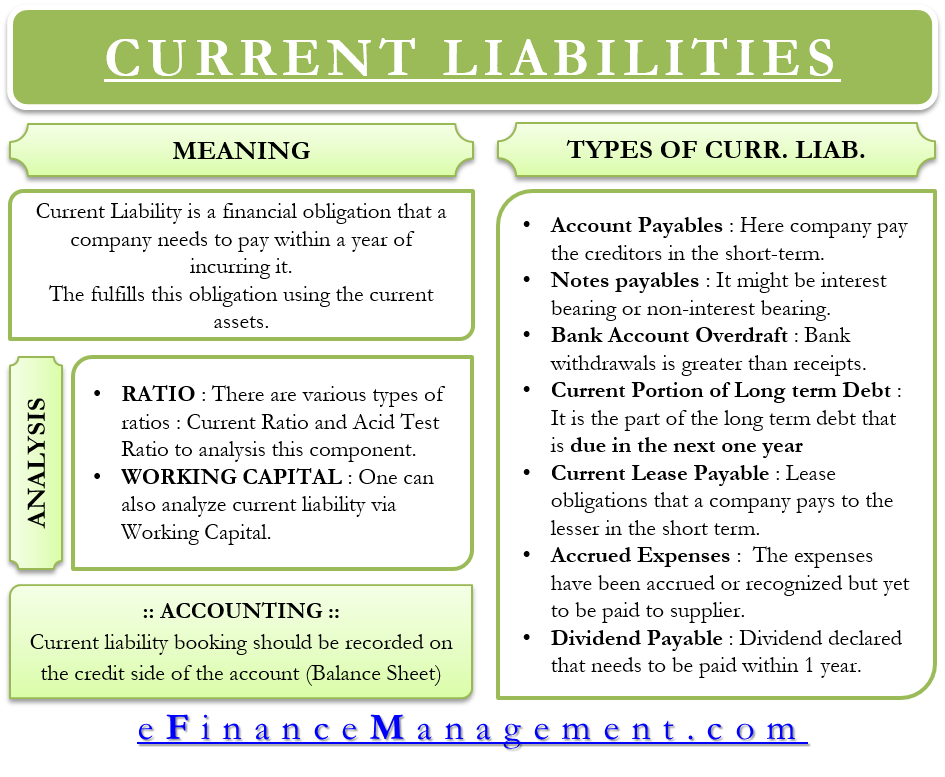

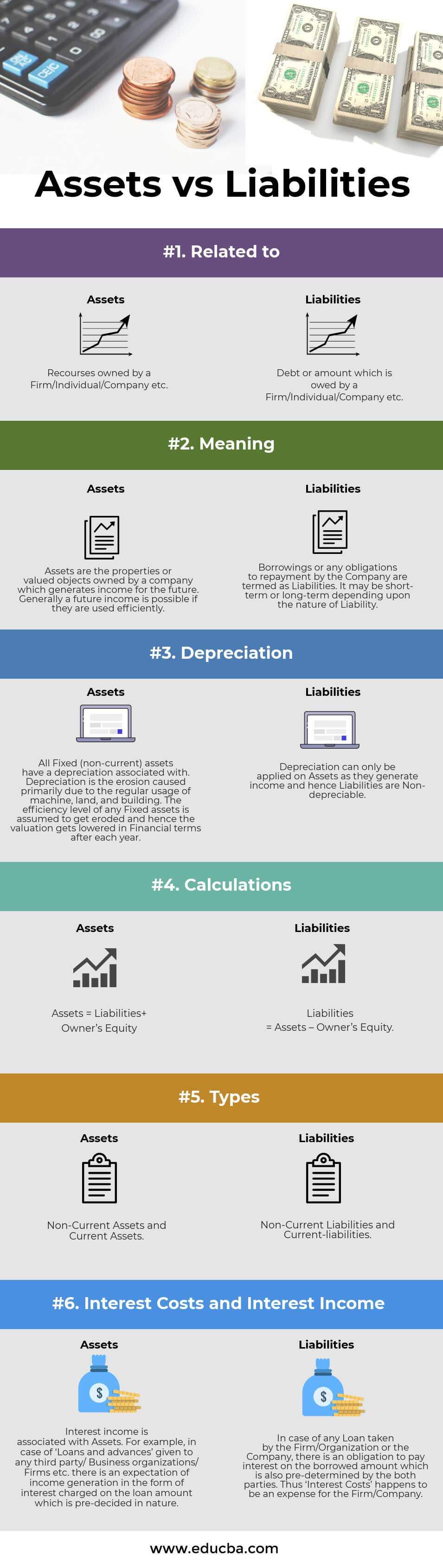

Asset definition, a useful and desirable thing or quality Organizational ability is an asset See more. Current assets are the key assets that your business uses up during a 12month period and will likely not be there the next year Current asset accounts include the following Cash in Checking Any company’s primary account is the checking account used for operating activities This is the account used to deposit revenues and pay expenses. The words “asset” and “liability” are two very common words in accounting/bookkeeping Assets are defined as resources that help generate profit in your business You have some control over it Liability is defined as obligations that your business needs to fulfill In simple words, Liability means credit.

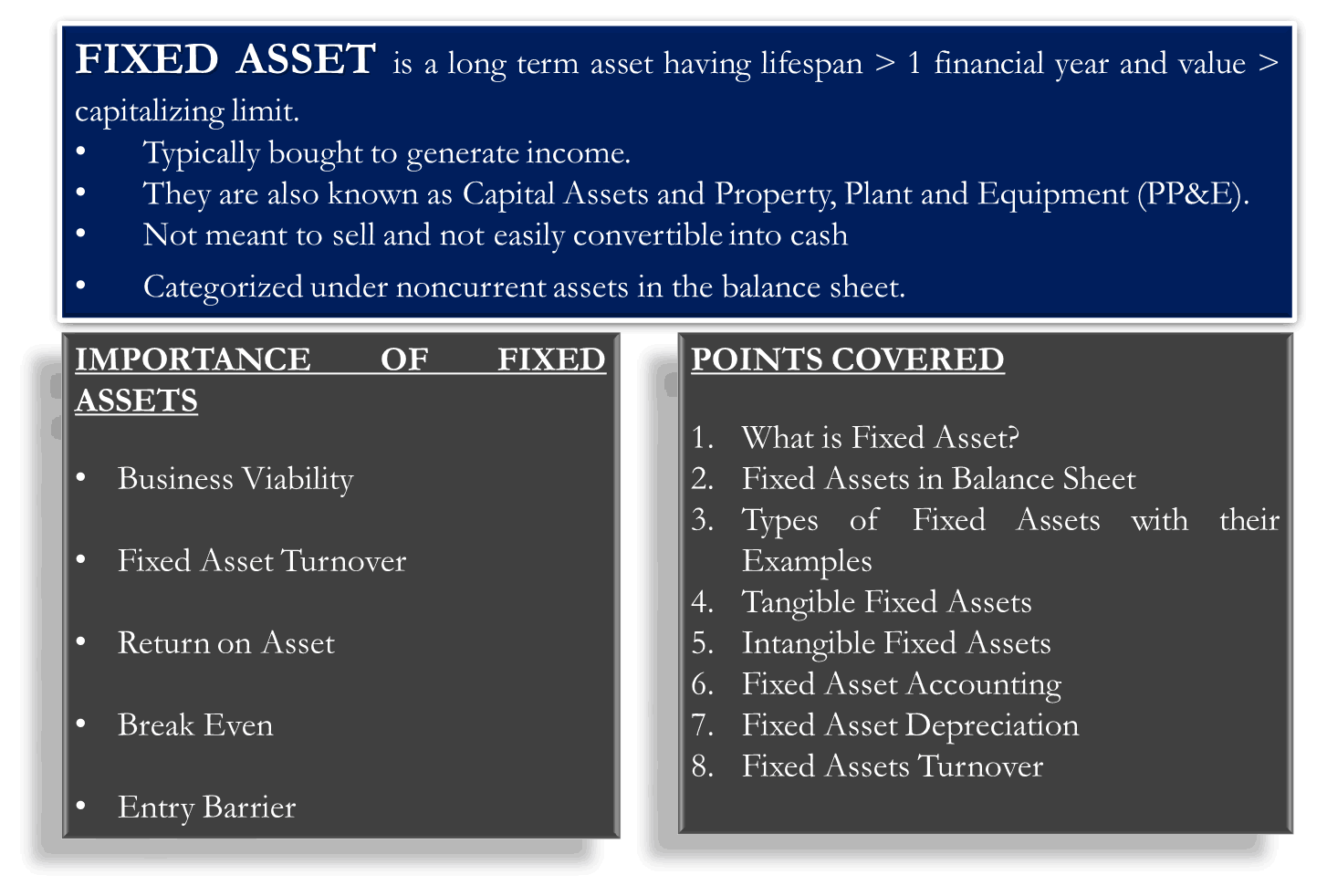

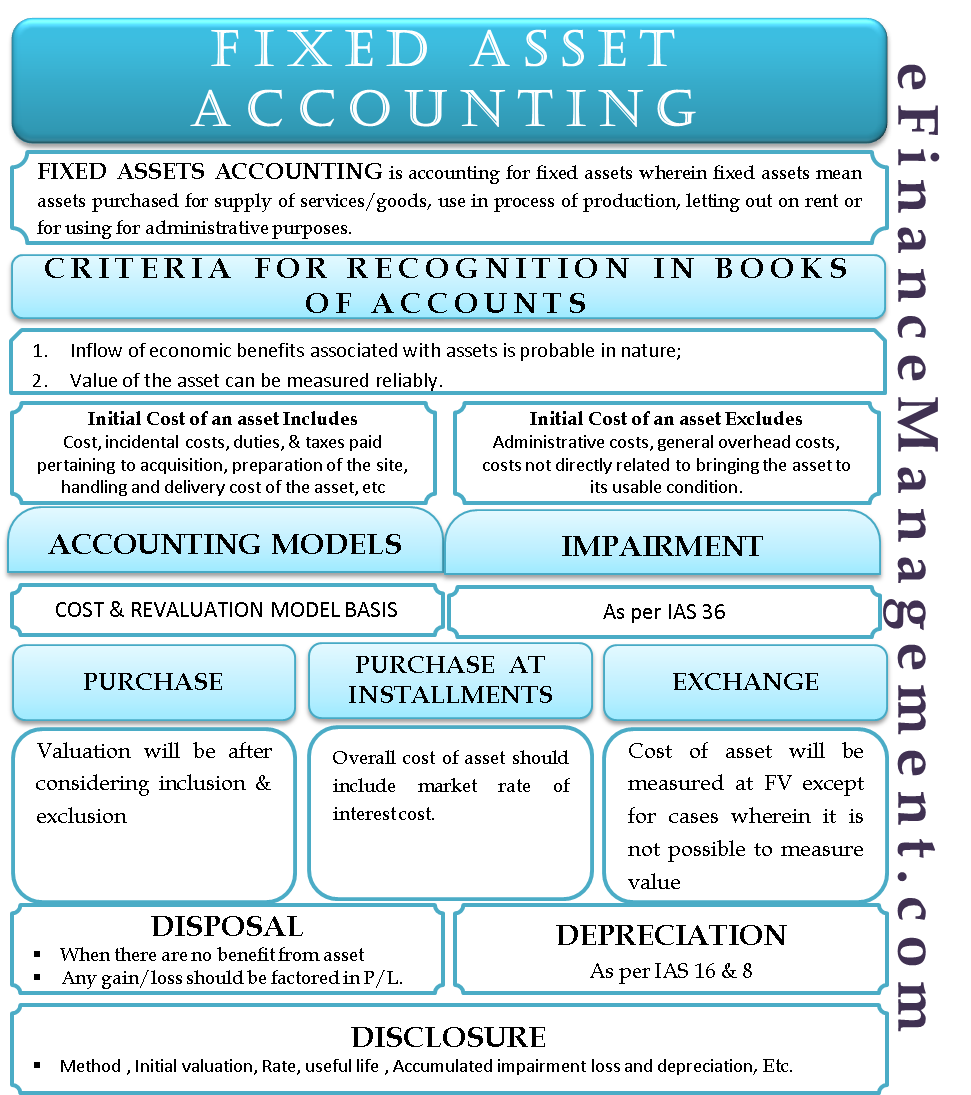

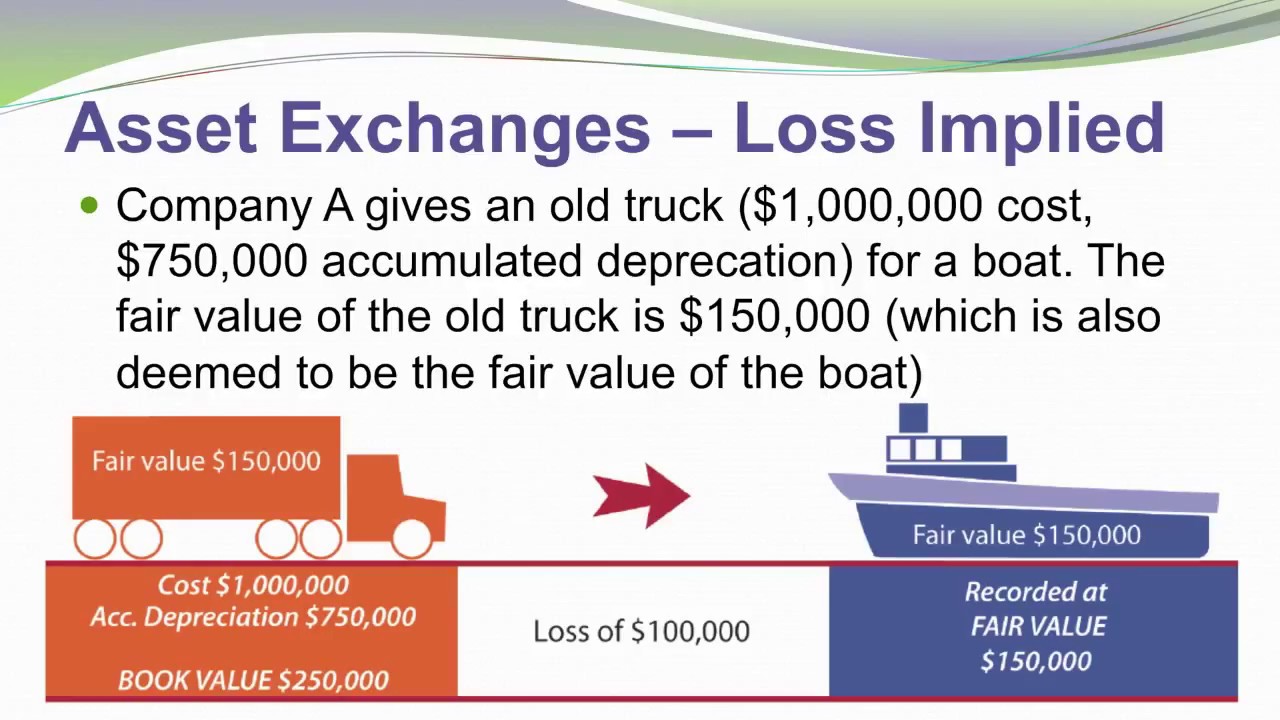

The asset's fair value less the cost of selling this asset Noncurrent assets 'held for sale' should be presented separately on the face of the statement of financial position as a current asset For a noncurrent asset (Fixed Asset) to be classified as 'held for sale', all of the following 4 conditions must be satisfied. Fixed assets—also known as tangible assets or property, plant, and equipment (PP&E)—is an accounting term for assets and property that cannot be easily converted into cashThe word fixed indicates that these assets will not be used up, consumed, or sold in the current accounting year Yet there still can be confusion surrounding the accounting for fixed assets. Under the PURCHASE METHOD OF ACCOUNTING, one entity is deemed to acquire another and there is a new basis of accounting for the ASSETS and LIABILITIES of the acquired company In a POOLING OF INTERESTS, two entities merge through an exchange of COMMON STOCK and there is no change in the CARRYING VALUE of the assets or liabilities.

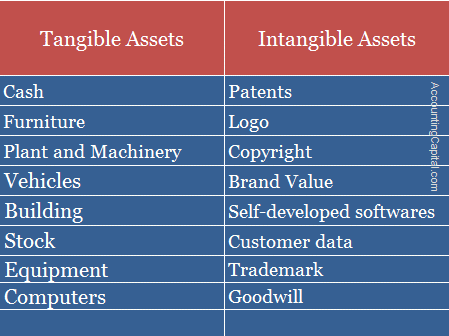

Asset – definition and meaning In finance and accounting, an asset refers to anything of economic value that we own In fact, it is anything that a person finds useful or valuable Anything that we can convert to cash is probably an asset Assets are items that people, companies, or even a country owns or controls We also expect that assets. Assets belonging to this category are cash, cash equivalents, and inventory Non Current Assets As opposed to Current Assets, it normally takes a year or more to convert these assets into cash Noncurrent assets are further classified into Tangible and Intangible Assets Tangible assets manifest a physical existence or appearance. This is one of the basic concepts of accounting The equation for the same goes like this Assets = Liabilities Owner’s Equity Here is the meaning of every term that ALOE stands for Assets Assets are the items that belong to you and you are the owner of it These items correspond to.

For accounting and tax purposes, your reported expenditures are based on the depreciation period whether you pay for your equipment up front or in monthly loan installments If you do take out a loan, your interest payments are tax deductible, but they are expenses separate from the cost of the capitalized equipment. Assets in accounting are the medium through which business can be undertaken, are either tangible or intangible and have a monetary value can be associated with it due to the economic benefits that can be derived from them. For accounting purposes, fiscal quantifiability must define assets Assets are the measurable resources of a company, able to be expressed in terms of a monetary value.

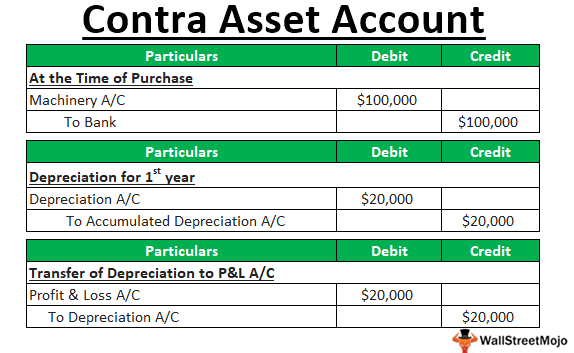

Contra asset accounts are a type of asset account where the account balance may either be a negative or zero balance This type of account can equalize balances in the asset account that it is paired with on a business's balance sheet The contra asset account has credited balances that can reduce the balance in its paired asset account. O E Owner’s Equity;. Asset disposal is the act of selling an asset usually a long term asset that has been depreciated over its useful life like production equipment Disposal of Assets Explanation According to its depreciation, many companies contain an asset disposal policy to replace equipment.

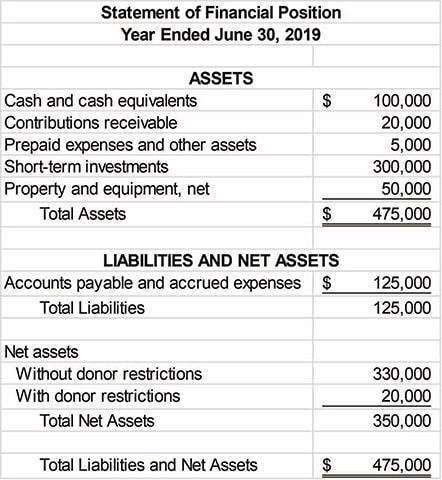

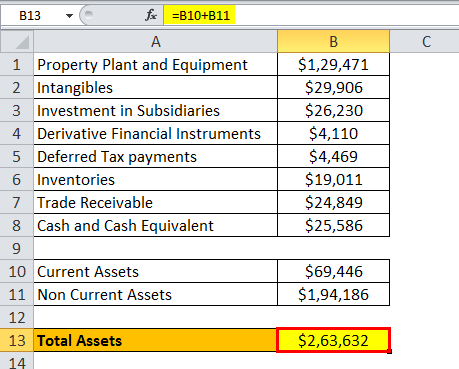

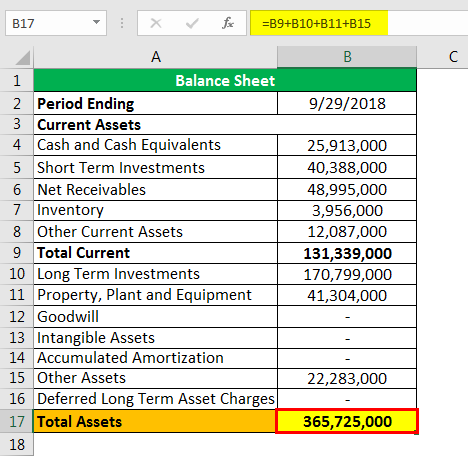

The meaning of total assets is truly reflected in the accounting equation as the sum total of liabilities and owner’s equity While “Net Assets” is a term used to state the difference between total assets and total liabilities. Assets definition Things that are resources owned by a company and which have future economic value that can be measured and can be expressed in dollars Examples include cash, investments, accounts receivable, inventory, supplies, land, buildings, equipment, and vehicles Assets are reported on the balance sheet usually at cost or lower. The meaning is clear.

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity It is anything (tangible or intangible) that can be utilized to produce value and that is held by an economic entity and that could produce positive economic valueSimply stated, assets represent value of ownership that can be converted into cash (although cash itself is also considered. Assets Ever heard the phrase “Tom is an asset to the company”?. What are Assets in Accounting?.

Royalty Meaning in Accounting Royalty is nothing but a periodical payment made by the user of the asset to the owner or the creator of such an asset for its use In other words, the owner/author of the asset such as mine, patent, book, artistic work etc may allow the third party like licensee, publisher etc to use its creation in exchange of a. Fundamentally, accounting comes down to a simple equation Assets = Liabilities Equity It seems simple enough but let’s really break it down What do these terms mean in relation to your business and how can they help you make sense of the books?. What is Asset Disposal?.

It is a contraasset account and is presented as a deduction to the related asset – accounts receivable Inventories – assets held for sale in the ordinary course of business Prepaid expenses – expenses paid in advance, such as, Prepaid Rent, Prepaid Insurance, Prepaid Advertising, and Office Supplies. Fixed assets are subject to depreciation to account for the loss in value as the assets are used, whereas intangibles are amortized 134 Fixed Asset Noncurrent Assets Definition. In accounting, an intangible asset is a resource with longterm financial value to a business It also isn’t a material object The meaning of intangible is something that can’t be touched or physically seen, according to the Cambridge Dictionary.

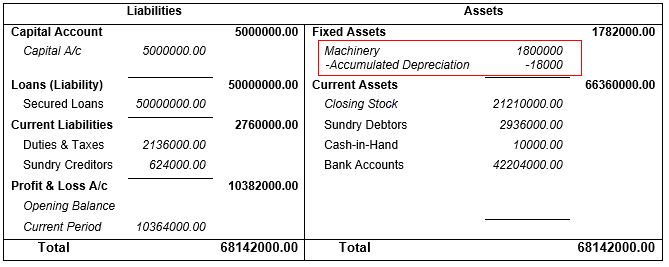

The general asset definition is anything possessed that is of value But what are assets in accounting?. Tangible Assets – Meaning, Importance, Accounting and More Accounting As said above, the hard assets come in the balance sheet at the original cost But finally, all these assets find their place in the profit and loss account, either by way of depreciation or conversion to debtors and cash, etc. Asset turnover is a comparison of sales to assets The intent is to show the amount of sales generated by investing in a certain amount of assets Thus, a high turnover ratio should mean that management is making excellent use of a small investment in assets to create a.

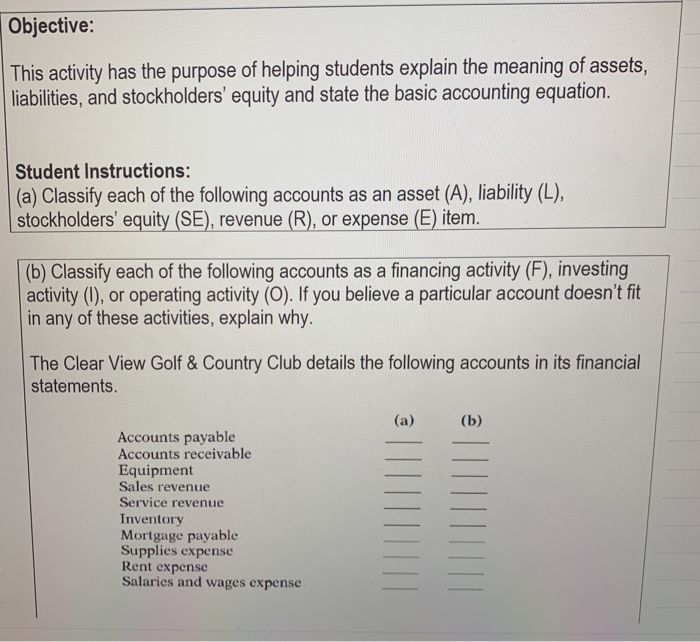

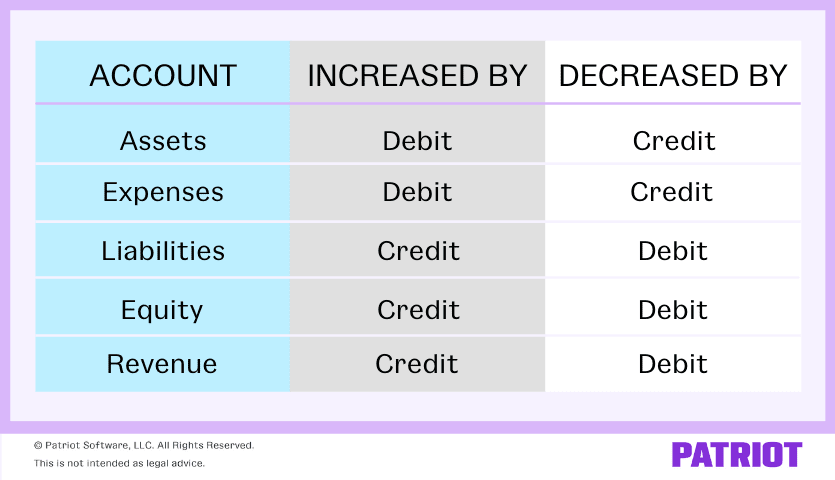

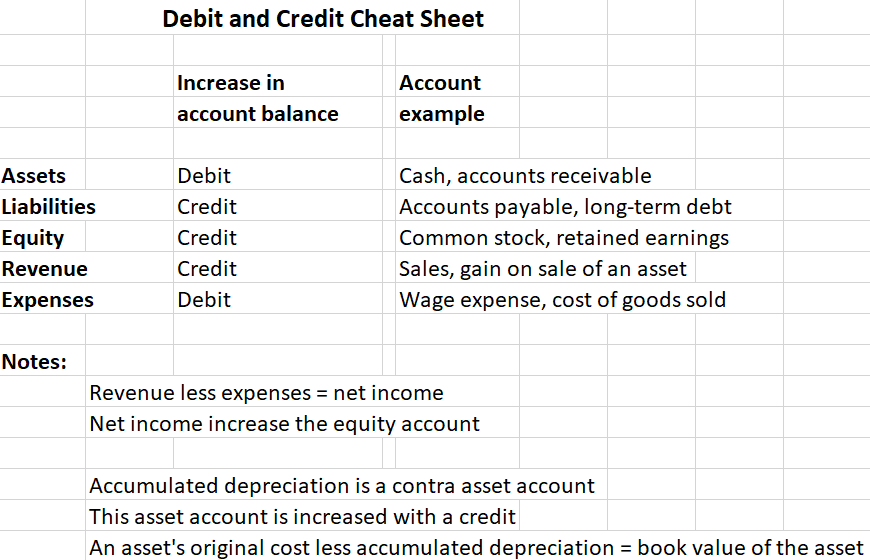

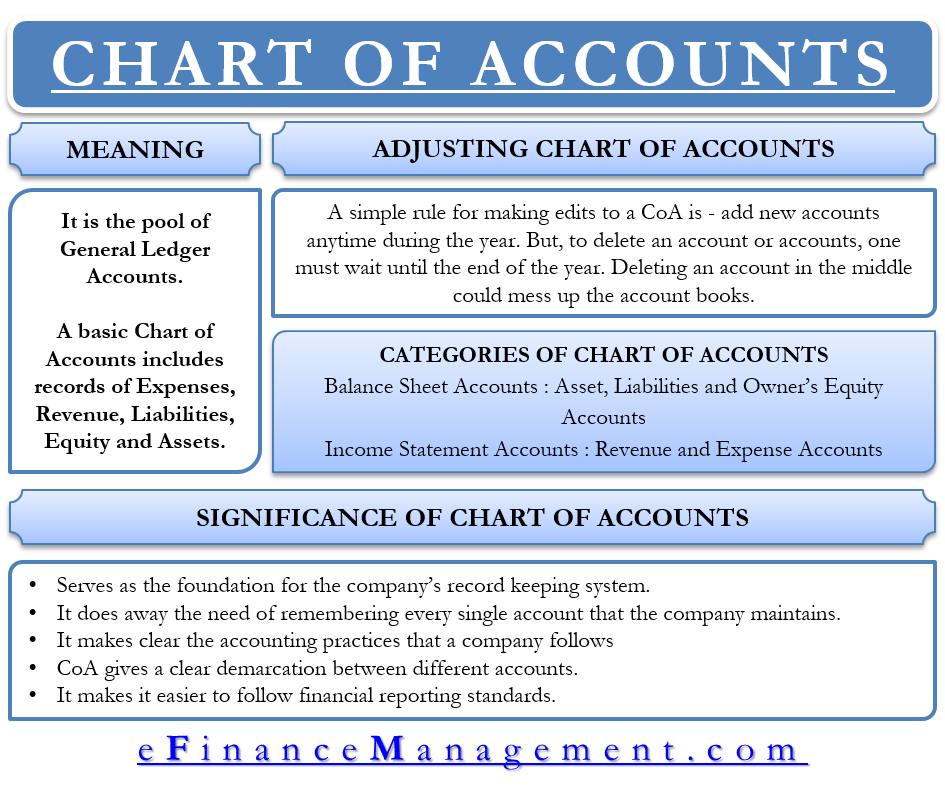

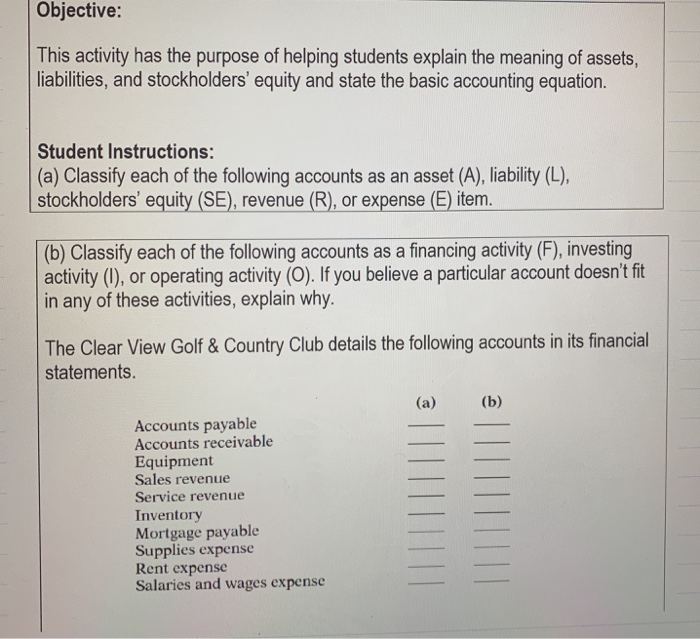

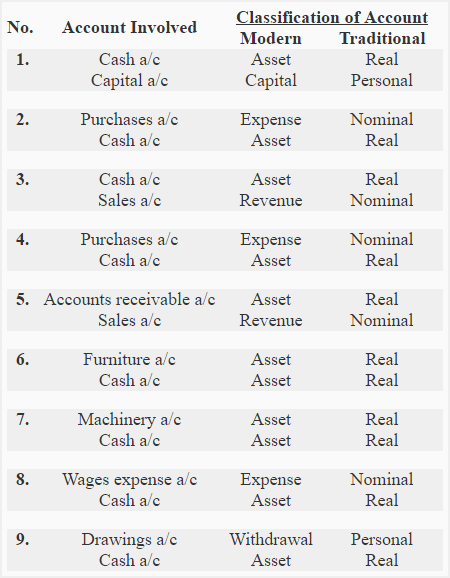

Since, by definition, an asset must be controlled by the entity in order for it to be recognized in the financial statements, certain ‘Assets’ would not qualify for recognition Consider a highly dedicated workforce Generally speaking, a hardworking and motivated workforce is the most valuable asset of any successful company. Account Type Overview The five account types are Assets, Liabilities, Equity, Revenue (or Income) and ExpensesTo fully understand how to post transactions and read financial reports, we must understand these account typesWe'll define them briefly and then look at each one in detail Assets tangible and intangible items that the company owns that have value (eg cash, computer systems. An asset is anything that will add future value to your business Asset Recognition Criteria in Accounting But the definition of assets above is not yet complete In accounting we have specific criteria which need to be fulfilled in order to recognize an asset in our accounting records.

Many business assets generate revenue and benefit the owner in the longrun A business balance sheet lists your assets and shows a snapshot of how you manage assets Carefully track assets in your accounting records to ensure your books are accurate You can record asset information manually or by using accounting software. Financial Assets Accounting Asset Definition In accounting, an asset has two criteria a company must own or control it, and it must be expected to generate future benefit for that company Assets on Balance Sheet A company records the value of its assets on the balance sheet Assets can be classified as current assets or as noncurrent assets. Definition An asset is a resource that has some economic value to a company and can be used in a current or future period to generate revenues These resources take many forms from cash to buildings and are recorded on the balance sheet until they are used.

Tangible Assets – Meaning, Importance, Accounting and More Accounting As said above, the hard assets come in the balance sheet at the original cost But finally, all these assets find their place in the profit and loss account, either by way of depreciation or conversion to debtors and cash, etc. Fundamentally, accounting comes down to a simple equation Assets = Liabilities Equity It seems simple enough but let’s really break it down What do these terms mean in relation to your business and how can they help you make sense of the books?. An asset is an expenditure that has utility through multiple future accounting periods If an expenditure does not have such utility, it is instead considered an expense For example, a company pays its electrical bill.

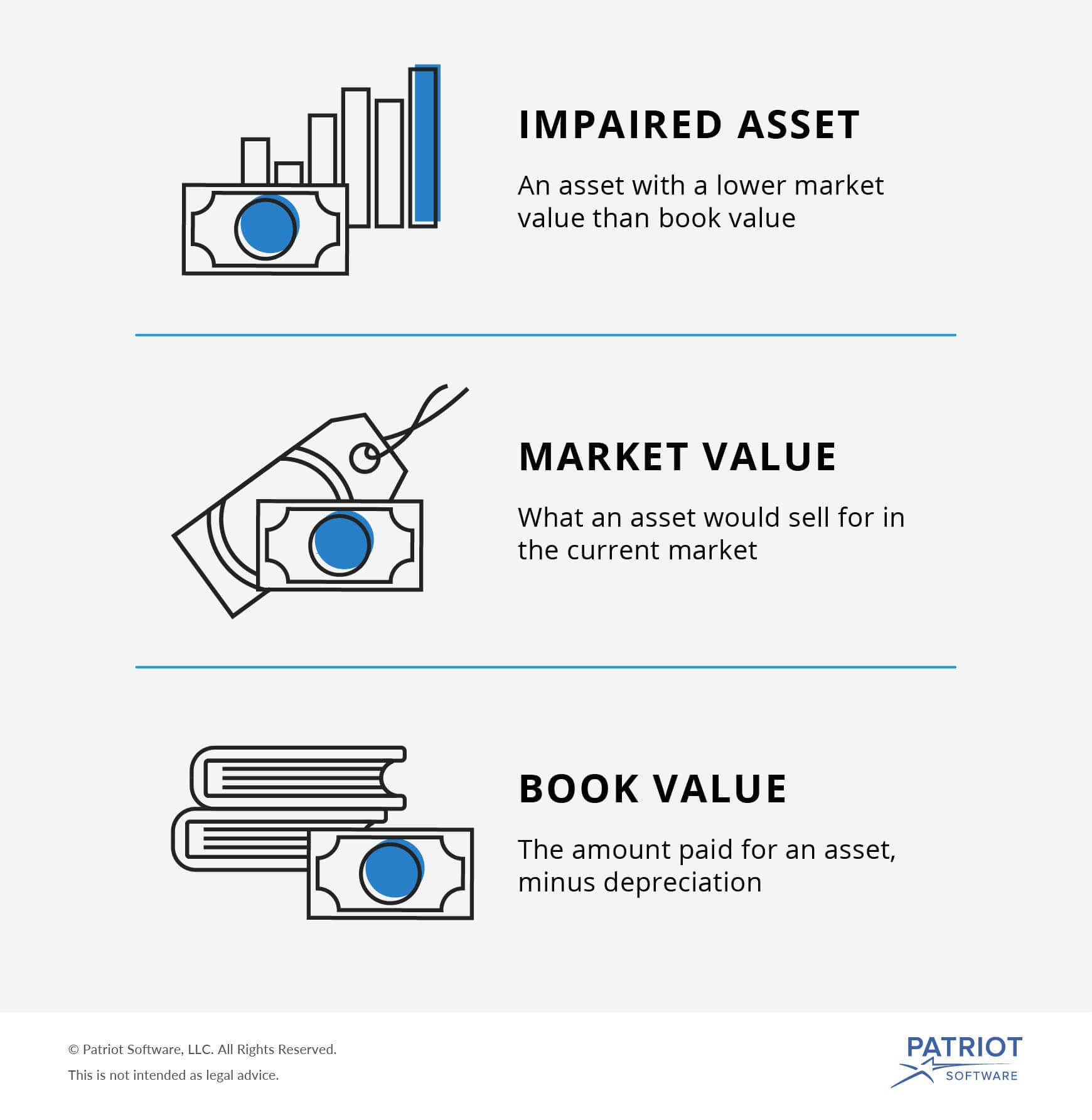

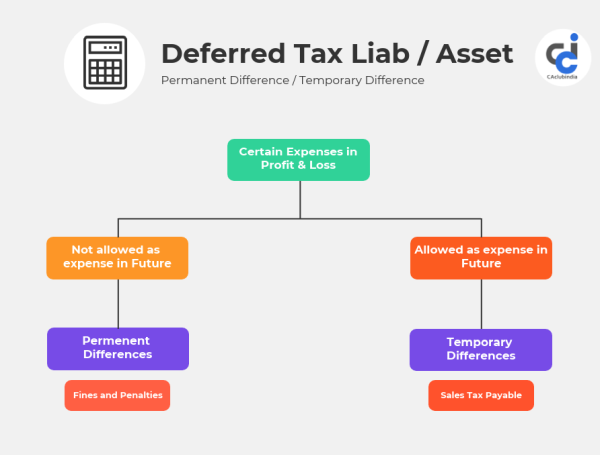

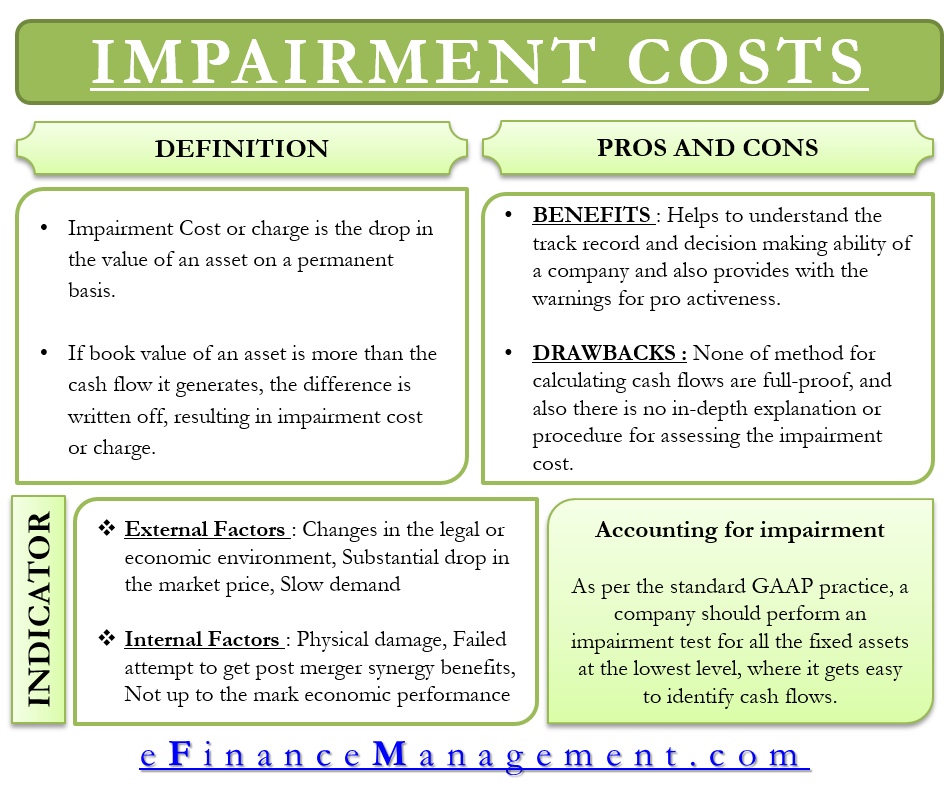

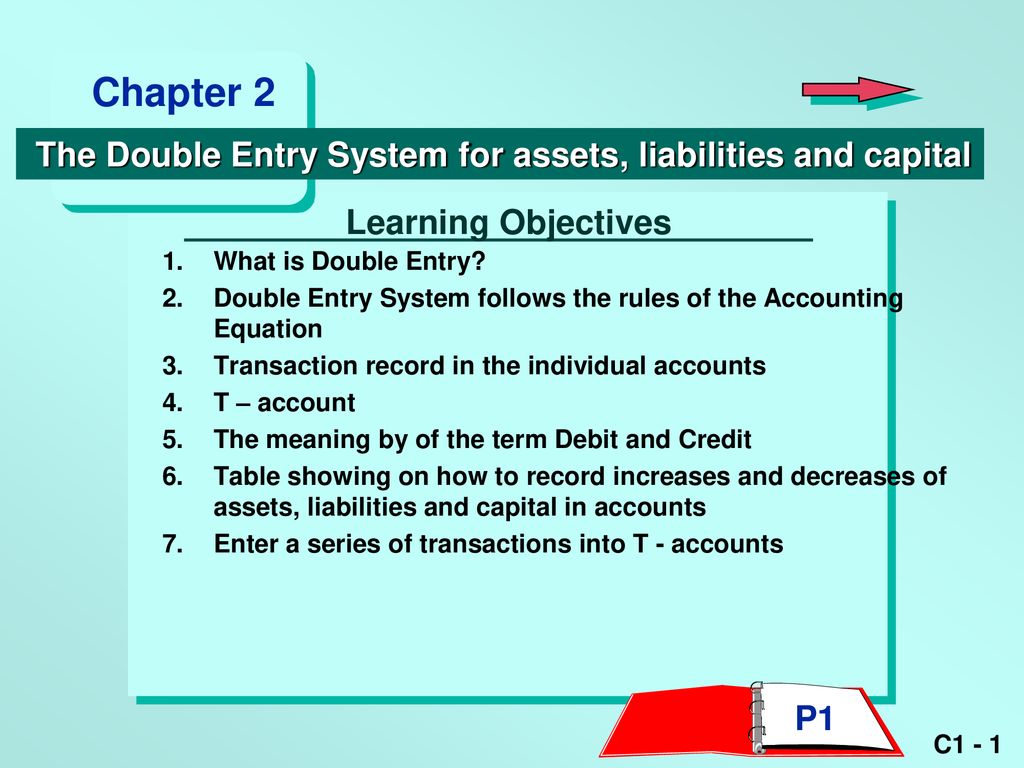

Impairment of assets may sound similar to the accounting processes of depreciation and amortization (a reduction in the value of an asset over the course of its useful life) While there are some relatively clear similarities between the two concepts, there’s one key distinction impairment denotes a sudden, irreversible drop in value. Asset disposal is the removal of a longterm asset from the company’s accounting records Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows These three core statements areIt is an important concept because capital assets are Types of Assets Common types of assets include current, non. Accounting Equation Definition Accounting Equation states that sum of the total liabilities and the owner’s capital is equal to the company’s total assets and it is one of the most fundamental parts of the accounting on which the whole double entry system of accounting is based.

An asset that the owner intends to hold and derive benefits from for a period of more than one year Capital assets include longterm investments such as land and major equipment It is difficult to liquidate capital assets, and companies usually do so when they are extremely cash poor They are intended to help produce a business' profits and are therefore usually necessary investments. In accounting and bookkeeping, a company's assets can be defined as Resources or things of value that are owned by a company as the result of company transactions Prepaid expenses that have not yet been used up or have not yet expired Costs that have a future value that can be measured. Assets, liabilities, equity and the accounting equation are the linchpin of your accounting system They tell you how much you have, how much you owe, and what’s left over They help you understand where that money is at any given point in time, and help ensure you haven’t made any mistakes recording your transactions.

Current assets are the key assets that your business uses up during a 12month period and will likely not be there the next year Current asset accounts include the following Cash in Checking Any company’s primary account is the checking account used for operating activities This is the account used to deposit revenues and pay expenses. Financial Assets Accounting Asset Definition In accounting, an asset has two criteria a company must own or control it, and it must be expected to generate future benefit for that company Assets on Balance Sheet A company records the value of its assets on the balance sheet Assets can be classified as current assets or as noncurrent assets. Asset – definition and meaning In finance and accounting, an asset refers to anything of economic value that we own In fact, it is anything that a person finds useful or valuable Anything that we can convert to cash is probably an asset Assets are items that people, companies, or even a country owns or controls We also expect that assets.

Accounting equation can be simply defined as a relationship between assets, liabilities and owner’s equity in the business Accounting Equations Rules The accounting equation connotes two equations that are basic and core to accrual accounting and doubleentry accounting system. An asset is an expenditure that has utility through multiple future accounting periods If an expenditure does not have such utility, it is instead considered an expense For example, a company pays its electrical bill. Definition An asset is a resource that owned or controlled by a company and will provide a benefit in current and future periods for the business In other words, it’s something that a company owns or controls and can use to generate profits today and in the future.

You should be familiar with the definition of an asset in a company and how to account for them on the balance sheet However, you may not know how an asset such as land with minerals is handled in accounting Depending on the company and its resource / asset in use, these methods reduce the value of the asset / resource which is taken into. Account Type Overview The five account types are Assets, Liabilities, Equity, Revenue (or Income) and ExpensesTo fully understand how to post transactions and read financial reports, we must understand these account typesWe'll define them briefly and then look at each one in detail Assets tangible and intangible items that the company owns that have value (eg cash, computer systems.

Solved Objective This Activity Has The Purpose Of Helpin Chegg Com

Asset Definition And Meaning Market Business News

How To Create Asset Classes In Sap What Is An Asset Class

Asset Meaning In Accounting のギャラリー

Impairment Of Assets What It Is How To Handle And More

Assets Balance Sheet Definition

Unrestricted Net Assets Definition And Meaning Bookstime

What Are Current Assets Definition Meaning List Examples Formula Types

Statement Of Financial Position Nonprofit Accounting Basics

What Is The Difference Between Fixed Asset Write Off And Disposal Wikiaccounting

What Are Assets Basic Accounting Terms In Urdu Hindi Youtube

Current Assets Meaning Examples Quiz Accountingcapital

Assets In Accounting Definition Examples Of Assets On Balance Sheet

Liquidation Basis Accounting And Reporting The Cpa Journal

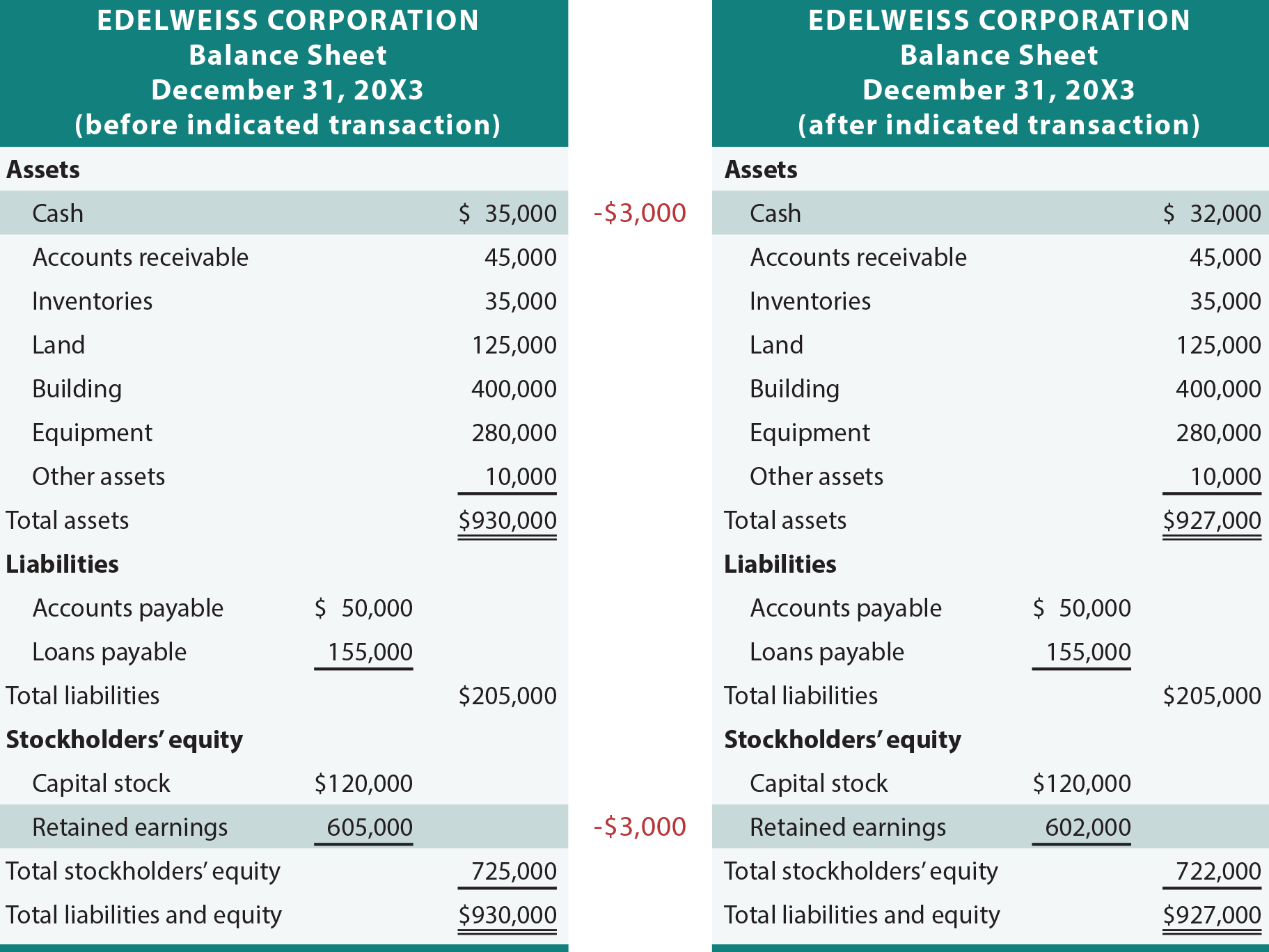

How Transactions Impact The Accounting Equation Principlesofaccounting Com

The Basics Of Accounting Boundless Accounting

Financial Statements Overview Objectives Double Entry Accounting

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

Long Term Assets Definition

Tangible Vs Intangible Assets What S The Difference

Fictitious Assets Meaning Examples Quiz Accountingcapital

30 Basic Accounting Terms Acronyms And Abbreviations Students Should Know Rasmussen College

What Are Current Assets Definition Examples Calculation Video Lesson Transcript Study Com

Balance Sheet Explained In Detail With Example Edupristine

Accounting 101 Assets

Write Off Meaning Examples What Is Write Off In Accounting

Fictitious Assets Meaning Examples Quiz Accountingcapital

How To Calculate Assets A Step By Step Guide For Small Businesses

What Is Contra Account And Its Importance Tally Solutions

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

Balance Sheet Definition

Balance Sheet Explained In Detail With Example Edupristine

What Are Tangible Assets Definition And Meaning Market Business News

Contra Asset Examples How A Contra Asset Account Works

What Is The Accounting Equation Overview Formula And Example Bookstime

Asset Definition And Meaning Market Business News

Meaning Of Deferred Tax Liability Asset In Simple Words

Accounting Equation How Transactions Affects Accounting Equation

16 Types Of Intangible Assets Each Explained In Brief Efm

What Are Fixed Assets Type Tangible Intangible Accounting Dep

Fixed Asset Accounting Examples Journal Entries Dep Disclosure

Difference Between Tangible And Intangible Assets With Examples

Prepaid Expenses Definition Example Financial Edge Training

Net Identifiable Assets Purchase Price Allocation Goodwill In M A

:max_bytes(150000):strip_icc()/what-is-your-net-worth-be7a33afb9da4529abd5e376b5d325c2.png)

Net Worth What Is It

Meaning Of Undervalued And Overvalued In Case Of An Asset And Its Treatment Also Are Liabilities Brainly In

Liquid Assets Finance Investing Accounting Basics Finance Literacy

The Definition Of Assets In Accounting

Asset Definition What Are Assets Youtube

Accounting Basics Debits And Credits

Debit Vs Credit

Liquidation Basis Accounting And Reporting The Cpa Journal

Chart Of Accounts Meaning Importance And More

Assets In Accounting Identification Types And Learning How To Calculate Them

Presentation Of Contract Assets And Contract Liabilities In Asc 606 Revenuehub

Current Assets Business Tutor2u

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

Property Plant And Equipment Pp E Definition

Total Assets Definition Example Applications Of Total Assets

The Basics Of Accounting Boundless Accounting

Fixed Assets Basics In Accounting Double Entry Bookkeeping

Looking At Fixed Assets In A Balance Sheet Dummies

Chart Of Accounts Explanation Accountingcoach

Solved Objective This Activity Has The Purpose Of Helpin Chegg Com

Understanding Net Worth Ag Decision Maker

What Are Current Assets Definition Examples Calculation Video Lesson Transcript Study Com

What Is Inventory

Revalutaion Of Fixed Assets Meaning Purpose Journal Entry Methods Bookkeeping Business Fixed Asset Financial Accounting

What Are Assets And Liabilities A Simple Primer For Small Businesses

Current Liability Meaning Types Accounting And More

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

Current And Noncurrent Assets The Difference

What Is Equity Definition Example Guide To Understanding Equity

Definition Depreciation Is A Measure Of The Wearing Out Consumption Or Other Loss Of Value Of A Depreciable Asset Arising From Use Effluxion Of Time Ppt Download

Intangible Assets Financial Accounting

Impairment Cost Meaning Benefits Indicators And More

How To Account For Assets And Expenses In Your Start Up c Ca

Define Explain And Provide Examples Of Current And Noncurrent Assets Current And Noncurrent Liabilities Equity Revenues And Expenses Principles Of Accounting Volume 1 Financial Accounting

What Is A Fixed Asset Definition Types Formula Examples List

How To Find Total Current Assets The Motley Fool

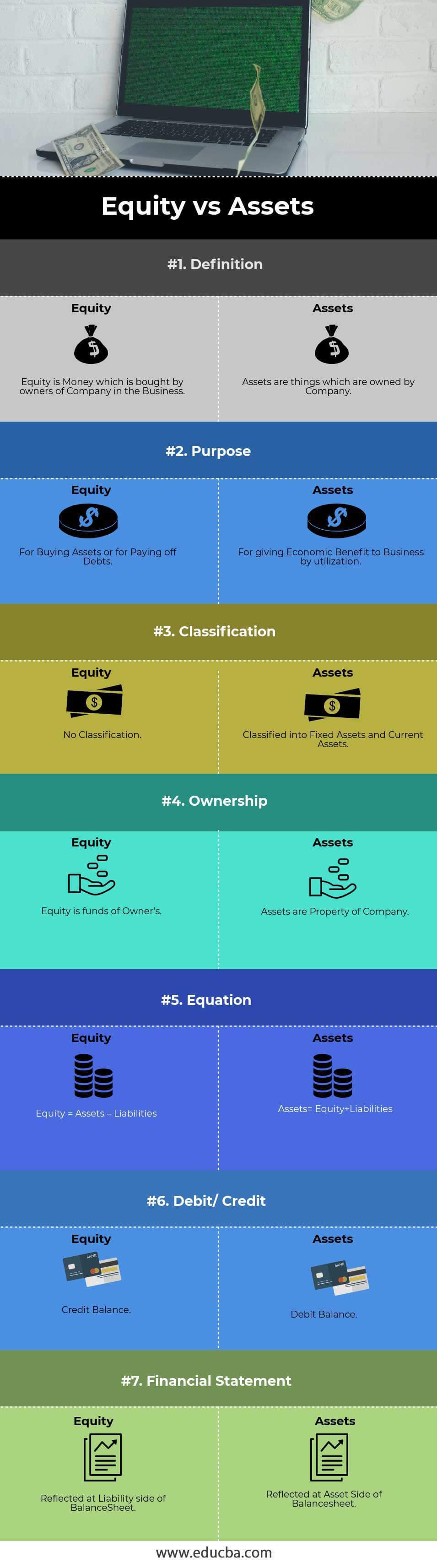

Equity Vs Asset Top 7 Best Differences With Infographics

Accounts Payable Explanation Accountingcoach

Assets Liabilities Expenses Revenue And Income In Financial Accounting Urdu Hindi Lecture 2 Youtube

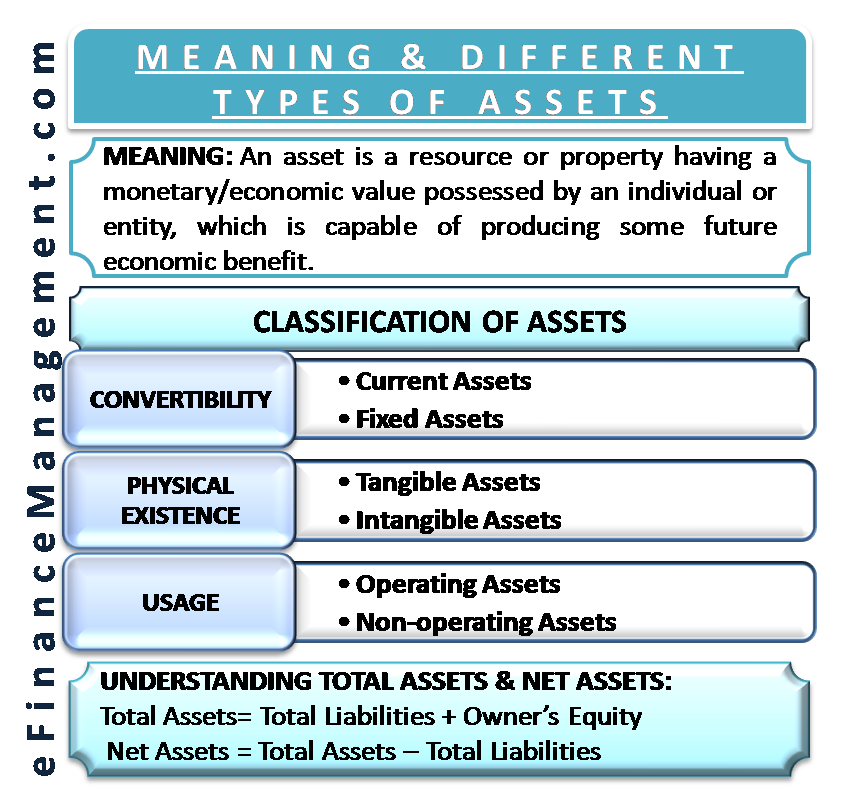

Meaning And Different Types Of Assets Classification More

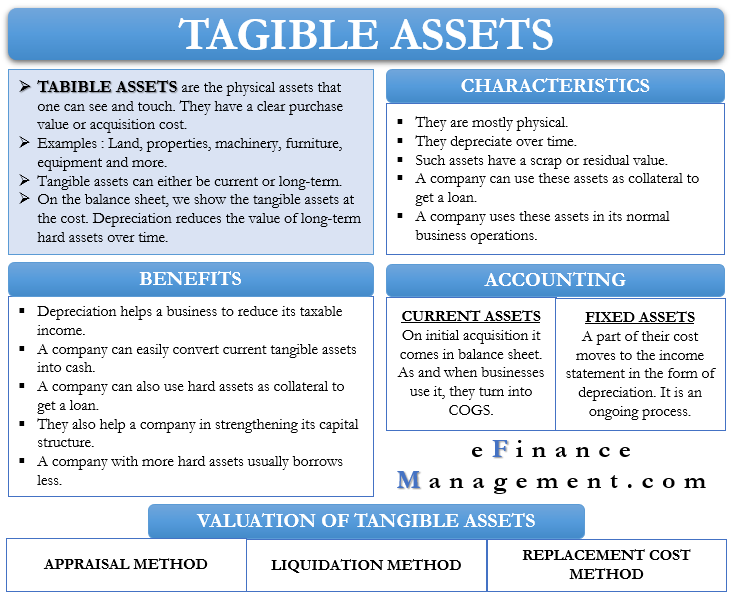

Tangible Assets Meaning Importance Accounting And More

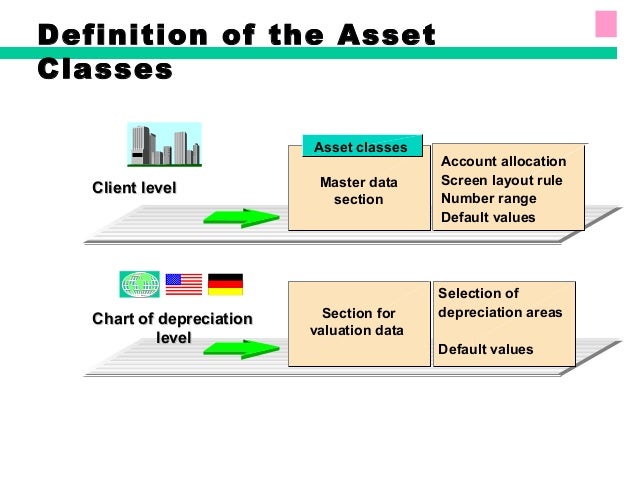

Sap Fixed Assets Accounting

Asset And Liability Management Wikipedia

Plant Assets What Are They And How Do You Manage Them The Blueprint

What Is An Intangible Asset A Simple Definition For Small Business With Examples

List Of Assets List Of Top 10 Balance Sheet Assets

Total Assets Definition Explanation Video Lesson Transcript Study Com

Chapter 2 The Double Entry System For Assets Liabilities And Capital Ppt Download

Contra Asset Account Definition List Examples With Accounting Entry

How Do Intangible Assets Show On A Balance Sheet

What Is Meant By Fictitious Assets

/financial-statement--pen-and-calculator-on-table-1056767352-2494fc4d57674fb68f434061f777107c.jpg)

Accounting Goodwill And Analyzing A Balance Sheet

Classification Of Accounts Definition Explanation And Examples Accounting For Management

Assets Vs Liabilities Top 6 Differences With Infographics

Bills Receivable In Accounting Double Entry Bookkeeping

Accounting For Asset Exchanges Principlesofaccounting Com

Fictitious Assets Meaning And Explanation Tutor S Tips

Assets In Accounting Definition Examples Of Assets On Balance Sheet

Fixed Assets Definition Characteristics Examples

Definition Of Accounting

Accounting Asset Definition The Strategic Cfothe Strategic Cfo