Fixed Asset Accounting

What Is Fixed Asset Accounting Software?.

Fixed asset accounting. I know that I made the correct Fixed Asset accounts with the Original Cost and Depreciation accounts My question come in how to categorize the transaction of t. Fixed asset accountants are majorly responsible for recording cost of an organization’s newly added fixed assets, tracking existing ones, which can be tangible or/and intangible, and calculating and recording their depreciation, as well as accounting for disposed fixed assets. Finally, a comprehensive solution for fixed asset and IT asset management Learn more about Exela’s fixed asset software and IT asset management software.

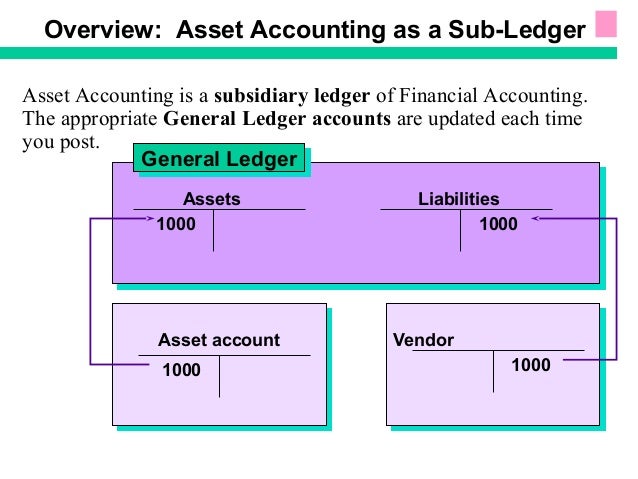

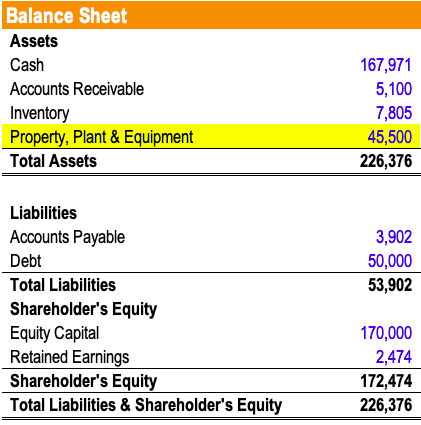

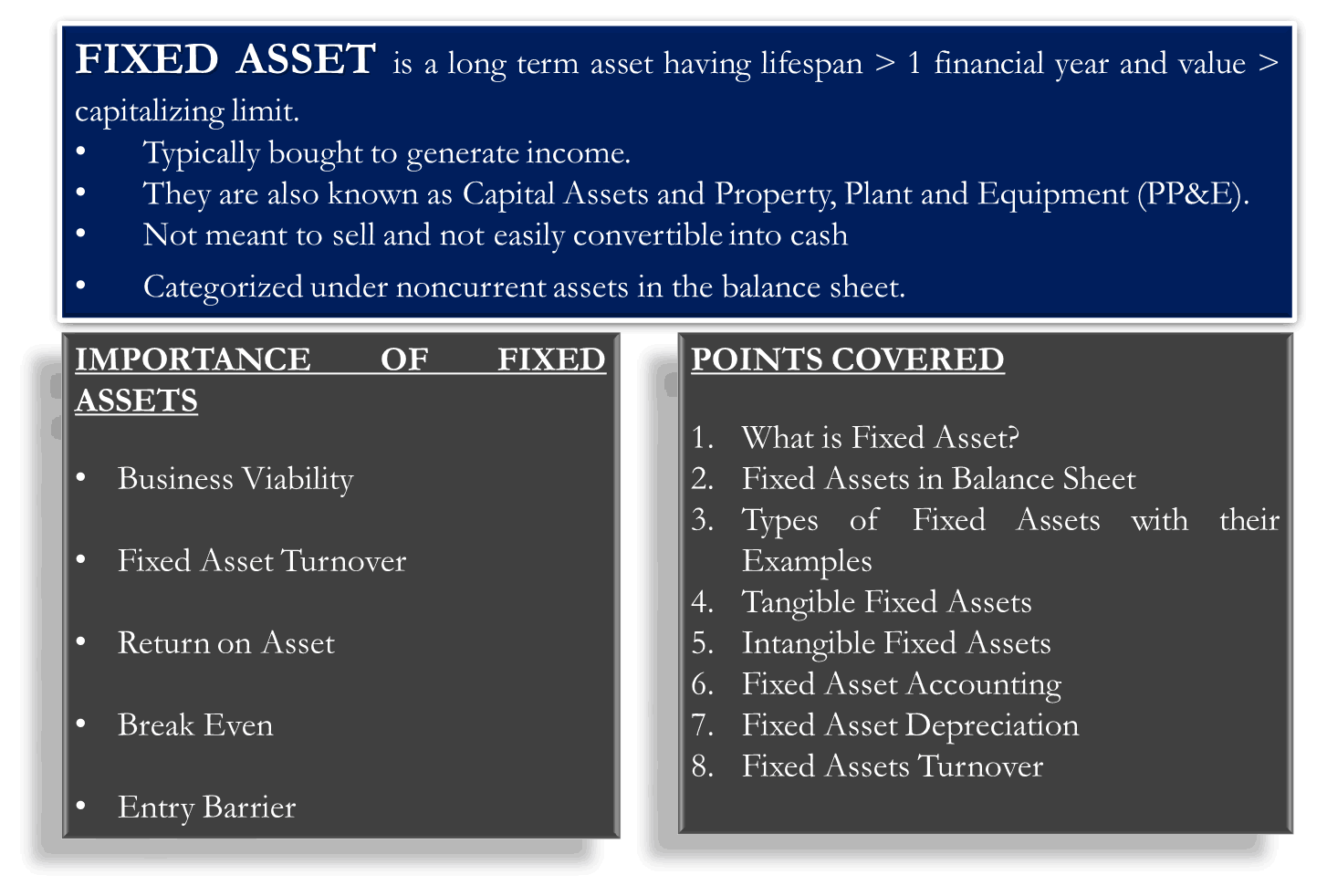

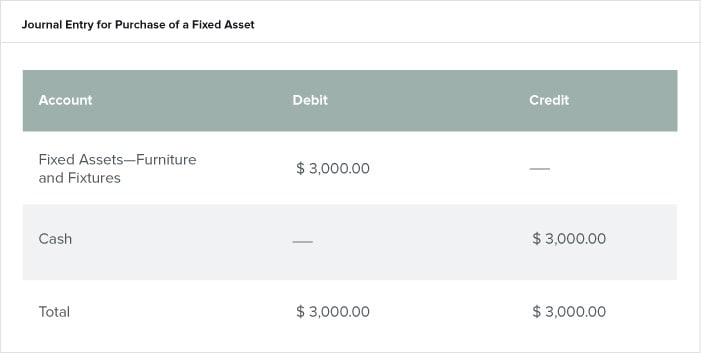

Fixed Asset Accounting Software – There is some specific asset accounting package, although this will have an additional cost Accounting Software – Enter a journal for the period of either a month or a year. Fixed assets are noncurrent assets, meaning the assets have a useful life of more than one year Fixed assets include property, plant, and equipment (PP&E) and are recorded on the balance sheet. The fixed assets journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of fixed assets In each case the fixed assets journal entries show the debit and credit account together with a brief narrative.

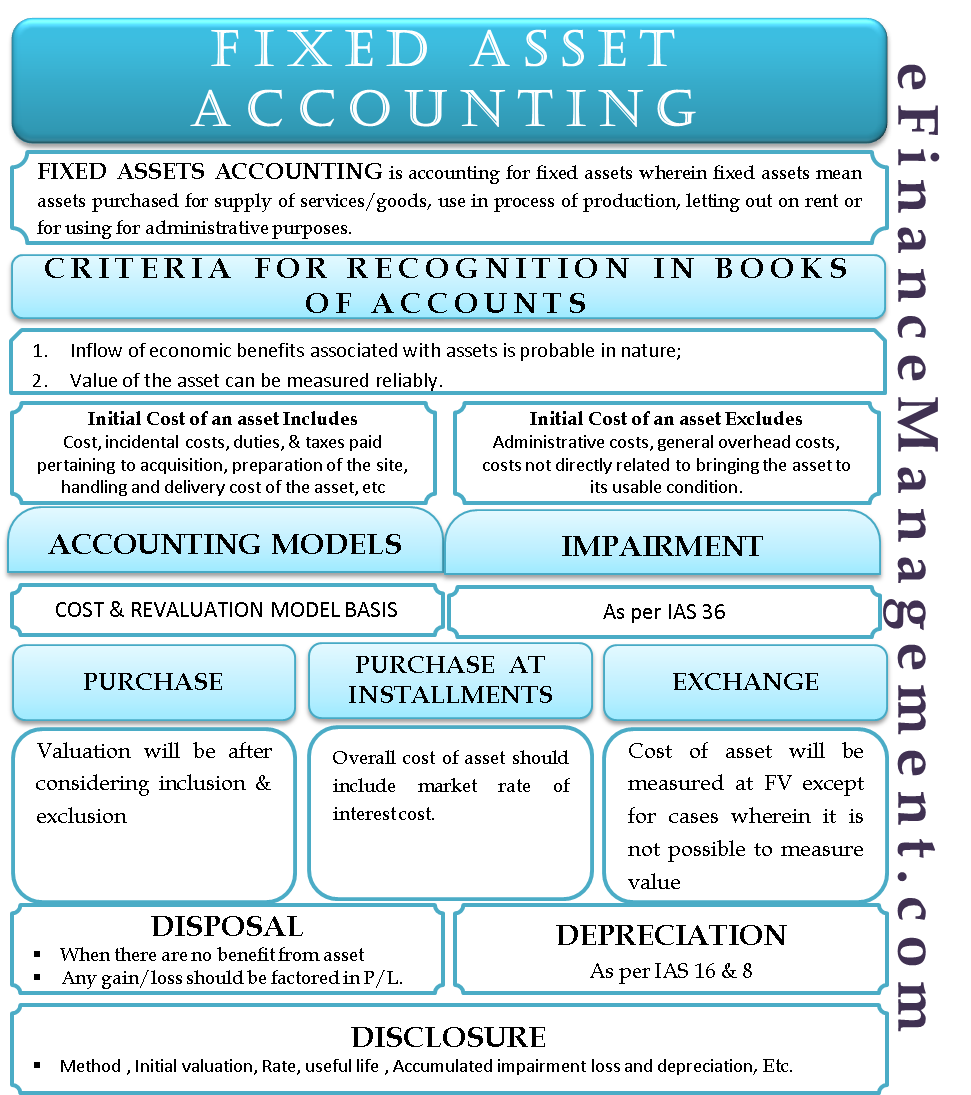

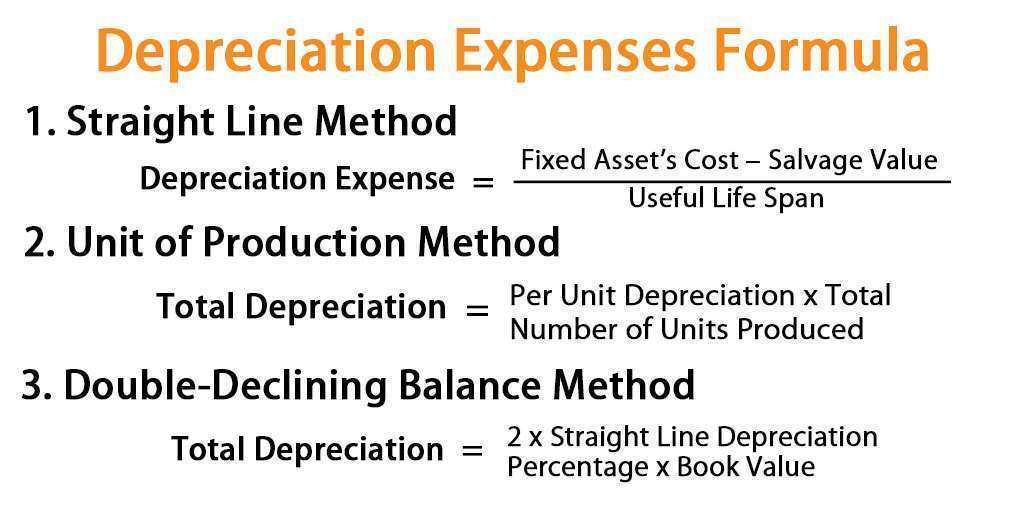

We're going back to the basics in accounting, and the objective of this post is to walk you through the correct way to book a fixed asset journal entry and how to do fixed asset accounting, all the way from asset purchase to sale and write offBut first, what is a fixed asset?. Below mentioned are the disclosures related to fixed assets in the financial statement of the organization Initial valuation of the asset for determining the carrying amount;. Method of depreciation adopted Rate of depreciation The useful life of the asset Accumulated impairment loss and.

Fixed assets definition Fixed Assets normally refer to property, plant, and equipment that are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes, and they are expected to be used with more than one year accounting period. I know that I made the correct Fixed Asset accounts with the Original Cost and Depreciation accounts My question come in how to categorize the transaction of t. Finally, a comprehensive solution for fixed asset and IT asset management Learn more about Exela’s fixed asset software and IT asset management software.

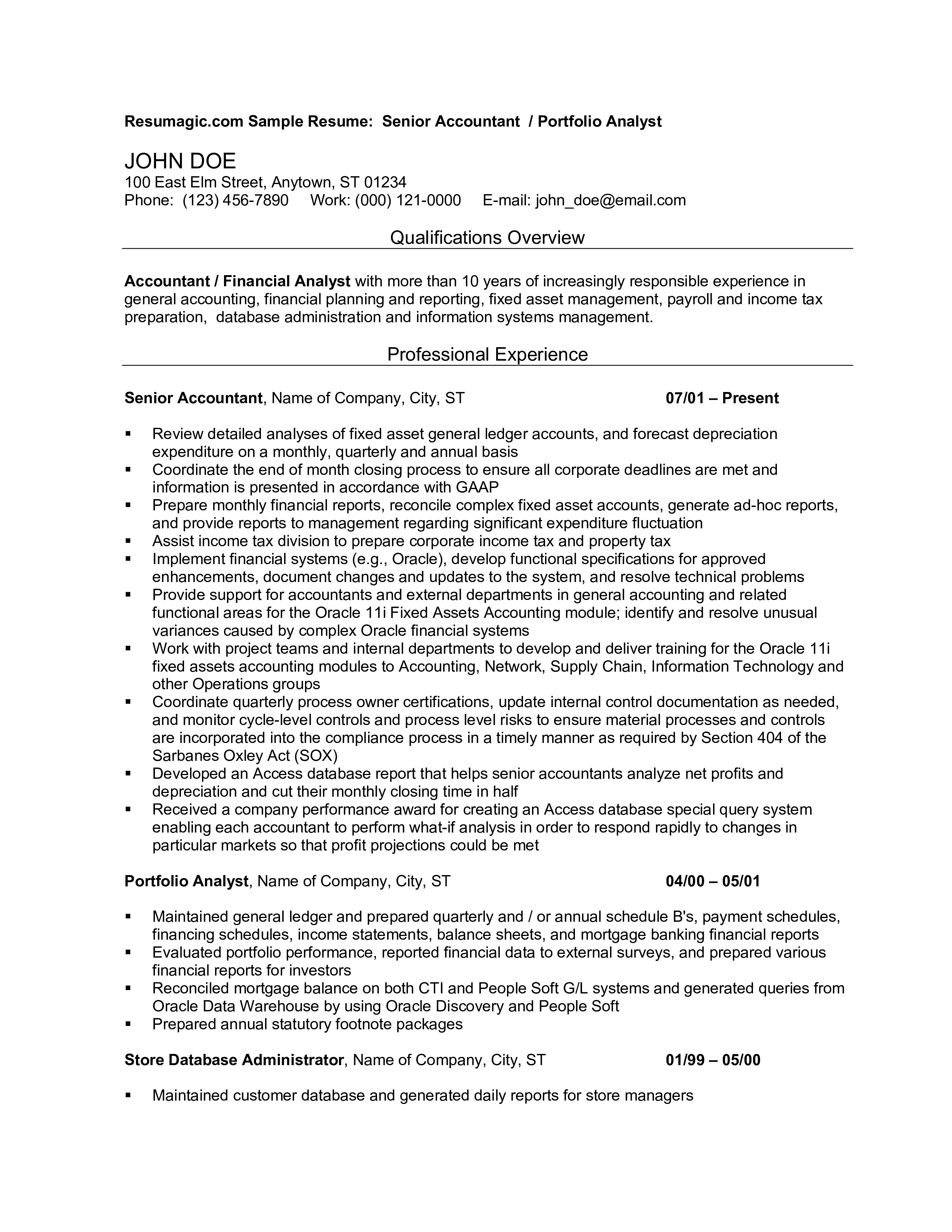

Accounting for fixed assets is not in accordance with GAAP Under the former rules, the above costs were accumulated in property ledgers and the totals were then posted to the Development account, the Modernization account, or the Fixed Asset account in the general ledger This means that the detail of the fixed assets is not in the general. Fixed Asset Accountant Involved in all areas of Fixed Asset Accounting and Capital Expenditures involving over 48,000 asset records Maintained Fixed Asset System, inventory controls, valuations, monthly closing activities, management reporting, variance and cost analysis, development of annual standards, internal control, and improving accounting processes. Fixed assets refer to tangible property and equipment with a useful life of more than a year (except collection items and assets held for investment purposes) that meet or exceed the organization’s capitalization threshold Assets with a useful life of more than a year are also referred to as “longlived” assets Common Asset Categories.

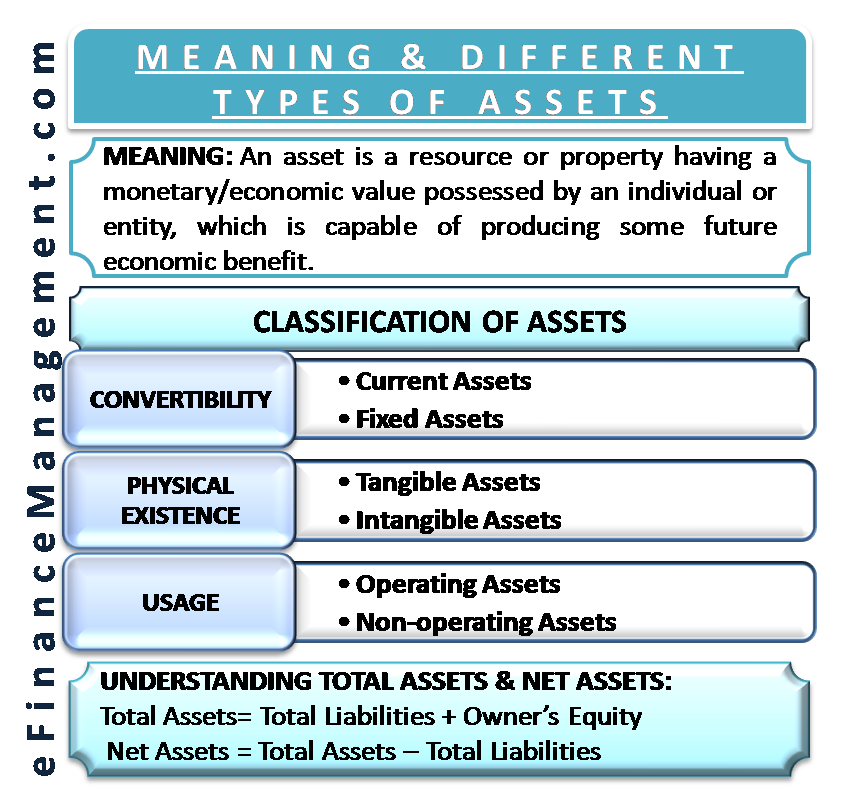

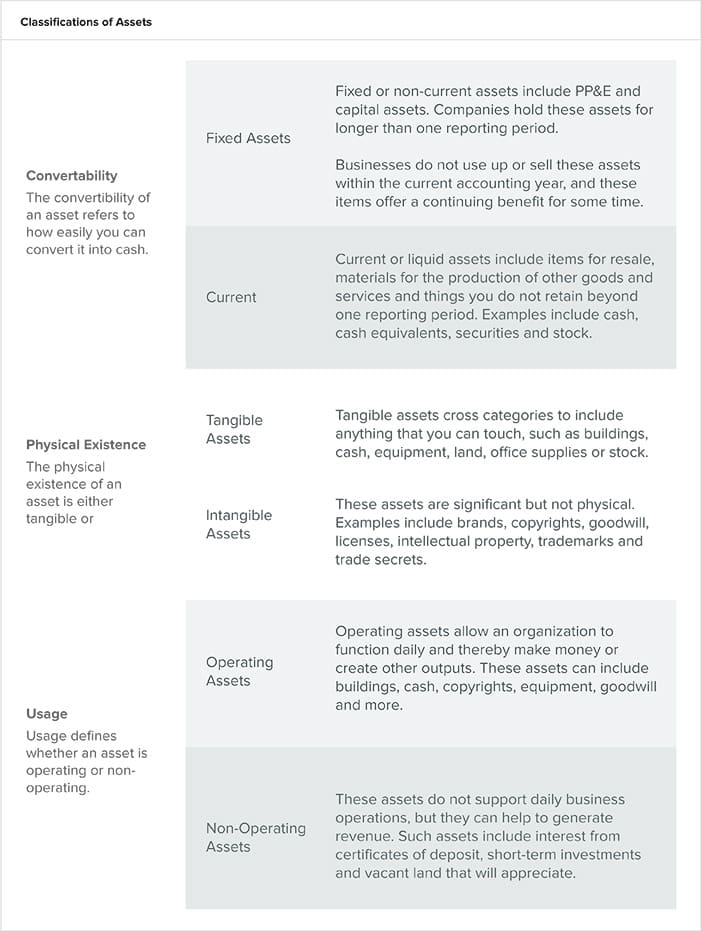

Fixed asset accounting is accounting for fixed assets In this accounting, the fixed assets are purchased for the supply of services and goods which will further be used in production, rental let out or/and administrative purposes. Fixed asset accountants are majorly responsible for recording cost of an organization’s newly added fixed assets, tracking existing ones, which can be tangible or/and intangible, and calculating and recording their depreciation, as well as accounting for disposed fixed assets. Fixed Assets vs Current Assets The concept of fixed and current assets is simple to understand The short explanation is that if it is an asset and is either in cash or likely to be converted into cash within the next 12 months (or accounting period), it is considered a current asset Fixed assets, on the other hand, as we said above, are not.

A fixed asset is a type of property belonging to a business that is used for production of goods and services Fixed assets are classified as either intangible or tangible Intangible fixed assets are nonphysical properties such as a. The fixed assets journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of fixed assets In each case the fixed assets journal entries show the debit and credit account together with a brief narrative. Examples of Fixed Assets A fixed asset is something that will be used in the business and that has a useful life of.

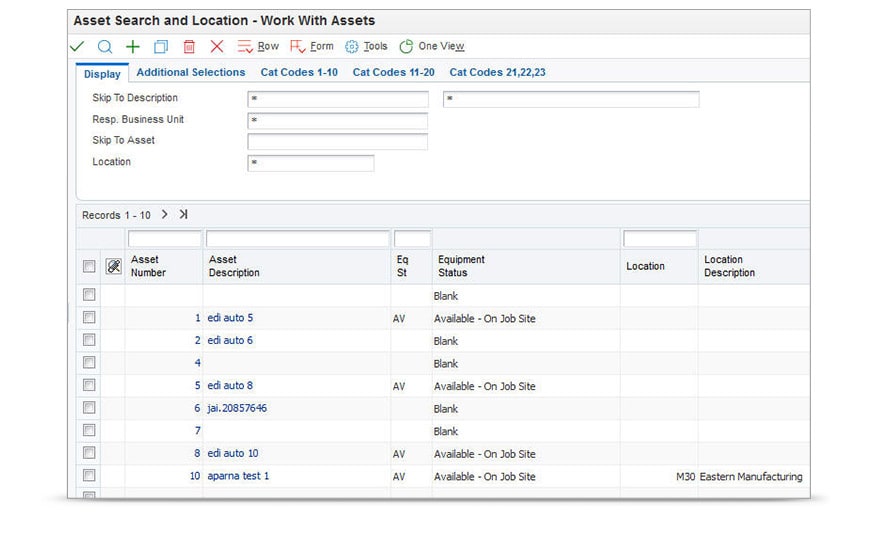

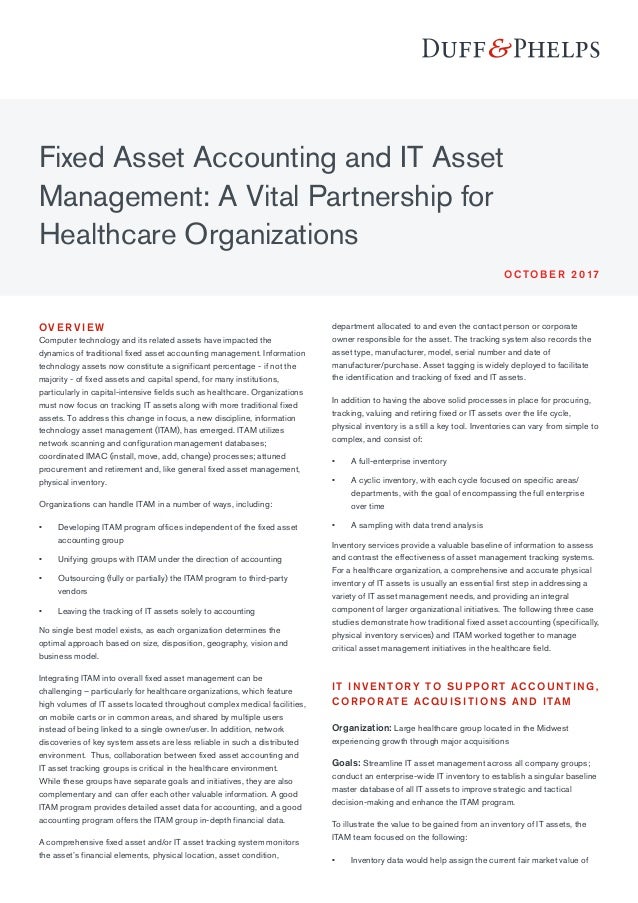

Finally, a comprehensive solution for fixed asset and IT asset management Learn more about Exela’s fixed asset software and IT asset management software. Best practices for fixed asset accounting 71 Establish a threshold for capitalization The first step towards maintaining errorfree accounts involves setting a 72 Ensure your assets have tags Many companies have fixed assets that they transport to various locations for 73 Automate your. The Fixed Assets Accounting department is part of the Controller’s Office and has the following main functions Ensure the purchase, transfer and disposal of district assets are performed according to district policy and accurately reflected in the district’s asset records.

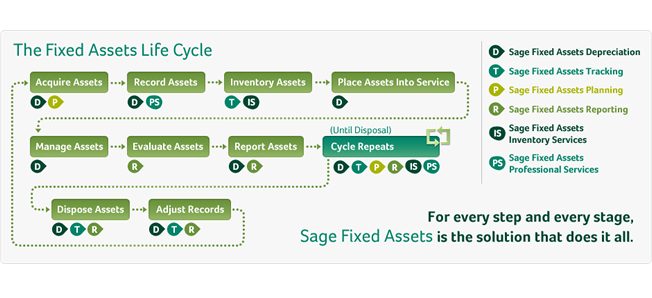

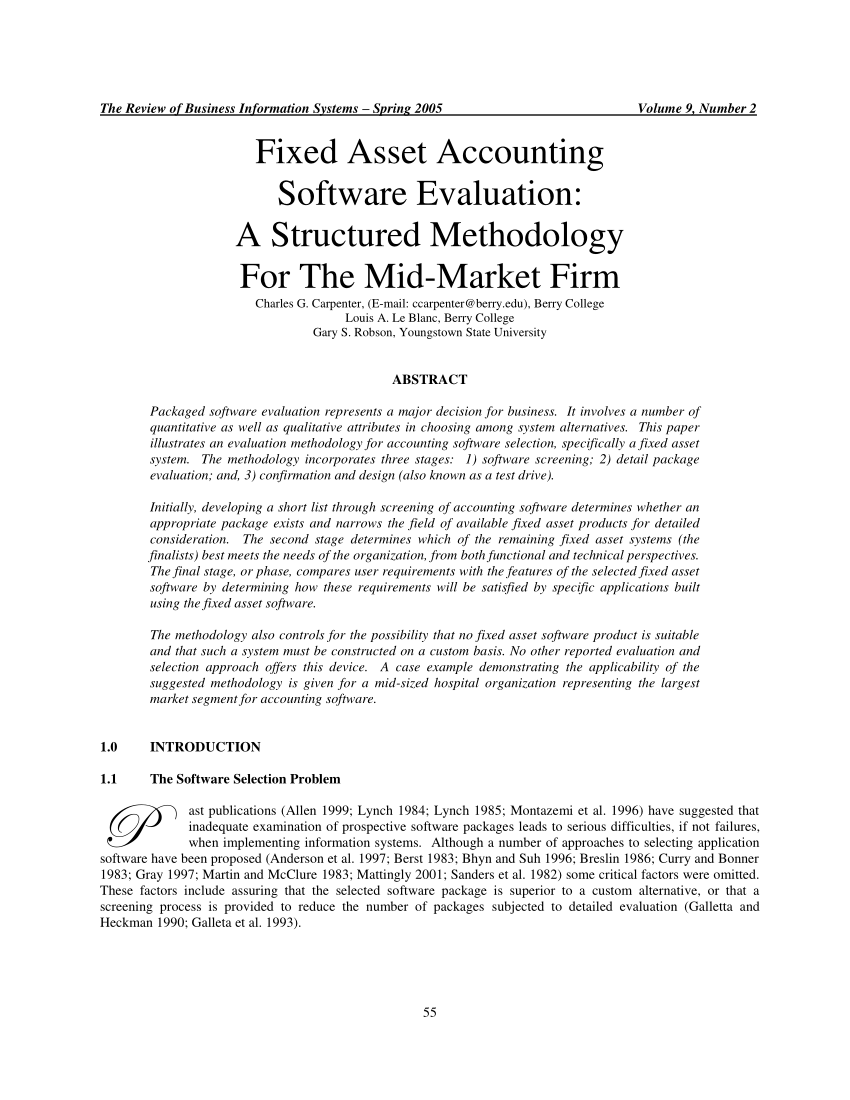

Fixed Assets Accounting for a NotForProfit Organization Fixed Assets Introduction In the accounting world, the asset is defined as an owned resource from which future economic benefits are expected On the balance sheet of any organization, be it a notforprofit or forprofit, the carrying amount of all assets is reported. Top 10 Fixed Asset Accounting Software Ratings and Reviews Virtuous Reviews presents the list of top 10 fixed asset accounting software to find the right solution for your business You can find the best fixed asset management software that can control, track and record every change that occurs during an asset’s lifetime, such as asset. This type of software automates the process of tracking assets through the various stages in the asset lifecycle, from acquisition through disposal With the right asset manager software, a business can improve efficiency and financial strength by maintaining its existing assets while avoiding.

A fixed asset is a longterm tangible asset that a firm owns and uses to produce income and is not expected to be used or sold within a year more Nonmonetary Assets. When assets are acquired, they should be recorded as fixed assets if they meet the following two criteria Have a useful life of greater than one year;. Here are some key facts to understand and insights to keep in mind Fixed assets are capitalized That’s because the benefit of the asset extends beyond the year of purchase, unlike other Fixed assets should be recorded at cost of acquisition Cost includes all expenditures directly related to.

Definition and Explanation Fixed assets, also known as Property, Plant and Equipment, are tangible assets held by an entity for the production or supply of goods and services, for rentals to others, or for administrative purposes These assets are expected to be used for more than one accounting period. Position Description Fixed Asset Accountant Basic Function The fixed asset accountant position is accountable for recording the cost of newlyacquired fixed assets (both tangible and intangible), tracking existing fixed assets, recording depreciation, and accounting for the disposition of fixed assets Principal Accountabilities. IAS 16 outlines the accounting treatment for most types of property, plant and equipment Property, plant and equipment is initially measured at its cost, subsequently measured either using a cost or revaluation model, and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life IAS 16 was reissued in December 03 and applies to annual periods.

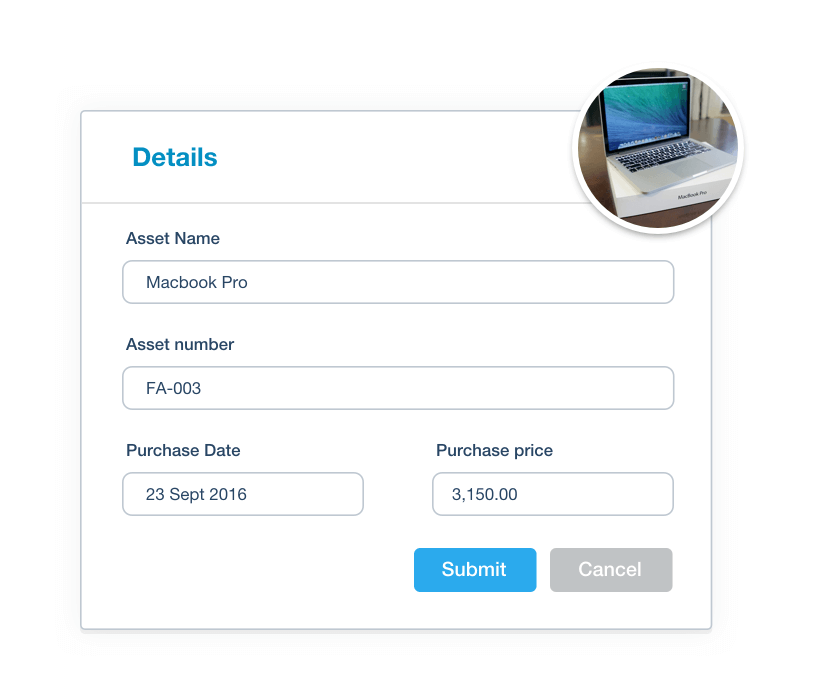

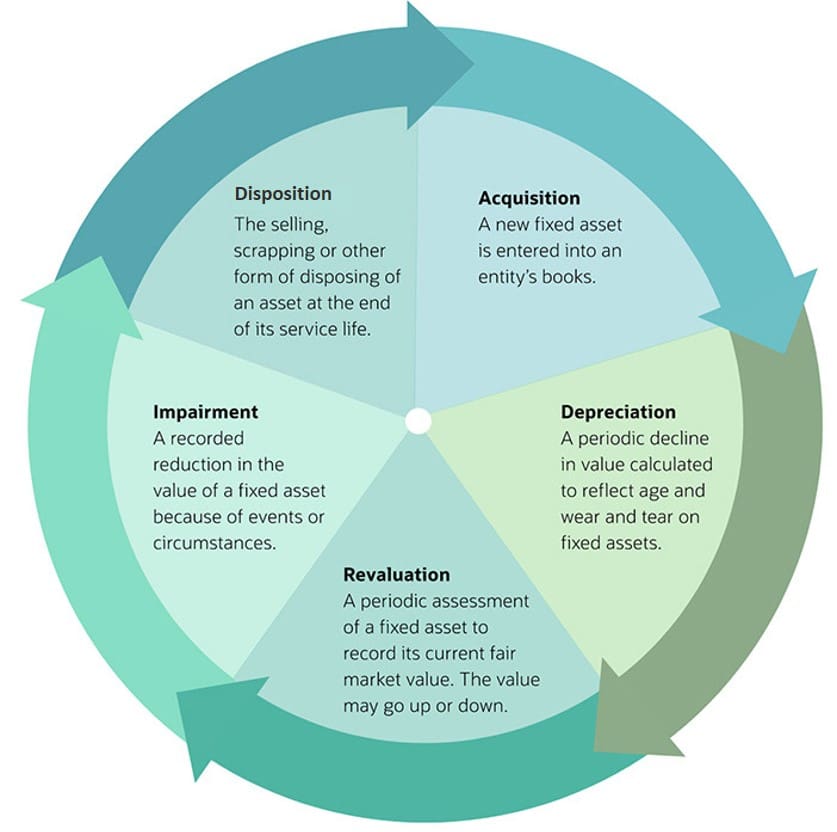

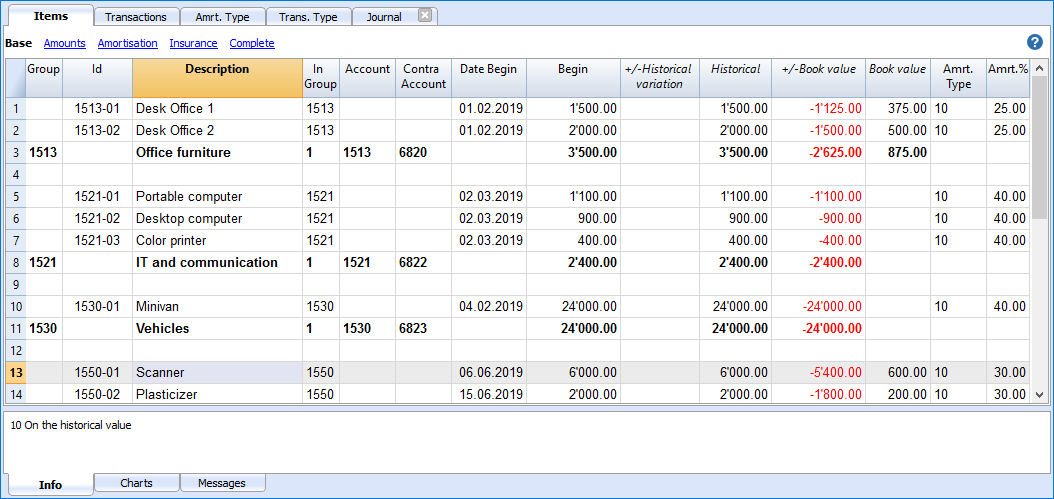

Fixedasset accounting records all financial activities related to fixed assets The practice details the lifecycle of an asset, such as purchase, depreciation, audits, revaluation, impairment and disposal In a company’s books, each asset has an account, where all the financial activities related to fixed asset are recorded. I need verify that I correctly entered the purchase of my printer (Fixed Asset with Depreciation) I am new to QB and accounting!. Fixed assets are a company's tangible, noncurrent assets that are used in its business operations The word fixed indicates that these assets will not be used up, consumed, or sold in the current accounting year A company's fixed assets are reported in the noncurrent (or longterm) asset section of the balance sheet in the section described as.

Basic Function The fixed asset accountant position is accountable for recording the cost of newlyacquired fixed assets (both tangible and intangible), tracking existing fixed assets, recording depreciation, and accounting for the disposition of fixed assets. The Fixed Assets Accounting department is part of the Controller’s Office and has the following main functions Ensure the purchase, transfer and disposal of district assets are performed according to district policy and accurately reflected in the district’s asset records. Fixed asset is an asset of a business held with the intention of being used for the purpose of producing or providing goods or services and is not held for sale in the normal course of business They can be categorized as.

Fixed assets can be one of the largest asset groups within an organization, and requires special accounting that differs from the accounting used for any other assets The Fixed Asset Accounting course comprehensively addresses every GAAP and IFRS accounting rule related to these crucial assets, including interest capitalization, asset. Finally, a comprehensive solution for fixed asset and IT asset management Learn more about Exela’s fixed asset software and IT asset management software. Fixed Assets Ratio Fixed Assets ratio is a type of solvency ratio (longterm solvency) which is found by dividing total fixed assets (net) of a company with its longterm funds It shows the amount of fixed assets being financed by each unit of longterm funds It helps to determine the capacity of a company to.

Fixed Assets Ratio Fixed Assets ratio is a type of solvency ratio (longterm solvency) which is found by dividing total fixed assets (net) of a company with its longterm funds It shows the amount of fixed assets being financed by each unit of longterm funds It helps to determine the capacity of a company to. Top 10 Fixed Asset Accounting Software Ratings and Reviews Virtuous Reviews presents the list of top 10 fixed asset accounting software to find the right solution for your business You can find the best fixed asset management software that can control, track and record every change that occurs during an asset’s lifetime, such as asset. Fixed assets accounting Training is a very important topic for any organization Fixed assets are the major resources used to produce products and then generate future benefits The management and accounting of fixed assets cover all the lifecycles of a fixed assets from the creation or a acquisition to utilization & maintenance until renewal.

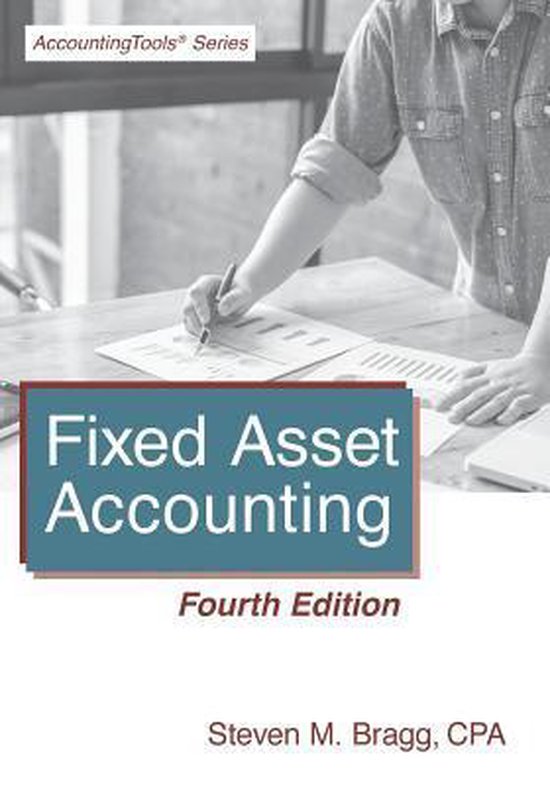

Accounting for fixed assets is not in accordance with GAAP Under the former rules, the above costs were accumulated in property ledgers and the totals were then posted to the Development account, the Modernization account, or the Fixed Asset account in the general ledger This means that the detail of the fixed assets is not in the general. Fixed assets can be one of the largest asset groups within an organization, and requires special accounting that differs from the accounting used for any other assets The Fixed Asset Accounting book comprehensively addresses every GAAP and IFRS accounting rule related to these crucial assets, including interest capitalization, asset retirement. Key Takeaways Fixed assets are items, such as property or equipment, a company plans to use over the longterm to help generate income Fixed assets are most commonly referred to as property, plant, and equipment (PP&E) Current assets, such as inventory, are expected to be converted to cash or.

The Complete Guide to Fixed Asset Accounting addresses all aspects of fixed asset accounting, including the most complex topics asset impairments, asset retirement obligations, and asset revaluations This course also addresses key controls, policies, and metrics $. The fixed assets are divided into tangible assets such as land, buildings, equipment, machinery, furniture, software, vehicles and intangible assets such patents, copyrights, and trademarks Longterm assets are important because they provide valuable information about a firm’s financial health and ability to generate earnings from. 3,141 Fixed Asset Accountant jobs available on Indeedcom Apply to Accountant, Staff Accountant, Senior Accountant and more!.

Overview Fixed assets are those longterm assets which can benefit the enterprise for more than 12 months and is above the particular threshold as defined by the enterprise as guidelines made in compliance with laws and regulations as well as align with the applicable accounting standards and frameworks There are certain procurement procedures when the fixed assets are purchased. A fixed asset is a longterm tangible asset that a firm owns and uses to produce income and is not expected to be used or sold within a year more Nonmonetary Assets. 18 Reviews of Fixed Asset Accounting Systems Whether you’re a startup, a multinational corporation, or somewhere in between, you have fixed assets Purchased for longterm use in a business.

Fixed Asset Accountant Job Description, Duties, and Responsibilities What Does a Fixed Asset Accountant Do?. Fixed assets are noncurrent assets, meaning the assets have a useful life of more than one year Fixed assets include property, plant, and equipment (PP&E) and are recorded on the balance sheet. Fixed asset challenges can include proper recording of cost and classifications of fixed assets, determining depreciation expense, accounting and reporting for disposition and/or transfer of fixed assets, and distinguishing between items that should be recorded as fixed assets and depreciated vs those items that are expendable equipment or.

The cost of a fixed asset for the purpose of accounting and taxation will include not only the cost of the asset, but also the expense(s) These incurred to get it installed and working like delivery charges, acquiring charges such as stamp duty and import duties, costs of preparing the site for installation of the asset, professional fees. The fixed assets are divided into tangible assets such as land, buildings, equipment, machinery, furniture, software, vehicles and intangible assets such patents, copyrights, and trademarks Longterm assets are important because they provide valuable information about a firm’s financial health and ability to generate earnings from. And Exceeds the corporate capitalization limit The capitalization limit is the amount of expenditure below which an item is recorded as an expense, rather than an asset.

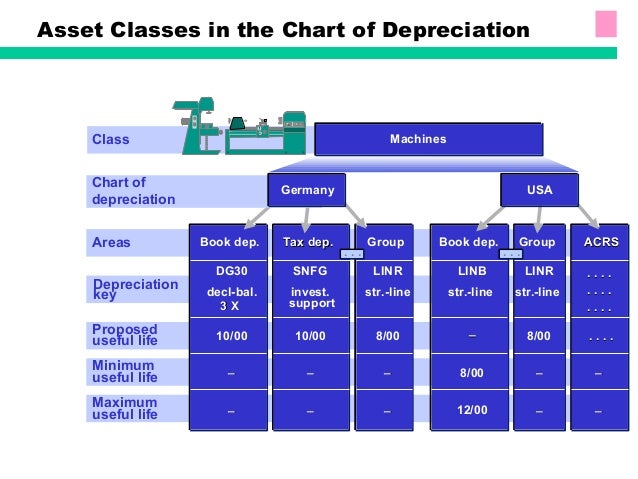

Fixedasset accounting records all financial activities related to fixed assets The practice details the lifecycle of an asset, such as purchase, depreciation, audits, revaluation, impairment and disposal In a company’s books, each asset has an account, where all the financial activities related to fixed asset are recorded. Fixed assets are the balance sheet items and they are report at their book value at the end of accounting period by present in different categories based on nature, the ways how they are used as well as the depreciation rate Their value decrease based on the depreciation that entity change. Fixed assets are initially recorded as assets, and are then subject to the following general types of accounting transactions Periodic depreciation (for tangible assets) or amortization (for intangible assets) Impairment writedowns (if the value of an asset declines below its net book value) Disposition (once assets are disposed of).

I need verify that I correctly entered the purchase of my printer (Fixed Asset with Depreciation) I am new to QB and accounting!. Accounting for fixed assets is not in accordance with GAAP Under the former rules, the above costs were accumulated in property ledgers and the totals were then posted to the Development account, the Modernization account, or the Fixed Asset account in the general ledger This means that the detail of the fixed assets is not in the general. Fixed Asset Accountant Involved in all areas of Fixed Asset Accounting and Capital Expenditures involving over 48,000 asset records Maintained Fixed Asset System, inventory controls, valuations, monthly closing activities, management reporting, variance and cost analysis, development of annual standards, internal control, and improving accounting processes.

Fixed Asset Accountant Job Description, Duties, and Responsibilities What Does a Fixed Asset Accountant Do?. Accounting For Fixed Asset If your business has a fixed assets, sound accounting standards can fill in as a manual for properly represent these long haul goods on your bookkeeping records Particular exchanges that influence capital to incorporate the buy, revaluation, devaluation and sale of the asset. Accounting for fixed assets is not in accordance with GAAP Under the former rules, the above costs were accumulated in property ledgers and the totals were then posted to the Development account, the Modernization account, or the Fixed Asset account in the general ledger This means that the detail of the fixed assets is not in the general.

Top 10 Fixed Asset Accounting Software Ratings and Reviews Virtuous Reviews presents the list of top 10 fixed asset accounting software to find the right solution for your business You can find the best fixed asset management software that can control, track and record every change that occurs during an asset’s lifetime, such as asset.

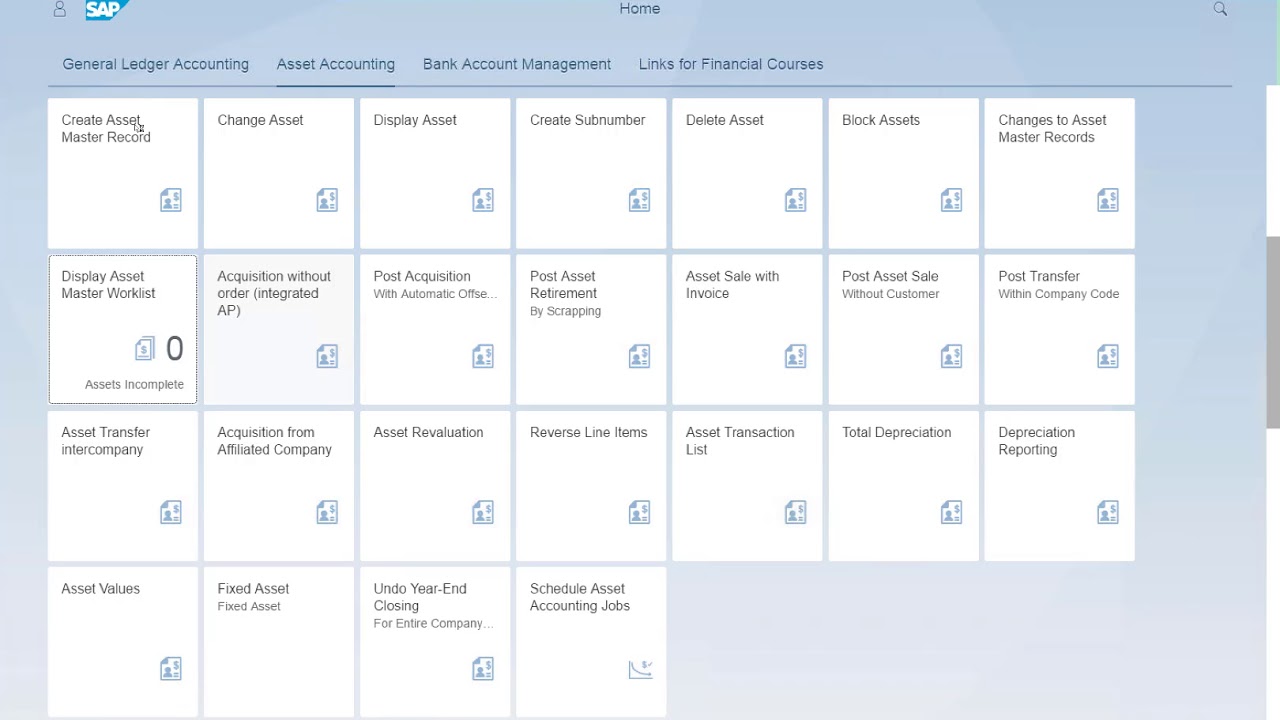

Process Fixed Assets Accounting In Sap Erp Solutions For Apparel And Footwear Implement Applications Frameworks Process

Fixed Asset Software Easy Compliance Mri Software

Ktp Company Plt Audit Tax Accountancy Sst In Johor Bahru

Fixed Asset Accounting のギャラリー

How To Generate An Expense Account Transfer Accounting Document In Fixed Assets Module Sage X3 Support Sage X3 Sage City Community

Fixed Assets Accounting Service In Mahim Mumbai Id

Fixed Asset Management Software Xero Ca

Fixed Asset Process Flow Chart Lewisburg District Umc

Experienced Accountant Resume Format Templates At Allbusinesstemplates Com

Sap Fixed Assets Accounting

Fixed Asset Accounting Mri Software

Nature Of Fixed Assets Course Hero

6 Major Benefits Of Fixed Asset Management Software Fams Letosys

Download Pdf Fixed Asset Accounting Fourth Edition

Fixed Assets Accounting And Depreciation Enterprise Operating System

Sap Simple Finance Asset Scrapping Tutorialspoint

Fixed Asset Purchase With Cash Double Entry Bookkeeping

Fixed Assets Accounting Policies Oregon University System Oregon State University

Ppt Fixed Asset Accounting Powerpoint Presentation Free Download Id

Fixed Asset Accounting Overview And Best Practices Involved

Meaning And Different Types Of Assets Classification More

What Fixed Asset Accounting Has To Do In A Business Asset Infinity

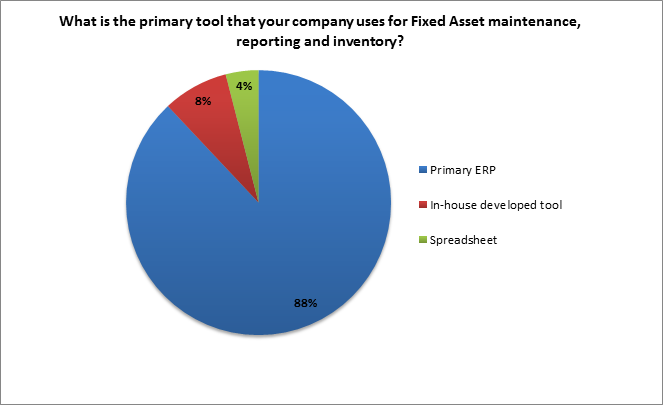

Companies Not Ready To Automate Fixed Assets Accounting Accounting Today

Ebook Fixed Asset Accounting Fourth Edition Free Books

Fixed Assets Fixed Asset Accounting And Finance Retail Business Plan

Isprotėti Apkabinti Kiemas Sap Asset Module Yenanchen Com

Sage Fixed Assets Accounting Aces Inc

Fixed Assets Definition Characteristics Examples

Sage Fixed Assets Fixed Asset Management Fixed Asset Training

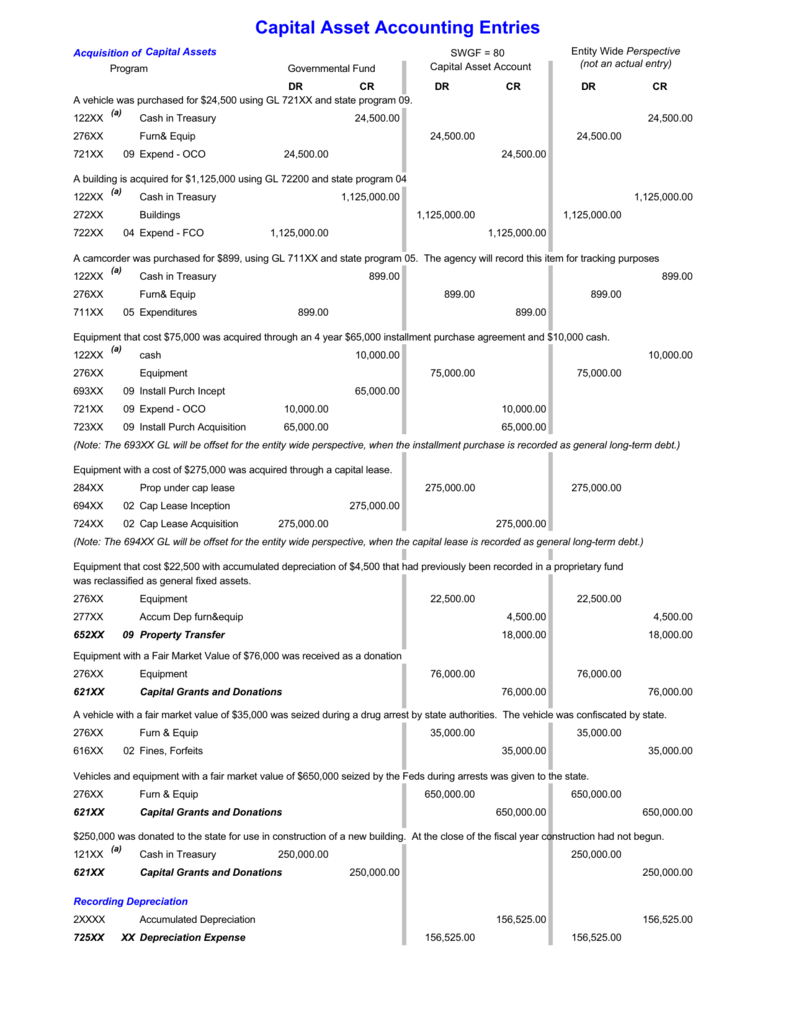

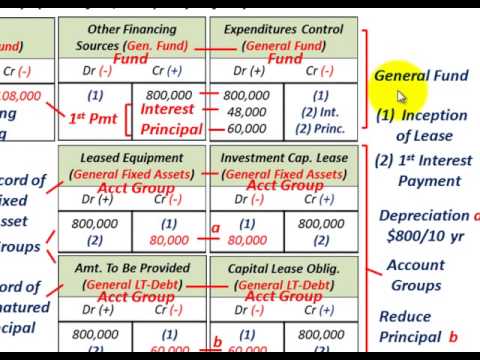

Capital Asset Accounting Entries

Fixed Asset Accounting Made Simple Netsuite

Fixed Asset Accounting Overview And Best Practices Involved

Bol Com Fixed Asset Accounting Steven M Bragg Boeken

What Does A Fixed Asset Accountant Do Zippia

Fixed Asset Accounting

Fixed Assets Accountant Resume Sample Mintresume

Fixed Asset Solarsys

Fixed Asset Accounting Western Cpe

Fixed Assets Software Sage Intacct Inc

Fixed Asset Accounting Examples Journal Entries Dep Disclosure

Asset Accounting Fi New

Jd Edwards Fixed Asset Accounting Resources Oracle

Fixed Asset Accountant Resume Sample Mintresume

Pdf Fixed Asset Accounting Software Evaluation A Structured Methodology For The Mid Market Firm

Fixed Asset Accounting And It Asset Management A Vital Partnership F

Introduction To Fixed Assets Process Youtube

Fixed Asset Accounting Made Simple Netsuite

Controller S Office Fixed Assets Accounting

Everything You Must Know On Asset Accounting

Buy Fixed Asset Accounting Fourth Edition Book Online At Low Prices In India Fixed Asset Accounting Fourth Edition Reviews Ratings Amazon In

Accounting For Fixed Assets As 10 Book Value Fixed Asset

Calameo Sage Fast Fixed Asset Accounting

Overcoming The Challenges Of Fixed Asset Accounting

Fixed Assets In Accounting Definition List Top Examples

Structuring Fixed Assets Sap Library Asset Accounting Fi

Fixed Assets Accounting In South Extension Ii New Delhi Id

Fixed Assets Basics In Accounting Double Entry Bookkeeping

Fixed Asset Accounting Definition And Example Bookstime

Isuite Fixed Assets Gsiaccountingapps Com

1

As 10 Accounting For Fixed Assets Accounting Standards

Posting Via A Clearing Account Excerpt From Sap Fixed Asset Accounting Espresso Tutorials Blog

Q Tbn And9gcqze5rq3p7sho558bklts1vjl3mwnkgsv5tq4uo Z6zbdpfci6g Usqp Cau

Fixed Asset Accounting Cycle With Acquisition Valuation And Disposal Presentation Graphics Presentation Powerpoint Example Slide Templates

What Are Fixed Assets Type Tangible Intangible Accounting Dep

Sap S 4hana Finance Fixed Asset Accounting Fi Youtube

Fixed Asset Management Software Xero Ca

Fixed Asset Accountant Resume Samples Qwikresume

Fixed Asset Accounting 07 Bonus Pack For Excel Full Asset Accounting

Fixed Asset Accounting Overview And Best Practices Involved

Fixed Assets Asset Accounting Overview Asset

Fixed Assets Software Sage Intacct Inc

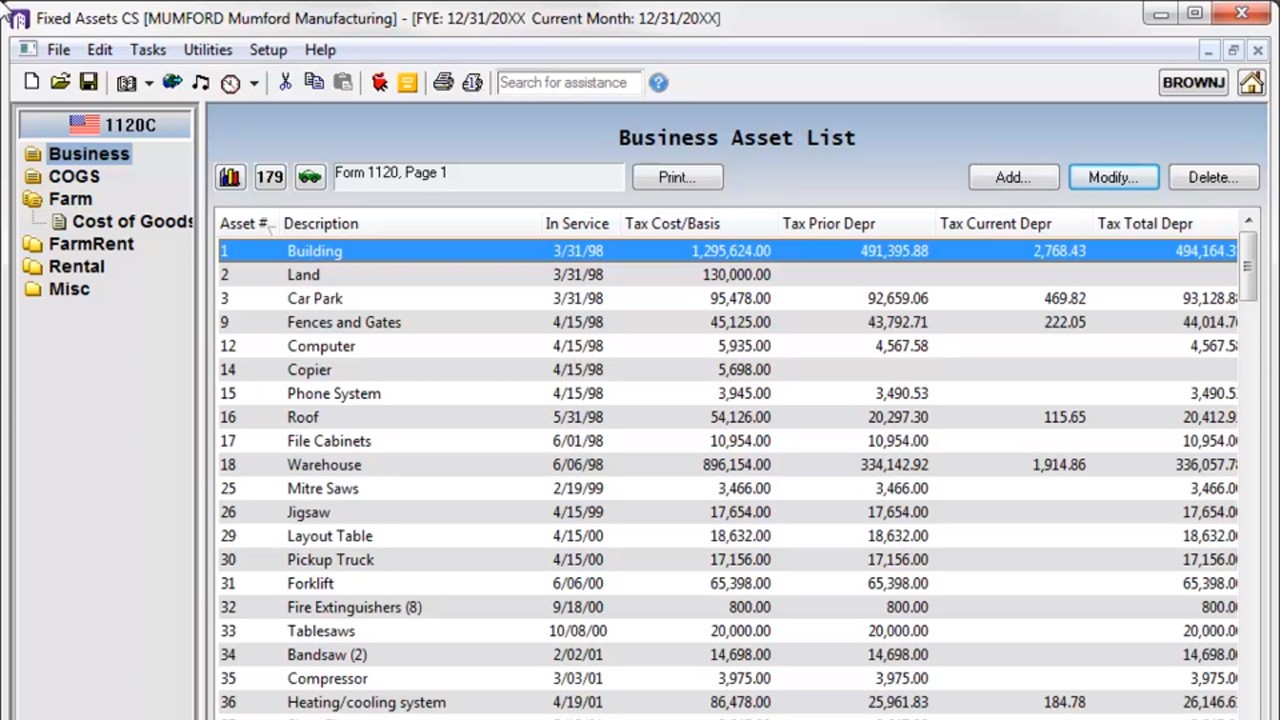

Fixed Asset Depreciation Accounting Software Fixed Assets Cs

What Fixed Asset Accounting Has To Do In A Business Asset Infinity

Fixed Assets Accountant Interview Questions

Bol Com Fixed Asset Accounting Steven M Bragg Boeken

Fixed Asset Accountant Resume John4279

What Is A Fixed Asset Definition And Example Goselfemployed Co Fixed Asset Finance Blog Asset

Accounting Tutorial Fixed Assets Training Lesson 3 7 Youtube

Assets In Accounting Identification Types And Learning How To Calculate Them

Learn Inventory And Physical Inventory In Sap Fixed Asset Accounting Zarantech

What Is Fixed Asset Everything You Need To Know About Fixed Assets

Governmental Accounting Fixed Assets Long Term Obligations Debt Control Groups Overview J E Youtube

Fixed Assets Accounting Abacus It Solutions

Fixed Asset Accountant Resume Samples Qwikresume

Q Tbn And9gcthliaxhldlbtv9kcptmaqkfqjmqmqf7hkcjquv8sii2hqsjxp9 Usqp Cau

Fixed Asset Life Cycle In Asset Accounting Powerpoint Slides Diagrams Themes For Ppt Presentations Graphic Ideas

What Is Fixed Asset Types Formula Calculation Methods

The Dos And Don Ts Of Fixed Asset Accounting Assertive Industries Inc

Fixed Asset Accounting Made Simple Netsuite

Jd Edwards Fixed Asset Accounting Oracle

Software Selection For Fixed Asset Accounting Peeriosity

Introduction To Jd Edwards Enterpriseone Fixed Assets

Fixed Asset Accountant Resume Samples Qwikresume

1

Fixed Assets Register Banana Accounting Software

Fixed Asset Trade In Double Entry Bookkeeping

Fixed Asset Accountant Resume Example Accountant Resumes Livecareer

18 Reviews Of Fixed Asset Accounting Systems Cpa Practice Advisor

Fixed Asset Accountant Resume Example Accountant Resumes Livecareer

Fixed Asset Software Fixed Assets Osas

Fixed Asset Accounting Overview And Best Practices Involved

.gif)

Fixed Assets Microsoft Docs

Fixed Asset Credit For Damages Double Entry Bookkeeping

Fixed Asset Modification Fc