Family Trust

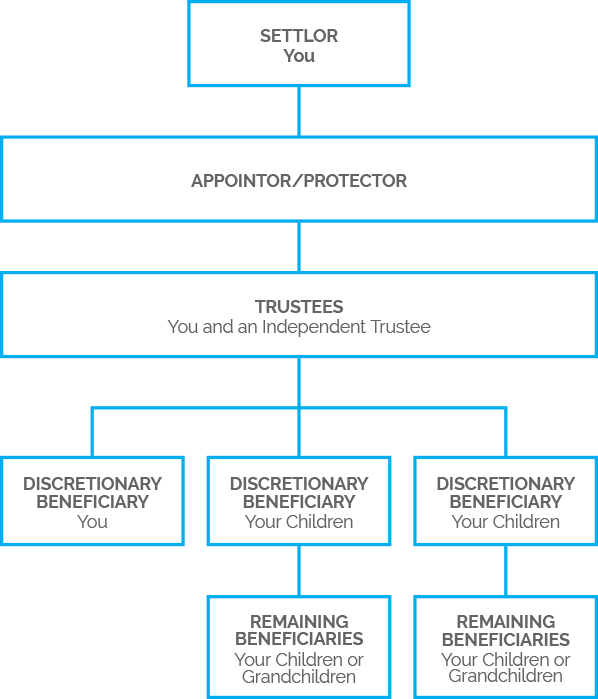

The marital trust is a revocable trust that belongs to the surviving spouse A revocable trust has terms that can be changed by the person who established the trust The family or B trust is irrevocable, meaning its terms cannot be changed When the first spouse passes away, their share of the estate goes into the family or B trust.

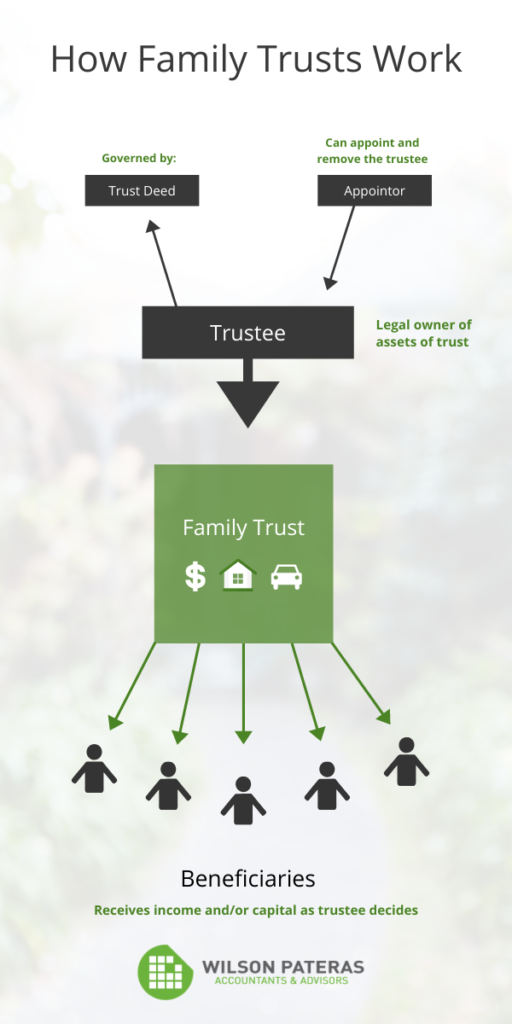

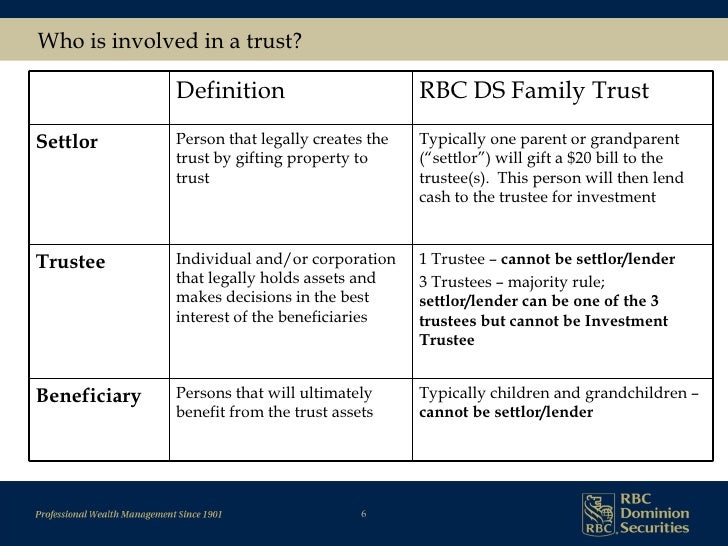

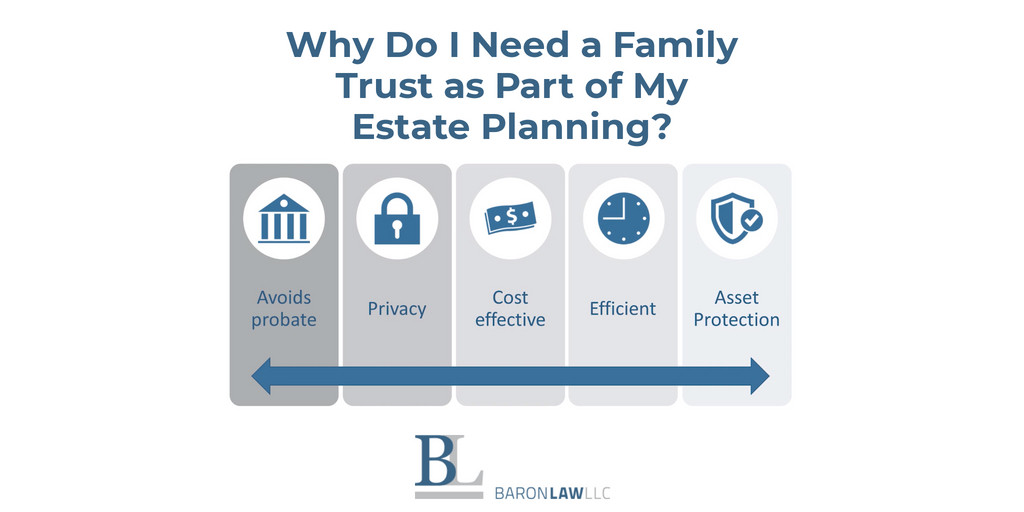

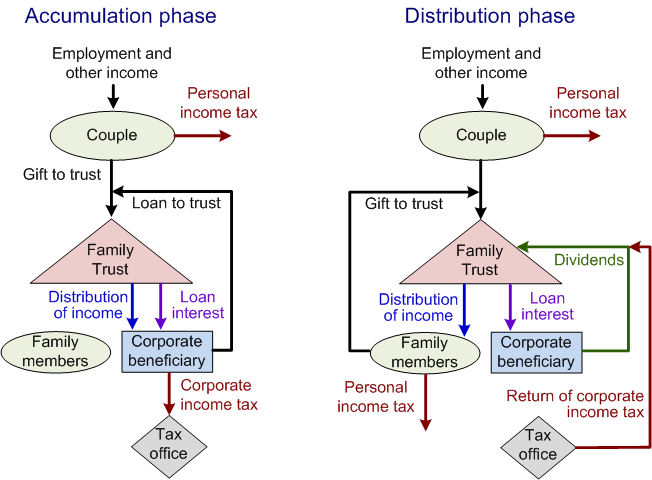

Family trust. The Family Court has wide powers to decide what can be divided, and generally the court included assets in the discretionary trust to be divided, where a spouse is a trustee, or has the means to. A trust can be used to manage estate taxes, shelter assets from creditors and pass on wealth to future generationsA family trust is a specific type of trust families can use to create a financial legacy for years to come There are several benefits to creating one, though not every family necessarily needs one. A family trust is a legal device used to avoid probate, avoid or delay taxes, and protect assets Here's an overview of the various types of trusts, what can be accomplished with each, and how they are created Basic Terminology.

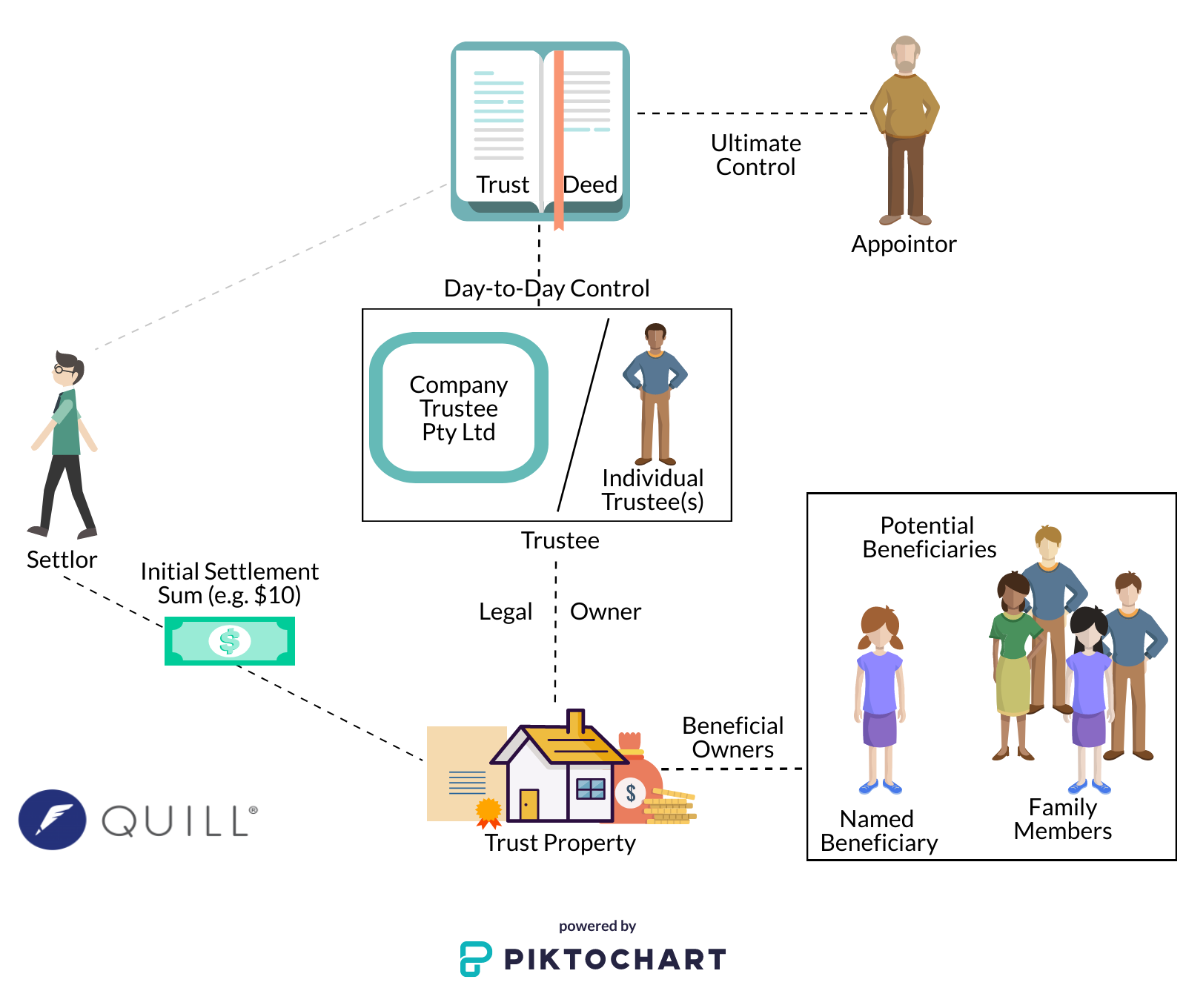

A trust is a legal entity that you can put your money and assets into so that you can then pass it on to one or multiple beneficiaries, typically after your death A family trust is any type of trust that you use to pass on assets to one or multiple family members Anytime you talk about trusts, there are a few terms to make sure you understand. Family foundations are a type of private foundation offering certain tax benefits and flexible giving options, and are generally governed, administered and funded by a family unit See if a private family foundation is the best fit for your family’s philanthropic goals and how it compares with other giving vehicles. A family trust is also known as a revocable living trust The family or living trust is a simple yet extremely powerful too One of the most important benefits is that it can help you avoid probate (if set up correctly) But it does much more than just that.

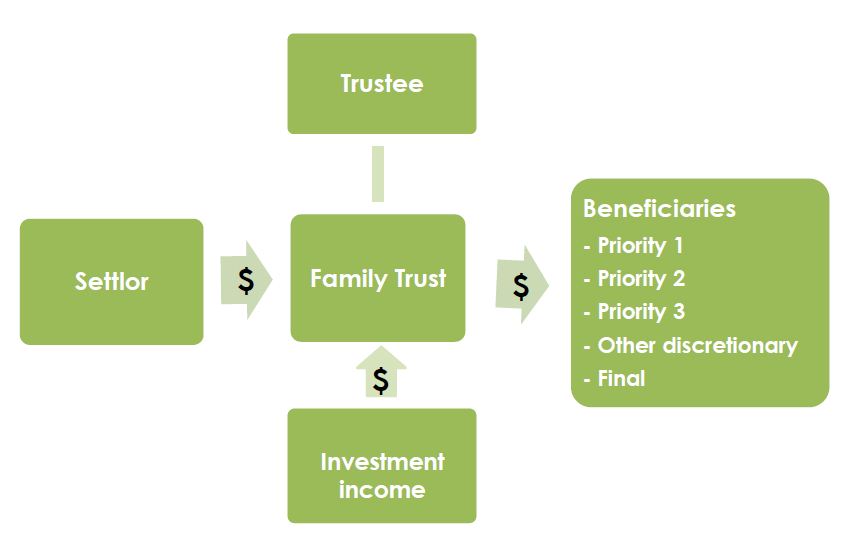

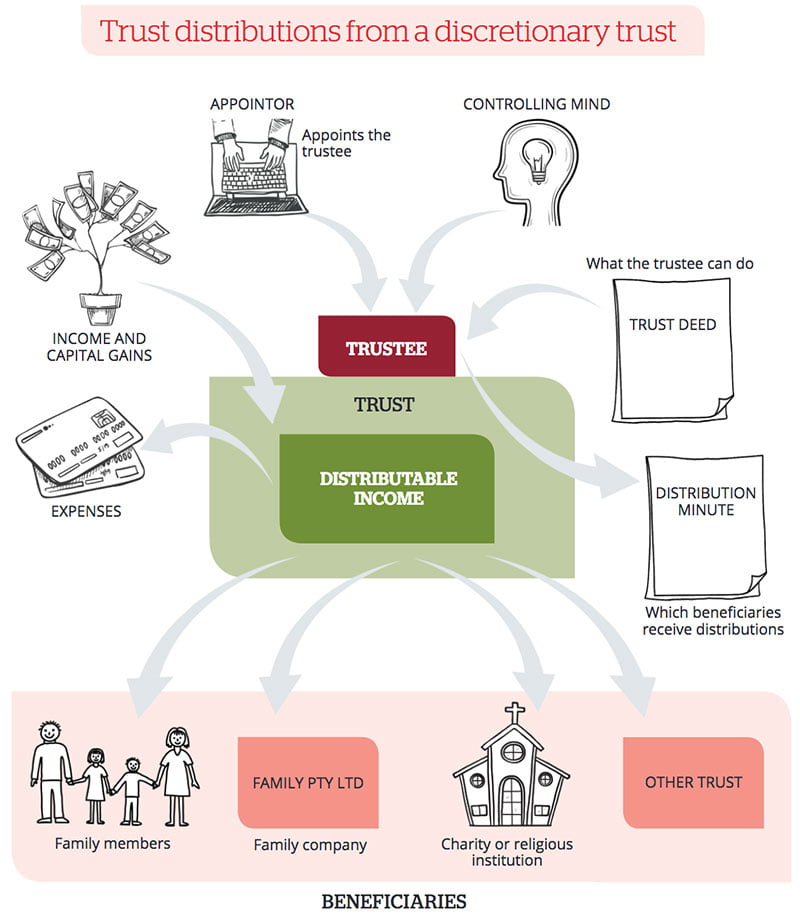

With Family Trust mobile banking, it’s more convenient than ever to access your Family Trust accounts on your iPhone or iPad The app allows you to transfer money between your Family Trust accounts and other financial institutions, make loan payments, find branches and surchargefree ATMs, and deposit checks. A family trust is an agreement where a person or a company agrees to hold assets for others’ benefit, usually their family members It is often set up by families to own assets A family trust is also referred to as a “discretionary” trust The word “discretionary” refers to the trustee’s powers or ability to decide which. {NAME} FAMILY TRUST AGREEMENT {Name}, of {Address}, {State}, {Zip}, referred herein as Trustee, herewith as Settlor establishes and declares the following trust I DECLARATION OF TRUST 11 Said Trustee declares that all certain selected and designated property, income, and profit now held or acquired after the effective date of this agreement shall be controlled by him, in trust pursuant to.

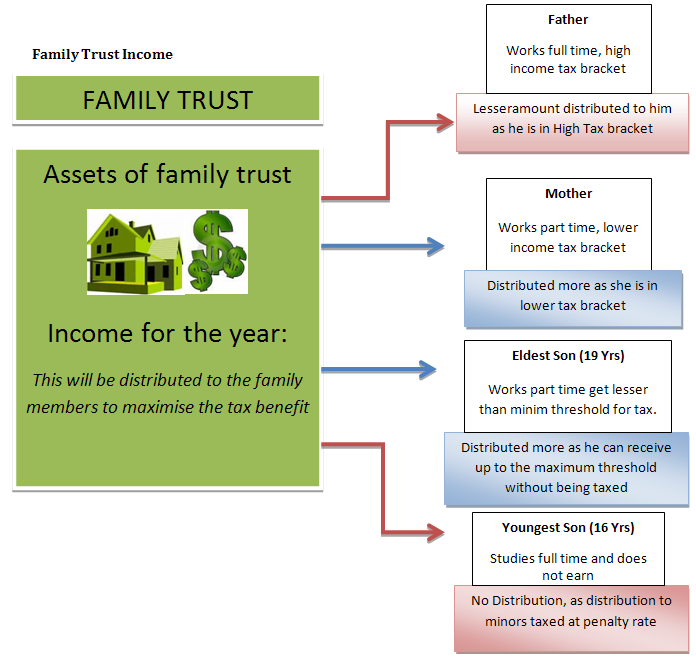

Alabama Family Trust is a nonprofit, 501(c) 3, pooled trust company administering special needs trusts for the disabled throughout the United States Disabled individuals, including the elderly entering nursing homes, can place assets from legal settlements, inheritance, gifts, alimony, and other forms of assets with Alabama Family Trust and. A family trust is a legal document that gives a trustee, often a family member, the legal authority to make decisions about the distribution of income, property or other assets to identified family members Often, a family member establishes a family trust to protect assets, create tax advantages and avoid probate. Where family trusts are utilized, and amounts are payable to children The amounts must be used for the benefit of the children Any amounts paid to the children will reduce the amount owing to them The amounts received by the children from the family trust could be used to pay certain expenses, which would otherwise have been paid by the parents.

A trust is a legal document that can be created during a person's lifetime and survive the person's death A trust can also be created by a will and formed after death Common types of trusts are outlined in this article Once assets are put into the trust they belong to the trust itself (such as a bank account), not the trustee (person) They remain subject to the rules and instructions of. A family trust is a common tool in the estateplanning process But while a family trust has many advantages, it's important also to understand the disadvantages What Is a Family Trust A family trust is a legal device set up to benefit family members, most commonly, your spouse and/or your children It is used to avoid probate, delay taxes. A trust agreement is a document that spells out the rules that you want followed for property held in trust for your beneficiaries Common objectives for trusts are to reduce the estate tax liability, to protect property in your estate, and to avoid probate Think of a trust as a special place in which ordinary.

Where family trusts are utilized, and amounts are payable to children The amounts must be used for the benefit of the children Any amounts paid to the children will reduce the amount owing to them The amounts received by the children from the family trust could be used to pay certain expenses, which would otherwise have been paid by the parents. A living trust is one way to plan for passing on your estate—property, investments and other assets—to your family or other beneficiaries It’s a legal agreement people often use to plan ahead for the possibility of becoming mentally incapacitated or so that the burdensome probate process can be avoided when they die. Family trusts are a common type of trust used to hold assets or run a family business A family trust is an inter vivos discretionary trust which means it is established by someone during their lifetime to manage certain assets or investments and support beneficiaries, such as family members There are certain advantages and disadvantages of family trusts, for example, if you are holding.

A family trust is a legal document that gives a trustee, often a family member, the legal authority to make decisions about the distribution of income, property or other assets to identified family members Often, a family member establishes a family trust to protect assets, create tax advantages and avoid probate. A Family Trust Deed provides the flexibility, control and protection that you need, to give significant gifts in your lifetime with complete peace of mind The deed of family trust lays down the terms and conditions of the trust and provides for the mechanism for the functioning of the same. A family trust is a trust established specifically for the benefit of members of a particular family The purpose of creating a family trust is to protect and manage family assets for current and / or future generations.

1 Trust is a separate Legal person hence tax planning tool 2 An individual can control use of his wealth even after death via Trust deed rules for few years when kids or family are yet to be matured enough to manage wealth or business empire. The family trust allows you to protect and pass on assets such as the family home, the family business or business interests, bank accounts, investment accounts, collections, personal property and other valuables The person or persons creating the family trust and placing items within the trust are the trustors. Confidentiality – Family trusts are not publicly registered and therefore can be kept confidential Disadvantages of Family Trusts The following are a number of the disadvantages of having a family trust Loss of Ownership of Assets – If you transfer your personal assets to a trust, then the trustees of that trust will control the assets.

A family trust is a legal entity Once you create it, you transfer your assets into it, so that the trust owns your property instead of you You set up the trust by defining the "beneficiaries," which are people that will someday get things from it, and the "trustee," who is in control of the trust. Family Trusts explained and Family Trust Elections explained The term family trust refers to a discretionary trust set up to hold a family's assets or to conduct a family business Generally, they are established for asset protection or tax purposes The importance of Family Trust Elections are explained below under the heading "Family trust elections — a word from the ATO on income. A family trust, also known as a “bypass trust,” is a trust created by a married couple with a large estate for the purpose of avoiding federal estate taxes when the first spouse dies The couple, known together as the “Trustors,” usually place ownership of assets whose value meets, but does not exceed, the federal estate tax exemption.

A trust is a legal entity formed under state law, creating a relationship where one person holds title to property subject to some benefit to another person(s), referred to as a beneficiary Trusts can be created for a living person or come into existence at a person's death Many trusts require the. A revocable family trust is a trust that is set up for the purposes of protecting assets and providing for your family members Trusts can be used to achieve many asset protection and estate planning goals and can be a powerful legal tool for those who want to protect their loved ones and legacy. What type of trust do you need?.

Family Trust Sam Smith has agreed to be the initial trustee of the trust The trustee is to act in accordance with this deed The trust is to commence on the day this deed is executed as specified in the Schedule and is to end on the ‘vesting day’ Beneficiaries of the trust 2 The beneficiaries of the trust are. Family Trust Federal Credit Union, Rock Hill 5,198 likes · 21 talking about this · 377 were here Family Trust represents over 50,000 members and has 7 locations in York County We've been serving. A family trust is a trust in which the beneficiaries are family relations of the grantor Since the assets of a revocable trust legally belong to the grantor, beneficiaries have no rights in trust assets that are not subordinate to the grantor's right to unilaterally revoke the trust.

Family Trust is a conventional trust but is prepared with the principal parties being within a family The Main Types of Trusts It is vital that the correct type of trust is provided for the client Our questionnaire needs to be completed to aid in assessing your situation This is generally followed by an interview with the client. Family Trust Insurance is a fullservice insurance agency located in Las Vegas, Nevada Visit our website or give us a call today for a free, noobligation insurance quote. A family trust can be either a living trust or a testamentary trust, depending upon the grantor’s objectives A living family trust might involve a married couple serving as cotrustees of a trust that holds title to their home until both have passed on, at which point a successor trustee transfers title to their children outside of probate.

A trust is a legal entity set up to manage assets on someone's behalf A living trust is a trust set up while the person is still alive, sometimes with the ability to modify the arrangement A family trust is essentially any trust set up for the benefit of someone's relatives. Many families set up trusts to provide for family members in need of financial assistance or to further their own estate planning goals Taxation of trusts can become extremely complicated, and. A family trust is essentially airtight legally, another potential advantage over a simple will Limitation of exposure to estate taxes, as part of a proper estate planning process Simplicity and Flexibility A family trust is a relatively easy document to prepare and account for, particularly with the help of an estate planning attorney.

Mention the term family trust and there are often visions of lots of money floating around inside it Assets typically held in a family trust include investment properties, cash, shares and non. Family Trust has been compared to The Nest but I enjoyed it more, found the pace swifter and the struggle around disposition of assets more interesting with the old parents still in the picture The insider view of Silicon Valley and its players was deliciously captivating as was the world of Stanley's and Linda's TaiwaneseAmerican friends. An irrevocable family trust avoids estate taxes by paying the gift taxes on property at the time of deposit into the trust Gift taxes are usually lower than estate taxes Limitations There are some limitations to a family trust When you transfer your ownership of the assets to the trust, you will no longer have control over them.

A family trust is a legal document that gives a trustee, often a family member, the legal authority to make decisions about the distribution of income, property or other assets to identified family members Often, a family member establishes a family trust to protect assets, create tax advantages and avoid probate actions. A family trust, also known as a living trust or revocable living trust, is a legal document that permits the person who prepares it or has it prepared to make changes to it at willThis type of trust covers how a person’s assets are handled before and after death These provisions can include anything from beneficiaries to property and cash allocations. A family trust is a way to structure finances that removes them from individual ownership and tax liability It places assets in the care of a third party, who manages the trust on behalf of its.

A family trust is a trust created to benefit persons who are related to one another by blood, affinity, or law It can be established by a family member for the benefit of the members of the family group Family trusts acts as an instrument to pass on the assets to future generations. Family Trust FCU is here to help you achieve all of your financial goals, whether you are looking to buy a house or planning for retirement or saving to send your new baby to college We’re also here to make the daily ins and outs of managing your money easier and more convenient. Learn the basics about trusts and how they are used in estate planning What is a trust?.

A Trust is an entity that owns property for the benefit of another, called the beneficiary A family Trust, also called a revocable living Trust, is a Trust created to hold the families assets in order to pass them to family members and avoid probate. Overview Trusts are essentially creatures of contract Virtually all trusts are made in written form, either through an inter vivos or "living trust" instrument (created while the settlor is living) or in a will (which creates a testamentary trust)Therefore, in understanding certain terms in a trust, general rules of construction regarding interpretation of wills or other testamentary. With Family Trust mobile banking, it’s more convenient than ever to access your Family Trust accounts on your Android phone or tablet The app allows you to transfer money between your Family Trust accounts and other financial institutions, make loan payments, find branches and surchargefree ATMs, and deposit checks The mobile banking app is available to Family Trust online banking users.

Family Trust vs Living Trust Quite simply, a “family trust" may refer to any trust created with family members as its beneficiaries A family trust can be set up in two ways Testamentary Trust Set up through a last will and testament, which means it will only come into existence upon the death of the grantor and probating of the will A. Since living trusts are revocable, allowing changes or, even, dissolution, at any time, the trust and the grantor enjoy no beneficial tax treatment Creating a trust without a good estate plan. Family foundations are a type of private foundation offering certain tax benefits and flexible giving options, and are generally governed, administered and funded by a family unit See if a private family foundation is the best fit for your family’s philanthropic goals and how it compares with other giving vehicles.

1 Trust is a separate Legal person hence tax planning tool 2 An individual can control use of his wealth even after death via Trust deed rules for few years when kids or family are yet to be matured enough to manage wealth or business empire. A family trust is an agreement where a person or a company agrees to hold assets for others’ benefit, usually their family members It is often set up by families to own assets A family trust is also referred to as a “discretionary” trust The word “discretionary” refers to the trustee’s powers or ability to decide which. Creating a family trust is an effective way of managing family assets There are two common types of family trusts revocable and irrevocable living trusts When someone sets up a revocable living trust, they transfer assets into the trust for the purpose of benefiting those to whom the assets ultimately pass, called the beneficiaries.

Watch and learn hereNOTE NOT LEGAL. The Family Court has wide powers to decide what can be divided, and generally the court included assets in the discretionary trust to be divided, where a spouse is a trustee, or has the means to. A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries Trusts can be arranged in may ways and can specify exactly how and when the assets pass to the beneficiaries Learn more about trusts and how they can help you in estate planning.

/what-is-a-revocable-living-trust-3505191-v3-5bfd7964c9e77c0026f13d1d.png)

Revocable Living Trust And How It Works

Bol Com Family Trusts Hartley Goldstone Boeken

Family Trust Inheritance Trust New Zealand Family Trust Services

Family Trust のギャラリー

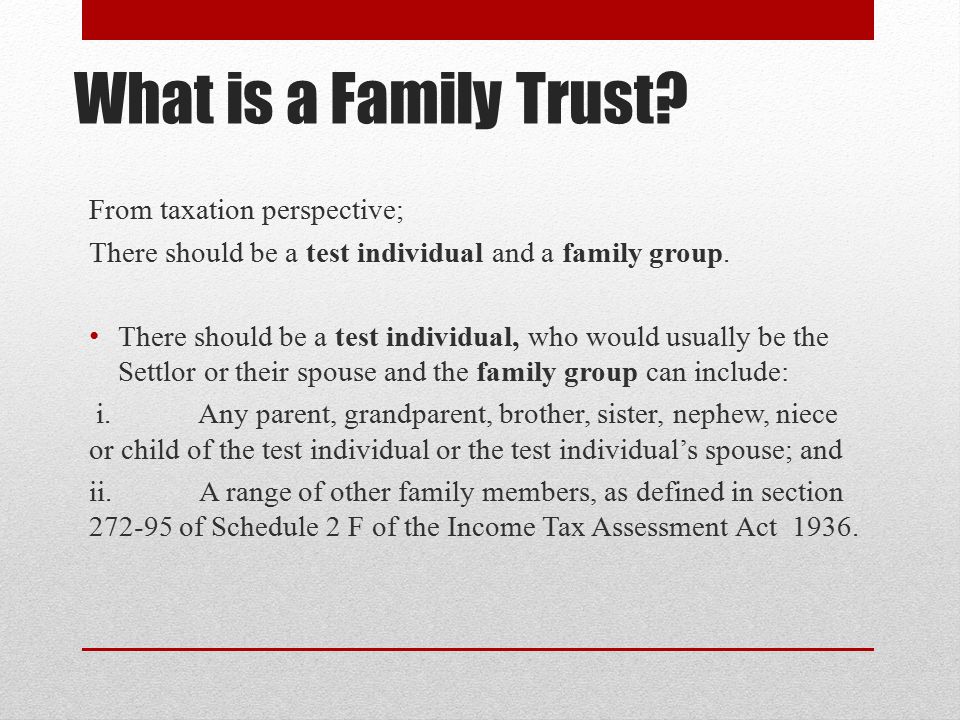

Everything You Need To Know About Family Trusts Parties To A Trust Settlor Trustees Beneficiaries Part Ppt Download

The Children S Family Trust Independent Fostering Agency And Charity

Family Trust A Novel English Edition Ebook Wang Kathy Amazon Nl Kindle Store

Are Online Trusts And Company Setups Worth The Discount For A Subdivision Project Propertychat

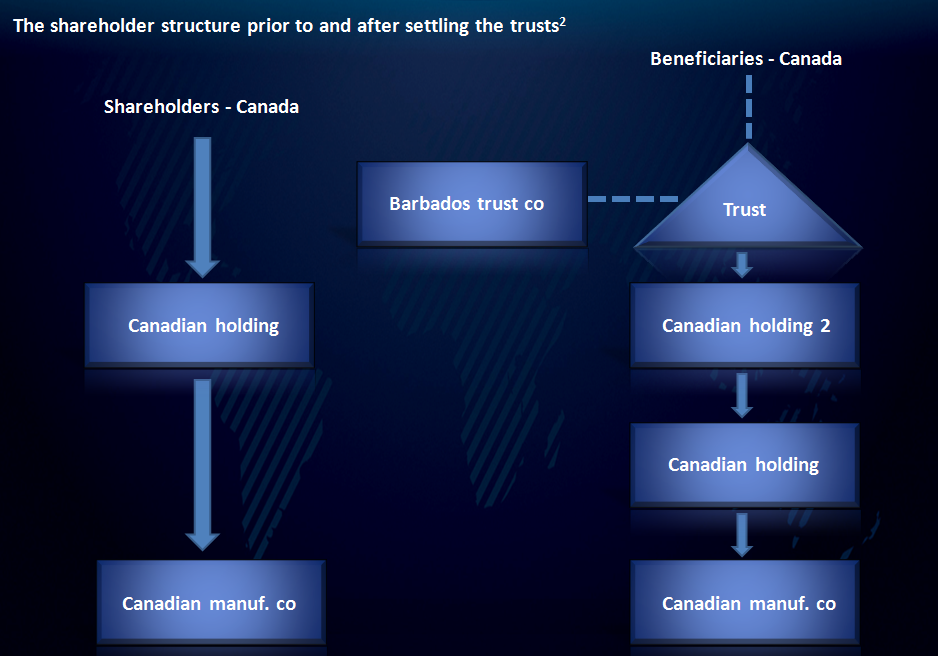

Garron Family Trust Case Tax Residence Of Trusts d Enterprisesbbd Enterprises

Family Trust Fcu Personal Finance Services

Should I Have A Family Trust Agilis Ca

Sylvester Family Trust Finance Without Borders

Trust Family Quotes Sayings Trust Family Picture Quotes

The Fischer Family Trust Fft

Mogelijkheden Met De Curacao Trust Ppt Download

Bol Com Family Trusts Hartley Goldstone Boeken

Family Trusts What You Need To Know

Sullivan Estate Law Llc How A Living Trust Helps Your Family

Pin Op Feelings Friendship Family

The Two Edged Sword Of Family Trust Distributions

What Happens To A Family Trust If The Trustee Dies Linda Alexander Law

Advantages And Disadvantages Of Family Trusts Ioof

Is A Family Trust Right For You Adapt Wealth

1

Family Trust Panama Legal Center

The Use Of Family Trusts

:format(jpeg):mode_rgb():quality(40)/discogs-images/L-301432-1515999462-5936.jpeg.jpg)

Zappa Family Trust Label Releases Discogs

Family Trusts Revised And Updated Pdf Chepshydkinddistni5

Kroll Family Trust Russian Art Culture Group

Private Trust Companies Factsheet By Jersey Finance Issuu

What Is A Family Trust Rushmore Forensic

Bol Com Family Trust Ebook Amanda Brown Boeken

Why You Need A Family Trust

Underwriting A Loan Transaction Where The Borrower Is A Family Trust

The Special Place For Family Trusts Cruz And Co

Trusts 101 A Guide To What They Are And How They Work In Australia The Smsf Coach

3

Best Family Trust Documents Scribd

F2 Finance Family Trust Leinfelden Echterdingen Facebook

In Family We Trust Altitude Business Group

/Naming-your-family-trust-funds-e38335a50d1243e5909671395050ad31.gif)

Here Are Some Helpful Tips On How To Name Your Family Trust Fund

Bol Com Family Trust Ann Miller Hopkins Boeken

Family Trust Home Facebook

Sample Chart Of Accounts For Family Trust Lewisburg District Umc

Family Trusts

Australian Shelf Companies Your Complete Company Registration And Corporate Compliance Provider

Tables For 4 Is An October 3rd Fundraiser We Ll Be Doing To Support The O Rourke Family Patrick O Rourke Was A 12 Year Vetera Bloomfield Family Trust Prentice

Bol Com Family Trust Kathy Wang Boeken

What Is A Family Trust The Essential Guide Box Advisory Services

Who Are We To Trust If Not Our Family Picture Quotes

Family Quotes For Hard Times His Family Is 1 Of The Disgusting Family I Could Family Love Quotes Famous Quotes About Family Beautiful Family Quotes

The Role Of A Trustee In Your Family Trust

Family Trust Guide Mactodd Lawyers Mactodd Lawyers Macalister Todd Philips Queenstown Central Otago

.png)

Do I Need A Will Or A Revocable Living Trust Carolina Family Estate Planning

Thaluvachira Family Trust Home Facebook

Family Trusts Advantages And Disadvantages Of Having A Trust

What Is A Trust Lawcrest A Modern Commercial Law Firm

Family Trust Discretionary A Simple Explanation Jdg Accountants

The Benefits Of Family Trusts Advisor S Edge

Everything You Need To Know About Family Trusts Part 1 Family Law Express Brief

Prs Family Trust Linkedin

Family Trust Investor Fti Gmbh Linkedin

/family-estate-planning-document-175427818-5a2dd1165b6e2400372f2d2c.jpg)

Sample Chart Of Accounts For Family Trust Lewisburg District Umc

Setting Up A Family Trust The Basics You Need To Know

The Benefits Of Family Trusts Advisor S Edge

What Is A Family Trust And How Do They Work Watson Watt Accountants

.webp)

Home Mysite

How To Manage A Family Trust Gaze Burt

What Are The Benefits Of A Family Trust In South Africa Tat Accounting

Why It Is Importance To Build Family Trust And Its Benefits

The Impact Of Ownership Transferability On Family Firm Governance And Performance The Case Of Family Trusts Sciencedirect

Benefits Of Family Trust Planning In Canada Manning Elliott Llp Accountants Business Advisors

What Your Clients Can Gain By Setting Up A Family Trust Acca Global

Q Tbn And9gcrge7qwpjonzfe028qt 4txo71nwtcfupa0pibc Woq3cjbosj8 Usqp Cau

How My Family Trust Fund Was Stolen By Anthony Weldon Issuu

Trust Powerbanks Prijsbest Nl

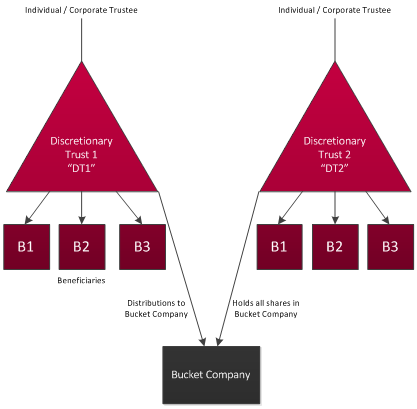

Family Trusts And The Bucket Company Why Should I Use One

Bol Com Family Trust Kathy Wang Boeken

Bol Com Family Trust Kathy Wang Boeken

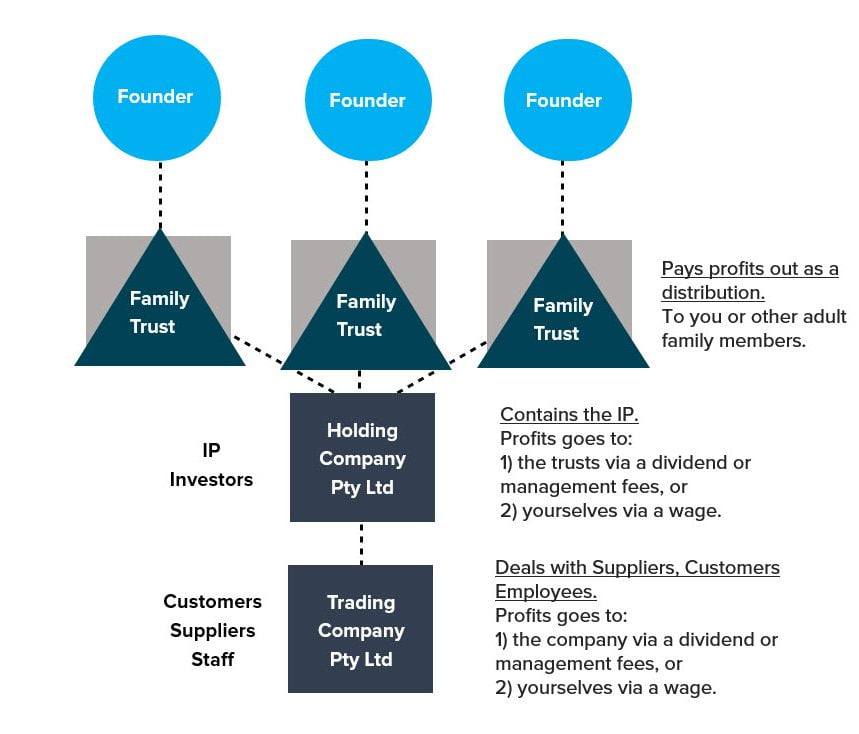

Australian Startup Structures Companies Trusts Corporate Trustees Dissecting All The Options For Founders By Kunal Kalro Medium

Using Family Trusts To Income Split

Quotes About Can T Trust Family 21 Quotes

K 1 Taxation Of A Family Trust Jeyakumar1962 General And Health Issues

Why Do I Need A Family Trust As Part Of My Estate Planning Baron Law Llc

How To Set Up A Family Trust Quill Group Tax Accountants Gold Coast

Family Trusts Recent Changes And Continued Benefits

Everything You Need To Know About Family Trusts Part 1 Family Law Express Brief

Uw Specialist Is Vermogensregie Family Capital Trust Family Capital Trust

Setting Up A Family Trust Can Save You Lots Dollar Wise

Why All The Fuss About Family Trusts

Should I Put My Assets In A Family Trust Maya On Money

Family Trust Inheritance Trust New Zealand Family Trust Services

7 Valuing A Beneficiary S Interest In A Family Trust

How Do You Set Up A Family Trust In Hong Kong Trust Law Trustee

Uw Specialist Is Vermogensregie Family Capital Trust Family Capital Trust

Effective Positioning Of A Bucket Company With In Family Trust Structure Propertychat

Van Straaten Family Trust Has Acquired Verimark Holdings Limited Deals Oaklins Netherlands Mid Market M A And Financial Advice Globally

Pros And Cons Of Setting Up A Family Trust Legalzoom Com

Diagram What Is A Trust Diagram Full Version Hd Quality Trust Diagram Diagramof Sibce It

3

Naming A Corporation As A Beneficiary Of A Family Trust Cv Trustco

Thaluvachira Family Trust Home Facebook

Living Abroad What About My South African Family Trust Family Trust South African South

Diagram What Is A Trust Diagram Full Version Hd Quality Trust Diagram Diagramof Sibce It

Csk Advisory Family Trust Planning