Asset Accounting Definition

IAS 38 outlines the accounting requirements for intangible assets, which are nonmonetary assets which are without physical substance and identifiable (either being separable or arising from contractual or other legal rights) Intangible assets meeting the relevant recognition criteria are initially measured at cost, subsequently measured at cost or using the revaluation model, and amortised.

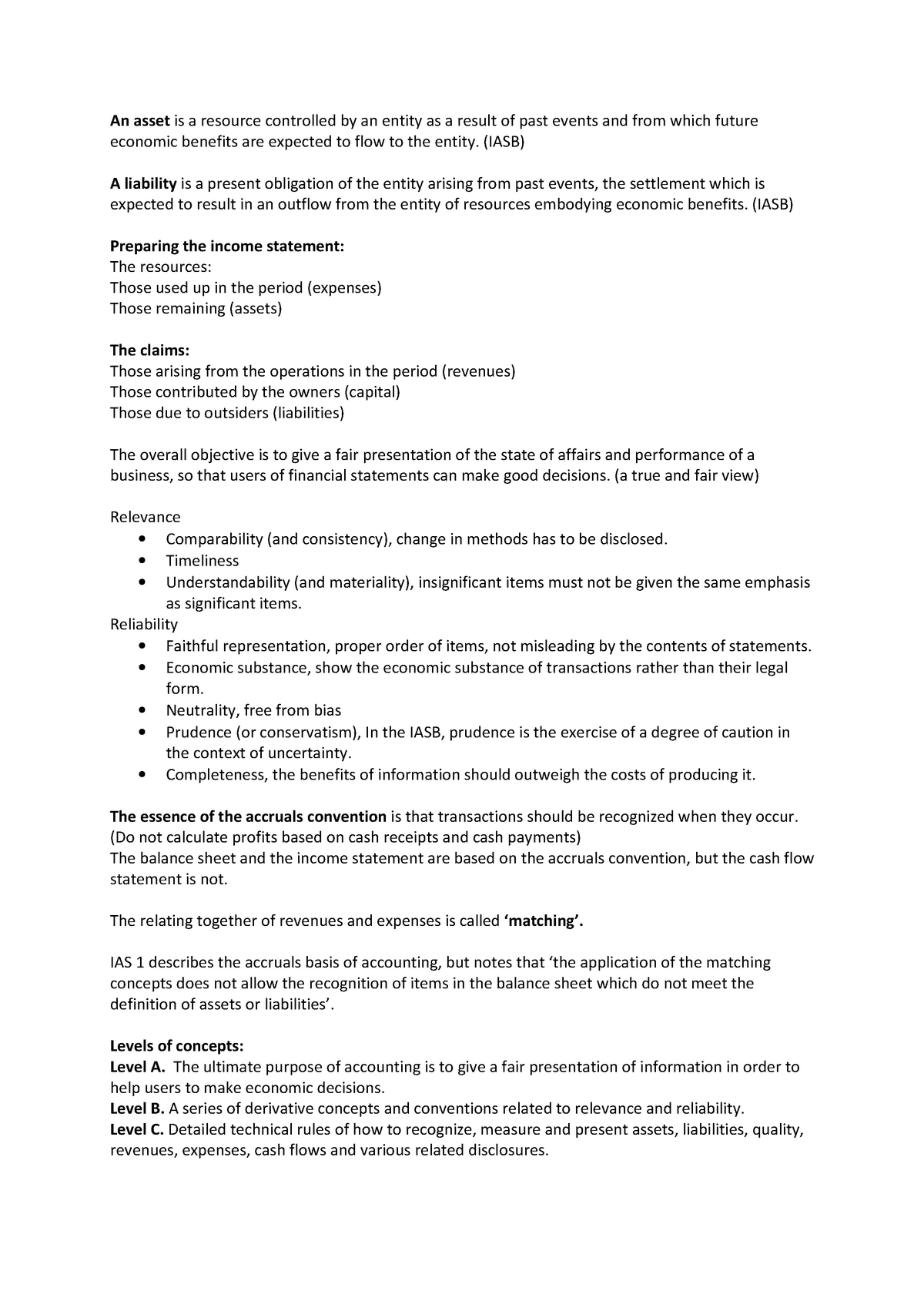

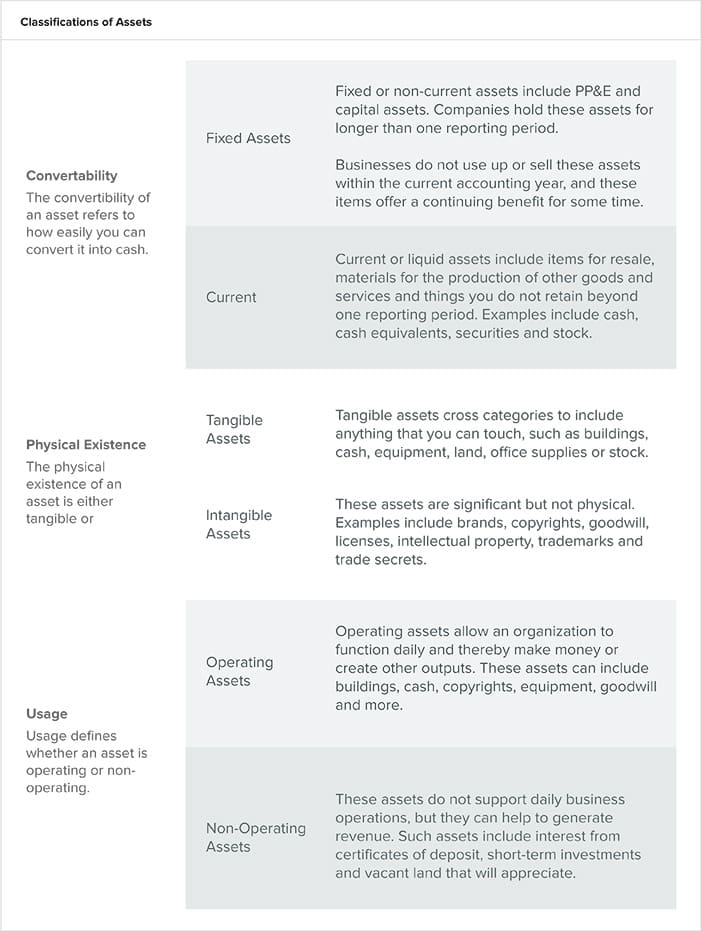

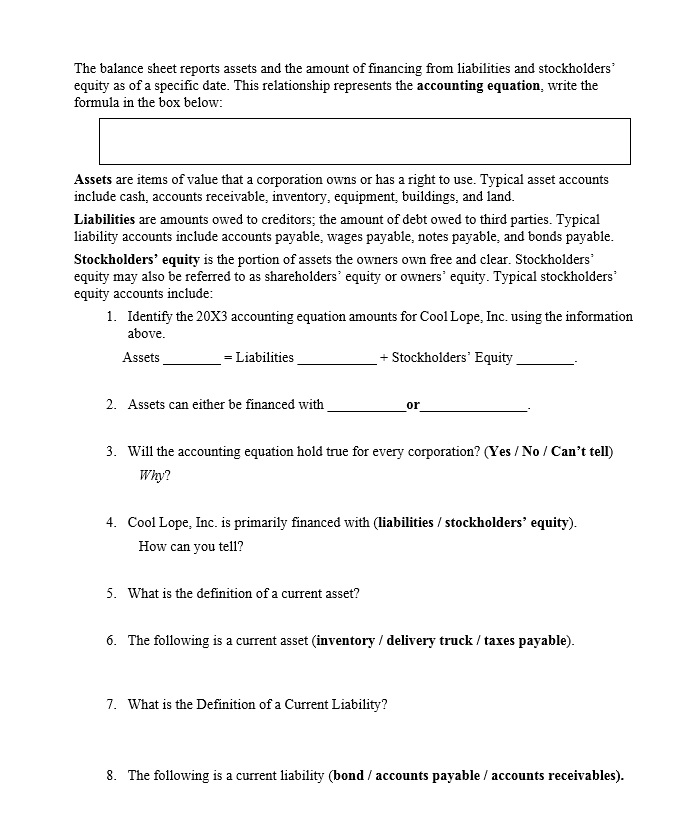

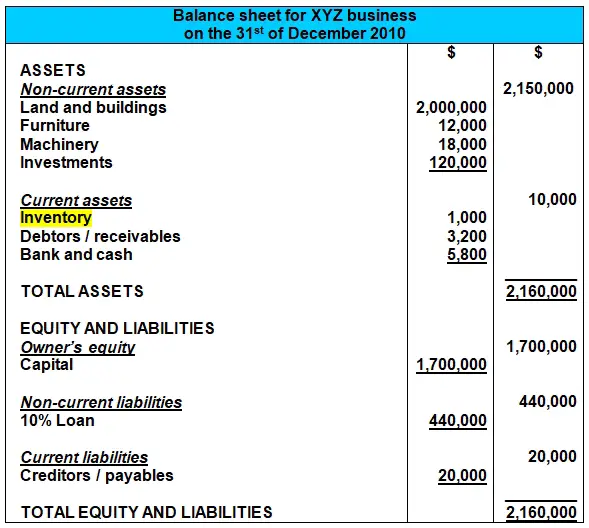

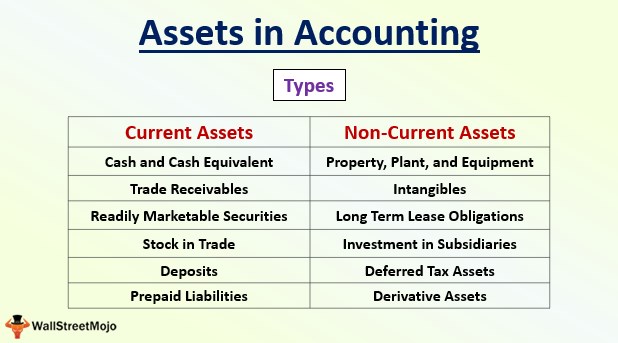

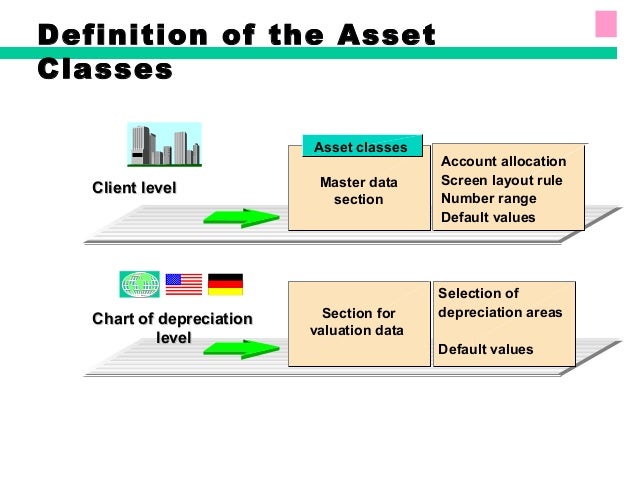

Asset accounting definition. Definition of Assets The General Accounting Plan (GCP) gives a definition of an asset that may seem rather abstract in the first place an asset is an identifiable element of the entity’s assets having a positive economic value for the entity, that is to say, An element generating a resource that the entity controls because of past events and from which it expects future economic benefits. Asset Accounting Configuration The Asset Accounting module 1 Organizational structures In this section, you define the features of the Asset Accounting organizational objects (chart of depreciation, FI company code, asset class) All assets in the system have to be assigned to these organizational objects that you define In this way,. Financial Assets Accounting Asset Definition In accounting, an asset has two criteria a company must own or control it, and it must be expected to generate future benefit for that company Assets on Balance Sheet A company records the value of its assets on the balance sheet Assets can be classified as current assets or as noncurrent assets.

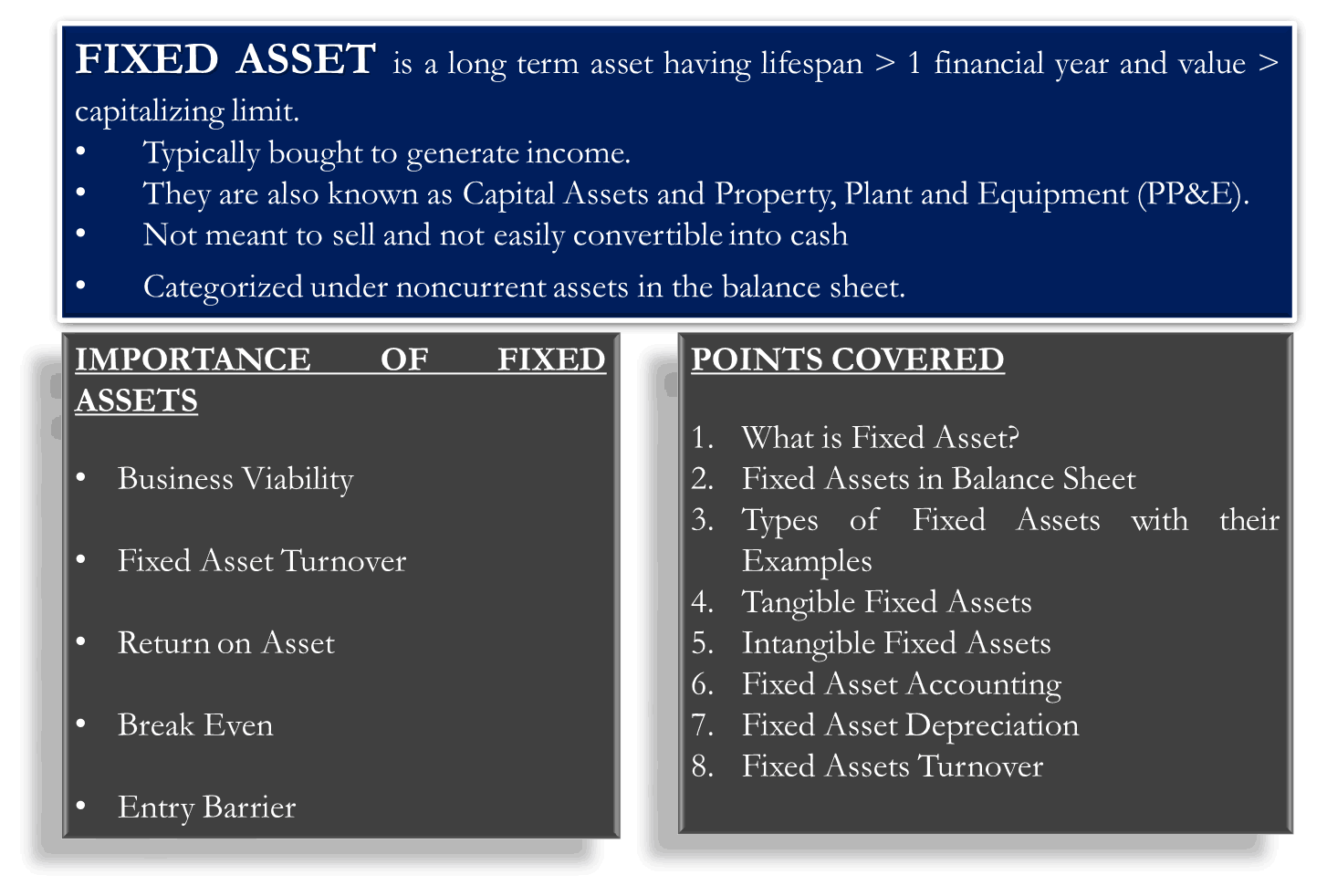

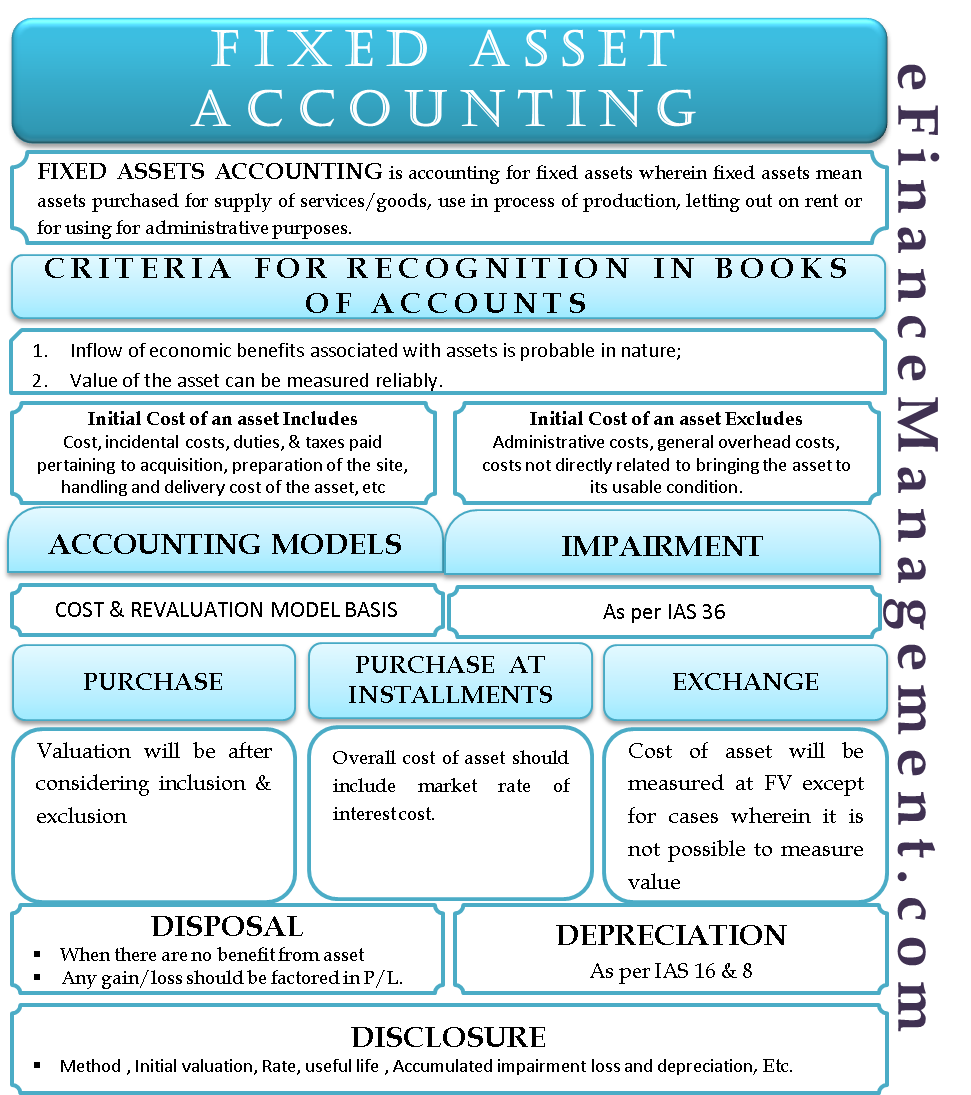

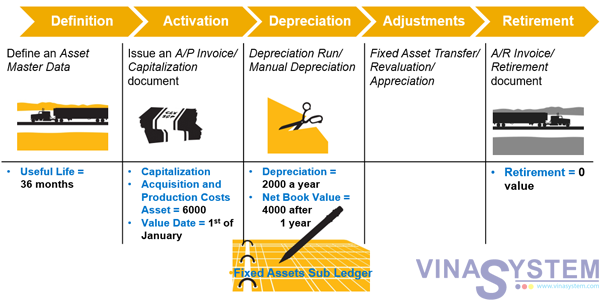

Required a) State, or otherwise explain, the accounting definition of an asset 2 marks b) Discuss (giving reasons for and against) if VEVO’s videos match the definition that you gave in part a) well enough to be shown as an asset in the Statement of Financial Position of i) VEVO;. Accounting Models for Measurement of Asset post its Initial Measurement Cost Model Basis The valuation of the asset is at its cost price less accumulated depreciation and impairment cost Revaluation Model Basis The valuation of the asset is the fair value less its subsequent depreciation and impairment. Fixed assets—also known as tangible assets or property, plant, and equipment (PP&E)—is an accounting term for assets and property that cannot be easily converted into cashThe word fixed indicates that these assets will not be used up, consumed, or sold in the current accounting year Yet there still can be confusion surrounding the accounting for fixed assets.

Definition Capital growth is the appreciation in the value of an asset over a period of time It is calculated by comparing the current value, sometimes known as market value of an asset or investment, to the amount paid when you originally bought it. Definition An asset is a resource that has some economic value to a company and can be used in a current or future period to generate revenues These resources take many forms from cash to buildings and are recorded on the balance sheet until they are used. Assets definition Things that are resources owned by a company and which have future economic value that can be measured and can be expressed in dollars Examples include cash, investments, accounts receivable, inventory, supplies, land, buildings, equipment, and vehicles Assets are reported on the balance sheet usually at cost or lower.

An asset is a resource with economic value that an individual, corporation, or country owns or controls with the expectation that it will provide a future benefit Assets are reported on a. Definition An asset is a resource that owned or controlled by a company and will provide a benefit in current and future periods for the business In other words, it’s something that a company owns or controls and can use to generate profits today and in the future What Does Asset Mean?. And ii) YouTube 12 marks c) YouTube and VEVO are both examples of brands.

What are Assets in Accounting?. Accounting Models for Measurement of Asset post its Initial Measurement Cost Model Basis The valuation of the asset is at its cost price less accumulated depreciation and impairment cost Revaluation Model Basis The valuation of the asset is the fair value less its subsequent depreciation and impairment. Since, by definition, an asset must be controlled by the entity in order for it to be recognized in the financial statements, certain ‘Assets’ would not qualify for recognition Consider a highly dedicated workforce Generally speaking, a hardworking and motivated workforce is the most valuable asset of any successful company.

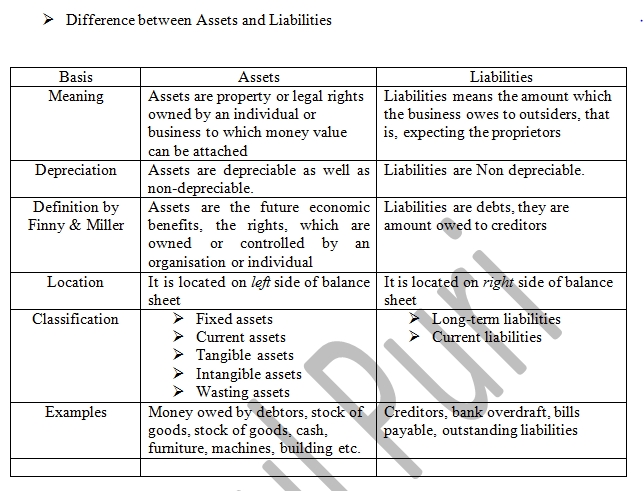

An asset is anything that will add future value to your business Asset Recognition Criteria in Accounting But the definition of assets above is not yet complete In accounting we have specific criteria which need to be fulfilled in order to recognize an asset in our accounting records. Definition & EXAMPLE The words “asset” and “liability” are two very common words in accounting/bookkeeping Some people simply say an asset is something you own and a liability is something you owe In other words, assets are good, and liabilities are bad. IAS 16 outlines the accounting treatment for most types of property, plant and equipment Property, plant and equipment is initially measured at its cost, subsequently measured either using a cost or revaluation model, and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life IAS 16 was reissued in December 03 and applies to annual periods.

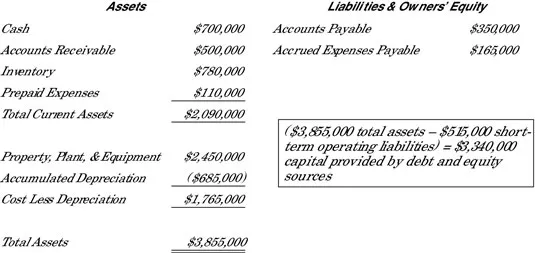

Definition of Assets In accounting and bookkeeping, a company's assets can be defined as Resources or things of value that are owned by a company as the result of company transactions Prepaid expenses that have not yet been used up or have not yet expired Costs that have a future value that can. From an accounting perspective, the asset definition is anything possessed by a person or company that is of value To define assets, they must be fully owned by the company and contribute to profitability in some way Learn more about common examples of assets and how they are measured. Financial Assets Accounting Asset Definition In accounting, an asset has two criteria a company must own or control it, and it must be expected to generate future benefit for that company Assets on Balance Sheet A company records the value of its assets on the balance sheet Assets can be classified as current assets or as noncurrent assets.

You should be familiar with the definition of an asset in a company and how to account for them on the balance sheet However, you may not know how an asset such as land with minerals is handled in accounting Depending on the company and its resource / asset in use, these methods reduce the value of the asset / resource which is taken into. From an accounting perspective, fixed assets – an item with a useful life greater than one reporting period, depreciated over time Fixed assets are also known as capital assets and tangible assets These are items that an organization purchases for longterm business purposes This is not inventory that business is planning to resell to make a profit, but rather an investment. Assets in accounting are the medium through which business can be undertaken, are either tangible or intangible and have a monetary value can be associated with it due to the economic benefits that can be derived from them.

Accounting (ACCG) definition A systematic way of recording and reporting financial transactions for a business or organization 3 Accounts payable (AP) Accounts payable (AP) definition The amount of money a company owes creditors (suppliers, etc) in return for goods and/or services they have delivered 4 Assets (fixed and current) (FA, CA). What is Asset Disposal?. Assets are economic resources controlled by a business which can potentially benefit its operations or are convertible to cash (cash itself is also an asset) Examples of Assets Following are the common assets of a business Cash Cash includes physical money such as bank notes and coins as well as amount deposited in bank for current use.

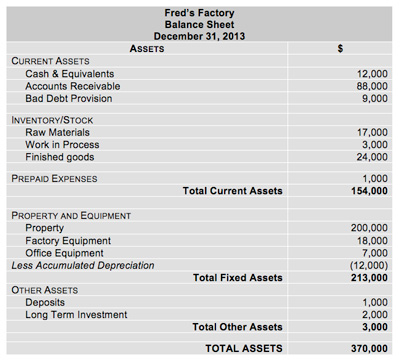

It is a contraasset account and is presented as a deduction to the related asset – accounts receivable Inventories – assets held for sale in the ordinary course of business Prepaid expenses – expenses paid in advance, such as, Prepaid Rent, Prepaid Insurance, Prepaid Advertising, and Office Supplies. Accounting Books Defining asset books is required for accounting entry processing Asset books are used to store financial information about assets such as cost history, depreciation rules, and retirement information An unlimited number of asset books per business unit can be defined The number of books that you use depends on your reporting. Asset disposal is the removal of a longterm asset from the company’s accounting records Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows These three core statements areIt is an important concept because capital assets are Types of Assets Common types of assets include current, non.

Definition of Assets In accounting and bookkeeping, a company's assets can be defined as Resources or things of value that are owned by a company as the result of company transactions Prepaid expenses that have not yet been used up or have not yet expired Costs that have a future value that can be measured. Definition Assets are resources that control by the entity and those resources are expected to have the economic inflow into the entity in the future Those assets included cash, account receivables, cares, computer equipment, land, building, and any other resources that control by the entity The balance sheet is one of five financial statements that report the entity’s financial. Fixed asset accounting relates to the accurate logging of financial data regarding fixed assets For this purpose, companies require details on a fixed asset’s procurement, depreciation, audits, disposal, and more.

The accounting model for longlived assets to be disposed of by sale is used for all longlived assets, whether previously held and used or newly acquired That accounting model retains the requirement of Statement 121 to measure a longlived asset classified as held for sale at the lower of its carrying amount or fair value less cost to sell. Example of Most Common Assets in Accounting #1 – Current Assets (Short Term in Nature) Cash It includes the bank balance and cash available in the business Temporary Investments It includes investment in short term money market instruments, debt instruments, mutual funds, or investment in the public equity of other businessesThe intent here is to park surplus cash in more productive. Capital assets are significant pieces of property such as homes, cars, investment properties, stocks, bonds, and even collectibles or art For businesses, a capital asset is an asset with a useful.

And ii) YouTube 12 marks c) YouTube and VEVO are both examples of brands. Accounting goodwill is the excess value of a firm’s net assets and is recorded at time of business acquisition or combination Goodwill is not associated with a physical object that the business owns, so it is an intangible asset and is listed on a company’s balance sheet. An asset is a possession of a business that will bring the business benefits in the future An asset is anything that will add future value to your business Asset Recognition Criteria in Accounting But the definition of assets above is not yet complete.

Required a) State, or otherwise explain, the accounting definition of an asset 2 marks b) Discuss (giving reasons for and against) if VEVO’s videos match the definition that you gave in part a) well enough to be shown as an asset in the Statement of Financial Position of i) VEVO;. The words “asset” and “liability” are two very common words in accounting/bookkeeping Assets are defined as resources that help generate profit in your business You have some control over it Liability is defined as obligations that your business needs to fulfill In simple words, Liability means credit. Financial assets can be categorized as either current or noncurrent assets on a company’s balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements These statements are key to both financial modeling and accounting Measurement of Financial Assets.

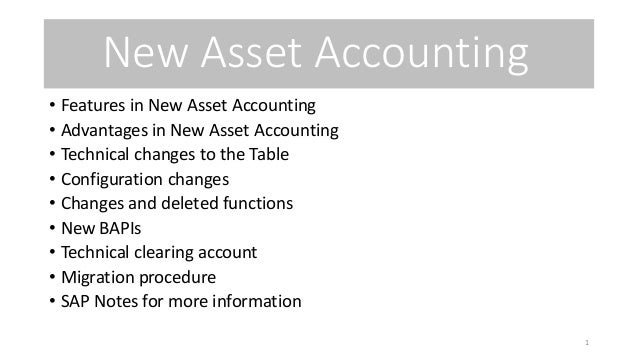

This blog is focused on New Asset accounting for ledger approach in multiple currency environment New Asset Accounting is the only Asset Accounting solution available in S/4 HANA, classic Asset Accounting is not available any more. Accounting Books Defining asset books is required for accounting entry processing Asset books are used to store financial information about assets such as cost history, depreciation rules, and retirement information An unlimited number of asset books per business unit can be defined The number of books that you use depends on your reporting. An asset is an expenditure that has utility through multiple future accounting periods If an expenditure does not have such utility, it is instead considered an expense For example, a company pays its electrical bill.

An asset group is a cluster of longlived assets that represents the lowest level at which cash flows can be identified that are independent of the cash flows generated by other clusters of assets and liabilities Related Courses Fixed Asset Accounting. Fixed assets are subject to depreciation to account for the loss in value as the assets are used, whereas intangibles are amortized 134 Fixed Asset Noncurrent Assets Definition. Asset an item or property which is owned by a business or individual and which has a money value Assets are of three main types physical assets such as plant and equipment, land, consumer durables (cars, etc);.

Assets are economic resources controlled by a business which can potentially benefit its operations or are convertible to cash (cash itself is also an asset) Examples of Assets Following are the common assets of a business Cash Cash includes physical money such as bank notes and coins as well as amount deposited in bank for current use. Assets in the accounting world, items that have monetary value and are owned by a business Tangible asset asset that has a physical form, such as a building. This accounting definition of assets necessarily excludes employees because, while they have the capacity to generate economic benefits, an employer cannot control an employee Similarly, in economics, an asset is any form in which wealth can be held.

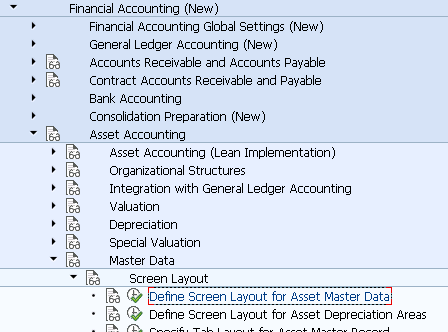

And ii) YouTube 12 marks c) YouTube and VEVO are both examples of brands. Capital Assets Accounting FAQs What is the definition of a capital asset?. Asset Accounting (FIAA) (New) Asset Accounting in the SAP system is used for managing and monitoring fixed assets In Financial Accounting, it serves as a subsidiary ledger to the general ledger, providing detailed information on transactions involving fixed assets.

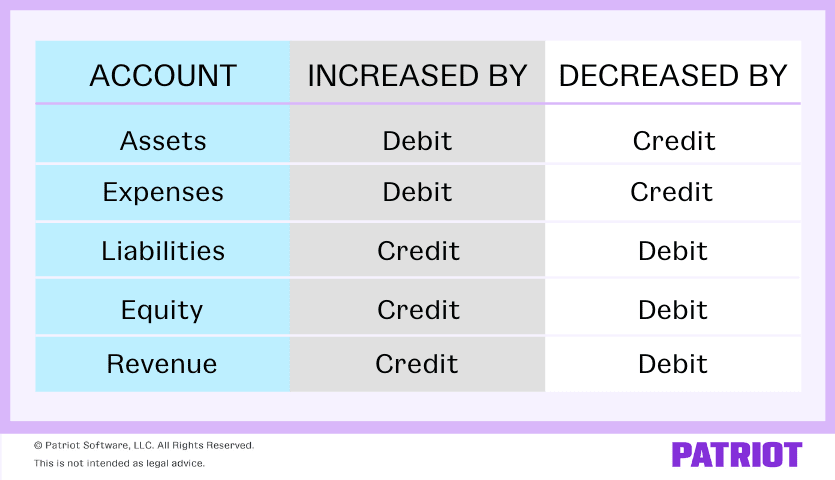

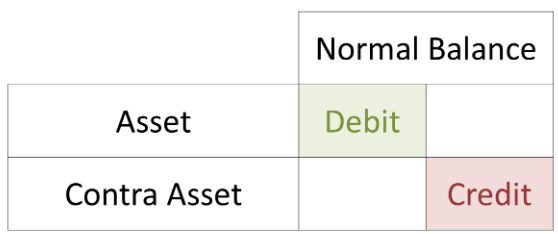

– Definition An asset is defined as a resource that is owned or controlled by a company that can be used to provide a future economic benefit In other words, assets are items that a company uses to generate future revenues or maintain its operations Assets accounts generally have a debit balance. Asset – definition and meaning In finance and accounting, an asset refers to anything of economic value that we own In fact, it is anything that a person finds useful or valuable Anything that we can convert to cash is probably an asset Assets are items that people, companies, or even a country owns or controls We also expect that assets. A liability is increased in the accounting records with a credit and decreased with a debit A liability can be considered a source of funds, since an amount owed to a third party is essentially borrowed cash that can then be used to support the asset base of a business.

In accounting, the company’s total equity value is the sum of owners equity—the value of the assets contributed by the owner(s)—and the total income that the company earns and retains Let’s consider a company whose total assets are valued at $1,000. Required a) State, or otherwise explain, the accounting definition of an asset 2 marks b) Discuss (giving reasons for and against) if VEVO’s videos match the definition that you gave in part a) well enough to be shown as an asset in the Statement of Financial Position of i) VEVO;. A Definition of Inventory Accounting Because inventory is a business asset , accountants must consistently and appropriately use an acceptable, valid method for assigning costs to inventory to record it as an asset.

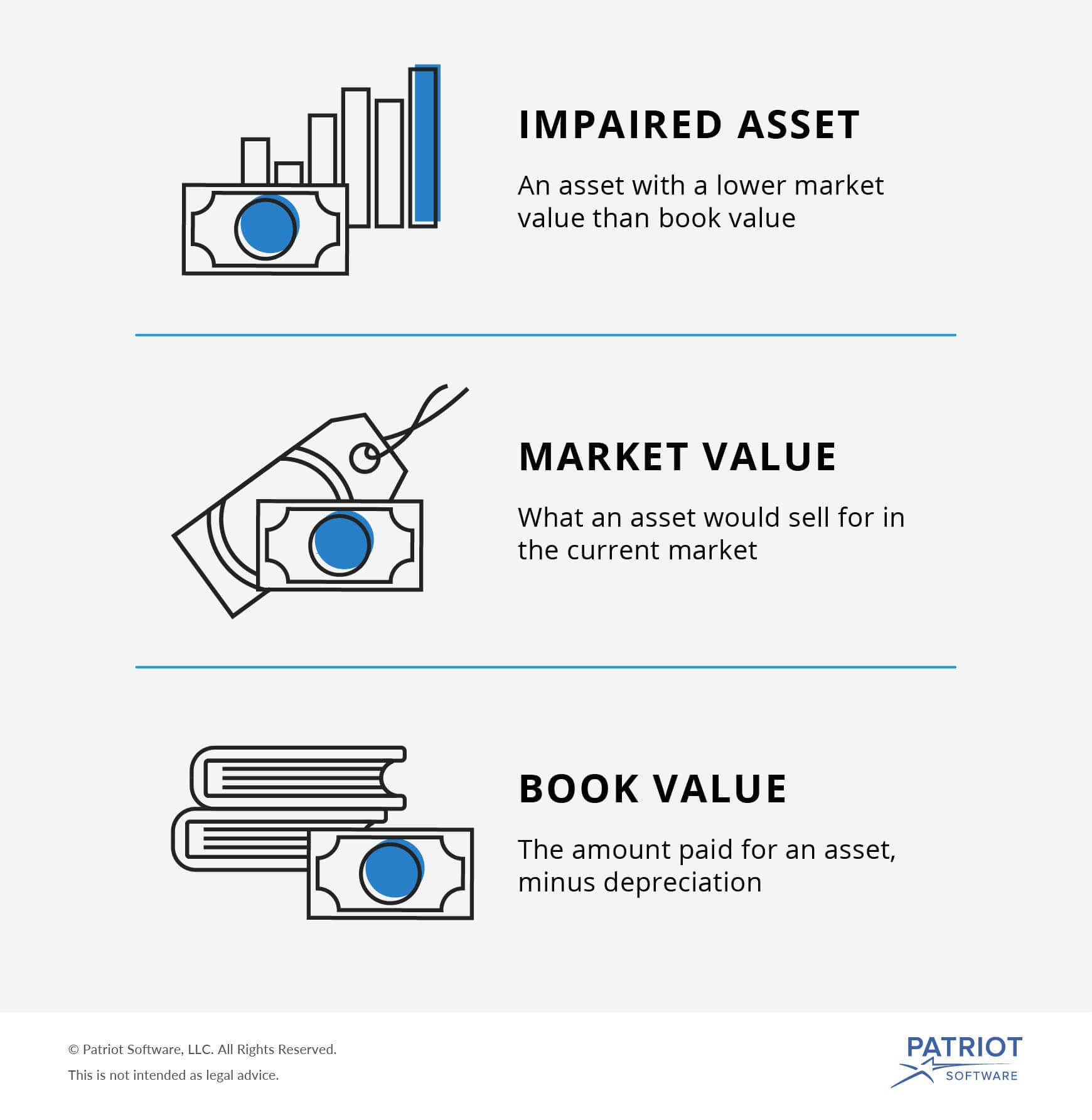

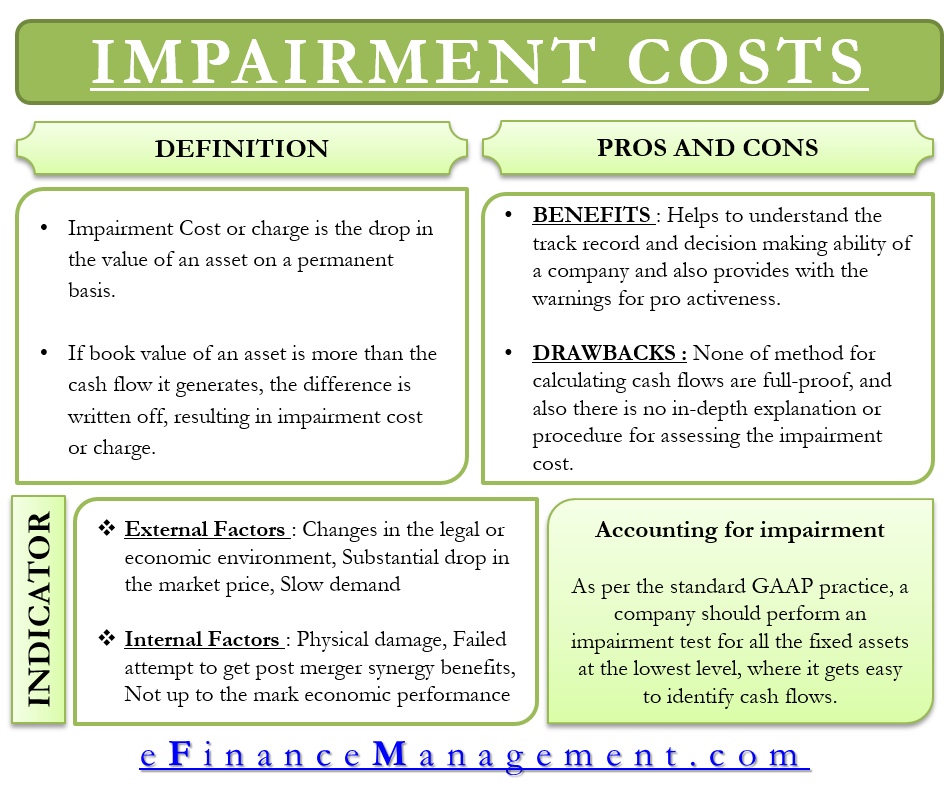

Impairment Of Assets What It Is How To Handle And More

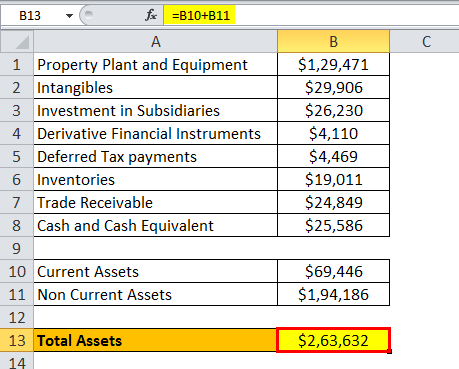

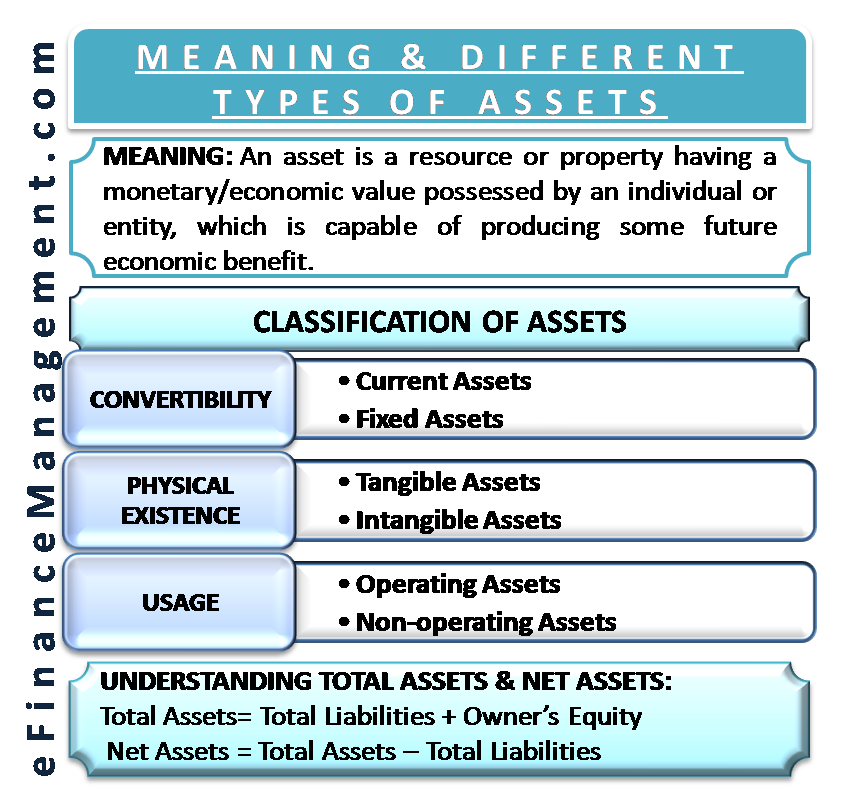

Assets In Accounting Definition Examples Of Assets On Balance Sheet

What Is The Difference Between Fixed Asset Write Off And Disposal Wikiaccounting

Asset Accounting Definition のギャラリー

1 Definition Of Accounting Variables Download Table

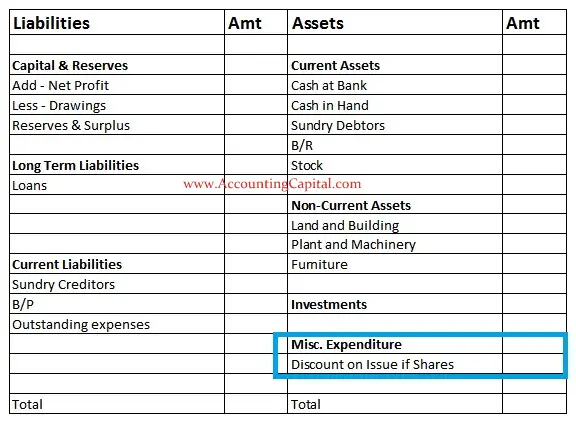

Fictitious Assets Meaning Examples Quiz Accountingcapital

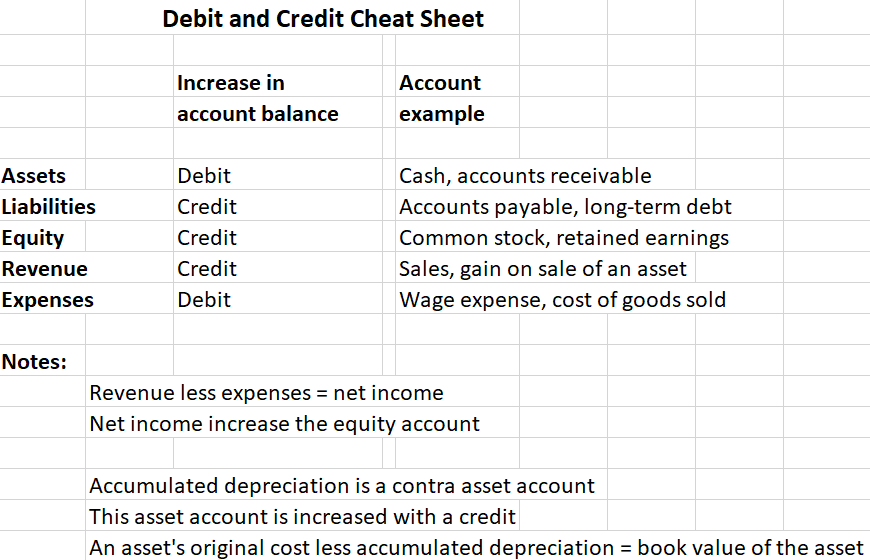

Debit Vs Credit

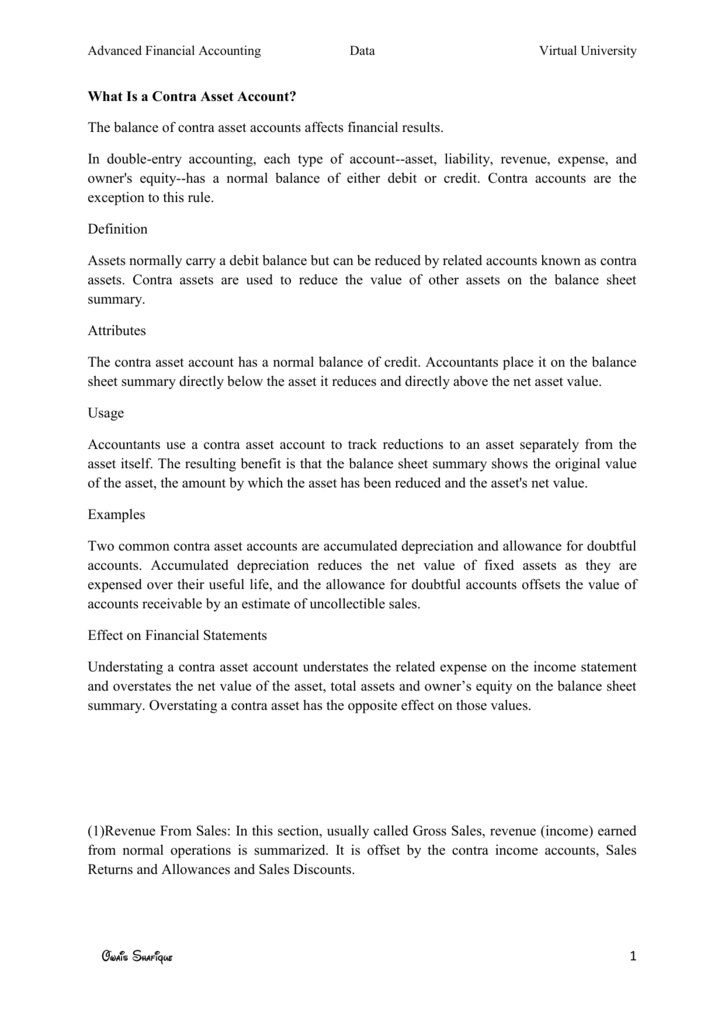

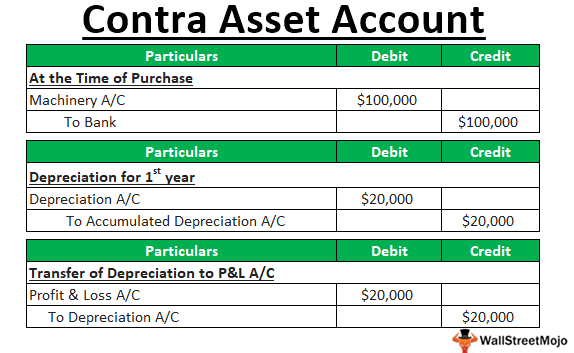

1 What Is A Contra Asset Account The Balance Of Contra Asset

Fixed Assets Definition Characteristics Examples

Q Tbn And9gcriogpcy0 Ejzq3lslu8fvth1ijguqwcla0n31kvwutfk9jqyxe Usqp Cau

The Definition Of Assets In Accounting

Fixed Assets In Accounting Definition List Top Examples

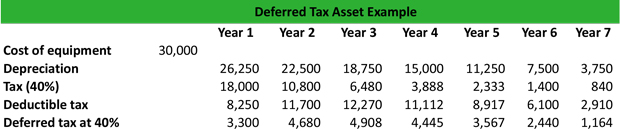

Define Deferred Tax Liability Or Asset Accounting Clarified

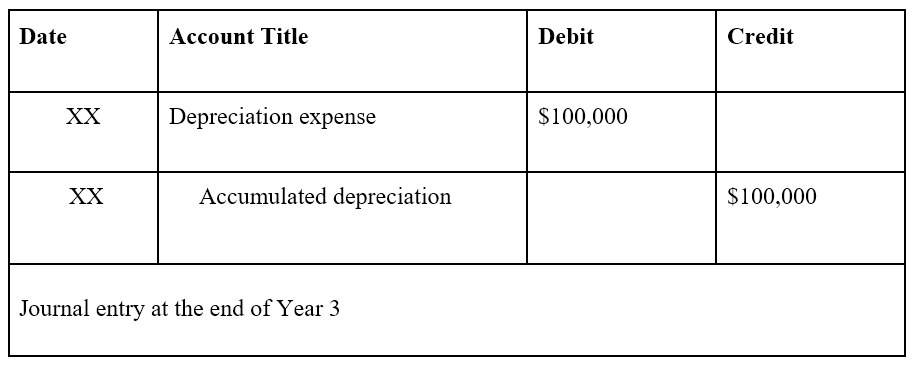

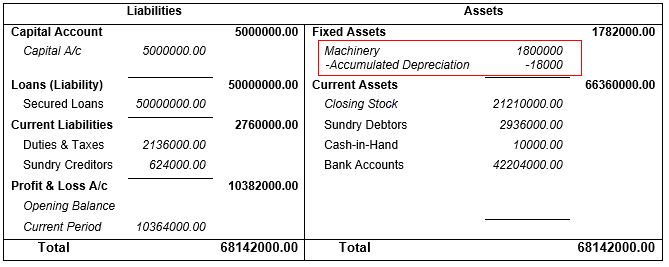

Sap Fixed Asset Configuration Presentation Updated bbbc867f D18a 41 A5f3 602af59bfe Fixed Asset Depreciation

Asset Definition What Are Assets Youtube

Contra Asset Examples How A Contra Asset Account Works

How To Create Asset Classes In Sap What Is An Asset Class

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

How Do Intangible Assets Show On A Balance Sheet

Difference Between Assets And Liabilities With Table Liability Asset Accounting Career

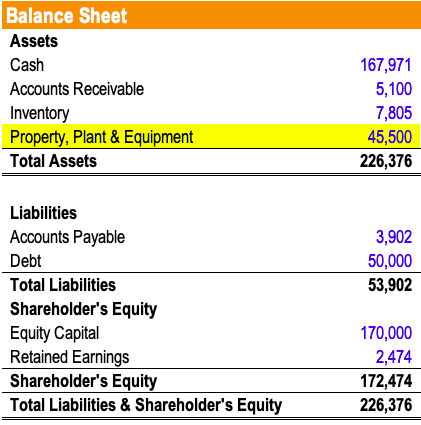

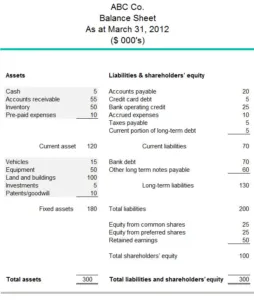

What Is A Balance Sheet Accountingcoach

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

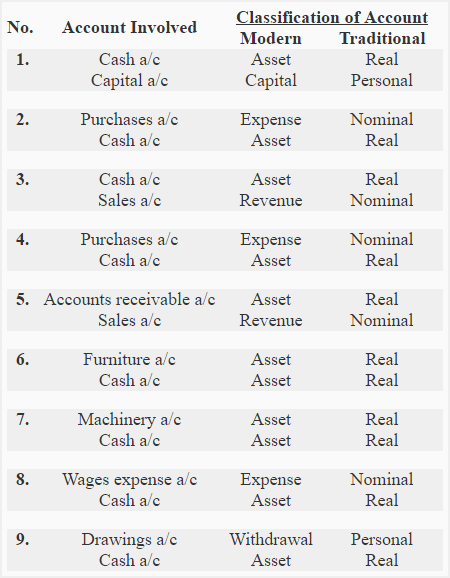

Classification Of Accounts Definition Explanation And Examples Accounting For Management

Fictitious Assets Meaning And Explanation Tutor S Tips

Asset Definition And Meaning Market Business News

Current Assets Meaning Examples Quiz Accountingcapital

What Is The Difference Between Fixed Asset Write Off And Disposal Wikiaccounting

Slow Adoption Progress Of Asc 842 Leases Slow Adoption Progress Of Asc 842 Leases Audit Analyticsaudit Analytics

What Is A Fixed Asset Definition And Example Goselfemployed Co Fixed Asset Finance Blog Asset

Assets Balance Sheet Definition

Total Assets Definition Explanation Video Lesson Transcript Study Com

Principles Of Natural Capital Accounting Office For National Statistics

Level 3 Assets Definition Business Accounting

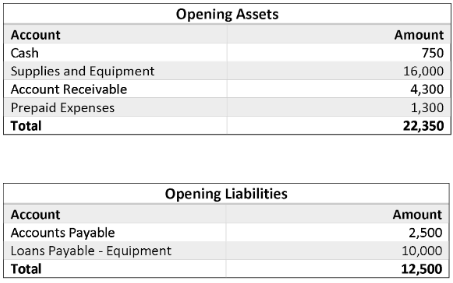

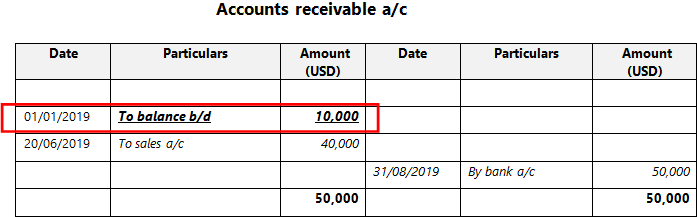

Opening Entry In Accounting Definition And Example Bookstime

Definitions For Accounting Studeersnel

Accounting Transparency And Governance The Heritage Assets Problem Emerald Insight

Q Tbn And9gct7i2xmciw5ftvktfmoudk8 Ewcvgp035uraasncdmezclyreh1 Usqp Cau

An Overview Of Nineteen Years Of Changes In Accounting Estimates An Overview Of Nineteen Years Of Changes In Accounting Estimates Audit Analyticsaudit Analytics

Net Assets Formula Definition Investinganswers

Total Assets Definition Explanation Video Lesson Transcript Study Com

Fixed Assets In Accounting Definition List Top Examples

2

What Is A Deferred Tax Asset Definition Meaning Example

Sample Chart Of Accounts For A Small Company Accountingcoach

Fixed Asset Accounting Made Simple Netsuite

What Is Operating Fixed Assets Definition Of Fixed Asset

Balance Brought Down Vs Balance Carried Down Definitions Explanations Differences Termscompared

Types Of Accounts In Accounting Assets Expenses Liabilities More

Asset Definition Assignment Point

What Are Fixed Assets Type Tangible Intangible Accounting Dep

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

Current And Noncurrent Assets The Difference

What Is A Contra Asset Account Definition And Example Accounting Services

2

Solved Activity 2 Balance Sheet Purpose 1 Understand Chegg Com

Asset Definition Accounting Terminology Acounting Definition 3 Youtube

Oracle Assets User Guide

What Is The Accounting Equation Overview Formula And Example Bookstime

What Are Current Assets Definition Meaning List Examples Formula Types

Financial Statements Overview Objectives Double Entry Accounting

Accounting Terms And Definitions

Contra Asset Account Definition List Examples With Accounting Entry

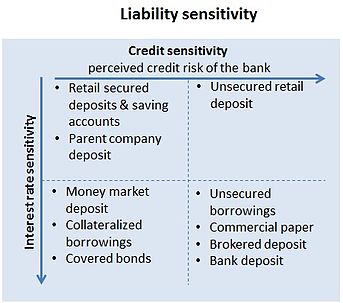

Asset And Liability Management Wikipedia

Fixed Asset Accounting Examples Journal Entries Dep Disclosure

What Is Assets And Current Assets Definition With Examples

2

Prepaid Expenses Definition Example Financial Edge Training

What Are Assets Definition Types And Examples

Statement Of Financial Position Nonprofit Accounting Basics

Balance Sheet Meaning Formula Format Types

The Basics Of Accounting Boundless Accounting

Depreciation Wikipedia

What Is Inventory

Debit And Credit In Accounting Double Entry System

Define Screen Layout For Asset Master Data S Alr

Liquidation Basis Accounting And Reporting The Cpa Journal

Understanding Net Worth Ag Decision Maker

Assets And Liabilities Difference Meaning Classification Videos

What Is A Fixed Asset Definition Types Formula Examples List

Sap Fixed Asset Configuration Presentation Updated bbbc867f D18a 41 A5f3 602af59bfe Fixed Asset Depreciation

1

Assets In Accounting Definition Examples Of Assets On Balance Sheet

Lease Accounting Operating Vs Financing Leases Examples

Accounting For Company Statement Of Financial Position Assets Ppt Download

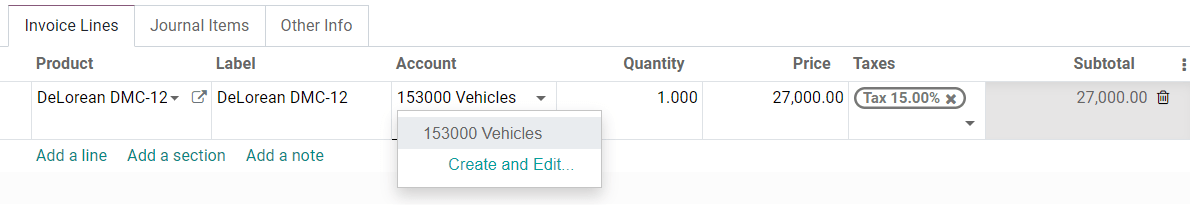

Non Current Assets And Fixed Assets Odoo 14 0 Documentation

Impairment Cost Meaning Benefits Indicators And More

Definition And Classification Of Assets In The Revised Seea Ppt Download

What Is Contra Account And Its Importance Tally Solutions

Connolly International Financial Accounting And Reporting 4 Th Edition Chapter 9 Intangible Assets Ppt Download

Assets In Accounting Definition Examples Of Assets On Balance Sheet

Definition Of Accounting

What Is An Intangible Asset A Simple Definition For Small Business With Examples

Meaning And Different Types Of Assets Classification More

New Business Definition Eases M A Accounting

The Basics Of Accounting Boundless Accounting

Current Assets Definition Types And Examples Tally Solutions

:max_bytes(150000):strip_icc()/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

Long Term Assets Definition

Fixed Assets In Sap Business One Introduction

Fixed Asset Induction Process From An Accounting Perspective Oracle Erp Financials Workout

What Does Asset Mean In Accounting

Definition Of Accounting

New Asset Accounting In S4 Hana

Confluence Mobile Community Wiki

Sap Fixed Assets Accounting