Variation Margin

A covered swap entity shall comply with the variation margin requirements described in paragraph (a) of this section on each business day, for a period beginning on or before the business day following the day of execution and ending on the date the noncleared swap or noncleared security based swap terminates or expires.

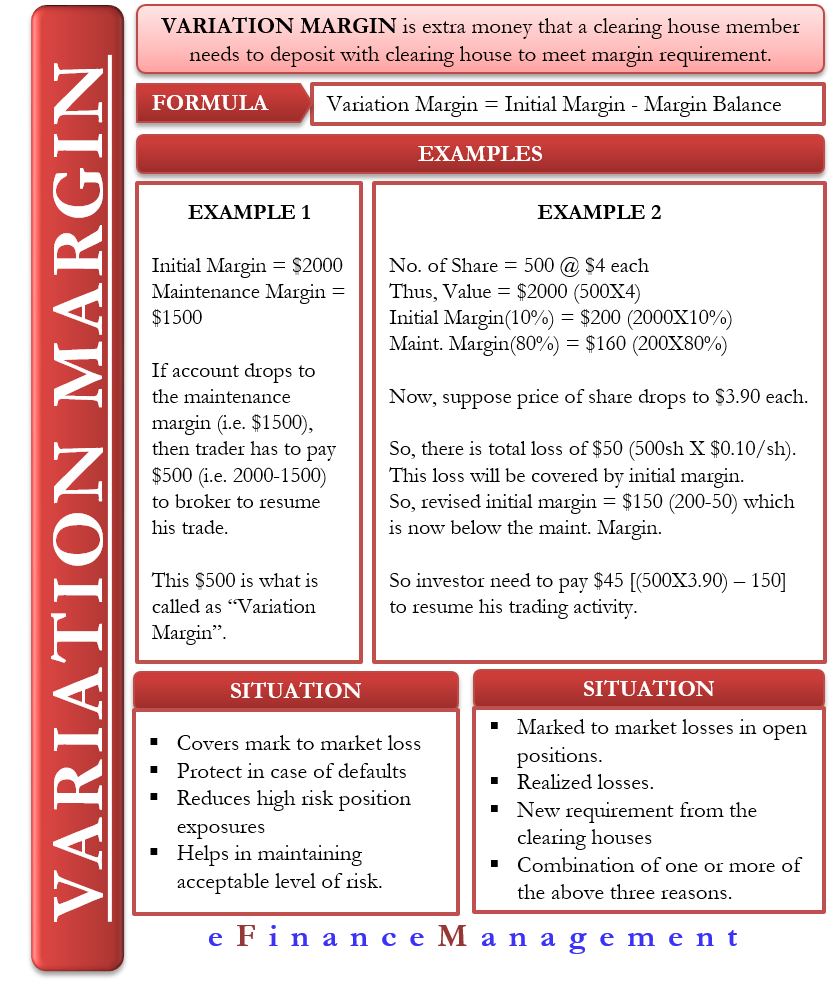

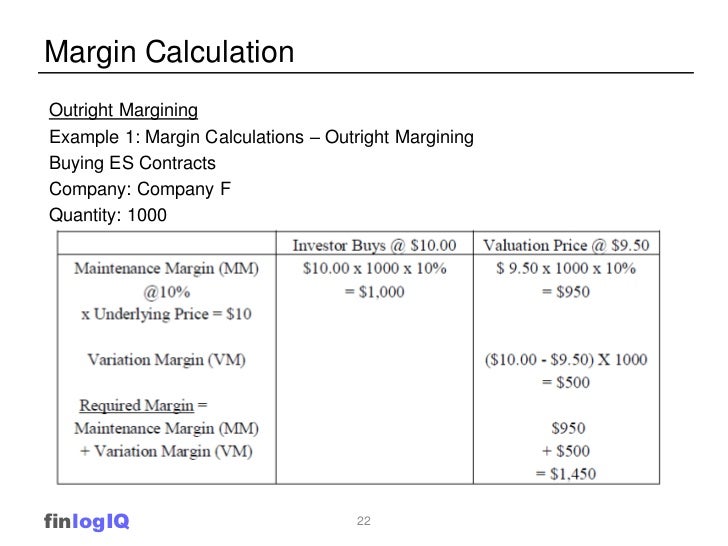

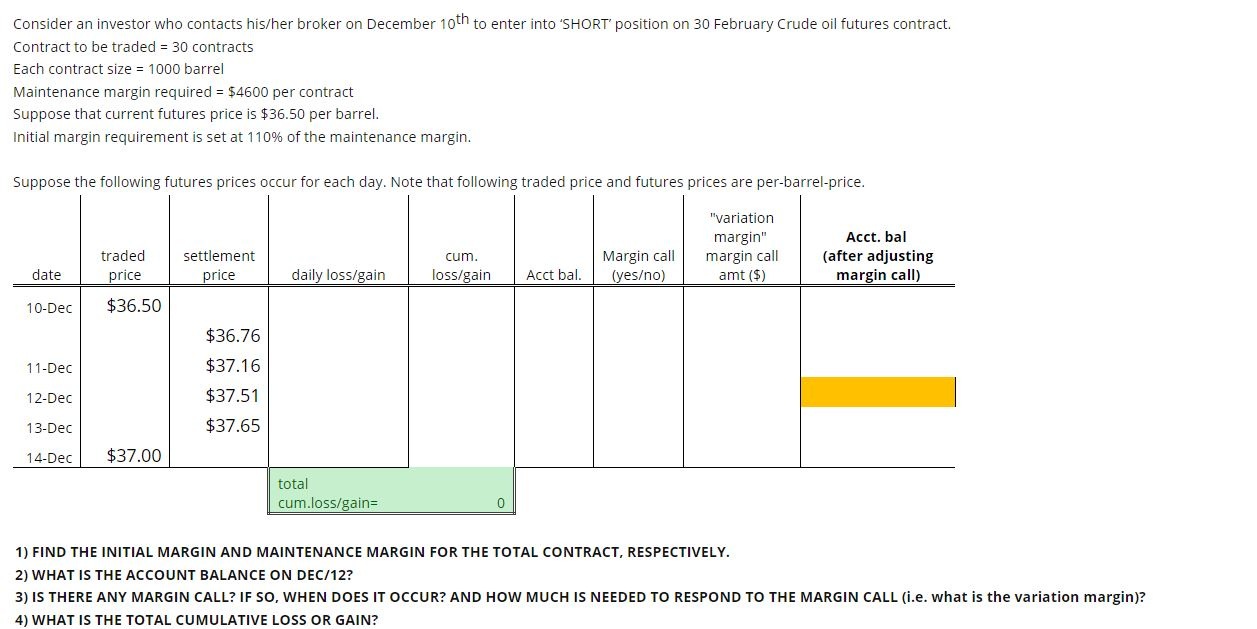

Variation margin. Variation Margin or maintenance margin represents additional requirements, unrealized profit (or loss) on open positions or transactions Total Margin = Initial margin Variation margin Initial and variation margin in stocks and futures trading. Initial Margin vs Variation Margin Del back al front office by Juan Manuel Lopez in Blog La nueva regulación de las operaciones de derivados ha cambiado la forma como éstas se realizan y sobre todo, la forma como se pactan y operan sus garantías. Variation margin is the profits or losses on open positions in futures and options contracts which are paid or collected daily.

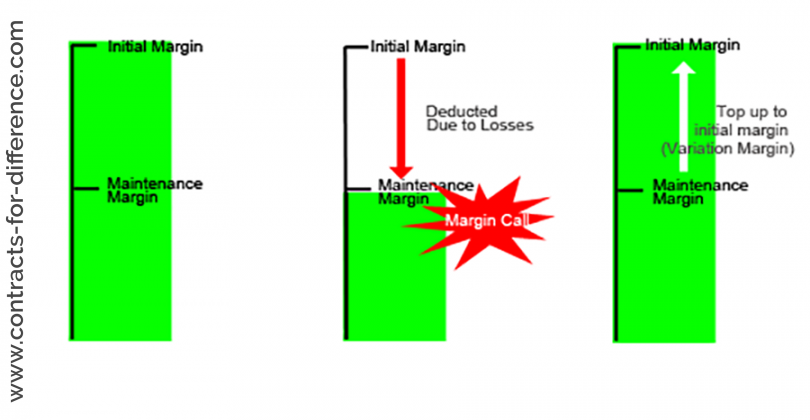

Variation margin An additional required deposit to bring an investor's equity account up to the margin level when the balance falls below the maintenance margin requirement Most Popular Terms. Variation Margin Extra money that a member of a clearing house must pay to the clearing house to meet its minimum maintenance requirements Members pay the variation margin each day or more often to protect the clearing house from the risks inherent to its members buying on margin Farlex Financial Dictionary © 12 Farlex, Inc. For any other noncleared swap or noncleared securitybased swap between a covered swap entity and a counterparty that is neither a financial end user nor a swap entity, the covered swap entity shall collect variation margin at such times and in such forms and such amounts (if any), that the covered swap entity determines appropriately addresses the credit risk posed by the counterparty and the risks of such noncleared swap or noncleared securitybased swap.

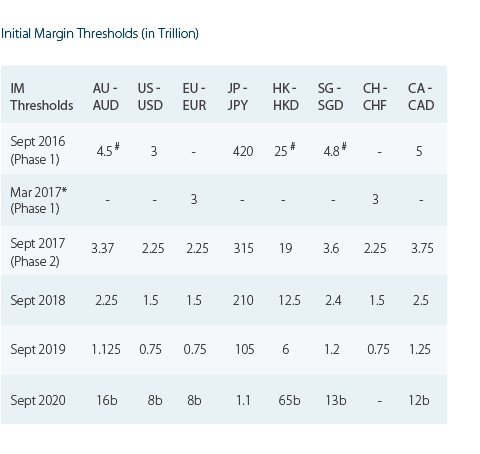

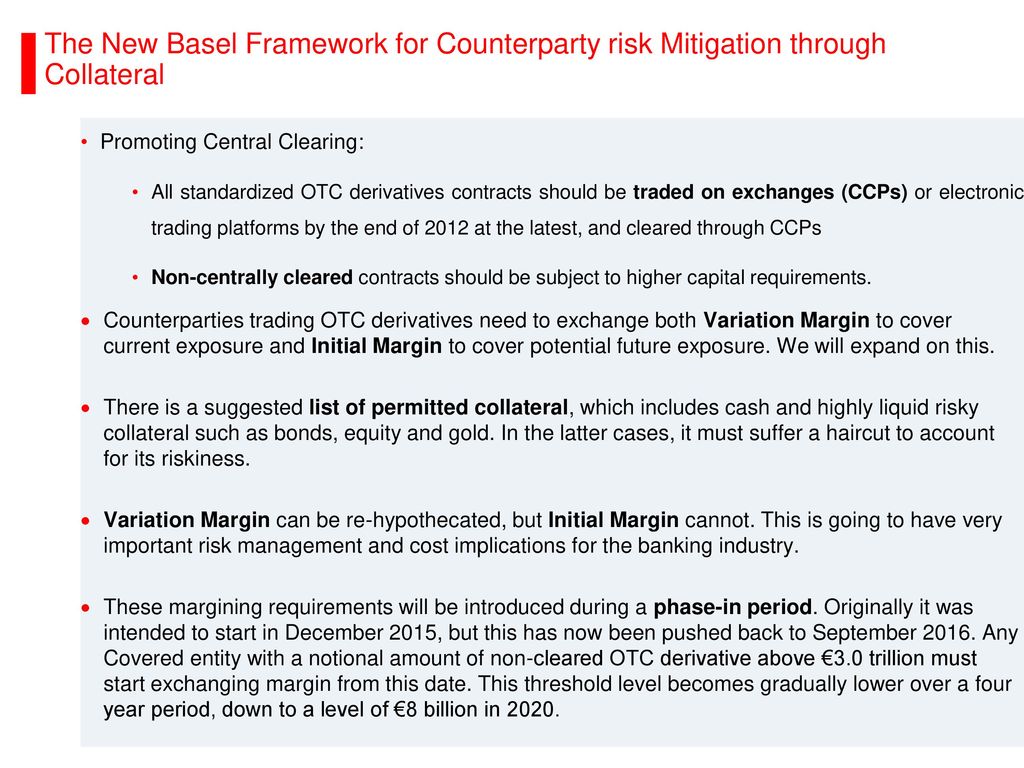

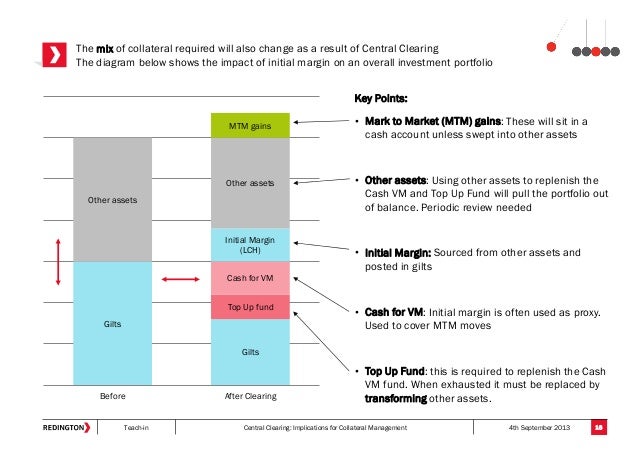

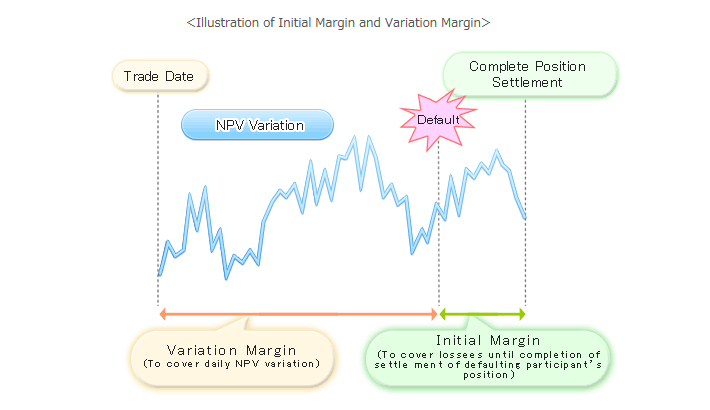

Variation margin (VM) In derivatives markets, variation margin is one of two types of collateral required to protect parties to a contract in the event of default by the other counterparty It provides for changes in the market value of the trade or a portfolio of trades VM payments are usually made daily, in cash, from the party whose position has lost value to the party whose position has gained value. Net presentation – If variation margin cash flows are viewed as “settlement”, then they should be considered within the same “unit of account” as the outstanding derivative, itself, for purposes of valuation and presentation This means that the variation margin payments should be presented “net” with the derivative and the resulting fair value of the combined instrument should generally be zero, or an amount close to zero, each day. These rules incorporate compliance dates that depend on the type of margin (initial or variation), the types of counterparties and, generally, the volume of transactions entered into by the counterparties The first of these compliance dates, which applies to trades between the largest derivatives users, is September 1, 16.

The ISDA 16 Variation Margin Protocol is designed to help market participants comply with new rules on margin for uncleared swaps, by providing a scalable solution to amend derivatives contract documentation with multiple counterparties. —Variation margin is recorded separate from the fair value of the derivative asset or liability —Market exposure is not reset or extinguished by the transfer of collateral —Some entities separately recognize interest income or expense related to variation margin amounts. When you buy stocks on margin, your broker lends you money for a portion of the purchase price To make sure you can repay your debt, regulators require you to keep a maintenance margin, or a minimum amount of equity in your account Equity is the portion of your stocks’ value that you don’t owe your broker similar.

Presumably, if the variation margin payments represent settlement and, therefore, derivatives carry a fair value of zero (or close to zero), the capital charge for these instruments will be significantly reduced compared to its previous treatment. The variation margin is a percentage of the total position size and the amount required will cover the adverse movement in the value of your position On the other hand, if you have a short position and the price falls, you would receive a variation margin equal to the positive movement in the value of the position. Variation Margin means Omnibus Variation Margin, Segregated Variation Margin and/or Variation Margin (as used in Chapter I Part 4 of the Clearing Conditions for the purposes of the ISA Provisions), as the context requires Sample 1 Sample 2 Sample 3.

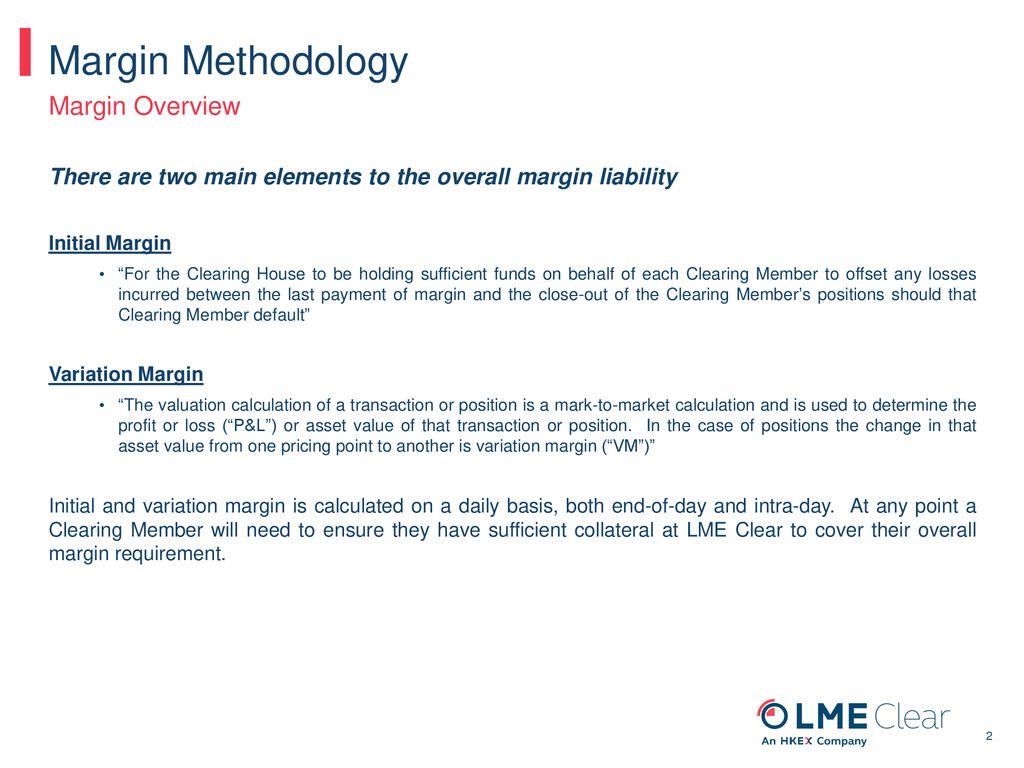

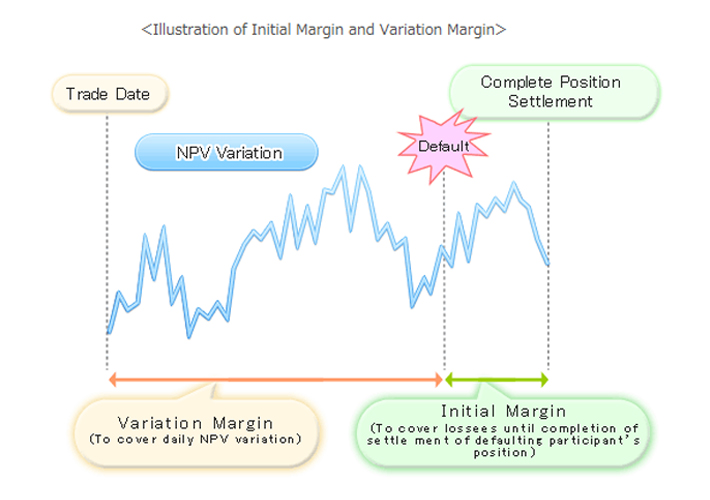

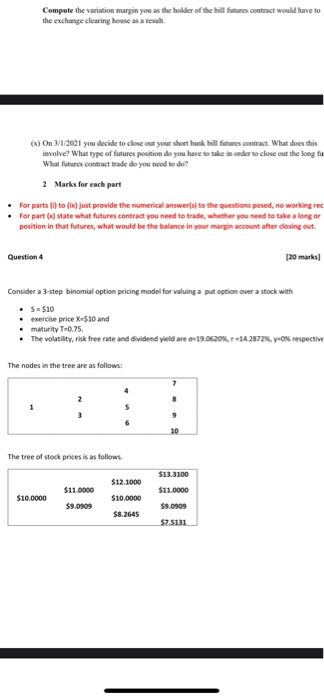

3) Variation Margin Suppose you do the trade, eg, assume buy one futures contract, at the closing price of the day One contract and you put in your margin of $5,000 The next day, the market might move slightly against you, so you lose $300 That is OK, as the exchange still has $4,700 remaining of the money you put up as initial margin. Margin (initial and variation) The amount that the holder of a financial instrument has to deposit (with their broker or exchange) to cover some or all of the risk associated with that instrument Variation margin covers daytoday changes in instrument marktomarket market values, and initial margin covers potential losses in excess of posted variation margin in the event of counterparty default. Variation margin provides protection to a party against the market value losses that could otherwise be incurred upon the default of its counterparty Posting of variation margin is aimed at ensuring that the exposure to a counterparty will be limited to the exposures due to market movement between margin calls.

Figure 3 shows Variation margin that needs to be paid or received on a given day to each of four counterparties;. Variation Margin reflects the daily change in market value of the contracts, ie the daily gain or loss of a contract due to market movements. In the context of reporting, variation margin means margins collected or paid out to reflect current exposures resulting from actual changes in market price, in turn, i nitial margin means margins collected by the counterparty to cover potential future exposure to the other counterparty providing the margin in the interval between the last margin collection and the liquidation of positions following a default of the other counterparty (see here further details on initial margin and variation.

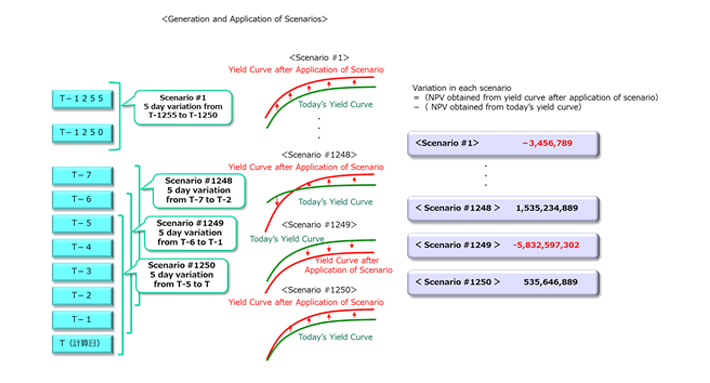

Variation margin is called so because its amount varies from case to case It is the amount that brings back the margin to the initial margin level after losses lower it to the maintenance margin level Such a margin payment is usually made daily and in cash. Variation Margin means the amount payable by a Clearing Member to the Clearing House or by the Clearing House to a Clearing Member, as applicable, in respect of, and in the amount of, the Clearing House’s variation margin requirements (as published from time to time by the Clearing House) in respect of a Contract and with reference to the change in the NPV of such Contract over a particular period of time. Variation Margin Collateral posted under a derivatives transaction to cover a party's exposure to its counterparty under the transaction due to Movements in the value of the parties' positions under the transaction Any changes to the value of collateral posted in connection with the transaction Typically the party acting as valuation agent under to the applicable ISDA® credit support annex (CSA) calculates marktomarket movements in the parties' trading positions as well as the value.

Margin is the equivalent of a 'good faith' deposit It's a small percentage, usually between 2% and 30%, of the value of the contract that is deposited with a provider and is required to open a position The amount varies according to the financial asset you're betting on volatile assets require a larger margin. Under the STM construct, the variation margin payments are partial settlements of the derivative contract but do not result in the modification or termination of the derivative contract Questions also arose regarding the application of the shortcut method to assess hedge effectiveness and measure ineffectiveness of these derivative contracts under ASC 815 through. This requirement is commonly referred to as posting or exchanging variation margin ("VM") Effective March 1, 17, the VM requirement to post margin collateral under EMIR will apply to most counterparties entering into OTC derivatives with EU financial institutions.

Sometimes referred to as a market to market margin, the variation margin involves additional deposits of assets when market fluctuations demonstrate a higher degree of volatility Variation margins are submitted to the clearinghouse handled the transactions by the clearing member The payment of a variation margin may occur on a daily basis or a less frequent but consistent schedule, based on the degree of volatility connected with the investment. Initial Margin & Variation Margin for OTC Derivatives Outline In March 17 Variation Margin (VM) requirements for noncleared derivatives went live Counterparts entering into any noncleared derivative trades with a notional value of $500k must agree and exchange VM bilaterally daily. Variation Margin Collateral posted under a derivatives transaction to cover a party's exposure to its counterparty under the transaction due to Movements in the value of the parties' positions under the transaction Any changes to the value of collateral posted in connection with the transaction.

The introduction of an "optout" from variation margin (VM) requirements applicable to physicallysettled FX swaps and physicallysettled FX forwards except where both counterparties are credit institutions or investment firms under the Capital Requirements Regulation (CRR)3, or thirdcountry equivalents;. The term variation margin refers to a margin payment made by a clearing member to a clearinghouse based on the price movements of futures contracts Futures Contract A futures contract is an agreement to buy or sell an underlying asset at a later date for a predetermined price It’s also known as a derivative because future contracts derive their value from an underlying asset. Variation margin transfer is not required below a certain amount Transfers below a Minimum Transfer Amount (MTA) are not required For instance, under the EU regime, there is a minimum amount of EUR500,000 which may be shared across VM and IM It may all be allocated to VM if IM is not applicable.

Variation margin transfer is not required below a certain amount Transfers below a Minimum Transfer Amount (MTA) are not required For instance, under the EU regime, there is a minimum amount of EUR500,000 which may be shared across VM and IM It may all be allocated to VM if IM is not applicable. Variation margin (or marking to market) the Eurosystem requires that a specified margin be maintained over time on the underlying assets used in its liquidityproviding reverse transactions. The first is variation margin (VM), which covers current exposure and is calculated using a marktomarket position The second is initial margin (IM), which covers potential future exposure for the expected time between the last VM exchange and the liquidation of positions on the default of a counterparty.

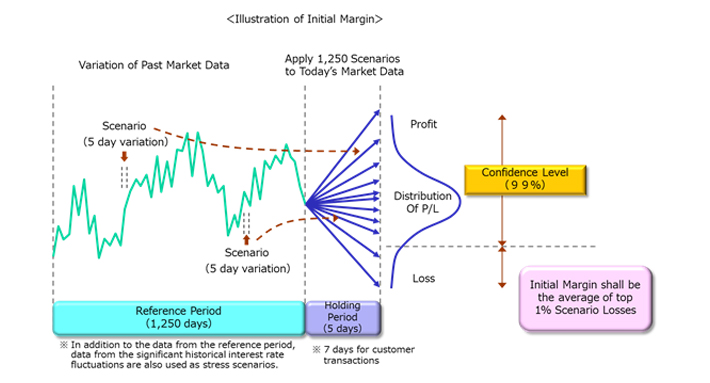

The 16 ISDA Credit Support Annex for Variation Margin (VM) (Title Transfer – French law) is an updated version of the 1995 ISDA Credit Support Annex (Title Transfer – French law) that is limited to variation margin, and allows parties to establish variation margin arrangements that meet the requirements of new regulations on margin for uncleared swaps. Scanning Risk The Scanning Risk is a worstcase portfolio loss based on the net position Scanning Ranges, Volatility Shifts and Intercurrency Shifts are all part of the Scanning. In March 17 Variation Margin (VM) requirements for noncleared derivatives went live Counterparts entering into any noncleared derivative trades with a notional value of $500k must agree and exchange VM bilaterally daily.

Rather, variation margin is deemed to “settle outstanding exposure” between them (with no right to reclaim or obligation to return the variation margin) and, after that settlement, the marktomarket between the parties resets to zero. Initial margin is the amount required to buy a stock on margin, while maintenance margin is the equity needed to keep the position open. Variation Margin refers to the difference between the initial margin and the margin needed to keep the position open as the position value changes For instance, if the initial margin for gold is $2,000 and the maintenance margin is $1,500, you would need to have $2,000 allocated from your account as initial margin to trade the gold contract.

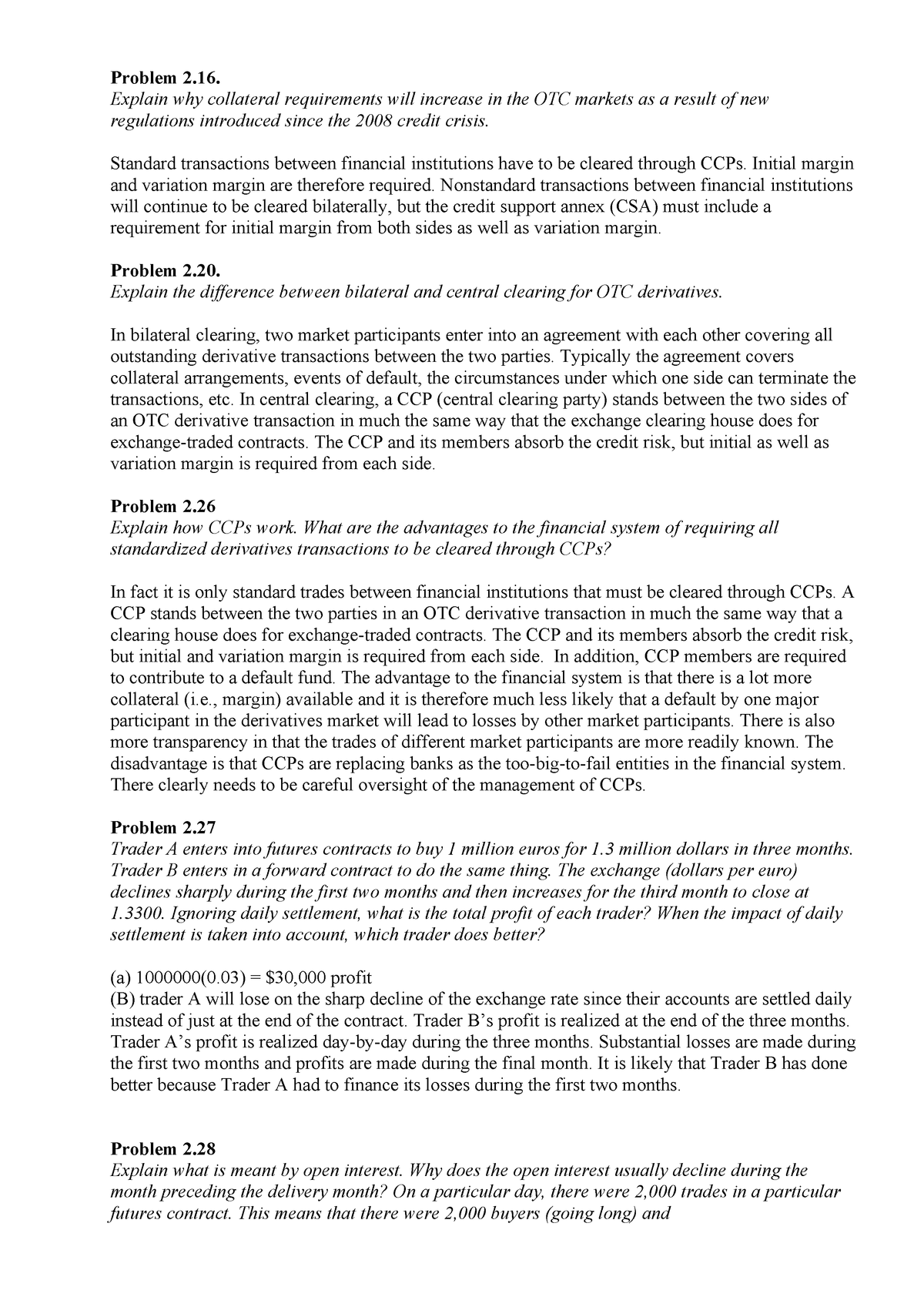

Initial margin can be viewed as a kind of deposit 'to open the trade The initial margin is basically the amount of money you are required to have in available funds in your account in order to open a trade, variation margin is the amount of money you are required to deposit to keep the trade open should your account run into negative. Variation margin is used to bring the capital in an account up to the margin level This margin, and the associated initial and maintenance margin, must be sustained by liquid funds allowing it to. —Variation margin is recorded separate from the fair value of the derivative asset or liability —Market exposure is not reset or extinguished by the transfer of collateral —Some entities separately recognize interest income or expense related to variation margin amounts.

In regulated futures markets, where the most wellestablished margining practices have long precedent, both cash and selected noncash securities are permissible for initial margin, but variation margin settlements must be satisfied exclusively in cash. Variation Margin Collateral posted under a derivatives transaction to cover a party's exposure to its counterparty under the transaction due to Movements in the value of the parties' positions under the transaction Any changes to the value of collateral posted in connection with the transaction. In a typical futures contract, the margin rate varies between 3% and 12% of the total contract value 5 For example, the buyer of a contract of wheat futures might only have to post $1,700 in margin Assuming a total contract of $32,500 ($650 x 5,000 bushels) the futures margin would amount to around 5% of the contract value.

Initial Margin vs Variation Margin Del back al front office by Juan Manuel Lopez in Blog La nueva regulación de las operaciones de derivados ha cambiado la forma como éstas se realizan y sobre todo, la forma como se pactan y operan sus garantías. Initial Margin Calculation SPAN utilises the margin parameters to calculate the Initial Margin SPAN splits the Initial Margin calculation into four components;. Variation margin requirements for physically settled FX forwards — EMIR update On 24 November 17, the European Supervisory Authorities (" ESAs ") issued a statement 28 on the variation margin requirements in respect of physically settled FX forwards under Commission Delegated Regulation (EU) 16/2251 of 4 October 16 with regard to riskmitigation techniques for OTC derivative contracts not cleared by a central counterparty 29 (the " Margin Rules " and, as the Margin Rules apply to.

When variation margin is treated as a settlement, gains or losses from derivatives are entirely reflected in the trading entity’s cash balance position, and simultaneously the derivatives carrying value reverts to a zero balance with each variation settlement. The ISDA 16 Variation Margin Protocol is designed to help market participants comply with new rules on margin for uncleared swaps, by providing a scalable solution to amend derivatives contract documentation with multiple counterparties. Variation margin provides protection to a party against the market value losses that could otherwise be incurred upon the default of its counterparty Posting of variation margin is aimed at ensuring that the exposure to a counterparty will be limited to the exposures due to market movement between margin calls.

Variation margin requirements for physically settled FX forwards — EMIR update On 24 November 17, the European Supervisory Authorities (" ESAs ") issued a statement 28 on the variation margin requirements in respect of physically settled FX forwards under Commission Delegated Regulation (EU) 16/2251 of 4 October 16 with regard to riskmitigation techniques for OTC derivative contracts not cleared by a central counterparty 29 (the " Margin Rules " and, as the Margin Rules apply to. A to D, the total of If these same position were all cleared at one CCP, the net variation margin payment would also be $35 million, so However for IM, the situation is very. Variation Margin, also known as Mark To Market Margin, is additional amount of cash you are required to deposit to your futures trading account after your futures position have taken sufficient losses to bring it below the "Maintenance Margin" Futures traders are typically required to provide variation margin through "Margin Calls".

Under the STM approach, variation margin reflects daily “gain” to the receiving party that is actually settled Despite the settlement of the gain on a daily basis, the derivative’s underlying economic terms remain the same (in other words, there is no amendment or recouponing of the trade). Evaluate your cleared margin requirements using our interactive margin calculator Education Home Now live ESG solutions Manage the risk associated with renewable energies, environmental change and sustainable investments Create a CMEGroupcom Account More features, more insights. Article Index 1 The posting counterparty shall provide the variation margin as follows (a) within the same business day of the 2 The provision of variation margin in accordance with paragraph 1 (b) may only be applied to the following.

Initial margin is intended to buffer against a potential counterparty default while variation margin may move on a daily basis reflecting the changing value of a swaps contract Although most fund managers already post variation margin for their uncleared swap trades, they will now have to do so following the specific rules imposed by either US or foreign regulators. Under the STM construct, the variation margin payments are partial settlements of the derivative contract but do not result in the modification or termination of the derivative contract. Sometimes referred to as a market to market margin, the variation margin involves additional deposits of assets when market fluctuations demonstrate a higher degree of volatility Variation margins are submitted to the clearinghouse handled the transactions by the clearing member.

Variation Margin Overview Margin Call And Rules

Iris Im Vm

Uncleared Otc Derivatives Margin Reforms And Implications For Counterparties

Variation Margin のギャラリー

Isda Margin Survey End 18 Behind The Numbers Margin Tonic

Cfa Tutorial Derivatives Maintenance Margin Settlement Fund Variation Margin Youtube

Cfds And Variation Margins Contracts For Difference Com

.png?la=en&hash=1AD9F9436B14A69218AFCF04608F6577AA73E2D7)

Variation Margin Margin Call

Impact Of Initial Margin Requirements And Margin Valuation Adjustment Ppt Download

What Is Variation Margin Definition By All Finance Terms

Download For A Practical Guide To The 16 Isda R Credit Support An

Pdf Initial Margin For Non Centrally Cleared Otc Derivatives Overview Modelling And Calibration Semantic Scholar

Margining Ppt Download

Www Ftfnews Com Wp Content Uploads 16 04 David Mengle 1 Pdf

Pdf Contagion In Derivatives Markets Semantic Scholar

Variation Margin Bionic Turtle

The Collateral Management Challenge In Europe Bnp Paribas Securities Services

Distribution Of Net Variation Margin Paid To Jse Clear By Clearing Download Scientific Diagram

Swaps Data Cleared Vs Non Cleared Margin Risk Net

Q Tbn And9gctax2tiq9p1i5z6hwgw42hijh 4uu6aaeaiasqkerhy8jt9 25 Usqp Cau

Outline Of Cds Margin Japan Securities Clearing Corporation

Margin Japan Securities Clearing Corporation

Initial Margin Emissions Euets Com

No Margin For Error Making The Margin Requirements For Non Cleared Otc Derivatives Happen Financial Services Uk

Cfds And Variation Margins Contracts For Difference Com

Variation Margin By Futurestradingpedia Com

Hester Bais Zowel De Margin Variation Margin Werd Geleend Door Bank Zelf Met Effectenkrediet Lang Leve De Liquiditeitscrisis Als De Remaining Margin Bewijs Dat Er Dagelijks Marginbewaking Plaatsvond Zijn

Margin Japan Securities Clearing Corporation

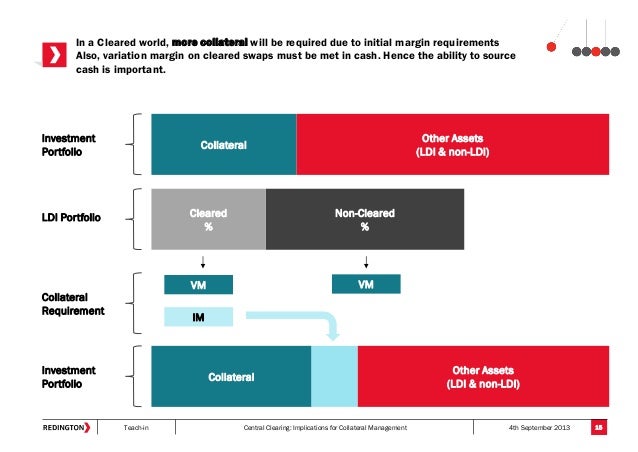

Central Clearing Implications For Collateral Management

Margin For Otc Derivatives October 16 Ashurst

Zerodha Margin A Comprehensive Guide About Margin

The Deadline For Compliance With The U S Variation Margin Rules Is Approaching Are You Ready Eversheds Sutherland Us Llp Jdsupra

Variation Margin Is Which Of The Following A The Difference In Margin Between Course Hero

Www Isda Org A Tkkde Market Guidance On Vm Csa Pdf

The Collateral Management Challenge In Europe Bnp Paribas Securities Services

Solved Compute The Variation Margin You As The Holder Of Chegg Com

Collateralization In Derivatives Initial And Variation Margin At The Download Scientific Diagram

Why Fcms Don T Like Intraday Margin Calls

Futures Market Ice Announces Changes To Intra Day Variation Margin Procedures Comunicaffe International

Cfa Level I Calculation Of Variation Margin Youtube

No Margin For Error Making The Margin Requirements For Non Cleared Otc Derivatives Happen Financial Services Uk

Emir Variation Margin Rules Effective March 1 17 Insights Jones Day

Collateral And Payment Japan Securities Clearing Corporation

Comparison Of The Variation Margin Of Glucose Insulin And Inflammatory Download Scientific Diagram

Variation Margin Meaning Example Importance And More

Kwm What A Marginal Relief Margin Dates Announced

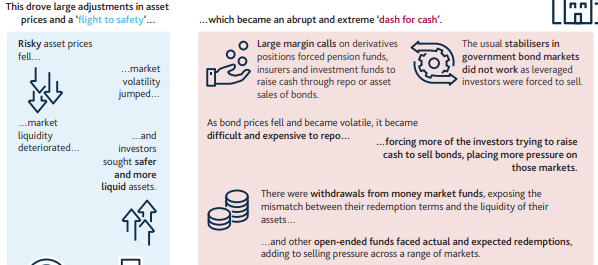

Margin Calls During Covid 19

Distribution Of Net Variation Margin Paid To Jse Clear By Clearing Download Scientific Diagram

Www Cmegroup Com Trading Interest Rates Files Treasuryfuturespriceroundingconventions Mar 24 Final Pdf

Margins Bmeclearing

Derivatives Related Liquidity Risk Facing Investment Funds

Chapter 18 Notes 12 08 05

Element Variationmargin Local Xml Schema Documentation

Q Tbn And9gcrbxverut9excnzwuphliyzpvriv Cfhunboaucjxkveckbskvm Usqp Cau

Collateralization In Derivatives Initial And Variation Margin At The Download Scientific Diagram

Why Fcms Don T Like Intraday Margin Calls

Permanent Exemption From Variation Margin Obligation For Fx Forwards Abbl

Boe Blog What Role Did Margin Play During The Covid 19 Shock Finadium

Final Us Rules On Margin For Non Cleared Swaps

Swaps Data Breaking Down Ccps 750 Billion Funding Bill Risk Net

Philip Stafford The Daily Variation Margin Calls Were About Five Times Bigger Than Normal

Outline Of Irs Margin Japan Securities Clearing Corporation

How Much Margin 19 Edition

Variation Margin Finance Reference

The Collateral Management Challenge In Europe Bnp Paribas Securities Services

Initial Margin Variation Margin For Otc Derivatives The Field Effect

Risk Management Lch Group

Variation Margin De Betekenis Volgens Financieel Woordenboek

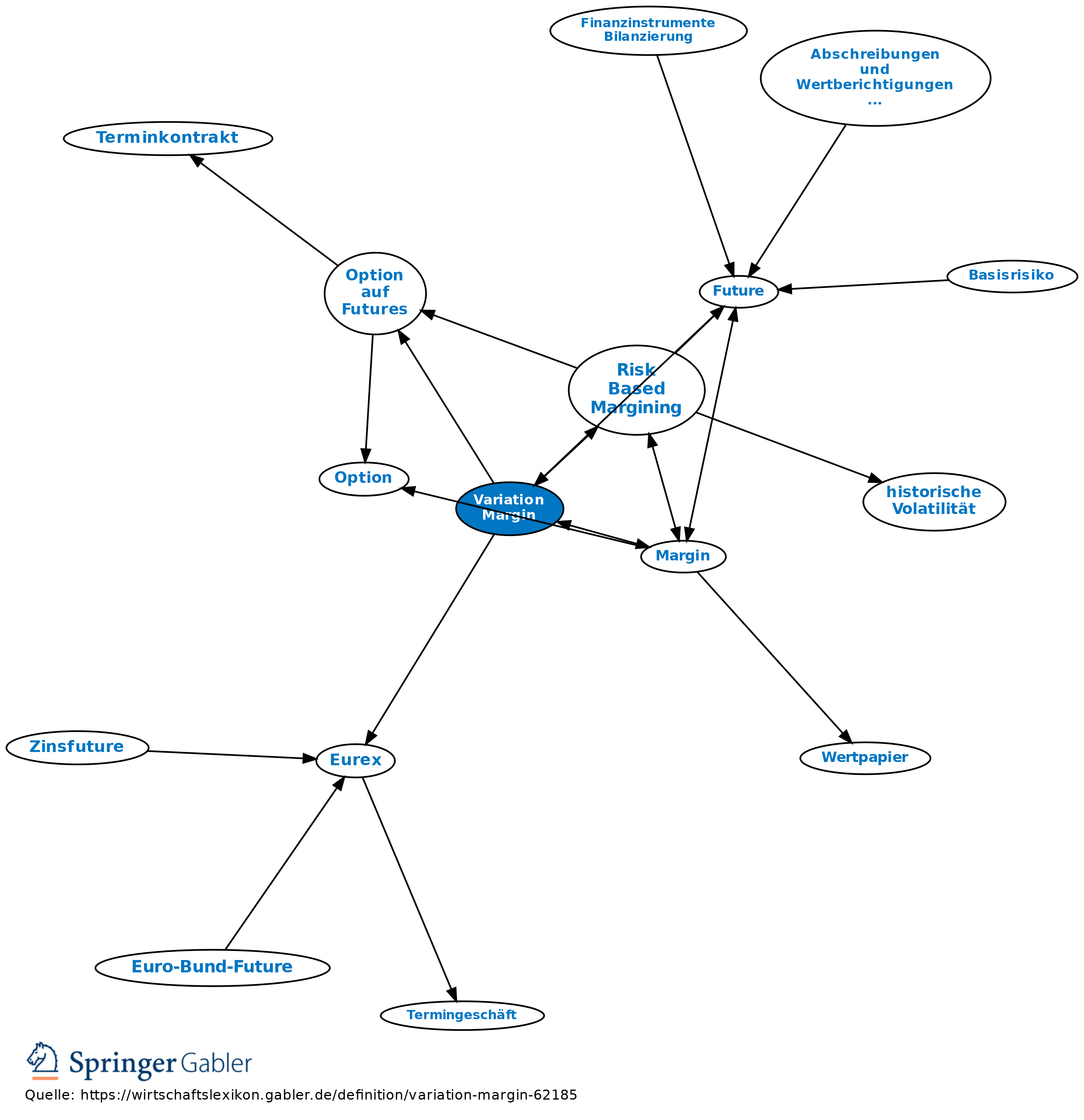

Variation Margin Definition Gabler Banklexikon

Top Pdf Margin Requirements 1library

Problem 2 Sustainable Development Econ 51 Studocu

Solved A Buyer Of A Futures Contract In Imaginationum Wit Chegg Com

Cleared Margin Setting At Selected Ccps Federal Reserve Bank Of Chicago

Iris Im Vm

Solved Question 18 A Explain The Difference Between In Chegg Com

Commodities Margin Requirements In Futures Markets

Www Bis Org Cpmi Publ D23b Pdf

Iris Im Vm

Variation Margin Vm Youtube

Getting It Right Collateral And Custody

Iris Im Vm

Solved Consider An Investor Who Contacts His Her Broker O Chegg Com

Www Isda Org A Ekkde Annotated Isda Vm Protocol Questionnaire Pdf

Variation Margin Definition Gabler Banklexikon

Variation And Initial Margin Download Scientific Diagram

Why Fcms Don T Like Intraday Margin Calls

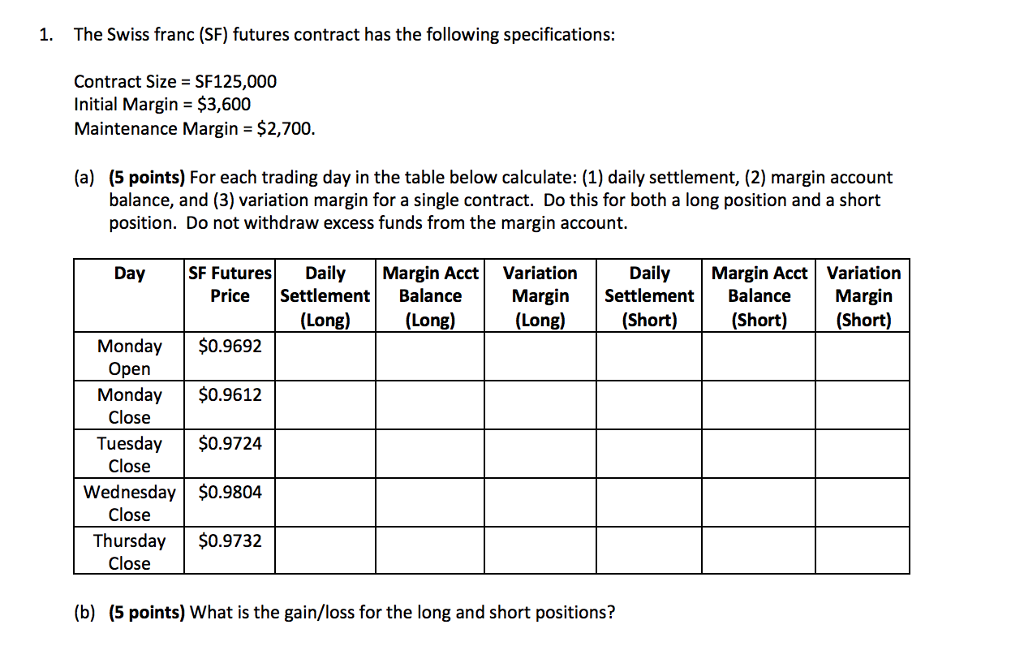

Solved 1 The Swiss Franc Sf Futures Contract Has The F Chegg Com

Margin Management Sap Documentation

Assets Subject To Variation Margin Expressed As A Fraction Of A Total Download Scientific Diagram

The Deadline For Compliance With The U S Variation Margin Rules Is Approaching Are You Ready Eversheds Sutherland Us Llp Jdsupra

Primer Initial Margin Under Umr International Financial Law Review

Introduction To Simm From First Principles

Assets Subject To Variation Margin Expressed As A Fraction Of A Total Download Scientific Diagram

Collateral Central Clearing Counterparties And Regulation

How Much Margin 19 Edition

Margins Exchange Clearing House

Www Cftc Gov Sites Default Files Idc Groups Public Newsroom Documents File Um Factsheet Pdf

Settle To Market What You Need To Know About Stm

Recovery And Resolution Of Central Counterparties Bulletin December Quarter 13 Rba

2

Variation Margin Archives Mh Derivatives Financial Education For Changing Markets

Calculating Initial Margin Im And Variation Margin Vm

Central Clearing Implications For Collateral Management