Credit Note In Gst

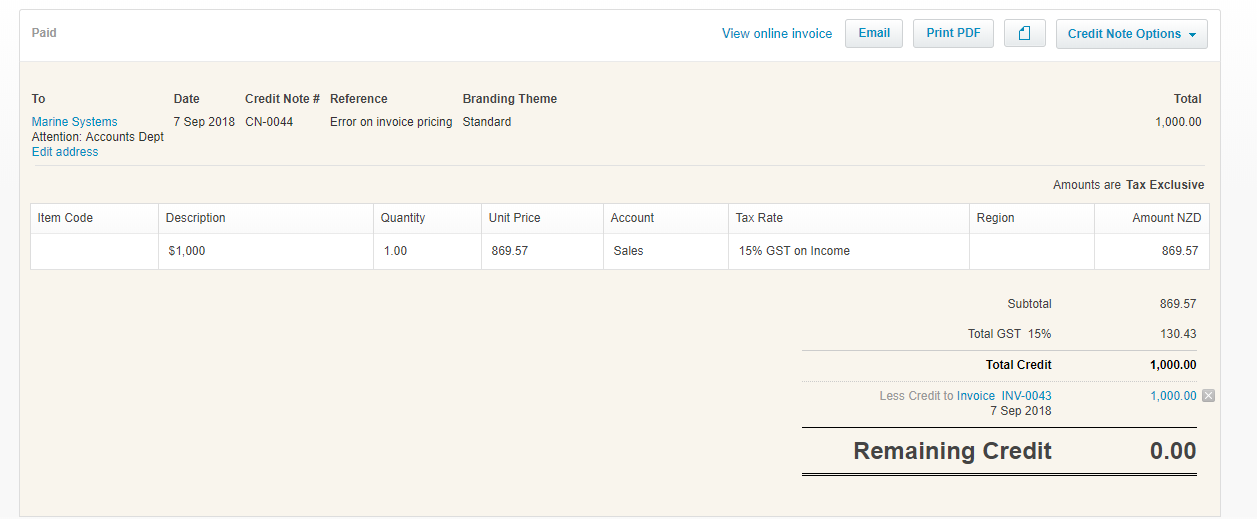

A seller can combine a credit or debit note with a tax invoice But the invoice must be for different goods or services than the credit or debit note The seller must include the credit or debit note in the GST return that covers the period the credit or debit note was issued Examples A seller issues a credit note when a buyer cancels an order.

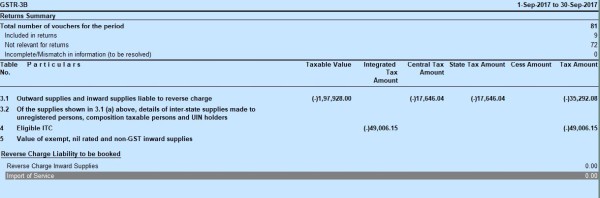

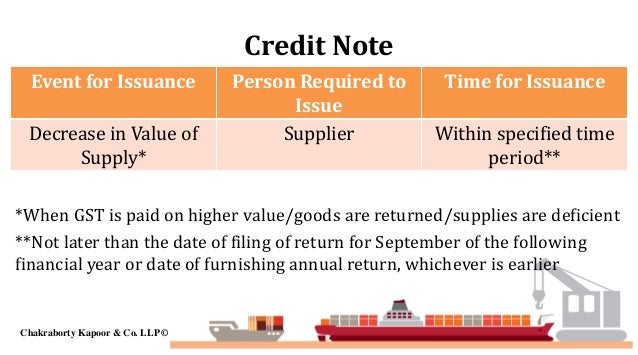

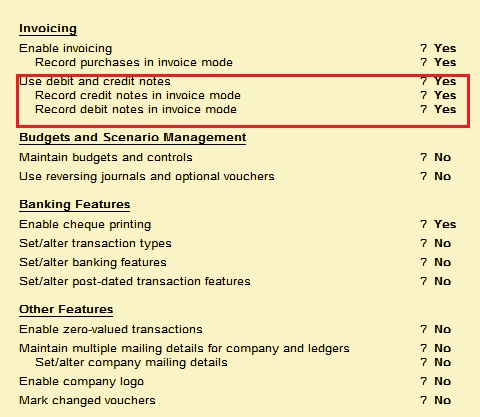

Credit note in gst. Supplier who is issuing credit note/Debit Note will declare the details of credit note/Debit Note issued under GSTR1 of that month or later but not later than September following the end of the financial year in which such supply was made, or the date of furnishing of the relevant annual return, whichever is earlier. Understanding Credit Note In accordance with the current GST law, section 2(35) read with section 24(1), credit note can be issued only if there is an original tax invoice issued for goods and services sold and in case if the tax mentioned in the invoice is more than the tax that is supposed to be paid on the respective supply. However, despite the above amendment in the CGST Act, 17, the GSTN portal did not have a functionality to link multiple invoices with a single credit note or debit note In this regard, the delinking of original invoices and credit debit notes on GST portal is a much awaited facility by each and every taxpayer Update as on 29th January, 19*.

Note If you've previously provided us with any of the information listed below, you don't need to provide it again The information we need for a private ruling or objection about treating a document as a tax invoice or adjustment note includes whether you have claimed any GST credits on the sale. There is no field for credit note, debit note, advances received etc then how the data regarding that has to be filled?. The credit note has to be issued based on an original invoice already issued The original invoice will get reduced to the extent of such credit notes In some cases, the original invoice value can become zero Credit notes are defined in section 2(37) of the GST Law Credit notes can be issued in the following cases.

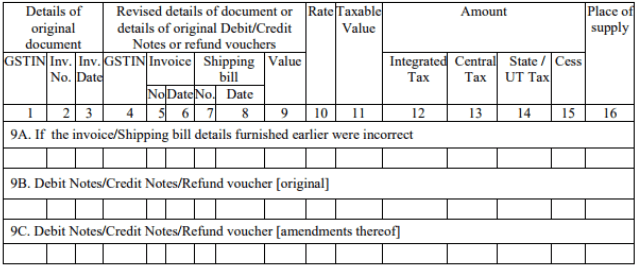

How To Report Credit/Debit Note In GSTR1?. As per Section 34(3) of the CGST Act 17, a supplier of goods and services issues a debit note when;. Or we can NONGST credit note commonly known as Financial Credit Note that do not have any GST impact and need not to be reported in GST returns, As per Circular No 72/46/18GST Dated 26th October, 18 which relates to Clarification in respect to return of expired drugs or medicines.

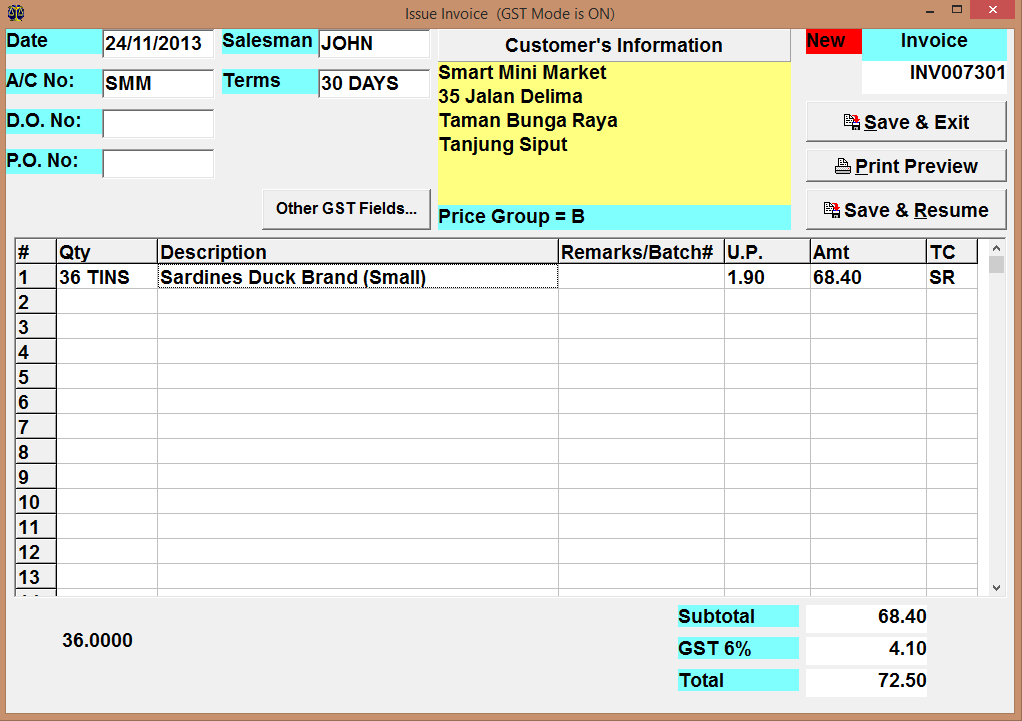

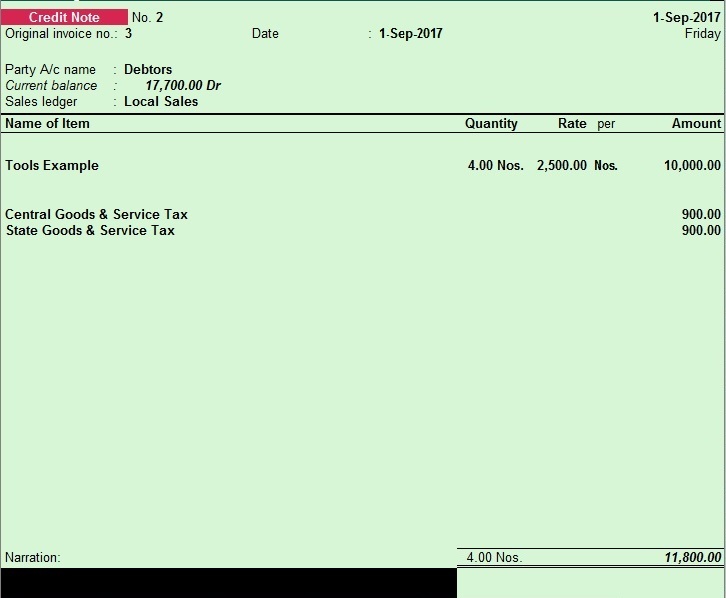

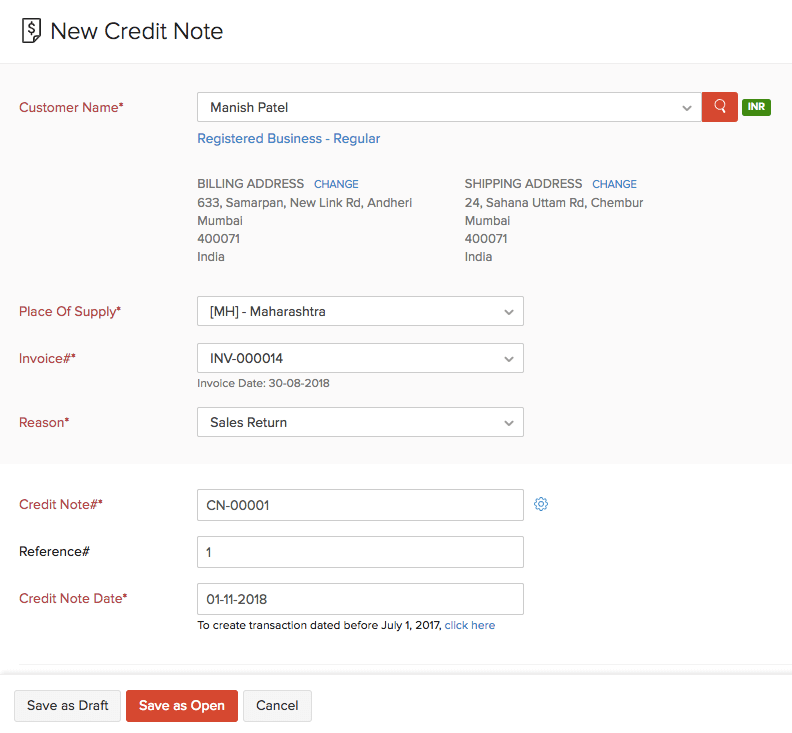

A credit note in GST is a document issued by the supplier to Supplies are returned or found to be deficient by the recipient – When goods/services supplied are returned/found to be deficient by the recipient, the supplier will issue a Credit Note It reduces the value of the original supply. How to fill Details of Debit Note and Credit Note in GST Last updated at Sept 5, 17 by Teachoo Credit Note Debit Note (Registered) It is to be filled in case of cases like Sales Return/Purchase Return Post Sale Discount Deficiency in Service Correction of Invoice. Credit Note in GST The suppliers need to provide the details of credit notes issued in a month in Form GSTR1 These details are available to the recipient in Form GSTR2A, post which the recipient needs to accept the details and submit in Form GSTR2.

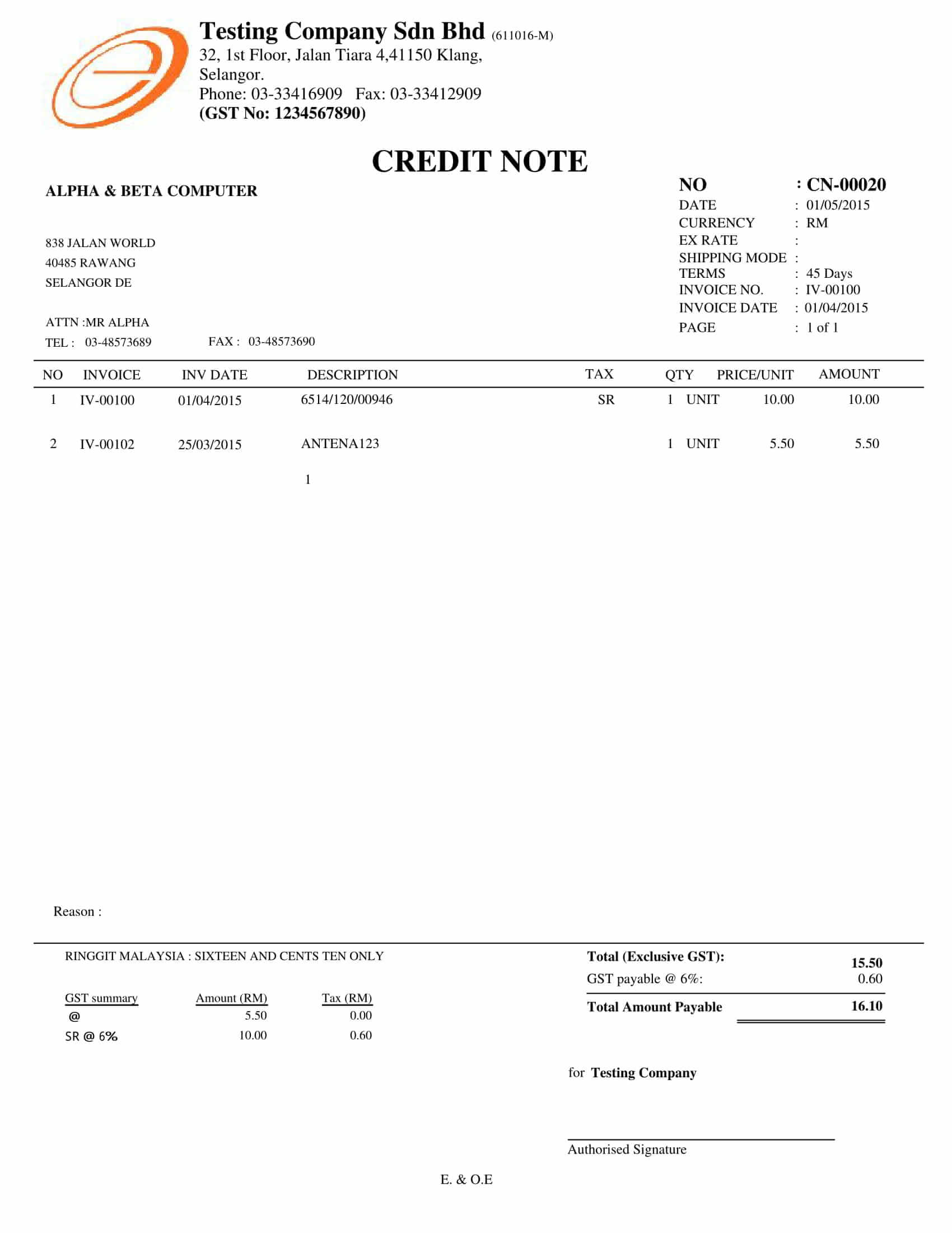

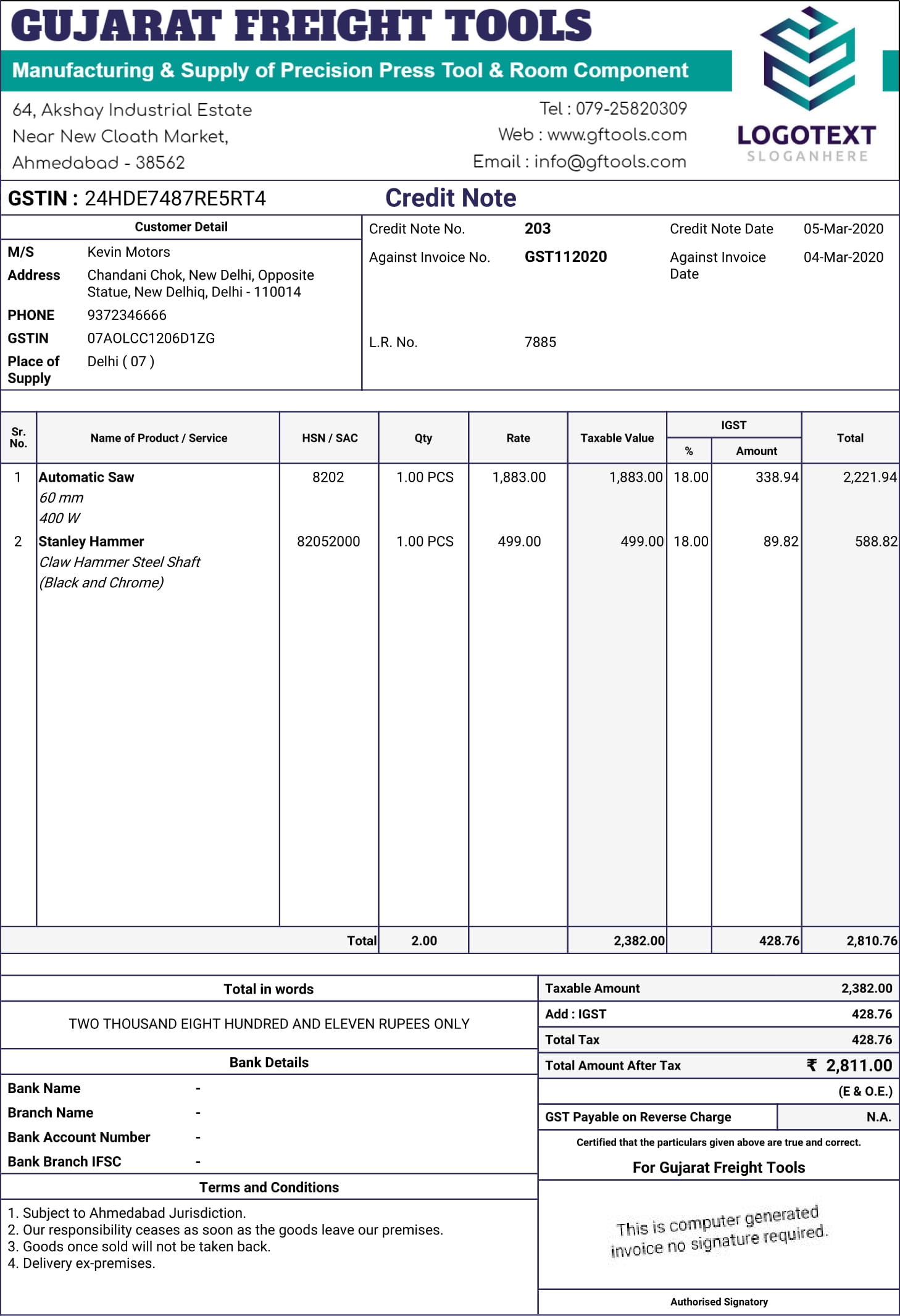

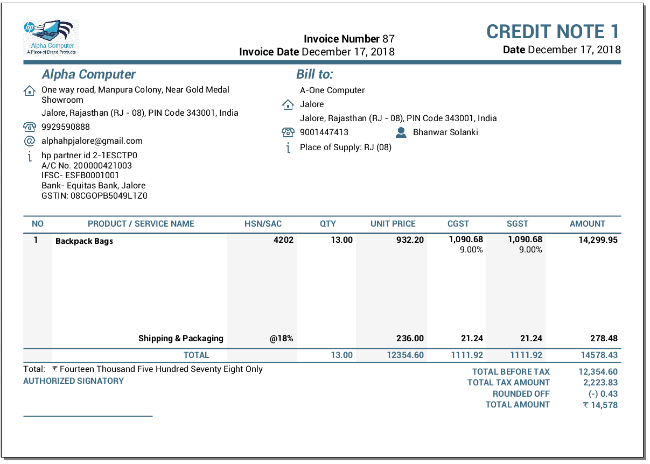

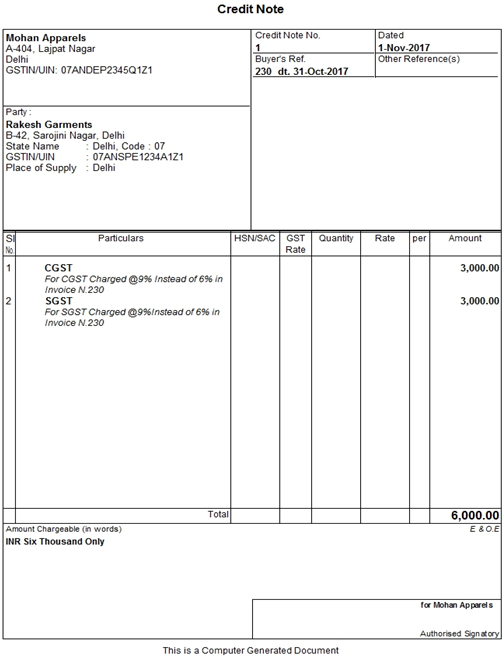

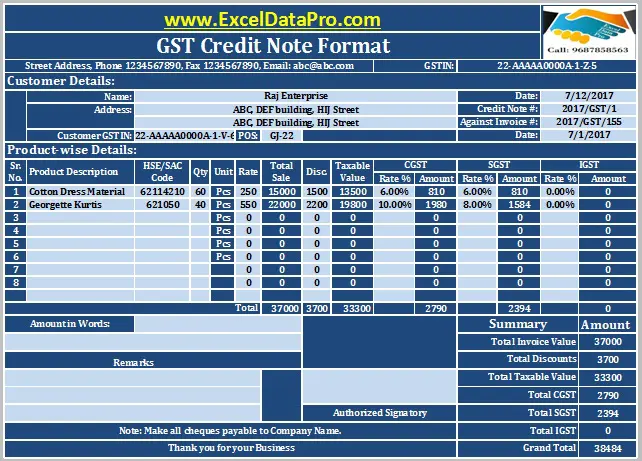

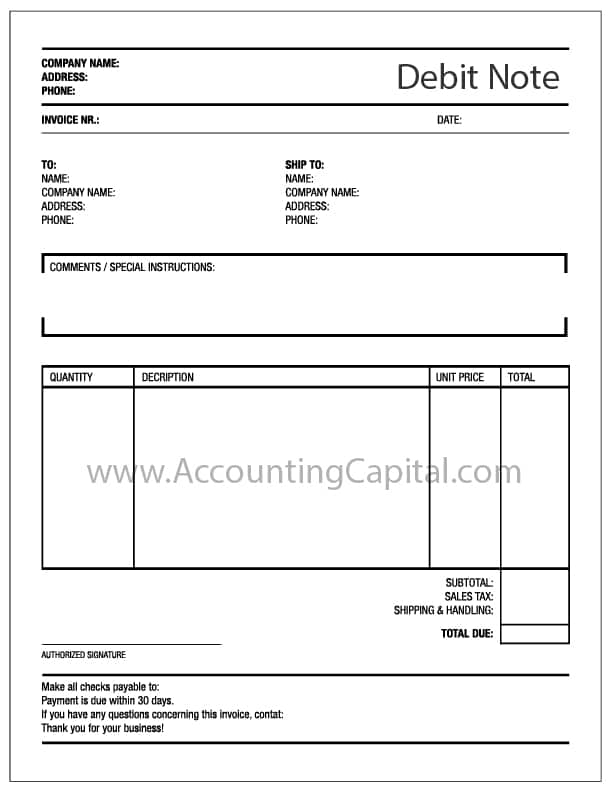

Tax liability on such debit note has to be adjusted accordingly in the return In such cases, the debit note should also include a supplementary invoice In GST law, format of credit and debit note has not been prescribed However certain mandatory details are prescribed to be mentioned in the debit and credit note. A credit note is issued when The taxable value declared by the supplier in the tax invoice is more than the actual taxable value of the goods or services supplied For example, if a product originally priced at Rs 100 is incorrectly invoiced at Rs 150, then a credit note of Rs 50 will be issued by the. Credit note in GST is defined under section 34 (1) of the CGST act 17 It is a document issued by the supplier of goods or services to the recipient where – a tax invoice has been issued for any supply of goods or services or both and.

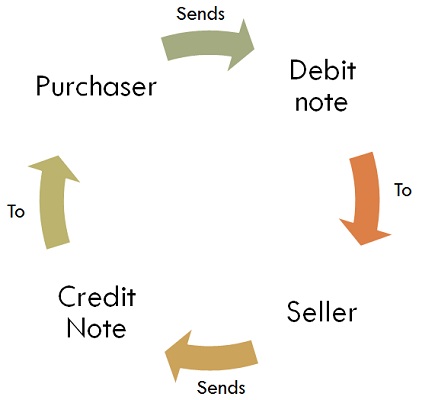

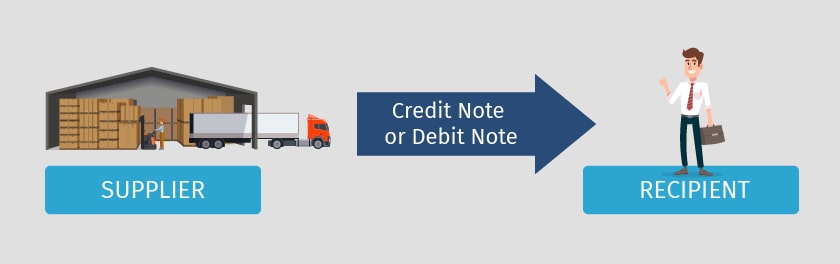

Or we can NONGST credit note commonly known as Financial Credit Note that do not have any GST impact and need not to be reported in GST returns, As per Circular No 72/46/18GST Dated 26th October, 18 which relates to Clarification in respect to return of expired drugs or medicines. A Credit Note or Debit Note under GST is a document which a seller issues to the buyer for making an adjustment to the original invoice issued Credit Note is issued when the value of the invoice reduces The buyer is liable to make lesser payment to the seller after adjusting the value of credit note from the original invoice issued to the buyer. You can create a Debit Note or a Credit Note in no time using ClearTax GST software Once you create a Credit or Debit Note the amount gets adjusted against the original invoice Simplify Your GST Invoicing Get Trained & Try Cleartax GST Software for FREE Start Free GST Software Trial & Training.

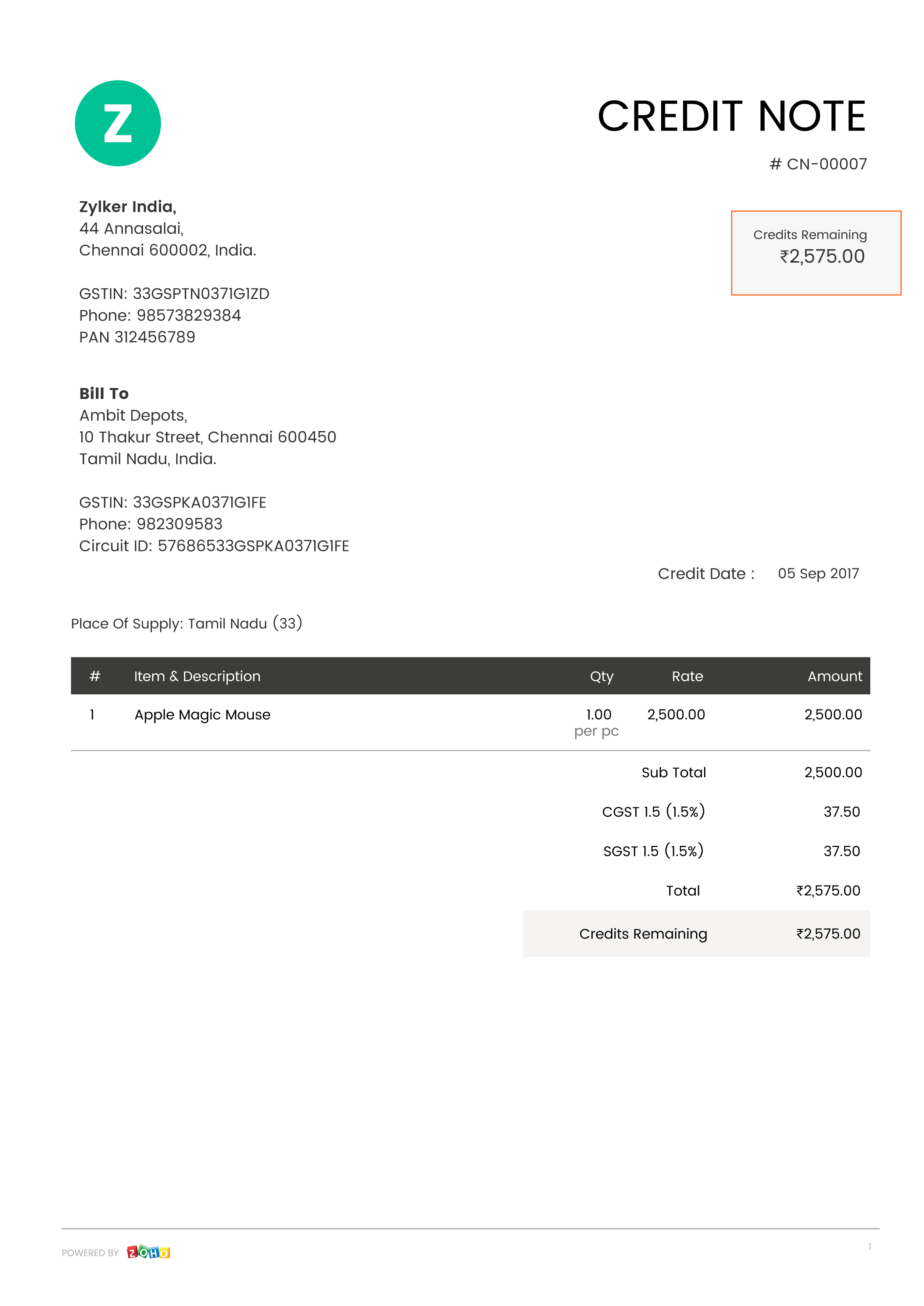

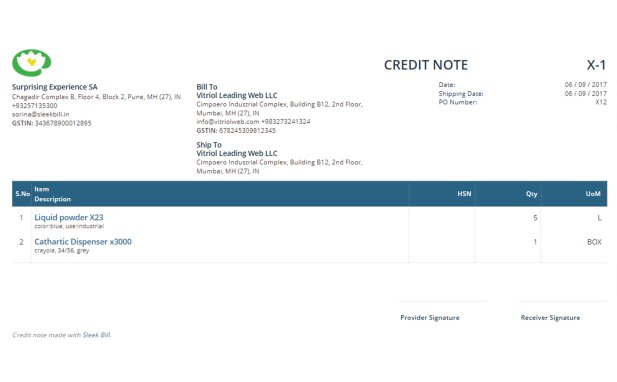

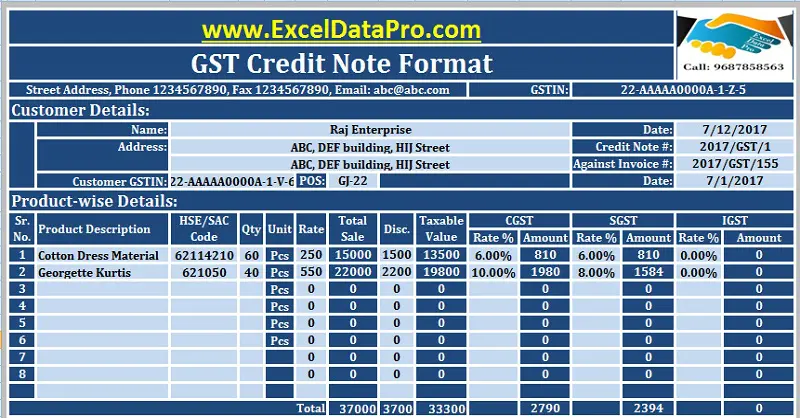

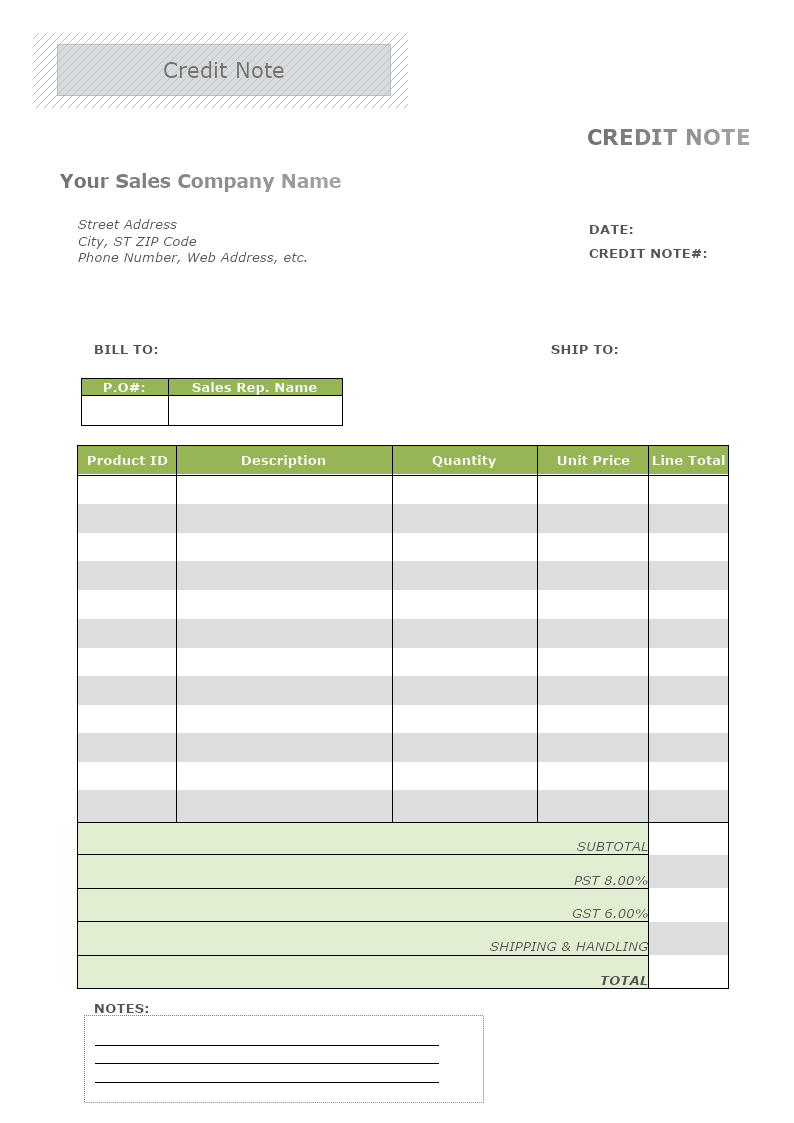

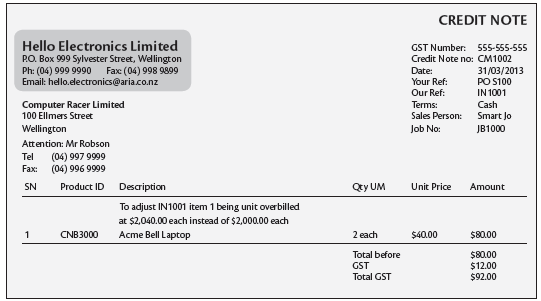

Once the credit note has been issued, the tax liability of the supplier will decrease Format of Credit Note There is no prescribed format but credit note issued by a supplier must contain the following particulars, namely (a) Name, address and GST no of the supplier (b) Nature of the document (c) A consecutive serial number not exceeding. Credit Note under GST 1 You need to issue a credit note, if the tax invoice has been issued earlier against material returned back by the customer A Tax Invoice shall meet the requirements of Section 31(1) of CGST Act/State GST Act for the supply of goods and under Section 31(2) for the supply of services subject to Rule 1 of Invoice Rules. Thus, the customer prefers the credit note with GST at least till September month following the end of the financial year to which the original supply pertains to Goods return Sec34(2) restricts the supplier to issue credit note with GST on sales return also The supplier can raise a credit note with GST only up to the month of September.

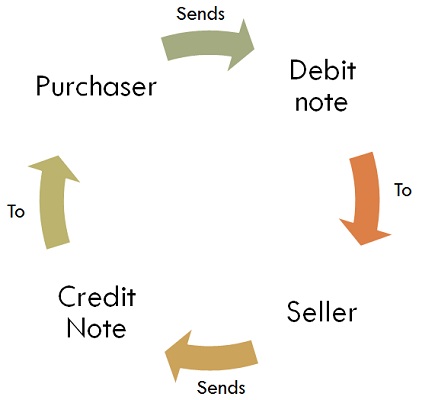

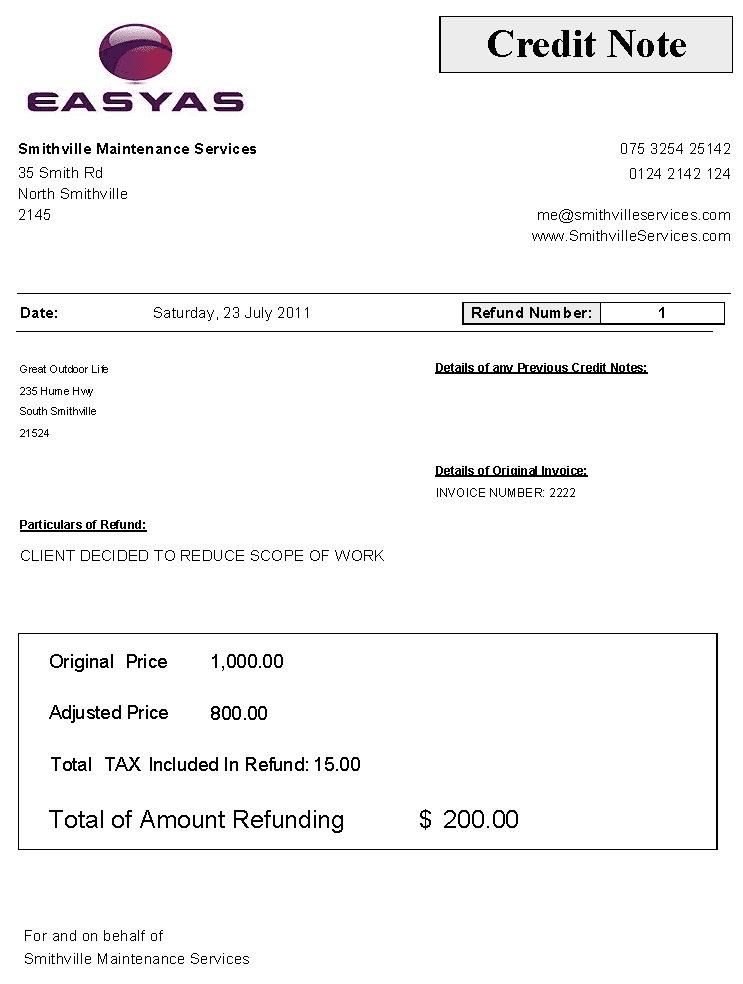

A credit note is also known as a credit memo, which is short for "credit memorandum" This is a commercial document that the supplier produces for the customer to notify the customer that a credit is being applied to the customer for various reasons The reasons normally include the following. Below is the basic understanding of Debit Note and Credit Note If there is a decrease in the amount payable by buyer to sellerAfter supplying the goods and services, there may be a change in the invoice generated by the seller This may happen due to the return of goods or goods being of bad. Credit and Debit notes under GST If you have issued a tax invoice for supply of goods or services or both, and if later on it is found out that the amount or tax charged was higher or goods are returned or goods or services are found to be deficient, you may issue a credit note.

When is a credit note issued under GST?. Credit Note in GST Introduction A supplier of goods or services or both is mandatorily required to issue a tax invoiceHowever, during the course of trade or commerce, after the invoice has been issued there could be situations like. A credit note request can be issued, however, when a customer notices discrepancy in the agreed terms and the invoice received So, the request is to refute the supplier’s claim by asking that a credit note be issued to reflect what is owed to the customer Usually the request is made by filling out a request form made available by the firm.

Note Credit Note Debit Note Unregistered is NOT to be issued in case of B2C Small Sales(Central Sales upto 25 lac or local sales any amt) In this case,We directly show Net amount in B2C Small (SalesSales Return) We do not separately fill Credit Note Debit Note Unregistered column. How will credit note be treated in GST, of performance incentive for achieving sales Targets etc, given on yearly or quarterly basis to authorized distributors, which is agreed to in the beginning of the year and not shown in the Invoices Same is the case of cash discount If payment made within agreed to schedule discount is given by credit. New sets of amendments and additions have recently been introduced in existing GST provisions via the Fourteenth GST Amendment Rules, This article focuses on one such crucial rule inserted relating to input tax credit with effect from Jan 1, 21 A new rule 86B has been inserted, requiring a certain unique segment of taxpayers to compulsorily discharge at least 1% of their output GST.

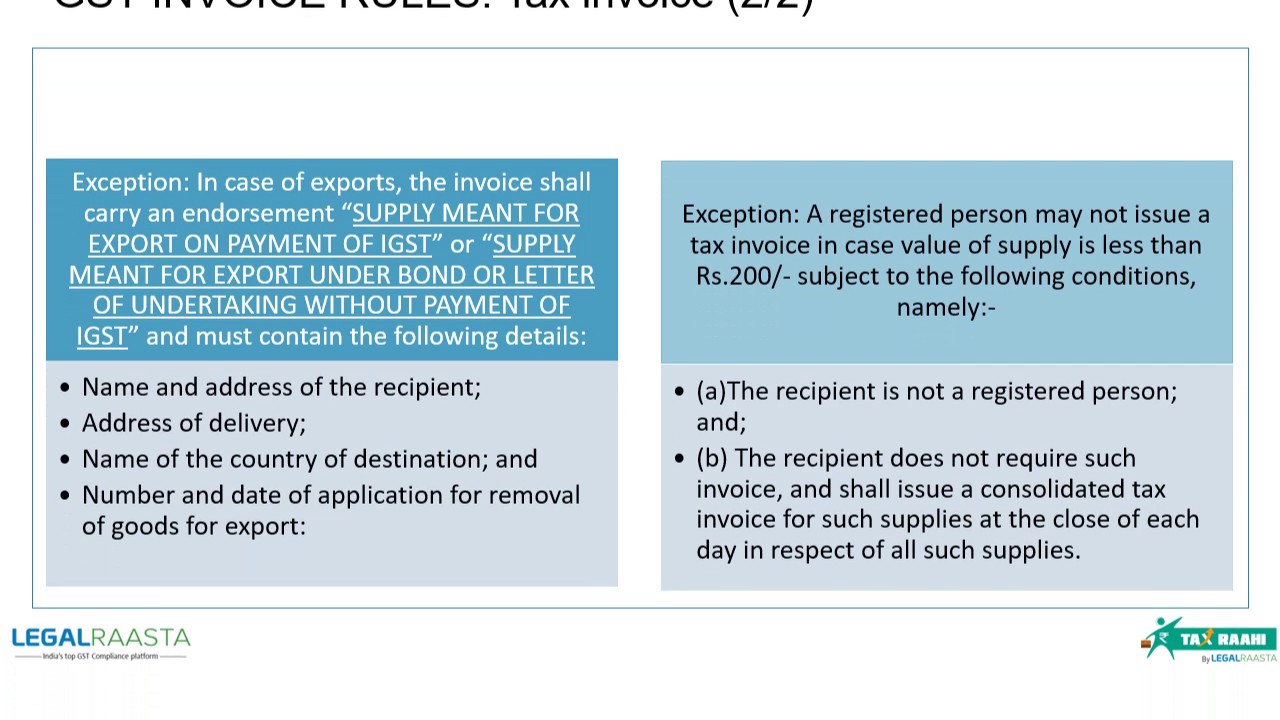

The rate of GST or Tax amount charged is at a lower rate than what is applicable for the kind of goods or services supplied;. Click here for Download GST Rule for Invoice, Credit Note, Debit Note Etc updated Formats (GST Tax Invoice,GST Credit Note Format in Excel,GST Debit note format in Excel ) RULE OF TAX INVOICE, GST CREDIT NOTE AND GST DEBIT NOTES Update 0107 Read more Disclaimer. A credit note in GST is a document issued by the supplier in the following cases Supplies are returned or found to be deficient by the recipient When goods supplied are returned by the recipient of Decrease in taxable value When a supplier requires to decrease the taxable value of a supply,.

A Credit Note and Debit Note for the purpose of GST Law, can be Issued by the Registered Person who has issued the tax Invoice ie The Supplier Any Such Document, by whatever name called (Debit Note or credit Note) when issued by the recipient to the registered supplier, will not be considered any document under GST Law CREDIT NOTE Sec 2 (37). Credit Note in GST Introduction A supplier of goods or services or both is mandatorily required to issue a tax invoiceHowever, during the course of trade or commerce, after the invoice has been issued there could be situations like. Note If you've previously provided us with any of the information listed below, you don't need to provide it again The information we need for a private ruling or objection about treating a document as a tax invoice or adjustment note includes whether you have claimed any GST credits on the sale.

The credit note is therefore a convenient and legal method by which the value of the goods or services in the original tax invoice can be amended or revised The issuance of the credit note will easily allow the supplier to decrease his tax liability in his returns without requiring him to undertake any tedious process of refunds. Credit Note in GST which such supply was made, or the date of furnishing of the relevant annual return, whichever is earlier In other words, the output tax liability cannot be reduced in cases where credit note has been issued after September The output tax liability of the supplier gets reduced once the credit note is issued and it is matched. Credit Note in GST Credit Note in GST Credit Note in GST, A supplier of goods or services or both is mandatorily required to issue a tax invoiceHowever, during the course of trade or commerce, after the invoice has been issued there could be situations like • The supplier has erroneously declared a value which is more than the actual value of the goods or services provided.

Tax liability on such debit note has to be adjusted accordingly in the return In such cases, the debit note should also include a supplementary invoice In GST law, format of credit and debit note has not been prescribed However certain mandatory details are prescribed to be mentioned in the debit and credit note. A credit note request can be issued, however, when a customer notices discrepancy in the agreed terms and the invoice received So, the request is to refute the supplier’s claim by asking that a credit note be issued to reflect what is owed to the customer Usually the request is made by filling out a request form made available by the firm. Credit notes are defined in section 2 (37) of the GST Law Credit notes can be issued in the following cases Taxable value present in the invoice is more than the actual taxable amount or Tax charged in the invoice is more than actual tax payable.

Credit note under GST is issued as per provisions of section 34 of the CGST/SGST Act And, if the credit note has been amended for And, if the credit note has been amended for Adjustment permitted under section 15 ie in respect to an agreement existing on the date of supply – shall be disclosed while filing an annual return. Under the GST regime, a Credit Note is a kind of commercial instrument that is issued by one party to the another party (sellerpurchaser) providing all the essential details for the amount credited to the purchaser’s account and the valid reason behind the same In practice, it is issued by the seller in exchange for the Debit Note issued by. Click here for Download GST Rule for Invoice, Credit Note, Debit Note Etc updated Formats (GST Tax Invoice,GST Credit Note Format in Excel,GST Debit note format in Excel ) RULE OF TAX INVOICE, GST CREDIT NOTE AND GST DEBIT NOTES Update 0107 Read more Disclaimer.

Credit Note in GST which such supply was made, or the date of furnishing of the relevant annual return, whichever is earlier In other words, the output tax liability cannot be reduced in cases where credit note has been issued after September The output tax liability of the supplier gets reduced once the credit note is issued and it is matched. Can credit note be issued without GST?. You may have a return goods policy where you will refund the selling price and GST for the return of defective goods You should issue a credit note to your customer for the returned goods The credit note must make reference to the original tax invoice issued.

The debit and credit note in GST shall contain the following details name, address, and GSTIN of the supplier nature of the document a consecutive serial number containing only alphabets and/or numerals, unique for a financial year date of issue of the document name, address and GSTIN/ Unique. RULE OF TAX INVOICE, GST CREDIT NOTE AND GST DEBIT NOTES Update 0107 This GST Rule updated and amended upto 1st July , has been prepared for convenience and easy reference of the Read more. In GST preferably the supplier should raise the credit note or debit note as the case may be If the credit note raised is in respect of B2B supply then it will be shown in table 9 of FORM GSTR1 and if it is against B2C supply it should be shown in table 7 of FORM GSTR1.

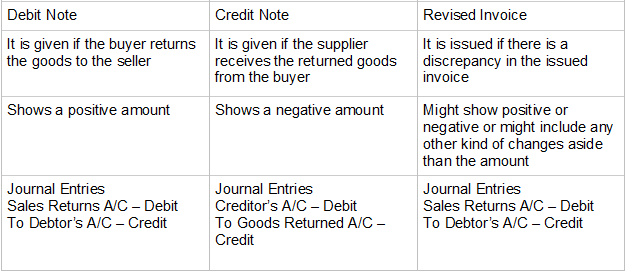

Under GST, such debit notes have no relevance, as the supplier issues, both debit and credit notes We will now take a look at when a debit note is issued;. When is a credit note issued under GST?. What is the Debit Note and Credit Note in GST?.

A Credit Note or Debit Note under GST is a document which a seller issues to the buyer for making an adjustment to the original invoice issued Credit Note is issued when the value of the invoice reduces The buyer is liable to make lesser payment to the seller after adjusting the value of credit note from the original invoice issued to the buyer. Credit note under GST is issued as per provisions of section 34 of the CGST/SGST Act And, if the credit note has been amended for And, if the credit note has been amended for Adjustment permitted under section 15 ie in respect to an agreement existing on the date of supply – shall be disclosed while filing an annual return. Credit Note under GST 1 You need to issue a credit note, if the tax invoice has been issued earlier against material returned back by the customer A Tax Invoice shall meet the requirements of Section 31(1) of CGST Act/State GST Act for the supply of goods and under Section 31(2) for the supply of services subject to Rule 1 of Invoice Rules.

Note Credit Note Debit Note Unregistered is NOT to be issued in case of B2C Small Sales(Central Sales upto 25 lac or local sales any amt) In this case,We directly show Net amount in B2C Small (SalesSales Return) We do not separately fill Credit Note Debit Note Unregistered column. Under the GST regime, a Credit Note is a kind of commercial instrument that is issued by one party to the another party (sellerpurchaser) providing all the essential details for the amount credited to the purchaser’s account and the valid reason behind the same In practice, it is issued by the seller in exchange for the Debit Note issued by. Benefits In the past, taxpayers had to issue separate credit or debit notes for every relevant tax invoice raised in a financial year under GST However, now, one credit/debit note shall suffice This facility will reduce the disclosure burden on the taxpayer and thus, simplify the GST compliance.

A credit note is issued when The taxable value declared by the supplier in the tax invoice is more than the actual taxable value of the goods or services supplied For example, if a product originally priced at Rs 100 is incorrectly invoiced at Rs 150, then a credit note of Rs 50 will be issued by the. Create a sales credit note for a taxable item In the Original invoice number field, select a value Verify that the Original invoice date field is automatically set based on the original invoice number that you selected, and then save the record Select Tax information Select the GST tab Select the Customer tax information tab Select OK. Ans Yes, credit note contains GST amount which is reversed in relation to original or previous invoice Credit note causes a reduction in Output GST liability for the supplier Q 2 How to treat following transaction in GST (i) Delivered supply shortages in Transit (ii) A customer gets less quantity and pays less.

GST Credit Note & Debit Note Format In India In a business, suppliers issue GST invoices quite frequently However, there are circumstances when an already issued invoice needs to be amended due to the rejection of a few products or add up a few products as the case may be. It is important to note that Credit Notes are only issued to adjust the taxable value and not issued for adjusting tax in the books of accounts However, the Tax liability of the supplier cannot be adjusted if the credit note is issued after the due date. Then the registered person, who has supplied such goods or services or both, shall issue a Debit Note to the recipient Once the Debit Note is issued, the tax liability of the supplier will increase 4.

Credit Note Can Be Issued Without Gst

Credit Note Zoho Books

Credit Note In Gst All You Want To Know

Credit Note In Gst のギャラリー

Horizon Erp Tutorial

04 Sales Credit Note With Gst Summary E Stream Msc

Credit Debit Notes Cleartax Help Center

Gst Tax Invoice Credit Note And Debit Note By Bhaskar Reddy Issuu

Debit Notes In Gst Law

Credit Debit Note Under Gst Credit Debit Note Under Gst

Gst Tax Invoice Gst Credit Note Format In Excel Debit Notes Formats In Excel Gst Rule For Invoice Credit Note Debit Note Etc Updated 18 04 18 Latest Law And Tax News

Gst Faq On Invoice Debit Credit Note Simple Tax India

What Is Debit Credit Note Treatment Under Gst Legalraasta

Credit Note Uses And Format Of Credit Note Legalraasta

Www Cbic Gov In Htdocs Cbec Gst E Flier Credit Notes Revised Pdf

What Are Debit Notes Credit Notes Under Gst Hostbooks

All About Credit Note Debit Note In Gst Return Filing

How To Report Debit Credit Notes In Gstr 1 Expert Speaks Sahigst Knowledge Centre

How To Return Goods And Create Credit Notes Including Gst How To Flectrahq

Using Invoice Debit Note Credit Note And Purchase Order Subsystems

Gst Credit Note Debit Note Format In India Lifetime Free Gst Billing Software

Credit Notes Template In Ms Excel Format Notes Template Excel Templates Credit Note

Debit Credit Note Under Gst

Gst Credit Debit Notes After Cgst Amendment Act Gstindiaguide

Debit Note Credit Note In Gstr 3b Gst Forum

Provisions For Issuing Credit Note Under Gst

2

.jpg)

Debit Note Credit Note Gstr1 Gst Return Format

Q Tbn And9gcq4ejzmf7vru4e Aj5ok8dsxatbeq6mto3tb0rrnqdrjtxsukqz Usqp Cau

Amendment Under Gst In Debit Note And Credit Note

Gst Tax Invoice Rules Format Credit Note Debit Note Rules Accounting Taxation

Q Tbn And9gctgohx9bakd7i642sjzv25guhu5zfzycinivsdegpgwq8cd6bwo Usqp Cau

Debit Note And Credit Note Entries In Tally Erp9 Waytosimple

Govt Issues Concept Notes On Credit Debit Notes Taxscan

Consolidated Debit Credit Note Enabled On Gst Portal

How To Report Debit Credit Notes In Gstr 1 Expert Speaks Sahigst Knowledge Centre

Gst Debit Credit Note In Tally Erp 9 Youtube

Q Tbn And9gctgohx9bakd7i642sjzv25guhu5zfzycinivsdegpgwq8cd6bwo Usqp Cau

Gstr1 How To Fill Credit Debit Note For Registered Persons In English By Ca Bhavishyasri Youtube

Credit Note And Debit Note Under Gst Differences And Meaning

What Are Debit Credit Note And Their Formats Khatabook

How To Enter Gst Debit Note In Tally Erp 9 Voucher Entry

Gst Faq On Invoice Debit Credit Note Simple Tax India

Quickbooks Refunds And Credits Solarsys

Gstr 1 Credit Note Entry In Tally Erp 9 Youtube

.jpg)

How To Fill Gstr1 Invoice Details 9b Credit Debit Notes Unregis

0sales Credit Note 7 Gst 1 E Stream Msc

What Are Credit Notes Debit Notes Under Gst

Concept Of Debit Note Credit Note And Revised Invoices In Gst

Gotw Xero Tip Credit Notes For Sales Bwr Accounting

Gst Istc

Debit Note And Credit Note Under Gst Accountingbuzz In

Http Prasarbharati Gov In Pbcircular Finance Wing 8580 Pdf

Credit Note Format For Gst

Gst Invoices Gst Invoice Format Rules For Supply Of Goods And Supply

.jpg)

Multiple Reference Invoice Against Single Credit Debit Note Gst

What Is Debit Note Credit Note And Revised Invoice

All About Revise Tax Invoice Under Gst With Debit Credit Note

How To Create A Sales Return Credit Note Entry Under Gst Regime Tally Knowledge

Franchise Return Can Now Be Treated As Gst Credit Note Ginesys

Debit And Credit Note Under Gst Hindi Debit And Credit Note Tutorial Video Hindi Youtube

Download Gst Credit Note Format In Excel Issued Against Goods Return Or Over Billing Exceldatapro

Credit Note Format Under Gst Gst Guide Indiafilings

Debit Credit Notes With Tax Invoices Under Gst

Delinking Of Credit Note And Debit Note On Gst Portal Masters India

E Way Bill And Debit Credit Notes All You Need To Know Ipleaders

All About Revise Tax Invoice Under Gst With Debit Credit Note

Create Credit Note In Tally Erp 9 Gst Credit Note Entry Example

Tax Invoice Credit And Debit Notes Under Gst

Fillable Online Formats Tax Invoice Credit Note Debit Notes In Excel Fax Email Print Pdffiller

What Is Credit Note In Gst Meaning And Example Quickbooks

E Way Bill And Debit Credit Notes All You Need To Know Ipleaders

What Is Credit Note Under Gst Tally Solutions

Gst Faq On Invoice Debit Credit Note Simple Tax India

What Is Credit Note In Gst Meaning And Example Quickbooks

Download Gst Credit Note Format In Excel Issued Against Goods Return Or Over Billing Exceldatapro

Sample Credit Note Includes Gst Sales Tax Refund Amount Easyas Accounting Software

Debit Note Vs Credit Note

Difference Between Debit Note And Credit Note Accountingcapital

1

Cleartax Gst Software How To Create View Bulk Import Credit Debit Notes

Gst Who Can Issue Tax Invoice Credit Note Debit Note Payment Vou

Credit Notes Help Zoho Books

Credit Note Template Mydraw

What Is Debit Note Credit Note And Revised Invoice Tax2win

Transaction File Maintenance Purchase Credit Note With Gst 6 Exclusive Except Im Sage Connected Learning

Credit Note Debit Note Meaning And Formats Under Gst Law

What Is Credit Note Under Gst Tally Solutions

What Is Debit Note Credit Note And Revised Invoice Tax2win

Gst Who Can Issue Tax Invoice Credit Note Debit Note Payment Vou

Credit Note In Gst All About Goods And Services Tax

Customer Credit Note And Tax Invoice Listing Smart Acc E Support

Gst 103 Adjustments Ps Help Tax Nz Myob Help Centre

What Is A Credit Note And Debit Note In Accounting Or Tally Quora

Time Limit To Issue Invoices Debit Note Credit Note Under Gst

What Is A Debit Note And Credit Note In Gst Vakilsearch

Credit Note And Debit Note Meaning With Format In Excel

Debit Note Voucher Ctrl F9 Purchase Return In Tally Erp9

What Is A Credit Note Under Gst Learn By Quicko

Image Result For Sample Of Gst Credit Note Credit Note Notes Credits

How To Edit Cancel And Delete Credit Note For Purchases With Hostbooks Gst Software

Debit Note And Credit Note Entries In Tally Erp9 Waytosimple

Service Credit Note Template

Transaction File Maintenance Sales Credit Note With Gst 0 Sage Connected Learning

Transaction File Maintenance Sales Credit Note With Gst Inclusive Sage Connected Learning