Business Line Of Credit

A line of credit is one of the most useful tools at a business owner’s disposal Merchants with a credit line can have shortterm funds available within a few days without going through a lengthy application process every time.

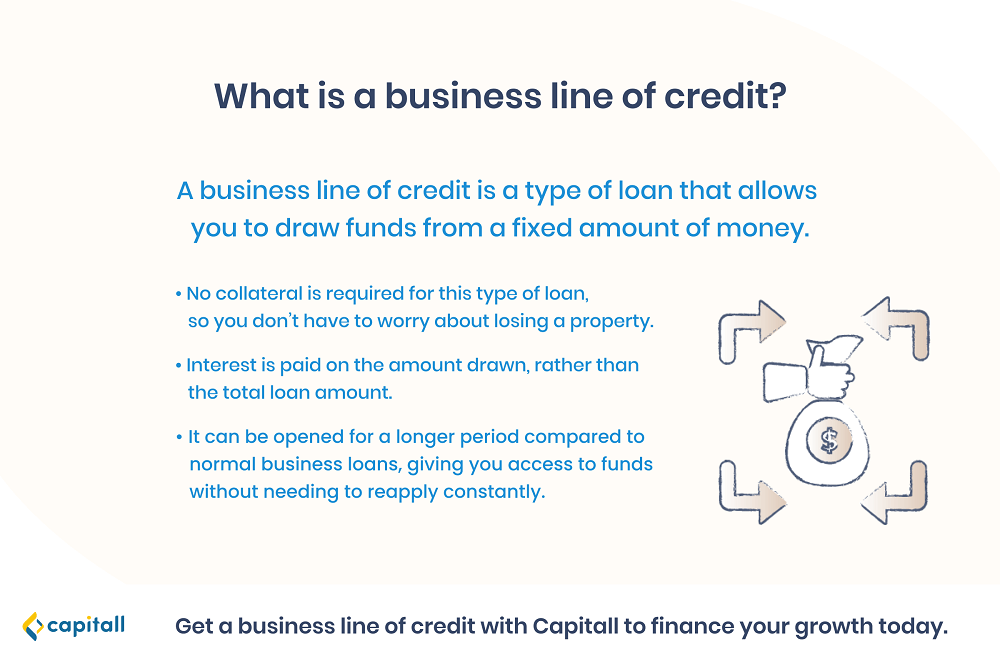

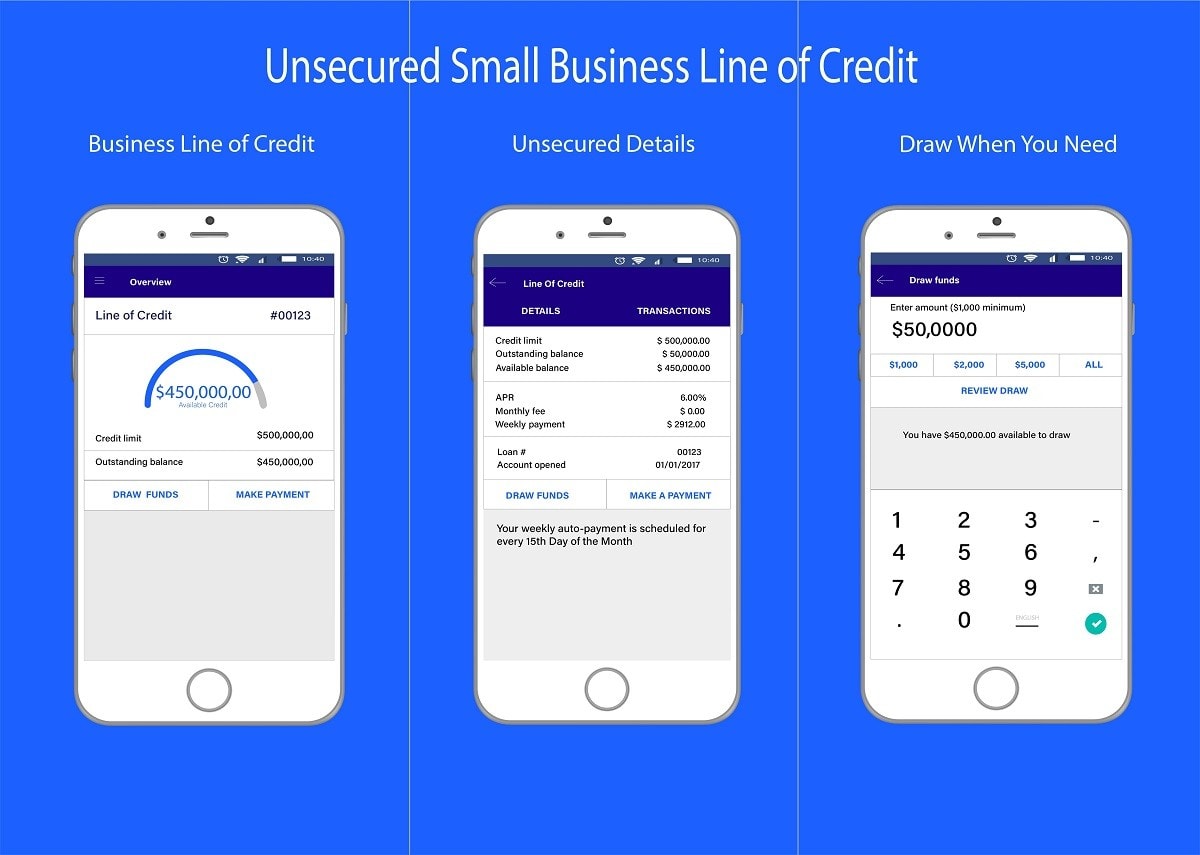

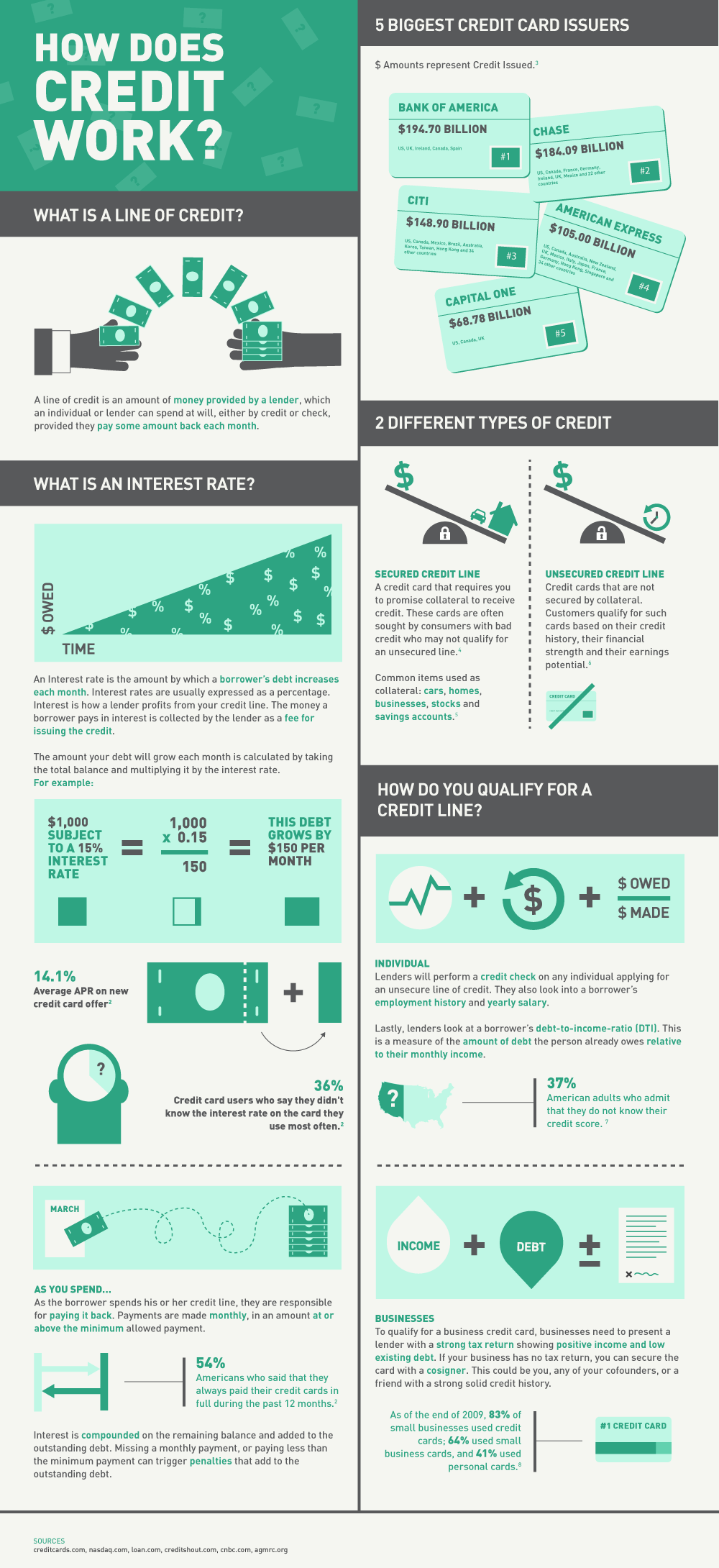

Business line of credit. A business line of credit is a type of financing similar to a credit card When approved, the borrower has access to a set amount of cash from which they can draw at any time The borrower can pull from their available funds as long as they don’t exceed the borrowing limit. BlueVine’s Flex Line of Credit and Term Loan is issued by Celtic Bank, a Utahchartered Industrial Bank, Member FDIC Certain financing may be made or arranged pursuant to California Financing LawLicense No Applications are subject to credit approval Rates and terms may vary based on your creditworthiness and are subject to change. To apply, please complete the Startup Business Line of Credit PreApproval Form or contact our Credit Line Department directly via email at support@fundingpilotcom or by calling our main line at Everything you need to know about the Startup Business Line of Credit $5,000 $250,000;.

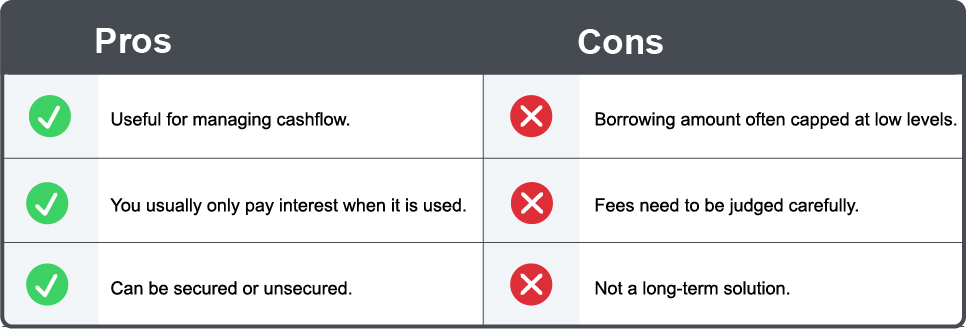

A business line of credit can be unsecured or secured (typically, by inventory, receivables or other collateral) Lines of credit are often referred to as revolving and can be tapped into repeatedly For instance, if there is access to a $60,000 line of credit and $30,000 is taken out, access to the remaining $30,000, if necessary, remains. An Amazon Business Line of Credit is ideal for organizations looking to simplify their purchasing and reconciliation, without having to sacrifice the flexibility and control required to manage their business Your Amazon Business Line of Credit comes with a dedicated account management team to help you personalize your credit line to suit the. A business line of credit is a revolving loan that allows access to a fixed amount of capital, which can be used when needed to meet shortterm business needs A business line of credit is the best financing option when you need extra working capital to cover recurring business expenses or bridge cash flow gaps With ongoing access to funds.

A business line of credit is a type of financing similar to a credit card When approved, the borrower has access to a set amount of cash from which they can draw at any time The borrower can pull from their available funds as long as they don’t exceed the borrowing limit. Business Line of Credit (1 Day to 2 Weeks) Though not technically a loan, this is capital that businesses may draw upon as needed, and they would only have to pay interest on what they borrow Business lines of credit may be used for shortterm or longterm needs and can be secured or unsecured. What is a business line of credit?.

Another line of credit option is nonrevolving lines of credit, which is a lump sum product Once you pay off the amount, your account will be closed Therefore, if you want a line of credit for ongoing expenses, this might not be the best option for your business Ultimately, your new business could benefit from either line of credit option. A line of credit is one of the most useful tools at a business owner’s disposal Merchants with a credit line can have shortterm funds available within a few days without going through a lengthy application process every time. Business lines of credit Lines of credit on the other hand, often have variable interest rates based on the prime rate, and although interest rates are usually lower for a line of credit versus a loan, your payment might go up or down as your interest rate does Additionally, some lenders impose a penalty interest rate on accounts with late or.

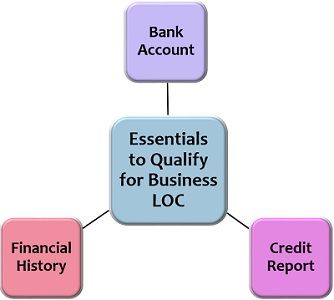

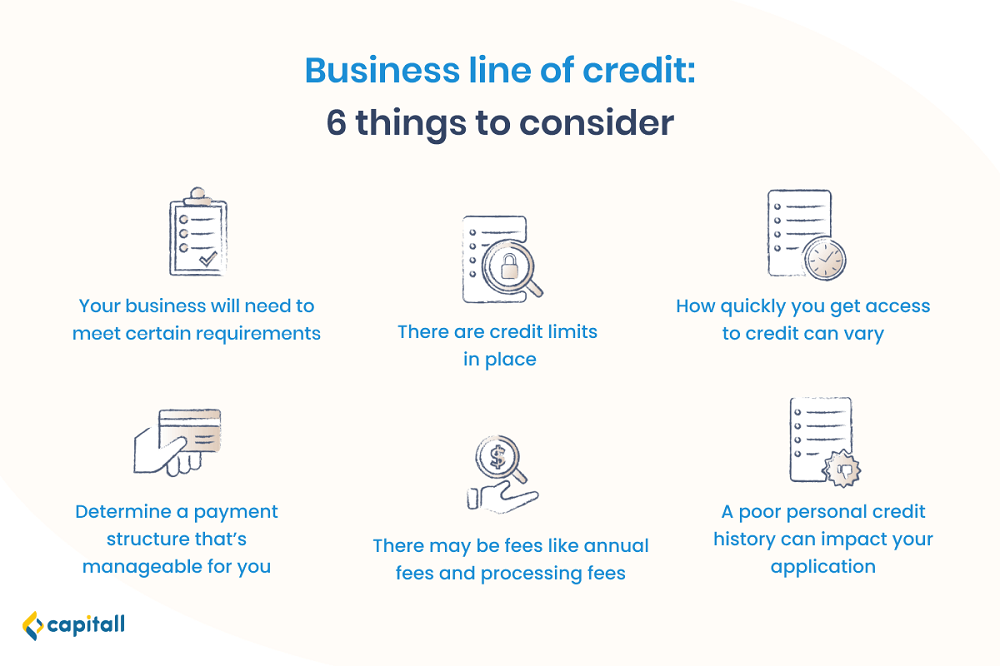

Business Line of Credit Requirements The requirements for a business line of credit are different from lender to lender In general, most lenders require having been in business for at least 6 months, at least $25,000 in annual revenue, and a credit score of around 500. A business line of credit is based on the monthly revenue and business owners credit score Newer, less established businesses might be able to qualify for shortterm lines of credit, even with a short time in business Mediumterm lines of credit are more for businesses with good credit and a solid financial history. An unsecured business line of credit may be the only option for businesses that don’t currently own real estate Without real estate to put up as collateral, an unsecured product may be the only option While you can obtain an unsecured line of credit, getting a business line of credit without a personal guarantee is a different story.

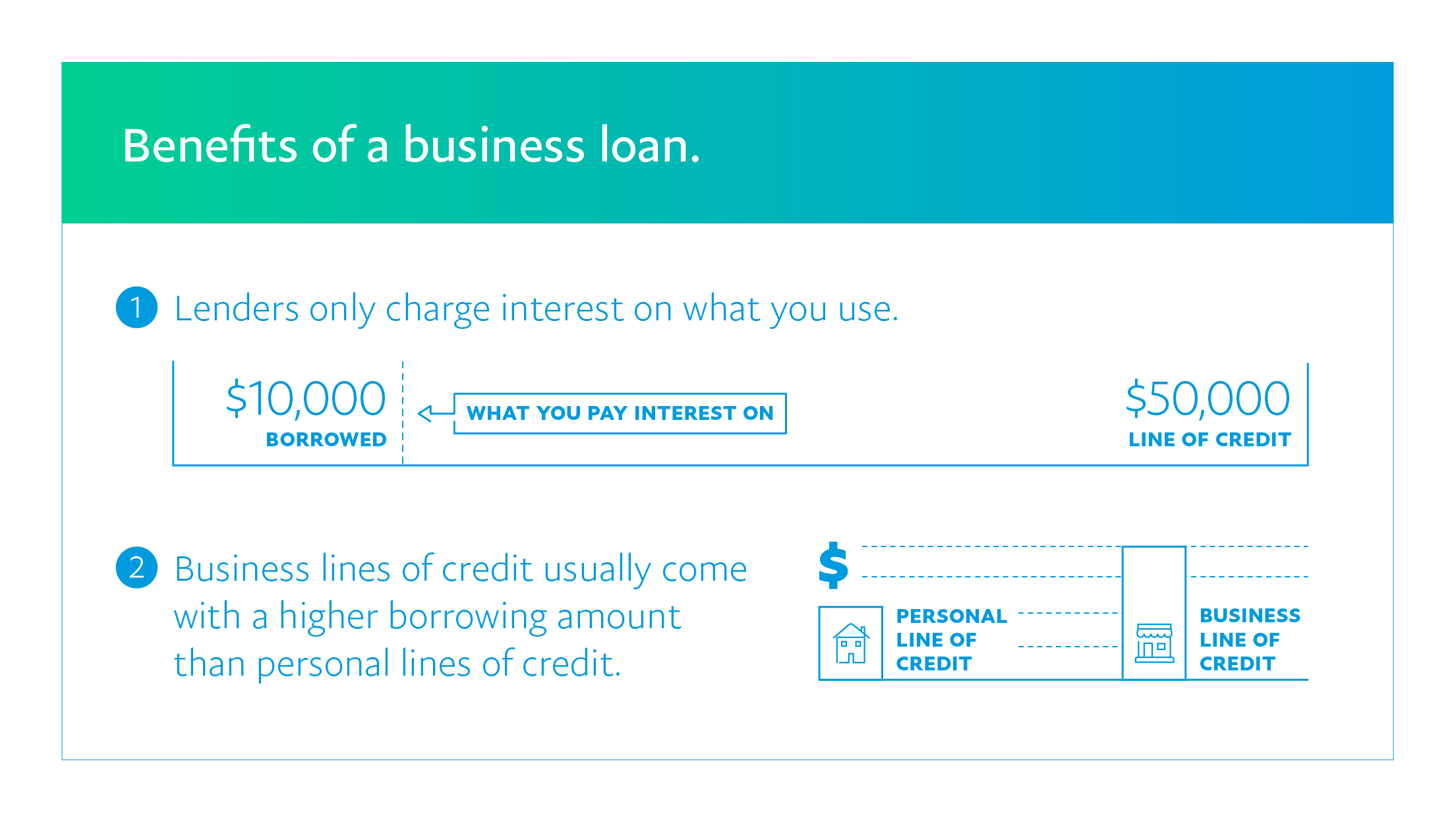

A business line of credit works kind of like a credit card A line of credit lets a business borrow up to a certain amount of money and will only charge interest on the amount of money borrowed It’s unlike a traditional loan where you’d be given a lump sum of money that you’d pay back with interest in monthly payments. A Chase Business Line of Credit is ideal if your business needs easy access to cash for shortterm capital, inventory purchase, supplier payment or an emergency fund $10,000 to $500,000 line of credit. Business Line of Credit (1 Day to 2 Weeks) Though not technically a loan, this is capital that businesses may draw upon as needed, and they would only have to pay interest on what they borrow Business lines of credit may be used for shortterm or longterm needs and can be secured or unsecured.

To get your business line of credit, you’ll typically need to be in business at least 6 months and have $50,000 or more in annual revenue You’ll also need a credit score of 560 or higher Your lender may ask you to make a personal guarantee, which is an agreement that the lender may be able to levy personal assets such as a car, house, or. Pros and Cons of Business Credit Lines A line of credit is a pool of money you can draw from as needed You get a maximum credit limit, and you can use almost any amount of the credit line up to that limit Credit lines are revolving loans, so you typically have the flexibility to repay your debt, leave the account open, and repeat. A business line of credit is based on the monthly revenue and business owners credit score Newer, less established businesses might be able to qualify for shortterm lines of credit, even with a short time in business Mediumterm lines of credit are more for businesses with good credit and a solid financial history.

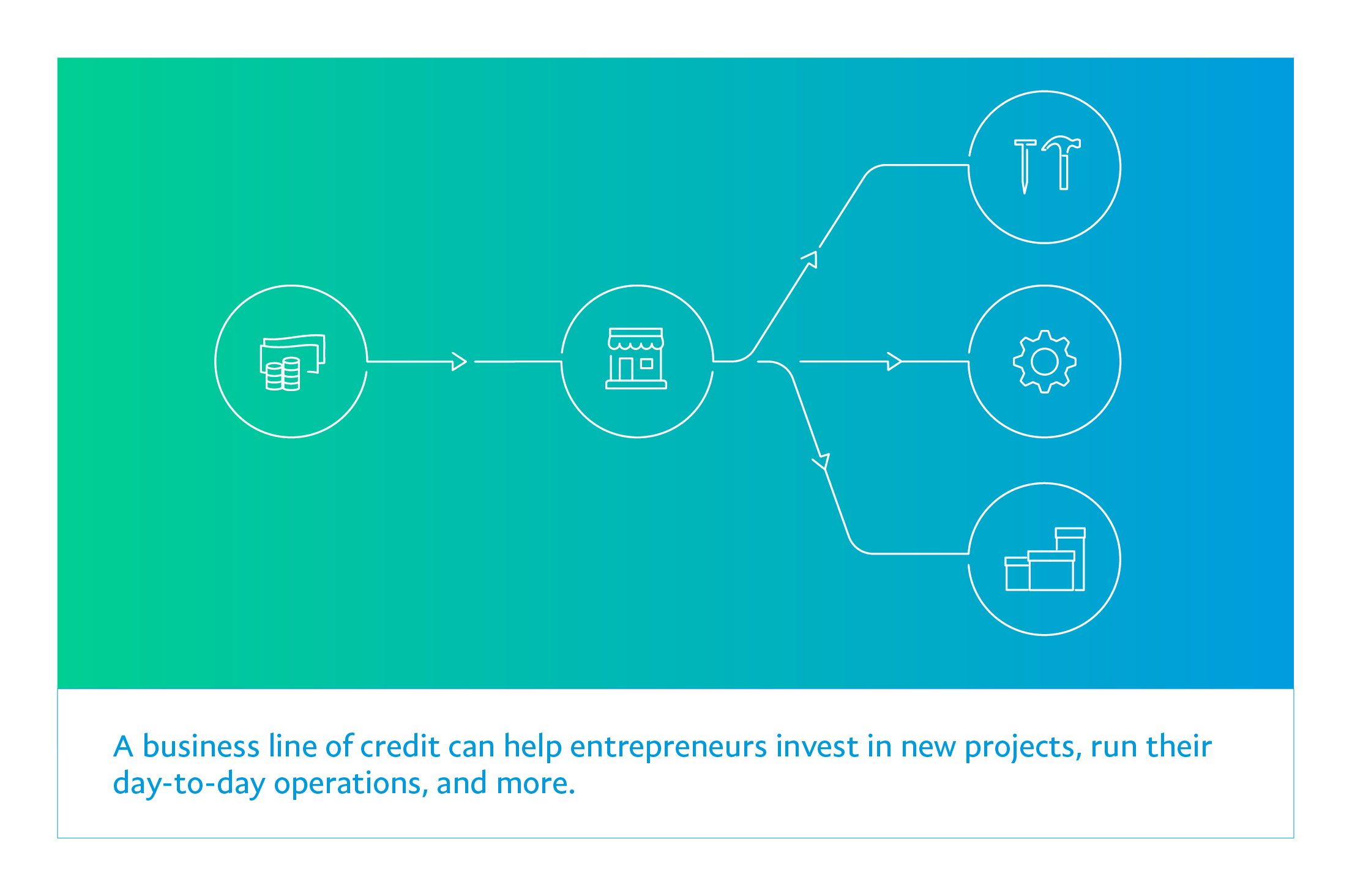

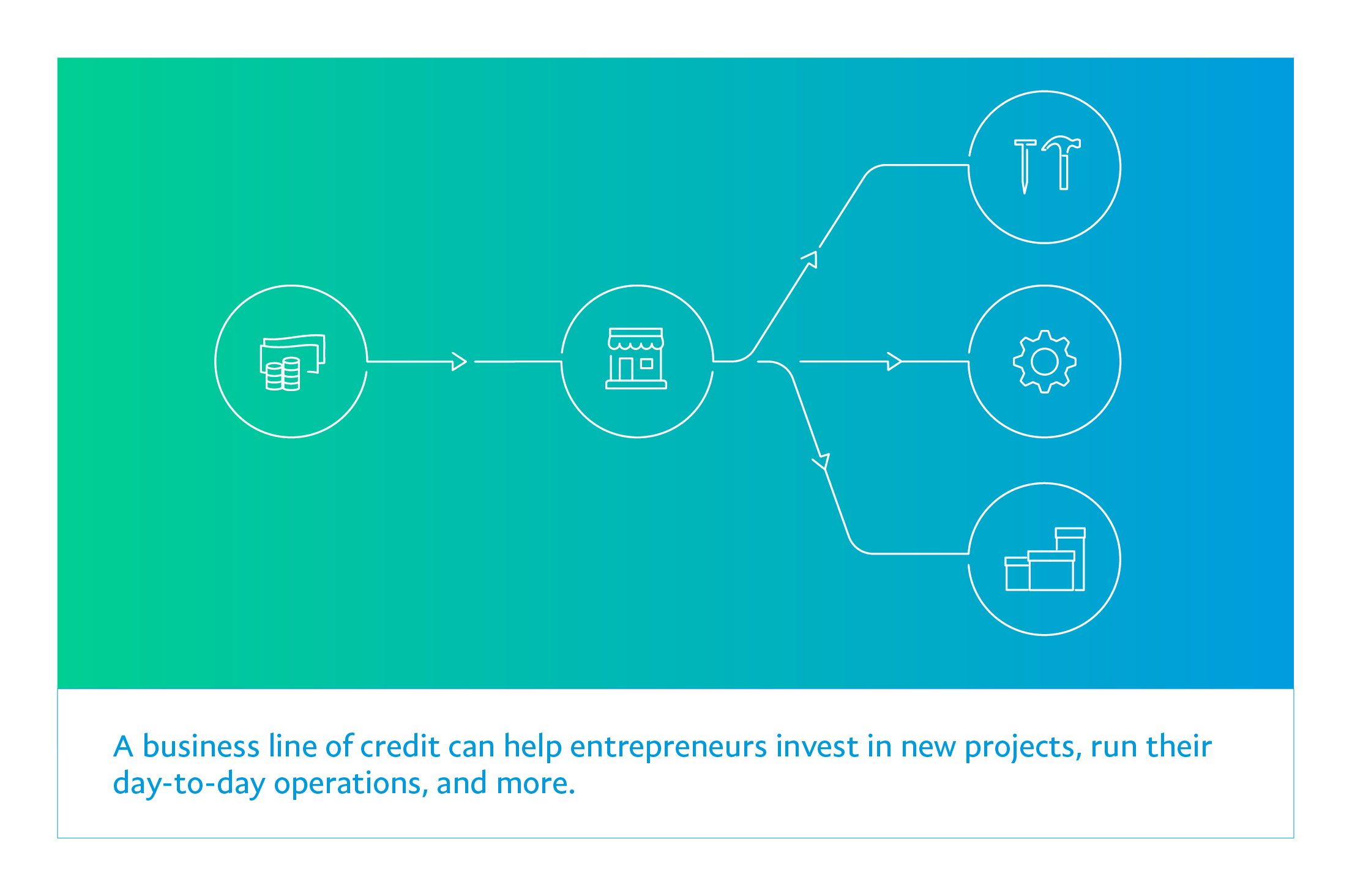

A business line of credit is a possible option for a small or startup business to get the capital needed to manage cash flow, fund daytoday operations and take advantage of new opportunities Best for rate discount Best for longer repayment term Best for higher limit Best for fixedrate option. Entrepreneurship is alive and well in America, with more than 30 million small businesses operating in the country, according to the US Small Business Administration 1 Still, cash flow management is a common concern for entrepreneurs, leading many businesses to apply for a line of credit to help them invest in new projects, run their daytoday operations, and more. Entrepreneurship is alive and well in America, with more than 30 million small businesses operating in the country, according to the US Small Business Administration 1 Still, cash flow management is a common concern for entrepreneurs, leading many businesses to apply for a line of credit to help them invest in new projects, run their daytoday operations, and more.

A SunTrust business line of credit offers flexibility and quick access to credit for your shortterm borrowing needs. Business Line of Credit (LOC) Experience the speed and simplicity of the Citizens Bank VantageLink TM online application Get a business loan or line of credit up to $150,000 in 23 days Apply Now. Business Line of Credit Requirements The requirements for a business line of credit are different from lender to lender In general, most lenders require having been in business for at least 6 months, at least $25,000 in annual revenue, and a credit score of around 500.

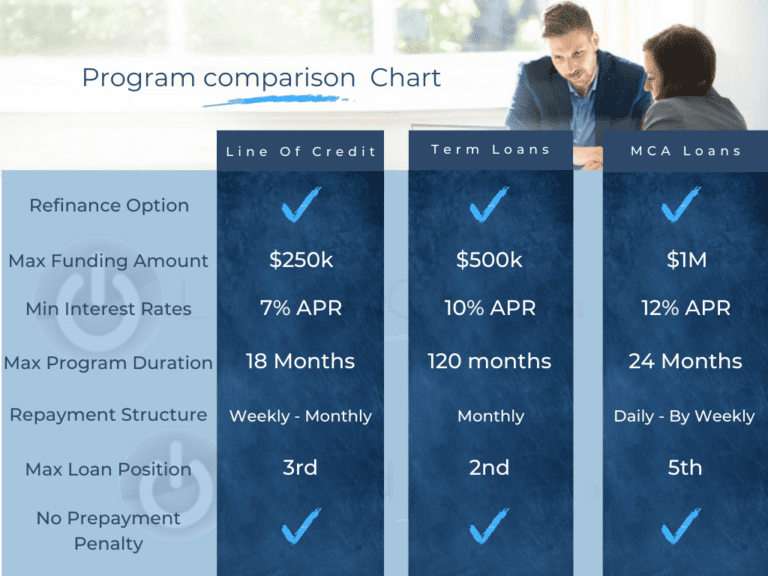

Apply Online for a Business Line of Credit Enjoy the flexibility of a revolving line of credit Draw as you need and pay only for what you use Apply now Apply Online for a Business Line of Credit Enjoy the flexibility of a revolving line of credit Draw as you need and pay only for what you use. 7 Best Small Business Lines of Credit BlueVine Overall Best Business Line of Credit Maximum Loan Amount $250,000 Minimum Credit Score 600 APR Range 15% to 78% Minimum Time in TD Bank Best for Interestonly Payments JPMorgan Chase Best Traditional Business Line of Credit. A SunTrust business line of credit offers flexibility and quick access to credit for your shortterm borrowing needs.

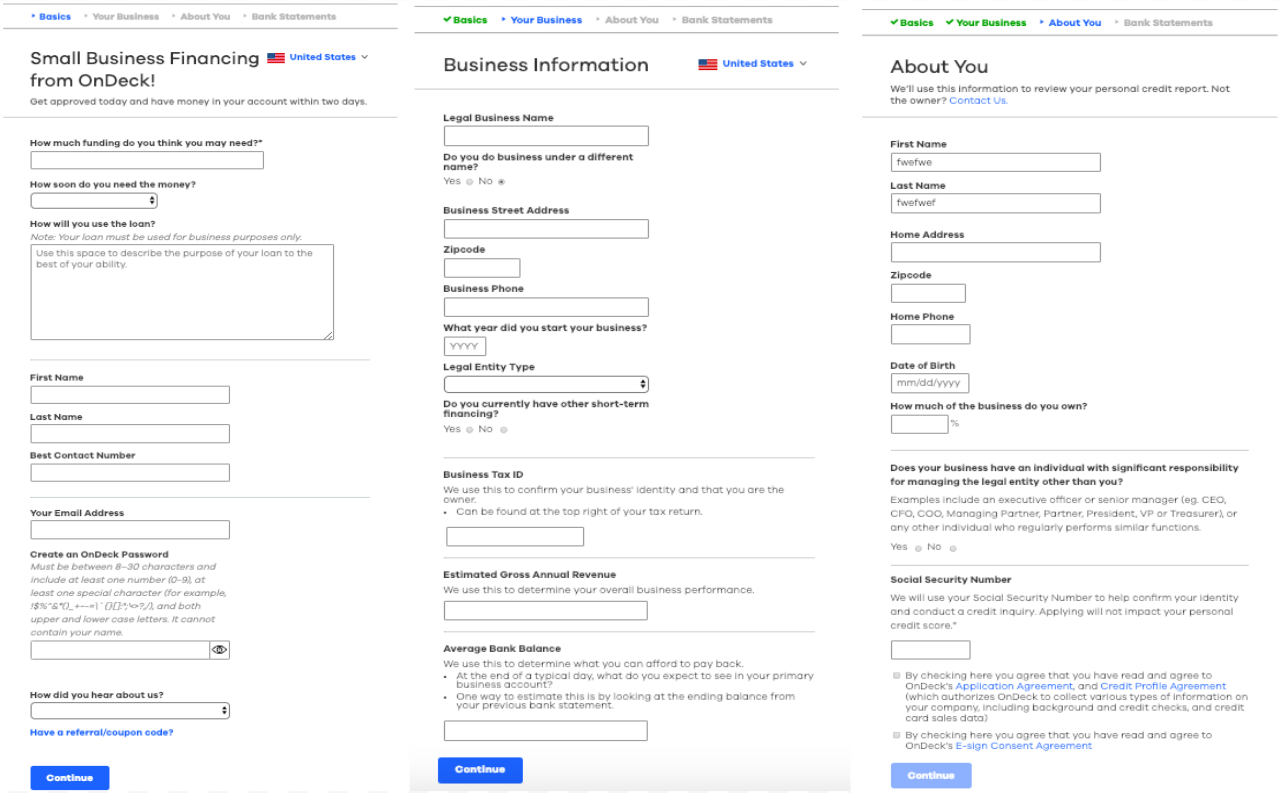

OnDeck business line of credit With OnDeck, lines of credit range from $6,000 to $100,000, with weekly payments of up to twelve months, making it worth considering for shortterm working capital needs To qualify for a loan with this online lender, you need at least one year in business, a FICO credit score of 600 or higher, $100,000 in annual revenue and a business bank account. Business Line of Credit (1 Day to 2 Weeks) Though not technically a loan, this is capital that businesses may draw upon as needed, and they would only have to pay interest on what they borrow Business lines of credit may be used for shortterm or longterm needs and can be secured or unsecured. A line of credit is similar to a credit card in that you can access your credit line, make repayment, and access the credit line again Unlike a business loan, which is distributed in a lump sum and a fixed periodic payment, a line of credit is repaid when the business draws from the line.

In today's business world, having access to cash can be a valuable asset Our lines of credit provide you with all the options you need Business Checking Overdraft You can rest easy with a Business Checking Overdraft Line of Credit In any business, unexpected expenses happen and we can help protect you, as well as offer you spending flexibility. Apply for a small business loan or line of credit online with US Bank Get a Quick Loan for a one time payout or Cash Flow Manager Line of Credit for ongoing access to funds. Business credit lines were designed to help you meet shortterm cash needs, such as purchasing supplies or additional inventory or covering operating expenses Essentially, a business line of credit can help small businesses thrive and grow.

A business line of credit is a type of small business financing that you can draw on periodically, up to an approved credit limit Its number one advantage is flexibility You borrow only the funds you need when you need them — you are not forced to take out the full amount in a lump sum And you pay interest on the money you draw out, only. A revocable line of credit is a source of credit provided to an individual or business by a bank or financial institution that can be revoked or annulled at the lender's discretion or under. Business line of credit and term loan interest rate discounts are available to business applicants and coapplicants who are enrolled in the program at the time of line of credit or term loan application for a new credit facility (excludes specialty lending products that receive customized pricing) The amount of the discount (025% for Gold.

OnDeck business line of credit With OnDeck, lines of credit range from $6,000 to $100,000, with weekly payments of up to twelve months, making it worth considering for shortterm working capital needs To qualify for a loan with this online lender, you need at least one year in business, a FICO credit score of 600 or higher, $100,000 in annual revenue and a business bank account. A business line of credit is a set amount of funds made available to a business by a lending institution, which typically comes with a fee The business doesn’t have to use all the funds that are extended, but many businesses need it to pay unexpected bills, purchase inventory for seasonal sales or to cover. A business line of credit gives access to a pool of funds to draw from when you need capital Unlike a traditional business loan, you have the flexibility to borrow up to a set amount (typically anywhere from $50,000 to $500,000), repaying only the amount you withdraw, with interest.

Kabbage To qualify for a secured business line of credit from Kabbage, you must have been in business for one year, and have $50,000 in annual revenue or $4,0 in monthly revenueEach time a business owner draws from their line of credit, a new loan agreement is drawn up. BlueVine's Flex Line of Credit is issued by Celtic Bank, a Utahchartered Industrial Bank, Member FDIC Applications are subject to credit approval Rates, credit lines, and terms may vary based on your creditworthiness and are subject co change Additional fees apply. A line of credit is a credit facility extended by a bank or other financial institution to a government, business or individual customer that enables the customer to draw on the facility when the customer needs funds A line of credit takes several forms, such as an overdraft limit, demand loan, special purpose, export packing credit, term loan, discounting, purchase of commercial bills.

To apply, please complete the Startup Business Line of Credit PreApproval Form or contact our Credit Line Department directly via email at support@fundingpilotcom or by calling our main line at Everything you need to know about the Startup Business Line of Credit $5,000 $250,000;. Apply Online for a Business Line of Credit Enjoy the flexibility of a revolving line of credit Draw as you need and pay only for what you use Apply now Apply Online for a Business Line of Credit Enjoy the flexibility of a revolving line of credit Draw as you need and pay only for what you use. OnDeck business line of credit With OnDeck, lines of credit range from $6,000 to $100,000, with weekly payments of up to twelve months, making it worth considering for shortterm working capital needs To qualify for a loan with this online lender, you need at least one year in business, a FICO credit score of 600 or higher, $100,000 in annual revenue and a business bank account.

A business line of credit gives access to a pool of funds to draw from when you need capital Unlike a traditional business loan, you have the flexibility to borrow up to a set amount (typically anywhere from $50,000 to $500,000), repaying only the amount you withdraw, with interest. Apply Online for a Business Line of Credit Enjoy the flexibility of a revolving line of credit Draw as you need and pay only for what you use Apply now Apply Online for a Business Line of Credit Enjoy the flexibility of a revolving line of credit Draw as you need and pay only for what you use. Amazon Business Lines of Credit An Amazon Business Line of Credit is ideal for organizations looking to simplify their purchasing and reconciliation, without having to sacrifice the flexibility and control required to manage their business Your Amazon Business Line of Credit comes with a dedicated account management team to help you personalize your credit line to suit the needs of your business.

Secured business line of credit With a secured business line of credit, the lender asks the borrower to pledge their assets against the loan as collateral Since this is a temporary liability, the lender may accept inventory or accounts receivable as collateral They probably won’t ask for significant assets like equipment or real estate. A small business line of credit is subject to credit review and annual renewal, and is revolving, like a credit card Interest begins to accumulate once you draw funds, and the amount you pay (except for interest) is again available to be borrowed as you pay down your balance. Apply Online for a Business Line of Credit Enjoy the flexibility of a revolving line of credit Draw as you need and pay only for what you use Apply now Apply Online for a Business Line of Credit Enjoy the flexibility of a revolving line of credit Draw as you need and pay only for what you use.

Business Line of Credit Requirements The requirements for a business line of credit are different from lender to lender In general, most lenders require having been in business for at least 6 months, at least $25,000 in annual revenue, and a credit score of around 500. A Business Line of Credit functions very similarly to a credit card You have a credit line that you can borrow from at any time If you’re carrying a balance, you’ll have a minimum payment You only pay interest on the portions that you borrow. A business line of credit is one of the most convenient forms of financing for businesses Before applying, it’s important to consider your business’s financial health, know the rates, understand your options, and gather the appropriate documents Make sure your application stands out by having a web presence, inputting the correct.

Business Line of Credit Requirements The requirements for a business line of credit are different from lender to lender In general, most lenders require having been in business for at least 6 months, at least $25,000 in annual revenue, and a credit score of around 500. 1 For approved business applicants, Santander Bank will waive the onetime origination fee of $250 on a new business line of credit (“BLOC”) between $10,000 and $350,000, if the approved applicant either has or opens at time of BLOC closing a Santander Business Checking or Santander Business Checking Plus account Additional fees, terms. A business line of credit is revolving credit, allowing you to carry a balance that accrues interest If you don't use the line of credit, you don't have to make any payments Once you draw from the credit line, as long as you make the minimum payment each month, you can either pay your balance in full or pay whatever you can afford.

Average Business Line Of Credit By Race Of Primary Owner And By Gender Download Scientific Diagram

Business Loan In Singapore How Can A Business Line Of Credit Help Your Sme Capitall

Summit Capital Financing Business Line Of Credit Qualification Requirements Summit Capital Financing

Business Line Of Credit のギャラリー

How To Get A Business Line Of Credit 2m7 Financial Solutions

Business Loans Vs Lines Of Credit Which Is Best For You

Line Of Credit Accountants Day

Business Lines Of Credit My Business Loans Your Loan Your Way

What Is A Business Line Of Credit How It Works How To Get One

Unsecured Business Lines Of Credit Gulf To Atlantic Commercial Capital

Business Line Of Credit How It Works And Best Options 21 Nerdwallet

Business Line Of Credit

Unsecured Business Lines Of Credit Capital Financing Corp

Business Line Of Credit Legacy 7 Funding

How To Get A Business Line Of Credit In 6 Steps

What Is The Best Business Line Of Credit In 21 Valuepenguin

Small Business Line Of Credit Up To 100 000 Ondeck

How A Business Loan Is Different From A Line Of Credit Fora Financial Blog

Line Of Credit Privatizedcapital Early Stage Funding And Smb Funding

Business Line Of Credit How Lines Of Credit Work Lebit Finance

Blessing Capital How You Can Benefit From An Unsecured Business Lines Of Credit

Business Line Of Credit Working Capital Explained Shortformconsultants Com

Business Line Of Credit What Every Entrepreneur Should Know

Does A Business Line Of Credit Make Sense For My Business Ondeck

Business Line Of Credit Incremental Capital Group

How To Get A Small Business Line Of Credit Market Business News

Stabilising Your Cash Flow By Getting A Business Line Of Credit

Small Business Credit Line Unsecured Revolving Line Of Credit

Line Of Credit Lend On Capital

Business Loans Arkm Commercial Finance Business Line Of Credit

How To Get A Business Line Of Credit Loans Canada

Compare The Best Top 5 Business Line Of Credit Options Lend

Restaurant Financing And Loans What Are The Best Options Lightspeed Hq

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition

3

Business Revolving Line Of Credit Increased Flexibility At A Lower Cost

3

Unsecured Business Lines Of Credit Liberty Capital Group

Business Line Of Credit Manage Your Business Cash Flow

What Is A Business Term Loan Lebit Finance Small Business Loans

Revolving Business Lines Of Credit Vs Loans National

What Is A Line Of Credit Loc Definition Example Essentials Types Uses Advantages Disadvantages The Investors Book

Business Line Of Credit How Lines Of Credit Work Lebit Finance

The Advantages Of Using A Business Line Of Credit Financial Group Consulting

Business Line Of Credit What Every Entrepreneur Should Know

4 Main Uses For A Business Line Of Credit Diversified Finances

Unsecured Business Lines Of Credit Monument Capital Solutions

Business Line Of Credit Business Loans Commercial Loans Commercial Business Loans Merchant Cash Advance

Unsecured Business Lines Of Credit Business Capital Services

Calculation Of Credit Risk And Market Risk For The Combination Of Download Scientific Diagram

Business Credit Card Vs Business Line Of Credit Price Features What S Best

6 Things Business Owners Should Consider When Taking A Business Line Of Credit Capitall

Factoring Versus Bank Loans Lines Of Credit Tci Business Capital

Business Line Of Credit Rates As Low As 5 Up To 250k

Seeking For A Begin Up Online Business Line Of Credit

What Is A Business Line Of Credit And How Does It Work Fundbox Blog

Business Line Of Credit Line Of Credit Loan Santander Bank

The Best Business Line Of Credit Lendingbuilder

Stream Capital

Business Line Of Credit

How A Line Of Credit Differs From A Loan Mwananchi Credit Limited Kenya

Credit Commercial Mortgage Unlimited Llc Nationwide

Business Loans Vs Line Of Credit A Detailed Entrepreneurial Guide Business 2 Community

Unsecured Business Line Of Credit 21 Lending Guide

Business Line Of Credit Apex Biz Funding

Business Line Of Credit What They Are Where To Get One Funding Circle

Things You Absolutely Need To Know About Business Line Of Credit Financial Tips

What Is A Business Line Of Credit

Best Line Of Credit On Demand Access Up To 300k

How A Business Line Of Credit Works Bizfly Funding

Unsecured Business Credit Line Infinity Commercial Lending Ct

Line Of Credit Guide Desir Financial Consulting

Acero Financial Unsecured Business Line Of Credit

Commercial Equity Line Of Credit Wells Fargo

Business Line Of Credit Aries4her Gmail Com

The Ultimate Guide To Use Your Business Line Of Credit

Business Loans Arkm Commercial Finance Business Line Of Credit

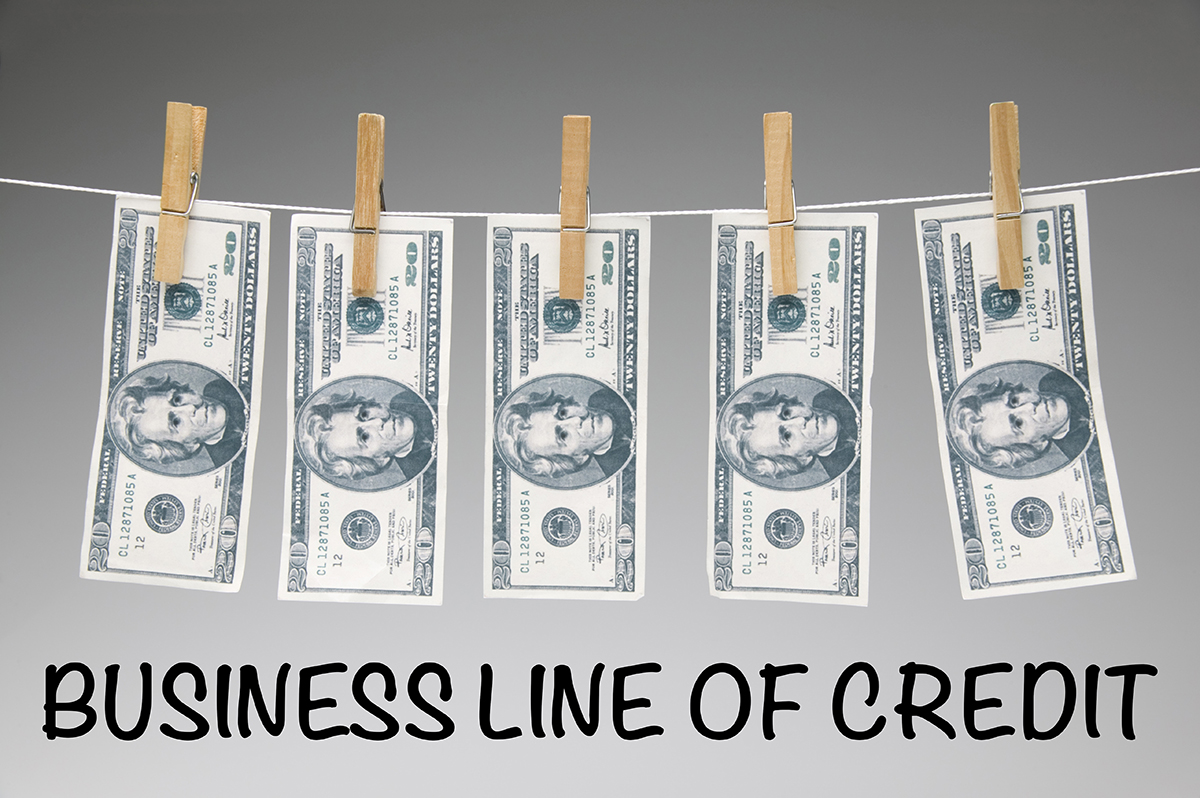

Types Of Business Loans Sbas Loc Factoring Equipment Fin Etc Efm

Business Line Of Credit By Businessloantips Issuu

Small Business Loan Vs Line Of Credit

Q Tbn And9gcreiy0ws5dfa M24onkcasystipb9biajlxihx29g4jckktfklh Usqp Cau

The Only Guide To Business Lines Of Credit You Ll Ever Need Myventurepad Com

Get Help For Unsecured Business Line Of Credit

Business Line Of Credit Mudra Home

What Is A Business Line Of Credit

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition

Small Business Loan For Startups Business Funding Team Lines Of Credit And Business Loans

Commercial Loans The Ultimate Guide For Small Businesses

Business Loan Up To 30 000 000 Online Credit Bank

6 Best Line Of Credit Loans For Your Small Business

How To Apply For A Business Line Of Credit 11 Steps

Unsecured Business Lines Of Credit Loans For Business 00

Business Line Of Credit What They Are Where To Get One Funding Circle

Business Lines Of Credit Commercial Source Funding

Business Line Of Credit Definition And How It Works Thestreet

How To Get A 100 000 Business Line Of Credit In 7 Minutes

Q Tbn And9gctsaw9xmmaf40pcdufynzcxwtu W45y98p2s4oinkaw Oyq 3zn Usqp Cau

What Is A Business Line Of Credit How Does It Work

The Best Business Lines Of Credit For 21 Digital Com

Is Now A Good Time To Apply For A Business Line Of Credit Financialtime

Unsecured Business Line Of Credit Wells Fargo Small Business

Business Lines Of Credit Opta Funding

Business Lines Of Credit Interest Rates Business Funding Team Lines Of Credit And Business Loans

Guides Types Of Small Business Loans Credibly

Business Line Of Credit Basics Finance And Taxes