Accounting Asset Turnover Formula

Total Assets Turnover Ratio = 8,000,000 / 9,00,000;.

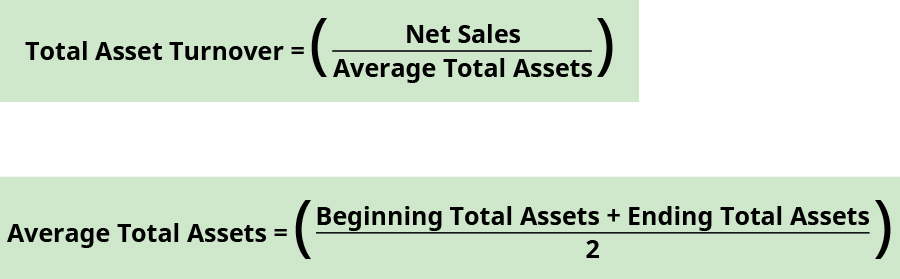

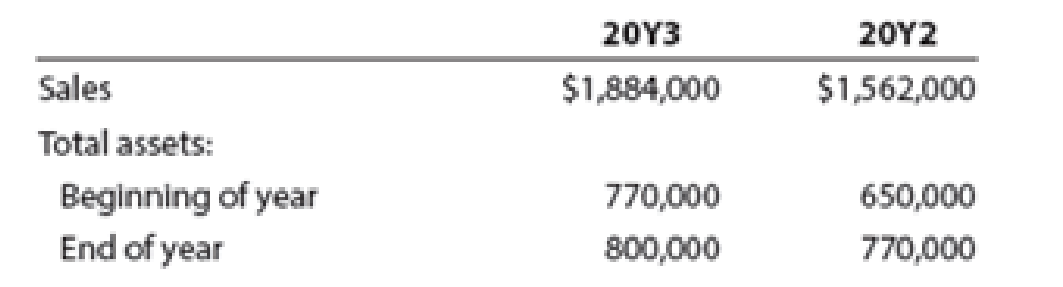

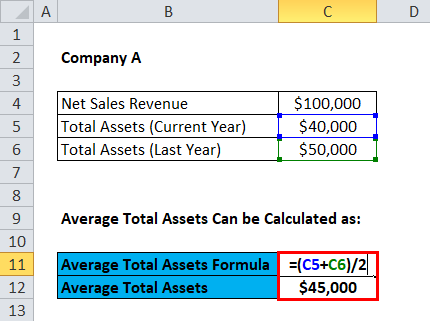

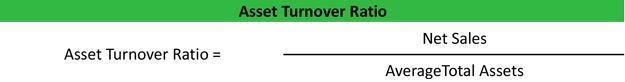

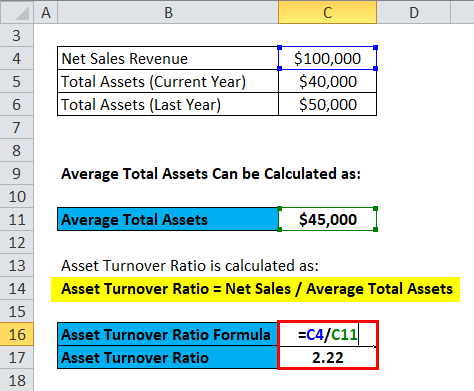

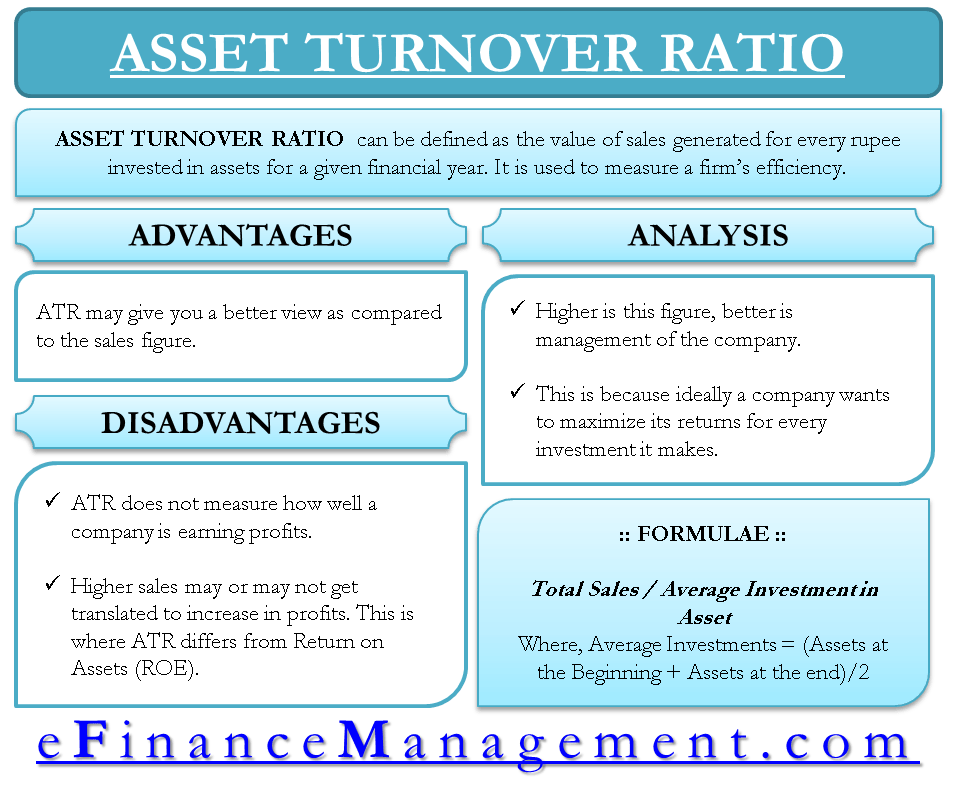

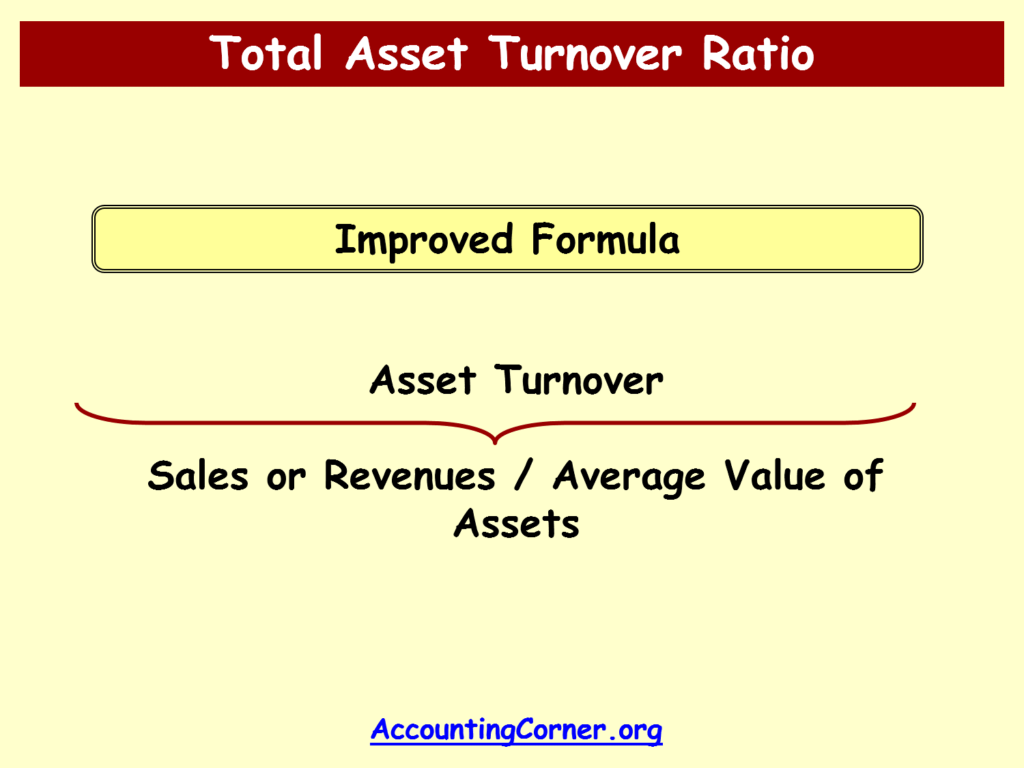

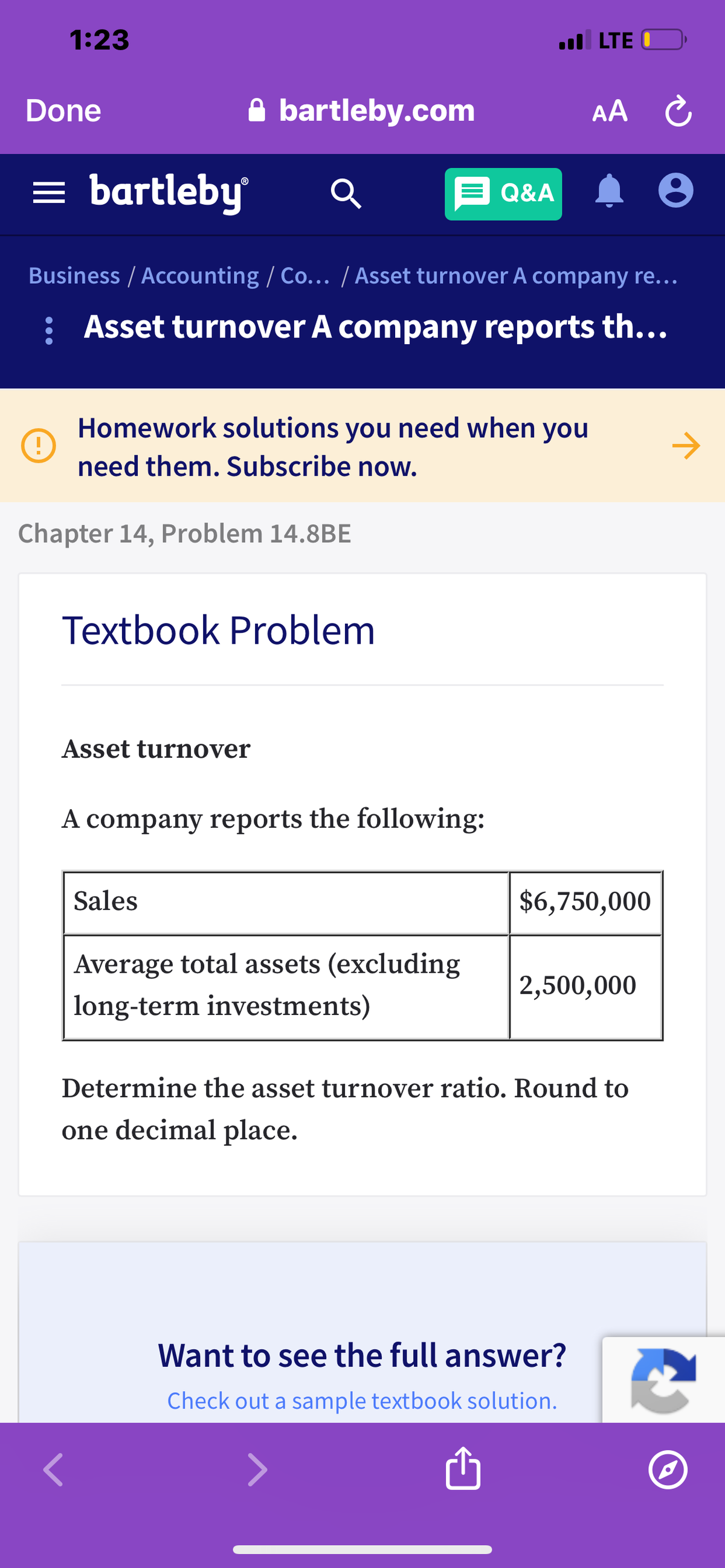

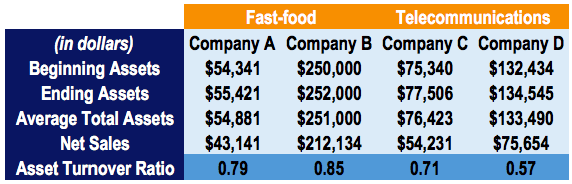

Accounting asset turnover formula. To calculate the asset turnover ratio, divide sales by total average assets The average assets figure is derived by adding together the beginning and ending asset totals for the measurement period and dividing by two The formula is Revenue ÷ Total average assets = Asset turnover ratio Example of the Asset Turnover Ratio. The formula for total asset turnover is Net sales ÷ Total assets = Total asset turnover It is best to plot the ratio on a trend line, to spot significant changes over time Also, compare it to the same ratio for competitors, which can indicate which other companies are being more efficient in wringing more sales from their assets Example of the Total Asset Turnover Ratio. Formula Assets turnover ratio is computed by using the following formula The numerator includes net sales ie, sales less sales returns and discount The denominator includes average total assets Average total assets are equal to total assets at the beginning of the period plus total assets at the ending of the period divided by two.

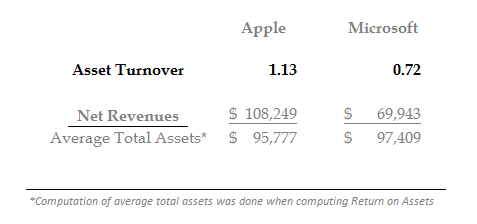

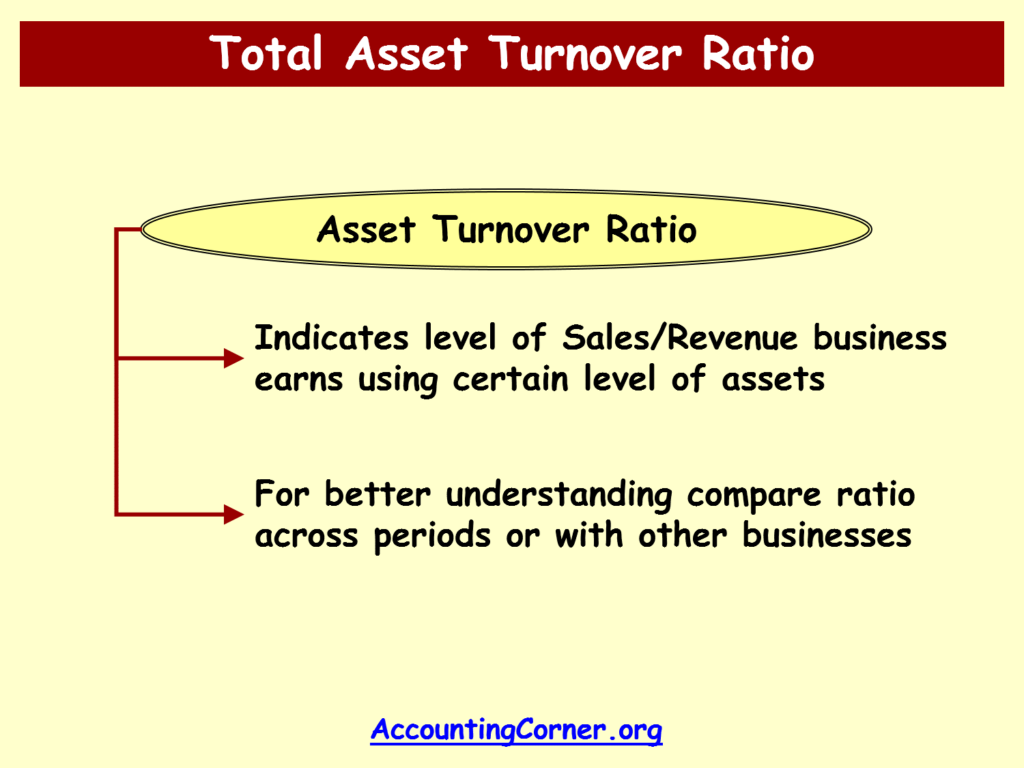

To calculate the asset turnover ratio, divide sales by total average assets The average assets figure is derived by adding together the beginning and ending asset totals for the measurement period and dividing by two. A company’s asset turnover is calculated by taking revenues during a period and dividing that by the company’s average total assets Asset Turnover Ratio Formula = Revenues / Average Total Assets Average total assets used in the above formula is calculated using the following formula which are found on a company’s balance sheet Average. Formula Total Assets Turnover = Sales/Average Total Assets Interpretation Like fixed asset turnover ratio, total asset turnover ratio is also affected by similar factors All else equal, a higher asset turnover is better as it indicates how effectively entire funds (Assets=Capital Liabilities) of a company is used It is a holistic measure.

The Asset Turnover Ratio formula is given below Sales / Assets = Number of times Example Assume a certain company's assets in 16 were ,000,000 and the sales were 100,000,000 Calculate the Asset Turnover ratio 100,000,000 / ,000,000 = 5 In the above example, it means that the assets of the company rotated five times that year. The Asset Turnover Ratio Formula The asset turnover ratio formula is net sales divided by average total sales It is an accounting formula that allows a business to see how efficiently they’re using their assets to create sales A good asset turnover ratio will differ from business to business, but you’ll typically want an asset turnover ratio greater than one. Sales for the stated time period – Customer returns and discounts / (Assets at the beginning of the time period Assets at the end of the time period) / 2 = Asset turnover ratio For example, if you had $150,000 in total revenue last year with an average total asset balance of $50,000, your asset turnover ratio would be 3.

Below is the asset turnover ratio formula Asset Turnover Ratio = Assets) Asset Turnover Ratio Example a somewhat illiquid current asset that can sit on 21/10/18В В· The current assets turnover ratio is fairly basic;. The asset turnover ratio is an accounting ratio that measures the ability of your business to use its assets to generate revenue Learn more about this ratio and how it can help your business. Total assets turnover ratio is calculated using the following formula Net sales equals gross sales minus any sales tax or VAT, sales returns and trade discounts Average total assets value is calculated by adding the beginning and ending balance of total assets and dividing the sum by 2.

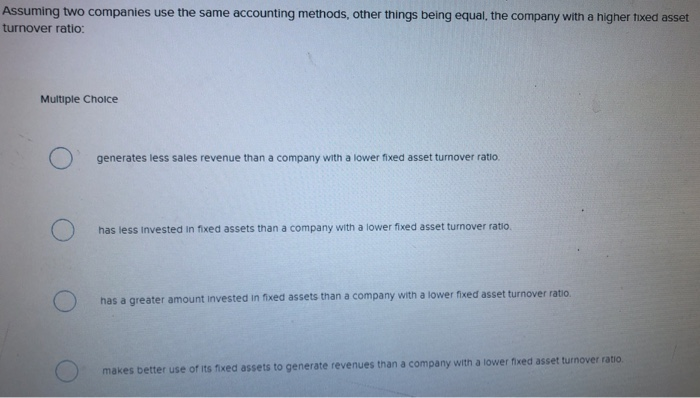

The asset turnover ratio uses the value of a company's assets in the denominator of the formula To determine the value of a company's assets, the average value of the assets for the year needs to. Formula The asset turnover ratio is calculated by dividing net sales by average total assets Net sales, found on the income statement, are used to calculate this ratio returns and refunds must be backed out of total sales to measure the truly measure the firm’s assets’ ability to generate sales. The asset turnover ratio, also known as the total asset turnover ratio, measures the efficiency with which a company uses its assets to produce sales The asset turnover ratio formula is equal to net sales divided by the total or average assets of a company A company with a high asset turnover ratio operates more efficiently as compared to competitors with a lower ratio.

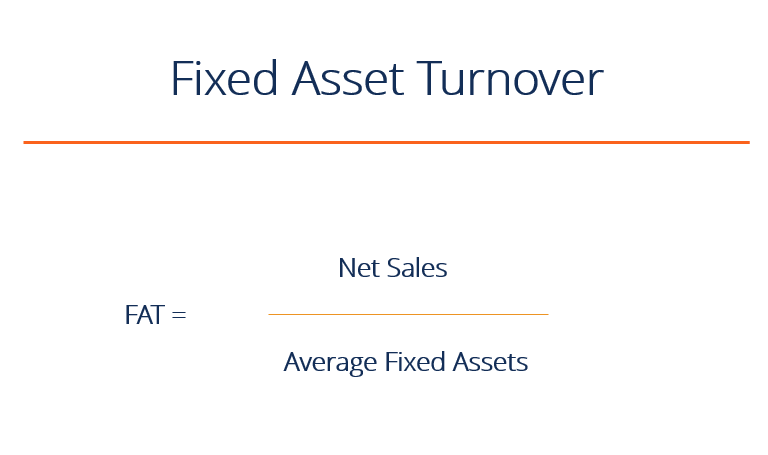

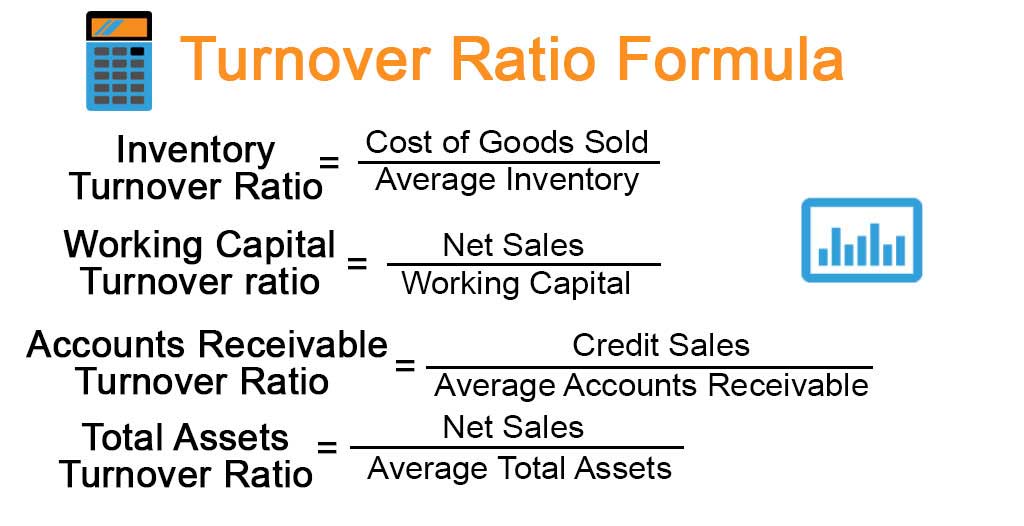

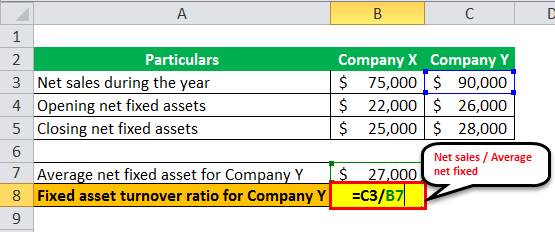

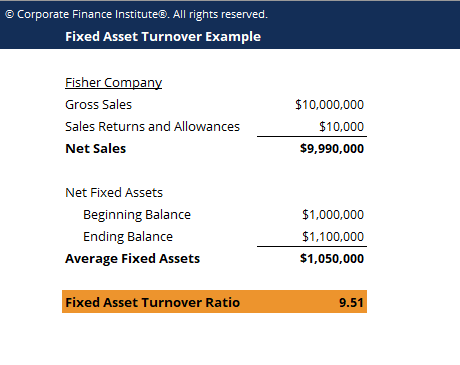

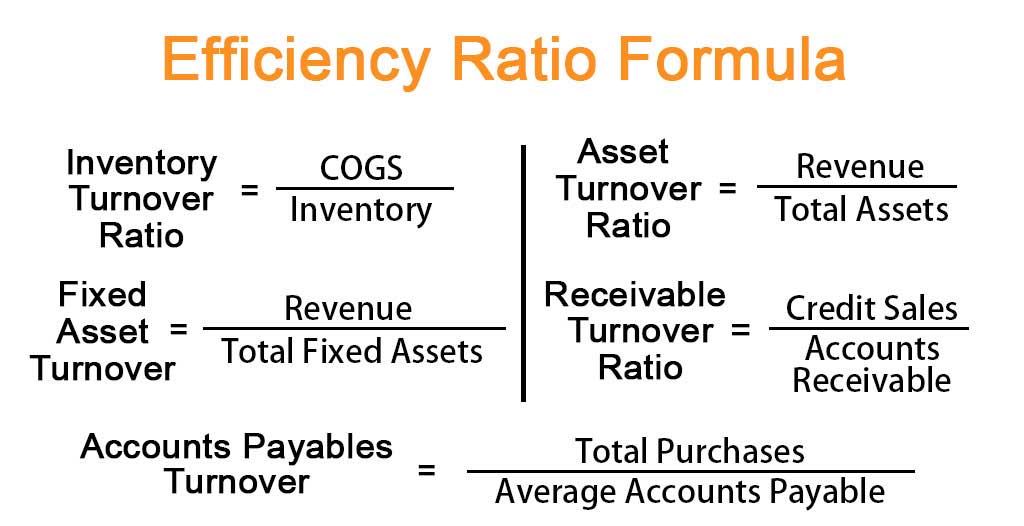

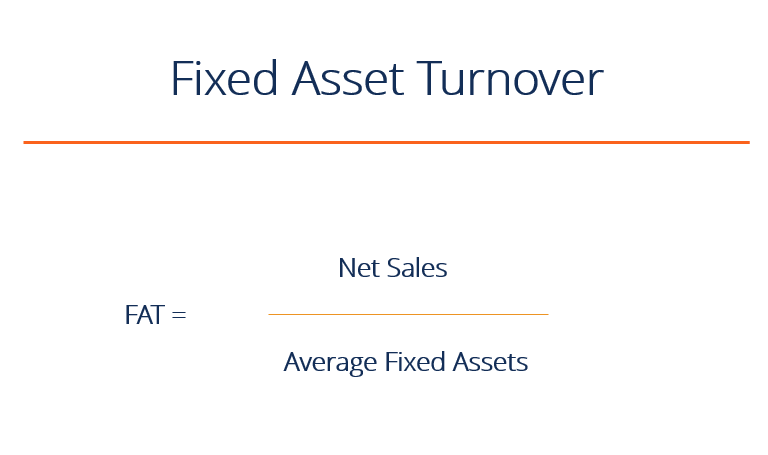

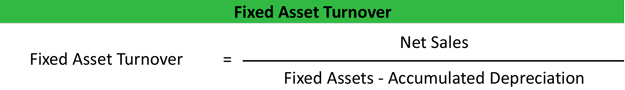

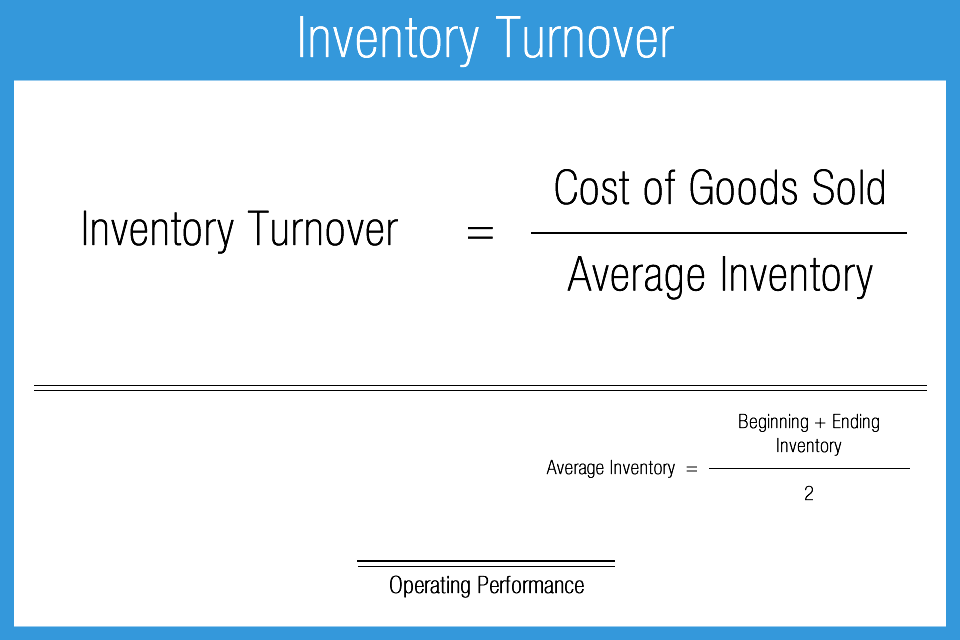

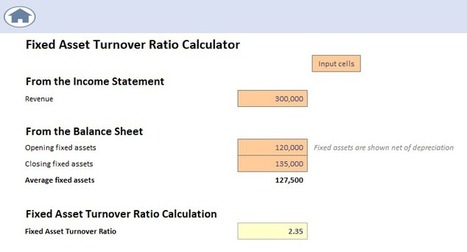

The formula is Annual cost of goods sold ÷ Inventory = Inventory turnover Inventory Turnover Period You can also divide the result of the inventory turnover calculation into 365 days to arrive at days of inventory on hand, which may be a more understandable figure Thus, a turnover rate of 40 becomes 91 days of inventory This is known as. Total Asset Turnover The formula for total asset turnover is Net sales ÷ Total assets = Total asset turnover For example, a business that has net sales of $10,000,000 and total assets of $5,000,000 has a total asset turnover of This calculation is usually performed on an annual basis. The fixed asset turnover ratio reveals how efficient a company is at generating sales from its existing fixed assets A higher ratio implies that management is using its fixed assets more effectively.

The formula for ROA is Net income is the amount of total revenue that remains after accounting for all expenses Asset turnover ratio measures the value of a company's sales or revenues. The formula is Annual cost of goods sold ÷ Inventory = Inventory turnover Inventory Turnover Period You can also divide the result of the inventory turnover calculation into 365 days to arrive at days of inventory on hand, which may be a more understandable figure Thus, a turnover rate of 40 becomes 91 days of inventory This is known as. The formula for figuring the asset turnover ratio is To see how to use this formula, let's look at the example of a company that makes jewelry We'll call it Linda's Jewelry, and Linda is the owner.

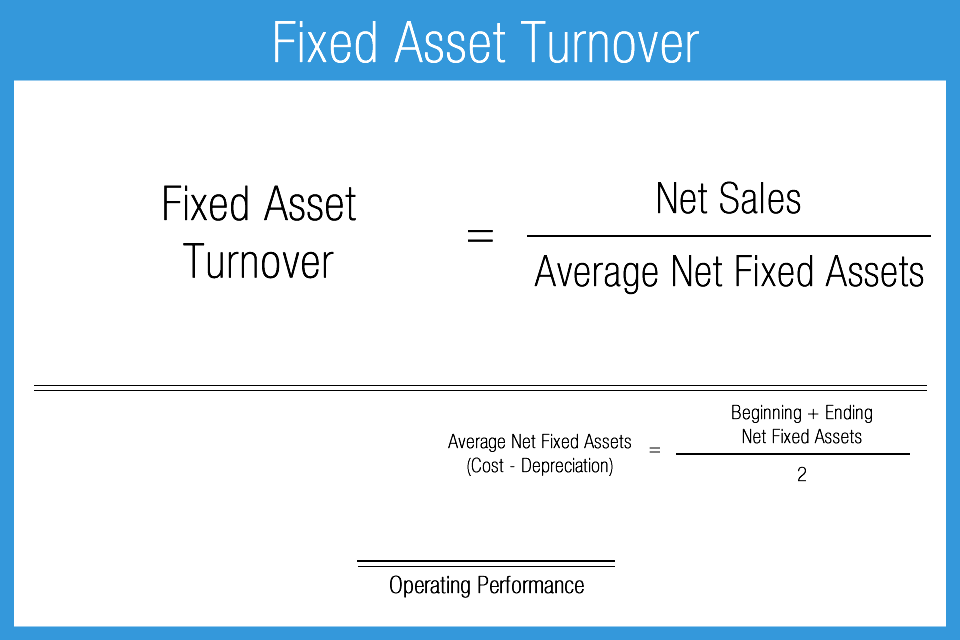

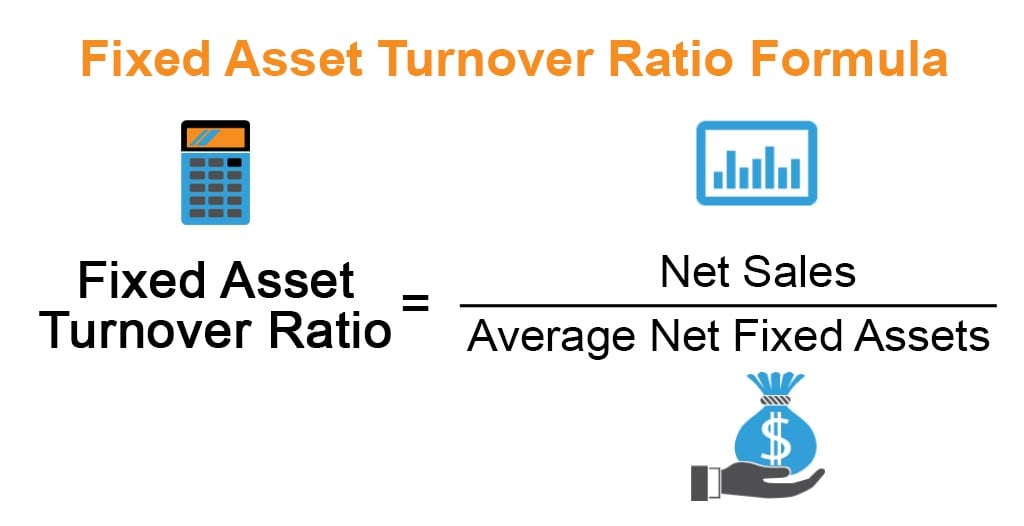

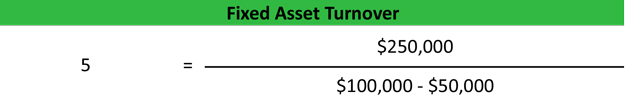

The asset turnover ratio formula determines your asset management’s efficiency or assets’ ability to generate sales Much like the concept of cash flow, this figure compares your sales’ dollar value to the dollar value of your current and fixed assets. Net annual sales ÷ (Gross fixed assets Accumulated depreciation) = Fixed asset turnover ratio Example of the Fixed Asset Turnover Ratio ABC Company has gross fixed assets of $5,000,000 and accumulated depreciation of $2,000,000 Sales over the last 12 months totaled $9,000,000 The calculation of ABC's fixed asset turnover ratio is. Fixed Assets Turnover Ratio is calculated using the formula given below Fixed Assets Turnover = Sales / Average Fixed Assets.

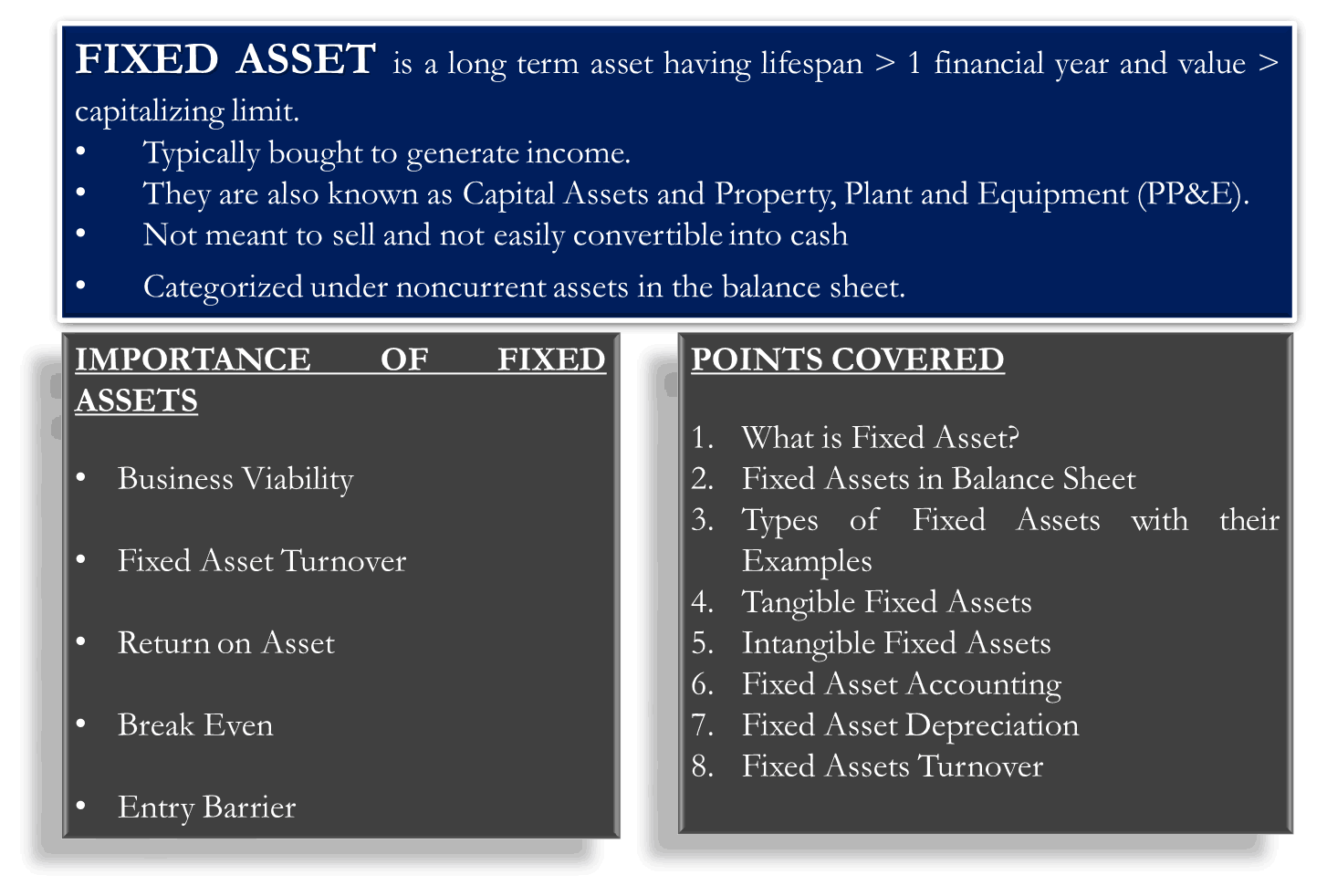

Fixed assets, also known as a noncurrent asset or as property, plant, and equipment (PP&E), is a term used in accounting for assets and property that cannot easily be converted into cash This can be compared with current assets, such as cash or bank accounts, which are described as liquid assets. The asset turnover formula is a simple equation you can calculate quickly You’ll simply need the total net sales for the period in which you’re calculating the ratio and your total average assets. Total Assets Turnover Ratio = 9;.

Asset turnover ratio meaning The asset turnover ratio tries to build a relationship between the company’s revenue and the company’s overall assets It indicates how much revenue is the company making from each dollar of assets This helps in determining if the company is assetheavy or assetlight Asset turnover ratio formula. Formula Accounts receivable turnover is calculated by dividing net credit sales by the average accounts receivable for that period The reason net credit sales are used instead of net sales is that cash sales don’t create receivables Only credit sales establish a receivable, so the cash sales are left out of the calculation. The asset turnover ratio is an accounting ratio that measures the ability of your business to use its assets to generate revenue Learn more about this ratio and how it can help your business.

The Asset Turnover Ratio Formula The asset turnover ratio formula is net sales divided by average total sales It is an accounting formula that allows a business to see how efficiently they’re using their assets to create sales A good asset turnover ratio will differ from business to business, but you’ll typically want an asset turnover ratio greater than one. Based on the scenario and formula provide about, Fixed Assets Turnover would be 50,000,000/100,000,000 = 50% The following is the analysis for this ratio Fixed Assets Turnover Analysis and Interpretation As per the result of the calculation, the ratio is 50% and compare to the industry average, ABC is performing very well. Now we can use the formula to calculate the ratio Investment\ Turnover = \dfrac{8{,}000}{700 900} = 5 LMO Limited has an investment turnover ratio of 5, and this means that for every $1 invested into the company, it generated $5 in revenue Investment Turnover Ratio Analysis.

Formula Use the following formula to calculate the asset turnover Where, Purposes of asset turnover • The assets turnover ratio reveals the effective utilization of assets in the business • The assets turnover ratio indicates the amount of assets used to generate the sales revenue of a business. The accounts payable turnover ratio, also known as the payables turnover or the creditor’s turnover ratio, is a liquidity ratio Financial Ratios Financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company that measures the average number of times a company pays. The formula for the asset turnover ratio evaluates how well a company is utilizing its assets to produce revenue The numerator of the asset turnover ratio formula shows revenues which is found on a company's income statement and the denominator shows total assets which is found on a company's balance sheet.

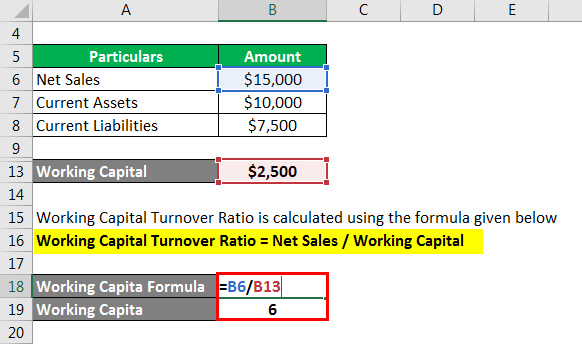

Asset Turnover Ratio Formula – Example #3 Asset Turnover Ratio is used in multiple ways, one of which is its usage is DuPont Analysis The DuPont Analysis calculates the Return on Equity of a firm and uses profit margin, asset turnover ratio, and financial leverage to calculate RoE. The basic asset turnover formula is Annualized sales ÷ Assets = Asset turnover The asset turnover formula can be subdivided for various types of assets, such as the following Accounts receivable turnover ratio Inventory turnover ratio Fixed asset turnover ratio Working capital turnover ratio. The formula for the Fixed asset turnover ratio is similar to the Asset turnover ratio We take Net Sales in the numerator and Average Fixes assets in the denominator Net Sales can be easily obtained from the company’s income statement It is nothing but the revenue company generates after reducing sales returns, if any.

Understand the purpose of the total asset turnover ratio The total asset turnover ratio is what a business uses to determine how much money is being generated by the assets a company owns For example, if the total asset turnover ratio is 072, that means that the company is making $072 per year for every dollar of assets that the company owns. The most common formula divides sales by average current the use of current assets. The average total assets are $3 billion ($1 billion $2 billion) ÷ 2 or $15 billion Therefore, the asset turnover ratio is 533 (that is, $8 billion ÷ $15 billion).

Asset Turnover = Sales or Revenues / Total Assets While calculating the value of total assets it is recommended to take average value, ie value at the beginning and end of accounting period divided by 2 Such calculation would better represent value of assets in the business, since it can fluctuate through the period depending on seasonality or other factors. Asset Turnover Ratio Formula Assets is given in the balance sheet, it is the total of fixed assets and current assets It is normal to average the accounting period beginning and ending values of assets Revenue is found in the income statement It may be called sales or turnover The amount to include is the revenue net of sales discounts. Asset Turnover ratio is one of the important financial ratios that depicts how the company has been utilizing its asset to generate turnover or sales Asset Turnover ratio compares the net sales of the company with the total assets It measures per rupee investment in assets used to generate amount of sales.

Total Assets Turnover Ratio = Net Sales / Average Total Assets Average Total Assets is the average of total assets held by the company throughout the period under consideration is calculated by taking into account both opening and closing figures and dividing it by two Relevance and Use of Turnover Ratio Formula. The asset turnover ratio formula is equal to net sales divided by the total or average assets Types of Assets Common types of assets include current, noncurrent, physical, intangible, operating, and nonoperating Correctly identifying and of a company A company with a high asset turnover ratio operates more efficiently as compared to competitors with a lower ratio. Start studying Accounting Financial Formulas Learn vocabulary, terms, and more with flashcards, games, and other study tools Asset Turnover Ratio Formula Net sales / Average total assets Cash Ratio Formula Rate of Return on Total Assets Formula (Net Income Interest Expense) / Average Total Assets Return on Assets Formula.

The receivables turnover ratio is an accounting method used to quantify how effectively a business extends credit and collects debts on that credit To calculate the Accounts Receivable Turnover divide the net value of credit sales during a given period by the average accounts receivable during the same period. The asset turnover ratio, also known as the total asset turnover ratio, measures the efficiency with which a company uses its assets to produce sales The asset turnover ratio formula is equal to net sales divided by the total or average assets of a company A company with a high asset turnover ratio operates more efficiently as compared to. Fixed Asset Turnover Formula Use the following formula to calculate fixed asset turnover Fixed asset turnover = sales ÷ fixed assets Fixed Asset Turnover Calculation For example, a company has $10,000 in sales and $100,000 in fixed assets Refer to the following calculation Fixed asset turnover = 10,000 / 50,000 = 02.

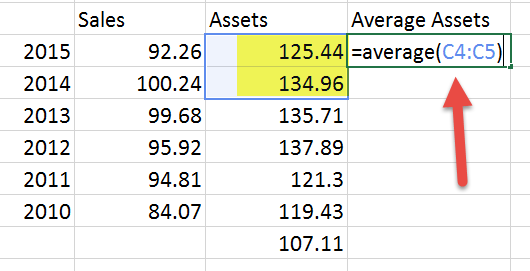

Receivables vs Asset Turnover Ratio An asset turnover ratio measures the efficiency of a company’s use of its assets to generate revenue The accounts receivables ratio, on the other hand, measures a company’s efficiency in collecting money owed to it by customers Importance of Your Accounts Receivable Turnover Ratio. The first step involves extracting the relevant data for Asset Turnover For Asset Turnover, you require two sets of Data – 1) Sales 2) Assets You can access Nestle’s Annual reports from here Once you have the data for say, the last 56 years, you can put those in excel, as shown below Calculate the Average Asset size for each year The next step is to calculate Asset Turnover = Sales / Average Assets.

Accounting Fixed Intangible Assets

Asset Turnover Ratio A Complete Guide For Investors Dr Vijay Malik

Asset Turnover Ratio Definition Formula Example Analysis Industrial Average Calculator

Accounting Asset Turnover Formula のギャラリー

Financial Statement Analysis Principles Of Accounting Volume 2 Managerial Accounting

Turnover Ratio Formula Example With Excel Template

Fixed Asset Turnover Ratio Formula Calculation Examples

Fixed Asset Turnover Ratio Formula Calculation Examples

Assets Turnover Ratio Accounting Management Notes

How To Use The Asset Turnover Ratio Magnimetrics

Asset Turnover Ratio Formula Analysis Example

/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg)

Asset Turnover Ratio Definition

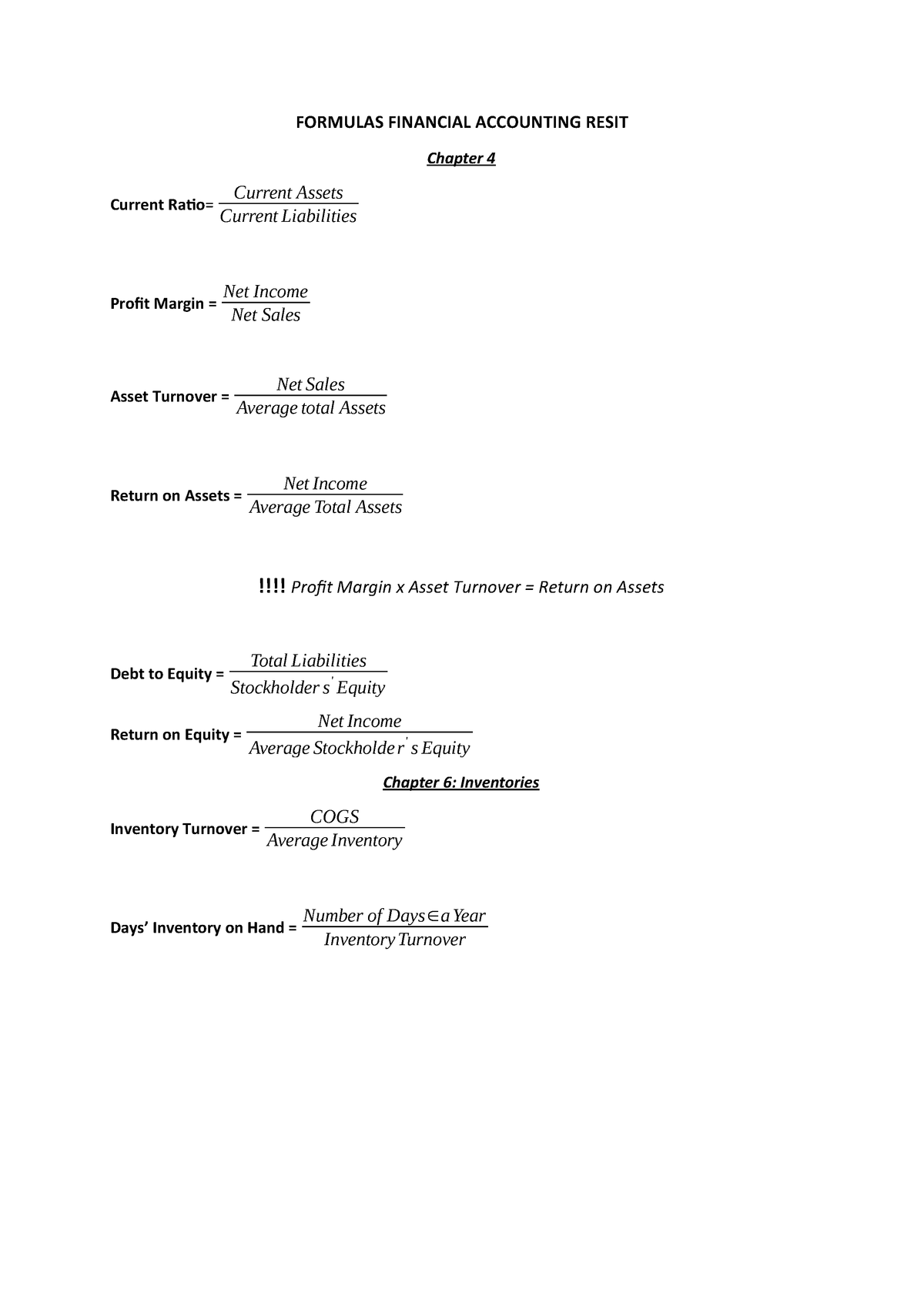

Formulas Financial Accounting Studeersnel

:max_bytes(150000):strip_icc()/dotdash_Final_DuPont_Analysis_Aug_2020-01-254eeb707b3e4ebc9527e054caa914a2.jpg)

Dupont Analysis Definition

What Is Fixed Asset Types Formula Calculation Methods

Total Assets Turnover Ratio Business Forms Accountingcoach

How To Use The Asset Turnover Ratio Magnimetrics

/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

Turnover Ratio Definition All Turnover Ratios Uses Importance Efm

The Asset Turnover Ratio What It Is And How To Use It The Blueprint

Fixed Asset Turnover Template Download Free Excel Template

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

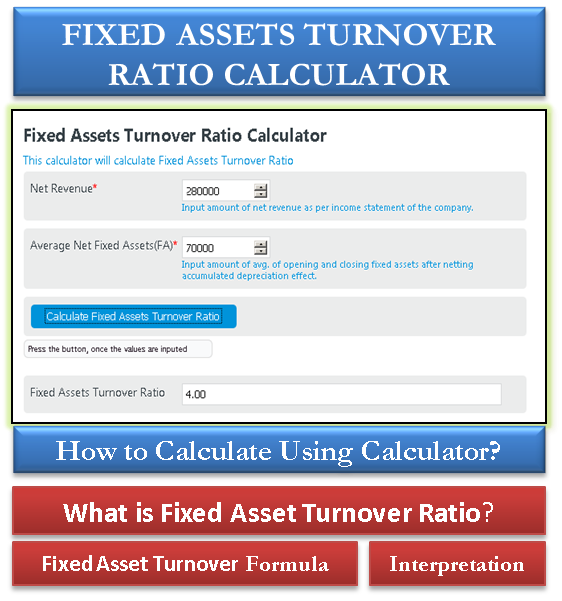

Fixed Asset Turnover Ratio Calculator With Formula Interpretation Efm

Financial Accounting 004 Ratio Analysis Learn More

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Fixed Asset Turnover Ratio Formula Meaning Example And Interpretation

Asset Turnover Ratio Formula Example Calculate Asset Turnover Youtube

How To Calculate The Total Asset Turnover 7 Steps With Pictures

Asset Turnover Ratio Formula Definition Formula Example Interpretation Importance

Preparation Of Income Statement And Balance Sheet With The Help Of Financial Ratios Solved Examples

Asset Turnover Ratio Meaning Formula How To Calculate

Using Return On Investment Roi To Evaluate Performance

:max_bytes(150000):strip_icc()/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg)

Asset Turnover Ratio Definition

Asset Turnover Ratio Meaning Formula How To Calculate

Ratio Analysis Using The Dupont Model Understanding Financial Statements

Fixed Assets Turnover Ratio Accounting Play

Asset Turnover Ratio Formula Examples How To Improve It

Fixed Asset Turnover Ratio Formula Calculator Example Excel Template

Asset Turnover Ratio Financial Statement Data For Years Ended December 31 y3 And y2 For Edison Company Follow A Determine The Asset Turnover Ratio For y3 And y2 B Is The Change

1

Fixed Asset Turnover Ratio Double Entry Bookkeeping

Solved Assuming Two Companies Use The Same Accounting Met Chegg Com

Asset Turnover Ratio Formula Meaning Example And Interpretation

Asset Turnover Ratio Formula Calculator Excel Template

How To Calculate The Total Asset Turnover 7 Steps With Pictures

How To Calculate Asset Turnover Ratio Formula Example Video Lesson Transcript Study Com

Total Asset Turnover Ratio Formula Accounting Corner

Accounting Blog What Is Accounting Ratio

Fixed Asset Turnover Ratio Calculator Double Entry Bookkeeping

:max_bytes(150000):strip_icc()/Income-Statement-for-Tutorial-copy_01-56a0a3303df78cafdaa37e67.png)

Financial Ratio Analysis Tutorial

Fixed Asset Turnover Ratio Definition Analysis Formula Example

Asset Turnover Ratio Formula Calculator Excel Template

How To Analyze And Improve Asset Turnover Ratio

How To Use The Asset Turnover Ratio Magnimetrics

Efficiency Ratio Formula Examples With Excel Template

Fixed Asset Turnover Overview Formula Ratio And Examples

Accounting Ratio Part 12 How To Calculate Fixed Assets Current Assets Turnover Ratio Youtube

Analysis Of Financial Statement Of A Business Solved Examples Of Financial Ratios

What Are Fixed Assets Type Tangible Intangible Accounting Dep

Asset Turnover Assets Sales Accounting Ratio Gmt Research

Asset Turnover Ratio Analysis Formula Example

Asset Turnover Ratio Financial Accounting Cpa Exam Far Ch 9 P 6 Youtube

Asset Turnover Ratio Double Entry Bookkeeping

/Balance-Sheet-for-Tutorial-copy-image_01-56a0a3303df78cafdaa37e61.png)

Financial Ratio Analysis Tutorial

How To Use The Asset Turnover Ratio By Dobromir Dikov Fcca Magnimetrics Medium

1

Asset Turnover Business Tutor2u

Asset Turnover Ratio Formula Calculator Excel Template

Adjusted Debt Ratio And Asset Turnover Ratio

Fixed Asset Turnover Ratio Formula Meaning Example And Interpretation

Current Asset Turnover

Fixed Asset Turnover Ratio Formula Example Calculation Explanation

Inventory Turnover Checkout Accounting Play

The Definitions Of Total Asset Turnover And Profit Margin

Solved The Numerator In The Asset Turnover Formula Is O Chegg Com

Davidpol Common Financial And Accounting Ratios And Formulas Pdf Revenue Equity Finance

Fixed Asset Turnover Ratio Formula Example Calculation Explanation

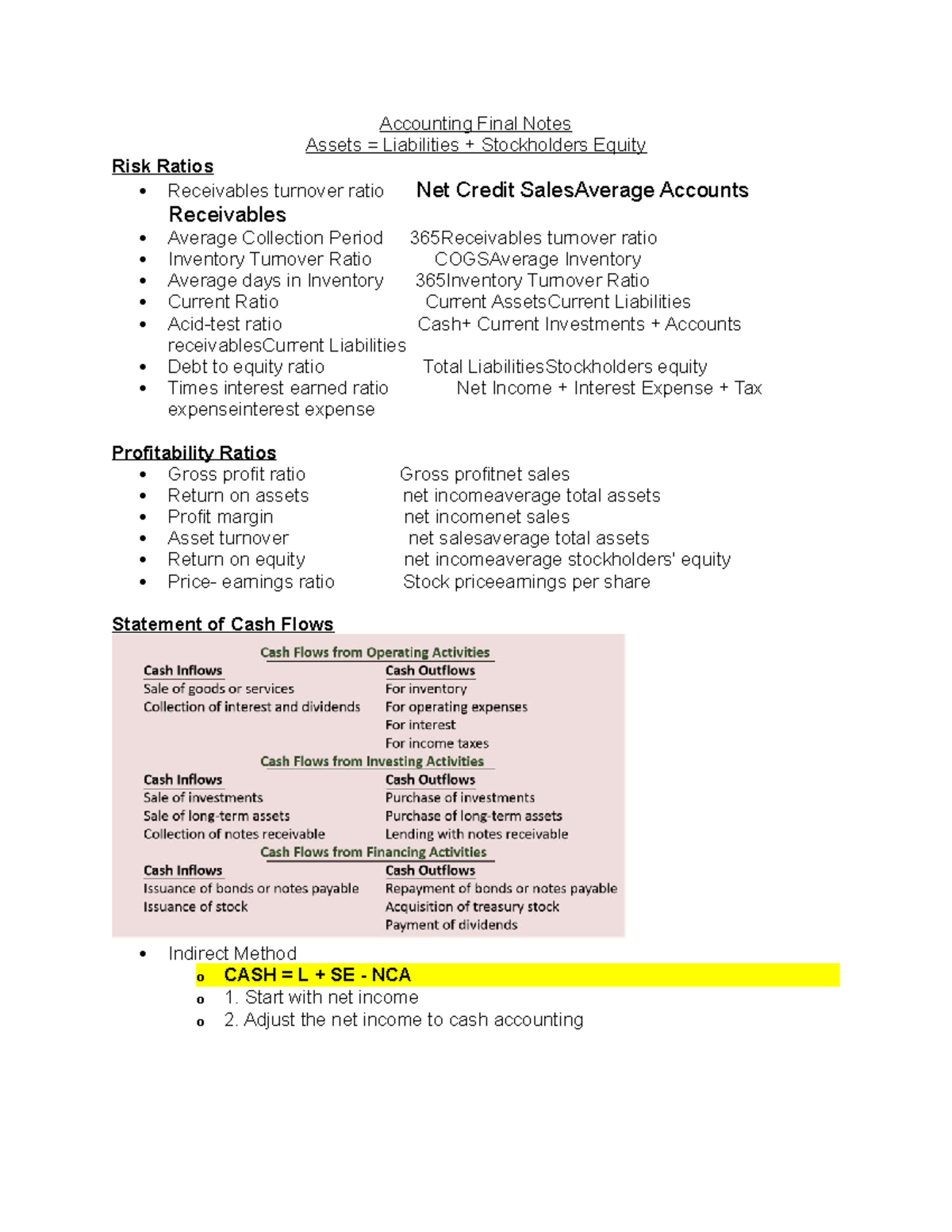

Accounting Final Notes Acct 2101 Studocu

Solved Fixed Asset Turnover Ratio Financial Statement Dat Chegg Com

Turnover Ratio Formula Example With Excel Template

1

Asset Turnover Ratio Definition Formula Example Analysis Industrial Average Calculator

Fixed Asset Turnover Ratio Formula Meaning Example And Interpretation

Calculate Capital Lease Accounting Journals E

Pdf The Impact Of Turnover Ratios On Jordanian Services Sectors Performance

Asset Turnover Ratio Atr

Pdf The Relationship Between Total Asset Turnover And Productivity Indicators Of Companies Listed In Tehran Stock Exchange

Total Asset Turnover Ratio Formula Accounting Corner

Asset Turnover Ratio Definition Formula Example Analysis Industrial Average Calculator

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Accounting Principles Ii Ratio Analysis

Requirement 3 Calculate Each Divisions Asset Turnover Ratio Interpret Your Course Hero

Answered A Company Reports The Following Sales Bartleby

Turnover Ratios Formula Calculation Examples

Fixed Asset Turnover Ratio The Fixed Asset Turnover Ratio Compares Net Sales To Course Hero

Accounting Principles Ii Ratio Analysis

How To Calculate Asset Turnover Ratio Formula Example Video Lesson Transcript Study Com

Fixed Asset Turnover Definition Formula Interpretation And Analysis Fixed Asset Financial Analysis Financial Strategies

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Acct7000 M12l4 Practice Fs Analysis Asset Turnover Ratiosrec University Of Cincinnati Lindner College Of Business

.gif)

Asset Turnover Ratio Formula Definition Example Investinganswers

Epiza2kv2pzm

Dupont Analysis Wikipedia

Fixed Asset Turnover Ratio Business Forms Accountingcoach