Asset Accounting

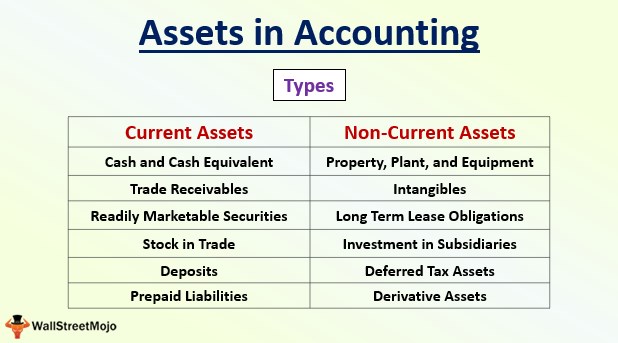

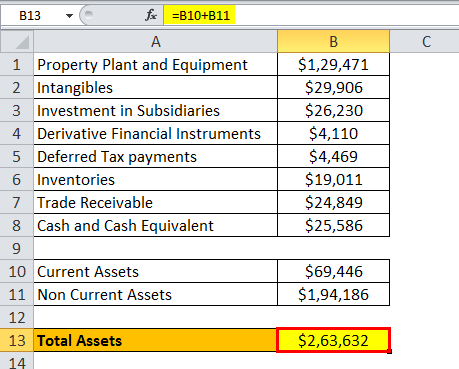

Fixed Assets vs Current Assets The concept of fixed and current assets is simple to understand The short explanation is that if it is an asset and is either in cash or likely to be converted into cash within the next 12 months (or accounting period), it is considered a current asset.

Asset accounting. Definition of an Asset Account An asset account is a general ledger account used to sort and store the debit and credit amounts from a company's transactions involving the company's resources The balances in the asset accounts will be summarized and reported on the company's balance sheet Generally, the asset account balances are debit balances and are increased. Migrating to SAP New Asset Accounting Generally, you are either going to be migrating to a Greenfield implementation of S/4 HANA or converting your existing system data to S/4 HANA Many customers already on SAP for a number of years are using this opportunity to reimplement and get rid of all the bad practices It is the only option. Fixed Asset Accounting What are Fixed Assets?.

Fixed assets can be one of the largest asset groups within an organization, and requires special accounting that differs from the accounting used for any other assets The Fixed Asset Accounting book comprehensively addresses every GAAP and IFRS accounting rule related to these crucial assets, including interest capitalization, asset retirement. Fixedasset accounting records all financial activities related to fixed assets The practice details the lifecycle of an asset, such as purchase, depreciation, audits, revaluation, impairment and disposal In a company’s books, each asset has an account, where all the financial activities related to fixed asset are recorded. Supporting the Company’s growth;.

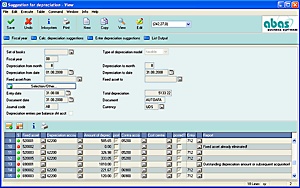

Accounting Standard 6 issued by the Institute of the Chartered Accountants of India defines ‘depreciation’ as “a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, effluxion of time or obsolescence through technology and market changes. Asset Accounting Creating journal entries is a two step process 1 At the end of each accounting period, run the depreciation program for each of your books Running the depreciation program closes the current period and opens the next period 2 Run the Create Journal Entries program to create journal entries to your general ledger. An asset is an expenditure that has utility through multiple future accounting periods If an expenditure does not have such utility, it is instead considered an expense For example, a company pays its electrical bill.

Overview of what is financial modeling, how & why to build a model and accounting The balance sheet displays the company’s total assets, and how these assets are financed, through either debt or equity It can also be referred to as a statement of net worth, or a statement of financial position. Capital Assets Accounting Removed requirement to capitalize interests during construction This is an early implementation of GASBS , Accounting for Interest Cost Incurred before the End of Construction Period which is applicable for reporting periods beginning after December 15, 19 Refunding Debt. The Complete Guide to Fixed Asset Accounting addresses all aspects of fixed asset accounting, including the most complex topics asset impairments, asset retirement obligations, and asset revaluations This course also addresses key controls, policies, and metrics.

The words “asset” and “liability” are two very common words in accounting/bookkeeping Assets are defined as resources that help generate profit in your business You have some control over it Liability is defined as obligations that your business needs to fulfill In simple words, Liability means credit. Migrating to SAP New Asset Accounting Generally, you are either going to be migrating to a Greenfield implementation of S/4 HANA or converting your existing system data to S/4 HANA Many customers already on SAP for a number of years are using this opportunity to reimplement and get rid of all the bad practices It is the only option. Overview of what is financial modeling, how & why to build a model and accounting The balance sheet displays the company’s total assets, and how these assets are financed, through either debt or equity It can also be referred to as a statement of net worth, or a statement of financial position.

What is ASSET ACCOUNTING?. Asset Accounting Our Team Our Services Your results We are a team of professional accountants, dedicated to providing efficient and effective advice, to help make the most of your business and financial future Menu admin@assetaccountingcomau 07 5491 3750 This is a static image header. FIXED ASSET ACCOUNTING AND MANAGEMENT PROCEDURES MANUAL SECTION 2 Asset Valuation REVISION 3 January 31, 13 8 Budget (OMB) Circular A102, which requires the capitalization of grant funded assets equal to or greater than $5,000 for local government entities Capitalization limits for.

Financial assets can be categorized as either current or noncurrent assets on a company’s balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements These statements are key to both financial modeling and accounting Measurement of Financial Assets. Contact us Tilburg University , Room E 106 E 108 Warandelaan 2, Tilburg, NoordBrabant 5037 AB The Netherlands Phone 31 (0) Info@AssetAccountingFinancenl. Asset Revaluation or Impairment Understanding the Accounting for Fixed Assets in Release 12 Brian Lewis eprentise Introduction Significant changes in financial reporting requirements have transformed the fixed asset accounting framework of companies.

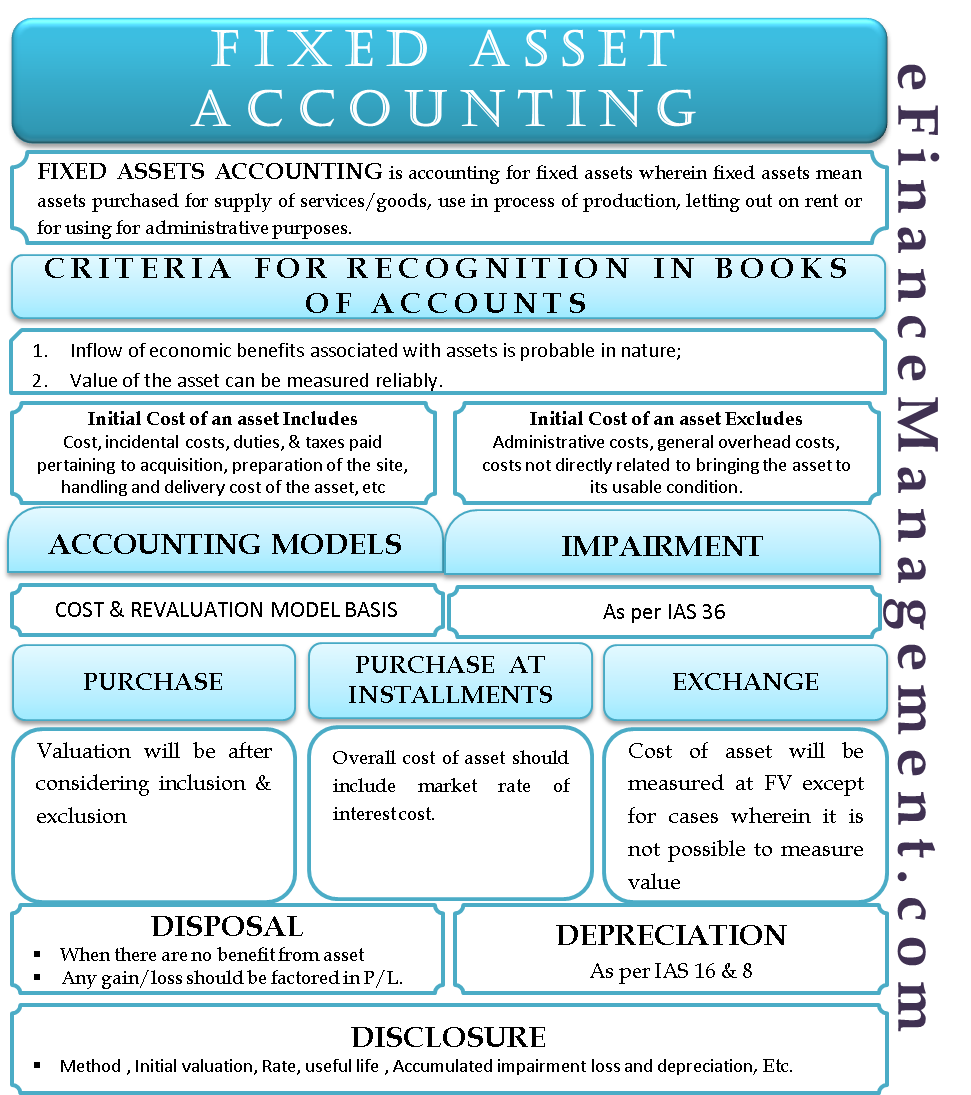

Asset Accounting is a really long concept in SAP FICO Thus, it really takes good efforts to properly understand this topic Asset Accounting has further taken a new direction with the launch of S4HANA With S/4HANA it has become more advanced and more important Must Read New Asset Accounting in SAP S4HANA Finance. An asset is an expenditure that has utility through multiple future accounting periods If an expenditure does not have such utility, it is instead considered an expense For example, a company pays its electrical bill. Fixed assets are tangible assets purchased for the supply of services or goods, use in the process of production, letting out on rent to third parties or for using for administrative purposes They are bought for usage for more than one accounting year.

Capital expenditures recorded to current fund must use object code 9700 At the end of each fiscal year, a listing of object code 9700 expenditures will be prepared and reviewed by Capital Asset Accounting for proper classification Refer to attachment A for cost examples that are capitalized as building improvements or expensed. Asset Accounting is a component of SAP FI module It represent as FIAA moduleIn this tutorial you will get an introduction about SAP Asset Accounting module, tcodes, tables, PDF study materials and subcomponents AA module provides the complete information about the fixed assets transactions inside a company. Change in Assets in Accounting Depreciation and amortization – One has to determine the method of depreciation of PPE by considering the nature of Impairment of assets – Impairment means to deplete the value based on the change in market factors It is considering Obsoleting of technology –.

Asset accounting without the manual pain A global car component manufacturer faced significant challenges with its asset accounting process, which consumed significant resources in its shared services center, finance team and factories. Accounting Models for Measurement of Asset post its Initial Measurement Cost Model Basis The valuation of the asset is at its cost price less accumulated depreciation and impairment cost Revaluation Model Basis The valuation of the asset is the fair value less its subsequent depreciation and impairment. Fixed asset accounting is a specific process that tracks the value and changes in the items a company uses to complete business processes Fixed assets can include a variety of different items, such as computers, software, buildings, equipment, office décor or vehicles, among other items.

Asset Accounting Purpose The University of Idaho has a significant investment in fixed assets, such as land, buildings, other improvements, and fixed and moveable equipment which are used to accomplish the primary missions of instruction, research and public service. Asset Accounting Period Control Skip to end of metadata Created by Former Member on Sep 26, 13;. What are the Main Types of Assets?.

Financial assets can be categorized as either current or noncurrent assets on a company’s balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements These statements are key to both financial modeling and accounting Measurement of Financial Assets. An asset is a resource owned or controlled by an individual, corporation Corporation A corporation is a legal entity created by individuals, stockholders, or shareholders, with the purpose of operating for profit Corporations are allowed to enter into contracts, sue and be sued, own assets, remit federal and state taxes, and borrow money from financial. Fixed assets are subject to an unusually large amount of record keeping, as well as somewhat different accounting treatment under the GAAP and IFRS accounting frameworks Given the large expenditures involved in fixed assets and the complexity of the accounting, you can expect a high degree of auditor interest in this area.

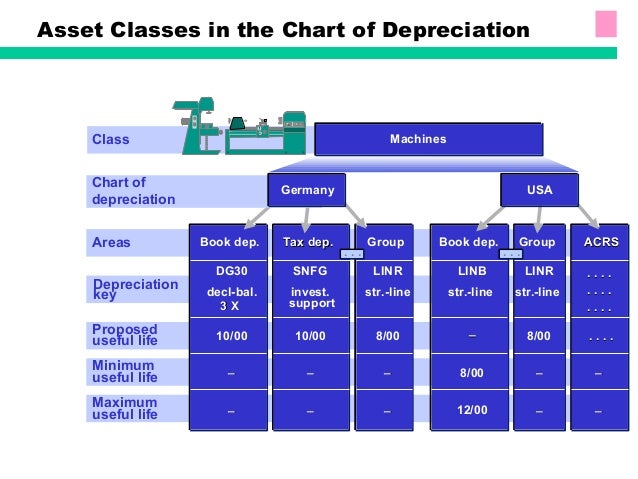

Capital assets are real or personal property that have a value equal to or greater than the capitalization threshold for the particular classification of the asset and have an estimated life of greater than one year. Asset Accounting Configuration The Asset Accounting module 1 Organizational structures In this section, you define the features of the Asset Accounting organizational objects (chart of depreciation, FI company code, asset class) All assets in the system have to be assigned to these organizational objects that you define In this way,. Overview of what is financial modeling, how & why to build a model and accounting The balance sheet displays the company’s total assets, and how these assets are financed, through either debt or equity It can also be referred to as a statement of net worth, or a statement of financial position.

Oracle Assets creates accounting events for every asset transaction that has accounting impact The Create Accounting process creates subledger accounting entries for these accounting events For example, an asset transaction takes place when an asset is acquired Simultaneously Oracle Assets creates an accounting event for this asset addition. Whether you’re an accountant or the member of a finance team, you need to understand the basic scope and function of the four major submodules in Financial Accounting General Ledger, Accounts Payable, Accounts Receivable, and Asset Accounting. The FIAsset Accounting (FIAA) component is used for managing the fixed assets in FI system In Financial Accounting, it serves as a subsidiary ledger to the General Ledger, providing detailed information on transactions involving fixed assets Integration with other components − As a result of.

Asset An asset is a resource with economic value that an individual, corporation or country owns or controls with the expectation that it will provide future benefit Assets are reported on a. Here are some key facts to understand and insights to keep in mind Fixed assets are capitalized That’s because the benefit of the asset extends beyond the year of purchase, unlike other Fixed assets should be recorded at cost of acquisition Cost includes all expenditures directly related to. Capital Assets Accounting FAQs What is the definition of a capital asset?.

Accounting Entry G/L Account is picking from the Additional g/l accounts for Asset accounting not from AO90 Display Asset AW01N Click on the line item to display the accounting document Scenario 2 Post the standard asset retirement by scrapping with transaction type 250 G/L Account should pick from the AO90 configuration Accounting entry. Asset Accounting is intended for international use in many countries, irrespective of the nature of the industry This means, for example, that no countryspecific valuation rules are hardcoded in the system You give this component its countryspecific and companyspecific character with the settings you make in Customizing To minimize the. Asset Accounting Asset Accounting Overview Asset Accounting is an important module in SAP and manages assets of an organisation by master records Asset accounting is a sub ledger to the SAP FI module for managing the Asset records SAP Asset Accounting Configuration Steps Step 1 Copy Reference Chart of Depreciation/ Depreciation Area.

Asset accounting focuses on the recording and reporting of financial information related to a company’s balance sheet financial statement The balance sheet reports all assets of a business Accountants must accurately report this information because assets represent a portion of the total wealth or economic improvements made by the company. Fixed asset accounting October 21, A fixed asset is an item having a useful life that spans multiple reporting periods, and whose cost exceeds a certain minimum limit (called the capitalization limit) There are several accounting transactions to record for fixed assets, which are noted below. Fixed assets can be one of the largest asset groups within an organization, and requires special accounting that differs from the accounting used for any other assets The Fixed Asset Accounting book comprehensively addresses every GAAP and IFRS accounting rule related to these crucial assets, including interest capitalization, asset retirement.

An asset is a resource owned or controlled by an individual, corporation Corporation A corporation is a legal entity created by individuals, stockholders, or shareholders, with the purpose of operating for profit Corporations are allowed to enter into contracts, sue and be sued, own assets, remit federal and state taxes, and borrow money from financial. Asset Accounting msndurgaprasd@gmailcom 91 Display of Asset Balance by Business area S_ALR_ 34 Asset Accounting msndurgaprasd@gmailcom 91 Transfer of Asset ABUMN Accounting Financial Accounting Fixed Assets Posting Transfer Transfer within Company Code Select New Asset Click on Master data. Asset Accounting in SAP system (FIAA) is primarily used for managing, supervising and monitoring fixed assets Asset Accounting is classified as a subset of Financial Accounting and serves as a subsidiary ledger to the general ledger providing detailed information on transactions involving fixed assets.

Assets are also part of the accounting equation Assets = Liabilities Owner's (Stockholders') Equity Some valuable items that cannot be measured and expressed in dollars include the company's outstanding reputation, its customer base, the value of successful consumer brands, and its management team As a result these items are not reported among the assets appearing on the balance sheet. Overview of what is financial modeling, how & why to build a model and accounting The balance sheet displays the company’s total assets, and how these assets are financed, through either debt or equity It can also be referred to as a statement of net worth, or a statement of financial position. Some assets like goodwill, stock investments, patents, and websites can’t be touched These intellectual assets can be quite substantial, however There are many more types of assets that aren’t mentioned here, but this is the basic list We will discuss more assets in depth later in the accounting course.

Fixed Assets vs Current Assets The concept of fixed and current assets is simple to understand The short explanation is that if it is an asset and is either in cash or likely to be converted into cash within the next 12 months (or accounting period), it is considered a current asset. Some assets like goodwill, stock investments, patents, and websites can’t be touched These intellectual assets can be quite substantial, however There are many more types of assets that aren’t mentioned here, but this is the basic list We will discuss more assets in depth later in the accounting course. Go to start of metadata Purpose The purpose of this page is to clarify the understanding of the system logic and requirements about period control.

Fixed Asset Accounting Software – There is some specific asset accounting package, although this will have an additional cost Accounting Software – Enter a journal for the period of either a month or a year If you are using XERO accounting software and set up all the fixed assets, the accounting software will calculate depreciation for. Asset Accounting Asset Accounting Overview Asset Accounting is an important module in SAP and manages assets of an organisation by master records Asset accounting is a sub ledger to the SAP FI module for managing the Asset records SAP Asset Accounting Configuration Steps Step 1 Copy Reference Chart of Depreciation/ Depreciation Area. And (iv) integrating and promoting synergy among several administrative areas 10 INTANGIBLE ASSETS The accounting practice adopted by the Company is to record intangible assets with defined useful lives and acquired separately at cost, less accumulated amortization and impairment, when applicable Amortization is recorded on the straight ‐ line basis over.

What is an asset account?. Traditional Asset accounting Preparation for consolidation Information system Processing leased assets. Asset Accounting Purpose The University of Idaho has a significant investment in fixed assets, such as land, buildings, other improvements, and fixed and moveable equipment which are used to accomplish the primary missions of instruction, research and public service.

Accounting Standard 6 issued by the Institute of the Chartered Accountants of India defines ‘depreciation’ as “a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, effluxion of time or obsolescence through technology and market changes. The Asset Accounting (FIAA) component is used for managing and supervising fixed assets with the SAP System In Financial Accounting it serves as a subsidiary ledger to the General Ledger, providing detailed information on transactions involving fixed assets The Asset Accounting component is intended for. For fixed asset accounting, the International Financial Reporting Standards (IFRS) is a framework that provides uniform guidelines to prepare and organize financial data Actively endorsed by more than 1 countries, the IFRS has been derived from the International Accounting Standards Board based in London.

An Overview Of Sap Asset Accounting Mastering Sap S 4hana 1709 Strategies For Implementation And Migration

Best Practice Scenario Asset Accounting Group Ledger Ifrs 1gb S4hana 1909 Release

Fixed Assets Accounting And Depreciation Enterprise Operating System

Asset Accounting のギャラリー

(1).jpg)

Asset Accounting Data Flow What Model Type To Use Aris Bpm Community

Isprotėti Apkabinti Kiemas Sap Asset Module Yenanchen Com

Jd Edwards Fixed Asset Accounting Oracle

Faces Adapt To Survive Belastingparadijs Nl The Accountancy Profession Is Subject To Change Is Nederland Nu Wel Of Geen Belastingparadijs Pdf Free Download

A Board Year At Asset Accounting Finance Steyn Van Poppel Faces Online

Cch Fixed Asset Register Wolters Kluwer

Asset Accounting Flow Chart In Sap Lewisburg District Umc

Best Practice Scenario Asset Accounting J62 S4hana 1909 Release

Een Bestuursjaar Bij Asset Accounting Finance Niels Van Blitterswijk Vice Chairman

Accountantsday Asset Accounting Finance Baker Tilly Berk Consultancy Nl

Asset Accounting System For The Segura River And Transfers Futurewater

Ey Launches Crypto Asset Accounting And Tax Caat Tool For Automated Tax Calculating

Fixed Asset Accounting Adjusting Entries Report Material Business Asset Management Png Klipartz

Fixed Assets Accounting In South Extension Ii New Delhi Id

Een Bestuursjaar Bij Asset Accounting Finance Shaiana Cripaul Faces Online

Asset Accounting Finance Student In Tilburg

Sap Fi Define Depreciation Areas By Feyza Derinoglu Medium

Asset Under Construction Through Mm Sapspot

Calameo Sage Fast Fixed Asset Accounting

Real Asset Management An Mri Software Company Linkedin

Ebook Fixed Asset Accounting Fourth Edition Free Books

Asset Accounting In Central Finance

Asset Accounting Finance Startpagina Facebook

A Guide To Asset Accounting In Local Governments Lgam Knowledge Base

Fixed Asset Life Cycle In Asset Accounting Powerpoint Slides Diagrams Themes For Ppt Presentations Graphic Ideas

Sap S 4hana For Sap Asset Accounting Sap Fi Beg By Sap Press

Fixed Assets Asset Accounting Overview Asset

A Board Year At Asset Accounting Finance Steven Stroo Secretary

Fixed Asset Accounting Examples Journal Entries Dep Disclosure

Pdf Human Asset Accounting And Measurement Moving Forward Semantic Scholar

Fixed Asset Accounting Investment Business People Investment Business Png Klipartz

Uniq Soft Technology

Bol Com Reporting For Sap Asset Accounting Thomas Michael Boeken

Asset Accounting Your Accounting Pain Ends Here

New Asset Accounting Fiaa

Amazon Com Reporting For Sap Asset Accounting Learn About The Complete Reporting Solutions For Asset Accounting Michael Thomas Books

Examples Of Assets In Accounting Top 12 Balance Sheet Assets

Best Practice Scenario Asset Accounting J62 S4hana 1909 Release

Knowledge Associates Knowledge Asset Accounting At Last Knowledge Associates

Asset Accounting

Barcode Fixed Asset Accounting Management Software India By Qelocity Issuu

Asset Accounting Finance Linkedin

Q Tbn And9gct7i2xmciw5ftvktfmoudk8 Ewcvgp035uraasncdmezclyreh1 Usqp Cau

Asset Accounting Finance

Assets In Accounting Definition Examples Of Assets On Balance Sheet

Fm Gm Account Assignment In Asset Accounting Sap Blogs

Asset Accounting In S 4hana Opensit

F3096 Asset Accounting Overview Sap Fiori Apps

Everything You Must Know On Asset Accounting

Asset Accounting Integration With General Ledger Accounting Fi Sapspot

Audit Activity Door Asset Accounting Finance Tilburg University 21 September Accon Avm

Asset Accounting Flow Chart In Sap Lewisburg District Umc

Assetaccountant Depreciation Made Easy

Asset Accounting Configuration In Sap Erp Springerprofessional De

Asset Accounting In Central Finance

Assetaccountant Depreciation Made Easy

Additional G L Accounts For Asset Accounting Sapspot

Isprotėti Apkabinti Kiemas Sap Asset Module Yenanchen Com

Assets In Accounting Definition Examples Of Assets On Balance Sheet

A Board Year At Asset Accounting Finance Daniek Veldhuis Secretary Faces Online

Bol Com Fixed Asset Accounting Steven M Bragg Boeken

.gif)

Fixed Assets Microsoft Docs

Bol Com New Fixed Asset Accounting In Sap S 4hana Ebook Kees Van Westerop

Fixed Assets Accounting And Depreciation Enterprise Operating System

Espresso Tutorials Reporting For Sap Br Asset Accounting

Fixed Assets Asset Accounting Overview Asset

Asset Accounting What Is New In S 4hana Sap Blogs

Accounting Finance

Abas Software Partner Erp Fixed Asset Accounting

Sap Fixed Assets Accounting

Ppt Fixed Asset Accounting Powerpoint Presentation Free Download Id

Sage Fixed Assets Accounting Aces Inc

Asset Accounting Finance Photos Facebook

Asset Accounting Finance Linkedin

Accounting Finance

Asset Accounting In Central Finance

Bol Com Fixed Asset Accounting Steven M Bragg Boeken

Asset Accounting Fiori Apps

Ebook Fixed Asset Accounting Third Edition Free Online Video Dailymotion

What Fixed Asset Accounting Has To Do In A Business Asset Infinity

Fixed Asset Accounting Depreciation Finance Kids Graduate Angle Text Logo Png Klipartz

Guidelines Asset Tilburg

Unit 5 Asset Accounting Group 2 Rizal Efendi Adinda Ryzki Yuninda Mega

Asset Accounting Finance Career Portal Facebook

Asset Accounting Sap Help Portal

Asset Accounting Finance About Facebook

Fi332 Umoja Asset Accounting Process Manualzz

Download P D F Fixed Asset Accounting Fourth Edition 4th Edition

Fixed Assets Asset Accounting Overview Asset

What Are Intangible Assets Double Entry Bookkeeping

Asset Accounting With Sap S 4hana Jotev Stoil Amazon Nl

Fixed Asset Accounting Life Cycle Template Presentation Sample Of Ppt Presentation Presentation Background Images

Asset Accounting Overview Sap Help Portal

Isprotėti Apkabinti Kiemas Sap Asset Module Yenanchen Com

Fixed Assets Cycle Flow Chart Lewisburg District Umc

Asset Accounting Redwood

Q Tbn And9gcq6gpfcmdfxeanrwjx55kznvq 4pqm06h1z2o4rr17qfgxe7pq Usqp Cau

The Dos And Don Ts Of Fixed Asset Accounting Assertive Industries Inc

Een Bestuursjaar Bij Asset Accounting Finance Luc Van Den Hurk External Affairs Faces Online

1