Private Equity Investor

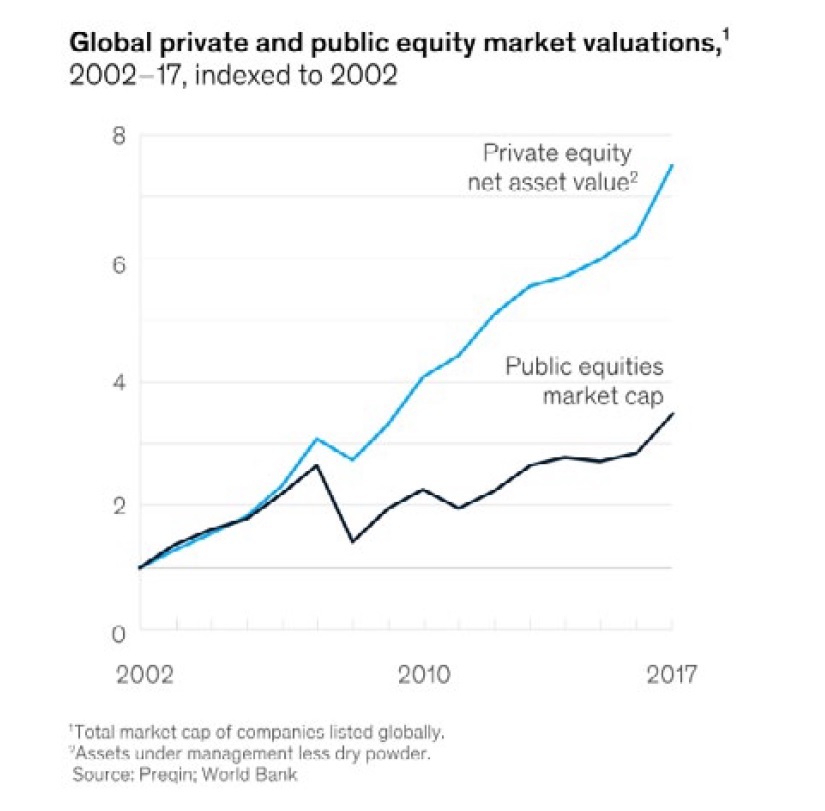

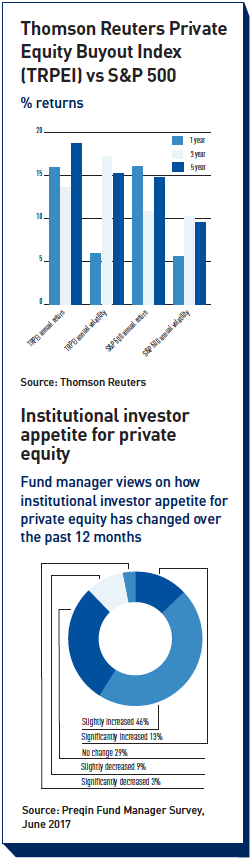

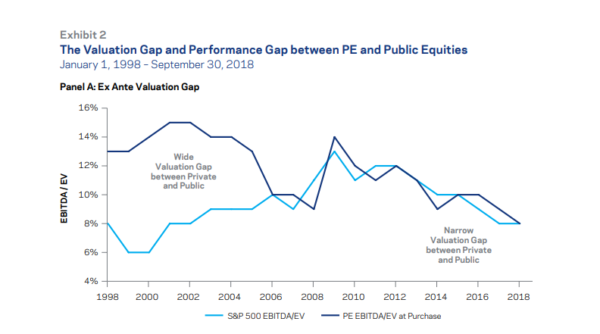

Private equity investing should always deliver an illiquidity premium when compared against public equity market investing Our investmentled process has been refined to focus on highconviction private equity strategies with riskreturn profiles that have rewarded illiquidity in the past, and where we believe that a supply and demand imbalance between the need for investment and available capital will persist in the future.

Private equity investor. Emerging Markets Report ;. Discussions have taken place in recent months Publicis Groupe holds sale talks with private equity investor Discussions have taken place in recent months. NiFi Investors encompasses all aspects of private equity, including firms focused on providing buyout, growth, venture, recapitalization, mezzanine, and debt capital Key details about each firm.

Operational Excellence Awards ;. Our global private equity team is active in fund investments, secondaries, and coinvestments— providing us with a differentiated perspective Proven Strategy We invest in all private equity strategies to deliver solutions that can help capture more upside when public markets perform well and less downside when they do not. Impact Investing Report ;.

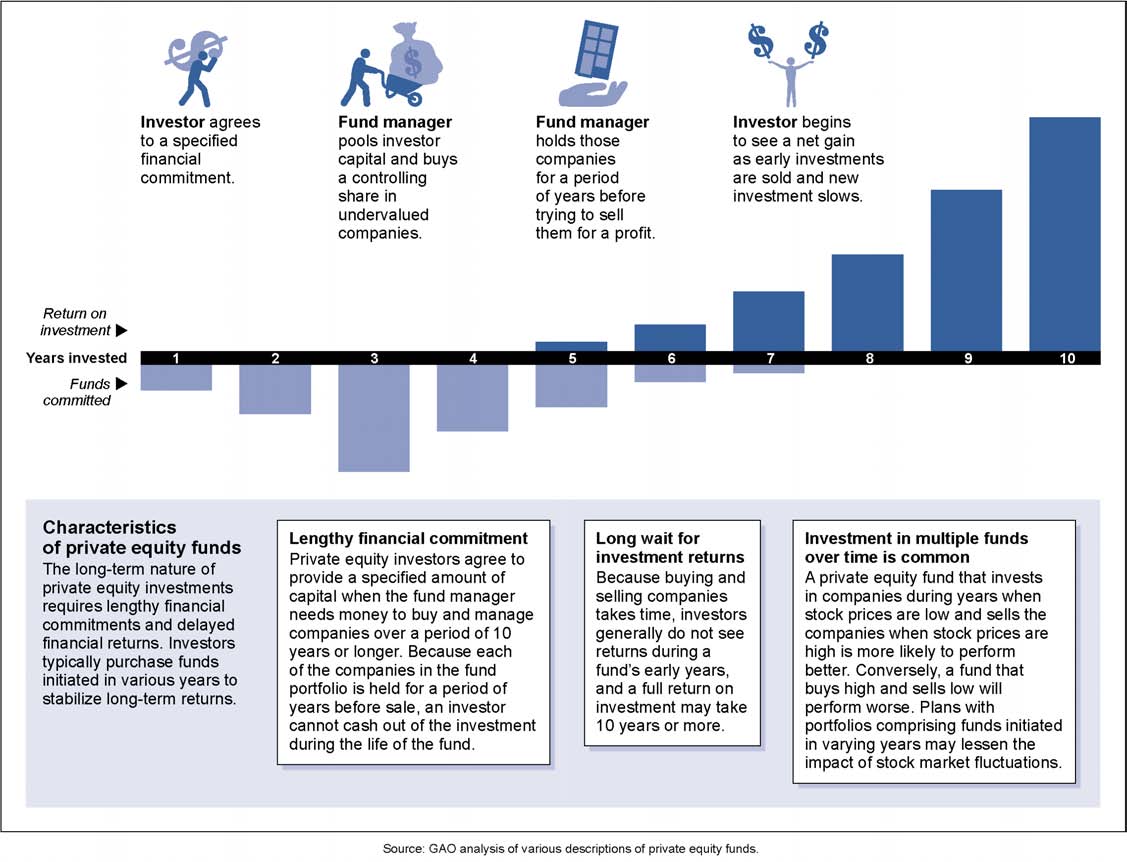

By Roxanne Henderson (Bloomberg) – Privateequity investors in southern Africa are closing deals again after a virusinduced lull, tapping a cash pile that stood at more than R30bn ($2bn) in June, according to an industry association Businesses in the education, health care and retail sectors operating online are among the top picks for investors seeking to take advantage of market gaps. Private Equity is defined as “an alternative investment class and consists of capital that is not listed on a public exchange Private equity is composed of funds and investors that directly invest. Similar to a mutual fund or hedge fund, a private equity fund is a pooled investment vehicle where the adviser pools together the money invested in the fund by all the investors and uses that money to make investments on behalf of the fund Unlike mutual funds or hedge funds, however, private equity firms often focus on longterm investment opportunities in assets that take time to sell with an investment time horizon typically of 10 or more years.

Institutional investment in the Indian real estate staged a smart recovery during Q4 with USD 35 billion worth of investments in different asset classes As a result, closed with USD 5. PrivateEquityListcom is a fast and easytouse platform to identify relevant private equity, venture capital and angel investors for any project, startup or a mature company At first, we started as a PE/VC database only, but then we decided to explore and consolidate other financing options for startups. The private equity fund has an existing sports investment in City Football Group, the holding company of Premier League club Manchester City, and was part of a consortium that bought out the UFC.

Private equity funds are pools of capital to be invested in companies that represent an opportunity for a high rate of return They come with a fixed investment horizon, typically ranging from four to seven years, at which point the PE firm hopes to profitably exit the investment Exit strategies include IPOs. Private equity is a type of investment that is provided for a medium to long term period to companies who have high growth potential in exchange for a certain percentage of equity of the investee These high growth firms are not listed companies on any exchange. By Roxanne Henderson (Bloomberg) – Privateequity investors in southern Africa are closing deals again after a virusinduced lull, tapping a cash pile that stood at more than R30bn ($2bn) in June, according to an industry association Businesses in the education, health care and retail sectors operating online are among the top picks for investors seeking to take advantage of market gaps.

Sometimes this type of investment is done to gain major or complete control of the company in anticipation of higher As an example, you may note from above, Lyft raised an additional $600 million Series G Private Equity funding that. Christopher is the Head Of Private Equity And Venture Capital at Cuesta Partners, which helps investors and companies evaluate, plan and build better tech to support their business He cofounded. 408 Private Equity Investor Relations jobs available on Indeedcom Apply to Private Equity Associate, Analyst, Director of Finance and more!.

ISTOX, a digital securities platform that wants to make private equity investment more accessible, has added new investors from Japan to its Series A round, bringing its total to $50 million Two. Manager outlook on in light of covid19;. What is Private Equity?.

Unlike publicly traded securities, private equity investing is an alternative investment where individuals own a portion of a private company Investors seek out private equity investing with the. Institutional investment in the Indian real estate staged a smart recovery during Q4 with USD 35 billion worth of investments in different asset classes As a result, closed with USD 5. There are two main ways for the average individual to become a private equity investor Perhaps the easiest way is to find a local company that can use some extra capital and buy in as a partner.

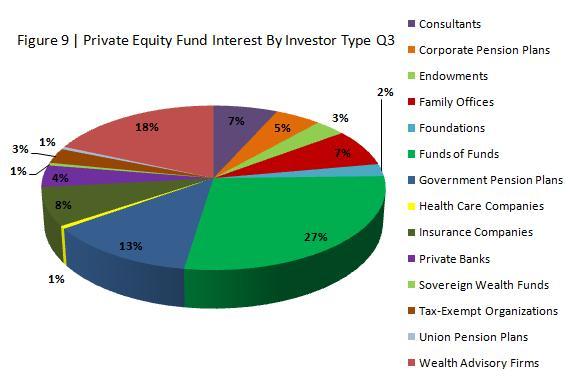

Private Equity Understanding Private Equity Private equity investment comes primarily from institutional investors and accredited History of Private Equity While private equity has garnered mainstream spotlight only in the last three decades, Concerns Around Private Equity Beginning in. Lower investment minimums ($50K) and eligibility requirements than most private equity funds A single capital call (traditional private equity can require multiple calls over a multiyear period). Private Equity Investor Report;.

Unlike publicly traded securities, private equity investing is an alternative investment where individuals own a portion of a private company Investors seek out private equity investing with the. New York City, New York, United States About Blog Private Equity International is the only global publication with a primary focus on the relationship between investors and fund managers in private equity the LPGP nexus It is independent magazine and website covering the global Private Equity industry. Private Equity Fundraising Reports;.

Lower investment minimums ($50K) and eligibility requirements than most private equity funds A single capital call (traditional private equity can require multiple calls over a multiyear period). Lower investment minimums ($50K) and eligibility requirements than most private equity funds A single capital call (traditional private equity can require multiple calls over a multiyear period). New York City, New York, United States About Blog Private Equity International is the only global publication with a primary focus on the relationship between investors and fund managers in private equity the LPGP nexus It is independent magazine and website covering the global Private Equity industry.

PRIVATE EQUITY & INVESTORS With almost 4,000 PE firms worldwide and nearly a trillion dollars of dry powder on the sidelines, competition for targets is fierce and deals are more complex than ever Smart decisionmaking is critical at every stage of the investment life cycle From performing due diligence to improving portfoliocompany performance to maximizing exit value, we collaborate with and enhance management teams. Private equity is something of an umbrella term to cover different types of investment, McKinnon says For example, it is capital that could be used to buy out an entire company, or to pump into a. Private equity is a type of investment where professional investors raise a large fund (generally from affluent investors) and reinvest those funds in a wide range of ways seeking the biggest possible profit.

Private equity is wellcapitalised to face the economic and social trauma caused by the covid19 pandemic Blackstone’s Joe Baratta tells us why, at times like this, it’s a blessing to be private equity owned Firms now need at least $14 billion to get into our ranking – versus $868 million in 10. There are two main ways for the average individual to become a private equity investor Perhaps the easiest way is to find a local company that can use some extra capital and buy in as a partner. Institutional investment in the Indian real estate staged a smart recovery during Q4 with USD 35 billion worth of investments in different asset classes As a result, closed with USD 5.

Private equity is something of an umbrella term to cover different types of investment, McKinnon says For example, it is capital that could be used to buy out an entire company, or to pump into a. Alpine Investors is a private equity firm based in San Francisco focusing on software and services Menu About Peopledriven private equity Team Investing in exceptional people Portfolio Taking businesses to new heights Stories Careers Updates Contact Login ONE CALIFORNIA STREET, SUITE 2900 SAN. PrivateEquity Private Equity AEA’s private equity funds have a long history of building businesses and creating value for its investors with limited downside risk The private equity funds focus on three sectors – ValueAdded Industrials, Consumer and Services This specialization and expert industry knowledge helps the funds source, evaluate and improve AEA portfolio companies.

CDPQ's allocation to private equity is the global market’s fourth largest, according to Private Equity International’s Global Investor 100 Lower distributions in 21 open doors for secondaries investors – report. Sebastien Canderle is a private equity and venture capital advisor He has worked as an investment executive for multiple fund managers He is the author of several books, including The Debt Trap and The Good, the Bad and the Ugly of Private Equity Canderle also lectures on alternative investments at business schools. Private equity investing includes earlystage, highrisk ventures, usually in sectors such as software and healthcare These investors try to add value to the companies they invest in by bringing.

Energy Capital Partners is a private equity and credit investor focused on existing and newbuild energy infrastructure projects 05 Founded 14year history $ billion in capital commitments 600 limited partners globally. Sebastien Canderle is a private equity and venture capital advisor He has worked as an investment executive for multiple fund managers He is the author of several books, including The Debt Trap and The Good, the Bad and the Ugly of Private Equity Canderle also lectures on alternative investments at business schools. Private equity is something of an umbrella term to cover different types of investment, McKinnon says For example, it is capital that could be used to buy out an entire company, or to pump into a.

Magazine and Special Reports Magazines;. Christopher is the Head Of Private Equity And Venture Capital at Cuesta Partners, which helps investors and companies evaluate, plan and build better tech to support their business He cofounded. The Sunley House team works closely with Advent’s private equity investment team Sunley House’s public equityfocused strategy is complementary to Advent’s core private equity business as it enhances the firm’s investment capabilities and knowledge globally Find out more Contact us to learn more about Advent LP XTRANET.

By Roxanne Henderson (Bloomberg) – Privateequity investors in southern Africa are closing deals again after a virusinduced lull, tapping a cash pile that stood at more than R30bn ($2bn) in June, according to an industry association Businesses in the education, health care and retail sectors operating online are among the top picks for investors seeking to take advantage of market gaps. ISTOX, a digital securities platform that wants to make private equity investment more accessible, has added new investors from Japan to its Series A round, bringing its total to $50 million Two. CPPIB is the biggest private equity investor among public pension funds globally at $77 billion, the paper shows Only five insurance companies made the top 40 biggest institutional investors in.

Private equity investing may broadly be defined as "investing in securities through a negotiated process" The majority of private equity investments are in unquoted companies Private equity investment is typically a transformational, valueadded, active investment strategy. By Roxanne Henderson (Bloomberg) – Privateequity investors in southern Africa are closing deals again after a virusinduced lull, tapping a cash pile that stood at more than R30bn ($2bn) in June, according to an industry association Businesses in the education, health care and retail sectors operating online are among the top picks for investors seeking to take advantage of market gaps. ISTOX, a digital securities platform that wants to make private equity investment more accessible, has added new investors from Japan to its Series A round, bringing its total to $50 million Two.

The same private equity investors bought AsatsuDK in 17 when it was the third biggest agency group in Japan after Dentsu and Hakuhodo Related Member Exclusive. The chief purpose of getting into private equity is to earn a lot more and work comparatively less But the truth of the matter is, private equity firms require you to work longer hours (sometimes longer than investment banking) if the need arises So earning great compensation by putting in lesser hours of work is a myth. Private equity is a form of investment in which investors gain ownership stake in private companies, as opposed to public companies on the stock market.

Publicis Groupe holds sale talks with private equity investor Discussions have taken place in recent months. Lower investment minimums ($50K) and eligibility requirements than most private equity funds A single capital call (traditional private equity can require multiple calls over a multiyear period). Arm’sLength Investor Under this model, principal investors provide highlevel strategic guidance to company management Counselor Under this model, principal investors take on the role of trusted advisor, working with the board and senior Active Tutor In this model, principal investors.

NB PRIVATE EQUITY PARTNERS INVESTOR PRESENTATION 15 Portfolio Liquidity During , NBPE has received $199 million of realisations (18% of 31/12/19 portfolio fair value) Over the past 10 years, average annual liquidity (as % of beginning of year value) was ~% Note As of 31 December Realisations $0 $50 $100 $150 $0 $250 $300 $350. Institutional investment in the Indian real estate staged a smart recovery during Q4 with USD 35 billion worth of investments in different asset classes As a result, closed with USD 5.

Private Equity Investor Group Aims To Improve Industry S Diversity

Venture Capital Wikipedia

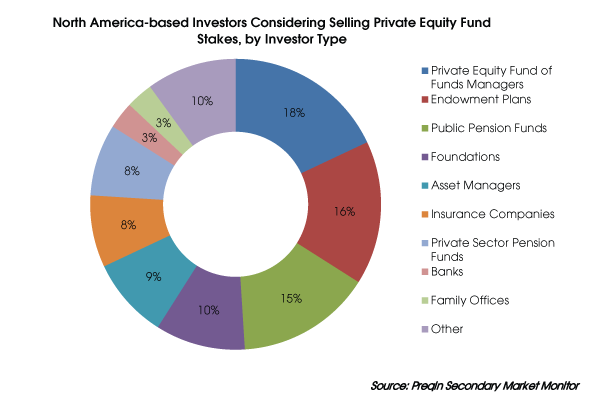

North America Based Investors Open To Selling Private Equity Interests On The Secondary Market Preqin

Private Equity Investor のギャラリー

Smg Private Capital Markets Smg A Family Of Companies

Private Equity Investor Value Creation

Private Equity Investment For Company Growth New Business Age Leading English Monthly Business Magazine Of Nepal

Private Equity Wikipedia

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

Private Equity Definition

Pdf Risk And Return Characteristics Of Listed Private Equity

Venture Capital And Private Equity Investor Assessment Of Effectiveness Download Scientific Diagram

Invest Europe Report European Private Equity Investments Increased 7 To 80 6 Billion In 18 Tech Eu

Private Equity Fund Investment In Different Sets Of Business Portfolios Icon Presentation Powerpoint Diagrams Ppt Sample Presentations Ppt Infographics

North America Based Private Equity Investors Appetite For Buyout Funds January 15 Preqin

Grain Barbarians At The Barn Private Equity Sinks Its Teeth Into Agriculture

Pei S Debut Quarterly Investor Report Private Equity International

Munich Based Private Equity Investor Acquires M Sicherheitsbeteiligungen Gmbh Research Germany

Private Equity Investor Cvc Capital Partners Makes 0m Esg Investment Esg Today

Private Equity Euromoney Learning On Demand Powered By Finance Unlocked

Building A Venture Capital Strategy For A Private Equity Investor Blue Future Partners

Private Equity Investor Calendar Private Equity International

Decoding Private Equity Performance Cfa Institute Enterprising Investor

Private Equity Investors Investor Portfolio Rounds Team Dealroom Co

/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

Private Equity Definition

Why Do Startups Prefer To Raise Funds From Venture Capitalists Rather Than From Private Equity Investors Quora

What Is Private Equity Is It Right For Your Portfolio Personal Capital

Pe Investor

Private Equity Investors Investor Portfolio Rounds Team Dealroom Co

Investors Eye A New Private Equity Opportunity

Growing Trends In Private Equity Secondary Market Investing Cfa Institute Enterprising Investor

Bol Com Private Equity Accounting Investor Reporting And Beyond Ebook Mariya Stefanova

Private Equity Firm Wikipedia

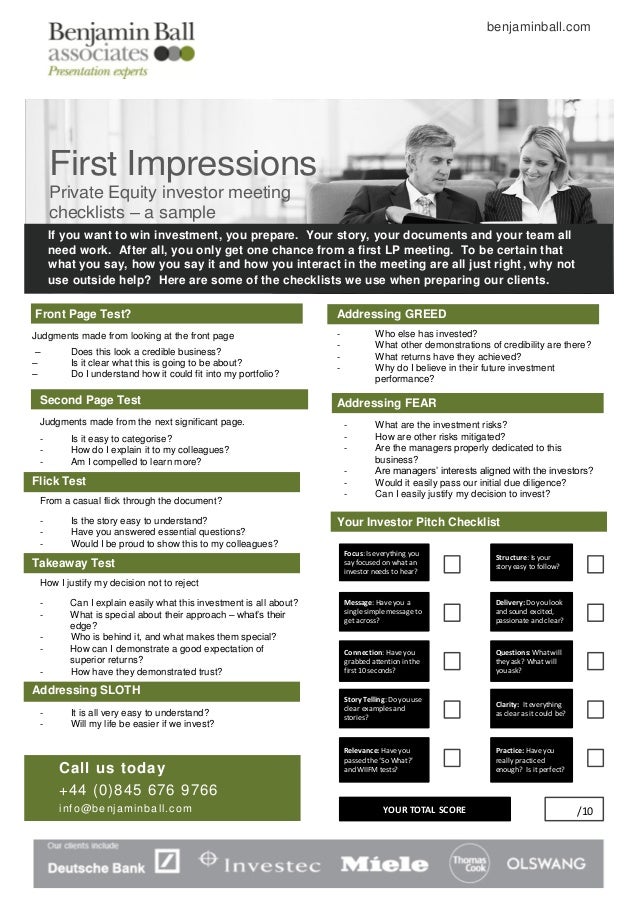

Private Equity Checklist

Large Private Equity Investor Opens International Doors For Windchallenge Investment Ready Program Investment Ready Program

Missing Private Equity In Your Investment Portfolio

Private Equity Investor Value Creation

Private Equity The Emperor Has No Clothes Cfa Institute Enterprising Investor

How Can Private Equity Funds Deliver Resilience Expert Investor Europe

Q Tbn And9gctkmkkvxzdyjvwbz6p2 8a643awuqnbzzrkouul9vc2xeadqjxm Usqp Cau

Private Equity And Family Firms A Systematic Review And Categorization Of The Field Sciencedirect

Berlin Private Equity Investor Buys Cologne Office Property Research Germany

A Thorough Understanding Of Private Equity

13 Ivca I Am A Private Equity Investor

Www Afm Nl Downloadregisterfile Aspx Type Openbaarmaking Voorwetenschap Enc 7rpj0bbamd5lzfwulyq9tie Xbkys1je7 Gvfxy2pxnqat3nvnkp3qcqci2wub5gs Pymhvg5ea E7fpgiengzj0nlamudbp Opnutkh27va0 Czgu7e4hlgdyywwwpdaoleqzzdmwepnpaemxluxxlvhf0wb Izxpufa0k21mgczwbxbefjz04uzplrmop1rjagfu905jt 9ma61mjn Nzm Vnc Vii2ffbr Ad9zy3ad65xpjrj464 Clypu87rlz K W Kj4 Zokawpsrpoaigy2l50mnn2lmsewbaohhgevxxfb51m2k316kdifu9vktna3hyinm1qnkglxew

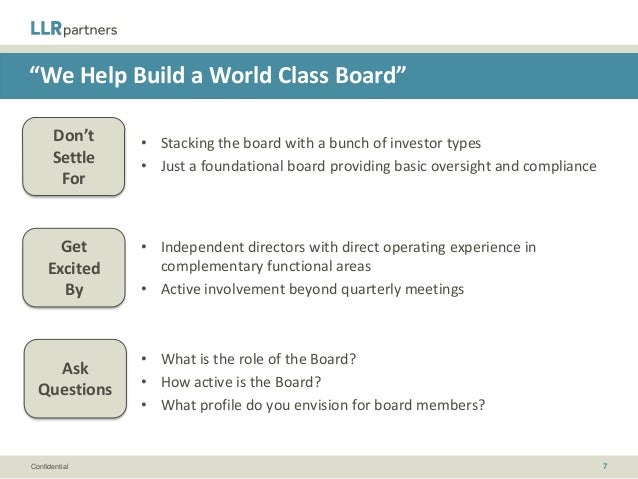

10 Tips For Working Successfully With A Private Equity Investor White Paper Vlerick Business School

How Private Equity Co Investments Can Accelerate Investor Returns Following A Crisis Professionele Schroders

Private Equity Dekker Stein Partners

List Of 150 Largest Private Equity Investors In Germany

Private Equity Investeerder Uit Baar Treedt Toe Tot Bsi Industryinsights Eu

Why Private Equity Should Be Looking Into Cryptocurrency More Aggressively

Private Equity For Dummies A Case Study Kudu S Skeptical Economics

Private Equity The Emperor Has No Clothes Cfa Institute Enterprising Investor

Q Tbn And9gcr T Ih8pge2pdbsz6oyx0qcd7gzy1reigmd6vd7j Cfjjd7xsd Usqp Cau

Venture Capital Wikipedia

Invest Europe Report European Private Equity Investments Increased 7 To 80 6 Billion In 18 Tech Eu

Private Equity Buying In A Seller S Market Features Ipe

What Returns Should Investors Expect From Private Equity

File Private Equity Long Term Investment Profile Jpg Wikimedia Commons

Pin Op Xmas T Shirt

Private Equity The Emperor Has No Clothes Cfa Institute Enterprising Investor

I See Myself As A Private Equity Investor That Helps Rebuild Picture Quotes

Venture Capital And Private Equity Investor Assessment Of Effectiveness Download Scientific Diagram

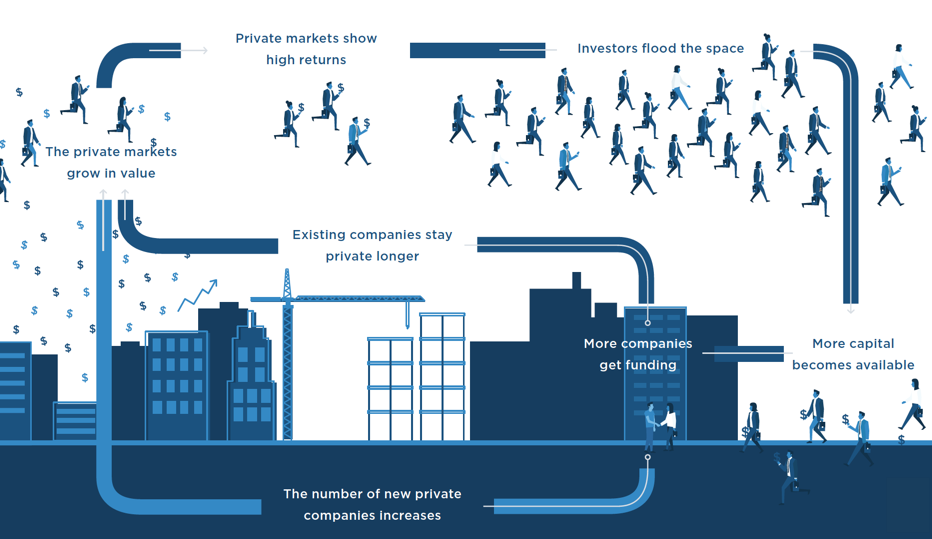

𝗿𝗶𝘃𝘃𝗲𝗿 Private Equity 2 0

How Pe Investors Can Become More Entrepreneurial In Private Equity Mckinsey

Private Equity In Mexico Empea

Diversity Across Private Equity Quarterly Review Of Private Equity Investors Seeking Alpha

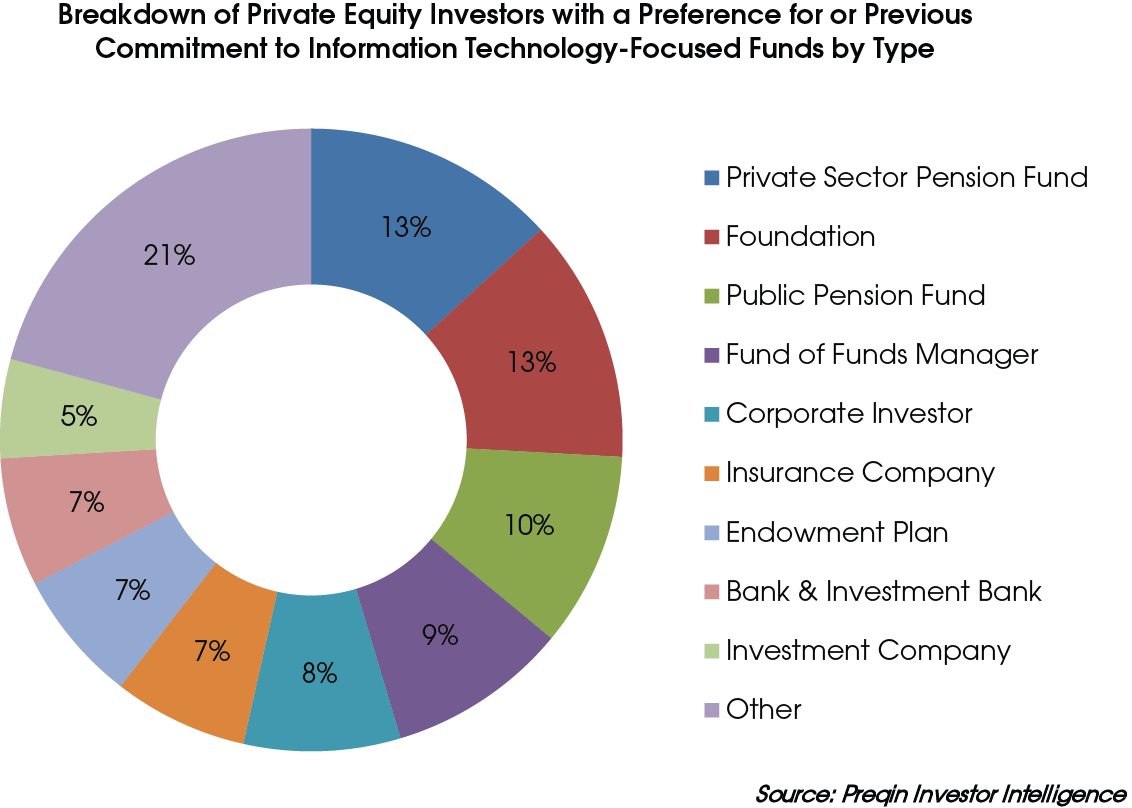

Institutional Private Equity Investors In The Information Technology Sector An Overview Preqin

Pdf Private Equity Investor Protection Conceptualizing The Duties Of General Partners In China Lin Lin Academia Edu

Private Equity Investor Cvc Capital Partners Makes 0m Esg Investment Esg Today

Understanding Impact Investing Mckinsey

Grunwalder Private Equity Investor Koopt Het Digitale Bedrijf Hrworks Industryinsights Eu

Pdf Private Equity Investor Protection Conceptualizing Duties Of Partners In China

Characteristics Of Private Equity Investors In Our Sample Download Table

Private Equity And Venture Capital Investment Agreements

Private Equity Vs Venture Capital Vs Angel Seed Investors By Roger Chua Medium

Respected Private Equity Investor Max Ra Mer Becomes Chairman Of Evca Financial Investigator

Insights And Valuation Metrics Tic Spot On

Institutional Investors Set To Keep Private Equity Commitments Going In 17 Valuewalk Premium

Investor Views What S Your Biggest Private Equity Portfolio Concern Private Equity International

Analysis How Is Private Equity Optimizing The Downturn Private Equity Insights

Continued Growth Continuing Challenges For Pe Investment In Germany

Pewin Private Equity Women Investor Network Linkedin

Growth Equity The Intersection Of Venture Capital And Control Buyouts Pe Hub

Esg Investing Will Private Equity Firms Refocus On Stakeholder Value Bspec

Private Equity And Family Firms A Systematic Review And Categorization Of The Field Sciencedirect

Private Equity Investing Alternative Investments Blackrock

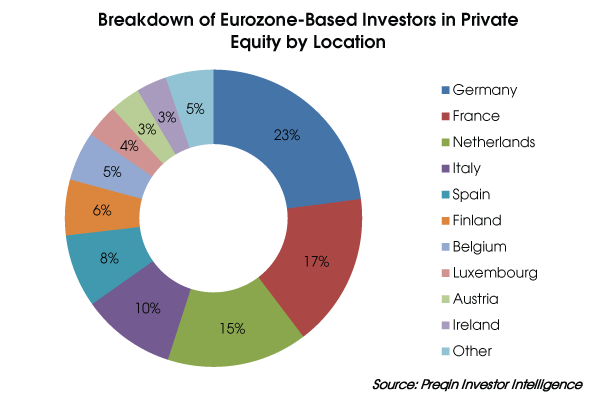

A Breakdown Of Eurozone Based Private Equity Investors July 15 Preqin

Number Of Portfolio Firms By Type Of Private Equity Investor Download Table

Private Equity Investor What Do They Do Reallyopen

Equity Co Investment Diagram Private Equity Slide Example Of Ppt Graphics Presentation Background For Powerpoint Ppt Designs Slide Designs

Venture Capital And Private Equity Dna Training Consulting

Frankfurtse Private Equity Investeerder Koopt Congatec Industryinsights Eu

Q Tbn And9gcr 8agwfxk Lvkb54ozdxulxrgvg0o53vhdwh4q4obl8m1y2ras Usqp Cau

Private Equity The Emperor Has No Clothes Cfa Institute Enterprising Investor

Private Equity Wikipedia

How Can Private Equity Funds Deliver Resilience Expert Investor Europe

/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

Private Equity Definition

Private Equity

Equity Co Investment Wikipedia

Private Equity Investments Investor Relations

What Is Private Equity What To Know Before Investing Thestreet

Investor Top Venture Capital Fund Amsterdam Netherlands Efinancialcareers

Private Equity Directory Capital Raising

The Investor Relations Manual Private Equity International